About essence of the analysis and planning in the management system finance of the economic actor

Автор: Shukshina Yu. A., Zmeyova L.

Журнал: Экономика и социум @ekonomika-socium

Рубрика: Основной раздел

Статья в выпуске: 12-1 (31), 2016 года.

Бесплатный доступ

Article is devoted to a research of essence of the analysis and planning in the management system finance of the economic actor. Contents of the analysis of the financial reporting and its indicators are analyzed. Besides this, the structure and contents of the financial plan are researched.

Financial reporting, analysis, planning, reading of reporting, financial plan

Короткий адрес: https://sciup.org/140124583

IDR: 140124583

Текст научной статьи About essence of the analysis and planning in the management system finance of the economic actor

The analysis and planning play an extremely important role in enterprise management. Any planned decision of management assumes some of its analytical validity and also creation of actions plan for its implementation. And therefore in any sphere of management including in the field of finance, there are planned and analytical procedures which are more or less formalized, carried out with a certain detailed elaboration, thoroughness, frequency and systematic character. The financial manager, as well as the accountant, is interested in first of all the complex of the planned and analytical procedures in a varying degree connected with financial side of activities of firm. We will call appropriate sections of this complex as a financial analysis and financial planning. These concepts are also very indistinct and aren't certain; to be more precise, the sense of definition and content of it can significantly differ at different authors’ variants.

In general set of planned and analytical procedures the special place take technical facilities and analysis techniques of the financial reporting. The reporting of both the entity and his partners undergoes analysis. The last circumstance is extremely important because any businessman (the financial manager, the investor) always should remember the known rule: "Before signing the contract with the partner, study his accounting records".

Information sources from which it is possible to scoop information on the partner are various. In their general set the special part is assigned to accounting (financial) records. The main reason is that structure, an order and rules of creation of this information source are registered in regulatory accounting that predetermines methodological commonality and uniformity of forms of account, their availability, and also a possibility of calculation of analytical indicators.

The main analytical function is born by two forms of account: balance sheet and profit and loss statement. Let's notice that in connection with the last changes of rather recommendatory formats of the reporting the profit and loss statement purchased the independent importance: exactly in this form it is possible to see the size of the net profit got by the entity in the accounting period.

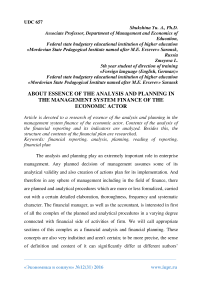

Kernel of modern analysis techniques of the reporting is the system of analytical coefficients. For understanding of logic of analytical procedures and convenience of interpretation of indicators they can be presented in the form of block structure — each block contains the indicators allowing to gain certain notion about some aspect of property and financial capacity of the entity (fig. 1).

Planning represents process of development and acceptance of purposes and determination of ways of their most effective achievement. These installations developed most often in the form of a tree of the purposes characterize the desirable future and are in number expressed by a set of the indicators which are key for this level of management. Planning is among the general management functions immanently inherent in any functioning social and economic system. Need of creation of plans is predetermined by many reasons; among them: uncertainty of the future, the coordinating plan role, optimization of economic consequences, limitation of resources.

Figure 1 – Block structure of indicators system of an opportunity assessment and effectiveness of activities of firm according to the reporting

There are the following stages of financial planning:

-

1) analysis of a financial position of the company;

-

2) making of forecast estimates and budgets;

-

3) determination of a general requirement of the company in financial resources;

-

4) forecasting of a structure of sources of financing;

-

5) making and sustentation of efficient system of managerial and financial supervision;

-

6) development of the procedure of modification of system of plans (feedback contour).

From a view of practice it is recommended to prepare several versions of the financial plan: pessimistic, the most probable and optimistic. During preparation of the plan it is necessary to consider availability of restrictions which the entity faces (requirements for environmental protection, market requirements on amount, structure and product quality; technological and personnel features of the entity), the disciplining plan role for work of the financial manager, convention of any plans owing to natural uncertainty of development of an economic situation in global and local scales.

«Экономика и социум» №12(31) 2016