Acquerer’s stock price dynamics around M&A announcement: airline company case

Автор: Tsypkina K.Y.

Журнал: Экономика и социум @ekonomika-socium

Статья в выпуске: 4-1 (23), 2016 года.

Бесплатный доступ

Merger and Acquisition, as consolidation tools, are experiencing a high demand in business world. Companies merge in order to obtain synergies and generate shareholders value. However, there are losers in M&A deals. While target companies gain positive returns and additional shareholders value, acquirers usually suffer losses or nearly zero returns. In this article I have looked at M&A deal from the acquirer company side and showed that positive returns may be generated by acquirer, too. As an example of such deal I have taken acquisition of AirTran Holdings Co (U.S.) by Southwest Airlines Co (U.S.) which was announced on 27. 09. 2010.

Короткий адрес: https://sciup.org/140119037

IDR: 140119037

Текст научной статьи Acquerer’s stock price dynamics around M&A announcement: airline company case

According to number of studies, typically, target company stocks are going up generating positive Abnormal Returns, while acquirer stock prices decline after the merger announcement. In order to reject this, I have conducted an analysis Air Tran Airways – Southwest Airlines acquisition deal.

The market reaction is usually analysed using different event-studies. Eventstudy examines the impact of an event on the stock returns of a firm, which is directly translated into the value of the firm. The market model is one of the most usable methodologies for event-studies.

-

• Finding daily stock returns (Rt) of Southwest company and daily

stock returns of market index Dow Jones (RMt)

-

• Regression coefficients were calculated by finding intersection and

slope between Rt and RMt data sets

-

• Calculating Expected Returns E(Rt) - putting coefficients and daily

stock returns into regression formula

-

• Calculating Abnormal Returns, AR = Rt- E(Rt). [3]

-

* All above were made for pre-acquisition (-240;-20) days period and event window (-20;+20) days period

-

• Calculating Cumulated Abnormal Returns – summarizing ARs day by

day.

The results were plotted.

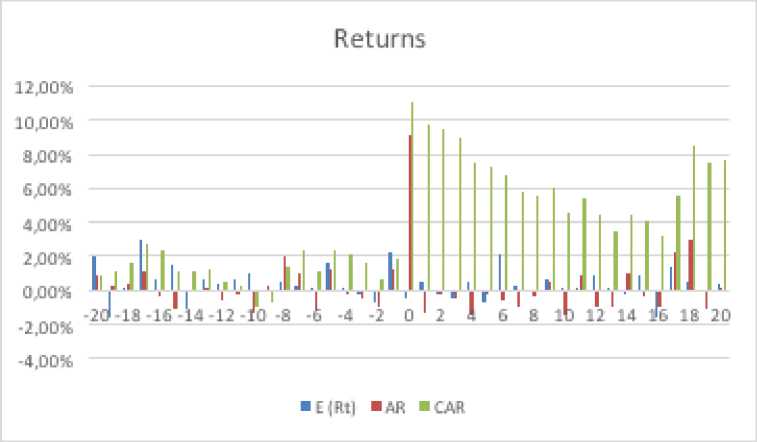

Graph 2. Southwest Airlines returns

From the graph above we clearly see positive Abnormal Returns of nearly 9% on announcement day. Moreover, CAR values also increased significantly. But these should be checked, this is why two more actions were carried out:

-

• Calculating standard deviation of ARs for pre-acquisition period

-

• Testing the results ( T-Test)

For determining weather this returns were really abnormal or just a result of standard deviation distribution error, I conducted T-test for 2 intervals.

|

CAR(-2;+2) |

t-test |

CAR (-1;+1) |

T test |

|

7,85% |

2,141 |

9,04% |

3,183 |

The abnormal returns are confirmed if the value of T-tests lies above 1.96 or below -1.96. The results say that there really took place Positive Abnormal Returns for Southwest Airlines after the deal announcement.

It has been shown that positive Abnormal Returns may be generated and significant shareholder value can be created during the merger and acquisition event for bidding company.

Despite the opinion, that no value for the acquirers can be created , it has been shown that abnormal returns are indeed significant and some strongly positive cumulated abnormal returns may be present on days after the announcement for the acquirer .

Список литературы Acquerer’s stock price dynamics around M&A announcement: airline company case

- DEALOGIC -M&A ANALYTICS, electronic source, access 20.04.2016 http://www.dealogic.com

- Rosen, RJ. (2013). ‘Merger Momentum and Investor Sentiment: The Stock Market Reaction to Merger Announcements’, Journal of Business, vol. 140, no. 2

- Brown, R. I., and J. B. Warner (1995), “Measuring Security Price Performance”, Journal of Financial Economics, Vol. 11