An Exploratory Research on Indian Digital Payment

Автор: Jitendra Singh, Darvinder Kumar

Журнал: International Journal of Information Engineering and Electronic Business @ijieeb

Статья в выпуске: 2 vol.16, 2024 года.

Бесплатный доступ

In order to achieve the aim of a cashless society, Indian government is patronizing and encouraging the usage of digital payment. In this work, an exploratory study related to digital payment using ‘credit and debit card’ and at ‘point of sales’ have been carried out considering several dimensions by drawing the inferences from the existing datasets. Inference related to ‘cards growth rate’ proved instrumental during study and presented the deep insight on the growth trend. Further, this work presents the popular digital payment modes, and comparisons among them is drawn to present the distinct features that justify the suitability of one over the other. Results revealed unprecedented emergence of COVID-19 had adverse impact on the overall growth of digital payment systems. This work will be profoundly helpful to the stakeholders involved in digital payment industry, and policy making to deeply understand the digital payment trend and formulate the futuristic policies.

Less-cash, digital payment, cashless society, COVID-19 impact on digital payment

Короткий адрес: https://sciup.org/15019408

IDR: 15019408 | DOI: 10.5815/ijieeb.2024.02.02

Текст научной статьи An Exploratory Research on Indian Digital Payment

Published Online on April 8, 2024 by MECS Press

Digital payment is the widely used payment mode in developed countries that include Switzerland, Netherland, USA, etc.[1]. Purchases involving small amounts to be paid by the purchasers are preferred for digital payment. Learning the benefits rendered, developing countries across the world are now luring towards digital payment[2]. It is believed that usage in digital payments leads to the growth of Gross domestic product (GDP) of a country. Increase in digital payment leads to equivalent growth in GDP [3].

The government of India is looking forward to promote digital payment by introducing attractive schemes[4]. Several measures that include waiving of transaction fees and taxes on transactions involving digital payment intensify the digital payment usage. On the other hand, several rewards based on lottery for the buyer and merchants was introduced to further boost the digital payments. To grab the opportunity of catching consumers early, Banks and wallet providers have jumped into the fray.

-

A. Demographic description

India is one of the most populous countries of the world and touched the mark of 1.35 billion in terms of population[5]. Owing to the poor earning, majority of the Indians amounting to around 21.92 percent of the total population are below the poverty line, hence cheap and affordable 2G phones are profoundly used as medium of communication by this segment of the market. Elderly people, irrespective of the income group are also the large market segment of 2G[5]. This can be easily traced among elderly and mid age people residing in the urban area and rural area. India is assumed as the young country with 65 percent people falling in the young category and below 20 years of age. Young Indians are tech savvy, well conversant with computers and smartphones. Such residents are open to learning new technology that can ease their daily life. Majority of advanced phones equipped with rich features and are owned by young Indians.

In the recent report of Telecom authority of India (TRAI) published the data for the year ending 2019, around 718.74 million[6] Internet subscribers are engaged in internet usage. Number of internet subscribers has registered a robust growth of 18 percent from the previous year. Among the total internet subscriber, around 96.80 percent constitute the wireless users equipped with mobile phones[6]. According to the recent data usage pattern released by the Telecom authority of India (TRAI), monthly data usage pattern (GB) is depicted in table 1, data present the deep insight on the range of technology’s data consumption pattern[6].

Table 1. Average wireless data usage (in GB) per data user per month[6]

|

Year |

2G |

3G |

4G |

CDMA |

GSM |

Total Wireless data usage |

|

2014 |

0.14 |

0.62 |

1.72 |

0.23 |

0.27 |

NA |

|

2015 |

0.20 |

0.75 |

2.53 |

0.35 |

0.41 |

NA |

|

2016 |

0.23 |

0.79 |

12.42 |

2.31 |

1.16 |

1.14 |

|

2017 |

0.30 |

2.29 |

7.95 |

3.67 |

4.13 |

4.11 |

|

2018 |

0.54 |

5.26 |

9.73 |

2.15 |

7.69 |

7.60 |

|

2019 |

0.64 |

7.05 |

11.26 |

0.00 |

9.85 |

9.85 |

B. Available infrastructure

2. Literature Review

Post demonetization, Indian government has laid greater thrust on generating and strengthening the infrastructure needed for digital payment. New licenses to bank and wallet operators have been granted to provide the boost on usage. To facilitate the digital payments, several methods that include increase in Internet bandwidths, launch of 4G, release of POS, introduction of AePS and development of new mobile applications have been initiated[4]. In order to participate in the digital payment system, one needs a device that may be a mobile, laptop or desktop. A strong and secure communication medium is needed to connect with the destination that can be provisioned by fast 4G connections, broadband and other forms of internet. Finally, a provider that should help in the digital payment of financial services holders is the key in this chain. With multi-vendor presence and the perceived huge market are driving the service providers to tap the majority of the customer to their services and get benefitted by catching the customers early in order to establish themselves as a leader in this domain. Accordingly, vendors such as Amazon, paytm, phonepe are the wallet providers holding the majority market share. To support digital payment, a large number of banks support the range of services. Details of digital payment used and number of banks supporting has been presented in table 2.

Table 2. Payment Methods and Bank[7]

|

S.No. |

Payment Mode |

Number of Banks |

|

1. |

Unified Payment Interface (UPI) |

168 Banks |

|

2. |

National Automatic Clearing House (NACH) |

1311 Banks |

|

3. |

Aadhar Enabled Payment Services (AePS) |

122 Banks |

|

4. |

National Financial Switch (NFS) |

122 |

|

5. |

*99#(USSD) |

86 Banks |

|

6. |

Bharat Billpay |

68 |

The rest of the paper has been organized as, Section 2 deals with the literature referred to in the current work. Section 3 highlights the research methodology used during this empirical study. Section 4 highlights major digital payment methods, and comparisons among them have been drawn. Section 5 presents the result generated and the discussion thereof. Finally, the conclusion of the present manuscript.

Customer’s behavior on digital payment varies according to the industry. Authors have highlighted the behavioural issue of digital payment in the hospitality industry[8] and their study revealed ‘intention of usage’ as a key factor driving the usage of digital payment. ‘Ease of financial payment’ is considered as the supporting factor and ‘technological security and concerns’ were cited as the major barrier towards digital payment acceptance[8] . s ocietal risks at the end of physical cash was highlighted by [9]. Authors have raised their concerns on the risks that may emerge due to the inclusion of digital payment.

According to [10], electronic mode of payments helps in effectively dealing with tax evasion. According to the authors, transaction happening due to the electronic payment can easily be traced hence tax cannot be avoided. Mobile based payment systems can grow only if the technology index is high, to this end, a study to determine gender preparedness towards digital technology was carried out in Nigeria. Study revealed that the comfort and convenience are the major factors driving the mobile based payment system. Risk, cost and insecurity are cited as the leading inhibitors discourage the digital payment usage [11]. A study on the factors that governs the mobile based payment in Vietnam was undertaken by [12]. Perceived usefulness, convenience, promotional offers and social approval were cited as the major driver leading to the mobile based payment system. On the other hand, lack of trust, limited opportunities for usage, complexity and habits associated with cash payment were discovered as major barriers [12]. Relation of electronic payments mode with that of paper based payment in a real economy has been established. To establish the relationship, data of 27 European Union members’ countries were collected. Study revealed that electronic based payment systems is linked with GDP growth[13].

-

[14] explored the consumer behaviour of financial innovations happening in Russian retail market. Positive correlation with the frequency of cashless payments and mobile, online banking, wallet payments emerged as the major contributors. [15]Credit card based method led to overspending; author proposed an approach to reduce the expenditure involved using credit card so that monthly bill remains manageable. With unobtrusive interventions, expenditure on purchase can be reduced to a great extent. Digital payment brings enormous benefit to the government in tracking the overall payment. However, the shadow economy can neutralize the benefits that it carries. According to the authors [16], 1 percent increase in underground activity leads to lowering the impact of cashless payment by .3 percent.

-

A. Findings

Aforementioned work indicates that digital payment is widely used and new measures are being initiated to further promote its usage. There are variety of reasons that are leading to the usage of digital based payment that includes government support and encouragement, ease of use, benefits offer to name a few. Outcome of country with that of another country varied. Several concern related to digital usage have also emerged that include world after the end of physical currency, security of digital data, technology index of the country. Usage pattern of digital payment in variety of purchases and divergence in spending behaviour.

Under the aforementioned findings it will be worth to undertake the empirical study on digital payment usage for the variety of purchase carried out. Objective of this study will be as follows:

-

B. Objectives

1. To highlight the digital payment methods prevailing with their comparison study

2. Analyzing the expenditure data based on ‘wallet’, and ‘point of sale’

3. Growth pattern in digital payment

3. Research Methodology

Under the digital India campaign, the government of India has initiated several measures and shifted many legacy based systems on the web. Hence, to avail services users are accessing the web services and data of usage is recorded in digital form. Data usage is available at two important portals one is data.gov.in and the other one at National Payment Corporation of India (NPCI), an initiative of Reserve Bank of India (RBI) and Indian bank’s Association (IBA) that is solely devoted to maintain the data of variety of transactions happening by leveraging the range of bank tools.

This work relied on the secondary data available at NPCI, a dedicated portal maintaining the banking related data for the citizen or anyone interested to analyze the data[7]. Since, this work is based on the bank data, hence relied on the data available at NPCI. In addition, websites on cashless payment were visited to explore the digital payments used. Research methodology adopted for this work can be categorized into a) selection of literature b) Data download and interpretation of data.

-

A. Literature Selection methodology

B. Data Collection and interpretation methodology

Undertaken empirical study is based on secondary data available at NPCI portal. On the ATM/POS/Card option, it began to publish the data since November,2020 and the last data published was of September 2020, till the writing of this manuscript was downloaded[7]. All the excel files available under the option Bank wise ATM/POS/card option of Statistics

4. Digital Payment Methods

main menu were downloaded. In the downloaded file, units used to represent the currency and counting were Indian; the same were also converted into international format for wider understanding and reach. In addition to available columns, new columns namely ‘Transactions per thousand’ for POS, Debit card and credit card were inferred from the existing columns. Jupyter Notebook of Anaconda python was used for charts and visualization. To accomplish this task, Python libraries namely, ‘pandas’, ‘matplotlib’ , and ‘seaborn’ were used for visualization of the data.

India is the country with great diversity in terms of income, locality of living, familiarity with technology to name a few. To meet the diverse users requirement, a number of digital payment methods have been introduced and used by the category of users to whom it well-suits. Digital payment instruments continue to gain support and directives from the agencies that include Reserve Bank of India, CERT-IN. In addition, the ministry of Finance also pitches from time to time, and eases policies for wider coverage. Popular instruments used are wallet, USSD, AePS, UPI, Mobile wallet, POS, internet banking, mobile banking, micro ATMs.

Wallet :- Wallet payment is growing at an increasing pace and enjoys wider accessibility due to its inherent analogy of physical wallet. Amazon, paytm, pay order etc. are the leading wallet provider used by the users and merchant. Owing to the benefit and bonuses offered, usages of wallet have surged in recent times, particularly post demonetization. Equipped with variety of regulations enforced by government to safeguards the interest of wallet customer and to counter the frauds happening during the digital payment, wallet is well prepared to serve the customer with higher degree of safety and satisfaction.

USSD:- According to the TRAI the apex body deals with the variety of issues related to telecom services, a large number of people are still using the 2G phones. In order to include them under the ensuing digital India campaign, a mechanism was needed. To meet the requirement of such mobile holders, USSD has been envisioned for digital payment. Users holding 2G mobile can transfer the digital fund using 2G phone by using special keys ‘*99#’. Around 68 banks across the country are supporting USSD.

AePS(Aadhar Enabled payment system) :- Customers bank account link with Aadhar can avail the Aeps services. Owing to the Aadhar based authentication, transactions carried out are assumed as secure. Account holders can visit the ATM or the Business Correspondent (BC)/ Bank Mitra that can facilitate the transaction. Customers aiming to avail the AePS services, share one’s Aadhar id along with the bank name to the BC. Afterwards, the user is asked to authorize oneself with a biometric method. Once authentication is successful, the transaction submitted is allowed to be completed. Designated center holds the finger point scanner or the iris scanner. Operations that include withdrawal and balance enquiry can be done with the help of AePS.

-

A. UPI (Unified Payment Interface)

UPI allows transfer of money from one account to another account instantly. Unified payment services allow seamless integration of one or more bank accounts into a single application. Once tied, users can carry out the transaction from one bank to another using the mobile phones. Transfer can be done on 24x7, only the internet should be in the working state. It is a real time payment system that transfers the payment in the other bank account instantly. UPI uses a virtual ID that is considered as safer than other methods. Customers begin acting without supplying many details. UPI is hassle free, since it Leverages the existing infrastructure. Well suited for e-com and m-com.

-

B. Mobile Wallet

Mobile wallet is the virtual method of payment where users are carrying the cash in a virtual wallet, money is transferred from the bank or with the help of bank cards. Sometimes folks are confused with e-wallet. Although, workings of both are similar, however, there is a slight difference between the two. In mobile wallet, app is loaded in the computer system and transfer operation of money happens with the help of mobile phones. E-wallet can also be accessed with the help of desktop, laptop or mobile phones using the internet browser. Paytm, Google pay, MobiKwick, Airtel, Samsung pay, Amazon pay, Citrus pay, Oxygen etc. are some of the Mobile-wallets that hold substantial market share. Under the bank pre-paid cards, Debit cards and credit cards fall under the category of pre-paid cards.

-

C. Point of Sales (POS)

POS is a system widely used in restaurants, shopping malls and other retailers for the payment. POS is the place where users purchase the articles and pay either with the help of credit card, debit card or e-wallet. On micro level, it is the place where the purchase is made. This computerized system helps the retailer to track the cash flow, manage inventory and simplify the bookkeeping to a great extent.

-

D. Internet banking

In internet banking, users are carrying out the online transactions from one’s bank account. Internet based banking allows the ease of access to the bank account with full functionalities. Account holder, availing the internet banking facility can carry out the range of activities that include transfer the money from one account to the other account, request cheque book, pay taxes, pay bills, open PPF accounts, allow to link it with the demat account thereby funds can be transferred from demat account to bank account and vice versa.

-

E. Mobile Banking

Mobile banking is carried out with the help of mobile applications developed for the variety of mobile operating systems that includes Android, IOS, etc. Users can perform a myriad of activities related to fund transfer without any hassle. Users can remain connected with the bank even during the move. Funds can be transferred at any point in time. In the case of mobile banking, app of the bank is to be installed on SmartPhone. However, in the case of internet banking same features can be accessed with the help of desktop, laptop or mobile phones using the browser. Once, installed on the mobile phones, it works as additional layer of security since device-id is also acting as a layer of authentication. It enables the holder to receive and send the money. Near Field Communication (NFC) is one of the advance mobile based payments that also need special hardware to communicate with other similar hardware in short range.

F. Micro ATMS

5. Experiment Environment and Work Flow

Aim of the micro ATM is to provide qualitative and reliable services to the consumers irrespective of their locality of residence that may be rural or urban. Being a portable device, it can be easily taken from one place to another. It bridges the gap of accessibility and availability for the citizens. Acting as a supplement to branches, Micro ATMs are small ATMs that are available to the businesses near them. Irrespective of availability, it does not compromise with the quality related to security. Clients aiming to access the account can easily access it with the help of micro ATMs. Consumers seeking to avail services can reach microATM operated by an agent who assists the customers in accomplishing a transaction. To initiate the service, consumers share their card to facilitate the transaction. Operations such as cash widrawal, balance enquiry and mini statement can be carried out with MicroATMs.

Table 3. Digital payment methods Comparison

|

Factors Instrument |

Service Activation |

Transaction Cost |

Funds transfer Limit |

1. Services Available |

|

Banking Cards |

|

merchant

applicable in case of credit cards is 1-3.5 % |

|

|

|

USSD |

|

|

|

|

|

AePS |

|

|

23. Bank Defined limit |

|

|

UPI |

|

|

30. Rs .1 million/transaction |

31. 30 Banks |

|

Mobile Wallets |

money to wallet |

|

|

38. 40 Companies |

|

Banks Pre-paid Cards |

|

|

|

|

|

Point of Sale |

|

52. Supports any card and AePS |

53. No limit from regulator |

54. 1.462 million |

|

Internet Banking |

55. Need internet accessibility permission from the bank |

56. NEFT and RTGS based payment system is supported |

57. Under RTGS minimum limit set to Rs. 2 lakh |

58. All the leading banks are offering |

|

Mobile Banking |

|

62. Zero |

63. Limit placed on the account by the bank according to the customer’s credibility and the balance. |

|

|

Micro ATMS |

|

70. Depends on the Business owner. Charges ranges from 02 % |

|

money deposit |

To analyze the digital payment happens at a variety of places such as POS (point of sale), micro ATM and other instruments of payments have been taken into account. In the dataset, ATM, POS and credit card data for the digital payment were highlighted. However, ATM based detail was dropped since it was not explicitly splitting the values in components that include withdrawal in cash and transfer of funds/payment using ATM. Hence, due to lack of clarity, this field was dropped. Table 4 depicts about the dataset, in remark column, columns that were part in the original dataset and the one inferred with the existing dataset is highlighted.

Table 4. Dataset description[7]

|

S.No |

Columns |

Description |

Remarks(Original column or inferred) |

|

1 |

Month |

Month of the year transaction happened |

Original field |

|

2 |

ATM onsite |

At ATM Site |

Original field |

|

3 |

POSOnline |

Number of POS active |

Original field |

|

4 |

Credit card outstanding |

Credit card issued |

Original field |

|

5 |

CreditCard ATM Transaction |

Transaction at ATM using credit card |

Original field |

|

6 |

Credit card POS transactions |

Credit card used at POS |

Original field |

|

7 |

Credit Card ATM Amount |

Amount withdrawn from ATM using credit card |

Original field |

|

8 |

Credit Card POS Amount |

Amount at which credit card is used at POS |

Original field |

|

9 |

outstanding Debit Card |

Total number of debit card issued |

Original field |

|

10 |

Debit Card ATM Transaction |

Debit card used for withdrawal at ATM |

Original field |

|

11 |

Debit Card POS transaction |

Debit card used at POS |

Original field |

|

12 |

Debit ATM transaction amount |

Debit card amount at ATM |

Original field |

|

13 |

Debit POS transaction amount |

Per Transaction amount at POS using Debit card |

Inferred field |

|

14 |

Credit card per transaction Value |

Per Transaction Value utilizing credit card |

Inferred field |

|

15 |

Debit card per transaction values |

Per Transaction value of debit card |

Inferred field |

|

16 |

Growth rate of credit card |

Rate at which credit card is growing |

Inferred field |

A. WorkFlow

Workflow followed during this experiment has been depicted in Figure 1. Major phases and the work carried out under a phase has been summarize as:

Load Dataset: Under the load dataset, target dataset is prepared from the monthly excel files available at NPCI site, and a consolidated excel file was prepared. This consolidated excel file was brought into the python environment. Afterwards, excel file is treated as a dataset. During the data loading, preprocessing is also carried out simultaneously, since, for instance, the header was not lying at the top row instead, it was lying at intermediate row.

Pre-process: During the pre-process phase, the data unit has been converted from Indian format into the international format for wider understanding. For instance rupees represented in ‘lakhs’ have been converted into thousands. In addition, columns that are not needed are dropped.

Load Dataset

Display data pattern inferencing new columns with the help of existing

Bringing the dataset into experiment environment

Inferencing New

Columns

Visualize the

DataSet

Analyze Dataset

Analyses of dataset

Pre-process

Removing unnecessary details from dataset

Fig. 1. Work Flow of applied approach

Inference of new column: Beyond the existing columns three new columns namely, growth rate of credit card, value of each transaction by debit card, value of each transaction by credit card was inferred from the existing columns using python.

Dataset visualization: To visualize the dataset, python libraries that include matplotlib and seaborn have been used. In order to have avuser friendly display of data, a regression graph has been used in all the figures and to draw the strong comparison, plots were displayed in adjacent row.

Analyze the dataset: Under analyze the dataset phase, the dataset visualized was interpreted. All the columns that include the original one and those derived from other columns were analyzed. Results thus revealed were interpreted and connected with the real life events.

6. Result and Discussion

-

A. Credit and Debit Card per Transaction Value

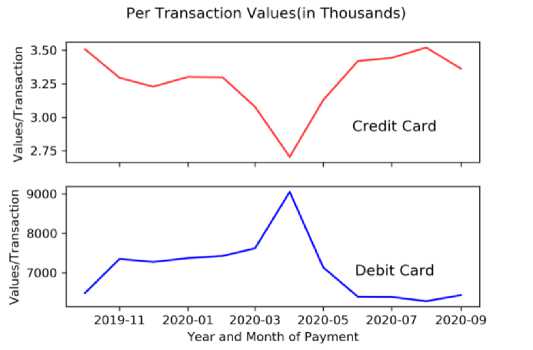

Digital payment using credit and debit card revealed an interesting pattern of payment. Debit card based payment had begun to decline since December 2019, well before the COVID-19 had surfaced. During lockdown, usage of both credit

Fig. 2. Values/ Transaction payment month wise card and debit card dropped. Post lockdown, usage pattern revealed that credit card witnessed surge in usage. In contrast, debit cards based payment reported decline in usage. This may be due to the fact that people might have exhausted the fund deposited in their account and relied on a credit card that allows them to pay the bill for expenditure incurred after 45 days of payment. Hence offer them enough opportunity to pay later and organize the fund from one source or the other.

-

B. Debit and Credit Card outstanding

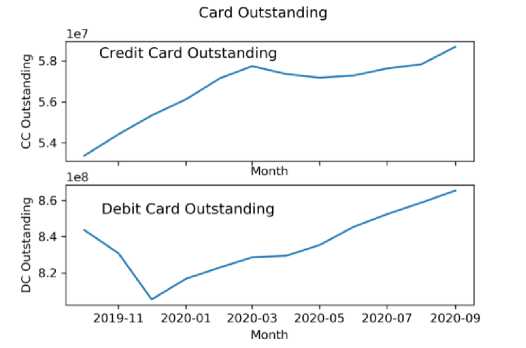

Another interesting trend surfaced related to outstanding credit and debit cards. Data revealed that despite passing several months of unlock, ‘outstanding card’ could not touch the mark that was attended before COVID-19. On the growth rate, according to figure 3, outstanding cards during and after lockdown have witnessed negative growth. This signifies that the large number of people have surrendered their debit and credit cards. Post lockdown, an encouraging data of September 2020 revealed a strong growth in the outstanding cards and registered the growth rate of 1.2 % that is one of the highest growth rates after lock down and close to the one of the highest mark that had prevailed prior to pandemic.

Fig. 3. Credit Card and Debit Card Outstanding

C. Point of Sales Analysis

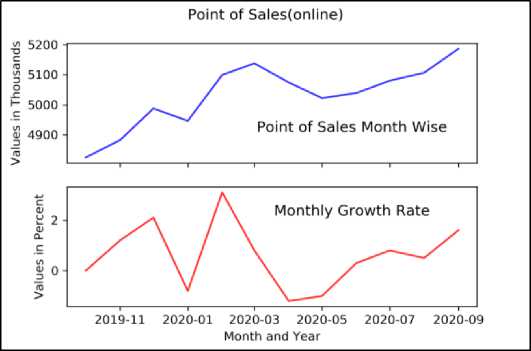

At the ‘point of sales’ side, payment had dropped during March 2020 to June 2020, that was the time of lockdown. Once the unlock process begins, usage pattern trends reached towards the value attended well before the lockdown. On deeply analyzing the growth rate of ‘‘point of sales’’, it is revealed that growth registered is not consistent. In the month of January,2020 growth rate was negative. However, in the next month that is February,2020 ‘point of sales’ have registered the highest growth rate and touched the growth mark of 2.4 percent. However, once again growth rates have fallen in the negative zone from March onwards and the same remained continued till July. Once again, in the month of September, 2020, a strong growth rate of 1.2 percent was touched that is one of the highest excluding the one attended in the month of February, 2020.

7. Conclusion

Fig. 4. ‘point of sales’ Month wise payment

On the value side of ‘Point of Sales’, no drop of payment has been reflected for the month of ‘March 2020’ that was the month when lockdown was pronounced. Instead, a surge has been reflected in figure 4. This may be due to due panic buying surfaced in March driven by the apprehension of lockdown and people have stored essential items in advance to meet their daily needs. In the month of July once again payment made at point of sales have touched the figure attended prior to covid-19 and eventually in the month of September, 2020 a new high has been attended that was much higher than the total monthly ‘value’ attended prior to COVID-19

With government policies, citizen’s participation and support of merchants, digital payment is registering strong growth. User friendly smartphone interface and rich connectivity is further boosting the digital payment. People are using this mode of payment in a range of services and perceived to be potential candidates for the replacement of physical currency. Despite laggard initially, developing countries are now gaining profound support from the people and government. Prior to Covid-19, growth rate was encouraging, post Covid-19, several modes of payments have once again touched the earlier mark. New policies and measures are further needed to be framed and propagated to the last person involved in the payment chain. This will lead to a long term growth for the digital payment, at the same time the attended growth rate will sustain for a long time.

Список литературы An Exploratory Research on Indian Digital Payment

- J. Singh, “Assessment of Digital Implementation in India and Challenges,” International Journal of Digital Literacy and Digital Competence, vol. 10, no. 2, pp. 37–53, Apr. 2019.

- G. P. Eze and D. Markjackson, “Cashless Policy and Financial Inclusion in Nigeria Dumani Markjackson Federal Polytechnic Ekowe Cashless Policy and Financial Inclusion in Nigeria,” International Journal of Research and Scientific Innovation (IJRSI) |, vol. VII, no. Ii, pp. 201–207, 2020.

- H. H. Tee and H. B. Ong, “Cashless payment and economic growth,” Financial Innovation, vol. 2, no. 1, p. 4, Dec. 2016, doi: 10.1186/s40854-016-0023-z.

- J. Singh, “LD Based Framework to Mitigate Threats in Mobile Based Payment System,” International Journal of Innovation in the Digital Economy, vol. 10, no. 4, pp. 1–17, Oct. 2019, doi: 10.4018/IJIDE.2019100101.

- planning commission, “Number and Percentage of Population below Poverty Line by states - 2011-12 based on Tendulkar Methodology,” Government of India. Accessed: Dec. 01, 2020. [Online]. Available: http://planningcommission.gov.in/news/pre_pov2307.pdf

- TRAI, “Yearly Performance Indicators Indian Telecom Sector (Fourth Edition),” 2019.

- NPCI, “Statistics.” Accessed: Dec. 10, 2020. [Online]. Available: https://www.npci.org.in/statistics

- A. B. Ozturk, “Customer acceptance of cashless payment systems in the hospitality industry,” International Journal of Contemporary Hospitality Management, vol. 28, no. 4, pp. 801–817, 2016, doi: 10.1108/IJCHM-02-2015-0073.

- P. de Almeida, P. Fazendeiro, and P. R. M. Inácio, “Societal risks of the end of physical cash,” Futures, vol. 104, pp. 47–60, 2018, doi: 10.1016/j.futures.2018.07.004.

- G. Immordino and F. F. Russo, “Cashless payments and tax evasion,” Eur J Polit Econ, vol. 55, pp. 36–43, 2018, doi: 10.1016/j.ejpoleco.2017.11.001.

- M. Humbani and M. Wiese, “A Cashless Society for All: Determining Consumers’ Readiness to Adopt Mobile Payment Services,” Journal of African Business, vol. 19, no. 3, pp. 409–429, Jul. 2018, doi: 10.1080/15228916.2017.1396792.

- V. S. Dinh, H. V. Nguyen, and T. N. Nguyen, “Cash or cashless?: Promoting consumers’ adoption of mobile payments in an emerging economy,” Strategic Direction, vol. 34, no. 1, pp. 1–4, Jan. 2018, doi: 10.1108/SD-08-2017-0126.

- Y. Zhang, G. Zhang, L. Liu, T. De Renzis, and H. Schmiedel, “Retail payments and the real economy,” Journal of Financial Stability, vol. 44, p. 100690, 2019, doi: 10.1016/j.jfs.2019.100690.

- E. Krivosheya, “The role of financial innovations in consumer behavior in the Russian retail payments market,” Technol Forecast Soc Change, vol. 161, p. 120304, 2020, doi: 10.1016/j.techfore.2020.120304.

- J. Huebner, E. Fleisch, and A. Ilic, “Assisting mental accounting using smartphones: Increasing the salience of credit card transactions helps consumer reduce their spending,” Comput Human Behav, 2020, doi: 10.1016/j.chb.2020.106504.

- P. Marmora and B. J. Mason, “Does the shadow economy mitigate the effect of cashless payment technology on currency demand? dynamic panel evidence,” Appl Econ, pp. 1–16, Oct. 2020, doi: 10.1080/00036846.2020.1813246.