Analysis and evaluation of the foreign capital in the banking sector of Russia

Автор: Tchubenko T.S.

Журнал: Экономика и бизнес: теория и практика @economyandbusiness

Статья в выпуске: 4-3 (62), 2020 года.

Бесплатный доступ

The article considers the main types and characteristics of banks with foreign capital and their importance in the domestic banking system. Indicators characterizing the participation of non-residents in the total authorized capital of operating credit organizations of Russia for the period from January 1, 2013 to January 1, 2020 analyzed. The priority areas of activity and the competitive advantages of the operation of banks with foreign capital in Russia are shown. The features of the activities of banks with foreign capital are considered.Conclusions about the possible prospects for the development of banks with foreign capital in modern conditions are indicated.

Banks with foreign capital, non-residents, total authorized capital, credit organizations, branches, subsidiaries of foreign banks, license of the bank of Russia

Короткий адрес: https://sciup.org/170182641

IDR: 170182641 | DOI: 10.24411/2411-0450-2020-10357

Текст научной статьи Analysis and evaluation of the foreign capital in the banking sector of Russia

Bank is a credit institution that has the exclusive right to collectively carry out the following banking operations: attracting deposits of funds of individuals and legal entities, placing these funds on its own behalf and at its own expense on terms of repayment, pay- ment, urgency, opening and maintaining bank accounts of individuals and legal entities.

Capital is the sum of all sources of funds of the bank. From here it is divided into two large categories:

-

1. Own capital:

Fig.1. Structure of equity capital of credit organizations.

-

2. Attracted capital:

-

– deposit capital is the funds held in the accounts of clients of a banking organization;

– non-depository capital is the funds received in bank vaults from repayment of loans by its creditors, as well as from the sale of its own debt obligations.

Adequacy of a bank’s capital is an essential indicator of its reliability; determines the ability to cope with possible financial problems on their own, and not to the detriment of their customers. As for Russian credit organizations, a capital adequacy ratio of H1.0 has been introduced. Its minimum value set by the regulator is 8.0%. The Bank of Russia is quite strict about compliance by credit organizations with the H1.0 standard. If, for example, it becomes less than 2%, the Central Bank is obliged to revoke its license [1].

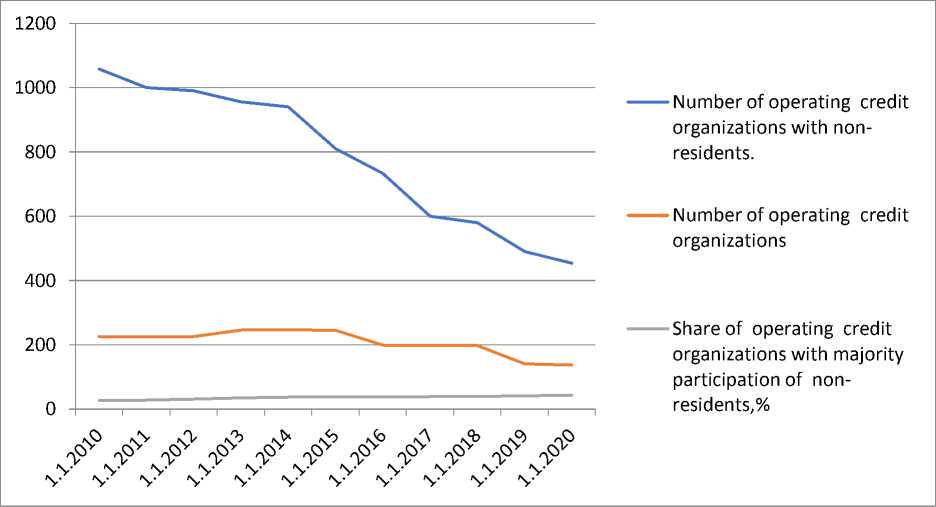

The evolution of the banking market over the past 10 years has led to the fact that now non-residents participate in 30% of credit organizations, and more than half of them (75 out of 137) own a majority stake. Over the past 10 years, “foreigners in Russia” has become much smaller, but the proportion of “survivors” has increased.

The structure of the banking system in each country is the result of the interaction of a combination of the economic and noneconomic factors, the characteristics of the formation of a competitive and regulatory environment. The number of the credit organizations, the extent of participation of foreign capital, the share of state banks, the degree of concentration of assets - these are the main factors, the combination of which forms the national specificity of banking systems.

Russia belongs to a group of countries whose banking systems, on the one hand, are dominated by residents in the ownership structure, and on the other, access for foreign capital is open. On 01.10.2019, 137 credit organizations operated with the participation of non-residents in our country, that is, 30% of their total number.

Among them, 75 credit organizations with majority participation of non-residents, where their share in the authorized capital exceeds 50%. On 1 of October of 2019, this group of banks accounts for 9.4% of total assets and 13.5% of the banking sector's own funds. Three of them – UniCredit Bank, ROSBANK and Raiffeisenbank - are among the systemically important credit organizations. It can be concluded that banks with the majority participation of non-residents form a cluster that affects the state of the competitive environment in the financial sector and the effectiveness of banking activities.

The access mode for non-residents to participate in the capital of Russian banks is characterized by the fact that, in accordance with the established procedure, a foreign investor has the right to have banking business in our country either through the creation of a subsidiary bank or through the purchase of a share in an existing credit institution. The Bank of Russia has established the features of registration of credit organizations with foreign investments. In particular, prior authorization by the Bank of Russia is required to create a bank with foreign capital, including obtaining his consent to the participation of a specific non-resident in the bank’s charter capital. Thus, all banks in Russia are registered under Russian law legal entities and have licenses of the Central Bank of the Russian Federation for banking operations.

On the one hand, the procedure established in Russia for non-residents to participate in the capital of banks does not allow the creation of branches of foreign banks. They can only be created by subsidiary banks operating under the license of the Bank of Russia. Due to this, both the inflow and outflow of speculative capital in the banking sector is sharply limited and becomes almost impossible.

The scale and dynamics of the participation of foreign capital in the Russian banking system can be divided into two large periods -before and after the global financial crisis of 2008-2009. The first stage covers the period from the beginning of the 90s of the XX century to 2010. In general, it was noted (with the exception of a pause in 1998-1999 and a change of sign from positive to negative in 2008-2009), an upward trend in the activity of foreign investors.

The arrival of non-residents in the banking sector of Russia began to gain momentum from the beginning of the 2000s, when the economy began to stabilize after the default in August 1998. The peak of the inflow of foreign capital came in the first half of 2008, when 28.5% of the total capital of banks was controlled by non-residents.

The second stage of non-residents' activity in the Russian banking sector - from 2010 to the present - is generally characterized by a downward trend, although in a number of areas foreign investors maintain and even strengthen their positions in the banking sector. The number of operating credit organizations with the participation of non-residents reached its peak at the beginning of 2014 (251 organizations).

At first, a significant role in reducing the influx of non-residents' funds into the banking sector was played by the problems of parent credit organizations, caused by the global financial crisis and its consequences. Another reason can be considered a change in the landscape of the business environment due to the imposition of sanctions. Subsidiary banks with the controlling participation of nonresidents began to lose trump cards in the competition – joining an international group and cheap foreign exchange funding. In addition, a significant part of large Russian enterprises gradually began to switch to servicing at state-owned banks.

Along with this, activity in the conduct of business by subsidiary banks is to some extent restrained conservative approach to risks taken in parent organizations. As a result, foreign investors who have not received sufficient work experience in the Russian market, who have already obtained Bank of Russia licenses, were unable to develop an adequate strategy and curtail their business. In particular, such large banks as the Dutch group Rabobank Group NV, the British banking group Barclays, the Belgian group KBC and a number of other credit organizations, left Russia.

As already noted, despite the presence of a general downward trend in the activity of non-residents in banking, one can observe a series of indicators of multidirectional trends.

On the one side, the positive dynamics of foreign investments in the aggregate authorized capital will continue, on the other side, the dynamics of the share of non-residents in the aggregate authorized capital of the banking sector has sharply decreased after 2014.

The number of operating credit organizations with non-residents participated in their peaks at the beginning of 2014 (251 organizations), and then gave way to a rather sharp decrease – to 137 banks on 01.10.2019. At the same time, the share of banks with nonresidents even increased in 2010–2019, which is explained by higher rates of license withdrawal from banks that do not have nonresidents in the ownership structure.

About the same situation is with the dynamics of the number of banks in which over 50% of the authorized capital is controlled by non-residents.

If we take the period of 2010-2019, then the increase in the number of foreign subsidiary banks was observed until 2014, when their number reached 122, but by October 2019 it had dropped to 75. However, due to the higher rate of license withdrawal from banks that are not controlled by non-residents, the share of subsidiary foreign banks even increases.

The number of operating credit organizations with non-residents participated in their peaks at the beginning of 2014 (251 organizations), and then gave way to a rather sharp decrease - to 137 banks on 01.10.2019.

At the same time, the share of banks with non-residents even increased in 2010–2019, which is explained by higher rates of license withdrawal from banks that do not have nonresidents in the ownership structure.

Due to the departure from the Russian market of a group of subsidiary foreign banks and the expansion of the activities of state-owned banks, the share of assets and equity of credit institutions controlled by non-residents tends to decrease. The share of their assets for the period 2010-2019 was halved – from 18.3 to 9.4%. The share of equity is decreasing more slowly – from 17 to 13.5%.

Source: Association of Banks of Russia on information of Bank of Russia. Fig. 2. Number of operating credit organizations with non-residents

Currently, branches of foreign banks in the Russian Federation are not registered; instead, foreign capital is involved through subsidiary Russian banks. At the same time, the total quota for the participation of foreign capital in the banking sector cannot exceed 50% [2].

Upon reaching the quota, the Bank of Russia takes the following measures with regard to foreign investment:

-

1) refuses to register a credit institution with foreign investments and issue it a license for banking operations;

-

2) imposes a ban on the increase in the authorized capital of a credit institution licensed to conduct banking operations at the expense of non-residents and the alienation of shares of a credit institution in favor of nonresidents, if the result of these actions is an excess of the quota.

With these measures, the government protects domestic financial institutions from competition from foreign banks. The fact is that the operating mode of branches of foreign banks does not fall under the jurisdiction of the Russian Federation: they cannot be fully controlled by Russian regulators, they are not required to comply with the standards for the allocation of funds to mandatory reserve funds, and report to the Central Bank in two accounting systems at once - the Russian and international, as well as monthly reporting to the Bank of Russia.

From the foregoing, we can conclude that today the creation of branches of foreign banks should be considered premature, based on the need to maintain equal competitive conditions for Russian credit organizations. However, in my opinion, the inflow of foreign capital in itself is necessary for the banking system of the Russian Federation, as it brings modern banking technologies, new financial products and a banking culture in general to the Russian market. Below there is a list of banks with foreign capital in the List of existing credit organizations with a nonresident participation in the paid authorized capital of a credit institution of 100% on 1 of January of 2020.

Table 1. List of banks with foreign capital in the List of existing credit organizations with a non-resident participation in the paid authorized capital of a credit institution of 100% on 1 of January of 2020.

|

№ |

List of existing credit organizations |

Number of registration |

Authorized capital, thouthand roubles |

|

1 |

АСBС-Bank (Joint-Stock Company) Moscow |

3475 |

10 809 500,00 |

|

2 |

Joint-Stock Commercial Bank "Asia-Invest Bank" АСBС-Bank (Joint-Stock Company) Moscow |

3303 |

216 500,70 |

|

3 |

Joint-Stock Company “Joint-Stock Commercial Bank” “ALEF-BANK" Moscow |

2119 |

1 525 817,20 |

|

4 |

American Express Bank Limited Liability Company, Moscow |

3460 |

377 244,00 |

|

5 |

Joint-Stock Company "Bank Intesa", Moscow |

2216 |

10 820 180,80 |

|

6 |

Joint-Stock Company "Bank Credit Swiss (Moscow)" |

2494 |

460 000,00 |

|

7 |

"Bank MBA-Moscow" Limited liability company, Moscow |

3395 |

4 091 782,70 |

|

8 |

Limited liability company "BMB-Bank", Moscow |

3482 |

895 000,00 |

|

9 |

"BNP PARIBA Bank" Joint-Stock Company |

3407 |

5 798 193,10 |

|

10 |

Limited liability company "Bank PSA Finance Rus" Moscow |

3481 |

1 900 000,00 |

|

11 |

Joint-Stock Commercial Bank "Bank of China" (Joint-Stock Company) Moscow |

2309 |

3 435 000,00 |

|

12 |

Limited liability company “Goldman Saks Bank” Moscow |

3490 |

1 450 000,00 |

|

13 |

Joint-Stock Company "DenizBank", Moscow |

3330 |

1 128 608,70 |

|

14 |

"J&T Bank", ( Joint-Stock Company) , Moscow |

3061 |

6 355 000,00 |

|

15 |

Commercial Bank "G.P.Morgan International"”(Limited liability company), Moscow |

2629 |

15 915 315,00 |

|

16 |

“Deutsche Bank” (Limited liability company) Moscow |

3328 |

1 237 450,00 |

|

17 |

Public Joint-Stock Company "Eurasian Bank", Moscow |

969 |

1 239 210,00 |

|

18 |

"ZiraatBank", (Joint-Stock Company) Moscow |

2559 |

1 334 807,50 |

|

19 |

Limited liability company "IcanoBank", Khimki, Moscow region |

3519 |

300 000,00 |

|

20 |

"ING BANK" (EURAZIA), Joint-Stock Company, Moscow |

2495 |

10 000 010,30 |

Source: Bank of Russia.

Foreign investments are not included in the calculation of foreign investments in the authorized capital of credit organizations licensed to conduct banking operations:

-

1) implemented in the authorized capital of credit organizations licensed to conduct banking operations, and financed from the profits of these credit organizations received in the Russian Federation or repatriated to the Russian Federation from abroad;

-

2) carried out by licensed subsidiaries of foreign banks holding banking operations to the authorized capital of credit organizations licensed to conduct banking operations, as well as all subsequent investments of these organizations in the authorized capital of credit organizations licensed to conduct banking operations;

-

3) carried out before 1 of January of 2007 in the authorized capital of credit organizations licensed to conduct banking operations [3];

-

4) carried out in the authorized capital of credit organizations licensed to conduct bank-

ing operations, the privatization of which was carried out after 22 of August of 2012;

-

5) constituting 51 or more percent of the shares (shares) of the authorized capital of a credit institution licensed to conduct banking operations carried out after 1 of January of 2007, provided that these shares (shares) are located in in the ownership of the investor for 12 years or more, if the Bank of Russia after the specified period has not decided to continue to include these investments in the calculation and did not publish this decision. The procedure for the Bank of Russia to make this decision and publish it is established by the Bank of Russia.

On 1 of January of 2020 (Table 2), 133 credit organizations with the participation of non-residents were registered and have a license for banking operations (in 2019 the number of such credit organizations decreased by 8). According to the data on 1 of January of 2020, non-residents' investments in the total authorized capital of operating credit organizations increased by 9231.5 mil- lion rubles, or 2.4%, and amounted to 400953.8 million rubles.

The total authorized capital of operating credit organizations for 2019 increased by 186904 million rubles, or 7%, and on 1 of January of 2020 amounted to 2884632 million rubles. The size of non-residents' participation in the total authorized capital of operating credit organizations decreased by 0.62 percentage points and, on 1 of January of 2020, amounted to 13.90%. In 11 credit organizations, non-resident participants, whose combined share in the authorized capital is more than 50%, are under the control of residents of the Russian Federation.

The participation of non-residents in the authorized capital of this category of credit organizations during 2019 increased by 4759.2 million rubles. and on 1 of January of 2020 amounted to 31040.3 million rubles.

Investments by non-residents in the total authorized capital of existing credit organizations, excluding the participation of nonresidents controlled by residents of the Russian Federation, on 1 of January of 2020 increased by 4472.3 million rubles. and amounted to 369 913.5 million rubles.

Table 2. Indicators characterizing the participation of non-residents in the total authorized capital of operating credit organizations 2013-2020

|

Indicators |

01.01.2013 |

01.01.2014 |

01.01.2015 |

01.01.2016 |

|

Number of operating credit organizations with non-residents, total. |

246 |

251 |

225 |

199 |

|

Investments of non-residents in the aggregate authorized capitals of operating credit organizations, miliion rbl. |

366 144,00 |

404 841,90 |

405 599,20 |

408 508,60 |

|

Aggregate authorized capitals of operating credit organizations, miliion rbl. |

1 401 030 |

1 532 615 |

1 870 731 |

2 417 288 |

|

Dynamics of foreign investments in the aggregate authorized capitals of operating credit organizations to 01.01.2007, % |

406,4 |

449,4 |

450,2 |

453,4 |

|

Dynamics of the aggregate authorized capital of all bank system to 01.01.2007, % |

247,3 |

270,5 |

330,2 |

426,7 |

|

Share of non-residents in the aggregate authorized capital of operating credit organizations, % |

26,13 |

26,42 |

21,68 |

16,90 |

|

Share of non-residents in the aggregate authorized capital without participation of non-residents under the control of residents of Russian Federation , % |

23 |

23 |

18,4 |

14,27 |

|

The size of the participation of foreign capital in the total authorized capital of operating credit organizations, calculated in accordance with Article 18 of the Federal Law “On Banks and Banking Activities”,% |

- |

- |

- |

13,44 |

|

The size of the participation of foreign capital in the total authorized capital of credit organizations, excluding foreign investments, comprising 51 or more percent of the shares (shares) of the authorized capital carried out after January 1, 2007, under condition provided that the said shares (shares) are owned by the investor for 12 or more years, (%) |

- |

- |

- |

- |

Continuation of table 2

|

Indicators |

01.01.2017 |

01.01.2018 |

01.01.2019 |

01.01.2020 |

01.01.2020 к 01.01.2019, в % |

|

Number of operating credit organizations with non-residents, total |

174 |

160 |

141 |

133 |

94,3 |

|

Investments of non-residents in the aggregate authorized capitals of operating credit organizations, miliion rbl. |

407 255,20 |

403 371,00 |

391 722,30 |

400 953,80 |

102,4 |

|

Aggregate authorized capitals of operating credit organizations, miliion rbl. |

2 458 486 |

2 670 170 |

2 697 728 |

2 884 632 |

106,9 |

|

Dynamics of foreign investments in the aggregate authorized capitals of operating credit organizations to 01.01.2007, % |

452,0 |

447,7 |

434,8 |

445,0 |

Χ |

|

Dynamics of the aggregate authorized capital of all bank system to 01.01.2007, % |

434,0 |

471,3 |

476,2 |

509,2 |

Χ |

|

Share of non-residents in the aggregate authorized capital of operating credit organizations, % |

16,57 |

15,11 |

14,52 |

13,90 |

Χ |

|

Share of non-residents in the aggregate authorized capital without participation of non-residents under the control of residents of Russian Federation , % |

14,29 |

13,44 |

13,55 |

12,82 |

Χ |

|

The size of the participation of foreign capital in the total authorized capital of operating credit organizations, calculated in accordance with Article 18 of the Federal Law “On Banks and Banking Activi-ties”,% |

13,51 |

12,94 |

12,41 |

11,79 |

Χ |

|

The size of the participation of foreign capital in the total authorized capital of credit organizations, excluding foreign investments, comprising 51 or more percent of the shares (shares) of the authorized capital carried out after January 1, 2007, under condition provided that the said shares (shares) are owned by the investor for 12 or more years, (%) |

- |

- |

- |

11,94 |

Χ |

The amount of non-residents' participation in the total authorized capital of operating credit organizations, excluding the participation of non-residents controlled by residents of the Russian Federation, decreased by 0.73 percentage points and, on 1 of January of 2020, amounted to 12.82%.

Calculated by the Bank of Russia in the manner specified in Article 18 of the Federal Law “On Banks and Banking Activities”, the size of the participation of foreign capital in the total authorized capital of existing credit organizations on 1 of January of 2020

amounted to 11.79%. For the first time in accordance with the legislation, when calculating the amount of foreign capital participation on 1 of January of 2020, foreign investments of 51% and more than percent of the shares (stakes) of the authorized capital carried out after 1 of January of 2007, provided that the said shares have been owned by the investor for 12 or more years. Excluding this exemption, the size of the participation of foreign capital in the total authorized capital of credit organizations would be 11.94%.

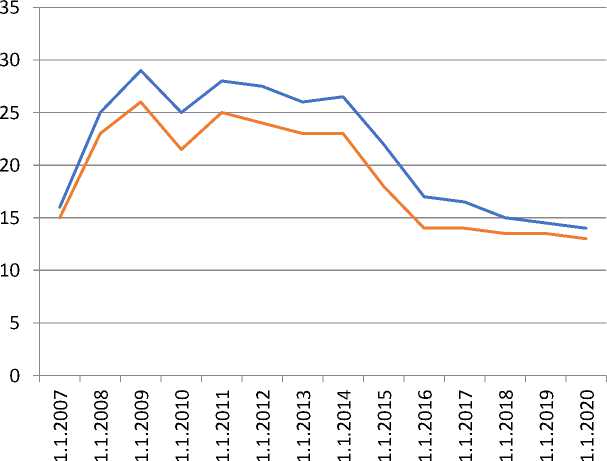

- ■ Rate of growth of foreign investments in the aggregate authorized capital of operating credit organizations.

^^^^^^^в Rate of growth of the aggregate authorized capital

Source: Bank of Russia

Fig. 3. Dynamics of the growth of foreign investments in the aggregate authorized capital of operating credit organizations and of growth aggregate authorized capital of all bank system to 01.01.2007, %

In 59 credit organizations (54 banks and 5 non-bank credit organizations), the authorized capital is 100% formed at the expense of nonresidents. The number of such credit organizations in 2019 decreased by 2. The size of the participation of non-residents in the au- thorized capital of credit organizations of this group for 2019 increased by 6227.1 million rubles and on 1 of January of 2020 amounted to 273273.1 million rubles. In 3 banks of this group, non-resident participants are controlled by residents of the Russian Federation.

^^^^^^^^вShare of non-residents in the aggregate authorized capital without participation of non-residents under the control of residents of Russian Federation

- - Share of banks with non residents in the aggregate authorized capital of operating credit organizations.

Source: Bank of Russia

Fig. 4. Dynamics of the share of non-residents in the total authorized capital of existing credit organizations, to 01.01.2007, %

In 15 credit organizations (14 banks and 1 non-bank credit organization) the participation of non-residents in the authorized capital is more than 50%, but less than 100%. The number of such credit organizations in 2019 decreased by 1. The amount of non-residents' participation in the authorized capital of credit organizations of this group in 2019 increased by 2065.5 million rubles. and on 1 of January of 2020 amounted to 43773.3 million rubles. In 8 credit organizations of this group, non-resident participants are controlled by residents of the Russian Federation.

Among the huge number of foreign structures I want to single out Raiffeisenbank, a bank which is now very actively gaining popularity among the population. The Raiffeisenbank Joint-Stock Company was registered by the Bank of Russia on 10.06.1996. At the moment, the authorized capital of the organization is 36 711 260 000.00 rubles, the latest date of change in the amount of the authorized capital: 13.01.2009.

Raiffeisenbank is a subsidiary of Raiffeisen Bank International AG. Raiffeisenbank is one of the most reliable Russian banks, which creates financial solutions for private and corporate clients, resi- dents and non-residents of the Russian Federation. According to Interfax-CEA, Raiffeisenbank is ranked 9th in terms of assets by the end of 2019, 8th in terms of private funds and 10th in terms of loans to individuals. According to Forbes magazine, Raiffeisenbank is recognized as the most reliable bank in Russia in 2020.

Priority areas of activity:

-

– lending to individuals, as well as micro, small and medium enterprises;

-

– lending to the real sector of the economy;

-

– issuing and servicing bank cards;

-

– investment banking operations;

-

– documentary operations and all internationally accepted forms of settlements for export and import contracts;

-

– depository and brokerage services;

-

– conversion operations on behalf of customers and at the expense of the bank;

-

– settlement and cash services and physical persons in rubles and foreign currency;

-

– operations to attract deposits from private investors and corporate clients;

-

– operations with securities.

Key RAS financials:

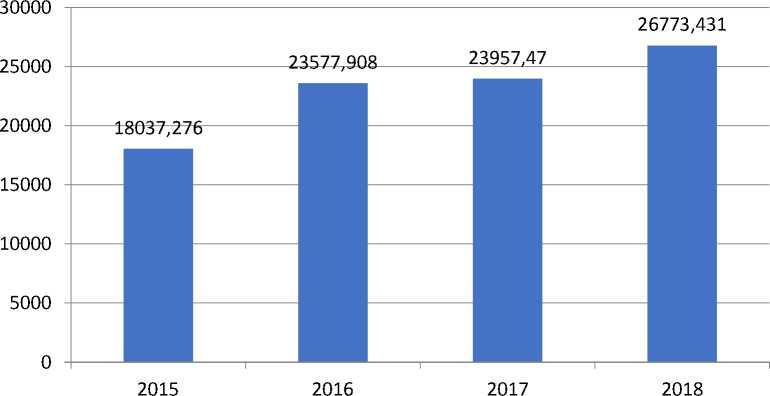

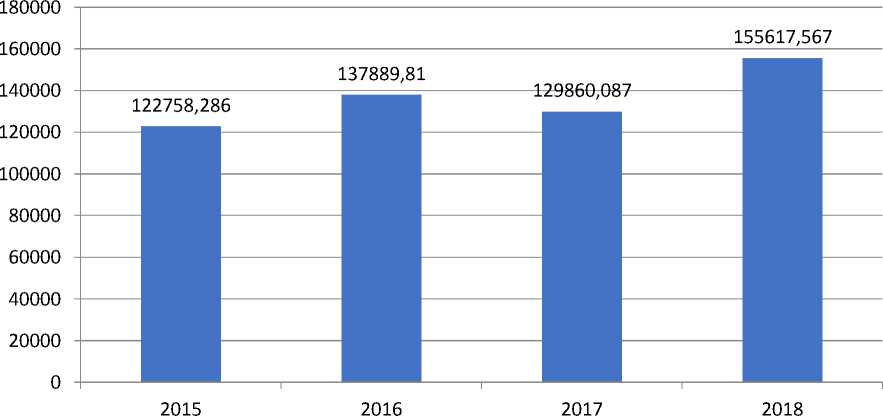

Fig. 5. Indicators of net profit of Raiffeisenbank in 2015-2018, million roubles

There is an annual increase in net profit. In 2018, the increase in net profit compared to 2017 amounted to 10.5%. The main factors behind the increase in profit were the increase in net fee and commission income, net interest income, and trading result. Net fee and commission income increased by 8.6% to RUB 17763.9 million. due to the growth of fee and commission income on settlement transactions, documentary business and asset management fees.

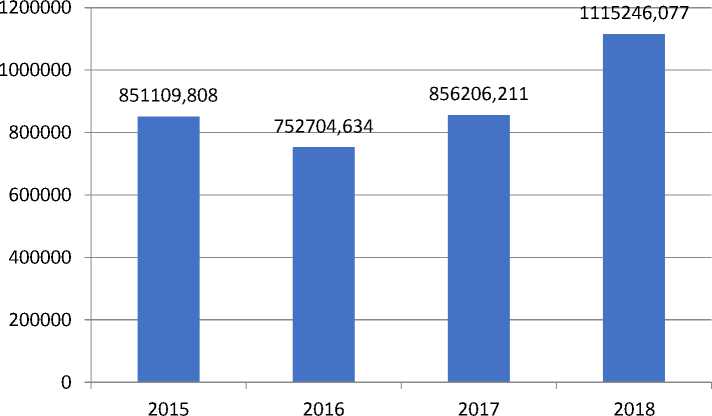

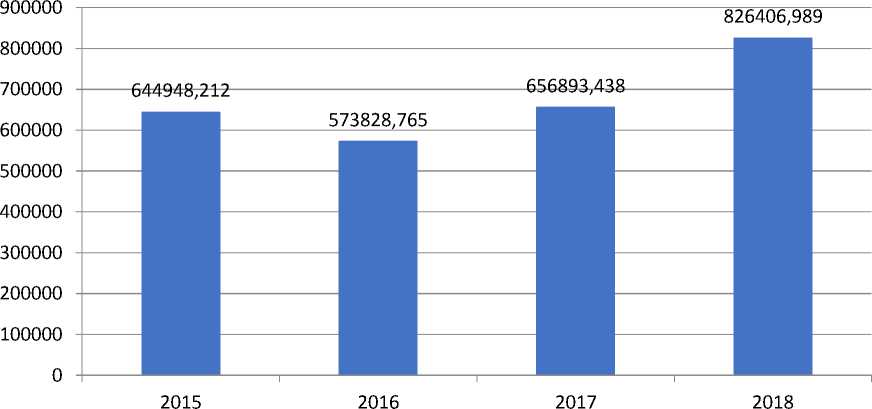

Fig. 6. Indicators of assets of Raiffeisenbank in 2015-2018, million roubles

The share of liquid assets in 2018 amounted to 32.5%. The investment portfolio of securities with a maturity of up to three months amounted to 225740.5 million rubles, cash and cash equivalents showed an increase of

36.6% to 225925.6 million rubles, the main growth was provided by the growth of repurchase transactions, as well as the growth of placements in the Central Bank of the Russian Federation.

Fig. 7. Indicators of Raiffeisenbank's capital in 2015-2018, million roubles

The Bank historically exceeded the Central Bank's liquidity standards: Н2 as of 01.01.2019 amounted to 105.0% (with a regulatory minimum of 15%), Н3 as of the same date was 136.8% (with a regulatory minimum of 50%), Н4 was 48.6% (with a regulatory maximum of 120%).

Fig. 8. Indicators of Raiffeisenbank's net loan debt in 2015-2018, million roubles

The portfolio growth was observed in the following segments: medium-sized business (+59.7% to 57382.8 million rubles), small and micro business (+ 23.6% to 22030.9 million rubles), retail customers (+ 20.9% to 266762.3 million rub.). The main growth factor among the products of the retail loan portfolio was mortgage loans, an increase of 23.9% to 118357.6 million rubles and unsecured loans by 23.6% to 127660.8 million rubles [4].

In 2018, Raiffeisenbank received permission from the Bank of Russia to use the TAC approach in assessing credit risk based on the bank's internal ratings. The permit entered into force on February 1, 2019. The effect on capital adequacy ratios was estimated at 80 basis points. Raiffeisenbank became the second bank in Russia after Sberbank which have received the right to apply the TAC approach. This status confirms the high quality of the bank's loan portfolio, as well as a high level of credit risk management [5].

In general, the presence of banks with foreign participation is useful for Russia. In this regard, the main advantages from the participation of foreign capital in the Russian banking system are noted.

Subsidiary foreign banks have an important competitive advantage - reliability and use of advanced customer service technologies. Due to the higher level of trust, outflow of funds of the population into state-owned banks affected foreign subsidiaries to a much lesser extent than the vast majority of private Russian banks. The share of household deposits placed in subsidiary banks decreased over the period 2010–2019 from 12% to 8.4%. The higher rate of decline in account balances of legal entities (from 18.5% to 10.9%) is largely due to the transition after 2013 of systemically important Russian enterprises to servicing state-controlled banks.

It is important to emphasize that foreign subsidiaries have a high potential for competitiveness by supporting the parent company, an effective risk management system and cost management. The extent of their participation in the formation of profit for the current year was invariably higher than the share of their assets, equity and loan portfolios in the total balance sheet of the Russian banking sector. The stability of foreign subsidiaries to external shocks is higher than that of private Russian banks. In relation to them, no sanitation and financial recovery procedures were carried out. There were no facts of revocation of licenses, except in cases of their voluntary surrender [6].

The foregoing gives reason to draw a general conclusion that this cluster of the national banking system makes it more stable, contributes to the development of competition and supports the open character of the Russian economy.

Thus, the main advantages of the participation of foreign capital in the Russian banking system are as follows:

-

1. the availability of modern banking technologies to provide customers with a full range of banking services, developed taking into account foreign experience;

-

2. the availability of modern management and marketing methods worked out in various developing markets;

-

3. the use of risk control mechanisms tested in emerging markets;

-

4. high reliability based on powerful financial resources (at the expense of the parent bank) and a long history of activity;

-

5. high credit rating of banks with foreign capital, which allows them to attract financial resources at lower interest rates, and to develop deposit and credit policies that are more competitive than those of national credit organizations;

-

6. the ability to provide qualified assistance to clients in entering international financial markets not only in terms of providing funds, but also in terms of counseling and the provision of the full range of related services.

Summing up everything, it should be noted that at present time the role of foreign inves- tors in increasing the capitalization of the Russian banking sector is becoming more noticeable. Despite the negative consequences from the participation of foreign capital in the Russian banking system, in my opinion, it needs the presence of foreign capital.

At the same time, in order to attract foreign investment in the Russian economy, in particular in its banking sector, and increase the confidence of foreign partners, it is necessary to improve the legislative support of investor rights, to improve the quality of corporate governance at enterprises and organizations in all sectors of the economy, to reduce noncommercial investment risks, to accelerate the transition of enterprises and organizations to international accounting and financial reporting standards.

Thus, the presence of foreign capital in the banking sector contributes to increased competition in the Russian banking services market, which is a positive factor in its development. Therefore, it is necessary to stimulate the activities of foreign participants. However, this is quite difficult due to the existing anti-Russian sanctions.

Список литературы Analysis and evaluation of the foreign capital in the banking sector of Russia

- Instruction of Bank of Russia dated November 29, 2019 N 199-I "On Mandatory Ratios and Premiums on Bank Capital Adequacy Ratios with a Universal License".

- Federal Law On Amendments to Articles 16 and 18 of the Federal Law

- "On Banks and Banking Activities"dated 12.12.2015 N 372-ФЗ (latest revision).

- Gukova I.N., Gorbunova E.I. Theoretical aspects of the study of banking in Russia // Modern trends in the development of science and technology. - 2017. - №1. - P. 41-46.

- Kovaleva E.I., Gorbunova E.I. The role of credit organizations with foreign participation in the authorized capital in the banking system of the Russian Federation // Innovations in science: a scientific journal. - 2017. - №10 (71). - P. 81-84.

- Why do banks with foreign participation leave Russia. - [Electronic resource]. - URL: http: //izvestia.ru/news/610159. Circulation time 03.02.2020

- Handruev A. Activities of banks with foreign participation in the Russian Federation. - [Electronic resource]. - URL: https://bankir.ru/. Circulation time 04.02.2020.