Analysis and forecast of competitiveness of Russian investment equipment in the foreign markets

Автор: Borisov Vladimir N., Pochukaeva Olga V.

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Sectoral economic studies

Статья в выпуске: 2 т.14, 2021 года.

Бесплатный доступ

The conducted research was aimed at developing and advancing methods of studying the impact of investments with a high share of costs of machines and equipment, scientific studies and developments for competitiveness dynamics of Russian investment equipment and construction of forecast options for its export. The studied groups of investment equipment were formed from high-tech, technically complex, and expensive types of products. The object of the study is the competitiveness of domestic investment equipment in the foreign markets. We considered the expansion of the export geography, which allowed exploring the competitiveness in the main (traditional) markets and in the growing (including new ones) markets of the far abroad countries. The authors have assessed the demand stability. The tasks, achieved in the reported study, are aimed at identifying the dependencies of quantitative assessments of competitiveness on quantitative assessments of investment factors, impact of which determines the pace and efficiency of the development of investment equipment production at Russian enterprises. The developed system of indicators allows obtaining quantitative, voluminous, and price estimates of investment equipment exports to the foreign countries and to assess and predict on its basis the pace of high-tech and technological development of this important branch of domestic engineering. The results of the study show a necessity to significantly increase spending on research and update of production equipment. The growth of knowledge-intensive investments will make it possible to expand the range of investment equipment with technological competitiveness on the global market. The conducted research has shown that the tools, existing and applied in the Russian Federation, allow us to ensure the constructive dynamics of factors affecting the competitiveness of mechanical engineering and its products. However, the resources that determine the impact of these tools are still insufficient.

Mechanical engineering, investment equipment, investment in fixed capital, competitiveness, export, technological structure of investments, knowledge intensity of investments

Короткий адрес: https://sciup.org/147234738

IDR: 147234738 | УДК: 338.27 | DOI: 10.15838/esc.2021.2.74.3

Текст научной статьи Analysis and forecast of competitiveness of Russian investment equipment in the foreign markets

Strategic tasks of the country’s development include high-performance export-oriented sector in industrial sectors, a significant increase in exports of non-primary sector products including the achievement of an annual export volume of machine-building products in the amount of 50 billion US dollars by 20241. This task is rather difficult, given that in recent years, the volume of exports of mechanical engineering products amounted to 28–29 billion $2. Its solution can be provided, first of all, by increasing efficiency and reliability of the operational parameters of the exported equipment.

At the same time, in the domestic and foreign markets, the competitiveness of domestic industrial products is the most important factor in Russian economy development, its diversification and sustainability which will allow solving the problems associated with growing exports of high-tech expensive products and developing import substitution. The economic justification of the domestic demand for investment equipment as a component of the investment flow to fixed assets is presented in [1; 2], and the innovative and technological one is in [3]. The competitiveness matrix fully discloses the concept of “competitiveness of investment equipment”, suitable for predictive and analytical research which can be filled with reliable statistical information. Its first column vector contains technical and operational characteristics; the second is price characteristics, the third – market characteristics and features of the promotion of investment equipment on the market. In mathematical theoretical models, a smaller number of indicators are used [4; 5]. In application models, one indicator is often used – the share of equipment in the market. However, from our point of view, it is the result of a large set of measures and efforts of manufacturers of investment equipment. We think that the influence process of investments on export dynamics deserves special study as a way to increase and display the competitiveness of domestic manufacturers of investment equipment in the market3.

When assessing the competitiveness of manufacturing products on the world market, it is necessary to take into account many factors that act simultaneously or with a certain periodicity on various market sectors of manufacturing products including factors that shape the purchasing power of consumers. Especially difficult in this aspect is the relatively small-scale and very diverse product range of the investment equipment market – the largest among the markets for products of the machinebuilding industries.

The purpose of the work is a predictive and analytical study of the impact of technical and technological, knowledge-intensive investments on the dynamics of competitiveness and construction of forecast options for investment equipment export, i.e., knowledge-intensive and technical and technological development of this most important component of domestic engineering which affects both the quality of mass production of technically complex consumer goods, and production of defense and dual-use products. The proposed method of assessing competitiveness is based on the study of the dynamics of export volumes, specific export prices and expansion of the exports’ geography by investment equipment groups. In recent years, against the background of quantitative shifts in the world economy, high-tech industries have developed at a faster pace [6], so when conducting research, the studied groups of investment equipment are formed mainly from high-tech, technically complex, and expensive types of products. The object of the research is competitiveness of domestic investment equipment in the markets of foreign countries which allows considering competitiveness of both the main (traditional) and growing (including new) markets. The research tasks are aimed at identifying the dependencies of quantitative assessments of competitiveness on quantitative assessments of factors affecting the development of investment equipment production at Russian enterprises. We should note that there are quite a lot of research developments on this issue, but they are usually devoted either to narrow, local markets of buyers and sellers, or to certain types of equipment, or to issues of methodology or management [7–12].

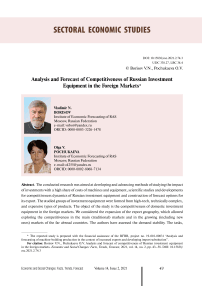

The main growth factors in domestic investment equipment export (Fig. 1) over the previous decade are the factors of production development at domestic enterprises: renewal of the active part of fixed assets and introduction of innovative technologies, as well as institutional factors supporting Russian equipment export. Creation of the Russian Export Center (REC)4 to support nonresource and non-energy businesses contributed to the geography expansion of the domestic investment equipment market. For instance, in 2008–2018, Russian investment equipment market has increased by 30 importing countries that are a part of the permanent group [13]. Currently, domestic investment equipment is exported to more than

Figure 1. Growth rates of output, export and import of domestic investment engineering products,%, 2010 = 100%

— ■ — Production of investment engineering products

—*— Export of investment engineering products

—•— Import of investment engineering products

Source: Foreign Trade Customs Statistics of the Russian Federation. Annual Collection. Moscow: Federal Customs Service of RF, 2010–2019; Russian Statistical Yearbook: stat. coll. Moscow: Rosstat, 2011–2020.

110 countries around the world5 . Russian exports support by companies that are REC members may contribute to influence growth of the financial factor on the dynamics of exports of domestic products, as financial assistance is also among the support measures. It is clear that export is a necessary condition for existing and functioning investment equipment production.

Successful promotion of domestic investment equipment to new markets of foreign countries is ensured by the dynamics of the set of parameters of technological competitiveness. The assessment of these parameters is possible by the indicators of the dynamics of the export characteristics of complex expensive types of exported products. The study of the indicators’ dependence on the characteristics of investment activity in the industries that produce such equipment allows obtaining quantitative estimates of the interaction of investment and industry technical and technological factors. These estimates are the basis for the construction of forecast options for developing production and export activities of investment engineering.

An approach to studying investment equipment competitiveness

The study covers 2010–2019. The period is divided into two identical five-year intervals: 2010–2014 and 2015–2019. During the last 10 years, the period 2010–1014 was the most favorable in terms of investment activity in investment engineering: investment growth in fixed assets was 162.4%, in machinery, equipment and vehicles – 164.3%, growth of expenditures on research and development – 162.7%, on technological innovations (ZTI) – 122.4%6.

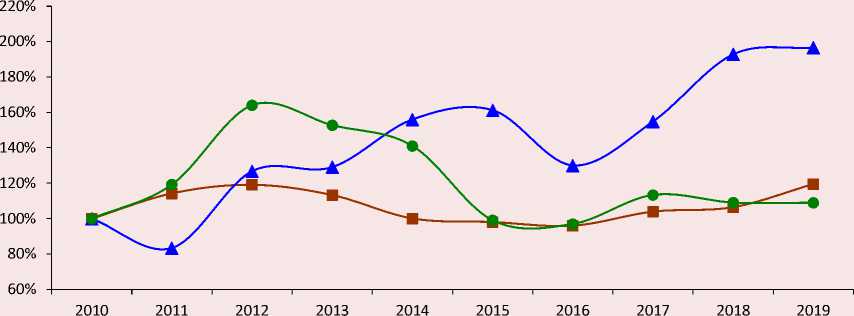

Sharp drop in domestic market demand for investment vehicles in 2015–2016 (decline in demand was 30% compared to the level of 2012– 2013) and slow growth in subsequent years (Fig. 2) led to a significant decrease in investment in fixed assets at enterprises that produce investment equipment. As the main part of investments is formed at the expense of the enterprises’ own funds, the decrease in income negatively affected the investment activity.

Figure 2. Growth rate of domestic market demand for investment products, %, 2010 = 100%

Source: Russian Statistical Yearbook: Stat. Coll. Moscow: Rosstat, 2011–2020.

engineering can be achieved mainly due to the prolonged impact of investment activity factors in the previous period. However, we should remember that in the branches and industries of investment engineering, there are different investment dynamics in fixed assets and dynamics of qualitative changes in the structure of these investments; hence, a very significant difference in dynamics of competitiveness for individual types of products is possible. In general, in the investment of machinery industry, export revenue in 2015–2019 increased by 11% compared to the previous period. Export revenue for hydraulic turbines doubled, for engines and power plants – by 71%, for lifting and transport equipment – by 67%, for freight cars – by 50%. At the same time, for certain types of high-tech, expensive investment equipment, there was a significant decrease in export revenue: for processing centers – by 2.7 times, for lathes – by 1.6 times, for tractors for agriculture and forestry – by 1.5 times.

We have selected types of products for assessing competitiveness according to the main nomenclature groups of investment equipment7. From each group, the types of products (according to four-digit code) that meet the criteria of complex, high-tech, expensive types of investment equipment and are provided with statistical data for calculating the effects indicators are identified. For example, from the group of agricultural machinery, tractors for agriculture and forestry are included in the study, but combine harvesters are not included, as the lack of natural export indicators does not allow calculating unit prices. In the structure of exports of investment equipment, the share of products included in the study in 2010–2014 it was 24%, in 2015–2019 – 30%. Thus, exports growth is mainly due to an increase in the volume of deliveries of complex, high-tech, expensive types of investment equipment.

Quantitative characteristics of foreign trade activity, as a rule, have a high degree of instability in the annual dynamics of volumes, both in value and in kind. This is due to the fact that: (1) groups formed by four-digit codes include products of different values, so more or less expensive types may prevail in different years; (2) export contracts may begin or end which also determines the volume of annual deliveries; (3) dynamics of world prices of foreign trade may also affect the value indicators of exports. Therefore, the effects of foreign trade activities of Russian manufacturers of investment equipment are presented by quantitative and structural indicators in the average annual rate for each of the two analyzed periods. The comparison allows assessing qualitative shifts in the export indicators of investment equipment which correspond to the shifts in its competitiveness.

The indicators, included in the effects matrix, make it possible to assess export structure quality and its changes over time. Export revenue is estimated by the value indicators of exports of this type of product at current prices. The specific weight of this equipment type in export structure of the enlarged group (lathes in the group of metalworking equipment or tractors in the group of machines for agriculture) is taken into account. For example, this indicator for lathes is calculated as the ratio of export revenue for lathes to the total export revenue for a group of metalworking equipment. The growth of the indicator indicates an increase in the share of expensive, high-tech equipment. Unit export prices show changes in the technological competitiveness of exported products. Of course, the unit prices of exports may be affected by instability of prices on the world market of these products, but this influence can not be strong and long-term. The ratio of the types of products that are included in the four-digit group has a decisive impact. The decline in this indicator indicates a decrease in the export of expensive products that have high competitiveness in terms of technological indicators. The ratio of unit export and import prices characterizes the ratio of price characteristics in foreign trade activities. A significant excess of specific export prices over specific import prices indicates that the exported equipment is knowledge-intensive, technically complex and expensive, and simple, relatively inexpensive equipment prevails in imports.

Assessment of investment equipment competitiveness by export performance indicators

The growth of competitiveness indicators is observed for most types of investment equipment included in this study. Exports, estimated by the value of export revenue, and the unit export price increased. This indicates an increase in the share of technically complex, expensive equipment in the total volume of exports for this type of equipment within the nomenclature group by four-digit codes. In some cases, a decrease in the unit export price is accompanied by an increase in export revenue and the share of this equipment in the total volume of exports for the corresponding group of equipment, for example, exports of forging and pressing equipment (Tab. 1) .

The decline in competitiveness indicators is most typical for certain types of metalworking equipment and tractors. A significant decrease in export volumes is observed in the group of processing centers. At the same time, in 2015–2019, there was a high increase in specific export prices. Consequently, domestic manufacturers carried out an exclusive production of very complex and expensive equipment during this period. But this has only happened twice: in 2015, more than 1 million dollars worth of equipment was delivered to China, and in 2017, about 2 million dollars worth of equipment was delivered to Saudi Arabia.

Table 1. Matrix of effects by types of investment products (In terms of exports to non-CIS countries)

|

Development factors |

Foreign trade activity effects on an average annual basis |

||||

|

Type of investment equipment |

Index of qualitative changes in technological structure ITstr % |

Export revenue, mil. doll. |

Specific weight of the type of equipment in the export structure of the enlarged group, % |

Unit export prices, thou. doll. |

Ratio of unit export and import prices, times |

|

Hydraulic turbines |

2010–2014 100.1 2015–2019 102.0 |

8.8 17.6 |

10.8 14.9 |

34.4 25.1 |

2.0 1.2 |

|

Engines and power plants |

2010–2014 98.1 2015–2019 103.1 |

184.5 315.7 |

11.1 13.6 |

81.3 124.4 |

4.7 8.2 |

|

Processing centers |

2010–2014 96.5 2015–2019 55.3 |

2.7 1.0 |

2.2 1.1 |

93.4 276.2 |

0.7 1.5 |

|

Turning machines |

2010–2014 98.3 2015–2019 43.0 |

6.1 3.9 |

4.9 4.4 |

47.9 46.0 |

1.3 1.2 |

|

Forging and pressing equipment |

2010–2014 113.7 2015–2019 102.1 |

21.8 23.5 |

17.4 26.4 |

50.2 47.9 |

6.5 10.9 |

|

Tractors for agriculture and forestry |

2010–2014 96.3 2010–2014 198.6 |

53.7 36.5 |

69.2 48.0 |

52.7 21.3 |

1.7 1.2 |

|

Lifting and transport equipment |

2010–2014 102.1 2015–2019 101.3 |

20.9 34.7 |

8.8 14.9 |

216.9 178.8 |

5.4 6.1 |

|

Bulldozers |

2010–2014 100.2 2015–2019 118.6 |

36.8 24.5 |

15.6 10.6 |

164.7 77.2 |

2.1 0.9 |

|

Railway locomotives |

2010–2014 124.3 2015–2019 75.6 |

37.3 27.8 |

17.6 14.9 |

1370.0 875.3 |

6.4 5.5 |

|

Freight stocks |

2010–2014 111.3 2015–2019 104.6 |

35.8 53.6 |

16.9 28.7 |

44.7 35.6 |

1.5 2.0 |

Source: Foreign Trade Customs Statistics of the Russian Federation. Annual Collection. Moscow: Federal Customs Service of RF, 2010–2019.

The production of such complex and expensive equipment indicates high competitiveness of certain types of products, but this is not enough to ensure export growth. Other equipment that is in high demand on the world market should also be competitive.

Machine tool construction is a strategically important industry for economic development [19]. In countries with a developed machine tool industry, the share of exports in the output structure of these products is more than 29% which exceeds the same indicator for the automotive industry [6]. A decrease in export of such equipment indicates a decrease in competitiveness, and possibly production termination. The recovery of exports of metalworking equipment is complicated by the fact that it is included in the lists of dual-use products. “This means that a transaction with a foreign buyer turns into a complex procedure for passing export control” [20, p. 59].

Export volume of tractors for agriculture and forestry has significantly decreased. Other indicators, such as the unit price of exports, have also decreased. In this case, decline in competitiveness is most likely the result of a significant and prolonged underfunding of industry technical and technological renewal which did not make it possible to increase production volume of competitive products. In 2015–2019, domestic market demand for tractors increased significantly: the growth of supplies to the domestic market was 139%8, growth of imports – 119%9, while the capacity utilization rate was 13.8%10 (in the previous period – 27.4%). The extremely low utilization of existing production capacities with increase in demand indicates an extremely low rate of production equipment updating and introduction of advanced technologies. However, the prolonged impact of the growth of industry costs on the technological renewal of production equipment in 2015–2019 allows predicting an increase in tractor exports in 2020–2024.

A similar situation has developed with regard to bulldozers: unit export prices have halved, while capacity utilization has decreased from 38 to 19%. The results are quite different in the sectors where high investment activity was observed in 2010–2014, for example, in railway engineering. Particularly significant is the export of freight stocks which was small in volume and was mainly limited to deliveries to Eastern European countries and Mongolia. In 2015–2019, exports increased by 1.5 times, mainly due to the expansion of its geography. Export growth is provided by growth of technological competitiveness [21].

Assessment of investment equipment competitiveness for export to foreign markets

Division of non-CIS markets into main and growing ones (Tab. 2) conducted according to the following indicators: (1) group of main markets includes importing countries, Russian exports of investment equipment to which have been stable over the past decades, exceeding 1% of the total export of investment equipment; (2) group of growing markets consists of importing countries, Russian exports of investment equipment to which have been increasing over the previous 10 years. Group of main markets includes 11 countries including the largest importers of Russian investment equipment: China – 17.7% of total exports of investment equipment, India – 8.9%, Germany – 7.5%, the United States – 4.3%.

Table 2. Structure of export of investment equipment to non-CIS countries, %

|

Type of investment equipment Hydraulic turbines |

Periods of investment activity 2010–2014 2015–2019 |

Distribution of investment equipment exports to non-CIS markets |

Reference |

|||

|

Total 100 100 |

Main markets 0.0 3.4 |

Growing markets 84.2 82.9 |

Other markets 15.8 13.7 |

export dynamics 2019–2015 to 2010–2014 202.3 |

||

|

2010–2014 |

100 |

85.2 |

4.0 |

10.8 |

||

|

Engines and power plants |

2015–2019 |

100 |

91.5 |

4.4 |

4.1 |

170.9 |

|

Processing centers |

2010–2014 |

100 |

6.8 |

1.8 |

91.4 |

37.0 |

|

2015–2019 |

100 |

45.5 |

16.2 |

38.6 . |

||

|

Turning machines |

2010–2014 |

100 |

28.7 |

29.2 |

42.1 |

63.9 |

|

2015–2019 |

100 |

17.7 |

30.2 |

52.1 |

||

|

Forging and pressing |

2010–2014 |

100 |

32.3 |

29.2 |

38.5 |

107.8 |

|

equipment |

2015–2019 |

100 |

35.8 |

45.0 |

19.2 |

|

|

Tractors for agriculture and |

2010–2014 |

100 |

27.4 |

29.1 |

43.5 |

68.0 |

|

forestry |

2015–2019 |

100 |

26.7 |

45.0 |

28.3 |

|

|

Lifting and transport |

2010–2014 |

100 |

19.2 |

36.3 |

54.5 |

166.0 |

|

equipment |

2015–2019 |

100 |

26.4 |

57.2 |

16.4 |

|

|

2010–2014 |

100 |

22.5 |

42.7 |

34.8 |

66.6 |

|

|

Bulldozers |

2015–2019 |

100 |

31.8 |

48.4 |

19.8 |

|

|

Railway locomotives |

2010–2014 |

100 |

0.0 |

87.7 |

12.3 |

74.5 |

|

2015–2019 |

100 |

0.5 |

85.1 |

15.4 |

||

|

Freight stocks |

2010–2014 |

100 |

0.9 |

13.6 |

85.5 |

149.7 |

|

2015–2019 |

100 |

9.4 |

50.1 |

40.5 |

||

Source: Foreign Trade Customs Statistics of the Russian Federation. Annual Collection . Moscow: Federal Customs Services of RF, 2010–2019 гг.

Group of growing markets consists of importing countries, export of investment equipment to which increased significantly in 2015–2019 compared to the previous period. The largest and most stable importers of Russian investment equipment are Belgium, Vietnam, Great Britain, Egypt, Iran, Italy, Cuba, Netherlands, and Finland. A total of 20 countries are included in this group.

The highest export growth occurred in the group of hydraulic turbines (see Tab. 2). The growth was mainly driven by demand from the growing markets of Cuba, Serbia, Turkey and Ecuador.

The decline in bulldozer exports came at the expense of markets that are not among permanent and growing ones. Regular importers of this type of construction equipment increased their purchases in 2015–2019. In the main markets, the permanent importers of bulldozers are Germany and Poland, in growing markets – Belgium, Vietnam, Spain, the Republic of Korea, Mongolia, Netherlands and Turkey.

Growth of freight stock exports is due to the main (traditional importers of the former socialist camp countries – Bulgaria, Poland, the Czech Republic and Slovakia) and mainly growing markets (mainly the markets of Iran and Cuba).

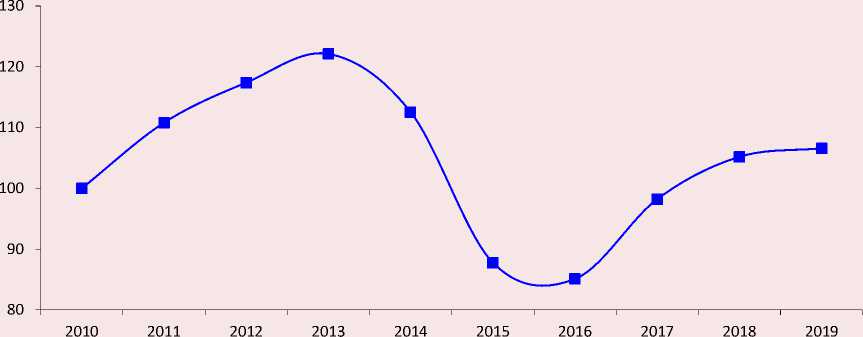

Distribution of exports of investment equipment by types of products included in the study in the group of competitive products (see Tab. 1 and 2), between main and growing markets is shown in Figure 3 . There is a fairly high growth in demand: in 2015–2019, demand of the main markets increased by 71%, growing – by 32%.

Figure 3. Export revenue for group of competitive investment vehicles in main and growing markets, bil. doll.

□ Main markets □ Growing markets

Source: Foreign Trade Customs Statistics of the Russian Federation. Annual Collection. Moscow: Federal Customs Service of Russia, 2010–2019.

Demand stability . We estimate this indicator based on constant annual deliveries over the entire period 2010–2019. The most stable demand is typical for the group “Engines and power plants”. The annual demand for this equipment is presented by 10 countries that are a part of the group of main markets: the largest importers are the United States, Germany and India. In the group of growing markets, 9 countries are permanent importers including the largest deliveries to Belgium, the United Kingdom, Vietnam, Italy, the Republic of Korea, Cuba and the United Arab Emirates.

In the markets of metalworking equipment, forging and pressing equipment is in steady demand. In the main markets, the largest importers in this area are China, India, Germany, the United States and the Czech Republic, while the growing ones are the Republic of Korea, Italy, the United Kingdom, Iran and Turkey.

The most regular and largest deliveries of tractors for agriculture and forestry are made to Germany and Poland, as well as to the countries that are a part of group of growing markets: Cuba, the Netherlands, Belgium, Vietnam and Mongolia.

The largest and permanent importers of construction equipment in the main markets are Germany, India, the United States, while Belgium, Vietnam, Mongolia, the United Arab Emirates and Turkey are the growing ones.

Investment activity as a factor of increasing investment equipment competitiveness

The basis for the construction of forecast options for growing competitiveness of investment engineering products is based on the quantitative estimates of effectiveness of investment activities as a result of the analysis, showing export growth rate of competitive types of investment equipment, as well as dynamics of specific export prices reflecting structural shifts toward an increase in expensive types of equipment. Two types of forecast options are proposed: (1) investment-active which assumes a significant increase in knowledge-intensive investments and investments in the renewal of the active part of fixed assets; (2) conservative, maintaining the growth rate of the previous period. In the investment-active variant, the effects will be formed by combining the prolonged impact of investments of the previous period and activation of knowledge-intensive and technical-technological factors – the result of growth of knowledge-intensive investments in the current period. The conservative version of the forecast assumes the preservation of a low level of investment in the renewal of the active part of fixed assets in the forecast period [22]. In this case, the export-oriented production of investment equipment will take place under the conditions of weakening effects of the prolonged impact of investments of the base period.

There we should note that in 2020, the economy including exports faced the challenges associated with the coronavirus pandemic. However, the measures taken in the Russian Federation [12] suggest that the dynamics of recovery and further development will be sustainable.

When constructing investment-active version of the forecast , we proceed from high investment growth rates (“real investment growth of in fixed assets is at least 70% compared to the indicator of 2020”11) and assume an increase in state participation in implementation of measures aimed at accelerated development of machinebuilding industries that produce investment equipment. At the same time, high dynamics of export indicators of machine-building products should be ensured already in the medium term and a significant increase in growth rates should occur in 2026–2030 (Tab. 3) . The projected export growth rates in 2021–2025 are due to the expansion of markets, but the main factor remains high

Table 3. Export of investment engineering products to non-CIS countries, %

|

Type of investment equipment |

Forecast indicators |

Base period growth rate* |

Growth rates for the forecast period* |

||||

|

2010– 2014 |

2015– 2019 |

Investment-active option |

Conservative or inertial option |

||||

|

2021–2025 |

2026–2030 |

2021–2025 |

2026–2030 |

||||

|

Investment equipment – total |

Investment in machinery and equipment |

164.3 |

118.3 |

150.0 |

140.0 |

120.0 |

130.0 |

|

Export** |

141.1 |

105.2 |

164.0 |

122.0 |

115.0 |

125.0 |

|

|

Hydraulic turbines |

Investment in machinery and equipment |

7.6 |

21.2 |

130.0 |

140.0 |

110.0 |

120.0 |

|

Export |

70.2 |

199.2 |

140.0 |

150.0 |

115.0 |

120.0 |

|

|

Unit export prices |

191.2 |

82.5 |

120.0 |

140.0 |

105.0 |

110.0 |

|

|

Engines and power plants |

Investment in machinery and equipment |

240.0 |

110.7 |

150.0 |

140.0 |

120.0 |

115.0 |

|

Export |

133.5 |

135.4 |

140.0 |

150.0 |

130.0 |

130.0 |

|

|

Unit export prices |

132.1 |

153.4 |

150.0 |

160.0 |

130.0 |

135.0 |

|

|

Processing centers |

Investment in machinery and equipment |

102.3 |

79.1 |

150.0 |

160.0 |

115.0 |

115.0 |

|

Export |

197.3 |

40.2 |

120.0 |

140.0 |

105.0 |

110.0 |

|

|

Unit export prices |

91.3 |

168.1 |

190.0 |

195.0 |

100.0 |

110.0 |

|

End of Table 3

|

Type of investment equipment |

Forecast indicators |

Base period growth rate* |

Growth rates for the forecast period* |

||||

|

2010– 2014 |

2015– 2019 |

Investment-active option |

Conservative or inertial option |

||||

|

2021–2025 |

2026–2030 |

2021–2025 |

2026–2030 |

||||

|

Turning machines |

Investment in machinery and equipment |

407.9 |

147.6 |

150.0 |

180.0 |

120.0 |

125.0 |

|

Export |

180.8 |

88.9 |

130.0 |

150.0 |

105.0 |

110.0 |

|

|

Unit export prices |

123.0 |

106.5 |

130.0 |

190.0 |

105.0 |

105.0 |

|

|

Forging and pressing equipment |

Investment in machinery and equipment |

174.3 |

37.7 |

150.0 |

170.0 |

120.0 |

125.0 |

|

Export |

119.6 |

93.0 |

120.0 |

140.0 |

105.0 |

105.0 |

|

|

Unit export prices |

59.7 |

57.4 |

150.0 |

150.0 |

99.8 |

99.5 |

|

|

Tractors for agriculture and forestry |

Investment in machinery and equipment |

52.0 |

363.1 |

130.0 |

160.0 |

115.0 |

110.0 |

|

Export |

53.7 |

68.0 |

120.0 |

130.0 |

105.5 |

100.5 |

|

|

Unit export prices |

93.7 |

45.9 |

130.0 |

140.0 |

90.0 |

90.0 |

|

|

Lifting and transport equipment |

Investment in machinery and equipment |

68.3 |

139.8 |

130.0 |

150.0 |

120.0 |

110.0 |

|

Export |

50.8 |

166.3 |

115.0 |

130.0 |

110.0 |

110.0 |

|

|

Unit export prices |

118.5 |

82.4 |

120.0 |

130.0 |

110.0 |

105.0 |

|

|

Bulldozers |

Investment in machinery and equipment |

173.1 |

158.3 |

150.0 |

150.0 |

120.0 |

125.0 |

|

Export |

104.0 |

66.5 |

125.0 |

130.0 |

115.0 |

110.0 |

|

|

Unit export prices |

101.7 |

46.9 |

120.0 |

120.0 |

110.0 |

105.0 |

|

|

Railway locomotives |

Investment in machinery and equipment |

636.3 |

55.0 |

200.0 |

150.0 |

130.0 |

120.0 |

|

Export |

454.5 |

74.6 |

150.0 |

150.0 |

120.0 |

110.0 |

|

|

Unit export prices |

340.9 |

63.9 |

110.0 |

115.0 |

100.0 |

105.0 |

|

|

Freight stocks |

Investment in machinery and equipment |

175.4 |

54.4 |

150.0 |

150.0 |

120.0 |

110.0 |

|

Export |

133.2 |

149.8 |

120.0 |

120.0 |

110.0 |

105.0 |

|

|

Unit export prices |

166.6 |

103.0 |

115.0 |

115.0 |

105.,0 |

105.0 |

|

* Growth rate is calculated as an increase in the indicator in the final year in relation to the initial year of the period.

** Export forecast is given in growth rate terms of export revenue.

According to: data f. P-2 Rosstat of RF, 2010–2019; Foreign Trade Customs Statistics of the Russian Federation. Annual Collection , vol. 14. Moscow: Federal Customs Service of RF, 2010–2019.

competitiveness of domestic investment equipment (both price and technological) which can be achieved with investment activity growth in the investment engineering industries. A prerequisite for competitiveness growth is a high innovation and technological saturation of investments.

In the long term (2026–2030), in the absence of force majeure, we can expect a significant increase in investment activity including an increase in the innovation and technological saturation of investments with priority for research and development costs. To ensure competitiveness growth of domestic equipment and create conditions for export growth, it is necessary to restore the steady growth of knowledge-intensive investments in industries that produce domestic investment equipment based on advanced research and development. It is necessary to ensure a significant increase in the costs of research and development [23] and production equipment renewal the decline of which in most industries has continued over the previous years. At the same time, a steady flow of investment equipment production can be provided only in the conditions of completing it with high-quality electronics and devices [24; 25]. Growth of knowledge-intensive investments will allow expanding investment equipment range that has technological competitiveness in the global market.

Conclusion

The developed author’s approach, based on relationship assessment between the qualitative changes in the technological structure of investments in fixed assets of the sub-branches of mechanical engineering that produce investment equipment, and dynamics of investment equipment export to the most inaccessible markets: the markets of far abroad, has shown its effectiveness for predictive and analytical research in order to develop forecasts for developing investment engineering and export diversification of the Russian Federation.

The conducted research shows that the existing and applied tools in the Russian Federation allow ensuring the positive dynamics of factors affecting competitiveness of mechanical engineering and its products. At the same time, investment equipment export to foreign countries is a leading indicator of its competitiveness. And the very fact of exporting machine-building products is, in view of the relatively low domestic demand, a necessary condition for the functioning of key machinebuilding enterprises, utilization of their production capacities. However, the resources that determine the impact of these tools are still insufficient.

Список литературы Analysis and forecast of competitiveness of Russian investment equipment in the foreign markets

- Porfiriev B.N. Prospects for economic growth in Russia. Vestnik Rossiiskoi akademii nauk=Herald of the Russian Academy of Sciences, 2020, vol. 90, pp. 243–250 (in Russian).

- Shirov A.A. Russian economy in 2019: Problems and solutions. Obshchestvo i ekonomika=Society and Economics, 2019, no. 10, pp. 5–12 (in Russian).

- Komkov N.I., Kulakin G.K. Technological innovations: Development, application and results. Problemy prognozirovaniya=Studies on Russian Economic Development, 2018, no. 5, pp. 137–154 (in Russian).

- Svetunkov S.G. Mathematical models of multi-level competition. Russian Journal of Entrepreneurship, 2017, no. 18 (22), p. 3447. DOI: 10.18334/rp.18.22.38453 (in Russian).

- Bazhanov V.A., Oreshko I.I., Veselaya S.S. Assessment of the export potential of Russian engineering. Mir ekonomiki i upravleniya=World of Economics and Management, 2020, vol. 20, no. 1, pp. 5–19. DOI: 10.25205/2542-0429-2020-20-1-5-19 (in Russian).

- Ivanova N.I., Mamedyarov Z.A. R&D and innovation: Competition is growing. Mirovaya ekonomika i mezhdunarodnye otnosheniya=World Economy and International Relations, 2019, vol. 63, no. 5, pp. 47–56. DOI: 10.20542/0131-2227-2019-63-5-47-56 (in Russian).

- Zheng T., Cordolino M., Baccetti A., Perona M., Zanardini M. The impacts of Industry 4.0: A descriptive survey in Italian manufacturing sector. Journal of Manufacturing Technology Management, 2019. DOI:10.1108/JMTM-08-2019-0269

- Miller A., Miller M. Study of the problems of technological integration in the manufacturing industry in Russia. Strategic Management, 2019, vol. 24, no. 3, рр. 33–42.

- Y Li, H Zhang, Y Liu, Q Huang. Complexity of industry export – an empirical study based on China’s equipment manufacturing industry panel. Special Issue “Preferential Trade Agreements and Global Value Chans”, 2020, no. 12 (17), р. 2694.

- Raizer Monro L., Kohl H. Maturity assessment in Industry 4.0 – a comparative analysis of Brazilian and German companies. Emerging Science Journal, 2020, vol. 4, no. 5, рр. 365–375.

- Wang T., Yin X. Study on the determinants of export sophistication of China’s manufacturing subdivided sectors. In: Wang TS, Ip A, Tavana M, Jain V (eds) Recent Trends in Decision Science and Management Advanced, 2020, vol. 1142. DOI: Org/10.1007/978-981-15-3580-8-89

- Ilyin V.A., Morev M.V. Efficiency of the state’s “manual” management. Challenges of 2020. Ekonomicheskie i sotsial’nye peremeny: fakty, tendentsii, prognoz=Economic and Social Changes: Facts, Trends, Forecast, 2020, vol. 13, no. 2, pp. 9–24. DOI: 10.15838/esc.2020.2.68.1 (in Russian).

- Borisov V.N., Pochukaeva O.V., Pochukaev K.G. Domestic investment equipment in the world market: Dynamics and structural changes. Problemy prognozirovaniya=Studies on Russian Economic Development, 2020, no. 5, pp. 3–13 (in Russian).

- Malyarov O.V. Gosudarstvennyi sektor ekonomiki Indii [Public Sector of the Indian Economy]. The Institute of Oriental Studies of the RAS. Moscow: Institut stran Vostoka, 2014. 359 p.

- Andronova I.V., Bokachev I.N. Government support for science, technology and innovation in India. Mirovaya ekonomika i mezhdunarodnye otnosheniya=World Economy and International Relations, 2019, vol. 63, no. 11, pp. 38–45 (in Russian).

- Frey C.B. Intellectual Property Rights and the Financing of Technological Innovation: Public Policy and the Efficiency of Capital Markets. Cheltenham, Edward Elgar Publishing, 2013. 304 p.

- Brown J.R., Martinsson G., Petersen B.C. Law, stock markets, and innovation. The Journal of Finance, 2013, vol. 68, no. 4, pp. 1517–1549.

- Aukutsionek S.P. Investment behavior of enterprises in 2019-2020. Rossiiskii ekonomicheskii barometr=Russian Economic Barometer, 2020, no. 4, pp. 3–11. DOI: 10.20542/2307-0390-2020-4-3-11 (in Russian).

- Kondrat’ev V.B. Otrasli i sektora global’noi ekonomiki: osobennosti i tendentsii razvitiya [Industries and Sectors of the Global Economy: Features and Development Trends]. Fond istoricheskoi perspektivy, Tsentr issledovanii i analitiki [Historical Perspective Foundation, Center for Research and Analytics]. Moscow: Mezhdunarodnye otnosheniya, 2015. 418 p.

- Grigor’ev V. Innovation from scratch. Rossiiskii eksporter=Russian Exporter, 2019, no. 3, pp. 59–61 (in Russian).

- Pochukaev K.G. Influence of investment and innovation factors on pricing in mechanical engineering. In: Nauchnye trudy: Institut narodnokhozyaistvennogo prognozirovaniya RAN [Scientific Works: Institute for Economic Forecasting of the Russian Academy of Sciences]. Moscow: MAKS-Press, 2018. Pp. 453–472 (in Russian).

- Kuvalin D.B., Zinchenko Yu.V. Russian enterprises in the spring 2020: Covid-19 pandemic reactions and opinions on the role of the state in the economy. Problemy prognozirovaniya=Studies on Russian Economic Development, 2019, no. 6, pp. 147–160 (in Russian).

- Minakov V.F., Lobanov O.S., Makarchuk T.A. Knowledge and research competencies as a factor of economic growth. Finansovaya ekonomika=Financial Economy, 2018, no. 6, pp. 90–94 (in Russian).

- Rumyantsev N.M., Leonidova E.G. Asymmetry problems of structural shifts in regional economy. Ekonomicheskie i sotsial’nye peremeny: fakty, tendentsii, prognoz=Economic and Social Changes: Facts, Trends, Forecast, 2020, vol. 13, no. 6, pp. 169–183. DOI:10.15838/esc.2020.6.72.10 (in Russian).

- Sidorov M.A. Territorial development based on stimulation of the Russian electronic industry. Problemy razvitiya territorii=Problems of Territory’s Development, 2020, no. 3 (107), pp. 27–44. DOI: 10.15838/ptd.2020.3.107.2 (in Russian).