Analysis of Foreign Experience in the Financial Regulation of the Arctic Territories Development and Its Application in the Northern Regions of the Russian Federation

Автор: Badylevich R.V.

Журнал: Arctic and North @arctic-and-north

Рубрика: Social and economic development

Статья в выпуске: 44, 2021 года.

Бесплатный доступ

The article examines foreign experience in implementing regional financial policy in relation to the Arctic territories. It assesses the experience of such sub-arctic countries as Canada, Finland, Denmark, Norway, Sweden, and the USA. The paper identifies two groups of financial instruments of territorial development: within the framework of general regional policy (instruments of fiscal capacity equalization, taxation instruments, instruments to increase investment attractiveness) and within the framework of special policy for the development of Arctic territories (program-targeted instruments, special development funds, direct allocation of funds for current expenses and development). It is concluded that the Arctic countries apply different approaches and tools to the development of the regions located in the Arctic zone, the choice of which is determined by the type of state structure, the degree of financial independence of the regions in the sphere of financial regulation, the level of development of the northernmost subjects compared to the rest of the country. In the conditions of Russia, it is possible to use the best foreign experience in the sphere of financial regulation of development of the regions located in the Arctic zone. In particular, it is possible to use the experience of applying program-targeted development tools, the formation of special development funds, which are based on revenues from the use of natural resources of the Arctic, as well as the experience of creating favourable conditions to attract investors for the implementation of economically attractive projects.

Financial regulation, regional policy, Arctic territories, foreign experience, Canada, Finland, Sweden, Norway, Denmark, USA

Короткий адрес: https://sciup.org/148322041

IDR: 148322041 | УДК: 332.146.2(470.1/.2)(045) | DOI: 10.37482/issn2221-2698.2021.44.5

Текст научной статьи Analysis of Foreign Experience in the Financial Regulation of the Arctic Territories Development and Its Application in the Northern Regions of the Russian Federation

Financial regulation of territorial development occupies an important place in the modern system of regional management. This is due to the heterogeneity of development conditions of territorial entities within the state economic systems, the necessity to equalize economic processes and eliminate territorial imbalances in operation of investment resources distribution mechanisms, organization of financial flows and ensuring the implementation of the overall financial potential of regions.

In general terms, financial regulation is the impact on economic and social processes by the concentration of financial resources in certain structures and levels of the socio-economic system. In financial regulation of territorial development, the impact is directed to the object of regulation, which is the regional financial system (for more details [1, Verbinenko E.A., Badylevich R.V.]).

The construction of an effective system of regional financial regulation, the choice of optimal financial levers and instruments, and their rational use are especially important for territorial systems, which are initially characterized by lower internal potential of economic growth due to their remote geographical location from financial and economic centres, difficult conditions for economic activity and residence, lack of infrastructure and labor resources. Such territorial systems should include the regions located in the Arctic zone. These regions, as a rule, are characterized by significant resource potential, large territories, access to the northern seas, which determine their strategic importance in the system of national security and implementation of economic development priorities. At the same time, the Arctic regions are characterized by low population density, unfavourable demographic processes, higher cost of living and economic activities due to difficult climatic conditions and remoteness from the centre. Under these conditions, the choice and rational use of effective financial levers to ensure their sustainable development are of particular importance and relevance.

The study of foreign experience in regional financial regulation of the Arctic territories development is an important condition for Russia for increasing the effectiveness of its own domestic regional policy, as well as for finding additional opportunities to ensure the development and implementation of the large-scale potential of territories located in the Arctic zone of Russia, the share of which is more than 18%.

Foreign practice of using financial regulation instruments for the development of the Arctic territories

At present, almost all the Arctic countries, including Russia, Canada, the United States, Norway, Sweden, Finland, Denmark and Iceland, face the problems of financial support for the development of their northernmost territories (Fig. 1).

Fig. 1. The distribution of Arctic territories among the countries 1.

1 URL: (accessed 16 December 2020).

In some countries (Russia, Canada, Finland, Denmark, Norway), the development of the Arctic territories is a priority national goal and a separate direction of state policy, in other countries (USA, Sweden, Iceland), the development of the northernmost regions is built into the general system of regional regulation. At the same time, the tools and levers used by both the first and the second groups of countries are of considerable interest for our country.

It should be noted that the experience of regional regulation in Iceland is of less interest for potential use in Russia due to the specifics of this country. Iceland is a small island state in the north of Europe. Despite the fact that an insignificant part of Iceland (Grimsey Island) lies in the Arctic zone, which is less than 1% of its total territory, it positions itself as a sub-Arctic country, entering the Arctic Council and other bodies that determine policy in the Arctic [2, Antyushina N.M., p. 17]. However, the insignificant territory of Iceland, the homogeneous climatic conditions throughout the territory and the absence of significant differences in the economic development of northern and other districts and communities (municipalities) of Iceland do not allow a full assessment of its regional policy and the range of financial development instruments applied in relation to its own Arctic territories.

The directions and instruments of financial regulation of territorial development, applied to the northern territories, vary significantly in the Arctic countries. This is due to the different proportions of territories in the Arctic zone in countries, differences in their resource provision, as well as various levels of differentiation of socio-economic development indicators of the northern and other regions.

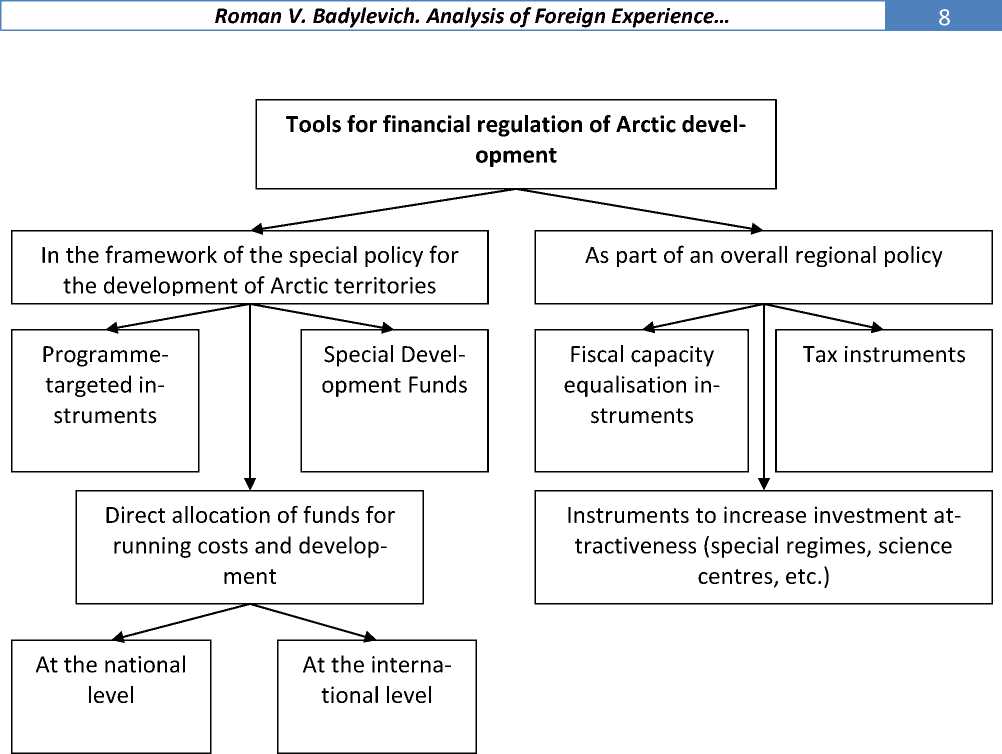

In general terms, the system of instruments for financial regulation of the Arctic territories development in foreign practice is shown in Fig. 2.

Fig. 2. Tools for financial regulation of the Arctic territories development in foreign practice.

All instruments of financial regulation of the Arctic territories development can be divided into those that are implemented within the framework of a general regional policy, and those that are implemented within the framework of a special policy for the Arctic territories development. When using the tools of the first group, the Arctic regions are considered on an equal basis with other subjects, while when the second group of instruments is applied, the Arctic territories are singled out as a separate priority object of state management. Definitely, none of the Arctic countries uses only one narrow range of financial regulation instruments. However, a priority group of financial levers can be identified for each country, which corresponds to the general policy of territorial development.

Financial regulation of Arctic development in Canada and Finland

Canada and Finland are two countries that have historically been dominated by policy-oriented instruments for the development of Arctic territories. Let us consider their experience in more detail.

Canada is the second country after Russia in terms of the area of the Arctic territories. Canada's Arctic area includes three regions: the Northwest territories, the Nunavut and Yukon territories, and the islands and water areas up to and including the North Pole. The Arctic covers about 35% of the country's total land area. However, the Arctic areas of Canada are much less densely populated than the more southerly regions, about 120 thousand people live here, which is only

0.3% of the total population of the country. Canada's northernmost territories have almost the same mineral endowment as Russia; significant reserves of natural gas, oil, coal, ferrous and nonferrous metal ores are concentrated here, which makes these territories an important strategic object of country's regional policy. However, in the absence of completely safe technologies for extracting offshore resources, Canada is limited to the development of continental deposits, paying considerable attention to environmental issues.

Canada can be classified as one of the countries with an active regional financial policy towards the Arctic territories. In terms of the intensity of using various groups of instruments, Canada should be classified as a country where direct tools for the development of the northern territories prevail (program-targeted instruments and a system of interbudgetary transfers) (for more details [3, Verbinenko E.A., Badylevich R.V., Ostretsov V.S.]).

An active policy of support and development of the Arctic regions in Canada can be traced back to the 1950s–60s, when several state programs aimed at the northern provinces and territories were formed and implemented (in particular, the “Facing the North” and “Road to Resources” programs).

Currently, the development policy of these territories is based on a set of strategic documents that have been adopted in Canada over the past few decades. The key ones include the Framework for Northern Strategy, which became the main development strategy for the northern territories, outlined the principles, goals and objectives in this direction (after the adoption of this document in 2004, the Arctic provinces received a one-time tranche in the amount of $120 million to achieve short-term development goals) [4, Kharevsky A.A., p. 98]. Canada's Northern Strategy, adopted in 2009, outlined four key areas for the Arctic territories development: taking measures to protect state sovereignty in the north, ensuring sustainable socio-economic development of the Arctic territories, protecting the environment and enhancing interaction with local authorities in in order to develop self-government, as well as to achieve Canada's goals in the Arctic, taking into account the interests of local communities. In 2019, the Government of Canada presented a new version of the Northern Territories Development Strategy, an active role in the formation of which was played by the local authorities of the northernmost provinces of the country (Yukon, Nunavut, Northwest Territories), certain areas of the northern provinces of Manitoba, Quebec and Labrador. A distinctive feature of the strategic documents of Canada is the socio-economic orientation, emphasis on improving the quality of life, and focus on a person as a central actor in the system of the northern dimension [5, Korchak E.A., Serova N.A., p. 152].

The Government of Canada uses a wide range of financial instruments to develop its northern territories.

Significant financial resources are currently being allocated as part of federal targeted programs such as the North Employment and Tourism Development Program, Inclusive Diversification and Economic Advancement in the North Program (IDEANorth) of the Canadian Northern Econom- ic Development Agency, which make fundamental investments in economic infrastructure, sectoral development and overall economic capacity building in the Arctic territories.

In recent years, funding through programme instruments has been actively used for major infrastructure projects in the north, shaping transport infrastructure, multi-purpose communications and energy security. For example, in 2019, more than $ 190 million was allocated to improve and expand the existing local air and maritime infrastructure, more than $ 71 million was directed through the National Trade Corridors Fund to four transport projects in the province of Nunavut (in particular, investments of $ 500 million in preparation of the largest port project and the Grace Bay road, which, if completed, would create the first road connecting Nunavut with the rest of Canada).

The Arctic territories of Finland (most often they include the provinces of Lapland and Oulu) occupy about 50% of its total area, while only 10% of the country's population lives on this territory, which makes the Finnish Arctic the least populated region of the country. At the same time, the northern regions have been economically underdeveloped throughout Finland's history. The reasons for this include harsh climatic conditions for life, which contributed to the population outflow to the southern regions of the country, significant distance from European financial and economic centers that made it difficult to establish economic ties with the leading European countries, which, after the break-up with Russia, turned into key partners of Finland. The features of the economy of the developed southern and southwestern regions were also noticeably different, where about 80% of the largest industrial companies were concentrated in the middle of the 20th century, mainly agricultural, specializing in forestry in the northern and eastern regions. In the last few decades, the processes of asymmetric development of various regions of Finland have only intensified due to the active development of new industrial sectors (development of the electronic industry) in southern Finland and, above all, in the Helsinki metropolitan area [6, A. V. Kuznetsov, p. 122–124]. Thus, the modern Finnish Arctic is characterized by such problems as the outflow of young population, gradual aging of population and reduction of labor resources in the overall age structure, remoteness from Finland's key European partners, higher costs of business due to difficult climatic conditions and less rich resource base in comparison with the Arctic territories of Russia, Canada, USA and other countries.

The Finnish Arctic economy, in contrast to other countries, is based less on extractive industries. The timber, metal ore, and energy industries account for no more than 10% of the region's output. In contrast, manufacturing accounts for more than a third of the gross product of the Finnish Arctic (with the electronics industry, centred in the city of Oulu, accounting for a significant part).

The economic policy towards the Arctic territories is a separate part of the regional policy of Finland, which started to develop actively in the 1960s. One of the first steps in the financial regulation of the northern regions development was the adoption in 1958 of the regional law “On tax incentives for industry in Northern Finland”, which established small industrial loans for rural areas and tax incentives for enterprises in Northern Finland. It should be noted that interest subsidies, loans and tax incentives are the main financial levers that the Finnish government used to develop its Arctic territories until the mid-1970s.

The next significant step in the development of regional policy towards northern communes in Finland was the creation of the Regional Development Fund in 1971 to finance small and medium-sized companies operating in the regions 2, and the adoption in 1973 of legislative acts that provided development subsidies to companies operating in eastern and northern Finland, as well as transport subsidies to compensate the costs associated with the remoteness of the northern and eastern communes from the capital region and European markets. In general, the regional policy of Finland towards its northern territories in the late 1970s and early 1980s can be characterized as a policy based on the allocation of various types of subsidies for economic and business development. Simultaneously with support for entities operating in the less-developed communes of Finland, during this period the Government of the country took such extraordinary steps as restricting the development of the capital and the most developed regions, in particular a special building tax was introduced in 1973–1974, which was valid only in southern Finland. It was believed that the artificial limitation of industrial growth and development of the capital region would redirect financial flows to less developed regions and, above all, to the northern communes of the country [6, Kuznetsov A.V., p. 128]. At the same time, an agreement was concluded between the Government of Finland and large industrialists on priority areas for the location of industrial facilities.

In the 1980s, Finland's regional policy towards the northern territories shifted towards the use of point development tools, and the regional policy itself during this period, according to Matti Sippola's research, was called the period of regional diversification [7]. During these years, the main goals in relation to the northern communes of Finland were the alignment of regional development (primarily in terms of the level of population income), the adoption of programs focusing on solving certain problems most typical for northern communes, and the spread of industrialization processes to development areas (rural development programs, regional technology programs). Such measures led to a gradual shift in the policy of supporting growth centers in the regions towards a policy of supporting backward territories and least developed zones. The creation of the so-called support belts is of great importance in the system of financial base forming for the development of northern Finland. Finland's Arctic communes entered the first support belt, where the level of development funding was the highest.

In the late 1980s and early 1990s, there were no significant changes in Finland's northern policy; regional programs remained the basis for development. The innovations of that time included the increased involvement of regional authorities (primarily, provincial governments) in the formation of territorial development programs, as well as the adoption of the law “On the devel- opment of regions” 3 in 1993, which consolidated the leading role of regional development programs in Finland's regional policy system. On the basis of these programs, state and local authorities under the leadership of a regional development body (a consortium of municipalities) drew up program agreements, which included the largest projects in various regions, as well as schedules and measures for their implementation. In the program agreements, the parties agreed on the distribution of funding for activities carried out within the framework of regional development programs. In order to implement the regional development programmes, the necessary financial resources were laid down in the state budget by establishing regional development funds, the use of which in the regions was coordinated and regulated in program agreements. The decision on the direct allocation of funds to the localities was taken by the consortia of municipalities, and the government of the country adopted annually a decision on the general criteria for the distribution of regional development funds among various administrative sectors. The maximum amount of funding for projects implemented by business entities was up to 70% of the total cost (exceptions were made for some projects in the northern regions of Finland, and the share of public funding exceeded this value). Besides, the law reaffirmed the division of the country's territory into three zones, depending on the need for development support.

Finland's regional policy underwent an important transformation in the mid-1990s when the country joined the European Union. Since then, the northern regions of the country have gained access to additional financial resources of European structural funds. Simultaneously with the expansion of financial opportunities for the development of remote northern regions, Finland faced the problem of limiting the adoption of its own decisions in the implementation of regional policy. In fact, over the past few decades, the European Union, through a series of directives, regulations and structural funds, has been guiding Finland's regional and local development policy, and the strategies and principles of the European Union determine the priorities financed by the EU structural funds. Local authorities are forced to formulate development policies in accordance with them.

The new conditions for the implementation of regional policy required organizational and regulatory changes. For example, important changes in the support system for the northern territories of the country are associated with the creation in 1999 of the Finnvera Special Fund, which was formed after the merger of the Regional Development Fund and the Guarantee Fund. It distributes a significant part of state and the European Regional Development Fund resources for the implementation of regional policy in Finland. In 2002, Finland adopted a new regional development law 4, according to which the main goal of the new regional policy was to create conditions for economic growth based on know-how and sustainable development, guaranteeing the competitiveness and prosperity of regions, developing economic activities and increasing employment, reducing imbalances in regional development and improving living conditions, as well as promoting balanced development of regions. The law explicitly stated that the objectives of the regional and structural policy of the European Community are taken into account in the implementation of Finland's regional policy. At the same time, the development of the northern territories of Finland is still based on the so-called provincial programs and plans (including the programs of regional structural funds of the European Union), which are formed by consortia of municipalities for a period of four years in accordance with the long-term goals of regional development that are developed and established by the Finnish government (programs are coordinated and approved by state authorities) in accordance with the priorities of the EU regional policy.

In recent years, several more noticeable trends in the system of implementing regional policy in Finland can be noted. In particular, there has been a noticeable shift in the priorities of financing regional development from direct assistance to business entities to creating conditions for the development of entrepreneurship and attracting additional investment in communes remote from the capital region. Besides, in 2007, the structure of zones that form conditions for financial support of local authorities was changed. Instead of the previously identified three zones, the division into two zones was established. In the urban development system, the emphasis is on the formation of innovation centers of growth, while in the northern and eastern regions of Finland, special emphasis is placed on supporting rural areas.

It should be noted that in the first years after Finland's accession to the EU, European structures allocated significant financial resources for the development of the country's northeastern territories, and the development of regions with the lowest population density was one of the priorities of structural funds in the Scandinavian countries. But in recent years, with the admission of new members to the EU, the financial resources allocated to Finland have significantly decreased (in the early 2000s, Finland accounted for up to 1% of total expenditures, by 2010 this figure dropped to 0.5% [6 , Kuznetsov A. V., p. 133]). In this regard, there are more and more frequent criticisms in Finnish academic community about the inability to solve problems of the northern remote areas of the country without increasing the involvement of local authorities in the decision-making process and reducing the influence of EU policy on internal regional processes. As a confirmation of this, in the north of the country imbalances in the development of some municipalities, the presence of unresolved problems of unemployment and aging of the population, and high rates of migration outflow of youth to the capital region are indicated [8, Lehtonen O., Muilu T.].

At the same time, it should be noted that, despite the problems in the area of the northern territories lagging in terms of industrial development from the capital regions, Finland manages to maintain a sufficiently high standard of living in the Arctic communes, to conduct an effective policy in the field of increasing the tourist potential, cultural identity and preservation of natural and recreational resources of these territories. In this regard, the regional policy in Finland is considered one of the most balanced and advanced in the European Union.

Financial regulation of development in Greenland

Direct allocation of funds for operating expenses and development as a priority financial instrument is typical for the overseas territory of Denmark — Greenland.

Greenland is the largest island in the world, a big part of which lies above the Arctic Circle, and is an autonomous territory of Denmark. The high degree of political and economic independence of Greenland is confirmed by the special status of this territory. In particular, Greenland is not a member of the EU (although Denmark has such a status), and this territory is also an independent member of the Nordic Council. At the same time, the entry of Greenland into Danish possessions allows this small country to be a full member of the Arctic Council, which creates unique opportunities for foreign economic activity [9, Allayarov R.A.U.].

Greenland is rich in natural resources (significant deposits of oil, uranium, rare earth metals have been discovered on the island's territory). Greenland's difficult climatic conditions prevented the full exploitation of its resources for many centuries, but in recent years, with the development of technologies in the field of nature management, moderate warming of the climate and, as a result, the consequent removal of ice from parts of the island, interest in the resources of Greenland has increased, and the growth interest is noted not only from Denmark and the European Union, but also from such countries as the United States and China.

Over the past decades, the Greenlandic authorities have been promoting an active policy to increase the political and economic independence of the island. The last significant progress in this direction is associated with 2008, when the island territory received the right to limited selfgovernment. According to the law on self-government, Greenland has the right to obtain complete independence from Denmark if the population supports this decision in a referendum 5, but in practice this scenario cannot be expected, primarily because throughout history, Greenland remains a highly subsidized region. Despite the fact that the population of the island is not large (about 56 thousand people), the total annual expenditures of Denmark for supporting Greenland are estimated at about 700 million dollars 6, which is a significant financial burden for such a small country. It should be noted that funding from Denmark is a significant source of revenue for the Greenland budget; currently, the share of financial support from Denmark in the structure of the island's income is about 50%. The instrument for allocating funds to Greenland from Denmark is grant funding.

Another source of financial support for Greenland is revenue from the European Union. Currently, the amount of funds received from the EU is about 30–35 million euros per year, which is significantly less than transfers from the Danish budget. These resources are allocated to the Greenlandic authorities mainly for the development and maintenance of the education system. The autonomous status of Greenland limits the flow of financial resources from the EU (the island is not a part of the EU, but is a special territory of an EU member state, and Greenland residents are EU citizens). This situation, for example, does not allow Greenland to apply for funding from the European Investment Bank, a large financial institution for regional support of the EU.

Additionally, the European Union transfers annual payments to Greenland for the use of its territorial waters for fishing. From 2016 to 2021, there is an agreement between the EU and Greenland, according to which the annual transfers for compensation for the use of fish resources amount to about $ 18 million, of which about 74% is transferred to the island's budget for the use of the territorial waters of Greenland, 16.5% is directed to the development of the island's fisheries, and the rest goes to the reserve fund 7.

Greenland actively promotes foreign investment for the development of various sectors of its economy and, above all, the sphere of environmental management. In the past decade, the Greenlandic government has lifted many of the restrictions on various mineral resource extraction for foreign investors and granted exploration licenses to such major natural resource companies as BP Plc, ConocoPhillips, Royal Dutch Shell Plc, Dong Energy A/S и Statoil ASA 8.

The most substantive interest in investing in Greenland projects is currently shown by such large global players as China and the United States. At the same time, their interests are not limited only to the economic indicators of project implementation, but include the development of global interests in the Arctic and access to territories with significant strategic potential.

In recent years alone, Chinese companies have applied for investment in such major Green-landic projects as the modernization of the international airport in the capital Nuuk, the development of a deep-water port, the exploration and development of rare earth metals, and many others. The United States is actively opposing the Chinese expansion, which, using links with the EU and directly with the Danish government, is trying to block deals with Chinese investors under the pretext of protecting the environment and ensuring security. In turn, the United States itself provides direct financial assistance to the Government of Greenland (in 2020, financial assistance in the amount of $ 12.1 million was allocated at the opening of the US Consulate), and in 2019, President D. Trump announced his desire to acquire an island in perpetual lease for an annual payment of about $ 700 million to Denmark [10, Drevet J.-F.].

The Greenlandic government, in conditions of limited financial resources, is forced to work with all potential investors, even at the expense of its own self-sufficiency and security interests. However, Greenland's financial self-sufficiency is to be expected to increase in the coming years. This will happen due to the introduction of new extractive industries on the island. At the same time, work in this direction is carried out both by attracting large international companies to activities in Greenland, and by creating their own state institutions (in recent years, the state oil company Nunaoil and the state company Nunamineral have been created). At this stage, the leading role in the Greenland economy belongs to fisheries (this industry accounts for up to 90% of the total exports of the autonomy), but currently ongoing projects to expand the production of ruby deposits, significant investments aimed at exploration and development of iron, uranium, aluminum ores , precious metal ores, as well as potentially economically attractive projects in the field of hydrocarbon development can significantly change the sectoral proportion of the Greenland economy.

Financial regulation of Arctic development in Sweden and Norway

An example of a country where the development of the northernmost territories located in the Arctic zone is carried out within the framework of the general state regional policy is Sweden.

According to the most common perceptions, among the Swedish läns (regions), the Arctic territories should include Norrbotten, which accounts for about 22% of the total area of the country and only about 2.5% of the population (260 thousand people).

Despite the fact that in some periods of history (for example, in the 1970–1980s) there was an outflow of population to the southern provinces of the country in Norrbotten, in terms of the level of economic development and the contribution of the region to the formation of the Swedish economy, this län cannot be classified as underdeveloped. Norrbotten has significant natural resources (forest resources, iron ore reserves and deposits of non-ferrous metal ores (copper, lead, zinc, silver)), the region is home to large enterprises of the steel industry. Län has played a key role in the industrialization of Sweden since the end of the 19th century until the second half of the 20th century.

Currently, Norrbotten's economy is based on mining iron ore production, forestry, as well as the small and medium-sized business sector, which is actively supported by the state. The level of economic potential of this territory is characterized, in particular, by the fact that more than 2.000 Norrbotten companies are participants in export-import operations. In terms of labor productivity, Norrbotten is consistently included (along with, for example, the province of Stockholm) in the top three among the territories of Sweden. In addition, the region is characterized by a high level of gross regional product and real investment per capita (according to the first indica- tor, Norrbotten is in third place among regions (in 2019, $ 54.6 thousand per capita), behind Stockholm and Västra Götaland 9).

There is no financial regulation of northern development in Sweden as part of the national regional policy. The development of the län Norrbotten is carried out within the framework of the application of common financial mechanisms and instruments for regional equalization. Currently, two instruments are of primary importance in the system of financial regulation: the tax system and the system of interbudgetary transfers.

Läns and municipalities in Sweden have rather wide authority to set individual taxes and regulate the income tax rate. It is the income tax that forms the basis of the revenue part of the budgets of the läns and municipalities (it accounts for more than 70% of tax revenues to the budgets of communes (municipalities) and more than 80% of tax revenues to the budgets of lästings (political organization of the läns management)). In Norrbotten, the income tax rate is close to the Swedish average of 32.74%.

Despite a relatively high degree of economic development, Norrbotten is a subsidised region for Sweden. The total amount of funds allocated to Norrbotten under the regional equalisation system in 2019 amounted to about $ 134 million (or $ 535 per capita 10). In terms of the volume of budget transfers to the Norrbotten budget per capita, län is in twelfth place among all regions of Sweden. The system of interbudgetary equalisation in Sweden (introduced in 2005) is quite complex and includes several types of subsidies: income equalisation, expenditure equalisation, structural grant, transit grant and regulatory grant [11, Krivorotko Y.V.]. Currently, the main place in the system of intergovernmental transfers is occupied by subsidies for income equalisation (60–65% of the total volume of transfers to the Norrbotten budget), subsidies for costs equalisation (25–30%) and structural grants (10–15%).

Along with subsidies to Norrbotten, financial transfers are allocated to the municipal level (communes of the län). The total amount of funding allocated from the state budget to communes in 2019 was 1.7 times higher than the amount allocated directly to Norrbotten, and amounted to about $ 230 million. At the same time, in terms of budget transfers per capita, the communes of Norrbotten differ significantly (more than six times). The structure of interbudgetary transfers to municipalities by type of subsidies roughly coincides with the structure of financing allocated to the läns.

The system of regional equalisation allows Sweden to level out territorial differences in financial security and form a high standard of living and the basis for economic growth for all regions, including the northernmost county of Norrbotten.

The country where the regulation of the development of northern entities is carried out within the framework of the implementation of an integrated approach is Norway.

Norway is one of the northernmost countries in the world, with almost half of its territory (Nordland, Tromsø and Finnmark counties, Spitsbergen archipelago and Jan Mayen Island) located in the Arctic zone. This geographical location makes the Arctic a priority in Norwegian foreign and domestic policy.

The modern understanding of the Arctic territories importance for the realization of national interests has developed in Norway not so long ago. The starting point of the current Norwegian northern policy is the 2006 national strategy the “Norwegian Government's High North Strategy” 11, which identified the opportunities inherent in the northern regions as one of the Norwegian government's most important policies. Subsequently, the strategy was repeatedly updated and supplemented. In 2009, for example, an updated version of the strategy “New Building Blocks in the North” was adopted. While maintaining the main tasks and goals in the Arctic, it shifted the focus to the development of the activities of economic entities in the northern territories, taking into account the environment preservation and economic priorities. In 2017, a new strategic document, “Norway's Arctic Strategy — Between Geopolitics and Social Development” 12, was issued, in which the Government sets a large-scale task of transforming its Arctic territories into an innovative and sustainable region.

It should be noted that for a long time the northern territories of Norway were significantly inferior to its southern regions in terms of the level of development and quality of life, but at the beginning of the 21st century, the government has made significant efforts to eliminate the territorial imbalance. In order to improve the attractiveness of the northern territories, increase their industrial potential and investment attractiveness, an integrated approach was applied, which included a fairly wide range of tools: the introduction of a system of tax incentives for economic entities of the northern provinces, the allocation of significant budgetary resources for the implementation of large infrastructure projects and support of socially significant spheres (education, health care), the development of the scientific and innovative potential of the northern territories, including through the creation of a network of technoparks, as well as the implementation of several large interstate projects in the scientific field (in particular, in cooperation with large scientific institutions of Russia).

The state plays a key role in the development of the northern territories in Norway. Modern production base has been created in the north of the country due to state support and the allocation of significant financial resources. In recent years, with the support of the state, several large enterprises have been opened in the northern provinces, thousands of jobs have been created, and a program to support small and medium-sized businesses is being implemented. Many infrastructure projects have been realized within the framework of public-private partnerships, for example, within the framework of partnership with Equinor in the field development and pipeline transport management system [12, Gutenev M.Yu., Konyshev V.N., Sergunin A.A.]. At the same time, such potentially attractive industries as Arctic tourism and maritime transport are actively developing in the north of Norway with the state participation. Direct budgetary expenditures in the Arctic increased from 140 million to 3.4 billion NOK in 2005-2017, not counting the share of northern Norway in national programs [13, Krivorotov A.K.].

One of the factors in the economic development of the northern territories in recent years has been the delegation of the right to make some decisions from the state level to the regional one, including in the financial sphere (through the transfer of tax powers). This has significantly increased the financial autonomy of the northern provinces.

Close attention of the Norwegian government to the development of the Arctic territories is associated not only with the desire to balance the economic development of individual regions, but also with the understanding of the role of the northern provinces in the system of further implementation of projects in the field of oil and gas resources production on the shelf of the Arctic seas, which currently form the basis of the production industry, occupying about 23% of the GDP structure [14, Kravchuk A.A.]. Access to the large-scale resource wealth of the Arctic, as well as a rational policy of environmental management allowed Norway to become one of the leaders in key economic indicators in the world (GDP per capita in Norway in 2018 amounted to 66.1 thousand dollars per person, which put the country in the top ten in the world on this indicator. In addition, Norway ranks first in the Human Development Index: in 2017, the indicator was 0.953 13).

At the same time, Norway does not seek to spend all of the revenues generated by Arctic oil sales on current consumption. In 1990, the State Oil Fund was created, which is formed from oil super profits, and its funds are invested outside Norway in the most promising stocks, bonds and real estate [15, Goergen M., O'Sullivan N.]. At the moment, the volume of the fund is about $ 1 trillion, and it is one of the largest in the world. The fund is managed by the Central Bank of Norway, and the funds received in the form of profit from the investment of the fund's resources are currently used, including for the implementation of large projects for the development of the country's Arctic territories.

In general, the regional financial policy of Norway in relation to its Arctic territories is considered one of the most progressive in the world, which is confirmed by the high rates of economic development of the northern provinces in recent years and the high standard of living of their population.

Financial regulation of Arctic development in the USA

The financial powers vested in individual US states are wide enough and allow regional authorities to pursue independent financial policies.

One of the main areas of financial regulation and attracting additional investment resources in Alaska is the system of tax incentives and preferences for mining companies operating in this US state. Currently, up to 90% of the state's budget revenues come from oil revenues. In this regard, attracting financial resources to the oil industry is one of the priorities for the state authorities. In the mid-1990s, Alaska developed a system of incentives and subsidies for extractive companies to stimulate oil production, the attractiveness of which was noticeably reduced against the background of an increase in the volume of proven reserves and the profitability of their development in other US states. Over the next 20 years, the system of preferences for companies was gradually expanded and supplemented, and by 2015 tax incentives allowed oil producers to return up to 85% of investments in exploration and development of fields in Alaska (the annual volume of preferences in the mid-2010s reached $ 1 billion). The favourable situation on the commodity markets, high oil prices and growth in Alaska's carbon production helped to maintain this support system. In 2012, for instance, oil and gas revenues made up $9.9 billion (93.3%) of the state's $10.6 billion general fund 14.

But since 2015, the situation has changed markedly, the fall in oil prices led to the fact that the state's revenues fell by almost half, and the budget deficit in Alaska approached $ 3 billion. By 2019, adjusted for inflation, oil and gas revenues fell from $ 9.9 billion to $ 2.05 billion. This led to the need to revise the existing system of preferences and develop a plan to abolish a number of benefits and reduce subsidies.

Alaska's high degree of state financial self-sufficiency has led to the creation of a specialized development fund “Alaska Permanent Fund”, which is used to make periodic payments to residents of Alaska only on the basis of actual residence in the state.

The Alaska Permanent Fund was established in the mid-1970s and is formed by deductions from rent payments for the exploitation of mineral resources, royalties, net profit of oil companies and federal payments for the extraction of mineral resources received by the state from all subsoil areas. The fund was created to effectively manage income from the use of Alaska's raw materials (primarily oil) and support the population by annually transferring a fixed amount to each resident (while transfers are due to each resident regardless of gender, age, job availability, etc.) [16, Butler V.M.]. The amount of the annual payment depends on the current oil prices, the volume of oil production by companies in Alaska, and the number of permanent residents in the state. In recent years, after the fall in oil prices, the amount of payments has noticeably decreased and, if back in 2015 it was slightly less than $ 2100 per person, in 2018–2019 payments were about $ 1600 (according to the State Department of Revenue, payments in 2020 will be $ 992 per resident, the lowest level of payments since 2013 15). Despite the fact that, in comparison with the average weekly income level in Alaska (about $ 1100), the amount of payments is small, they provide quite significant support, primarily to the socially least protected categories of the population (pensioners, housewives, single mothers, etc.).

It should be noted that the mechanism of periodic payments to the population of Alaska in recent years has been the subject of heated political and public discussions [17, Onifade T.T.]. The reason for this was a significant decrease in the budgetary capacity of the Alaska authorities after the fall in oil prices in 2014–2015, which led to a decrease in budget revenues from oil and gas production by about 50%. With the budget of Alaska remaining in deficit in recent years, and the authorities are constantly looking for additional opportunities to reduce spending liabilities, the decision to direct more than $ 1 billion to direct payments to the population is increasingly criticized, and the amount of payments is turning into a subject of active political bargaining.

It should also be noted that direct financial payments from the Permanent Fund of Alaska are not the only preferences for residents of the northernmost state of the United States. The available measures to support the population of Alaska can also include the right to receive free land allotments.

Overall, despite the high dependence of the Alaska budget on commodity prices, the policy aimed at the development of the state in the past few decades has made this region attractive to investors and ensure a sufficiently high standard of living for the local population.

Possibilities of using foreign experience in the financial regulation of Arctic development in the Russian Federation

Previously, the author analyzed the state financial support for the development of the Arctic zone of the Russian Federation [18, Badylevich R.V.]. It was concluded that at present the state uses mainly fiscal methods for these purposes, primarily the system of interbudgetary transfers and program-targeted instruments. The Arctic regions are characterized by high indicators of nonrepayable transfers and subsidies for budget equalisation in relation to the national average, but these resources are directed mainly to financing current expenditures and do not form a sufficient basis for the development of the regions of the Russian Arctic. Over the past twelve years, a large number of target-oriented documents have been adopted aimed at the socio-economic development of the Russian Arctic. However, they are characterized by such problems as the declarative nature of many of the stated goals, the lack of consistency and non-fulfillment of the planned indicators of financial support for the implementation of certain areas.

The analysis of foreign experience in the implementation of financial regulation of Arctic development makes it possible to assess the possibilities of using various financial instruments in Russian practice (Table 1).

Table 1

Possibilities of using various financial instruments in Russian practice (based on the analysis of foreign experience)

|

No. |

Instruments of financial regulation for the development of Arctic territories |

Experience of priority use in the circumpolar countries |

Practice and limitations of use for development of the regions of the Arctic zone of the Russian Federation |

Opportunities for use for the development of regions in the Arctic zone of the Russian Federation |

|

1. |

As part of a general regional policy |

|||

|

1.1 |

Fiscal equalisation instruments |

Finland, Sweden |

Fully implemented, but with limited funds, mainly used to cover current expenditures of regional authorities |

The prospects for increasing the amount of transfers allocated to the regions are low in the coming years |

|

1.2 |

Tax instruments |

USA, Sweden, Norway |

Use is constrained by the strict scope of Russia's unified tax policy and low taxing powers of regional authorities |

Opportunities are limited |

|

1.3 |

Tools to improve investment attractiveness (special regimes, science centres, etc.) |

Norway, Sweden, USA, Finland |

Limited scope of application, low efficiency |

Broad applicability with improved regulation and governance, including through foreign experience |

|

2. |

In the framework of the special policy for the development of the Arctic territories |

|||

|

2.1 |

Programmatic-targeted instruments |

Canada, Finland |

Actively used over the last decade as a regional development tool in Russia |

Currently not very effective, there is scope for improving effectiveness of this tool in Russia |

|

2.2 |

Special Development Funds |

USA, Norway |

Not used until 2020 for the Arctic zone of the Russian Federation |

Current prospects for use are related to the extension of the mandate of the Far East Development Fund to the Arctic regions |

|

2.3 |

Direct allocation of funds for running costs and development (at national level) |

Denmark, Canada |

Used as a tool to finance recurrent expenditure if additional needs arise |

Capacity is limited |

|

2.4 |

Direct allocation of funds for running costs and development (internationally) |

Denmark, Finland |

Not used in RF |

No capacity available |

In the coming years, we should expect a change in priorities in the system of financial regulation of the development of the Arctic zone of the Russian Federation, the emphasis will shift from direct budgetary financing of large projects in the Arctic to increasing the attractiveness of these territories for potential investors and attracting large financial institutions to the development of the Arctic, which have proven themselves in the Far East (in particular, the Far East Development Fund). In this context, Russia will benefit from the experience of using tools to increase the investment attractiveness of the northern territories, which have shown their effectiveness in the Scandinavian countries and in Alaska, the experience of forming special development funds (Norway, USA), as well as the experience of implementing the mechanisms of the program-targeted approach used in Canada and Finland, which can significantly increase the effectiveness of government programs for the development of the Russian Arctic. At the same time, the possibility of adapting these tools to Russian conditions requires further scientific and practical research.

Conclusion

The study of foreign experience in the implementation of financial regulation of Arctic development and the possibilities of its application in the northern regions of the Russian Federation made it possible to formulate the following conclusions:

-

• The subarctic countries differ significantly in the area of their Arctic territories, their provision with natural resources, the density of the population living in the northernmost regions, as well as in the level of socio-economic development of the northernmost regions and the main territory.

-

• The territorial structure of the state, the principles of organization of government bodies and budgetary systems determine a different degree of financial independence of the Arctic regions and the choice of financial instruments for their development. In some countries (USA, Canada, Denmark) the Arctic regions are characterized by a high degree of financial independence and a wide range of opportunities in making financial decisions, in others (Finland, Sweden, Norway) such opportunities are lower.

-

• According to the presence of a pronounced internal Arctic policy, we can distinguish countries (Canada, Finland, Denmark, Norway), where the development of the Arctic territories is a priority goal at the national level and a separate direction of state policy, and states (USA, Sweden, Iceland), where the development of the most northern regions is built into the general system of regional regulation.

-

• Despite the fact that for the development of the Arctic territories, both as a separate state policy and as part of the unified regional regulation in the subarctic countries, a whole range of mechanisms is used, priority financial instruments can be distinguished: program-targeted approach (Finland, Canada) , the system of interbudgetary equalisation (Sweden), grant financing (Denmark), tax instruments and development funds formed from income from the use of Arctic resources (USA, Norway).

-

• In Russia, where the emphasis is shifting from direct financing of the Arctic to attracting potential investors to these territories and using financial institutions with state participation for their development, we are primarily interested in the experience of application of instruments to improve the investment attractiveness of northern territories, which have proved effective in the Nordic countries and Alaska, the experience of establishing special development funds (Norway, USA), and the experience of implementing mechanisms of target-oriented approach used in Canada and Finland, which can significantly increase the effectiveness of state programs for the development of the Russian Arctic.

Acknowledgments and funding

The study has been carried out within the RFBR grant 20-010-00776 “Improvement of the state financial regulation of the regions development of the Arctic zone of the Russian Federation as the basis for ensuring the economic security of the Russian Arctic”.

Список литературы Analysis of Foreign Experience in the Financial Regulation of the Arctic Territories Development and Its Application in the Northern Regions of the Russian Federation

- Verbinenko E.A., Badylevich R.V. Finansovye rychagi regulirovaniya territorial'nogo razvitiya [Fi-nancial Levers of Regulating Territorial Development]. Sever i rynok: formirovanie ekonomich-eskogo poryadka [Sever i Rynok: Formirovanie Èkonomičeskogo Porâdka], 2016, no. 3 (50), pp. 28 39.

- Antyushina N.M. Arkticheskiy vyzov dlya natsional'noy i mezhdunarodnoy politiki: monografiya [Arctic Challenges in the National and International Politics]. Moscow, Institute of Europe RAS, Rus. Souvenir Publ., 2012, 136 p.

- Verbinenko E.A., Badylevich R.V., Ostretsov V.S. Instrumenty, formy i metody finansovogo reguli-rovaniya razvitiya arkticheskikh territoriy: zarubezhnyy opyt [Tools, Forms and Methods of Fi-nancial Regulation of Development of the Arctic Territories: the Foreign Experience]. Sever i rynok: formirovanie ekonomicheskogo poryadka [Sever i Rynok: Formirovanie Èkonomičeskogo Porâdka], 2017, no. 2 (53), pp. 104 115.

- Kharevsky A.A. Arkticheskaya politika Kanady: transformatsiya podkhoda k upravleniyu sever-nymi territoriyami [Canadas Arctic Policy: Transforming Approach to Northern Territories Man-agement]. Izvestiya Komi nauchnogo tsentra UrO RAN [Proceedings of the Komi Science Centre Ural Branch Russian Academy of Sciences], 2011, no. 2 (6), pp. 97 102.

- Korchak E.A., Serova N.A. Polyarnye vzglyady na Zapolyar'e: arkticheskaya politika Rossii i za-rubezhnykh stran [Polar Views on the Arctic: Arctic Policies of Russia and Circumpolar Coun-tries]. Kontury global'nykh transformatsiy: politika, ekonomika, pravo [Outlines of Global Trans-formations: Politics, Economics, Law], 2019, vol. 12, no. 5, pp. 145 159. DOI: 10.23932/25420240 2019 12 5 145 159

- Kuznetsov A.V. Regional'naya politika stran ES: monografiya [Regional Policy of EU Countries]. Moscow, Centre of European Studies of IMEMO RAS, 2009. 230 p.

- Sippola M. Kehitysalueista aluekehitykseen. Suomen virallisen aluepolitiikan 30 ensimmäistä vuotta 1966 1995. Työja Elinkeinoministeriön Julkaisuja, 2010, no. 31, 701 p.

- Lehtonen O., Muilu T. Paikallisesta kehittämistarpeesta kriteeri paikkaperustaisen aluekehittämi-sen kohdentamiseksi. In Paikkaperustainen kehittäminen Suomessa. In Näkökulmana paik-kaperustainen yhteiskunta. Työja Elinkeinoministeriön Julkaisuja, 2016, no. 25, pp. 109 129

- Allayarov R.A.U. Strategicheskie interesy Danii v Arktike. Grenlandiya glavnyy faktor sokhraneniya arkticheskogo statusa. Problemy i perspektivy [Strategic Interests of Denmark in the Arctic. Greenland is the Main Factor in Preserving the Arctic Status. Problems and Pro-spects]. V sbornike: Global'nye tendentsii razvitiya v Arktike: vzglyad iz Arkhangel'skoy oblasti. Materialy nauchno prakticheskoy konferentsii (13 noyabrya 2017 g.) Severnyy (Arkticheskiy) federal'nyy universitet imeni M.V. Lomonosova [Global Development Trends in the Arctic: a View from the Arkhangelsk Oblast. Proc. Sci. Practical Conf. (November 13, 2017). Northern (Arctic) Federal University named after M.V. Lomonosov]. Arkhangelsk, 2018, pp. 7 11.

- Drevet F. Is Greenland still for sale? Futuribles: Analyse et Prospective, 2020, no. 6 (436), pp. 113 120.

- Krivorot’ko Y.V. Evolyutsiya modeli ravenstva byudzhetnoy obespechennosti v Shvetsii: poslednie korrektirovki [Evolution of Budgetary Security Equality’s Model in Sweden: Last Updating]. Fi-nansy i kredit [Finance and Credit], 2009, no. 30 (366), pp. 53 62.

- Gutenev M.Yu., Konyshev V.N., Sergunin A.A. Arkticheskiy vektor Norvegii: preemstvennost' i novatsii [Norway’s Arctic Vector: Continuity and Innovation]. Sovremennaya Evropa [Contemporary Europe], 2019, no. 4 (90), pp. 108 119. DOI: 10.15211/soveurope42019108118

- Krivorotov A.K. Norvezhskoe Zapolyar'e: gosudarstvennaya politika i regional'noe razvitie [Arctic Norway: Governmental Policies and Regional Development]. Eko [ECO Journal], 2017, no. 8 (518), pp. 77 92.

- Kravchuk A.A. Norway’s Economic Policy in the Arctic. World Economy and International Rela-tions, 2020, no. 64(5), pp. 101 108. DOI: 10.20542/0131 2227 2020 64 5 101 108

- Goergen M., O'Sullivan N. Sovereign Wealth Funds, Productivity and People: The Impact of Norwegian Government Pension Fund Global investments in the United Kingdom. Human Re-source Management Journal, 2018, vol. 28, no. 2, pp. 288 303.

- Dvoretskiy V.M. Pravovoy status «Postoyannogo fonda Alyaski»: obshchaya kharakteristika [The Legal Status of the “Alaska Permanent Fund”: General Description]. Finansy i upravlenie [Fi-nance and Management], 2019, no. 1, pp. 10 18. DOI: 10.25136/2409 7802.2019.1.29222

- Onifade T.T. Regulating Natural Resource Funds: Alaska Heritage Trust Fund, Alberta Permanent Fund, and Government Pension Fund of Norway. Global Journal of Comparative Law, 2017, No. 6(2), pp. 138 173. DOI: 10.1163/2211906X 00602002

- Badylevich R.V. Otsenka gosudarstvennogo finansovogo obespecheniya razvitiya arkticheskoy zony RF [Assessment of State Financial Support for the Development of the Arctic Zone of Rus-sian Federation]. Fundamental'nye issledovaniya [Fundamental research], 2020, no. 9, pp. 11

- DOI: 10.17513/fr.42836