Analysis of participation of banking institutions in the strategic development programs of the Russian Arctic

Автор: Badylevich Roman V., Verbinenko Elena A.

Журнал: Arctic and North @arctic-and-north

Рубрика: Social and economic development

Статья в выпуске: 41, 2020 года.

Бесплатный доступ

The article examines the issues of financing the development of the Russian Arctic territories and the participation of banking structures in this process. A set of strategic documents for the development of the Arctic zone of the Russian Federation is considered, the dynamics of approved amounts of funding for Arctic development programs are analyzed, and the structure of sources of financing for investment in fixed assets in regions whose territory belongs to the Arctic zone of the Russian Federation is studied. It is concluded that banks are not sufficiently involved in investment activities in most of the Arctic regions (except the Yamal-Nenets Autonomous district, where the active role of banking institutions is due to participation in the financing of large gas and oil production projects in the Northern part of the region), and in recent years, foreign banking structures decline investment activity. The article describes the prospects of participation of the largest Russian banking structures in implementing large-scale projects in the Arctic, such as VTB Bank, Sberbank of Russia, and Gazprombank. The analysis of the possibilities of concentration of banking capital, as well as the use of mechanisms of public-private partnership based on the creation of a single financial institution with state participation is performed. The most effective form of improving the efficiency of financial flows management in the framework of strategic development of the Arctic territories can be the creation of The Bank for reconstruction and development of the Arctic.

Russian arctic, regions of the russian federation's arctic zone, strategic development program, investment structure, bank financing, bank for reconstruction and development of the arctic

Короткий адрес: https://sciup.org/148318358

IDR: 148318358 | УДК: [332.146.2](985)(045) | DOI: 10.37482/issn2221-2698.2020.41.5

Текст научной статьи Analysis of participation of banking institutions in the strategic development programs of the Russian Arctic

The Arctic has been one of the key strategic development priorities in our country over the past decade. Arctic natural resources, especially those of the continental shelf, are a strategic reserve of national importance. The land border of the Arctic regions of Russia is quite long - about 22,600 km. The territories differ considerably in terms of study and development, settlement and level of socio-economic development. Therefore, ensuring sustainability of the Arctic regions’ economy functioning requires state regulation and support. In the context of increasing attention to the resources and capabilities of the Arctic on the part of major powers such as the United States, Canada, China, in Russia in recent years, on the initiative of the President of the Russian Federation, a separate direction of state policy — the development of the Arctic zone of the Russian Federation — has been formed.

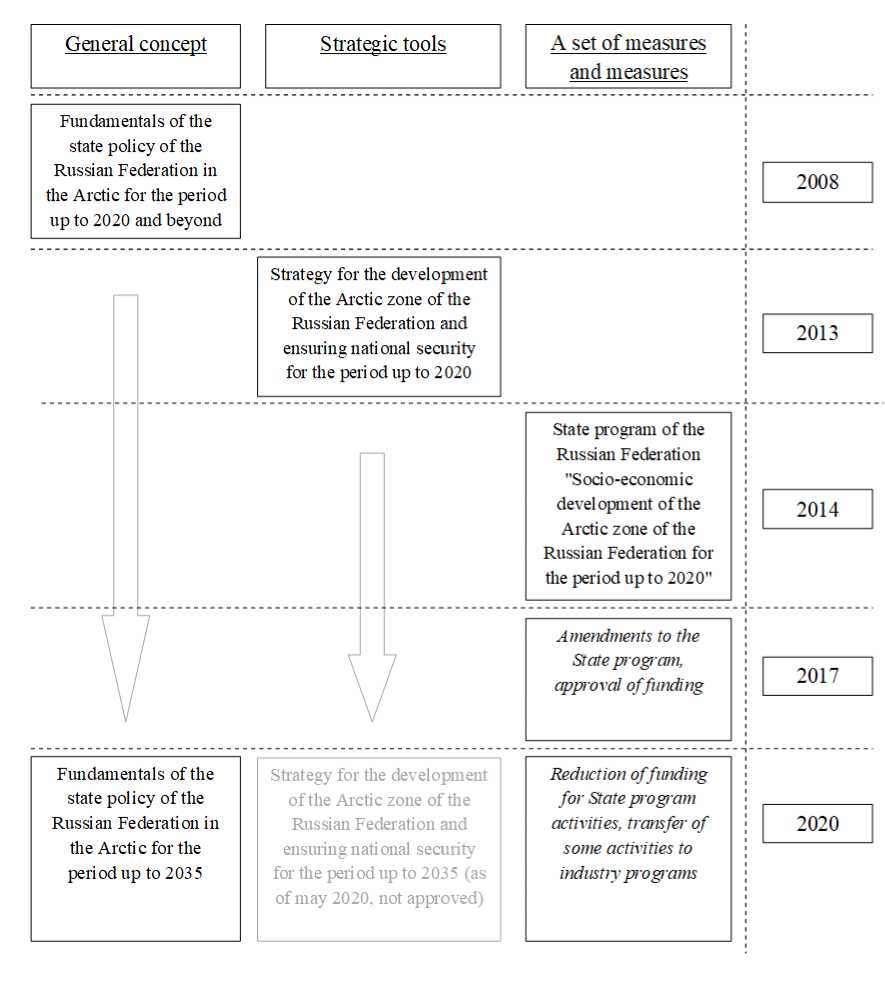

In recent years alone, several key policy documents aimed at the development of the region have been adopted (Fundamentals of the State Policy of the Russian Federation in the Arctic

for the period up to 2020 and beyond, the Strategy for the Development of the Arctic Zone of the Russian Federation and ensuring national security for the period up to 2020, State program of the Russian Federation "Socio-economic development of the Arctic zone of the Russian Federation for the period up to 2020", Fundamentals of state policy of the Russian Federation in the Arctic for the period up to 2035), a system of state bodies for the implementation of such a policy is being actively formed — the State Commission on Development of the Arctic under the Government of the Russian Federation was established, the Ministry of the Russian Federation for the Development of the Far East was reorganized into the Ministry of the Russian Federation for the Development of the Far East and the Arctic.

Leading researchers associate the development of the Arctic zone of the Russian Federation with the implementation of major infrastructure projects [1, Borisov V.N., Pochukaeva O.V.], the implementation of complex technological solutions on the Arctic shelf and in remote areas [2, Balashova E.S., Gromova E.A.], the need to modernize operating production facilities [3, Romash-kina G.F., Didenko N.I., Skripnuk D.F.], the implementation of large international innovation projects [4, Skvortsova I., Latyshev R., Oskolkova M.], the formation of new Arctic clusters [5, Afonich-kina E.A., Afonichkin A.I.]. These areas of development are based on the need for significant financial resources, which cannot be satisfied only at the expense of internal sources of economic entities operating in the Arctic regions, or state investments. In this regard, the study of the possibilities of attracting funds from the financial sector (one of the main links of which is the banking system) for the formation of sufficient financial potential for the development of these regions is an important condition for ensuring the necessary rates of economic growth of these territories.

Strategic documents aimed at the development of the Arctic territories of Russia

At the end of the last decade and the beginning of this one, large-scale projects aimed at the comprehensive development of the Russian Arctic were formed. It was supposed to send significant funds for their implementation. But with the emergence of crisis phenomena in the economy, the imposition of sanctions on Russia in 2014–2015 funding for most projects has been significantly reduced. In recent years, only military projects and related projects were continued to be implemented in full and on time. At the same time, even initially economically attractive projects in the field of exploration and production of raw materials in the Arctic were postponed until better times or were financed in a very limited amount. Also, projects for the creation of territorial clusters (with the exception of a ship-repair innovation cluster in the Arkhangelsk oblast), special economic zones (with the exception of the Murmansk port zone) were not implemented.

In 2017 amendments to the State Program of the Russian Federation "Social and Economic Development of the Arctic Zone of the Russian Federation for the Period up to 2020" were made, the most important of which was the calculation of the need for financing the proposed activities aimed at the development of the Arctic Zone of the Russian Federation, which, at the proposal of the Government of the Russian Federation, should have amounted to about 210 billion rubles by

2025 1, and the key direction of the development of the Russian Arctic has become the process of creating support zones (it was supposed to form support zones along the entire route of the Northern Sea Route in all regions, whose territory wholly or partly belongs to the Arctic zone of the Russian Federation). However, in today's difficult economic conditions, it is impossible to expect full compliance of the established obligations. In particular, in February 2020, a decision to reduce the measures of the State Program by 50 billion rubles in 2020–2022 (from 190 billion rubles to 140 billion rubles) was made 2. In fact, further funding is expected only in the key areas of the program — the creation of support zones in the Arctic and the development of human capital. All other areas and activities in the program will remain only in the form of transfers, and their implementation will be carried out within the framework of sectoral programs. At the same time, given the emerging objective reality associated with the announcement of a pandemic of a new coronavirus infection in the world, and the gigantic efforts of the authorities at all levels to contain and counteract the infection, which require significant financial costs, we should expect further cuts in funding for industry and territorial development programs, including the state program for the development of the Arctic.

One of the steps taken to increase the effectiveness of the Russian Federation Government efforts in the development of the Arctic territories of Russia should be the adoption of the Strategy for the development of the Arctic zone of the Russian Federation and ensuring national security for the period up to 2035. The objective of the early adoption of this strategic document is outlined in the Fundamentals of State Policy of the Russian Federation in the Arctic for the period up to 2035, adopted in March 2020 3. The task of adopting such a strategy was outlined by the President of the Russian Federation back in April 2019 during a speech at the V International Arctic Forum "The Arctic — Territory of Dialogue", which took place in St. Petersburg. By the end of 2019, the Ministry of the Development of the Far East and the Arctic created a draft of such a strategy. The scientific community, experts, regional authorities, and the public were involved in the formation of the project. In May 2020 the content of the Strategy is being adjusted, in particular, the draft has been sent to the federal authorities, the document is being coordinated with the regional strategies of the constituent entities of the Russian Federation included in the Arctic zone of the Russian Federation. Dated back to the late January it was planned that by the end of March 2020 the revised draft strategy would be submitted to the Security Council of the Russian Federation, and in June it would be presented at the International Economic Forum in St. Petersburg 4, but a new economic reality and concentration of efforts Governments in the fight against coronavirus infection pushed these plans back.

At the moment a set of strategic documents aimed at the development of the Russian Arctic is shown in Fig. 1. It should be noted that the strategic basis for the development of the Arctic zone of the Russian Federation is currently in the stage of active formation and change.

Fig. 1. Set of strategic documents aimed at the development of the Arctic Zone of the Russian Federation (created by the authors).

Let us consider the main sources and forms of the proposed financing of the measures listed in strategic documents and aimed at the development of the Arctic.

As already mentioned above, the total amount of financial resources that were planned to be directed to the development of the Russian Arctic until 2025 was estimated at 210 billion rubles in 2017. More than 90% of these resources (over 190 billion rubles) were planned to be allocated at the expense of budgetary allocations from the federal budget. It is already clear that it is not possible to find sufficient budgetary allocations. Therefore, the state has to look for alternative ways of attracting funding to ensure the development of the Russian Arctic. Thus, it is planned to finance many projects for the Arctic development with the involvement of extra-budgetary sources.

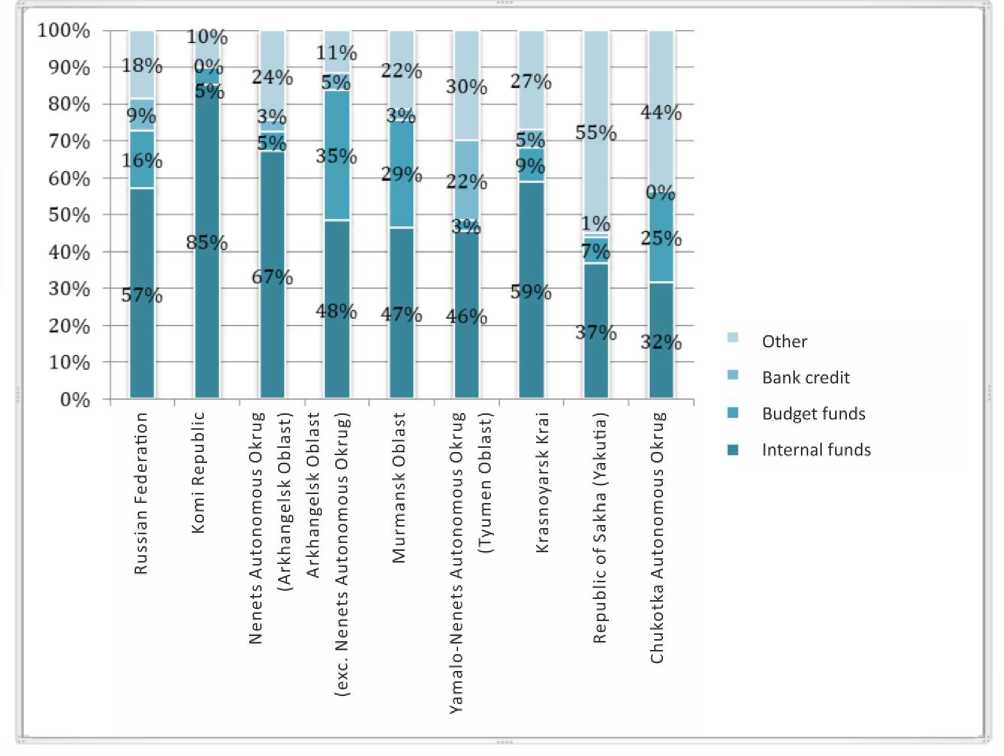

Let us analyze the participation of non-budgetary sources in financing investments to the capital stock of the regions, whose territories belong to the Arctic zone of the Russian Federation. The graph shows the structure of financing investments sources to the capital stock in 2019.

Fig. 2. Structure of investments in capital stock by sources of financing in 2019, % (according to UISIS) 5.

According to the data presented, the structure of sources in financing investments to the capital stock of the regions for the constituent entities of the Arctic zone of the Russian Federation is significantly different. So, for example, in the Komi Republic and the Nenets Autonomous Okrug, enterprises' own funds prevail in the structure of sources (85% and 67% of the total volume of in-

5 Investitsii v osnovnoy kapital po istochnikam finansirovaniya v 2019 godu. Dannye sistemy EMISS [Fixed Capital Investments by Source of Funding in 2019. UISIS System Data]. URL: (accessed 03 June 2020).

vestments). The share of budgetary funds in the structure of sources significantly exceeds the average Russian level (16%) in the Arkhangelsk oblast (35%) and the Murmansk oblast (29%). In the context of a reduction in funding for the State Program of the Russian Federation "Social and Economic Development of the Arctic Zone of the Russian Federation", as well as a decrease in business activity and profitability of large industrial enterprises in the context of the 2020 crisis, we should expect a decrease in investment in real investment projects in the Arctic.

Place of bank lending in the structure of funding sources activities for the development of the Arctic

Bank lending in the absolute number of the Arctic regions occupies a much smaller share in the structure of sources of financing for investments in capital stock compared to all-Russian data (in 2019 the share of bank loans in investments in capital stock in Russia was about 9%). An exception is the Yamalo-Nenets Autonomous Okrug, where in recent years the share of bank loans has exceeded 20% (in 2019 the value of this indicator was 22%). At the same time, 140 out of 188 billion rubles of bank loans aimed at financing investments in non-financial assets in the Yamalo-Nenets Autonomous Okrug fell on loans from foreign banks. The main volume of investments in capital stock in the Yamalo-Nenets Autonomous Okrug falls on the development and formation of infrastructure for large gas and oil production projects in the northern part of the region. In particular, these are Bovanenkovskiy, Tambeyskiy, and Kamennomysskiy gas production areas and Novoportovskiy and Messoyakhskiy oil production areas.

It should be noted that banking structures in Russia as a whole are quite far away from the real investment processes. During 2016–2018 the share of bank loans in the structure of funding sources was at the level of 10%–11%, and according to preliminary data, in 2019 this indicator decreased to 9%. At the same time, a similar indicator in developed countries is at least 35% (in the USA this indicator is at the level of 40%, in European countries on average — 45%, in Japan — about 65%) [6, Urmancheev I.Sh.]. The share of participation of foreign banks in financing investments in capital stock in recent years has decreased from 5.4% in 2017 to 2% in 2019. According to 2018 data, only in seven Russian regions (including The Khanty-Mansi Autonomous Okrug and The Yamalo-Nenets Autonomous Okrug, which are also part of the Tyumen oblast) loans from foreign banks were sent to finance investments in non-financial assets. The Yamal-Nenets Autonomous Okrug has become the only such region among all the Arctic regions of the Russian Federation. In recent years, foreign credit institutions prefer to invest only in large oil and gas projects with a significant margin of financial strength and high profitability.

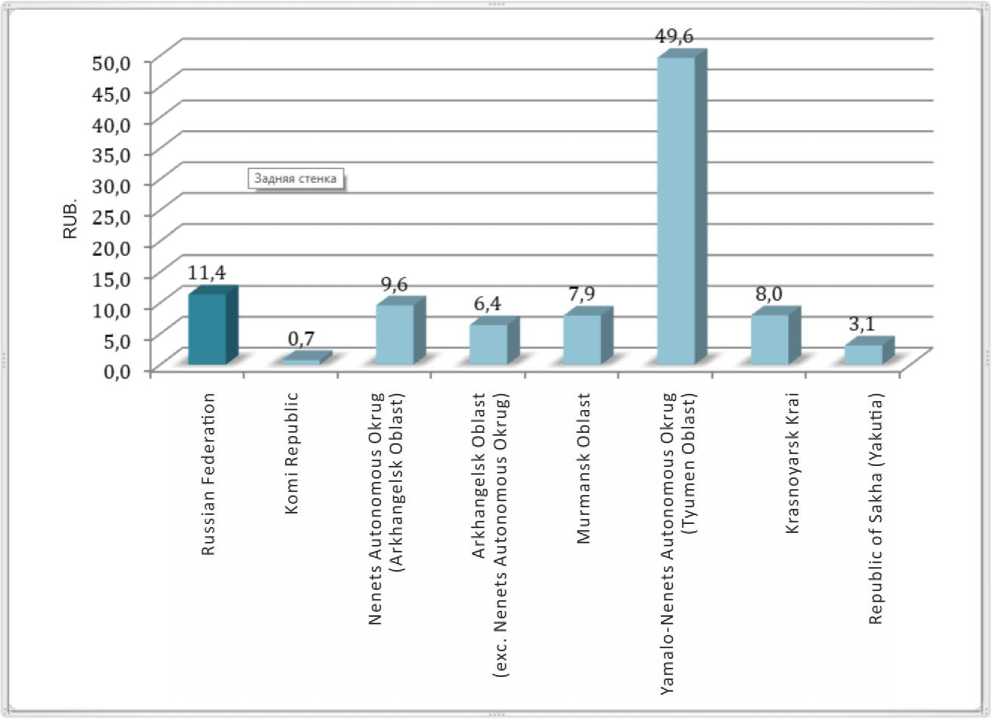

In addition to the structure of investments in capital stock by sources of financing, the ratio of bank loans directed for real investment purposes per thousand rubles of gross regional product is quite indicative. This indicator for the Arctic regions is shown in Fig. 3.

Fig. 3. The relative volume of bank loans aimed at financing investments in capital stock, per 1,000 rubles. GRP6 for the subjects of the Arctic zone of the Russian Federation, rubles7

According to the graph, the only region of the Arctic zone of the Russian Federation where the volume of bank loans aimed at financing investments in capital stock is significant (more than four times higher than the average Russian level) is the Yamalo-Nenets Autonomous Okrug. The same region, as it was established by the authors in previously published works [7, Verbinenko E., Badylevich R.], is the leader among the Arctic regions of the Russian Federation in terms of the volume of investments in capital stock, financed through bank lending per capita. Despite a slight decrease in investment activity in the Yamalo-Nenets Autonomous Okrug in 2017–2019, the forecasts of regional authorities, according to which it is planned to attract up to 9 trillion rubles by 2050 only for the implementation of large investment projects in the north of the region 8, make it possible to speak with confidence about a further active role of banking structures in investment activities in this region. In all other Arctic regions the participation of banks in investment activities is insufficient.

Banking resources, according to the federal authorities’ vision, is one of the main sources of financing for the implementation of large investment projects in the Arctic. In conditions when the volume of allocated budgetary allocations for the implementation of the main directions of development of the Arctic zone of the Russian Federation is being reduced, and the situation in the world commodity markets and the growing economic crisis in connection with the coronavirus pandemic in the world do not allow hoping for an increase in the investment opportunities of the state, large financial institutions can become significant participants in the implementation of state policy in the Arctic. This may be facilitated by the presence of large blocks of shares of the most influential Russian banks in state ownership (currently, according to official data, more than 50% of shares of Sberbank of the Russian Federation and almost 100% of shares of "Otkrytie" Bank belong to the Central Bank of the Russian Federation, Rosimushchestvo owns more than 60% of shares bank "VTB" and 100% of shares of "Rosselkhozbank" and "Promsvyazbank" and so on) and the presence of loyal managers, who are actually appointed with the participation of senior government officials.

The position of the President of the Russian Federation should become a catalyst for attracting banking structures to finance large projects for the development of the Russian Arctic. Many large financial institutions are already joining the process of implementing Arctic megaprojects now.

Since 2019 "VTB" Bank will increase its participation 9. At the end of 2019 participation of "VTB" Bank in Arctic projects is about 500 billion rubles (80% of this amount is lending to investment projects, the remaining 20% are financial guarantees). In 2020 – 2021 the bank plans to increase its participation in the development of the Arctic at least twofold — to 1 trillion rubles. It is planned to accomplish this through the bank's participation in the project of an icebreaker fleet creation, which is currently being carried out by the "Rosatom" corporation. In 2019 the total amount of VTB's participation in this project was estimated at 150 billion rubles. In addition, the bank plans to participate in the implementation of an investment project for the development of the Baimskiy copper-gold deposit, which is located in the south-west of the Chukotka Autonomous Okrug and is, according to estimates, one of the largest deposits of copper and gold ores in the world. Up to 270 billion rubles can be allocated for these purposes. The construction and commissioning of the Baimskiy copper-gold deposit is currently being implemented by the Kazakh company KAZ Minerals. Another project that "VTB" Bank wants to invest in is a project for the extraction of platinoid ores on the Taimyr Peninsula of the Krasnoyarsk Territory. The bank's executives did not disclose the exact amount of VTB's participation in this project, owned by "Norilsk Nickel", but it is known that the total amount of investments required to implement the project in Taimyr is about 15 billion dollars.

Since 2019 Sberbank has also been planning to participate actively in lending to large in- vestment projects in the Russian Arctic. In particular, in April 2019 an agreement was reached between Sberbank and AEON Corporation to finance two large-scale projects: the first is connected to the development of a large coal deposit in the Krasnoyarsk Territory (on the Taimyr Peninsula) and the second is the creation of a port with associated infrastructure in the Nenets Autonomous Okrug in the Indiga village, which will become an important link in the development of the Northern Sea Route. The total amount of investments required for the implementation of these two projects is estimated at about 35 and 120 billion rubles 10. Another initiative of Sberbank is related to the proposed financing of the "Severnaya Zvezda" company, which in the coming years plans to transport coal along the Northern Sea Route.

“Gazprombank”, the third largest in terms of assets, also participated actively in lending projects for the development of the Arctic in 2019. Within the framework of the St. Petersburg International Economic Forum, the bank signed an agreement on the creation of port infrastructure in the city of Murmansk. The project envisages the construction of the coal terminal “Lavna”, works on deepening the port area, and development of the port infrastructure 11. Gazprombank's planned participation in the project is over 30 billion rubles. In addition, the bank supports many projects in the framework of the cluster of shipbuilding and production of marine equipment development in the Arkhangelsk oblast, participates actively in the development of transport and social infrastructure in the Yamal-Nenets Autonomous Okrug (currently the bank is implementing a project to build a bridge across the Pur River, is investing in the airport reconstruction in the city of Novy Urengoy 12).

At the same time, in recent years, it has become increasingly difficult for the Government of the Russian Federation to count on participation of large foreign banks, which until 2014 had actively invested in Russian Arctic projects. There are at least two reasons for this. Firstly, the Western sanctions since 2014 have seriously complicated the participation of large international financial structures in the implementation of extracting and infrastructural Russian projects, which form the basis for the development of the Russian Arctic (for example, European companies are prohibited from lending and investing in development and exploitation of the offshore projects ). And secondly, more and more large banks refuse to lend to projects in the Arctic and Antarctic for image-building reasons. The implementation of gas and oil production projects in the Arctic and

Antarctic currently contradicts many fundamental international documents in the field of ecology, in particular, the Paris Climate Agreement. For this reason, two major international banks, the British banking group Lloyds and the American JPMorgan Chase refused to invest in oil and gas projects in the Arctic and Antarctic in early 2020 13. Earlier, ABN Amro, Societe Generale and Goldman Sacs announced their rejection of financial participation in such projects.

Proposals to improve the sustainability of financial development of the Arctic zone of the Russian Federation

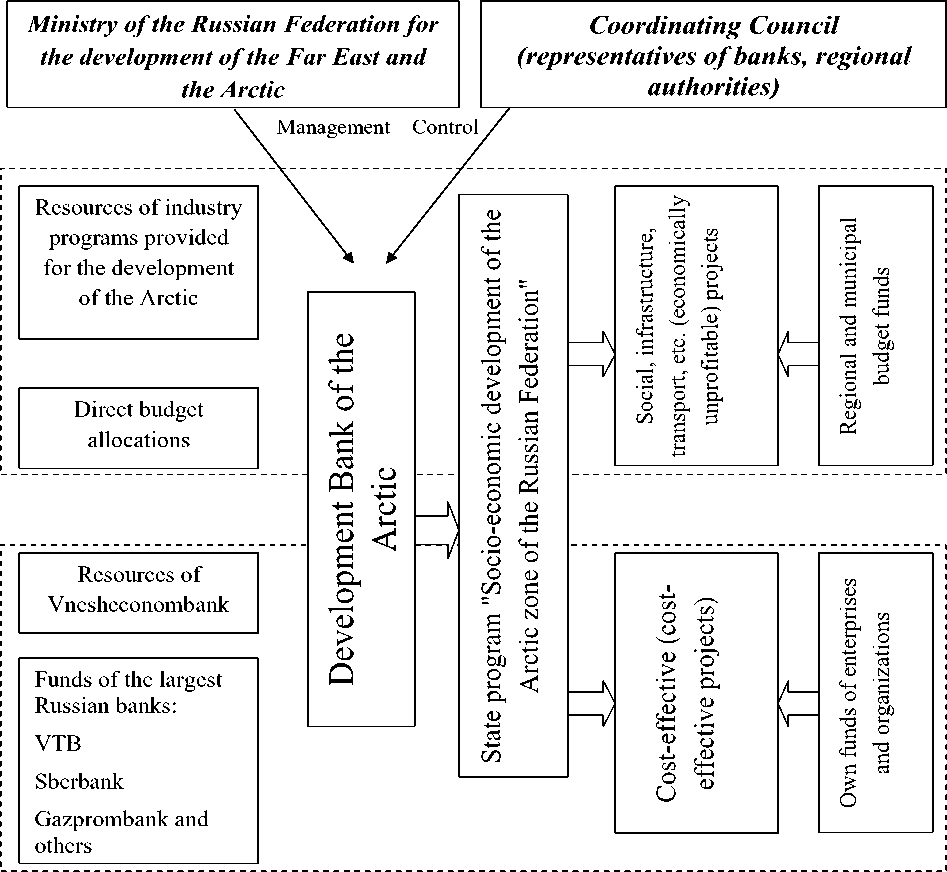

In the present circumstances, when, on the one hand, the state participation in the implementation of various directions of development of the Arctic decreases, and on the other hand, the role of individual banking structures in financing individual large projects in the regions of the Arctic zone of the Russian Federation is increasing, it makes sense to return to the consideration of the possibility of creating a single financial institution for the concentration and centralization of financial opportunities and improving the efficiency of investment flow management.

Many authoritative scientists and researchers have discussed the possibility of creating such an institute in recent years in their scientific works. In particular, proposals to create an Arctic Development Bank were made. In recent years the effectiveness of such institutions has been expressed by the President of the St. Petersburg Arctic Public Academy of Sciences Mitko V.B. [8, Zimin N.S., Minina M.V., Mitko A.V., Mitko V.B.], vice-governor of St. Petersburg Albin I.N.14, full member (academician) of the public Russian Academy of Social Sciences and the Academy of Geopolitical Problems Lukin Yu.F. [9] and many others . This structure should be a mixed national investment and credit institution, which is being created to implement large investment projects in the Russian Arctic, as well as to ensure the formation of the necessary infrastructure in this territory. In general, the creation of such an institution involves the centralization of decision-making on the allocation of funding in the areas presented in the State Program “Socio-economic development of the Arctic zone of the Russian Federation”. An important feature of such a bank is that its resource base can be formed not only at the expense of budget allocations, but also by attracting financial resources from large commercial banks.

As an alternative to the creation of the Arctic Development Bank, the scientific literature quite often proposes the formation of the Arctic Development Fund. In particular, the proposal to create such a tool for the development of the Arctic territories is found in the works of Ta-tarkin A.I., Loginov V.G., Zakharchuk E.A. [10, Tatarkin A.I., Loginov V.G., Zakharchuk E.A.], Pasynkov A.F., [11, Zakharchuk E.A., Pasynkov A.F.]. The main difference between such an insti- tution and a banking structure is the mechanism of the resource base formation. The researchers propose to form the fund's resources mainly at the expense of deductions from the tax on the extraction of minerals, which are paid to the budget by large business entities operating in the Arctic zone of the Russian Federation. When companies use preferential taxation schemes, it is possible to transfer part of the value added to the fund. Researchers also propose to transfer export customs duties on “hydrocarbons” and payments for the use of natural resources received from the Arctic regions, while the fund itself, by analogy with the road fund, should be included in the state budget [12, Nikulkina I.V., Romanova E. V.]. The management of the fund's activities should be entrusted to the state commission for the development of the Arctic. It is proposed to use the resources of the fund on the terms of public-private partnership for the development of social, transport, and energy infrastructure of the Arctic regions.

With all the attractiveness of the idea of creating an Arctic Fund at the moment in the context of the development of an unprecedented global financial crisis, a significant reduction in gross domestic product and a probable recession in Russia in 2020, fall in world prices for raw materials, the possibility of forming the fund's resources in sufficient volume due to deductions from the mineral extraction tax seems highly questionable. Therefore, the creation of the Arctic Development Bank with the involvement of private capital for the development of the Arctic, including banking, is seen in modern conditions as more effective. At the same time, separate mechanisms for the formation of the Arctic Fund can be used when creating the Arctic Development Bank.

A prospective scheme of creation and functioning of the Arctic Development Bank, according to the authors, is presented in Fig. 4.

To a certain extent, when implementing the project of creation the Arctic Development Bank, it is possible to use the experience of the Far East Development Fund establishing, which was formed by Vnesheconombank in 2011. For almost a decade this fund has been actively involved in projects aimed at developing the Far Eastern and Baikal macroregions of Russia, attracting private investors and resources of Vnesheconombank15. Since 2015 the Fund has invested in 17 projects (including such large ones as the construction of the Inaglinskiy mining and processing complex (South Yakutia), the creation of a gas chemical complex for the production of methanol for export in the “Neftekhimicheskiy” ASEZ (Primorskiy Territory), the launch of a mining and processing plant based on the Malmyzhskoe field (Khabarovsk Territory) and a number of others) about 60 billion rubles, and the total investment in projects supported by the Fund amounted to more than 477 billion rubles 16. By co-financing projects, the Fund makes it possible to reduce the cost of credit resources allocated to priority projects significantly, since resources obtained through subsidies from the federal budget are provided for investment purposes. Another advantage of the Fund's participation in project implementation is the involvement of Fund experts to work on projects, which allows reducing management costs at the design, construction and commissioning stages.

Fig. 4. Scheme of creation and functioning of the Arctic Development Bank.

Since 2019, according to the instructions of the President of the Russian Federation, the activities of the Far East Development Fund can be expanded to the territory of the Arctic zone of the Russian Federation17. However, this step, according to the authors, may be less effective than the creation of a separate Institute, specializing in the implementation of state policy aimed at the development of the Russian Arctic, with the attraction of funds not only from Vnesheconombank, but also from other large banking structures.

-

17 «V Arktike tselesoobrazno nachinat' s proektov, svyazannykh s razvitiem transportnykh uzlov». Interv'yu s glavoy Fonda razvitiya Dal'nego Vostoka. Material portala «Pro-Arktik». ["In the Arctic, it is Advisable to Start with Projects Related to the Development of Transport Hubs". Interview with the Head of the Far East Development Fund. Material of the "Pro-Arctic” Portal]. URL: http://pro-arctic.ru/05/06/2019/expert/36837 (accessed 07 June 2020).

Conclusion

The Russian Arctic is the most important strategic macro-region, the development of which has received focused attention in recent years due to its economic, commercial and geopolitical importance. The study of the processes of financial support for achieving the strategic development goals of the Arctic zone of the Russian Federation is of great importance in the system of state Arctic policy. The search for effective ways to form a sufficient financial base, as well as the optimization of financial flow management processes are integral elements of the well-timed and complete implementation of measures of the state program of the Russian Federation “Socioeconomic development of the Arctic zone of the Russian Federation for the period up to 2020”, the implementation of large commercial and infrastructure projects, preservation and development of labor potential in the Arctic.

At the present time in the context of decrease in the possibilities of allocating state resources for the development of the Russian Arctic, it is especially important to attract extrabudgetary financing, in particular, the resources of the banking system. However, the conducted study allowed us to conclude that bank lending in most of the Arctic regions occupies a much smaller share in the structure of sources of financing for investments in capital stock compared to the average indicators for Russia. Besides, lending activity of foreign institutions has decreased in the Arctic regions in recent years, which is primarily due to the imposition of sanctions against the Russian Federation in 2014. The only Arctic region where the indicators of bank lending for investments are much higher than the national average is the Yamalo-Nenets Autonomous Okrug.

The position of the President of the Russian Federation, who urged leading Russian banks to increase participation in the implementation of Arctic projects, makes it possible to look optimistically at the intensification of the participation of the largest banking structures. In 2019–2020 the banks such as “VTB”, Sberbank of Russia, and “Gazprombank” came forward with the intention to participate in financing the development of the Arctic.

The creation of the Arctic Development Bank can systematize the participation of the largest banks in the implementation of the state policy for the development of the Arctic territories. The creation of such a structure will allow solving the following tasks:

-

• to attract the resources of the largest banking structures to the financing of the state policy for the development of the Arctic In conditions of budgetary resources deficit;

-

• to concentrate limited financial resources on the most priority projects for the development of the Arctic zone of the Russian Federation;

-

• to use the mechanisms of public-private partnership more actively in order to implement socially significant projects and programs in a wide range of areas of activity (from basic industries and R&D to the provision of public services), contributing to the development of the Arctic territories;

-

• to systematize the work in the field of financing projects included in the State Program "Social and Economic Development of the Arctic Zone of the Russian Federation";

-

• to attract the resources of Vnesheconombank to the implementation of large industrial and infrastructure projects in the Arctic, which are mainly used for the development of the Far Eastern and Baikal macroregions.

Список литературы Analysis of participation of banking institutions in the strategic development programs of the Russian Arctic

- Borisov V.N., Pochukaeva O.V. Relationships between Development Factors of the Arctic Zone of the Russian Federation. Studies on Russian Economic Development, 2016, no. 27 (2), pp. 159–165. DOI: 10.1134/S1075700716020040

- Balashova E.S., Gromova E.A. Arctic Shelf Development as a Driver of the Progress of the Russian Energy System. MATEC Web of Conferences, 2016, pp. 06008. DOI: 10.1051/matecconf/201710606008

- Romashkina G.F., Didenko N.I., Skripnuk D.F. Socioeconomic Modernization of Russia and Its Arctic Regions. Studies on Russian Economic Development, 2017, vol. 28, no. 1, pp. 22–30. DOI: 10.1134/S1075700717010105

- Skvortsova I., Latyshev R., Oskolkova M. Cluster as a Form of International Cooperation in the Devel-opment of the Arctic Region in the Framework of the International Innovation System. MATEC Web of Conferences, 2018, pp. 04020. DOI: 10.1051/matecconf/20182390402

- Afonichkina E.A., Afonichkin A.I. Synergies of the Economic Development of the Arctic Cluster Sys-tem. IOP Conference Series: Earth and Environmental Science, 2018, vol. 180, iss. 1, p. 1. DOI: 10.1088/1755-1315/180/1/012011

- Urmancheev I.Sh. Povyshenie roli rossiyskikh bankov v investitsionnoy deyatel'nosti real'nogo sektora ekonomiki [Increasing the Role of Russian Banks in The Investment Activity of the Real Sec-tor of Economy]. Problemy sovremennoy ekonomiki [Problems of Modern Economics], 2017, no. 2 (62), pp. 151–156.

- Verbinenko E., Badylevich R. Effect of the Banking System on the Economic Development of the Rus-sian Arctic Regions. IOP Conference Series: Earth and Environmental Science. DOI: 10.1088/1755-1315/302/1/012140

- Zimin N.S., Minina M.V., Mit'ko A.V., Mit'ko V.B. Tekhnologii strukturnogo kompleksirovaniya sredstv monitoringa dlya arkticheskogo prostranstvennogo planirovaniya [Structural Complexing of Moni-toring Means Technologies for Arctic Space Planing]. Inzhenernyy vestnik Dona [Engineering Journal of Don], 2015, no. 4–2 (39), p. 36.

- Lukin Yu.F. Rossiyskaya Arktika prirastaet ostrovami [Russian Arctic Increases with Islands]. Arktika i Sever [Arctic and North], 2015, no. 18, pp. 61–80.

- Tatarkin A.I., Loginov V.G., Zakharchuk E.A. Sotsial'no-ekonomicheskie problemy osvoeniya i razvitiya rossiyskoy arkticheskoy zony [Socioeconomic Problems in Development of the Russian Arctic Zone]. Vestnik Rossiyskoy akademii nauk [Bulletin of the Russian Academy of Sciences], 2017, vol. 87, no. 2, pp. 99–109. DOI: 10.7868/S086958731701011X

- Zakharchuk E.A., Pasynkov A.F. Rossiyskaya Arktika: otsenka i vozmozhnosti finansovogo razvitiya [The Russian Arctic: Evaluation and Capabilities of Financial Development]. EKO, 2016, no. 5, pp. 107–119.

- Nikulkina I.V., Romanova E.V. Novye finansovye instituty razvitiya arkticheskikh territoriy kak instru-ment realizatsii gosudarstvennoy finansovoy politiki v Arkticheskoy zone Rossiyskoy Federatsii [New Finance Institutions for the Development of the Arctic Territories as a Tool for Implementation of State Financial Policy in the Arctic Zone of the Russian Federation]. Ekonomika. Nalogi. Pravo [Eco-nomics. Taxes. Law], 2017, vol. 10, no. 3, pp. 106–117.