Analysis of the presence of “Dutch disease” in Sweden

Автор: Korotkiy R.M.

Журнал: Экономика и социум @ekonomika-socium

Статья в выпуске: 2 (33), 2017 года.

Бесплатный доступ

Economy of the country should have a very solid basis to prosper. Some states use natural resources as foundation for further economic development. “Dutch disease” phenomenon shows that large investments in this sphere will cause deindustrialization of economy. This article is devoted to detection of “Dutch disease” in Sweden based on local natural resources.

"dutch disease", sweden, econometrics, natural resources

Короткий адрес: https://sciup.org/140122565

IDR: 140122565

Текст научной статьи Analysis of the presence of “Dutch disease” in Sweden

At all times, natural resources were extremely important for the economy. Export can generate steady income for the country at rather low extraction cost, and the proceeds can be allocated to the most important sectors of economy. However, on practice we faced “Dutch disease”, when country experience deindustrialization of the economy, “…as that which occurred in Holland with the exploration of North Sea Oil, which raised the value of the Dutch currency, making its exports uncompetitive and causing its industry to decline” [2]. Sweden in the second half of 20th century became one of the richest and most advanced countries due to export of natural resources, mostly wood and ores.

Later, the country focused on more technological production and today companies like Volvo and Ikea are known worldwide. At the same, the news, that Swedish economy is oriented on resources export more than it should be, are anxious [1], [3]. In this work, I want to inspect, is country still very dependent on natural resources or “Dutch disease” is not a threat to the country.

Model construction was based on the last year study [4]. As soon as the main indicator for this case is industrial sector of the economy, it was decided to link it to ore and metal export, because Swedish market capacity is relatively low and big part of extracted resources should be exported. For them as the main dependent indicator current exchange rate SEK/EURO was chosen, as biggest trade partners for the country are from Eurozone. Concerning industrial production, there were more influential indicators. Unemployment can show how the overall workforce reacts to the changes in economy. In case of deindustrialization, the unemployment will increase in an unusual way, being a consequence of companies closing. GDP fluctuations will be part of structure changes, with significant part of ores export and decreasing part of production sector. The last factor, which was included, is SEK/EURO exchange rate, which has a significant effect on industrial production, as biggest part of it is export-oriented and focused mostly on Eurozone countries.

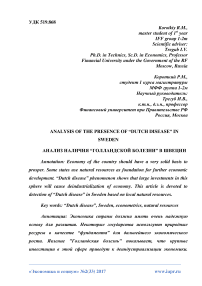

Both industrial production and ores and metal export are included in each other models, making it possible to construct a system of 2 models [5]. It is the following:

[s] System: SWEDEN Workfile: ECONOMETRICS'!::Econometrics\ - П X

|

|view |

Proc |

Object |

|

Name |

Freeze |

| InsertTxt | |

Estimate |

fspec |

Stats | |

Resids | |

||

|

System: SWEDEN Estimation Method: Least Squares Date: 02/14/17 Time: 13:58 Sample: 1995 2014 Included observations: 20 Total system (balanced) observations 40 |

||||||||||||

|

Coefficient |

Std. Error t-Statistic Prob. |

|||||||||||

|

0(1) 0(2} 0(3} 0(4) C(5) 0(6) 0(7} 0(8} C(10) |

1442.300 -69.16771 -29.50441 -1.508824 6.833192 -27.15107 4.194833 -0.421561 0.021872 |

153.0817 9.421767 0.0000 24.33380 -2.842454 0.0079 6.324036 -4.665439 0.0001 0.317014 -4.759488 0.0000 0.826275 8.269875 0.0000 16.14249 -1.681963 0.1026 1.480589 2.833219 0.0080 0.169983 -2.480017 0.0188 0.002151 10.16823 0.0000 |

||||||||||

|

Determinant residual covariance |

112.3611 |

|||||||||||

|

Equation: INDUSTRIAL_PRODUCTION_IN = 0(1) + C(2) *ORES_AND_METALS_EXPORTS_ + C(3)*UN EMPLOYMENT + 0(4) ’GDP +C(5)’EXP0RT_VALUEJNDEX + C(6)*EUR_SEK Observations: 20 |

||||||||||||

|

R-squared 0.938231 Mean dependent var 1123.028 Adjusted R-squared 0.916170 S.D. dependent var 115.4123 S.E. of regression 33.41578 Sum squared resid 15632.60 Durbin-Watson stat 1.635661 Equation: ORES_AND_METALS_EXPORTS_= 0(7) + C(8)*EUR_SEK+ C(10)*EXPORT_V.ALU E_IND EX Observations: 20 |

||||||||||||

|

R-squared 0.860248 Adjusted R-squared 0.843807 S.E. of regression 0.411242 Durbin-Watson stat 0.965660 |

Mean dependent var 3.478888 S.D. dependent var 1.040559 Sum squared resid 2.875046 |

|||||||||||

Pic. 1. Eviews system estimation, 2017

Ores and metals exports – bln. dollars; industrial production index – index points; unemployment – percentage; GDP - PPP bln. dollars; Export value index – index points; EUR/SEK exchange rate – ratio. Indicators influence dependent variables the following way: increase in unemployment by 1 percent will lead to decrease in industrial production index by 69,16 index points.

As it can be observed, system is self-sufficient. R2 test like practically all other tests are passed, except for the Durbin-Watson test. Durbin–Watson statistic is a test statistic used to detect the presence of autocorrelation - a relationship between values separated from each other by a given time lag - in the residuals (prediction errors) from a regression analysis. [6] In both models D-W statistic is situated in so-called “gray zone”, where is no statistical evidence that the error terms are positively or negatively autocorrelated. Thereby it is impossible to say, whether there is presence of correlation or not. This was the best possible way to construct model, using above mentioned indicators for the last 20 years.

Sweden has an export-oriented mixed economy. Timber, hydropower and iron ore constitute the resource base of an economy with a heavy emphasis on foreign trade. Nevertheless, not all resources are subjects to trade, industrial production is another important sector of economy.

Analysis of the results shows us how complicated it can be to identify “Dutch disease” in country, where no clear signs of it, like in UAE or Saudi Arabia. Possible autocorrelation of both models is not a good sign, so it is difficult to make fair conclusion on this problem. One of the reasons of such result can be changes in structure of economy, where ores and metal export is increasing, or, vice versa, decreasing. Following observations are recommended.

«Экономика и социум» №2(33) 2017

Список литературы Analysis of the presence of “Dutch disease” in Sweden

- De Vylder Stefan. "Den "holländska sjukan" och bistånd" 09.2010, URL:http://nationalekonomi.se/filer/pdf/20-6-sv.pdf

- Dutch disease. URL:www.thefreedictionary.com/Dutch+disease

- Munkhammar V. Makrorådet: Sverige lider av holländska sjukan, 14.09.2015 URL:http://www.di.se/artiklar/2015/9/14/makroradet-sverige-lider-av-hollandska-sjukan/

- Magnusson Pär. Varning för holländska sjukan, 15.09.2015 URL:http://www.di.se/di/artiklar/2015/9/15/varning-for-hollandska-sjukan/?timestamp=1442534400317

- Трегуб А.В., Трегуб И.В. Методика прогнозирования показателей стохастических экономических систем//Вестник Московского государственного университета леса -Лесной вестник. -2008. -№2 (59). -С. 144-152.

- Трегуб И.В., Хацуков К.Л. Проверка применимости модели для прогнозирования экономических показателей//Экономика и социум. 2014. № 4-4 (13). С. 1345-1349.