Analysis of trends in the Russian banks’ eurobond market

Автор: Baryshnikov Pavel Y.

Журнал: Экономика и социум @ekonomika-socium

Статья в выпуске: 5-1 (24), 2016 года.

Бесплатный доступ

This article considers last trends in the Russian banks’ Eurobond market. Current research is aimed to better understand direction of the Russian banks’ Eurobond market development.

Eurobonds, bonds, banks, securities, financial markets

Короткий адрес: https://sciup.org/140119792

IDR: 140119792

Текст научной статьи Analysis of trends in the Russian banks’ eurobond market

FINANCIAL MARKETS.

In this article we will carry out detailed analysis of the Russian banks’ Eurobond market in the last 5 years and will try to show trends of its development. For the further analysis we have collected and examined all the Eurobond issues made by Russian banks for a five-year period from 2011 to 2015. During this time 34 banks made 430 Eurobond issuers. Using this data, we can understand more clearly the structure and trends of Russian banks’ Eurobond market. However, let’s consider first the structure of Russian banks’ liabilities and examine the share of bonds in its portfolio.

From the figure below we can see that the share of bonds in liabilities of Russian banks is pretty small (about 2%) and doesn’t have a significant influence on the change of Russian banks’ liabilities structure. In the recent five years it didn’t change considerably, however, in money terms amount of bonds raised by 7.8 bn. rubles from 666.7 bn. rubles in 2011 to 674.5 bn. rubles in 2015 (Figure 1). The biggest share in both 2011 and 2015 had deposits of private individuals and legal entities. These two components accounted about a half of Russian banks’ liabilities.

Figure 1

Structure of Russian banks’ liabilities in 2011 and 2015

Source: Central Bank of Russia

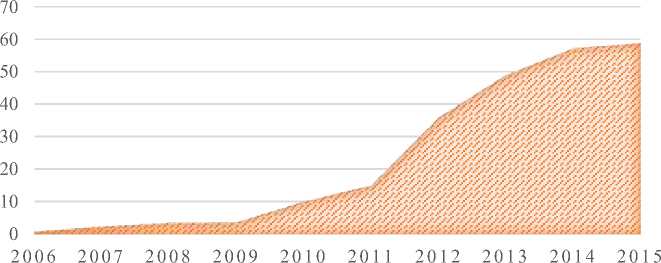

As of the 2015 year-end Russian bond market consisted of 1641 bond issues including government, municipal and corporate bonds and Eurobonds totally worth $336.1 bn. About 90 % of total bonds (outstanding) are corporate bonds worth more than $250 bn. The share of the banking sector in this volume was more than one-third. In the past decade Russian banks’ Eurobond market got not only more than 80 times larger but also showed a significant growth even during and after the 2008’s crisis. Starting from 2010 the market showed unprecedented growth raising from $10 bn. in 2010 to $58,8 in 2015.

Figure 2

Volume of Russian banks’ Eurobond market, USD bn.

Talking about the volumes of Russian banks’ Eurobond issues it can be noted that as compared to 2014 year-end in 2015 it shrunk more than 5 times and amounted to $1.57 billion. In addition, the number of both issues and issuers has significantly reduced. In 2015 only 7 Russian banks entered international debt market, while in 2013 the number of Eurobond issuers among Russian banks figured up to 28.

Thus, in 2015 situation in the Russian banks’ Eurobond market got even worse. Because of US and EU sanctions top Russian banks hadn’t opportunity borrow in the international market, thus in 2015 all Eurobond issues were made by medium-sized private banks and denominated generally in USD.

It is interesting to note that the Eurobond market of Russian banks began gradually shrank in size already since 2012. However, up until 2014, the volume of issued Eurobonds exceeded the amount of bonds denominated in the national currency.

In 2015, in view of worsening of external economic and political environment as well as prohibition for major Russian financial institutions to enter international capital markets, the popularity of ordinary bonds has increased. Despite the fact that the total amount of such bonds in 2015 has dropped, the number of both issues and issuers has grown.

As mentioned above, the volume of Eurobond issues since 2011 increased by 65% to $8.24 billion in 2014. This is thanks in large part to the stable development of the Russian economy with average GDP growth of 3.4% per year. The significant decline in raised funds stemmed from the sanctions of the EU and US. These sanctions cut off the access to Western capital markets for such large Russian banks as “Sberbank“, “VTB”, “Gazprombank“ and “Rosselkhozbank” (Russian Agricultural Bank).

Meanwhile, in previous years these organizations issued the main part of Eurobonds in Russia. Moreover, the ratings of companies not included in the sanctions list were downgraded, which led to a significant increase in the cost of borrowing. Together with the weakening of the Russian currency it has led to a significant loss of the attractiveness of debt securities as a source of fundraising.

This situation has put Russian companies in a predicament. However, for investors has opened a good opportunity to enter into market of Russian Eurobonds. In addition, the average yield to maturity of Russian companies Eurobonds with a credit rating BB and B in 2014 showed a significant increase. At the same time yields of investment grade Eurobonds remained as in 2012-2013.

High discount of Russian Eurobonds (30-40%) at the end of 2014 was stipulated by a significant risk of investments in these tools because of geopolitical tension and worsening of economic situation in Russia. However, in 2015 the economic situation in country began to improve, foreign policy condition has shown signs of normalization, which led to a substantial reduction of investment risks

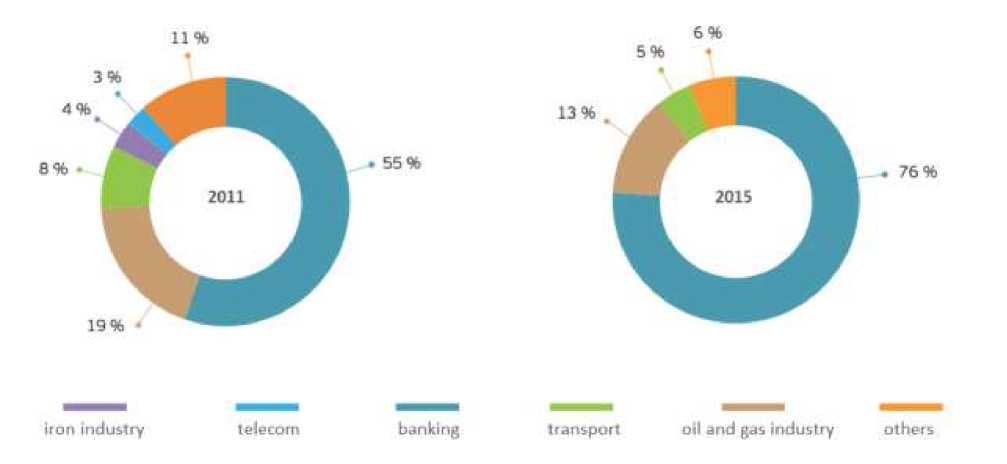

Figure 3

Industry map of Russian Eurobond market

At the industry level a clear predominance over the last six years had banking sector (Figure 3). More than half of all emissions from January 2011 to December 2015 were made by banks. Representatives of this sector were also major issuers of Russian Eurobonds. In particular, these representative were top 4 Russian banks by assets: “Sberbank of Russia”, bank “VTB”, “Gazprombank” and “Rosselkhozbank“ (Table 1).

Table 1

The largest Eurobond issues of Russian banks during 2010-2015

|

issuer |

issues during 2010-2015 |

the largest issue during 2010-2015 ($ billion) |

|

|

total issuing volume ($ billion) |

number of issues |

||

|

Sberbank |

15,5 |

17 |

2 |

|

Gazprombank |

10,8 |

20 |

1,1 |

|

Rosselkhozbank |

6,2 |

10 |

1,3 |

|

VTB |

5,3 |

5 |

2,3 |

|

Alfa-Bank |

3,2 |

5 |

1 |

|

Russian Standard |

1,1 |

4 |

0,4 |

Source: Russian issuers Eurobond market overview // QB Finance Investment Company official website. URL:

In the recent five years Russian banks issued Eurobonds worth about $63.4 bn. and more than three quarters of these bonds was issued in US dollars ($48.7 bn.). It should be noted that small and medium-sized banks are afraid to experiment with a currency of issue and therefore all of their issues are denominated in USD. Shares of the other currencies are many times smaller than USD share. For example, shares of EUR and CHF account for 8.36% and 6.35% respectively followed by RUR that has a 5% share.

Figure 4

Currencies of Eurobond issues

CZK 0,04%

SEK 0,10%

TRY I 0,30%

AUD I 0,43%

SGD I 0,95%

CNY ■ 1,32%

RUR 5,03%

CHF 6,35%

EUR 8,63%

USD 76,85%

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

It is interesting to note that in theory a bond issued in national currency can’t be a Eurobond. However, ruble is among the most popular currencies of Russian banks Eurobonds issues. Apparently, the practice does not contradict the theory simply because in order to issue Eurobonds denominated in ruble Russian banks always use its SPV (Special purpose vehicles). SPV are such companies that are created directly for the implementation of certain projects, for example, economy on tax payments. These companies are located in other countries, for which the ruble is foreign currency.

Eurobonds in exotic currencies such as Renminbi (CHY), Singapore Dollar (SGD), Turkish Lira (TRY), Swedish Krona (SEK), Czech Koruna and others were mainly issued by the large banks. For example, in the recent 5 years there were 5 CNY issues totally worth $838 mln. These issues were made mainly by top 10 Russian banks such as “VTB”, “Gazprombank” and “Rosselkhozbank”. About the same banks from top 10 have issued Eurobonds in other “exotic” currencies. The biggest Eurobond issue in “exotic” currencies was made by “VTB” Bank in CNY worth ¥2 bn. or about $312.5 mln. As a comparison, the largest Eurobond issue worth $2.3 bln. was made by “VTB” Bank in 2012, thus we conclude that middle as well as large-sized banks prefer more conventional currencies for its Eurobond issues.

The most common sort of Eurobonds issuing by Russian banks is Loan Participation Note (LPN). It accounts for about 90% of all Eurobonds issued by the Russian banks. LPN is a debt security which allows investors to buy shares in the issued loan or the borrower's loan portfolio. This loan is provided by the issuer of Notes - a specially created company: SPV (Special Purpose Vehicle). As opposed to Credit notes, credit event of default of LPN is connected with particular loan instead of a credit event of the borrower. LPN holders participate on a pro rata basis in receiving of interest and principal payments on a loan.

When it comes to yields of Russian banks Eurobonds it may be noted that it has increased and exceeds by some retail banks 40%. As of the end of 2015 the highest Eurobond’s yield among Russian banks had "Renaissance Credit" (43.8%). This bond is denominated in USD with maturity in 2018. Yield of "Transcapitalbank" Eurobond maturing in 2020 increased to 25.5%. In autumn 2015 yields of both banks were much lower (about 17-20%). Eurobond’s yield of other retail banks increased not significantly: up to 16% by "TCS" and to 14.3% by "Home Credit". This is the lowest yield on Eurobonds since 2009 when yield of one of the "Russian standard" Eurobonds was greater than 60%.

From the crisis of the banking system generally suffered subordinated issues of bonds and banks specializing in consumer loans, most of which have shown significant losses in the first half of 2015. Some experts say that yields above 20% indicates a pre-default state of the company [1]. They also claim that interest rates growth is connected with imposed western sanctions, which have reduced and, in some cases, shut down the possibility of refinancing. Occurred a global reduction of limits on Russian “risk”: many funds can’t keep securities of Russian issuers with a speculative credit rating. Investors primarily sell securities of issuers from “problematic industries”.

Retail lending is one of them. The sector faced with the general trend of reduction in the quality of loan portfolios in mid-2013. The case is not only in reducing of bank’s credit quality from the time of its bonds issue, but also in the negative developments in the Russian economy in general: devaluation of ruble, sanctions closed foreign markets, as well as the fall in oil prices.

Returning to the question of increased yields on Eurobonds it may be noted that, according to a representative of the bank “Russian Standard”, this yields are calculated on the basis of indicative prices which not reflect transactions and include a significant premium for the fact that it is “a capital tool” - all of these bonds are subordinated (such debt securities which rank after other debts if a company falls into liquidation or bankruptcy).

This fact acknowledged “Transcreditbank”, “Gazprombank”, bank “Saint-Petersburg”, “Absolut Bank”, “Nomos Bank” and others. They have spent, only according to their official statements, more than $0.5 billion. In March 2009 “VTB” bank redeemed its subordinated notes (maturing in 2015) at the price of 64% of its face value. The yield on this issue, according to Bloomberg, those time exceeds 15% and the bank bought more than half of the issue worth $ 750 million.

These days such pattern follows only “Renaissance Credit”. The Bank redeems senior notes maturing in 2016, which price has fallen to about 88% of the nominal value. This corresponds to yield to maturity of approximately 17%. Of the $350 million placed in 2013 in the market is now about $280 million. Other banks either pass over in silence about the redemption of its securities, or say that they don’t do it. They have a fear that this will reduce their capital. because according to IFRS, banks are required to reduce its capital in proportion to the repurchased securities.

However, some corporate Eurobonds get cheaper because of rising yields on government Eurobonds. Price of Russian sovereign issues to comparable securities of other countries began to grow almost from the beginning of 2015 and since then has increased by 110-150 basis points. At present Eurobonds "Russia-22" are traded with the yield of 4.04% against 2.7% in January.

Thus, the longer are sanctions used and companies feel the lack of liquidity - the worse is the credit quality of the issuers. If everything will remain the same, then in a while the situation will become even worse.

Moreover, because of Western sanctions began the process of gradual refocusing on the Asian markets. Potential issuers expect closer relations with China and the Arab countries. For example, “Vnesheconombank” negotiate with the international Islamic bank “Al Baraka” about the issue of Islamic bonds “Sukuk” [2], which are based on religious principles and prohibit direct charging interest.

However, Russian economy is showing a slowdown in its fall. It is expected a further stabilization of economy, that likely will lead to an increase in credit rating of banks and corporations and will improve its performance. In this regard, it is expected an increase in the Eurobonds issuing volumes, as well as the growth of Eurobonds quotations, which are currently in circulation. Moreover, undervaluation of Russian Eurobonds along with a reduction of investment risks indicates good entry opportunities for investors on the Russian Eurobond market.

Finally, due to the strengthening of the ruble, as well as to increase of Asian markets attractiveness because of Western sanctions and higher credit ratings of Russian companies in the Asian region, it is expected that during 2016 Russian companies probably will start the placement of its debt securities on the Asian markets. This tendency will be also affected by the desire of Russian companies to diversify its debt in conditions of volatile ruble exchange rate. This will help to reduce the level of dollar-denominated debt and take on debt denominated in currencies other than US dollar.

Список литературы Analysis of trends in the Russian banks’ eurobond market

- The yield on Eurobonds of Russian retail banks has increased//Vedomosti. URL: http://www. href='contents.asp?titleid=38819' title='Ведомости прикладной этики'>Vedomosti.ru/finance/articles/2014/11/19/russkij-standart-dohodnosti

- Vnesheconombank and Bank Al Baraka held talks on cooperation in the issue of “Sukuk”//Arafnews expert informative internet platform. URL: http://www.russarabbc.ru/rusarab/?ELEMENT_ID=34557