Anti-crisis influence reverences of the state

Автор: Sovetov Pavel Mikhailovich

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Development strategy

Статья в выпуске: 2 (6) т.2, 2009 года.

Бесплатный доступ

The article describes the author's view on the measures taken by the federal government to overcome economic crisis, the direction of forming the country's stable financial system is concerned.

State economic policy, crisis management and its tools

Короткий адрес: https://sciup.org/147223127

IDR: 147223127 | УДК: 338.124.4(470)

Текст научной статьи Anti-crisis influence reverences of the state

The article describes the author's view on the measures taken by the federal government to overcome economic crisis, the direction of forming the country's stable financial system is concerned.

State economic policy, crisis management and its tools.

Pavel M.

SOVETOV

The openness of the Russian Federation economy in the context of globalization naturally reflected in the rapid coverage of the country by the world's financial crisis, which was introduced by U.S. credit institutions in mid-2008. The Russian government, confident in the «fermented» economic growth due to energy exports, has been caught napping. Not having the experience of crisis management, it reacted by more than six months late anti-crisis program presenting. Before that spontaneously use of monetary measures of government impacts on the credit market happened that could not provide impenetrable protection against unfolding economic reaction.

Subjects of the Russian market are sensitive to how the recession turns into an economic downturn, with its rise in inflation, cost of credit, depreciation of the ruble against the dollar, rising stock market, capital outflows from the country, increasing unemployment rate.

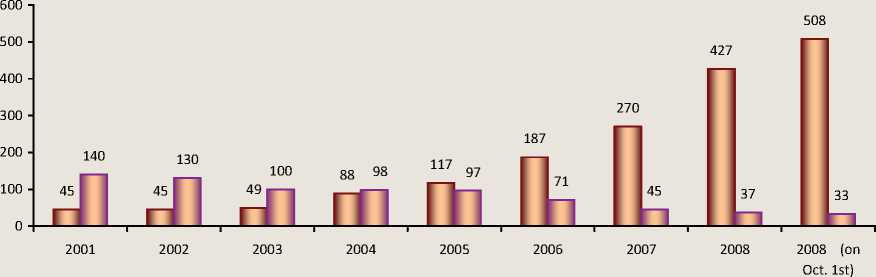

In the given circumstances, for market subjects it is certainly interesting to know what criteria are evaluated by the State crisis management decisions. To what extent they are crises, to whom they will be ultimately benefit? Can the economic institutions of Russia mitigate the effects of deteriorating economic conditions in a situation when the two major sources of growth in the Russian economy are exhausted, namely: a sharp fall in prices of domestic exports of basic products, cheap financial resources disappeared in the world market, of which businesses so fond in recent years (fig. 1). And how couldn’t they be fond of, if the refinancing rate in Russia was 11 – 12%, and in the United States it was reduced from 5,25 to 1% per annum, in Japan – up to 0,3%! And it is not surprising that the foreign borrowing of Russian commercial banks reached 65 – 70% of the total borrowings.

But debts must be paid, and a natural question arises: how can Russian companies do it independently, relying on the returns from past investment in the investment projects of money?

Figure 1. The volume of Russia's foreign debt (at the beginning of the year, $ billion) *

□Volume of foreing commercial debt □ Volume of foreing state debt

* Compiled according to the Central Bank of Russian Federation.

It is now clear that a direct borrowing on world financial markets have turned to debt problems for Russian companies. As a result, foreign corporate debt, including debt of banks and non-residents reached $ 500 bil-lion1. And loans abroad have become virtually non-existent, as in the modern crisis, foreign banks are reducing the external operations and consolidate the liquidity of its head office2. For Russia, this contraction of leverage led to a drop in the stock market.

So, it is no accident that Russian businessmen and bankers together rushed for help to the state. And the State responded immediately purchasing “bad” debts are protected speculators from financial ruin. Already in August 2008 the deployment of so-called “balances the federal budget” on deposits began in commercial banks which has reached 800 billion rubles over two months. There also were deployed means of state corporations: “Housing and communal services” (180 billion rub.), “Rosnano” (130 billion rub.), as well as the national wealth Fund (175 billion rub.). Total as at March 16, 2009 the crisis state help to credit organizations amounted to more than 2,5 trillion rubles, while for the manufacturing sector it is planned 1,2 trillion rubles, and 23 companies out of 289 managed to obtain documents.

Naturally, a question arises: under what conditions are the taxpayers’ means placed and, apparently, will continue to be placed in commercial banks? What are the obligations taken by commercial banks on the targeted use of funds received, i.e., specific directions and the length of the loan of the real economy? How is margin of commercial banks for transactions with this type of loan limited? And what is the insurance that direct government support for banking liquidity and the subsequent amount of lending by commercial banks will not be factors in promotion of new inflation, will not be transformed by them into the currency and moved abroad? Unfortunately, no barriers were established, no restrictions are indicated.

Banks, which the State has provided liquidity prefer to translate it into foreign currency for hedging against currency risk or to reduce its debt to foreign creditors. Only in the third quarter 2008 net capital outflow from Russia by private sector amounted to 17,4 billion dollars, of which 13,4 billion, or 77%, taken out by commercial banks.

A great concern of experts is of the order of public funds provision to business entities for the repayment of foreign debt. Without the introduction of the necessary security conditions and restrictions on management decisions regarding the allocation of the Bank of Russia 50 billion dollars in order to «provide credit organizations for settlement and servicing of loans and loans received from foreign organizations», and a new allotment for the same goal of 450 billion rub. from the national wealth will only lead to a new exodus from the country's capital.

From the perspective of the social interests government support for financial sector, in principle, should benefit all citizens of the country, if the effect would be to prevent the depreciation of deposits, preservation of jobs, etc. But, if look at it more attentively, it is easy to find that the Government refers to a way out of crisis through infusions of “new wine” (resources from the taxpayers) in the “old bottles’ (financial corporations standing on the brink of bankruptcy).

It turns out that financial institutions and economic agents, whose speculative activities immediately became crisis’ “launching hook”, not only don’t give up their savings, but do not reduce their superhigh income. It seems that this crisis is not an obstacle to them. Fees, which the top managers of major Russian banks receive are not reduced. Thus, according to the banks’ quarterly reporting, Gazprombank has paid its 14 top managers more than 70 million rubles remuneration, the Bank of Moscow – 67 million, Sberbank’s “top” of 23 people received 933 million rubles. And none of them returned mul- timillion bonuses obtained by means of state, in contrast to the well-known top-managers of the American insurance company AIG Financial Products (of course, at the request of USA prosecutors).

It is pertinent to recall the rule that liability for poor financial transactions must be assumed by those who commit them, not society. Hence it would be logical for the State concerned with how to prevent the collapse of the banking sector, and taking steps to its rescue and welfare, to speak only on the system generating banks and the recapitalize implementation in exchange for shares. Rescuing the debtor and giving the banks capital by increasing the guarantee on citizens’ deposits, the State assumes the risk for their decisions and these risks should be based on the material base of those for whom it has taken risks. Meanwhile, the fact that the Russian government spent half the gold reserves of the state to preserve the banking system does not facilitate access to credit producers and the public. On the contrary, there is compression of the credit market, while maintaining an artificial shortage and inaccessibility of money.

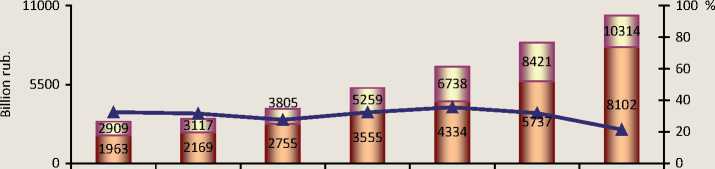

In the country it is not used to accumulate up to one third of national savings. In 2005 – 2007 this amount was an annual 2,3 – 2,6 trillion rubles (fig. 2) , about 10,5% of GDP were distracted from the economic turnover. Excess of total financial resources over resources that were actually used for gross capital formation is a net Russia’s lending to other economies. And even in 2008 the RF Ministry of Finance has increased from 32,7 billion to 116,4 billion dollars the amount of funds placed in U.S. Treasury debt securities, which put Russia eighth in the list of the U.S. economy’s creditors.

The present deplorable trend of foreign borrowing and capital flight suggests lowering the threshold of economic security and leading to the need to strengthen national owner-

Figure 2. Saving and gross capital formation in Russia in 2001 – 2007

2001 2002 2003 2004 2005 2006 2007

Out of them used for savings, billion rub.

Е ---- ] Gross savings, billion rub.

Curve of specific weight of savings not used for gross capital saving, %

The volume of bank deposits of legal and natural persons, involving credit institutions in Russia, at the end of the year

|

Indicators |

2000 |

2005 |

2006 |

2007 |

2008 * |

|

In the Russian Federation

including deployed in Sberbank |

644,3 199,5 444,9 347,1 |

3 464,3 741,5 2 722,7 1 500,1 |

4 866,0 1 062,5 3 752,2 2 028,6 |

8 383,5 3 231,8 5 151,6 2 656,2 |

9 693,5 3 929,7 5 763,8 |

of which:

including deployed in Sberbank |

331,2 171,6 159,6 81,1 |

948,6 298,2 650,4 274,8 |

1 454,9 302,3 1 152,6 257,6 |

2 071,9 1 407,2 664,7 264,6 |

1 510,9 726,8 784,1 |

|

In the Vologda region

including placed in Sberbank |

6,7 2,8 3,9 2,6 |

28,5 9,1 19,4 10,6 |

39,9 12,5 26,9 14,9 |

50,4 16,5 34,0 19,3 |

59,4 21,5 37,9 |

of which:

including deployed in Sberbank |

2,1 1,3 0,8 0,4 |

3,8 2,0 1,8 1,1 |

4,1 2,5 1,6 1,1 |

8,5 6,8 1,7 1,0 |

3,3 2,7 0,6 |

|

* 9 months. Sources: Russian Statistical Yearbook. 2007: Rosstat. – M., 2008. – 819 p.; Bulletin of Banking Statistics (regional application). – Moscow: Central Bank of Russia, 2008. – № 1. |

|||||

ship of stock market3 and forming of strong domestic liquidity sources. The basic element could make deposits from legal entities and natural persons (see table). It is important to ensure that entering into the financial system resources reach the national producers in the real sector of the economy, serve a source of innovative investment projects, rather than remain in the wallet of Russian and foreign financial speculators.

Most analysts are united in agreement that the measures being taken by the federal authorities aimed at addressing short-term stabilization of financial market problems are weak. Ample fiscal injections in speculative banking sector have not turned it to solve the problem of efficiency and economy in order to upgrade the structural transition to qualitatively new production systems.

The marked challenge of technological change dictates the need for enhanced style of government regulation of Russia's economy on the basis of an immediate public-enterprise economy with a predominance of the nationalized economy (to which, inter alia, the U.S. government resorts in the financial sector). And if the economic entities of the Russian Federation intend to survive, and the country does not want to stay raw appendage of industrialized Western nations, first it should stop the movement of the budget trillions of rubles, and billions of dollars into the pockets of financial speculators, and not very clean at their hands oligarchs, and, next, to implement fiscal subsidies to the productive sector in the soft-landing basis as soon as possible.

Список литературы Anti-crisis influence reverences of the state

- Global crisis, its refraction and the reaction of the Russian federal authorities (reflection and evaluation of M. Ershov, S. Glazyev, R.Grinberg and O. Dmitrieva)//Russian Economic Journal. -2008. -№ 9-10. -P. 3-16.

- Kazantsev, S.V. Manmade crisis/S.V. Kazantsev//EKO. -2009. -№ 2. -P. 2-22.

- Yudina, I.N. The causes of banking crises and the conduct of the State/I.N. Yudina//EKO. -2009. -№ 2. -P. 163-171.