Anti-innovations as a factor of macroeconomic instability(the case of derivative financial instruments)

Автор: Shcherbakov Gennadiy Anatolyevich

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Development strategy

Статья в выпуске: 4 (22) т.5, 2012 года.

Бесплатный доступ

The theory of innovative economic development is based on the concept of “innovation”, which implies novelties that have a progressive impact on the development of a society. At the same time, human ingenuity often goes beyond the limits of public interest, giving birth to an intellectual product, which is not directly linked to the public progress. In this regard, such notions as “pseudo-innovation” and “anti-innovation” emerge, which transfer innovative topics from their constructive interpretation to their critical perception. Using the examples of derivative financial instruments, the article describes the process of transforming the innovation implemented to increase market reliability into its opposite, i.e. a significant factor of creating instability of modern financial markets.

Innovation, innovative development, financial markets

Короткий адрес: https://sciup.org/147223375

IDR: 147223375 | УДК: 330.341

Текст научной статьи Anti-innovations as a factor of macroeconomic instability(the case of derivative financial instruments)

The theory of innovative economic development is based on the concept of “innovation”. J. Schumpeter, the founder of the theory, defines it as a new scientific-organizational combination of production factors, motivated by entrepreneurial spirit.

The Austrian economist, in the early twentieth century, determined that innovations can be the instrument of counteracting economic downturns, and the source of increasing business profitability can be found not only in cost reduction and price manipulation, but also in the change of products in accordance with the changing demand and willingness of the market to accept a new product. In his work “the Theory of Economic Development”, he noted, “Under the enterprise we understand the implementation of new combinations, as well as what these combinations are implemented in:

plants, etc. We define entrepreneurs as business entities, the function of which is to implement new combinations and which function as its active element”. J. Schumpeter describes an entrepreneur using such notions as initiative, authority, the gift of foresight, etc., citing a well-known definition by J.-B. Say: the function of an entrepreneur consists in joining and combining production factors [7, p. 169, 170, 171].

The “implementation of new combinations” in the Schumpeter theory refers to the following types of activities:

-

• creating a new good that was not previously known to consumers or achieving new quality of a good;

-

• introducing a new production method, emerging of which is not necessarily related to a scientific discovery, and may even lie in another form of commercial use of goods;

-

• access to new markets, where this industry has not yet been presented, regardless of whether this market existed previously;

-

• obtaining a new source of raw materials or semi-finished products, regardless of whether he existed previously, or was unavailable, or was not taken into account;

-

• conducting the necessary reorganization, such as achievement of a monopolistic position, as well as undermining the same position on the market of another enterprise [7, p. 159].

The followers of the innovation theory significantly expanded the understanding of innovations stated above, supplementing it with novelties in the field of technology, work organization and management, based on the use of advanced experience and scientific achievements (B.A. Rayzberg, L.Sh. Lozovskiy [4, p. 136]), setting up the production of new goods, introduction of new production methods or application of a new type of business organization and enterprise (K.R. McConnell, S.L. Bru [3, p. 391]), which are perceived by the consumer as fundamentally new or possessing certain unique properties (P. Kotler [2, p. 589]). Yu. Yakovets defines innovation as introduction into various fields of human activity of new elements (methods, ways), improving the effectiveness of such activities [8, p. 9]. Exclusively pragmatic approach is demonstrated by B. Twiss, who considers innovation as a process in which an idea or invention receives the economic content [5]. A. Akayev gives a similar interpretation and calls innovation the knowledge, embodied in a commercial product [1, p. 141-162].

Thus, the innovation is implied to be an object, not only put into production, but also effectively implemented in the market and making profit. As a result of a scientific dis covery or carried out research, the specified object qualitatively differs from its prototype.

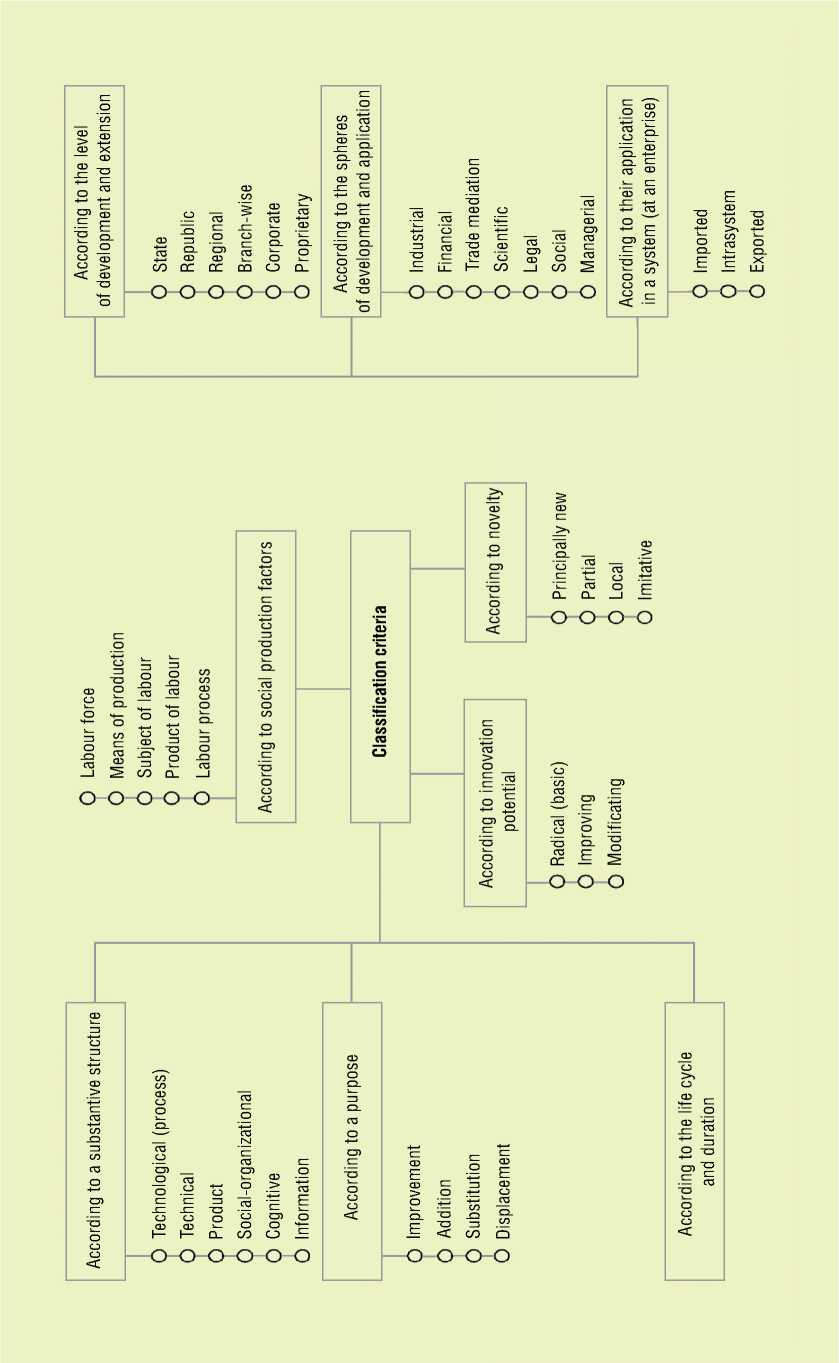

Particularly important for understanding the notion of “innovation” is their classification, the correct construction of which is essential for elaborating the innovation management methods. One of the attempts of such classification is presented in figure 1, however, despite the potential advantages, it, like many others, can not claim to be thorough and widely recognized. The reason probably lies in the dynamics of innovative science development, which is being constantly supplemented with new scientific observations and definitions.

As a rule, when describing the innovations we are talking about novelties, having the purpose of public utility and exercising a progressive impact on the development of a society. At the same time, the limits of human ingenuity often go beyond the limits of public interests, giving birth to an intellectual product, which is not directly linked to the public progress. In this regard, such category as “pseudo-innovation” and “anti-innovation” emerge, that transfer innovative topics from their constructive interpretation to their critical perception.

Figure 1. Extended classification of innovations

Anti-innovation is a category, introduced by Russian scientist Yu.V. Yakovets to determine the novelties that have regressive character, causing partial degradation in a certain field of human activity [8, p. 17].

These innovations, in contrast to other types of novelties, represent intellectual products, introduced in the economic practice, that have short-term economic effect, but in prospect they will exert an extremely negative impact on the dynamics of economic growth. One of the examples can be an introduction to the financial and stock markets of derivative financial instruments, which became tangible factors of macroeconomic instability over the past two decades.

The derivatives themselves and financing schemes, created on their basis, are just financial and legal instruments, which, like different methods of treatment, can bring benefit or cause harm. The latter is expressed in the uncontrolled growth of the volume of operations with secondary (derivative) securities, which undermines the stability of financial markets and in general has a negative impact on the stability of the world economic system. In addition, the corrupted nature of such an activity should be taken into account, when market participants carry out mutually exclusive activities: they create instability and sell insurance instruments against it.

The essence of the concept “derivative financial instruments” consists in creating a fictitious value “produced” from the main liquid asset, each new operation with which is issued by a new financial instrument, that stands farther and farther from the initial obligation.

The most common financial innovations are the following [6, p. 80-89].

-

• Interest-Rate and CrossCurrency Swaps – financial products, providing the opportunity to exchange money flow in the form of a floating rate, increased or reduced by some margin1, by the cash flow

in the same or different currency, expressed in the form of a fixed rate 2.

The first deals with the use of interest rate swaps were developed and carried out by the JPMorgan bankers in the mid-1980s. Special conditions, arising in regard to the rates of coupons on the floating rate notes, became the predecessors of interest-rate and currency swaps, largely influencing the demand for them. In conditions of prevailing low interest rates in the mid-1980s, large corporate borrowers felt the necessity to protect themselves from a potential increase of the reference interest rates in the future, which could result in higher costs for servicing their debt obligations linked to floating interest rates. In order to solve this problem, the investment banks, preparing the issue of securities for a client and collecting a syndicate of investors, began to organize issuing of bonds with floating rate, which have a maximum limit on the amount of the overall coupon rate.

-

• Basis swap is a financial instrument, which enables counterparties to exchange money flows, connected either with different reference rates, or with one and the same rate quoted for different terms. An example is the exchange of money flows linked to Libor in USD for 3 and 6 months, respectively.

-

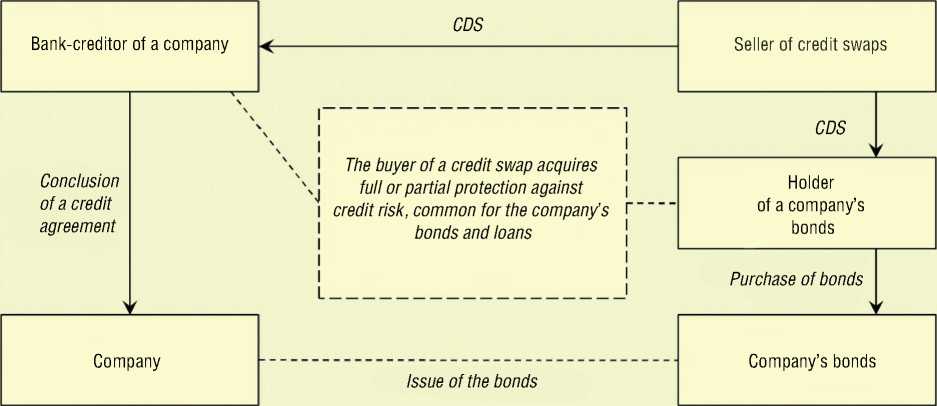

• Credit Default Swap (CDS) – financial products, that redistribute the credit risks typical of some instruments (liabilities), including loans and bonds. The buyer of a credit swap acquires protection against credit risk, and the seller of the credit swap guarantees the security of the basic liability. Thus, the risk of default on the basic instrument is fully or partially transferred from the holder (lender or owner of the bonds) to the seller of the credit swap. However, the seller of the credit swap can also be subject to a certain credit risk, i.e. the risk of its failure to perform its obligations under the credit swap, so the buyer of a credit

swap acquires protection against credit risks on the basic liability and assumes the risk of execution of obligations under the credit swap by its seller (fig. 2) .

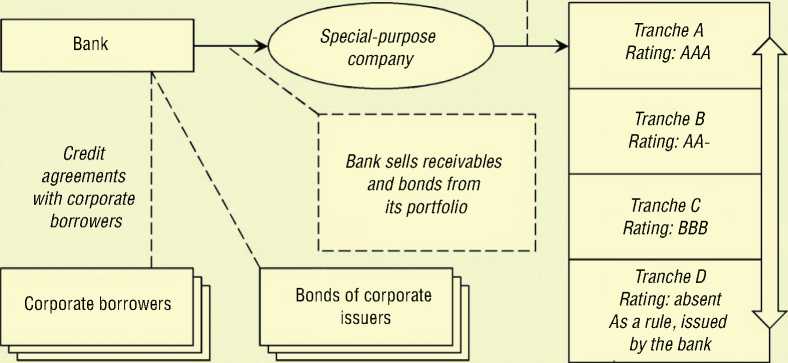

Collateralized debt obligations (CDO) – financial instruments, obligations under which are ensured by a certain portfolio of bonds, loans or other underlying assets ( fig. 3) 3.

Figure 2. Examples of the use of credit default swaps (CDS)

Source (including fig. 3, 4): Financial crisis in Russia and in the world. Ed. by E.T. Gaydar. Moscow: Prospekt, 2009. P. 83, 84, 87.

Figure 3. An example of issuing collateralized debt obligations (CDO)

Issue of several subordinated tranches

CDO backed by the portfolio of credits and bonds

High coupon rate and high risk ow coupon rate, but high degree of protection of investors

As a rule, collateralized debt obligations are issued by several subordinated tranches. Junior tranches have higher risk of non-fulfillment of liabilities compared with the senior tranches, the obligations on which are executed in order of preference. Such a mechanism of risks redistribution allows the senior tranches to get high ratings of investment level, which exceed the ratings of the underlying assets.

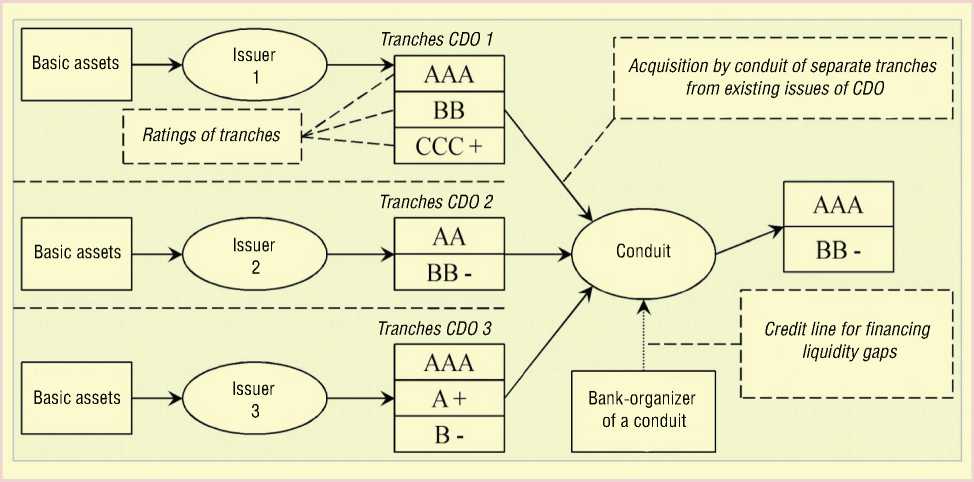

Asset Backed Commercial Paper Conduits . The large investors’ demand for derivative securities with a high degree of protection against credit risks and other specified parameters has led to the emergence of double and multiple repackaging of cash flows from the underlying assets. The technique of double repackaging consists in the selection of certain tranches out of the already existing CDO and other financial instruments, and in the issue of new securities backed by the selected tranche. The advantage of such schemes is achieving a higher level of diversification of the sector and country risks in relation to the basic issues of CDO.

Conduits that issued short-term commercial papers (maturing through 90 days) backed by medium- and long-term derivative instruments, including CDO, became a common example of double repackaging schemes in the U.S. and European countries.

To obtain high credit ratings for these commercial papers, banks-organizers of conduits provided these structures with credit lines for financing the possible liquidity gaps. At the same time, bank-organizer governed the composition of collateral portfolio for these commercial papers, adding or removing certain parts of the portfolio, which led to a change in the parameters of the incoming cash flow and the risk profile of collateral for commercial papers ( fig. 4 ).

-

• Securitization represents the scheme of refinancing packages of similar rights of claims through the provision of loans or issued securities, backed by the above mentioned

packages and loan support instruments introduced in such schemes. As a rule, securitization transactions are based on actual selling, in the course of which the originator (creditor Bank) transfers all its loans from its balance34 to a Special Purpose Vehicle (SPV), which, in turn, for the purchase of a package, attracts financing through issuing the securities purchased by investors.

The structure of securing and subordination of tranches in securitization transactions is similar as compared to CDO transactions. From the rating agencies’ viewpoint, the main difference between securitization and CDO lies in the fact that the ultimate borrowers in securitization, as a rule, have no credit ratings, that is why a most important factor here is reaching high level of portfolios diversification, analysis of the groups of borrowers’ credit history (geographical, sectoral, income level, etc.) and modeling their behavior in stressful economic scenarios.

The most widespread refinanced portfolios are mortgage loans to individuals, including subprime loans. Securities issued in the course of such transactions are called Residential Mortgage Backed Securities (RMBS). In January – September 2007, the share of RMBS transactions accounted for about 54% [6] of the total volume of new issues of structured securities in Europe, which more that twice exceeded the volume of new CDO issues (24%) for the same period. Among other types of assets, financed through securitization, one should mention Commercial Mortgage Backed Securities (CMBS), car loans, lease payments, receivables (factoring transactions), credit card debt, future cash flows, etc.

-

4 It should be noted that securitization is also possible without selling the assets from the balance sheets of banks. The so-called balance sheet securitization is used in some European countries including Germany. Lack of assets selling from the balance sheets of banks is also typical for issuing Covered Bonds, the credit quality of which is determined not only by the structure and security of a transaction, but also by the financial position of the bank that granted the loans.

Figure 4. Example of assets’ double repackaging scheme

The above stated list is not exhaustive. The financial sector responded to the need for credit by offering the more diverse products. This pyramid of credit interdependencies including commodity futures and currency options, forward deals, charging instruments, swaps, repeatedly resold raw materials and mortgage contracts, bonds secured by mortgages of borrowers, etc. is becoming more and more vulnerable. Duplication, triplication has become a favorite method of increasing the liquidity of modern financial markets, moreover, often, under the guarantees of the state that is itself in debt and actively borrows both on internal and external markets.

Financial novelties introduced by investment innovative banks (definition by J. Schumpeter) and tested in the markets, are quickly spread by imitator banks. The emergence and spreading speed of the new investment products, as a rule, depends on the degree of their demand among market participants. In addition to the institutional conditions (legislation and regulation of demand for such products is largely determined by the macroeconomic situation and the current state of financial markets.

The main macroeconomic conditions of the pre-crisis 2000 – 2007 period, which determined the relevance of secondary financial instruments, include a very low inflation level in developed countries, low interest rates, high degree of macroeconomic indicators predictability, including the sustainable GDP growth rate. Despite the rapid growth in the volume of debt instruments, in particular, derivative financial instruments, along with price hikes for the basic assets, the above stated factors created an illusion among a number of investors and economists concerning the actual level of credit risk and the fair price of the assets.

As a result, the total volume of existing contracts envisaging derivative financial schemes, at the end of 2007 amounted to $ 60 trillion that was approximately 20 times greater than the total capitalization of the companies listed on the London stock exchange [10]. At the same time, financial transactions related to the securitization accounted for about $ 8.7 trillion at the end of 2008 [9]. Taking into consideration the high degree of interdependence between different markets, it is difficult to overestimate the threat lying in the potential risk of the chain non-fulfillment of such obligations for individual participants of the financial market and the world financial system as a whole.

Derivative financial instruments have been functioning on their own for a long time already, causing the rapid growth of liquidity. The economic and political elite in the conditions of innovation financial boom obviously lost control over their movement, so the crisis situation in the world financial markets can be defined as “the revolt of financial innovations” against their creators [6, p. 166].

If this statement is true, than stiffening the rules, regulating financial markets functioning at both national and international levels, is inevitable. Given the rapidly increasing complexity of derivative instruments’ structures and extremely high-speed copying of financial technologies on the market, it can be noted that the issue is becoming very acute, concerning the understanding by the state regulators of the influence of new derivatives of financial schemes on the markets and the responsibility of professional investors’ associations for the consequences of their uncontrolled use.

Список литературы Anti-innovations as a factor of macroeconomic instability(the case of derivative financial instruments)

- Akayev A.A. Modern financial and economic crisis in the light of the theory of innovation-technological development of the economy and innovation process management. In: System monitoring: global and regional development. Ed. by D. A. Khalturina, A.V. Korotayev. Moscow: URSS, 2009.

- P. Kotler, G. Armstrong, J. Saunders, V. Wong. Principles of marketing. Transl. from English. 2nd Europ. ed. Moscow: Publishing house “Williams”, 2000.

- K.R. McConnell, S.L. Bru. Economics: principles, problems and policies. In 2 Vols. Vol. 2. Trans. from English.:Moscow, 1997.

- Rayzberg B.A., Lozovskiy L.S., Starodubtseva E.B. Modern economic dictionary. 2nd ed. Moscow: INFRA-M, 1999.

- Twiss B. Managing technological innovation. Moscow: Economics, 1989.

- Financial crisis in Russia and in the world Ed. by E.T. Gaydar. Moscow: Prospekt, 2009.

- Schumpeter J. The theory of economic development. Moscow: Progress, 1982.

- Yakovets, Yu.V. Milestone innovations of the 21century. Moscow: Economics, 2004.

- Does the world need securitisation? Citibank, 2008.

- Financial Times. 31.05.2008.

- G. Mensch Das Technologische Patt: Innovationen bervinden die Depression. Frankfurt, 1975.