Anxious expectations

Автор: Ilyin Vladimir Aleksandrovich

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: From the chief editor

Статья в выпуске: 5 (23) т.5, 2012 года.

Бесплатный доступ

ID: 147223394 Короткий адрес: https://sciup.org/147223394

Текст ред. заметки Anxious expectations

Vladimir Putin is nearing the end of the first six months of his presidency in Russia.

A new six-year period of V.V. Putin’s presidency has began during the crisis in the global economic system and under the problems of socio-political order established in Russia over the past 20 years. According to a well-known publicist M. Shevchenko, “…the state power in Russia was forcing against Russia speaking on behalf of Russia during the last decades. This paradox does not allow Russia, in fact, to form a conceptual development vector. And we wonder: why is our right hand very patriotic while our left hand is making international economic agreements, which put our country in the total dependence on the global capital?”1

In his seven pre-election articles, as well as at the meetings with all the strata of Russian society (from oligarchs to state employees and villagers), Vladimir V. Putin has shown that he sees the urgency of the situation, when the state power blocks the modernization of the socio-economic development of the country due to clannish, oligarchic and bureaucratic interests. As a result, there is an increase in the gap between Russia and the world developed countries not only in the context of economy, but also – and most importantly – in terms of human development. These trends have been convincingly represented in the recent report of Academician S.Yu. Glazyev and Professor V. Lokosov devoted to assessing the critical threshold values of the indicators of the state of Russian society and their use in the socio-economic development management.

Scientists believe that “ ... as a result of the poor state management efficiencies of the resource potential of Russia is more than twice lower than the critical value” 2 .

In his 13 decrees (No. 594 – 606 as of 7 May 2012) the President made the organizational base for the system implementation of his pre-election programme, which was supported by 64% of voters. One of the real instruments for implementing RF President’s orders is the budget for the period from 2013 to 2015.

However, according to an editorial article in the journal “Expert”, real values and longterm strategic objectives were not considered in the draft budget as priorities. There is a question at the end of the article, “Who will restrain and make the Russian Ministry of Finance listen to reason? Who will stop this bad endlessness?” 3

It will be extremely important if the President is able to defend his policy of developing the country according to the strategic directions outlined in his pre-election articles, or liberal-oligarchic elite blocks the implementation of the President’s programme, considering the preservation of the existing system as the main condition of its own well-being.

Scientific expert K. Mikulskiy characterizes the situation in the following way, “It is very important for the country that big business and partly middle-sized business reduce their relationship with the Russian economy and acquire offshore nature. The state has made purposefully the conditions for capital emigration and transferring the profits of Russian companies and personal income abroad. The most important thing in this process in not the economic attractiveness of foreign investments but the desire of the Russian capital, especially bureaucrats and oligarchs, for breaking away from the Russian day-to-day realities, reducing the tax burden and – it is probably the most significant desire – for protecting themselves in the case of political forces regrouping at the highest level of power and social disruptions”4.

More than once, our Journal has published the materials on this topic based on the analysis of the dynamics of three leading steel RF corporations’ indicators 5 .

Tables and graphs that are included in this issue confirm once again the conclusion that the state makes purposefully the conditions for transferring companies’ profits and personal incomes abroad. In reality, this has a very negative impact on the budget system of the Russian Federation and its regions.

The analysis of information on three major metallurgical corporations has showed the following:

-

1. There was a decrease in the role of ironworks as the mobilizers of revenue sources to the budgets of all the levels in the period from 2000 to 2011.

-

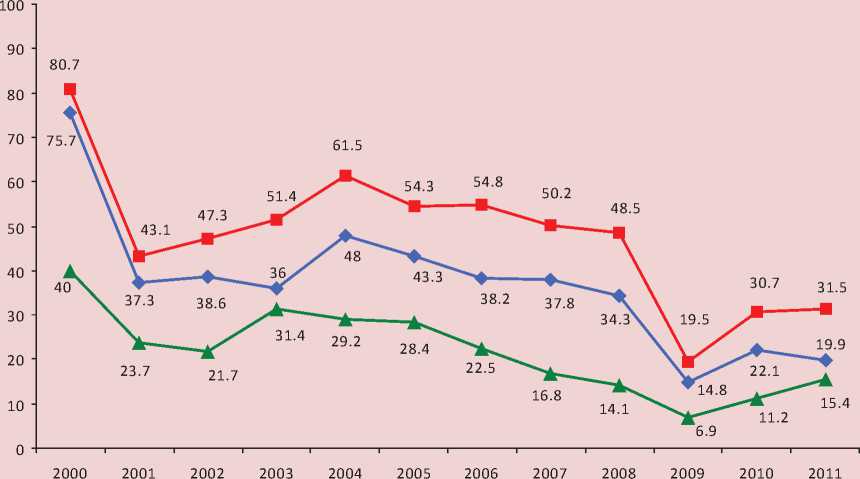

2. There was a decrease in the share of tax revenues from metallurgical corporations in the total regional budgets from 76 to 20% in the Vologda Oblast (ChMK is located here), from 81 to 32% in the Lipetsk Oblast (NLMK) and from 40 to 15% (MMK) (fig. 2) .

-

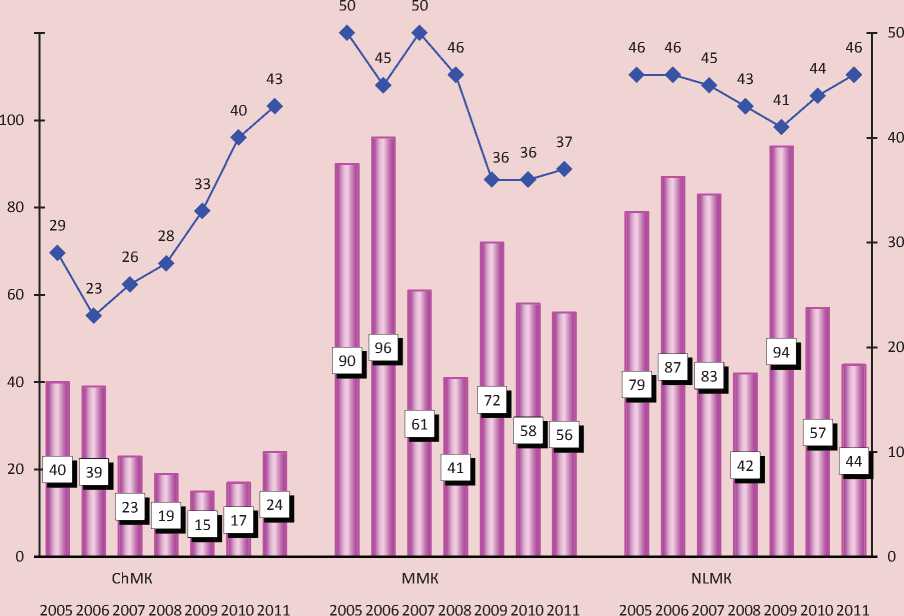

3. Over the period from 2004 to 2011, the incomes of the owners of metallurgical corporations increased 2 – 3.5-fold; as opposed to this, profit tax return to all the levels of RF budget system decreased 2 – 3.5-fold (tab. 2) .

-

4. In the period from 2008 to 2011, the metallurgical enterprises’ revenue losses from export sales accounted for 308.4 billion rubles due to underpricing by 25 – 30%.

Figure 2. Dynamics of the share of tax revenues from the metallurgical production in the total volume of tax and non-tax (own) revenues* in the regional budget for 2000 – 2011, %

— ■ — Lipetsk Oblast —0= Vologda Oblast —*— Chelyabinsk Oblast

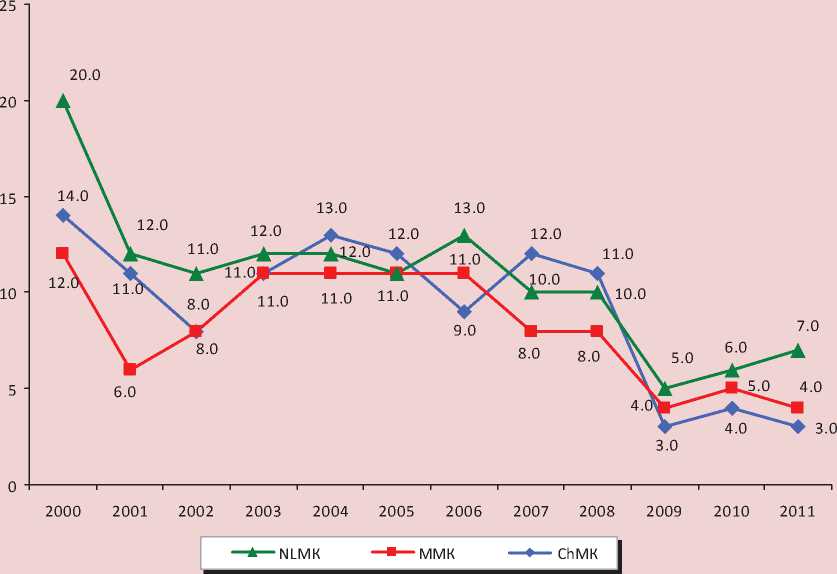

Tax revenues from Cherepovets Metallurgical Plant (ChMK) to the budget system of the Russian Federation decreased from 14 to 3% in relation to revenue, the tax revenues from Novolipetsk Steel (NLMK) decreased from 20 to 7% and the tax revenues from Magnitogorsk Iron and Steel Works (MMK) – from 12 to 4% (fig. 1) .

Figure 1. Dynamics of metallurgical complexes’ tax burden* in 2000 – 2011, % to sales revenue

* Includes all the taxes paid by metallurgical complexes to the federal, regional, local budgets and state non-budgetary funds without VAT recovery and income tax.

Sources: Annual Reports of OJSC Severstal, OJSC MMK and OJSC NLMK (RAS); ISEDT RAS calculations.

It should be noted that the decline in the share of tax revenues from metallurgical enterprises in the total revenues of regional budgets began in 2000, and there was a 2-3-fold decrease in this share in 2008.

There was a similar trend in the post-crisis period: in 2011, the share of revenues from the steel production was lower by 17 percentage points in the Lipetsk Oblast and by 14.4 percentage points in the Vologda Oblast in comparison with the level of 2008.

As a result, in the post-crisis period from 2010 to 2011, tax revenues from the steel production decreased by 24% down to 6.2 thousand rubles per capita in the Vologda Oblast and by 20% down to 7.6 thousand rubles per capita in the Lipetsk Oblast as compared with average annual values of five previous years (tab. 1) .

* Tax revenues include income tax, personal income tax, excise tax, total revenue tax, payments for the use of natural resources, state duty. Non-tax revenues include income from the use of state-owned (municipal) property, tangible and intangible assets sales return, administrative fees and charges, payments for public services, payments for the use of natural resources, fines, etc.

Sources: Annual Reports of OJSC Severstal, OJSC MMK and OJSC NLMK (RAS); Federal Treasury; ISEDT RAS calculations.

As a result, additional profit tax, calculated to this sum, accounted to 64.8 billion rubles, including 9.1 billion rubles of allocations to the federal budget and 55.7 billion rubles to the regional budgets (tab. 3) .

budget and 7.75 billion rubles to the regional budgets (tab. 4) .

Table 1. Dynamics of non-tax (own) revenues of the regional consolidated budgets and the share of tax revenues from metallurgical production in them for 2000 – 2011, thsd. rub. per capita

|

Revenues |

g |

g |

g |

co |

g |

g |

о |

g |

о |

CD |

CD CD C\l □) I cd 1 ® о |

||||

|

Vologda Oblast |

|||||||||||||||

|

Tax and non-tax (own) revenues * |

7.15 |

6.3 |

7.5 |

11.7 |

18.4 |

10.2 |

18.8 |

22.4 |

29.3 |

37.5 |

22.9 |

26.2 |

29.9 |

33.5 |

31.7 |

|

Tax revenues from metallurgical production |

5.3 |

2.2 |

2.7 |

4.0 |

8.4 |

4.5 |

7.7 |

7.9 |

10.2 |

12.0 |

3.1 |

8.2 |

6.2 |

6.2 |

6.2 |

|

The share of tax revenues from metallurgical production in the total volume of tax and non-tax (own) revenues of the regional budget, % |

75.7 |

37.3 |

38.6 |

36.0 |

48.0 |

46.4 |

43.3 |

38.2 |

37.8 |

34.3 |

14.8 |

33.7 |

22.1 |

19.9 |

20.9 |

|

Lipetsk Oblast |

|||||||||||||||

|

Tax and non-tax (own) revenues * |

5.8 |

6.0 |

8.4 |

11.1 |

17.9 |

9.8 |

17.3 |

22.3 |

23.3 |

28.7 |

22.4 |

22.8 |

26.0 |

29.3 |

27.7 |

|

Tax revenues from metallurgical production |

4.6 |

2.5 |

3.5 |

5.5 |

10.7 |

5.4 |

8.8 |

11.5 |

10.7 |

12.7 |

3.9 |

9.5 |

7.0 |

8.1 |

7.6 |

|

The share of tax revenues from metallurgical production in the total volume of tax and non-tax (own) revenues of the regional budget, % |

80.7 |

43.1 |

47.3 |

51.4 |

61.5 |

57.0 |

54.3 |

54.8 |

50.2 |

48.5 |

19.5 |

45.6 |

30.7 |

31.5 |

31.1 |

|

Chelyabinsk Oblast |

|||||||||||||||

|

Tax and non-tax (own) revenues * |

4.13 |

4.1 |

5.0 |

7.5 |

10.3 |

6.2 |

11.7 |

16.9 |

22.0 |

25.4 |

16.9 |

18.6 |

24.6 |

27.5 |

26.1 |

|

Tax revenues from metallurgical production |

1.6 |

0.9 |

1.0 |

2.2 |

2.8 |

1.7 |

3.1 |

3.4 |

3.3 |

3.2 |

1.0 |

2.8 |

2.4 |

3.7 |

3.1 |

|

The share of tax revenues from metallurgical production in the total volume of tax and non-tax (own) revenues of the regional budget, % |

40.0 |

23.7 |

21.7 |

31.4 |

29.2 |

29.3 |

28.4 |

22.5 |

16.8 |

14.1 |

6.9 |

17.0 |

11.2 |

15.4 |

13.4 |

|

* Tax revenues include income tax, personal income tax, excise tax, total revenue tax, payments for the use of natural resources, state duty. Non-tax revenues include income from the use of state-owned (municipal) property, tangible and intangible assets sales return, administrative fees and charges, payments for public services, payments for the use of natural resources, fines, etc. Sources: Data of the Federal Treasury; Russia’s Federal Tax Service; ISEDT RAS calculations. |

|||||||||||||||

Table 2. Dynamics of profit tax funds from metallurgical enterprises to the budget system of the Russian Federation and their principal owners’ capital, 2005 – 2011, bln. rub.

|

Indicator |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

|

ChМК |

|||||||

|

Principal owner’s capital |

245 |

319 |

602 |

126 |

299 |

564 |

493 |

|

Profit tax* |

12 |

12 |

16 |

18 |

0.4 |

5.2 |

5.3 |

|

ММК |

|||||||

|

Principal owner’s capital |

155 |

240 |

391 |

74 |

296 |

341 |

180 |

|

Profit tax* |

10 |

12 |

12 |

11 |

0.5 |

1.6 |

3.1 |

|

NLМК |

|||||||

|

Principal owner’s capital |

325 |

398 |

587 |

153 |

478 |

732 |

512 |

|

Profit tax* |

11 |

18 |

14 |

18 |

1.3 |

5.3 |

7.1 |

* Profit tax to all the levels of the budget system of the Russian Federation.

Sources: Data of The Forbes. Available at: ; annual reports of OJSC Severstal, OJSC MMK and OJSC NLMK (RAS).

Table 3. The estimated amount of RF budgetary system’s revenue losses from metallurgical enterprises due to export underpricing as compared with the world prices over the period from 2008 to 2011, bln. rub.

|

Indicator |

ChМК |

ММК |

NLМК |

Total |

|

Average export price of an enterprise, dollars/t |

638 |

519 |

578 |

|

|

Average world price, dollars/t |

818 |

817 |

728 |

|

|

Price variations, % |

-22.0 |

-36.5 |

-20.6 |

|

|

Revenue losses |

65.6 |

126.8 |

116.0 |

308.4 |

|

Profit tax losses |

13.6 |

27.0 |

24.2 |

64.8 |

|

Including: by federal budget |

1.4 |

4.3 |

3.4 |

9.1 |

|

by regional budget |

12.2 |

22.7 |

20.8 |

55.7 |

|

Sources: Data of Federal State Statistic Service and Annual Reports of OJSC Severstal, OJSC MMK and OJSC NLMK (RAS); ISEDT RAS calculations. |

||||

Table 4. The effect of increasing the share of commercial and administrative expenses in metallurgical enterprises’ revenues on profit tax formation in 2006 – 2011

|

Indicator |

ChМК |

NLМК |

||

|

2006 – 2008 |

2009 – 2011 |

2006 – 2008 |

2009 – 2011 |

|

|

Sales revenues, bln. rub. |

597.3 |

607.7 |

497.3 |

529.7 |

|

Commercial and administrative expenses, bln. rub. |

31.3 |

53.4 |

36.1 |

60.0 |

|

The share of commercial and administrative expenses in sales revenues, % |

5.2 |

8.8 |

7.3 |

11.3 |

|

Commercial and administrative expenses in 2009 – 2011 on condition of keeping the share of expenses at the level of 2006 – 2008, bln. rub. |

31.6 |

38.7 |

||

|

Decrease in taxable profit as a result of rising scale of commercial and administrative expenses, bln. rub. |

21.8 |

21.3 |

||

|

Profit tax that could be received in 2009 – 2011 on condition of keeping the share of these expenses at the level of 2006 – 2008, bln. rub. |

4.36 |

4.26 |

||

|

Including: to federal budget |

0.44 |

0.43 |

||

|

to regional budget |

3.92 |

3.83 |

||

Sources: Annual reports of OJSC Severstal, OJSC MMK and OJSC NLMK (RAS); ISEDT RAS calculations.

Figure 3. Changes in the level of depreciation of fixed assets and the share of metallurgical complexes’ fixed capital investments in the total investment of corporations in 2005 – 2011

The share of fixed capital investments in corporation’s investment, % Depreciation of fixed assets, %

Sources: Annual Reports of OJSC Severstal, OJSC MMK and OJSC NLMK (RAS); ISEDT RAS calculations.

Upon availability of considerable investment resources, owners did not invest enough money in the programmes for the development of enterprises – the volumes of undistributed profits were 5 – 10 times higher than capital costs 6 .

According to the data mentioned above, it can be concluded that the liberal and oligarchic elite has created the conditions in the country that do not stimulate the increase in taxable income and growth on this basis of the national budget revenues.

Many experts 7 point out other available reserves to fill the federal and regional budgets which include:

-

• legislative prohibition or severe restriction of transferring Russian property to offshore jurisdictions;

-

• cancelling of VAT refund for the largest exporters;

-

• introducing a progressive scale of personal income tax 8 ;

-

• determining a tax on luxury and expensive real estate;

-

• increasing dividend tax rate from 9% to 13 – 15% and equalizing this tax for Russian and foreign corporate entities;

-

• radical change in the law regulating the insurance payments to social funds; in particular, the matter is the cancellation of margin annual revenue (463 thousand rubles) that is the highest limit for social contributions;

-

• expansion of tax authority rights, primarily territorial, in the sphere of control over cash flows of the largest taxpayers and in order to obtain all necessary information on their activities;

-

• introduction of changes in the law on joint stock companies in terms of expanding a list of information that is required to be disclosed;

-

• introduction of hard currency repatriation tax.

In our opinion, these measures fit well in the structure of organizational and economic mechanisms proposed by Vladimir V. Putin in his pre-election articles and the presidential decrees of May 7 in order to overcome clannish, oligarchic and bureaucratic obstacles that restrain the socio-economic modernization of the country. People, who voted for Vladimir Putin, are expecting his real steps to ensure overcoming the obstacles that block the economic and social development of the country.

A writer A. Salutskiy has expressed exactly the expectations that were established in the Russian society during Vladimir V. Putin’s presidency.

“Just today, after challenging election, Putin has got a chance to become a true tsar – in the sense of a real national leader, who is in charge for the greatest obligations to the Russian people. However, does Putin himself understand in full measure the responsibility that was heaped on his shoulders?

Meanwhile, time presses. Tsar authority appears in the first key days. And civil responsibility should be above personal obligations. People are tired of dual power and endless behind-the-scenes struggle. People are waiting for Munich speech on our home themes, and they do not want to know about tightening or weakening the screws but they want him to put an end to bureaucratic maneuvering at one tsar’s word, step up to the plate and solve all the problems in the sphere of power in his own way…

If Putin is able to become such a high moral authority, then everything in Russia will go with a run. It he is still overnice to solving personnel problems, considers all the possible side interests too vigilantly and, in fact, shares his supreme authority with anyone, the people won’t recognize him as a tsar and the voters, who elected him to be the President, will call for a vote of confidence” 9 .

-

9 Salutskiy A. New Putin. Literary Gazette. 2012. No. 39 (6386). P. 3.

j

Like in the previous issues, we provide the results of the last assessments of public opinion monitoring concerning the state of Russian society*.

The following tables show the dynamics of some indicators of social well-being and sociopolitical moods of the Vologda Oblast population for the period from October 2011 to October 2012 (the data for 8 months including August 2008 are used to assess the public moods in the pre-crisis period).

Estimation of power activity (How do you assess the current activity of..?)

|

Vertical power structure |

Approval in % to the total number of respondents |

Dynamics indices. Oct. 2012 to 8 months 2008 |

Dynamics indices. Oct. 2012 to Aug. 2012 |

|||||||||

|

8 mnth. 2008 |

Oct. 2011 |

Dec. 2011 |

Feb. 2012 |

Apr. 2012 |

June. 2012 |

Aug. 2012 |

Oct. 2012 |

|||||

|

The President of the RF |

75.0 |

56.6 |

51.7 |

47.3 |

50.3 |

54.5 |

53.7 |

50.9 |

0.68 |

0.95 |

||

|

The Chairman of the Government of the RF |

76.4 |

59.1 |

52.9 |

52.6 |

51.7 |

49.5 |

48.5 |

47.1 |

0.62 |

0.97 |

||

|

The Governor of the Vologda Oblast |

57.8 |

47.7 |

41.9 |

37.7 |

37.7 |

44.7 |

45.3 |

43.6 |

0.75 |

0.96 |

||

|

Vertical power structure |

Disapproval in % to the total number of respondents |

Dynamics indices. Oct. 2012 to 8 months 2008 |

Dynamics indices. Oct. 2012 to Aug. 2012 |

|||||||||

|

8 mnth. 2008 |

Oct. 2011 |

Dec. 2011 |

Feb. 2012 |

Apr. 2012 |

June. 2012 |

Aug. 2012 |

Oct. 2012 |

|||||

|

The President of the RF |

9.3 |

29.0 |

35.7 |

35.7 |

33.3 |

28.9 |

31.1 |

32.1 |

3.45 |

1.03 |

||

|

The Chairman of the Government of the RF |

10.4 |

24.7 |

32.7 |

32.0 |

33.1 |

31.5 |

34.5 |

32.8 |

3.15 |

0 |

.95 |

|

|

The Governor of the Vologda Oblast |

10.4 |

24.7 |

32.7 |

32.0 |

33.1 |

31.5 |

34.5 |

32.8 |

3.15 |

0 |

.95 |

|

What party expresses your interests?

|

Party |

In % to the total number of respondents |

Dynamics indices. Oct. 2012 to 8 months 2008 |

Dynamics indices. Oct. 2012 to Aug. 2012 |

|||||||

|

8 mnth. 2008 |

Oct. 2011 |

Dec. 2011 |

Feb. 2012 |

Apr. 2012 |

June. 2012 |

Aug. 2012 |

Oct. 2012 |

|||

|

United Russia |

40.5 |

29.8 |

26.1 |

26.0 |

28.3 |

31.9 |

31.4 |

26.6 |

0.66 |

0.85 |

|

KPRF |

40.5 |

29.8 |

26.1 |

26.0 |

28.3 |

31.9 |

31.4 |

26.6 |

0.66 |

0.85 |

|

LDPR |

7.7 |

9.1 |

9.2 |

9.1 |

9.5 |

7.7 |

6.7 |

6.8 |

0.88 |

1.01 |

|

A Just Russia |

5.0 |

5.6 |

13.9 |

10.2 |

8.2 |

4.6 |

5.6 |

5.5 |

1.10 |

0.98 |

|

Other |

1.4 |

3.1 |

4.6 |

3.1 |

3.2 |

2.8 |

2.3 |

2.4 |

1.71 |

1.04 |

|

No party |

20.1 |

28.1 |

23.9 |

25.7 |

28.6 |

31.5 |

33.2 |

36.1 |

1.80 |

1.09 |

|

It’s difficult to answer |

13.7 |

12.2 |

9.0 |

15.8 |

10.8 |

11.6 |

11.1 |

12.3 |

1 0.90 . |

1.11 |

Estimation of social condition

|

In % to the total number of respondents |

Dynamics indices, Oct. 2012 to 8 months 2008 |

Dynamics indices, Oct. 2012 to Aug. 2012 |

|||||||

|

8 mnth. 2008 |

Oct. 2011 |

Dec. 2011 |

Feb. 2012 |

Apr. 2012 |

June. 2012 |

Aug. 2012 |

Oct. 2012 |

||

|

What would you say about your mood in the last days? |

|||||||||

|

Usual condition, good mood |

|||||||||

|

70.2 |

64.7 |

64.2 |

62.9 |

63.4 |

69.0 |

71.3 |

69.0 |

0.98 |

0.97 |

|

Feeling stress, anger, fear, depression |

|||||||||

|

22.1 |

29.4 |

30.2 |

33.5 |

30.2 |

23.4 |

23.3 |

25.5 |

1.15 |

1.09 |

|

What statement, in your opinion, suits the current occasion best of all? |

|||||||||

|

Everything is not so bad; it’s difficult to live, but it’s possible to stand it |

|||||||||

|

81.0 |

73.9 |

78.6 |

74.9 |

76.5 |

77.3 |

73.2 |

77.5 |

0.96 ■_______1 |

1.06 |

|

It’s impossible to bear such plight |

|||||||||

|

10.9 |

15.8 |

14.1 |

18.1 |

16.8 |

13.6 |

17.0 |

15.6 |

1.43 |

0.92 |

|

Consumer Sentiment Index |

|||||||||

|

107.5 |

88.5 |

85.6 |

89.8 |

90.1 |

93.4 |

92.3 |

91.7 |

0.85 |

0.99 |

|

What category do you belong to? |

|||||||||

|

The share of people who consider themselves to be poor and extremely poor |

|||||||||

|

39.8 |

44.6 |

41.9 |

43.2 |

43.6 |

45.0 |

44.2 |

44.1 |

1.11 |

1.00 |

|

The share of people who consider themselves to have average income |

|||||||||

|

50.7 |

41.8 |

42.2 |

44.9 |

46.5 |

45.3 |

43.4 |

44.7 |

0.88 ■_______1 |

1.0 |

The data in the tables show that the level of positive assessments of V.V. Putin’s activities as the RF President is very stable. In October 2012, the degree of approval of his activities increased as compared with April - a month, which preceded his accession to the presidency. It is also important that people’s attitude toward the vertical of power at all levels is stabilizing as well. The people’s assessments of their social status prove that their dynamics according to key parameters remains positive.

The first regional election campaign held on 14 October 2012 that took place after the federal elections and political reform showed that the “United Russia” remains the dominant party. In all five subjects, where the governor’s elections were held, the candidates from “United Russia” won, its representatives headed the elections in the vast majority of the regional and local representative power bodies. However, considering these results, one should take into account the fact that the last campaign was distinguished by the low voter turnout. So, in the city of Vologda only 52% of registered voters participated in the elections of deputies of the Vologda Oblast Legislative Assembly. As for the additional elections of the deputies of the Vologda city Duma, the voter turnout decreased to 14 – 16%. For instance, in the voting station No. 365 only 16 people or 3.2% took part in the elections out of the electoral roll of 447 voters. This circumstance compels us to assess the results of the elections and the degree of population’s support of the authorities more critically.

j

As in the previous issue, in this one we publish the journal articles rating.

The first ten articles according to the frequency of their viewing for the recent 12 months (November 2011 – October 2012)

|

5 |

го 11 ГО |

< < |

о |

О "> О ■> I -1 i | аз СП аз ™ ^ 5 ^ 03 го аз й < Го < Го О^ ^ о 9 о го ^ > CL rxj |

"го со |

-го S го >. 15 |

2 ОО |

UD го СО |

||

|

% аз Ь го аз ТЗ СС |

5 ° |

§ |

О- СМ |

5 ° |

Е g |

|||||

|

= |

о |

о |

О |

о |

6 |

^ |

6 |

|||

|

1 ^iг .« аз "В В с о Я СП 03 ш D ГО О 03 £ — ~ о Е 5 Я " |

со |

СП |

ОО |

Ю |

со |

см |

ОО |

|||

|

- « б S “ В 8 Я Я £ = = 5 £ Е |

1- |

СМ |

со |

^2 |

1- |

CD |

со |

со |

1- |

СО |

|

- и б 5 2 В см о |

со |

со |

со |

S |

S |

8 |

со |

|||

|

03 a CD 03 "О |

3 |

аз |

со |

см |

СО |

со |

со |

со |

||

|

аз а ° и, - S 5 £ — ”"=■ = го аз о аз о Е в |

о |

S |

я |

S |

S |

со |

СО |

3 |

||

|

аз а аз 60 ~ Я Я Я _ ГО 0 3 го аз £ с £ о ^ £ Е |

аз |

СО |

аз |

3 |

со |

СО |

3 |

3 |

||

|

о 2 1^1 о > g го го си 1 II В Я .Е |

И о g 1— ГО |

я 5 го |

а га го £ га £ ° В □ Я |

“ го Го |

го |

'о о ^ го Е |

Е 5 Е го Е a |

^ .S г? е Я о 2 в Я |

1 я | ^ £ 'о ГО -2 Е Е го — ОГО > ~ о а го ё |

|

|

Вицец |

1- |

см |

со |

СП |

«о |

г- |

аз |

аз |

CD |

Account of the site’s viewing has been carried out since 2009, December, 12.

Список литературы Anxious expectations

- Philosophy of victory: a report from the first meeting of the Izborsk Club. Zavtra. 2012. No. 37 (982). P. 2-3.

- Glazyev S.Yu., Lokosov V.V. Assessment of the critical threshold values of the indicators of the state of Russian society and their use in the socio-economic development management. Bulletin of the Russian Academy of Sciences. Vol. 82.

- How can a pupil fight riffraff: editorial article. Expert. 2012. No. 39 (821). P. 19

- Mikulskiy K. Russian social system blocks the progress of the country. Society and Economy. 2012. No. 7 -8. P. 5-12.

- Ilyin V.A. The influence of ferrous metallurgy corporations' interests on the regional development. Economic and social changes: facts, trends, forecasts. 2011. No. 3 (15). P. 14-38

- Povarova A.I. The influence of the metallurgical corporation owners' interests on the financial performances of the parent enterprise (in the case of OJSC «Severstal»). Economic and social changes: facts, trends, forecasts. 2011. No. 5 (17). P. 36-51

- Ilyin V.A., Povarova A.I., Sychov M.F. The influence of the metallurgical corporation owners' interests on the socio-economic development: preprint. Vologda: ISEDT RAS, 2012.104 p.

- Krichevskiy N.A. You were robbed! Arguments and Facts. 2011. No. 28

- Inozemtsev V.L. Tax jail. Ogonyok. 2011. No. 40

- Senchagov B. Finance modernization. Problems of Economics. 2011. No. 3. P. 419

- Shvetsov Yu. National budget as a national property//Society and Economics. 2011. No. 8-9. P. 119-131

- Zubarevich N. Way out of the crisis: regional projection. Problems of Economics. 2012. No. 4. P. 64-84.

- Salutskiy A. New Putin. Literary Gazette. 2012. No. 39 (6386). P. 3