Applying management accounting information for ESG reporting

Автор: Grigoryan L.H., Hakobyan A.S.

Журнал: Международный журнал гуманитарных и естественных наук @intjournal

Рубрика: Экономические науки

Статья в выпуске: 4-2 (91), 2024 года.

Бесплатный доступ

The article considers the possibilities of using management accounting information for sustainable development reporting purposes within the ESG framework. The author presents the information flows formed in the management accounting system, identifies the directions of application of the summarized information, justifies the appropriateness of applying the information formed in the management accounting system for ESG reporting. As a result of the research, for the purpose of sustainability reporting, the directions of management accounting information processing were presented.

Esg reporting, managerial accouting, information flows, internal reporting, sustainability reporting, trends, strategic management accounting

Короткий адрес: https://sciup.org/170204868

IDR: 170204868 | DOI: 10.24412/2500-1000-2024-4-2-140-143

Текст научной статьи Applying management accounting information for ESG reporting

-

- Management accounting system is perceived as a system dealing with financial information, non-financial information in some cases is ignored.

-

- Organizations are not well acquainted with IFRS-S1, IFRS-S2 standards and the possibilities of sustainable development reporting. Such reports are prepaired by few Armenian organizations. They are prepaired in cases where there is an international investor, or when the organization is going to

apply for a loan from an international financiers.

-

- The possibilities of using management accounting information for ESG-reporting or sustainablity reporting purposes are also not well understood.

Analysis of recent researches and publications: The issues of management accounting information for ESG purposes have been reflected in the works of international authors [2, 5, 8], as well as in the reports of several international organizations [1, 6, 7]. In the mentioned sources, propositions about the importance of ESG reporting, directions of preparation, as well as statistics regarding the preparation of such reports are mainly presented. In this context, there is a need to introduce management accounting possibilities for ESG reporting.

Formulation purposes of article (problem): The purpose of the article is to present the possibilities of applying the information flows formed in the management accounting system for the purposes of internal and external (ESG) accountability. To achieve that goal, we tried to solve the following problems:

-

1. present the information flows forming in the management accounting system,

-

2. distinguish the directions of application of management accounting information,

-

3. justify the expediency of using the information generated in the management accounting system for ESG reporting.

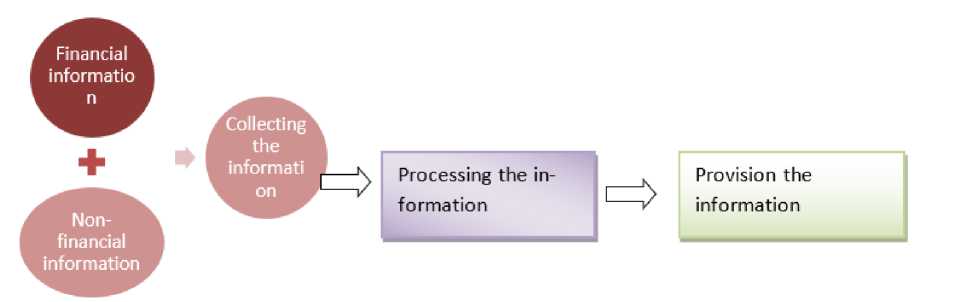

The main material: By many authors management accounting is characterized as the process of collecting, processing and transmitting financial and non-financial information for the purposes of managerial decision making and control.

Figure 1: The process of Management accounting

Source: Prepaired by the author.

This process is carried out both to manage the day-to-day operational activities of the organization, and to achieve long-term, visionary, strategic goals, that is, to operate continuously and develop sustainably. In fact, the construction of a management accounting system aimed at sustainable development and strategic goals can be considered one of the main issues of management accounting. The goal of building that system should be to collect, process, and provide information related to the organization's development to support sustainability reporting.

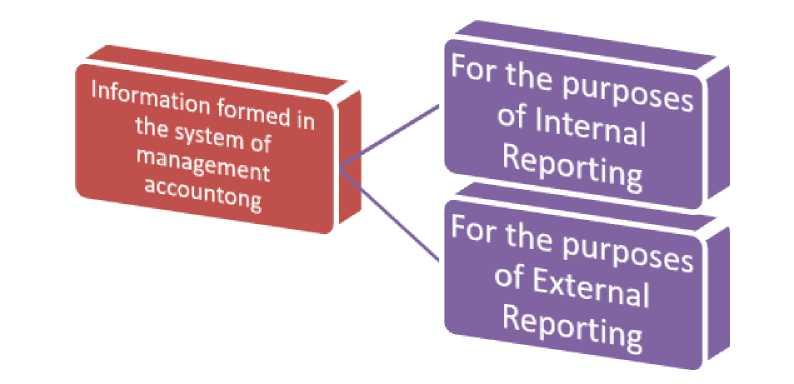

Figure 2: Directions of Management accounting information presenatation

Source: Prepaired by the author.

Financial information generated in the management accounting system refers to Revenues, Profits, Sales Profitability, Gross profitability and other information. However, this system also forms information about the sustainable development of the organization, including data on what part of the Revenues is allocated to trainings to increase the profes- sionalism of employees, how much money is allocated to the creation of new products, to the implementation of new equipments and technologies, how many new products were developed during the reporting period, did the Labor productivity increased. As well as, information about how much money the organization has spent for social purposes (for example, they visited orphanages, nursing homes), or created an attitude towards certain positive values among the society (by preparing social ads).

The management accounting system also contains information on what part of Revenues or Profits was allocated to compensate for the damages caused to nature or people's health (for example, the mining company, after opening a mine in a forested area, how much money has spent to organize tree plantings), or How much money did the organization in tobacco industry allocated for the construction of the new park. Information about Governance issues is also formed in the management accounting system. For example, information about, how much money was allocated to the implementation and maintenance of MRP or ERP systems.

го

0) E e о

About the expenses for the recovery of the damage allocated to nature.

о in

About the amount of expenses allocated for the implementation of social programs

About the measures aimed at

ш о c ro

ш > о о

n.

About the expenses incurred for the purpose of improving the corporate governance

increasing the staff U professionalism

Figure 3. The pillars of management accounting information preparation for ESG reporting Source: Prepaired by the author.

The examples of information described above show that a management accounting system generates enormous amounts of information that, if processed in a certain way, can be useful for sustainability reporting.

Insights from this study and perspectives for further research in this direction: Thus, the financial and non-financial information generated in the management accounting system can be useful not only for providing reports to managers for decisionmaking and control purposes. The information generated in the management accounting system is also applicable for the preparation of the sustainability reporting and ESG reporting purposes. Observing the management accounting information with this approach will allow avoiding additional costs of preparing information for ESG reporting, as the necessary information will be generated from accounting registers already operating in the organization. Since in many cases such reports are not produced to avoid additional costs and complications, another advantage is that the perception of data availability can support the spread of ESG reporting.

Список литературы Applying management accounting information for ESG reporting

- CIMA, Ash N. The Sustainability & ESG Imperative for the Accounting and Finance Profession.

- Diala L., Integrating ESG in a Managerial Accounting Class // Journal of Accounting and Finance. - 2023. - Vol. 23(6).

- International Financial Reporting Standards (IFRS) S1. (2023). IFRS Sustainability Disclosure Standard: General requirements for disclosure of sustainability-related financial information.

- International Financial Reporting Standards (IFRS) S2. (2023). IFRS Sustainability Disclosure Standard: Climate-related Disclosures.

- Knachel E., Porter B., Deloitte & Touche LLP, Accounting Considerations for Environmental Objectives, Heads Up | Volume 28, Issue 14, November 4, 2021.

- KPMG. (2022). Big shifts, small steps: Survey of sustainability reporting.

- PwC report on G reporting and preparation of a Sustainability Report.

- Tsang A․, Frost T․, Cao H․ Environmental, Social, and Governance (ESG) disclosure: A literature review // The British Accounting Review. - 2023. - Volume 55, Issue 1. P. 101149. ISSN 0890-8389.