Approaches to Assessing and Monitoring of the Budget Potential Use in the Far North

Автор: Barasheva T.I.

Журнал: Arctic and North @arctic-and-north

Рубрика: Social and economic development

Статья в выпуске: 49, 2022 года.

Бесплатный доступ

In the current crisis conditions, improving the financial security of the territories as a factor of development and investment attractiveness of the regions is a key task. An important role in its solution is played by assessment of the budget potential, which allows creating the information basis for the development of recommendations on the mobilization of financial resources and their effective use. It has defined the goal of this article: substantiation of the methodological approach to assessing the level of budgetary potential use. It has been determined, that an increase of budget potential can be influenced by the activity of regional authorities in the course of implementation of the budget process. Within the developed methodological approach to evaluation of the budget potential, based on application of the integral and matrix approaches, selection of indicators is substantiated with the allocation of two groups characterizing financial security of the regions and quality of the budget process governance. In the course of the methodology approbation on the basis of data from the Far North (FN) regions, the calculations of the total integral index, assessing the level of use of budgetary potential in the regions, and its components — individual integral indices — were carried out. The FN regions are leveled by the budget potential use. Matrices grouping the regions on the level of financial security and governance quality are formed. The comparison of typological groupings and analysis of coefficients included in calculation of the integral index made it possible to study the tendencies, to reveal the specificities and problems of forming and using the budget potential in region of the Far North. It is found out that the FN regions with high and moderate levels of the budget potential use are characterized mainly by governance problems. In the regions with reduced or low level of the budget potential use, the financial problems are amplified along with managerial problems. The problem areas identified in the course of the study are a guideline for development of measures aimed at effective governance of the budget potential.

Budget potential, Far North region, financial security, quality of the budget process management, typologization, regional development

Короткий адрес: https://sciup.org/148329260

IDR: 148329260 | УДК: 316.334.52(98)(045) | DOI: 10.37482/issn2221-2698.2022.49.5

Текст научной статьи Approaches to Assessing and Monitoring of the Budget Potential Use in the Far North

The tasks of restoring sustainable growth of regional economies in the context of the crisis caused by sanctions and the global pandemic determine the particular importance of strengthening the financial base by increasing the fiscal potential of the territories, which actualizes the problem of creating a reasonable system for assessing the latter. A rationally constructed system for assessing the budget potential will contribute to the implementation of an effective budget process and, in general, to the effective management of regional finances. The issue of sufficiency of author-

∗ © Barasheva T.I., 2022

ities’ financing of their powers is the most acute in the Far North regions, which is due to the overestimated costs of life here.

In Russian and foreign practice, there are various methodological approaches to assessing the budgetary potential of territories. At the same time, the choice of a system of indicators is significant. Methods of foreign researchers, who identify the fiscal potential with the tax potential, include the following criteria for evaluation: state and local tax and non-tax revenues, tax burden, taxation load [1]. The most common methods for assessing the budget potential developed by Russian researchers [2, Golodova Zh.G., p. 3], [3, Naydenova T.A., Shvetsova I.N., p. 42–44] are based on the calculation of analytical coefficients that describe the state of regional budgets in terms of their balance, sustainability, and ability of the region to finance its own needs. The methodology of Yashin S.N. and Yashina N.I. also suggests the use of budget coefficients, for the calculation of which the grouping of “expenditures and revenues of the budget, asset and liability items of the budget balance; that is, based on the use of funds and sources of their financing” is preliminarily carried out [4, p. 37]. In later studies, Russian scientists update the issue of assessing the use of budgetary capacity, paying attention to the management side of this process. For example, Kuklina A.A. and Naslung K.S. introduced additional criteria along with generally recognized budget indicators into the methodology that evaluate the “quality of planning”, “orientation of the regional budget” and “the impact of budget indicators on key economic indicators” [5, p. 397]. The methodology of E.N. Gladkovskaya proposes criteria that are included in the information base of control and accounting bodies, which makes it possible to identify the targeted and effective use of budgetary funds [6, p. 34–35]. Separate indicators for assessing the managerial impact on the level of budgetary potential are also considered in the works of Russian scientists: Igonina L.L. and others [7, p. 359–360], Su-leimanova M.M. [8, p. 46–48], Tkacheva T.Yu. [9, p. 12–16], Zenchenko S.V. [10, p. 191–196], Zinchenko N.V. [11, p. 28–29].

The basis for expanding the research field in terms of assessing the budgetary potential in terms of its use is, according to the author, the following interpretation of the concept of “used” or “realized” budgetary potential. On the one hand, the realized budgetary potential can act as the amount of financial resources formed and accumulated in the regional budget at the end of the period. On the other hand, it can also be considered as used by the authorities to perform budgetary functions (regulating, stimulating, social) in order to ensure the development of the territory and improve the welfare of citizens [12, Barasheva T.I.]. Taking into account the above, as well as the fact that the managerial component of the analysis is not sufficiently informative in modern assessment methods, which is confirmed by a limited list of criteria characterizing the participation of public authorities in the management of budgetary potential, it seems appropriate to assess the budgetary potential in terms of its use not only by budget coefficients, describing the financial condition of the regional budget, but also to include a separate block of indicators that make it possible to indirectly assess the quality of regulatory influences on the part of regional governments that have a direct impact on changes in the budget potential. The two blocks of indicators proposed for analysis indirectly reflect the result of managerial influence on this process. At the same time, if the first block of indicators characterizing the financial state of the budget evaluates the consequences of making managerial decisions by both federal (they determine the conditions for interbudgetary regulation) and regional authorities, then the second block of indicators — by regional administrations.

The purpose of the study is to clarify the indicators and develop a methodology for assessing the level of use of the budgetary potential. The objectives are the following: to explore modern methods for assessing the budget potential; to substantiate the choice of indicators for assessing the level of the budgetary potential use from the perspective of managerial impact of regional authorities on this process; to calculate integral indices, assessing financial security of the territory and quality of budgetary process management, as well as the total integral index; to form matrices allowing to carry out the typology of the Far North regions according to the level of using the budgetary potential and depending on the level of financial security and the quality of budgetary process management, and to identify the main problems hindering the effective management of budgetary potential for each group of the Far North regions.

The proposed methodological approach, which allows estimating the level of budget potential usage, is based on the application of indicative and matrix analysis, methods of generalization, analysis, synthesis and includes a system of evaluation parameters divided into two groups:

-

• indicators assessing the financial security of the region (Table 1);

-

• indicators assessing the quality of regulatory impacts in the course of implementation of budgetary functions by regional authorities (Table 2).

Table 1

Indicators assessing the financial security of the region

|

defined as the ratio between the average per capita income in the region and the average per capita income in the Russian Federation |

nues to meet obligations to the population compared to the national average. |

Golodova Zh.G., Naydenova T.A., Shvetsova I.N. |

Table 2

Indicators assessing the quality of budget management in the region 1

|

Indicator |

Characteristic |

|

1. The expenditure prioritisation ratio is defined as the ratio of social expenditure to total expenditure |

Assesses the priority of spending of regional budgets. The higher the value of the coefficient, the higher the level of support for the population. Its value should not be lower than the national average. |

|

2. The investment activity ratio is defined as the ratio of investment to total expenditure |

Assesses the capacity to implement investment policy in a region. The higher the value of the coefficient, the higher the level of investment activity in the region. |

|

3. The tax collection ratio is defined as the ratio of tax revenues to possible tax receipts (sum of taxes collected and tax arrears to the budget, other budget losses) |

Indicates the level of tax collection from the potential amount of tax revenues, including budget losses from tax arrears, exemptions, etc. The higher the value of this coefficient, the higher the tax collection rate. |

|

4. The income tax effort ratio is defined as the ratio between the amount of income tax collected and the amount of income tax base |

Assesses the efforts to collect income tax. The higher the value of this coefficient, the higher the tax potential of the territory due to the regional authorities' efforts to attract (retain) big businesses as taxpayers. |

Based on the coefficients of the first group, an integral index assessing the level of financial security of the region (IFS) is determined. The coefficients of the second group are used to calculate the integral index assessing the quality of budgetary process management (IQM). To quantify the level of use of the budgetary potential, the aggregate integral index is calculated on the basis of all eight coefficients. To make indicators comparable, a standardization procedure was carried out (private values of the indicator for the region were correlated with the numerical value of this indicator for Russia).

Integral indices, both within the boundaries of groups and in general (cumulative integral index) were calculated using the geometric mean formula (the product of the coefficients from which the root is extracted, the degree of which is equal to the number of coefficients) in accordance with the method of Zh.G. Golodova [13, p. 37–38]. The obtained integral indicators make it possible to rank and classify regions depending on the level of use of the budgetary potential. The data of the Federal Tax Service of Russia and the Federal State Statistics Service of Russia for the five-year period (2016-2020) were the information base of the analysis.

1 Author’s research.

Assessment of the level of use of budgetary potential in the regions of the Far North

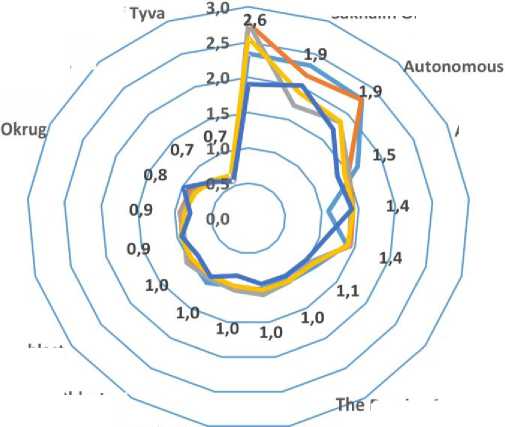

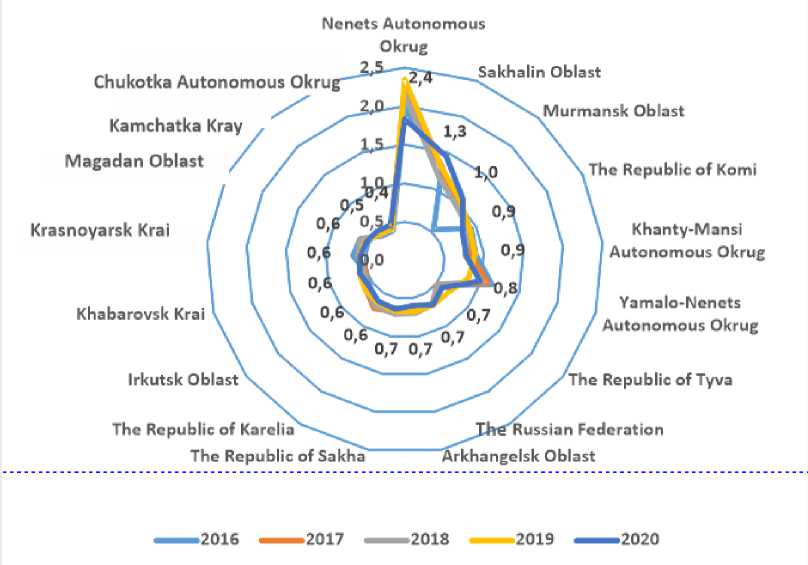

On the basis of the developed methodology, a cumulative integral index that determining the level of use of the budget potential (IUBP) in the regions of the Far North was calculated (Table 3), and the regions were ranked according to this criterion (Fig. 1).

Table 3

Distribution of the regions of the Far North according to the cumulative integral indicator (CII) 2

|

2016 |

2017 |

2018 |

2019 |

2020 |

|

|

Group 1 — high level of use of budget potential |

|||||

|

High (>1.8) |

Nenets Autonomous Okrug, Yamalo-Nenets Autonomous Okrug, Sakhalin Oblast |

Nenets Autonomous Okrug, Yamalo-Nenets Autonomous Okrug, Sakhalin Oblast |

Nenets Autonomous Okrug, Yamalo-Nenets Autonomous Okrug, Sakhalin Oblast |

Nenets Autonomous Okrug, Yamalo-Nenets Autonomous Okrug, Sakhalin Oblast |

Nenets Autonomous Okrug, Yamalo-Nenets Autonomous Okrug, Sakhalin Oblast |

|

Group 2 — moderate level of use of budget potential |

|||||

|

Above average (from 1.5 to 1.8) |

Khanty-Mansi Autonomous Okrug |

Republic of Komi, Murmansk Oblast, Khanty-Mansi Autonomous Okrug |

Republic of Komi, Khanty-Mansi Autonomous Okrug |

Republic of Komi, Murmansk Oblast, Khanty-Mansi Autonomous Okrug |

Murmansk Oblast |

|

Average (from 1.2 to 1.5) |

Republic of Komi, Krasnoyarsk Krai |

- |

Murmansk Oblast, Republic of Sakha |

- |

Republic of Komi, Khanty-Mansi Autonomous Okrug |

|

Group 3 — reduced level of use of budget potential |

|||||

|

Below average (from 0.9 to 1.2) |

Russian Federation, Republic of Karelia, Arkhangelsk Oblast, Murmansk Oblast, Irkutsk Oblast, Sakha Republic, Khabarovsk Krai, Magadan Oblast, Chukotka Autonomous Okrug |

Russian Federation, Republic of Karelia, Arkhangelsk Oblast, Krasnoyarsk Krai, Irkutsk Oblast, Sakha Republic, Khabarovsk Krai, Magadan Oblast, Chukotka Autonomous Okrug |

Russian Federation, Republic of Karelia, Arkhangelsk Oblast, Krasnoyarsk Krai, Irkutsk Oblast, Khabarovsk Krai, Magadan Oblast, Chukotka Autonomous Okrug |

Russian Federation, Republic of Karelia, Arkhangelsk Oblast, Krasnoyarsk Krai, Irkutsk Oblast, Sakha Republic, Khabarovsk Krai, Magadan Oblast, Chukotka Autonomous Okrug |

Russian Federation, Arkhangelsk Oblast, Krasnoyarsk Krai, Irkutsk Oblast, Sakha Republic, Khabarovsk Krai, Magadan Oblast, Chukotka Autonomous Okrug |

|

Group 4 — low level of use of budget potential |

|||||

|

Low (< 0.9) |

Tyva Republic, Kamchatka Krai |

Tyva Republic, Kamchatka Krai |

Tyva Republic, Kamchatka Krai |

Tyva Republic, Kamchatka Krai |

Republic of Karelia, Tyva Republic, Kamchatka Krai |

Table 3 shows that the regions of the Far North (FN) differ significantly in terms of the level of CII. Within the boundaries of the first and second groups with a high and moderate level of CII, there are highly developed producing FN regions. The third and fourth groups include most of the regions that differ significantly in terms of economic development, and the level of use of the budg- etary potential did not exceed the average for Russia. In general, there is a relative stability of the regions in terms of the level of the budgetary potential use.

Figure 1 demonstrates the dynamics of CII and gives a ranking of the FN regions for 2019 (the year not affected by the pandemic). The Nenets Autonomous Okrug was the leader in terms of the use of budgetary potential in 2016 and 2019, the Sakhalin Region — in 2020. The region with the lowest CII throughout the analyzed period was the Republic of Tyva.

Nenets Autonomous

Okrug

The Republic of

Sakhalin Oblast

Yamalo-Nenets Okrug

The Republic of Karelia

Khabarovsk Krai

Murmansk Oblast

The Republic of Komi

Krasnoyarsk Krai

Khanty-Mansi

Autonomous Okrug

Irkutsk Oblast

Russian Federation

Republic of Sakha

Magadan Oblast

Arkhangelsk Oblast

The

Kamchatka Kray

Chukotka Autonomous

2016 2017 2018 —2019 2020

Fig. 1. Dynamics of the cumulative integral index characterizing the level of use of the budgetary potential in the regions of the Far North (CII) 3.

In order to identify the causes and problem areas in the management of budgetary potential, we detail the analysis by examining the impact of its individual components on the result (CII). For this purpose, integral indices were calculated using the geometric mean formula based on the coefficients included separately in the first (Table 1) and second (Table 2) groups.

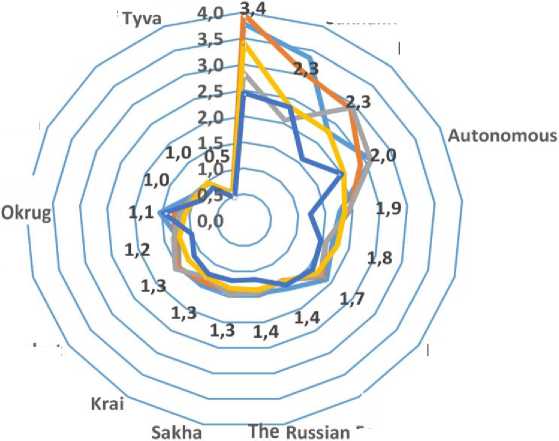

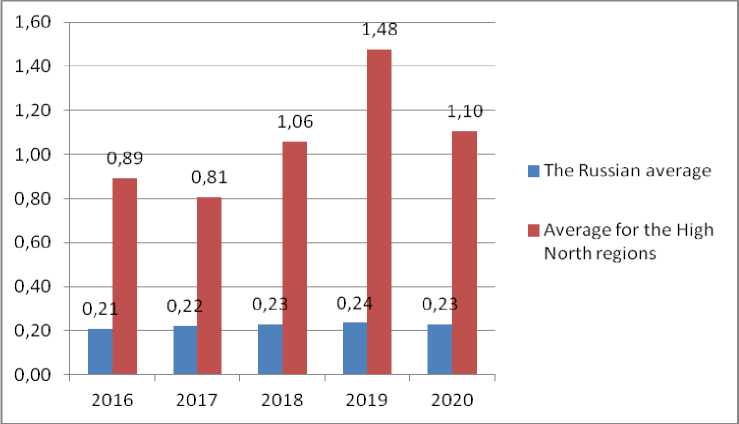

The integral indices, assessing the financial security of the regions (IFS) and calculated on the basis of the coefficients of the first group (Fig. 1), demonstrate a generally higher level compared to the integral indicators characterizing the quality of budget process management (IQM), calculated on the basis of the coefficients of the second group (Fig. 2).

Yamalo-Nenets

Okrug

Sakhalin Oblast

Nenets Autonomous Okrug

Khanty-Mansi Okrug

Autonomous

The Republic

Autonomous

Arkhangelsk Oblast

The Republic of Karelia

Kamchatka Kray

The Republic of Kom

Krasnoyarsk Krai

Murmansk Oblast

Khabarovsk

The Republic of

Magadan Oblast Federation

Irkutsk Oblast

^—2016 ^—2017 ^—2018 ^—2019 ^—2020

Fig. 2. Dynamics of the integral index assessing the level of financial security of the regions of the Far North (IFS).

Fig. 3. Dynamics of the integral index assessing the level of management quality in the regions of the Far North (IQM).

It is noteworthy that for the period from 2016 to 2019, there is a decrease in the average values of the IFS and IQM in the studied groups, a trend that has continued in 2020.

Assessment of the impact of indicators characterizing financial security of the regions on the level of use of the budget potential

In order to assess the impact of the IFS on the CII, let us compile a matrix that compares the levels of the CII and the IFS for 2016 and 2019 (Tables 4, 5).

Table 4

Distribution of the FN regions by the level of use of the budgetary potential and the level of financial support of the territories in 2016

|

Aggregate integral indicator assessing the level of use of budgetary potential (CII) |

||||||

|

ф O 4—> Ф 4—> О 5 С го с о ф ф ф ею с ф го о го ею ф с |

High (>1.8) |

Above average (from 1.5 to 1.8) |

Average (from 1.2 to 1.5) |

Below average (from 0.9 to 1.2) |

Low (< 0.9) |

|

|

High (> 2.1) |

Nenets Autonomous Okrug, Yamalo- Nenets Autonomous Okrug, Sakhalin Oblast |

Khanty-Mansi Autonomous Okrug |

- |

- |

- |

|

|

Above average (from 1.7 to 2.1) |

- |

- |

Republic of Komi |

Murmansk Oblast |

- |

|

|

Average (from 1.3 to 1.7) |

- |

- |

Krasnoyarsk Krai |

Russian Federation, Sakha Republic, Magadan Oblast, Irkutsk Oblast, Khabarovsk Krai, Chukotka Autonomous Okrug |

- |

|

|

Below average (from 0.9 to 1.3) |

- |

- |

- |

Republic of Karelia, Arkhangelsk Oblast |

Kamchatka Krai |

|

|

Low (< 0,9) |

- |

- |

- |

- |

Tyva Republic |

|

Table 5

Distribution of the FN regions by the level of use of the budgetary potential and financial support in 2019

|

Aggregate integral indicator assessing the level of use of budgetary potential (CII) |

||||||

|

"о _ ф ш ф ^ ф ф о ею ф £ ГО 4-» сю £ |

High (>0.8) |

Above average (from 1.5 to 1.8) |

Average (from 1.2 to 1.5) |

Below average (from 0.9 to 1.2) |

Low (< 0.9) |

|

|

High (> 2.1) |

Nenets Autonomous Okrug, Yamalo-Nenets Autonomous Okrug, Sakhalin Oblast |

- |

- |

- |

- |

|

|

Above average (from 1.7 |

- |

Republic of Komi, Khanty-Mansi |

- |

Krasnoyarsk Krai |

- |

|

|

to 2.1) |

Autonomous Okrug |

|||||

|

Average (from 1.3 to 1.7) |

- |

Murmansk Oblast |

- |

Russian Federation, Sakha Republic, Magadan Oblast |

- |

|

|

Below average (from 0.9 to 1.3) |

- |

- |

- |

Republic of Karelia, Arkhangelsk Oblast, Irkutsk Oblast, Khabarovsk Krai, Chukotka Autonomous Okrug |

Kamchatka Krai |

|

|

Low (< 0,9) |

- |

- |

- |

- |

Tyva Republic |

It is possible to distinguish groups of regions by the level of financial security: high level — the Sakhalin Oblast, the Nenets and Yamalo-Nenets Autonomous okrugs; moderate level (includes average and above average) — Khanty-Mansi Autonomous Okrug, Murmansk and Magadan oblasts, Komi and Sakha republics, Krasnoyarsk Krai; low level (below average) — the Republic of Karelia, Arkhangelsk and Irkutsk oblasts, Khabarovsk and Kamchatka krais, Chukotka Autonomous Okrug; the lowest level is the Tyva Republic. In the last two groups of FN regions, the integral indicator (IFS) did not exceed the national average. The Sakhalin Oblast, the Nenets and Yamalo-Nenets Autonomous okrugs demonstrate complete impeccability in maintaining a high level of financial security in 2016 and 2019. The situation of the Khanty-Mansi and Chukotka Autonomous okrugs, Murmansk and Irkutsk oblasts, Khabarovsk Krai worsened. Only the Krasnoyarsk Krai moved to a higher level of financial security.

Integral indicators assessing the financial security of the territories decreased in all regions over the analyzed period, which affected the value of the total CII. Of all the four coefficients involved in the calculation of integral indicators, the financial independence coefficient had the greatest impact on their decrease, which on average in the regions decreased by almost 2 times in 2019 compared to 2016, and by 3 times in 2020 (with the exception of the Kamchatka Krai).

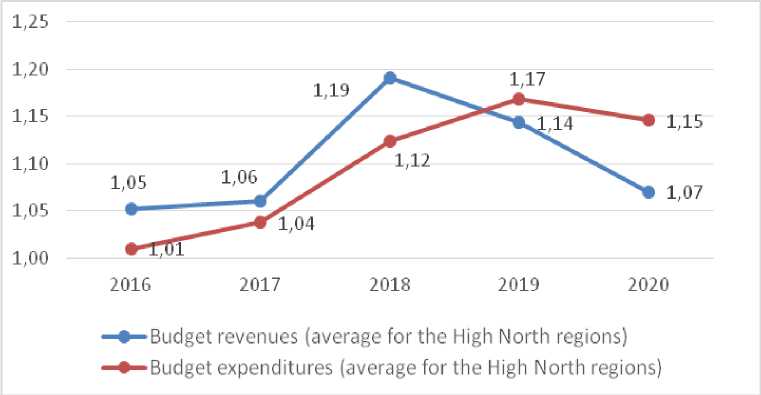

The reason for the decrease in the coefficient was the reduction in the growth rate of own income compared to the growth rate of non-repayable receipts (Table 6). In 2019, the growth rate of own revenues, calculated in prices of 2016, is lower than the level of the previous year in the Nenets and Khanty-Mansi Autonomous okrugs and the Republic of Sakha, and in all regions in 2020, with the exception of the Khabarovsk Krai. The decrease in the coefficient indicates an increase in the financial dependence of the majority of regional budgets on financial assistance from a higher level.

Table 6

Dynamics of growth rates of key budget indicators 4

|

2016 |

2017 |

2018 |

2019 |

2020 |

|

|

Own income (average for FN regions) |

1.05 |

1.05 |

1.15 |

1.10 |

1.00 |

|

Non-repayable receipts (average for FN regions) |

1.06 |

1.09 |

1.71 |

1.32 |

1.46 |

4 Calculated and compiled by the author based on data from the Federal State Statistics Service of Russia.

There is also a downward trend in the regional average income concentration coefficient, which is associated with a reduction in the share of own income in the total budget revenues of the region and an increase in transfers. In 2019, own income increased by 1.39 times compared to 2016, and non-repayable receipts included in income increased by 2.2 times. In 2020, the growth of own income compared to the level of 2016 amounted to only 1.37 times, while the growth rate of transfers increased by 3 times. The reduction in the coefficient in 2019 is noted in all FN regions, with the exception of the Republic of Komi and the Kamchatka Krai. In 2020, negative dynamics was observed in all 16 northern regions.

The coefficient of expenditure coverage by incomes also slightly decreased in the regions of the North. Its maximum growth was noted in 2018, and it declined in 2019 and 2020 due to the excess of expenditure growth over income (Fig. 4). As a result, the balance of budgets was disturbed, which led to an increase in the budget deficit in a larger number of northern regions.

Fig. 4. Growth (decline) rates of budget revenues and expenditures 5.

In 2019, budget expenditures exceeded its revenues in the Irkutsk and Magadan oblasts, the Khabarovsk and Kamchatka krais, the Tyva and Sakha republics. In 2020, 11 northern subjects were in a similar position.

The coefficient of average per capita income, which characterizes the level of income security of the population relative to the average Russian indicator, decreased over the analyzed period in the republics of Sakha, Komi and Tyva, the Khanty-Mansi Autonomous Okrug, and the Sakhalin Oblast. The coefficients of the Republic of Tyva, Khabarovsk Krai, Khanty-Mansi Autonomous Okrug, Arkhangelsk and Irkutsk oblasts are below the national average.

Assessment of the impact of indicators of the budget process management quality on the level of use of budget potential

In order to quantitatively assess the quality of budgetary process management, integral indicators (IQM) were calculated using the coefficients of the second group for the period 2016–2020.

-

5 Calculated and compiled by the author based on data from the Federal State Statistics Service of Russia.

Based on the results of the calculations, matrices were compiled to assess the change in the IQM and its impact on the total integral indicator (CII) (Tables 7, 8).

Table 7

Distribution of the FN regions by the level of use of the budgetary potential (CII) and the level of management quality (IQM) in 2016

|

Aggregate integral indicator assessing the level of use of budgetary potential (CII) |

||||||

|

2 О С ф Е ф ею го с го Е го с ф го ф ■О о ■W ГО Ф ею с ф го о го ею ф с |

High (>0.8) |

Above average (from 1.5 to 1.8) |

Average (from 1.2 to 1.5) |

Below average (from 0.9 to 1.2) |

Low (< 0.9) |

|

|

High (> 1.6) |

Nenets Autonomous Okrug |

- |

- |

- |

- |

|

|

Above average (from 1.3 to 1.6) |

Sakhalin Oblast |

- |

- |

- |

- |

|

|

Average (from 1 to 1.3) |

Yamalo-Nenets Autonomous Okrug |

- |

- |

- |

- |

|

|

Below average (from 0.7 to 1) |

- |

Khanty-Mansi Autonomous Okrug |

Republic of Komi |

Khabarovsk Krai |

- |

|

|

Low (< 0,7) |

- |

- |

Krasnoyarsk Krai |

Russian Federation, Murmansk Oblast, Republic of Karelia, Arkhangelsk Oblast, Irkutsk Oblast, Sakha Republic, Magadan Oblast, Chukotka Autonomous Okrug |

Tyva Republic, Kamchatka Krai |

|

Table 8

Distribution of the FN regions by the level of use of the budgetary potential (CII) and the level of management quality (IQM) in 2019

|

Aggregate integral indicator assessing the level of use of budgetary potential (CII) |

||||||

|

6 го ф ■О О Ж ГО 4-. Ф ф Е £ Ф ^ СЮ сю го с с го Я ^ Й ГО ГО 4-> о и "с го сю ф с |

High (>0.8) |

Above average (from 1.5 to 1.8) |

Average (from 1.2 to 1.5) |

Below average (from 0.9 to 1.2) |

Low (< 0.9) |

|

|

High (> 1.6) |

Nenets Autonomous Okrug |

- |

- |

- |

- |

|

|

Above average (from 1.3 to 1.6) |

- |

- |

- |

- |

||

|

Average (from 1 to 1.3) |

Sakhalin Oblast |

Murmansk Oblast |

- |

- |

||

|

Below average (from 0.7 to 1) |

Yamalo-Nenets Autonomous Okrug |

Republic of Komi, Khanty-Mansi Autonomous Okrug |

- |

|||

|

Low (< 0,7) |

- |

- |

- |

Russian Federation, Republic of |

Tyva Republic, Kam- |

|

|

Karelia, Arkhangelsk Oblast, Irkutsk Oblast, Sakha Republic, Magadan Oblast, Chukotka Autonomous Okrug, Krasnoyarsk Krai, Khabarovsk Krai |

chatka Krai |

On the basis of the existing matrix, we single out four groups of FN regions by the level of management quality: high level (Nenets Autonomous Okrug); moderate level (Sakhalin and Murmansk oblasts); lower level (Yamalo-Nenets and Khanty-Mansi Autonomous okrugs, Komi Republic); low level (below the Russian average) — this is the most numerous group of FN regions.

It should be noted that management problems in the northern regions are no less acute than financial ones. Despite the fact that the Sakhalin Oblast and the Yamalo-Nenets Autonomous Okrug show a high level of CII, which is ensured by a stable financial base throughout the analyzed period, they have problems in terms of the quality of budgetary process management. The Murmansk Oblast has improved its position in the ranking, moving from a low level of IQM to an average one by 2019. Khabarovsk Krai, on the contrary, moved down to a lower position.

Let us assess the influence of the coefficients involved in the calculation of the IQM on the integral indicator of management quality (IQM) and on the total integral indicator (CII).

The tax collection rate, estimated on the basis of potential revenues, taking into account arrears, deferred, suspended for collection and other types of debts, calculated for the FN regions, determines the effectiveness of tax administration measures and demonstrates a higher efficiency of the work of control authorities in most of the northern territories than the Russian average. It had a positive impact on the total score of the CII. In 2019, compared to 2016, there was an increase in the coefficient in 15 FN regions (with the exception of the Nenets Autonomous Okrug), which was ensured by a reduction in tax arrears in certain regions and an increase in tax revenues, in 2020 — in 11 regions. In 2019, compared to 2016, debt growth is recorded in the republics of Komi and Tyva, Khabarovsk Krai, Nenets, Khanty-Mansi and Yamalo-Nenets Autonomous okrugs, Irkutsk and Sakhalin oblasts, in 2020, it remained the same in the last five regions.

The tax effort coefficient for income tax shows the manifestation of the activity of regional authorities to attract (preserve) large economic entities as taxpayers, which are the main payers of income tax for the northern regions. There is a positive dynamics of the indicator in the northern regions for 2016–2019 (Fig. 5). At the same time, in the most productive year of 2019, individual indicators decreased in the Khanty-Mansi and Yamalo-Nenets Autonomous okrugs, the Krasnoyarsk Krai, the Magadan and Sakhalin oblasts, continuing the trend in 2020 (except for Sakhalin Oblast). At the same time, in 2020, the average value of the coefficient for the northern regions increased compared to 2016, and its value was 4.8 times higher than the average Russian indicator. The coefficient of tax effort demonstrates the highest level of fluctuation among the analyzed indicators, as evidenced by the coefficient of variation, the value of which exceeded 200%. The Nenets Autono- mous Okrug, the Sakhalin and Murmansk oblasts, and the Komi Republic retain the leadership among the FN regions in this indicator.

Fig. 5. Dynamics of the coefficient of tax efforts on income tax 6.

The expenditure priority ratio shows that the budgets of the FN regions are mainly socially oriented. At the same time, the Chukotka Autonomous Okrug has the lowest level of social spending, which amounted to 34% of all spending in 2016, 23.2% in 2019, and 32% in 2020. The coefficient below the average Russian level is shown in 2019 in the Nenets, Yamalo-Nenets and Chukotka Autonomous okrugs, the Republic of Sakha, Kamchatka Krai, Magadan and Sakhalin oblasts; in 2020, the situation worsened in Khabarovsk Krai. The average indicator for the FN regions, correlated with the average Russian level, showed negative dynamics in 2019 and 2020 and did not reach the Russian average, which was reflected in the decrease in the cost priority ratio and on the IQM, as well as on the total integrated indicator of the CII.

Investment activity in the FN regions and in the country as a whole, increased by 2018, was declining, which negatively affected the CII. The investment activity ratio in 2019 decreased in half of the FN regions (Nenets Autonomous Okrug, the republics of Komi and Karelia, Sakhalin, Magadan and Arkhangelsk oblasts, Krasnoyarsk Krai). At the same time, the level of investment activity in the Yamalo-Nenets, Nenets and Khanty-Mansi Autonomous okrugs and the Murmansk Oblast exceeded the national average throughout the whole period under analysis.

Conclusion

At this stage of the study, various approaches to assessing the budgetary potential and the indicators used in them are considered. It is determined that the available indicators do not allow to fully assess the level of budgetary potential in terms of its use. A methodical approach to evaluating the level of use of the budgetary potential is proposed, based on the developed system of indicators that assess the financial security of the territories and the quality of the management of the budgetary process, as a result of the adoption of managerial decisions by regional authorities. The use of a methodological approach in the study made it possible to quantify the level of use of the budgetary potential in the FN regions, to perform their ranking (the leader in terms of the level of use of the budgetary potential in 2016 and 2019 was the Nenets Autonomous Okrug, in 2020 — the Sakhalin Oblast. The Republic of Tyva remains the laggard in the ranking), to implement a typology of the northern subjects of the Russian Federation, highlighting regions with a high, moderate, reduced, low level of use of budgetary potential. High and moderate levels of use of the budget potential were noted in the highly developed extractive regions. In most of the regions that differ significantly in terms of economic development, the level of use of the budgetary potential is below the average for the Russian Federation. In dynamics, there is a relative stability of the position of the regions in terms of the level of use of the budgetary potential. Based on the formation of matrices that compare integral indices that assess the financial security of the territory and the quality of budgetary process management with the aggregate index of the use of budgetary potential, and the analysis of the coefficients included in the calculation of the indices, it was revealed that the value of the aggregate integral index characterizing the level of use of budgetary potential in the FN regions is decreasing in dynamics, which is largely due to the reduction of the ratios, assessing financial security of territories. The quality of budget process management remains at a low level in both economically developed and underdeveloped FN regions.

The analysis revealed the main problems of the process under study. Thus, regions with a high index of the use of budget potential are distinguished by a significant level of financial resources. With a relatively high quality of management in general, some regions of this group have problems in terms of weakening the tax efforts of regional authorities to ensure the collection of income tax, the payers of which are large export-oriented business structures; reducing the level of tax collection due to the growth of debt to the budget; slowdown in investment activity in the FN regions. Regions, the level of use of the budgetary potential of which is defined as moderate, are experiencing problems in terms of the quality of management: a decrease in activity in collecting income tax due to a reduction in the tax base; growth in tax arrears; decrease in the level of investment activity; limiting budget spending for social purposes. Northern subjects with a reduced and low level of use of the budgetary potential (did not exceed the average Russian indicator) are characterized by significant financial problems: low level of financial security due to limited opportunities to increase their own income; dependence on revenue sources coming from the federal budget; a decrease in the level of budgetary security. The financial problems are overlaid with managerial ones: low level of tax efforts made by the authorities in terms of collecting income tax and expanding the tax base; low effectiveness of measures to reduce tax arrears; reduction of expenditures on social obligations to the population; low investment activity.

In order to solve the identified problems, which determine the directions of further research, it is necessary to develop measures and mechanisms related to the strengthening of financial independence of regions, expanding the tax base, increasing the efficiency of tax administration, strengthening the role of “functional interaction between financial and tax authorities in the budget process” [14, Borovikova E.V., p. 28], etc. Particular attention should be paid to the intensification of investment activity in the northern regions — the driving force behind the economic development of the territories, the source of tax revenues and improvement of living standards of citizens through the development of incentive instruments within the framework of state investment policy.

The practical significance of the study is due to the possibility of applying the proposed approach by the territorial authorities to solve the problems of improving the efficiency of managing the budgetary potential in the regions.

Список литературы Approaches to Assessing and Monitoring of the Budget Potential Use in the Far North

- Murzina E.A. Modeling a Regions Tax Potential Allowing for the Uniformity Ratio. Academy of Strategic Management, 2019, vol. 18, iss. 5, pp. 1 5.

- Golodova Zh.G. Formirovanie i otsenka byudzhetno nalogovogo potentsiala sub"ekta RF (na primere sub"ektov Ural'skogo federal'nogo okruga) [Formation and Assessment of the Budgetary and Tax Po-tential of a Subject of the Russian Federation (on the Example of the Subjects of the Ural Federal Dis-trict)]. Finansovyy vestnik: finansy, nalogi, strakhovanie, bukhgalterskiy uchet [Financial Bulletin: Fi-nance, Taxes, Insurance, Accounting], 2010, no. 5, pp. 33 41.

- Naidyonova T.A., Shvetsova I.N. Otsenka byudzhetnogo potentsiala severnykh territoriy [Assessment of budgetary capacity of northern territories]. Finansy i kredit [Finance and Credit], 2013, no. 40 (568), pp. 40 51.

- Yashin S.N., Yashina N.I. Nekotorye aspekty analiza byudzhetnogo potentsiala munitsipal'nykh obra-zovaniy [Some Aspects of the Analysis of the Budgetary Potential of Municipalities]. Finansy i kredit [Finance and Credit], 2003, no. 5 (119), pp. 35 44.

- Kuklin A.A., Naslunga K.S. Metodicheskie osobennosti otsenki sostoyaniya regional'nykh byudzhetov [Methodological Features of the Assessment of the Regional Budget’s Situation]. Ekonomika regiona [Economy of Regions], 2018, vol. 14, iss. 2, pp. 395 407. DOI: 10.17059/2018 2 5

- Gladkovskaya E.N. Instrumentariy otsenki byudzhetnogo potentsiala i vyyavlenie rezervov ekonomicheskogo rosta regionov Rossii [Methodology for Estimating the Budgetary Potential and Identifying the Reserves for the Economic Growth of the Regions of Russia]. Fundamental'nye issledovaniya [Fundamental Research], 2018, no. 10, pp. 31 36.

- Igonina L.L., Yaroshenko D.V., Vikharev V.V., Shurygin S.V. Budget Potential of the Region: Attributive Features and Methods of Assessment. International Journal of Economics and Business Administra-tion, 2019, vol. 7, special iss. 1, pp. 355 361. DOI: 10.35808/ijeba/279

- Suleymanov M.M. Ob otsenke effektivnosti fiskal'noy politiki regiona [On Assessing the Effectiveness of the Region's Fiscal Policy]. Finansy [Finance], 2014, no. 11, pp. 46 50.

- Tkatcheva T.Yu. Vozmozhnosti ispol'zovaniya statisticheskikh instrumentov pri raschete byudzhetnogo potentsiala regiona [Use of Statistical Tools in Calculating the Fiscal Capacity of the Region]. Izvestiya Yugo Zapadnogo gosudarstvennogo universiteta [Proceedings of the Soutwest State University], 2013, no. 2 (47), pp. 10 17.

- Zenchenko S.V. Byudzhetnyy potentsial regiona i metodicheskie podkhody k ego otsenke [Budgetary Potential of Region and Methodical Approaches to Its Estimation]. Regional'nye problemy preobra-zovaniya ekonomiki [Regional Problems of Transformation of the Economy], 2008, no. 1 (14), pp. 186 198.

- Zinchenko N.V. Menedzhment kachestva upravleniya finansovymi resursami regiona [Management of the Dispensation Quality the Region’s Financial Resources]. Uchenye zapiski Krymskogo inzhenerno pedagogicheskogo universiteta [Scientific Notes of the Crimean Engineering and Pedagogical Universi-ty], 2016, no. 1 (51), pp. 26 30.

- Barasheva T. Budget as a Tool for Managing Socio Economic Development of the Arctic Territories. IOP Conference Series: Earth and Environmental Science, 2020, iss. 539, p. 012081. DOI: 10.1088/17551315/539/1/012081

- Golodova Zh.G. Otsenka byudzhetno-nalogovogo potentsiala regiona v usloviyakh reformirovaniya sistemy mezhbyudzhetnykh otnosheniy [Estimation of the Budged & Tax Potential of a Region Under the Conditions of Inter-Budget Relations System Reformation]. Finansy i kredit [Finance and Credit], 2009, no. 5 (341), pp. 33–41.

- Borovikova E.V. Finansovyy potentsial kak kompleksnyy pokazatel' effektivnosti finansovo byudzhetnoy politiki [Financial Potential as a Comprehensive Indicator of the Effectiveness of Fiscal Policy]. Ekonomicheskiy analiz: teoriya i praktika [Economic Analysis: Theory and Practice], 2008, no. 18 (123), pp. 25 28.