Assessing the efficiency of tax incentives in the system for managing regional finances

Автор: Igonina Lyudmila Lazarevna, Mamonova Irina Vladimirovna, Suleimanov Magomed Magomedovich

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Public finance

Статья в выпуске: 6 (48) т.9, 2016 года.

Бесплатный доступ

The paper analyzes existing techniques for assessing the effectiveness of tax incentives in the system for managing regional finances and reveals their advantages and disadvantages. It points out major conditions that determine the effectiveness of tax incentives at the regional level. The authors prove that assessing the effectiveness of tax incentives should focus, first, on identifying the relationship between the amounts of falling-out incomes and real economic benefits to the state and taxpayers that they entail; second, on determining the degree of correlation for this relationship; third, on adopting the decisions proceeding from the analysis of decisions concerning the extension of the incentive and its adjustment or possible abolition. The paper substantiates the conclusion that the effectiveness of tax incentives should be evaluated on the basis of three criteria: fiscal, economic and social. At that, the effectiveness of tax incentives at the regional level should be analyzed in several stages: calculation of budgetary, economic and social efficiency ratios; definition of the integral coefficient reflecting the total assessment of tax incentives efficiency; adoption of the decision about the appropriateness of introducing or further using the incentive, the decision being based on the calculations carried out previously...

Tax incentives, efficiency assessment, criteria, regional finance, integral index, falling-out incomes, tax administration, deflator index, algorithm budget revenues

Короткий адрес: https://sciup.org/147223886

IDR: 147223886 | УДК: 336.1 | DOI: 10.15838/esc.2016.6.48.10

Текст научной статьи Assessing the efficiency of tax incentives in the system for managing regional finances

The objectives of restoring sustainable growth of the Russian economy in the conditions of significant budget constraints initiated by the crisis processes determine the special importance of increasing budget revenues and optimizing budget expenses [4, p. 118]; this brings to the fore the issues of assessing the effectiveness of tax incentives. The latter are the tool which, if used optimally, can be a powerful driver of economic growth. However, their use in the short term can lead to substantial reduction in budget revenues. So, the decrease in the revenues of consolidated budgets of constituent entities of the Russian Federation, as a result of application of tax incentives, exceeded 400 billion rubles in 2014, including income tax incentives – 152.2 billion rubles1.

Thus, the application of tax incentives should be treated with caution and care. The optimal solutions in this respect involve providing the most effective tax benefits with simultaneous quality analysis of economic feasibility of existing benefits and improvements of tax administration, which in the initial period of their application could compensate for falling out budget revenues [1, p. 112; 10, p.124].

Tax authorities in the field of legislation at the regional and local levels in Russian tax practice are as follows:

– establishing tax rates in the limits established by federal legislation;

– establishing the procedure and terms of tax payment;

– reflecting the specifics of determining the tax base in the cases determined by law;

– introducing tax incentives and the procedure for their application.

Federal benefits are set at the federal level and their list is not duplicated in the regional laws on taxes and also in the regulations of local governments introducing local taxes. Legislative authorities at the regional and local levels adopt their own benefits that can be used on their territory [2, p. 383; 14, p. 737-768].

The composition of tax benefits, their scope of application and terms of provision are not restricted by any normative acts; therefore, in order to use tax incentives optimally, it is necessary to develop economically feasible methods to assess their effectiveness.

The main conditions that determine the effectiveness of assessment of tax incentives efficiency are as follows:

– establishment of a list of public authorities that should have the power to assess the effectiveness of tax incentives at the regional level;

– the database on quantitative indicators relating to benefits must be accessible to these authorities;

– there should be a substantiated set of indicators that reflect the effectiveness of tax incentives and their regulatory value;

– a normative base regulating the procedure of the assessment, its frequency, and the algorithm of action according to the results of the evaluation must be established [17, p. 35].

When establishing the parameters for assessing the efficiency of tax privileges, we should bear in mind that the specifics of the benefits as part of the tax consist in its ambiguity depending on the purposes for which it is used [12, p. 75; 15, p. 320].

For instance, social benefits that are used in the tax practice are, in their essence, the irreplaceable losses for the budget because they are focused on the achievement of social objectives. The possibility of their granting, their total value, and the number of taxpayers for which they are intended are determined to a greater extent by the amount of financial resources that the government can “donate” in a particular case. These include, for example, standard, social, property deductions for individual income tax, the benefits for socially vulnerable categories of persons on land tax, transportation tax, and tax on the property of physical persons [18, p. 2].

Tax incentives differ from those mentioned above. The purpose of their introduction is to help economic entities focus on the development of activities in a direction that at this particular point in time is the highest priority for the state [11, p. 596-617; 17, p. 35]. Tax incentives unlike social benefits have, as a rule, the investment or innovative nature, they have a time lag and suggest a very real and tangible return in the form of further broadening the tax base, replenishment of budgets of all levels on this basis, the increase in the number of jobs, amount of extracted minerals, and the energy efficiency of production [13, p. 320-340]. The presence of such incentives enables to a greater extent to reconcile the interests of the state and taxpayers, which in turn is one of the factors that allow the fundamental principles of taxation to be implemented.

Mechanisms of incentives can be very diverse, they include the application of reduced rates and reducing the object of taxation, the withdrawal of part of the tax base from taxation, and the use of raising factors [9, p. 18]. Example can be the incentives for organizations that implement investment projects, or for credit institutions granting loans for investment purposes [8, p. 85; 16, p. 1500]. The introduction and use of incentives is aimed at economic growth, development and modernization of production, improvement of industrial structure of national economy and creation of necessary infrastructure objects [3, p. 57; 19, p. 13]. Analytical calculations to determine the effectiveness of existing tax incentives are not conducted in all constituent entities of the Russian Federation, but even in the territories where such transactions are carried out, they are not systematic and uniform due to the lack of a uniform calculation methodology. And despite the overall and quite impressive number of benefits in Russia, the growth of investment activity remains unsatisfactory [5, p. 242; 6, p. 270; 7, p. 34; 20, p. 21].

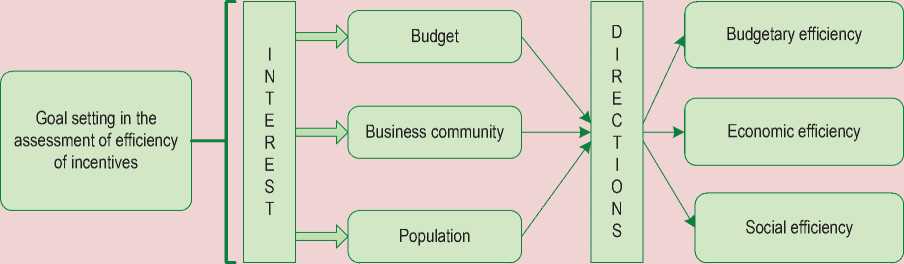

Evaluation of the effectiveness of tax incentives should aim, first, to identify the relationship between the amounts of falling out income and those real economic benefits to the state and taxpayers that they entail, and second, to determine the degree of correlation of this relationship, thirdly, to adopt the decisions concerning the extension of the benefit, its adjustment or possible abolition, the decisions should be based on the analysis conducted. In general we can say that evaluating the effectiveness of tax incentives is usually performed according to three criteria:

fiscal, economic and social; the objects of evaluation are budgetary, economic and social implications of providing tax incentives. This approach allows us to take into account the interests of both the state and taxpayers. The content of the criteria and parameters of assessing their effectiveness are shown in Fig. 1 .

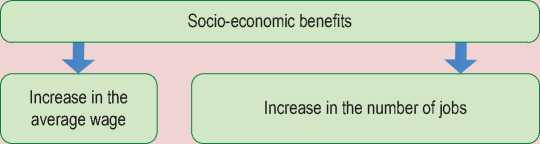

In the context of existing financial constraints, it is most important to evaluate the effectiveness of tax incentives according to all criteria, since the methodology for assessing tax incentives should consider not only the fiscal interests of regional budget, but also the interests of business entities and individuals. The target vector of assessment of tax incentives is presented in Fig. 2 .

Figure 1. Criteria of efficiency of tax privileges and parameters of their assessment

Budgetary efficiency

Impact of the incentive on the formation of the revenue part of the budget

Efficiency of the incentive

Economic efficiency

Increase in the fixed capital investment

Increase in profitability

Social efficiency

Increase in the volumes of production (profit)

Figure 2. Target space of the assessment of tax incentives at the regional level

The effectiveness of tax incentives at the regional level should be assessed in several stages:

-

1) calculation of the coefficients of the budgetary, economic and social efficiency;

-

2) determination of the integral coefficient reflecting the overall evaluation of tax benefits;

-

3) adoption of decisions about the appropriateness of the introduction or further use of the incentives on the basis of calculations.

Assessment of budgetary efficiency of tax incentives involves the correlation of the increase in budget revenues and the shortfall in income. The problem is that the impact of the introduction of incentives will not be seen immediately, which requires tracking of budgetary effectiveness of a particular tax incentive in the dynamics for several tax periods. Therefore, when calculating the indicator, it is necessary to adjust its value for inflation to ensure the compatibility of the data.

As the criterion of fiscal efficiency it is proposed to use the ratio of budget efficiency, which reflects the ratio of changes from the proceeds of this particular tax in the analyzed period compared to the previous year, adjusted by the deflator of GRP (gross regional product) to the shortfall in budget revenues in the analyzed year:

^ bef =

H t - Ны x 100 ™t

where Нt – proceeds of this tax in the year under consideration;

Нt-1 – proceeds of this tax in the previous year;

It – deflator of gross regional product for the region in the year under consideration;

FRt – falling out budget revenues due to the provision of the incentive in the year under consideration.

When making the analysis, not only the ratio calculated is important, but also its dynamics that during the period of provision of the incentive needs to be improved, reflecting a growth of the effectiveness of its introduction, this fact should be taken into account when forming the scoring on the budgetary efficiency index. The lack of positive dynamics will indicate that the incentive is inefficient.

The budgetary efficiency index assumes the value of 0; 0.5 or 1 depending on the following parameters:

-

– if Ibef > 1 and has a positive dynamics, then the index is assigned one point (0.5 points for each index);

-

– if Ibef > 1 but has a negative dynamics, then the index is assigned 0.5 points;

-

– if Ibef< 1, but has a positive dynamics, then the index is assigned 0.5 points;

– if Ibef< 1 and has a negative dynamics, then the index is assigned 0 points.

It is proposed to use as a criterion of economic efficiency the rate of growth of basic economic indicators of financial and economic activities such as the volume of production (revenue), investment in fixed capital, profitability of sales of that very category of taxpayers that is granted the incentive, in comparison with other payers of this tax. Depending on the exact tax by which the economic efficiency of the incentive is calculated, the composition of the indices can vary. For example, for tax on the property of organizations it is rational to take into account investment in fixed capital, for income tax – gross profit.

After calculating the growth rates of selected indicators, it is necessary to assign each of them a value from 0 to 1 according to the following rule:

– if the growth rate of the indicator calculated for the preferential group of taxpayers exceeds the growth rate of this indicator for the remaining taxpayers, then the indicator receives the value of 1;

– if the growth rate of the indicator calculated for the preferential group of taxpayers is lower than the growth rate of this indicator for the remaining taxpayers, then the indicator receives the value of 0.

After that, it is proposed to calculate the total economic efficiency index based on the values assigned to the three indicators, by calculating the simple arithmetical mean (if all the variables are equally representative) or the weighted arithmetical mean (if the indicators can be classified according to the degree of representativeness).

The simple arithmetical mean:

, _ 2П=1Л Ieef п , where Ai – the assigned value of the analyzed indicator;

n – number of indicators.

The weighted arithmetical mean:

п

^eef =

\л X W i

i = l where Ai – the assigned value of the analyzed indicator;

n – number of indicators;

wi – weight of the analyzed index Ai.

It is proposed to assess the criterion of social efficiency of the incentive similarly to analyzing economic efficiency. In order to assess social efficiency it is necessary to compare the growth rates of indicators such as average wages and number of jobs at the enterprises that apply this incentive with the average regional indicators. The rate of wages must be indexed on the basis of the statutory minimum wage.

Further, the indicators must be assigned the values from 0 to 1 according to the scheme described above (used to assess economic efficiency), and then it is necessary to calculate the overall index of social efficiency using the simple or weighted arithmetical mean.

At the next stage of assessing the incentive, the integral index of efficiency is calculated taking into account the weight of each indicator.

In our opinion, the presence of three efficiency criteria (fiscal, economic, and social) implies the formation of an integral coefficient that would take into consideration the overall effect of the use of the incentive:

п lef = ^C X St , i=l where Ief – integral index of the efficiency of the regional incentive;

Ci – the value of the corresponding criterion of budgetary, economic or social efficiency;

Si – coefficient of importance of this criterion.

The level of correlation of each of the criteria in relation to an incentive is strongly differentiated, therefore, this fact should be considered when establishing the significance coefficient. The closest correlation will be observed with the budgetary efficiency index, since the presence of the incentive definitely affects the budget; moreover, in virtue of the information that public authorities possess, the taxpayers receiving benefits almost always state the value of falling out

Table 1. Budgetary efficiency criteria used at the regional and local levels in Russia

As for economic efficiency index, the relationship is less pronounced here, because the change in revenues, profits, fixed capital investment and profitability may be affected by other factors, both external and internal, reflecting the specifics of the financial and economic activity of a business entity. The weakest degree of correlation will be observed in the criteria of social efficiency; therefore, the coefficient of significance of this criterion will be the lowest. The suggested weight values applied to the coefficients will be: 0.6 for budget efficiency, 0.3 – for economic efficiency and 0.1 – for social efficiency. The minimum control time period, after which a decision should be taken in relation to the incentive, is three years.

The decision-making algorithm will depend on the rating of the incentive.

It is possible to allocate three variants of actions of the authorities:

– extension of the validity of the incentive;

– adjustment of the incentive;

– cancellation of the incentive.

Due to the fact that after the calculation, in the presence of the maximum efficiency for all the three indicators, the integral coefficient of the incentive is equal to 1 point, then the recommended ranking can be constructed as follows:

1 ≤ I ≥ 0.7 – high rating, the incentive is subject to further application;

0.7 < I ≥ 0.4 – median rating, the incentive is subject to adjustment;

0.4 < I = 0 – low rating, the incentive is subject to cancellation.

Currently, many regions have their own methodologies for assessing the efficiency of tax incentives, each of them forms its own system of criteria. These methodologies differ in the set of indicators, their calculation, regulatory indicators, consideration of certain incentives, presence or absence of the integral indicator, etc.

Most regions and municipal entities form their own system of efficiency criteria on the basis of absolute and relative indicators.

Table 1 reflects some budgetary efficiency indices used in various regions and by local self-governments in Russia.

Some regions adopt not only generalized criteria, but also individual criteria for taxpayers engaged in innovation, investment activities, agriculture, environmental protection, education and healthcare. In some constituent entities of the Russian Federation there exist the differentiated criteria for budget, government and independent agencies, non-profit organizations, and state authorities. However, the analysis of existing methodologies for assessing the effectiveness of tax incentives shows that the unified methodological approaches to the calculation of efficiency, which would make it possible to adopt the decisions about the need to introduce or apply an incentive, do not exist; this fact determines the need for their establishment.

In this regard the advantages of the methodology described in the present paper are as follows:

– absence of absolute indicators that are ineffective and that do not reflect a comparison of costs with the effect from their implementation;

– when calculating the points, the degree of dynamic processes is taken into consideration, reflecting the presence or absence of the growing effect of the application of incentives;

– taking into account the correlation between the criteria and the indicators used for comparative purposes;

– availability of the information base for the calculation of indicators;

– use of the deflator index, the use of which reduces the calculations to the comparable view;

-

- availability of the integral index that helps take into account all the directions of efficiency of the analyzed incentive;

-

- universal character, which makes it possible to vary both the indicators themselves and their weights without changing the calculation algorithm.

The developed methodology gives an opportunity to evaluate the effectiveness of incentives at the regional level in the dynamics and taking into consideration the most significant criteria affecting the composition and structure of the budget, economic performance of taxpayers, and significant socio-economic indicators of the region. The presence of the outcome integral index allows the legislative and executive authorities to implement well-grounded decisions concerning existing incentives aimed to develop the investment and innovation vector at the sub-national level.

Список литературы Assessing the efficiency of tax incentives in the system for managing regional finances

- Berlin S.I., Mamonova I.V. Nalogovye preferentsii kak instrument fiskal'nogo regulirovaniya v usloviyakh nestabil'nosti ekonomiki . Sovremennaya ekonomicheskaya mysl' , 2016, no. 2, pp. 111-118..

- Igonina L.L. Metodologiya otsenki effektivnosti realizatsii nalogovogo potentsiala regiona . Regional'naya ekonomika. Yug Rossii , 2012, no. 13, pp. 380-390..

- Igonina L.L. Otsenka effektivnosti byudzhetno-nalogovoi politiki: retrospektivnyi i tseleorientirovannyi podkhody . Natsional'nye interesy: prioritety i bezopasnost' , 2014, no. 28, pp. 2-10..

- Igonina L.L. Finansovoe razvitie i ekonomicheskii rost . Vestnik Finansovogo universiteta , 2016, no. 1 (91), pp. 111-120..

- Mamonova I.V. Otsenka kachestva sistemnogo podkhoda k formirovaniyu nalogovogo zakonodatel'stva RF . Nalogi i finansovoe parvo , 2012, no. 5, pp. 240-244..

- Mamonova I.V. Investitsionnaya sostavlyayushchaya nalogovoi politiki Rossiiskoi Federatsii . Nalogi i finansovoe parvo , 2008, no. 10, pp. 269-275..

- Panskov V.G. Nalogovye l'goty: tselesoobraznost' i effektivnost' . Finansy , 2012, no. 10, pp. 34-36..

- Soboleva G.V., Yakovleva V.S. Effektivnost' nalogovykh l'got v stimulirovanii innovatsionnoi deyatel'nosti . Ekonomika. Nalogi. Pravo , 2014, no. 3, no. 84-88..

- Tyutyuryukov N.N., Ternopol'skaya G.B., Tyutyuryukov V.N. Nalogovye l'goty i preferentsii: tsel' -odna, a mekhanizm -raznyi . Nalogovaya politika i praktika , 2009, no. 10, pp. 18-23..

- Maiburov I.A., Ivanov Yu.B. (Eds.). Fiskal'nyi federalizm. Problemy i perspektivy razvitiya: monografiya . Moscow: YuNITI-DANA, 2015. 415 p..

- Abbas S. M. A., Klemm A.A. Partial Race to the Bottom: Corporate Tax Developments in Emerging and Developing Economies. International Tax and Public Finance, 2013, vol. 20, pp. 596-617.

- Bird R.M., Zoland E.M. Tax Policy in Emerging Countries. Environment and Planning: Government and Policy, 2008, vol. 26, pp. 73-86.

- Girma S., Görg H., Pisu M. Exporting, Linkages and Productivity Spillovers from Foreign Direct Investment. Canadian Journal of Economics, 2008, vol. 41, pp. 320-340.

- House C., Shapiro M. Temporary Investment Tax Incentives: Theory with Evidence from Bonus Depreciation. American Economic Review, 2008, vol. 98, pp. 737-768.

- Klemm A. Causes, Benefits, аnd Risks of Business Tax Incentives. International Tax and Public Finance, 2010, vol. 17, pp. 315-336.

- Zee H., Stotsky J., Ley E. Tax Incentives for Business Investment: A Primer for Policy Makers in Developing Countries. World Development, 2002, vol. 30, pp. 1497-1516.

- Aliev B.Kh., Musaeva Kh.M., Suleymanov M.M. Methodological approaches towards assessing the efficacy of a region's budgetary-taxation policy. Asian Social Science, 2014, no. 10 (24), p. 35

- Aliev B.Kh, Igonina L.L., Musaeva Kh.M., Suleymanov M.M., Alimirzoeva M.G. Priority Guidelines for Strenthening Regional Taxable Capacity as a Factor of Sustainable Development of the Territorial Entities. Mediterranean Journal of Social Sciences, 2015, September, vol. 6, no. 5, p. 2.

- Musaeva Kh.M., Aliev B.Kh, Suleymanov M.M., Dyukina T.O. Tax relieves: costs of their application in taxation and issues of the efficiency evaluation. Asian Social Science, 2015, vol. 11, no. 7.

- Musaeva Kh.M., Suleymanov M.M., Isaeva Sh.M., Pinskaya M.R. Improvement of the efficiency of the instruments of tax regulation in the context of the development of fiscal federalism and strengthening of the taxable capacity of the subject of the Russian Federation. Ecology, Environment and Conservation Journal Papers. Issue: Vol. 21 Suppl. Issue August 2015.