Asymmetry problems of structural shifts in regional economy

Автор: Rumyantsev Nikita M., Leonidova Ekaterina G.

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Regional economy

Статья в выпуске: 6 т.13, 2020 года.

Бесплатный доступ

In the absence of a significant dynamics of economic growth rates in the Russian Federation and its regions and the exhaustion of the recovery increase potential, a negative impact of economic crises and existing export-raw production orientation manifest themselves especially clearly. As a result, a necessity to find new development drivers, which includes a great significance of the structural factor of the economic growth at the regional level in the context of achieving economic growth of the country, becomes relevant. In this regard, the purpose of the research is the analysis of structural shifts in regional economy at different phases of the economic dynamics. The novelty of the research is the definition of the contribution of structural shifts in the region's economic growth at different phases of the economic dynamics. The methodology is based on the calculation of structural shifts' indicators - magnitude, index, velocity, and power. We conducted the analysis of sectoral structural transformations of the regional economy on the basis of the Vologda Oblast's materials for 2005-2018. The research revealed a low diversification and efficiency of adding economy into global chains of value added. We calculated the impact of the structural factor on the growth of gross regional product depending on an increase or decline in the economy. The activation of the potential of agriculture, mechanical engineering, and electronic industry sectors is seen as very promising. We calculated the multipliers of the impact of the stimulation of the proposed sectors on the basis of the inter-sectoral balance model. We reviewed the structural-investment policy as an important instrument of changing national economic proportions. The idea of forming the benchmarking system, concerning the efficiency of conducted structural policy, was substantiated. A practical importance of the research is an opportunity to use its results by authorities for the formation of regional structural policy. We will continue the studies related to the determination of the dependence of regional economy's growth dynamics on structural dynamics in the investment process, organization of the factor analysis of the industry shifts and economic growth, and formation of the system of optimal indicators of the structural policy benchmarking.

Structural shift, economic growth, region, investments, regional economy, sectoral structure

Короткий адрес: https://sciup.org/147225502

IDR: 147225502 | УДК: 332.14 | DOI: 10.15838/esc.2020.6.72.10

Текст научной статьи Asymmetry problems of structural shifts in regional economy

In modern dynamically changing global geopolitical and geo-economic environment, a steady economic growth is a key purpose of the Russian Federation’s economic policy. However, due to a multi-level Russian economy, this issue must be solved not only at the federal and sub-federal levels. Regions must be the flagships of the state’s economic policy within the strengthening of the national economy.

Areas of the regions’ economic growth intensification include the development of interregional cooperation, active implementation of the import substitution policy, stimulation of entrepreneurial activity, and formation of strong “business-power” ties [1]. Nevertheless, there is a need for a new driver of economic development due to the regions’ dependence on foreign economic conditions, stagnation of technical and technological development of production based on the production base of the Soviet Union, as well as a decrease in consumer demand [2]. Managed structural transformations can become such a driver: especially ones necessary for the sectoral structure of the regional economy [3]. This is related to a number of reasons: first, there is a decline in the economic growth due to a significant impact of global financial crises and foreign sanctions. Second, the structure of the Russian economy and most regions does not effectively fit into the global economy due to the raw material orientation and the industry of primary processing. Third, a low investment and scientific and innovative activity of the economy does not allow imposing competition on imported products.

It is important to note that, due to a weak diversification of the Russian economy and its raw material orientation, the inclusion of regional economies in interregional and international value added chains (VAC) is quite difficult. At the moment, the participation of the country’s economy in VAC is related to its integration as a supplier of raw materials, which does not provide the growth effect of high-tech and competitive industries but only inflates the export commodity sector. To integrate national and regional economies into global production chains, the importance of studying economic sectors’ structural shifts increases.

The relevance of this research is related to the need to obtain quantitative estimates of structural transformations taking place in the regional economy that makes it possible to form an analytical basis for the study of value added chains based on the methodology of interindustry balance, which also relies on national economic proportions.

Structural shifts are assessed using a casestudy of the Vologda Oblast – an old industrial region of the Russian European North with an export-oriented mono-structured economy [4]. The choice of an entity for the analysis is caused by the fact that the transformation of old-industrial regions can become the engine of the economic growth due to a significant scientific, technical, and production potential [5–7]. At the same time, a number of acute problems in the development of these regions at the moment can turn them into a stopper of the national economy.

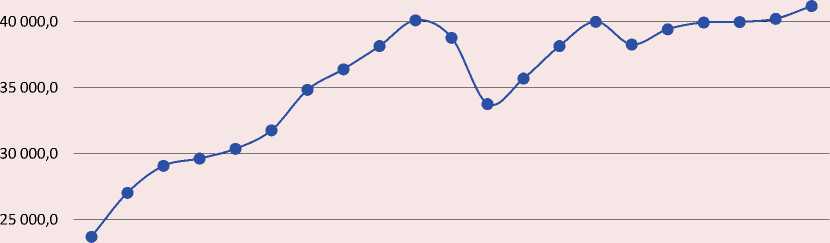

The Vologda Oblast was not able to completely rebuild itself during the transition to the market, and it turned from a donorregion into one of the subsidized ones. Demonstrating stable initial growth, the region’s economy poorly reacted to the 2008– 2009 global financial crisis and the 2014– 2015 currency crisis, which can be proven by changes in the gross regional product volume produced at comparable prices of 1998 (Fig. 1).

Analyzing the behavior of the gross regional product (GRP) volume curve, we can distinguish five periods of economic dynamics: 1998–2007, 2008–2009, 2010–2012, 2013– 2014, and 2015–2018. Considering this, the purpose of the study was to analyze structural shifts in the industry structure of gross value added (GVA) at various stages of economic dynamics. Achievement of the research goal required solving the following tasks: quantitative assessment of structural changes, determination of their impact on economic dynamics, as well as development of directions for adjusting structural policy.

Figure 1. Dynamics of GRP in the Vologda Oblast’s economy for 1998–2018 (in 1998 comparable prices), mil. rub.

45 000,0

20 000,0

Source: own compilation according to Rosstat data.

Theoretical and methodological aspects of the research

Issues of structural rebuilding of the economy and its impact on the economic growth more often become a topic for scientific findings among Russian and foreign researchers. In the work of RAS corresponding member V.A. Ilyin, the necessity of breakthrough changes in the country’s economic strategy is substantiated; its main driver may be the structural rebuild of Russian economy [8]. The work of T.V. Uskova and E.V. Lukin evaluates the results of the assessment of main structural changes of regional economy and states that the structural policy is the main instrument of the economic policy for achieving balanced and sustainable development [9]. Also, a team of American researchers empirically justified the hypothesis that the structural policy may accelerate economic growth rates in a short-term perspective [10], and A.A. Shirov states that the GVA change may be caused by a single transformation of the economic structure even with a zero output change1. The works [11–12] highlight the importance of the structural policy in investments and social capital, name the economic structure issues at different phases of the economic dynamics in the country. The interconnection between the structural factor and development of value added chains in the economy is shown in the E.V. Lukin’s work [13]. M. Peneder and J. Faderberg understand structural changes, aimed at the production diversification with an emphasis on high-tech processing industries [14–15], as the “growth locomotives”. However, in general, the scientific community pays insufficient attention to structural shifts at the regional level and the interconnection between economic dynamics and changes of the national economy proportions.

The definition of a structural shift, which is taken as the base one in the study, is clearly formulated in the works of O.S. Sukharev who significantly contributed to the studying of structural transformations of the national economy. A structural shift is understood as a visible in its magnitude structural change which happened at a certain limited time interval, and it is clearly identified and registered because of this [16].

The methodological basis of the research is based on methodological approaches of such scientists as O.Yu. Krasil’nikov, Yu.S. Kharin and V.I. Malyugin, S.A. Suspitsin, B.A. Zamaraev and T.N. Marshova, I.K. Shevchenko and Yu.V. Razvadovskaya, and several foreign works on structural analysis [17–24]. Despite a significant number of scientific works in this area, issues of the structural shifts’ impact on the region’s economic growth, based on a quantitative assessment, are not thoroughly studied.

The reliability of conclusions is provided by the usage of such general scientific methods as the system approach, analysis and synthesis, induction and deduction, analogy, and the usage of special methods of the economic research – methods of grouping, comparison, and structural analysis of economic indicators. The information base of the study consists of data from the territorial bodies of the Federal State Statistics Service for the Vologda Oblast, data from the Unified Interdepartmental Statistical Information System, as well as the works of leading researchers in the field of regional economics.

To analyze structural economic transformations, a set of various indices is used for quantitative and qualitative assessment. For quantitative analysis of structural shifts in the regional economy, we used several indicators – the magnitude, velocity, index, and power of structural shifts [19].

The magnitude of the structural shift ( M ) is calculated as the difference between the shares of the industry in the structure of the economy for the base and current period (1).

M i = d i- d iO , (1)

where: i – sector, di 0 – relative share of i -sector for the base period, di – relative share of i -sector for the current period.

The magnitude indicator shows how sectoral proportions in the region’s economy have changed, and it also allows assessing their uniformity.

However, it does not give an idea about the significance of the structural shift for the economy and the industry as a whole, so it should be supplemented with the structural shift index (2) .

J _ di-diO _ Mi i di0 di0

where: Ii – structural shift index, Mi – value of the structural shift in the studied period.

This indicator allows us to determine the significance of the structural dynamics of the national economy’s sectoral proportions, and it resembles the variant coefficient in terms of content.

Velocity indicator ( V ), defined as a change of the structural shift magnitude per time unit ( T ), provides information on an average annual rate of the transformation of the national economy’s proportions (3) :

-

V i = M T i . (3)

The resulting indicator of the quantitative analysis of structural shifts in the economy will be an indicator of the structural shift’s power

(P), calculated using the formula (4). The greater this indicator, the greater the impact of the changes on the structural proportions of the region’s economy is .

P i = M i ∙ V I . (4)

The aforementioned indicators will be calculated for the structure of gross value added. Structural changes will be considered for the period from 2005 to 2018, and industry statistics are provided for the OKVED-2007 (Russian Industry Classification System) for comparability of the indicators used.

Then, in order to measure the influence of structural changes on the economy, we used the metrics studied in the R.M. Uzyakov’s work [25]. The influence on the economic dynamics is understood as a positive or negative shift in GRP growth at the expense of changes in sectoral proportions. At the same time, the growth phase takes into account the contribution of a positive growth of the sector’s share in the structure, and, correspondingly, the decline phase considers a negative growth. With these provisions, the contribution of a summary increase in the share of sectors, which grew (declined) to the common rate of the GPR increase. Formula (5) describes the calculation of the metric during the growth phase of the economy, formula (6) – during the recession phase .

n

S + =^Ash /(\1X1 -1 -1), (5) i=i where: S+ – the share of the structural factor in increasing the growth rate of the economy, ∆shi+ – positive values of structural shifts of i-sector, X t – GRP in t-year.

-

5 - = £ A sh - /( X t I X t - 1 - 1), (6 ) i = 1

where: S – – the share of structural factor in the decline of economic growth, ∆ shi – – negative values of structural shifts in the i -industry.

As E.V. Lukin notes [26], to maintain the uniformity of calculations, it is necessary to have a period of growth or decline. Consequently, 2016 should be excluded from the analysis due to the fact that the dynamics of economic growth is virtually zero.

The model of inter-sectoral balance is used to select industries that are priorities of structural policy. It contains enlarged types of economic activities: agriculture, hunting, forestry and fishing, mining, industry (without mining), construction, financial and nonfinancial services. The separation of the studied sectors was made on the basis of the aggregation of an expanded list of data separated by types of economic activity, reflecting the production of goods, work, and services provided by Russian enterprises.

The model is based on the basic equation of inter-industry balance, which is the following in the matrix form (7):

X = A x + y , (7)

where: x – vector of total production volume; А – matrix of coefficients of direct costs; y – vector of final product.

The following equation is used for modeling (8):

(Е-Ау^у = x , (8)

where: Е – identity matrix; ( E – A )-1 – matrix of total cost coefficients.

On the basis of acquired matrix dependence, it is possible to calculate the x volume realization in all economic sectors, if the change of the y final demand is planned2.

Within the current research, it is necessary to conduct three analytical stages: a retro-spective assessment of the socio-economic development of the region, the study of structural changes in the sectoral proportions of the Vologda Oblast’s economy, and the calculation of the metric of structural shifts’ impact on economic dynamics.

Main research results

Prevailing sectors of the national economy in the Vologda Oblast are ferrous metallurgy and chemical production, food industry and timber industry complex are also developed. These sectors are the main areas of the investment activity in the region. Average annual growth rates of main indicators of the region’s socioeconomic development for studies periods are given in table 1 .

Table 1. Average annual growth rates of the main indicators of socio-economic development of the Vologda Oblast, %

|

Indicator |

2005–2007 |

2008–2009 |

2010–2012 |

2013–2014 |

2015–2018 |

2005–2018 |

|

Gross regional product (GRP) |

104.8 |

91.8 |

105.8 |

99.3 |

101.1 |

101.2 |

|

Industrial production |

106.2 |

92.9 |

106.1 |

103.1 |

102.3 |

102.6 |

|

Agricultural products |

98.1 |

97.8 |

97.9 |

95.6 |

100.6 |

98.3 |

|

Investments in fixed capital |

111.1 |

78.4 |

127.9 |

69.9 |

108.1 |

101.2 |

|

Commissioning of total area of residential buildings |

117.7 |

100.1 |

92.6 |

141.1 |

91.2 |

104.2 |

|

Cargo transported by transport |

97.4 |

89.5 |

103.3 |

100.0 |

100.6 |

98.7 |

|

Passengers transported by public transport |

85.7 |

89.3 |

106.4 |

100.3 |

100.3 |

96.6 |

|

Retail trade turnover |

113.0 |

98.5 |

114.4 |

101.8 |

98.6 |

105.3 |

|

Paid services to the population |

109.3 |

102.9 |

100.1 |

100.2 |

98.7 |

102.0 |

|

Source: own calculation according to Rosstat and Vologdastat data. |

||||||

2 More information on the usage of the inter-sectoral balance model and calculations, based on it, are given in [27].

Until 2008, there was an active economic growth, increase of the industrial production output on the background of reducing transport activity and agricultural industry; besides, there was the growth of consumer sector. During these years, the industry really was the driver of the Vologda Oblast’s economy, and the region was one of a few donor-entities in the national economy of the country.

However, the 2008 global economic crisis significantly impacted the economy; there is a negative dynamics of the economic growth and noticeable shrinking of main types of activities due to reduced demand and price drops: it especially affected the locomotive of the Vologda economy – ferrous metallurgy. Clear recession followed by a reduced ruble’s stability, decline on the labor market, and the freezing of investment projects due to a lack of funding.

Since 2009, a post-crisis recovery was difficult; the recession overcoming only began in the first half of 2010, but the next crisis of 2013–2014 gave an economy a chance to come back to the 2007 level only in 2018.

At the same time, over the whole studied period, there was a significant growth decline of industrial production and decrease in agriculture. The consumer demand sector as a whole showed growth but a significantly slow one in comparison with the pre-crisis period; there was a reduction of cargo and passenger traffic. The economy of the Vologda Oblast is in a state of stagnation, as its growth in most parameters significantly slowed down during the studied period.

The described processes of the dynamics of the region’s national economy were accompanied by significant structural changes that determine quantitative and qualitative parameters of the economic growth. To analyze the deformations that occurred, we will consider changes in the industry structure of the GVA formation.

Figure 2 includes the changes in the relative share of the value added formation of major activity types in the Vologda Oblast’s economy from 2005 to 2018. The analysis of the dynamics of shares of the sectoral structure of gross value added formation revealed that there is a general reduction in the share of the commodity production sector3 (67.9% in 2005 vs. 56.9% in 2018) and an increase in the relative share of the service sector. Wholesale and retail trade, thanks to a stable growth in the studied period, has nearly doubled its share in the structure of the GVA formation, the importance of the financial services industry has increased, and the share of the public sector has grown. In general, the growth rate of the service sector’s share significantly exceeds the growth rate of the material production sector’s share. For the region, the reduction in the share of the commodity production, coupled with an unfavorable external economic situation, is dangerous because the region’s exports are based on the industrial output – metal products, fertilizers, and intermediate consumption products. Systemforming industries, losing revenue, strongly undermine the regional budget reducing the ability of regional authorities to stimulate the transformation of the Vologda Oblast’s economy. Agriculture, which is important for the region’s food industry and one of the most important processing industries, noticeably loses its positions.

Figure 2. Dynamics of changes of the relative share of the main types of economic activity in the GVA formation structure in the economy of the Vologda Oblast for 2005–2018

|

Process manufacturing 46.6 50.0 . . 42.4 33.1 |

|

тюг-оототчгчгп^тюг-оо ОООООНгНгНгННгНгНгНгН оооооооооооооо |

|

Wholesale and retail trade |

|

12.2 |

|

6.6 |

|

тюг-оототчгчгп^тюг-оо ОООООНгНгНгННгНгНгНгН оооооооооооооо |

|

Real estate operations 8.6 |

|

5.7 |

|

3.9 |

|

1ЛОГ'ООСЛО^НГ^Г<)т±1ЛОГ'00 ОООООтЧтЧтЧтЧтЧтЧтЧтЧтЧ оооооооооооооо |

|

Agricultural industry |

|

7.5 7.8 |

|

4.1 |

|

4.0 |

|

тюг-оототчгчгп^тюг-оо ОООООтЧтЧтЧтЧтЧтЧтЧтЧтЧ оооооооооооооо |

|

Energy, gas, and water production |

|

4.9 3.5 3.5 |

|

2.7 |

|

тюг-оототчгчгп^тюг-оо ОООООтЧтЧтЧтЧтЧтЧтЧтЧтЧ оооооооооооооо |

|

Transport and communications 17.2 13.0 11.9 9.4 |

|

тюг-оототчгчгп^тюг-оо ООООО^Н^Н^Н^Н^Н^Н^Н^Н^Н оооооооооооооо |

|

Construction |

|

12.2 10.3 |

|

6.5 |

|

4.7 |

|

тюг-оототчгчгп^тюг-оо ООООО^Н^Н^Н^Н^Н^Н^Н^Н^Н оооооооооооооо |

|

Public administration |

|

7.9 |

|

4.7 |

|

2.4 |

|

тог^оототчгмт'Я-тог^оо ОООООтЧтЧтЧтЧтЧтЧтЧтЧтЧ оооооооооооооо |

|

Healthcare |

|

6.1 |

|

3.6 |

|

3.3 |

|

тог^оототчгмт'Я-тог^оо ОООООтЧтЧтЧтЧтЧтЧтЧтЧтЧ оооооооооооооо |

|

Education 3.5 |

|

2.3 |

|

2.2 |

|

тог^оототчгмт'Я-тог^оо ОООООтЧтЧтЧтЧтЧтЧтЧтЧтЧ оооооооооооооо |

Source: own compilation according to Rosstat data.

Turning to the index analysis of structural shifts in the analyzed components of the economic structure, it should be noted that the transformations within the structures of the GVA formation are not synchronous. This should be taken into account by the regional authorities when forming a structural policy.

The calculation of quantitative indicators, presented in table 2 , shows that the most intensive transformation of the structure of the GVA formation occurred in the process manufacturing, trade, construction, and agriculture sectors.

The process manufacturing productions reacted differently to crisis phases of the economic dynamics: the 2008 crisis considerably shortened their relative share in the structure of the GVA formation; the output volume in the region in 2009, in comparison with the previous year, decreased by 31.4% in mechanical engineering sector, in metallurgy – by 22.4%, in pulp and paper production – by 14.9%, in woodworking – by 7.8%, and there are no signs of post-crisis recovery in the industry. However, the 2013–2014 crisis was less severe, and the process manufacturing productions managed

Table 2. Quantitative indicators of structural changes in the sectoral structure of the GVA formation in the Vologda Oblast’s economy*

|

Sector |

Magnitude of the structural shift, p.p. |

Index of the structural shift, p.p. |

||||||||||

|

20052007 |

20082009 |

20102012 |

20132014 |

20152018 |

20052018 |

20052007 |

20082009 |

20102012 |

20132014 |

20152018 |

20052018 |

|

|

Process manufacturing |

-0.6 |

-13.4 |

-2.0 |

1.6 |

3.4 |

-4.2 |

0.0 |

-0.3 |

-0.1 |

0.0 |

0.1 |

-0.1 |

|

Transport and communications |

-2.5 |

3.6 |

-0.5 |

-0.4 |

-4.0 |

1.1 |

-0.2 |

0.4 |

0.0 |

0.0 |

-0.2 |

0.1 |

|

Wholesale and retail trade |

1.3 |

1.0 |

0.9 |

0.5 |

0.3 |

5.6 |

0.2 |

0.1 |

0.1 |

0.0 |

0.0 |

0.8 |

|

Construction |

-0.6 |

0.3 |

4.3 |

-0.5 |

1.8 |

-3.8 |

-0.1 |

0.0 |

0.5 |

-0.1 |

0.4 |

-0.4 |

|

Real estate operations |

0.3 |

0.2 |

0.3 |

-0.4 |

0.1 |

1.8 |

0.1 |

0.0 |

0.1 |

-0.1 |

0.0 |

0.5 |

|

Public administration |

1.9 |

2.7 |

0.4 |

-0.4 |

-0.7 |

2.3 |

0.8 |

0.6 |

0.1 |

-0.1 |

-0.1 |

1.0 |

|

Agricultural industry |

-0.8 |

0.8 |

-1.9 |

0.6 |

-0.4 |

-3.4 |

-0.1 |

0.1 |

-0.3 |

0.1 |

-0.1 |

-0.5 |

|

Healthcare |

0.5 |

1.4 |

-0.2 |

-0.1 |

-0.2 |

0.3 |

0.2 |

0.4 |

0.0 |

0.0 |

-0.1 |

0.1 |

|

Energy, gas, and water production |

-0.1 |

1.6 |

-0.9 |

-0.4 |

-0.2 |

0.0 |

0.0 |

0.5 |

-0.2 |

-0.1 |

-0.1 |

0.0 |

|

Education |

0.2 |

1.1 |

-0.5 |

-0.2 |

0.0 |

0.1 |

0.1 |

0.5 |

-0.2 |

-0.1 |

0.0 |

0.0 |

|

Sector |

Velocity of the structural analysis, p.p. per year |

Power of the structural shift, p.p. |

||||||||||

|

20052007 |

20082009 |

20102012 |

20132014 |

20152018 |

20052018 |

20052007 |

20082009 |

20102012 |

20132014 |

20152018 |

20052018 |

|

|

Process manufacturing |

-0.2 |

-6.7 |

-0.7 |

0.8 |

0.9 |

-0.3 |

-0.2 |

-6.7 |

-0.7 |

0.8 |

0.9 |

-0.3 |

|

Transport and communications |

-0.8 |

1.8 |

-0.2 |

-0.2 |

-1.0 |

0.1 |

-0.8 |

1.8 |

-0.2 |

-0.2 |

-1.0 |

0.1 |

|

Wholesale and retail trade |

0.4 |

0.5 |

0.3 |

0.3 |

0.1 |

0.4 |

0.4 |

0.5 |

0.3 |

0.3 |

0.1 |

0.4 |

|

Construction |

-0.2 |

0.2 |

1.4 |

-0.3 |

0.5 |

-0.3 |

-0.2 |

0.2 |

1.4 |

-0.3 |

0.5 |

-0.3 |

|

Real estate operations |

0.1 |

0.1 |

0.1 |

-0.2 |

0.0 |

0.1 |

0.1 |

0.1 |

0.1 |

-0.2 |

0.0 |

0.1 |

|

Public administration |

0.6 |

1.4 |

0.1 |

-0.2 |

-0.2 |

0.2 |

0.6 |

1.4 |

0.1 |

-0.2 |

-0.2 |

0.2 |

|

Agricultural industry |

-0.3 |

0.4 |

-0.6 |

0.3 |

-0.1 |

-0.3 |

-0.3 |

0.4 |

-0.6 |

0.3 |

-0.1 |

-0.3 |

|

Healthcare |

0.2 |

0.7 |

-0.1 |

0.0 |

0.0 |

0.0 |

0.2 |

0.7 |

-0.1 |

0.0 |

0.0 |

0.0 |

|

Energy, gas, and water production |

0.0 |

0.8 |

-0.3 |

-0.2 |

-0.1 |

0.0 |

0.0 |

0.8 |

-0.3 |

-0.2 |

-0.1 |

0.0 |

|

Education |

0.1 |

0.6 |

-0.2 |

-0.1 |

0.0 |

0.0 |

0.1 |

0.6 |

-0.2 |

-0.1 |

0.0 |

0.0 |

* We consider the ongoing structural shifts in the sectoral proportions of the Vologda Oblast’s economy taking into account the sign of the structural shift’s mass; so the sign “+” means a positive shift. At the same time, its impact on the region’s economy may be different. Source: own calculation.

to overcome the 2009 level. However, the share of industry in the GVA for 2005–2018 significantly decreased in general, average annual decline rates were 0.32 p. p. per year. During a weak diversification of the Vologda Oblast’s economy, this trend is dangerous in terms of the decline of the population’s real income and budget revenues, reduction of the living standards and economic growth.

The negative shift in the construction sector is caused by a decrease of effective demand for housing during an unfavorable global economic situation. At the same time, in the post-crisis period of 2009–2012, with a reduction in the commissioning of residential buildings, the relative share of the construction in the economy increased.

We should also pay attention to the negative processes taking place in agriculture. Despite the fact that this sector is declared one of the priorities of the economic policy of the Vologda Oblast and the area of the diversification of the region’s industry structure, this type of economic activity has a negative value of the shift’s magnitude for most of the studied period. The industry stagnates, and the production output declines every year.

One of the main problems of negative structural changes is the need to modernize the fixed capital of the manufacturing sector. This is also shown by structural imbalances between the commodity production and service sectors. To eliminate them, as well as to improve the production base, it is necessary to attract significant capital investments.

Positive shifts are recorded in the wholesale and retail trade, but it is a consequence of other sectors having faster negative dynamics than trade in crisis periods. However, there is also a contribution of the turnover growth of the retail trade. At the same time, during crisis periods, the service sector significantly expanded its share in the GVA production, responding more mildly to the unfavorable macro-economic situation. However, in the post-crisis periods, the commodity production sector begins to catch up with the pre-crisis development levels due to anti-crisis management measures; the service sector reduces its share in the value added produced (in 2012–2009, the mass shift is negative for most types of economic activities providing services).

The positive shift in the share of transports and communications sector in the GVA is defined by the fact that large infrastructural projects of federal companies create a significant share of the value added formation (PJSC Gazprom, JSCo “RZD”, PJSC FGC UES, and PJSC “IDGC North-West”). Due to the stagnation of the industry, a significant share of the economy of the region and the country is made up of companies exporting raw materials, which actively increase their transport and communication capacities.

The most prominent changes, according to the calculated index of structural shifts, occurred in the share of the public administration, wholesale and retail trade, and agriculture sectors. The activity of such fluctuations is more of a result of the dynamics of other types of economic activity than active structural changes within the industry. Big “players” of the regional economy have less significant fluctuations in the proportions of the national economy.

The average annual rate of structural changes is clearly dependent on the phase of economic dynamics. During the 2008–2009 crisis, the rate of changes in the proportions of the national economy increases markedly compared to the rate of changes during the economic growth or recovery. At the same time, the 2013–2014 crisis did not significantly affect structural changes. This is also indicated by data on the power of structural shifts in the sectoral structure of the GVA formation in the Vologda Oblast’s economy.

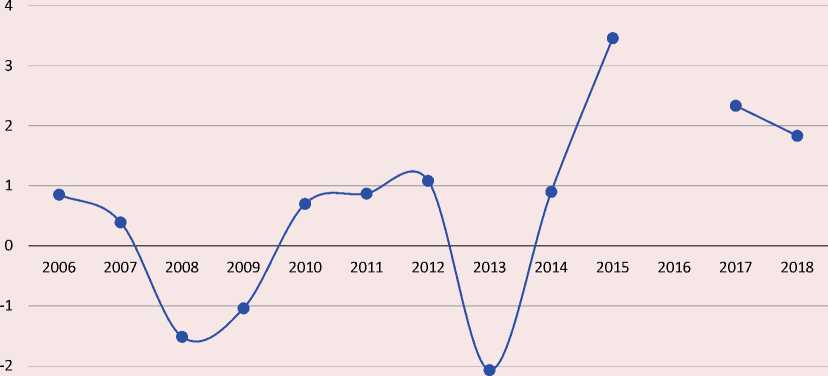

Calculation of the metric of the impact of structural changes on the dynamics of GRP at different phases of the economic cycle showed that changes in the power of structural changes and sharp changes in the impact of the structural factor on economic growth occur at the time of a crisis – such points are 2008 and 2013 ( Fig. 3 ).

This behavior of the calculated indicator can serve as an indicator for predicting possible significant changes in the functioning of the national economy. However, a complete and objective modeling of the economy’s behavior, depending on structural changes, requires a much broader set of indices and metrics, as well as a comprehensive analysis of structural changes in the economy based not only on the analysis of the industry structure but also the structure of prices and costs, demand and income.

Conclusion

In 2005–2018, the sectoral structure of the Vologda Oblast’s economy had noticeable and heterogeneous structural shifts mostly caused by economic crises and their consequences. These changes have major consequences for economic and social spheres. Their impact led to a decline of the investment activity in the leading sectors of the economy, which will also affect fluctuations of the economic growth levels.

Adverse prospect can be the increase of the share of the service sector without a secured production basis on the background of the reduction of the impact of the manufacturing

Figure 3. Dynamics of changes in the contribution of structural changes to the dynamics of changes in GRP for 2006–2018, p.p.

-3

The value of the calculated metric for 2016 differs by its magnitude and introduces distortions in the graph. Source: own calculation.

sector on the regional economy due to uncompensated obsolescence of fixed capitals. The commodity production sector reduces its share in the economy because of negative shifts in agriculture among other things. There is a noticeable impact of the manufacturing industry’s state on the growth rate of the region’s gross product due to a weak diversification of the economy.

All these deformations affect the level of the Oblast’s economic growth and its competitiveness as an entity of the national and world economy. Without managed structural transformations, there will be fewer opportunities to include the Vologda Oblast in interregional and international production value added chains in the future. Therefore, structural policy measures should be aimed at eliminating sectoral imbalances and increasing economic diversification, including vertical one.

The flexibility of regional structural policy, based on a differentiated approach to entities of the Russian Federation, should be an important step toward the formation of a sustainable regional economy. Structural policy at the sub-federal level is more efficient due to the proximity of regional authorities to companies, especially small- and medium-sized businesses [2].

The regional authorities apply specific control measures in these areas of the structural economic policy. They pay a lot of special attention to the diversification of the Oblast’s economy. This idea was first mentioned in the Concept of the Strategy (2004) and then in the Socio-Economic Development Strategy of the Oblast (2010 and 2016). The purpose of the region’s development was the preservation of people, and the family policy, public healthcare, development of physical culture, sports, education, etc. were the priorities.

Currently, the main document, which defines the structural policy in the Vologda Oblast, is the “Socio-economic development strategy of the Vologda Oblast until 2030”4. This document set the structural policy in the region too. However, due to the absence of a clear division between macro-economic and structural policy, standard events of the former may neutralize the latter [28]. This provision should be considered by regional authorities while making operational and tactical decisions, as well as in strategic planning.

Structural policy optimization, based on the results of the analysis, should be carried out in the following areas:

-

1. Promotion of modernization and diversification in the production sector in order to form the industry framework of the region’s economy.

-

2. Development of structural and investment policy within the strategic planning.

-

3. Formation of a benchmarking system for monitoring the effectiveness of structural policy measures.

The promising sectors, which could be highlighted by the structural policy, may include agro-industrial complex (in particular, agriculture), electronics, and mechanical engineering. In addition to economic diversification and structural changes, these industries contribute to national security and spatial development in rural and urban areas.

Despite one of the macro-economic policy priorities, announced in the Strategy, being the complication of the economy’s structure – support for agriculture, forestry, and food production in particular, their growth rates are insufficient and even negative in case of the agro-industrial complex. The food industry, existing in the region, can provide a stable demand for crop and livestock products, which indicates a significant potential for stimulating the development of agriculture. In addition, this type of economic activity is named one of the most promising sectors – a tool for integrating the Russian economy into the global one [26]. At the same time, Vologda products of the agroindustrial complex can compete with many world leaders.

A significant contribution to the economic growth can be made by more active mechanical engineering and electronics. These knowledgeintensive industries with high value added are significant tools of import substitution policy, and their development will contribute to a deeper integration of the regional economy into global value chains.

According to our calculations, the activation of these industries has a significant multiplicative effect. So, each ruble of demand for agricultural products will create 2.064 rubles of GRP, electronics products will bring 2.368 rubles, and mechanical engineering – 2.758 rubles. For comparison, the same multiplier in mining is equal to 1.7 rubles per ruble of demand for products and 1.495 rubles for financial services [27].

The necessity to manage investment aspects of structural economic transformations is caused by a number of existing problems in the economy: significant obsolescence of fixed capital and the need for their modernization, low innovation activity and investment “hunger” due to an insufficiently high norm of gross accumulation of fixed capital [4].

It is necessary to create a mechanism for the redistribution of investment resources from the export-raw materials sector, improve the means of converting savings into gross savings, and reduce the withdrawal of capital from the region to offshores. It is also important to attract budget investments that could become the engine of the investment process in the region’s economy [29]. It also makes sense to increase the investment attractiveness of the Vologda Oblast for Russian and foreign investors. Given the acute problem of low innovation activity, it will be important to provide investment support for science and education, which will increase the economy’s technological and human resources potential.

Due to the aforementioned problem of a lack of a clear division between regional economic and structural policies, it will be important to create a system for benchmarking the conducted structural policy in order to track its effectiveness and make adjustments if necessary. At the same time, the assessment should be independent, and external auditors should be involved. It makes sense to exchange experience with other regions and countries to select the best mechanisms for implementing structural policies.

Besides, the benchmarking system includes not just key points of the structural policy results (like KPI and BSS5 already applied in management, including public management) but assessment of the best existing practices of regional administration of structural economic transformation and opportunities for their adaptation to a benchmarking object. However, it is currently impossible to objectively determine the criteria for such a system of evaluating structural policy measures.

The following studies will be related to the identification of structural shifts’ dependence in the formation of gross value added on proportions of investment distribution in fixed capital within the regional economy sectors, as well as to conducting the factor analysis of the impact of changes in sectoral proportions on

-

5 KPI – Key Performance Indicators, BSS – Balanced Scorecard System.

the economic growth. The limitations of our research include insufficient development of a criteria system that allows the structural policy benchmarking.

The study of changes of the national economy proportions gives an opportunity to adjust models considering the structural factor’s impact. It is achievable within the work on the modelling and designing interregional value added chains on the basis of the inter-sectoral balance methodology. Consequently, it defines the organization of such studies regarding regions-partners of the Vologda Oblast in value added chains. Moreover, one of the points of scientific novelty is the approbation of the research methodology concerning the contribution of structural shifts in the regional economic growth.

Scientific novelty of the study, substantiating its contribution in the scientific advancement, is the disclosure of current trends in the processes of the economic industrial structure transformation at different phases of economic dynamics. The practical significance of the study is to provide analytical conclusions for regional authorities in order to form efficient structural policy measures to ensure the region’s economic growth and sustainable development.

Список литературы Asymmetry problems of structural shifts in regional economy

- Uskova T.V. et al. Problemy ekonomicheskogo rosta territorii: monografiya [Issues of Economic Growth in the Territories: Monograph]. Vologda: ISEDT RAS, 2013. 170 p.

- Simachev Yu.V. et al. Industrial policy in Russia: New conditions and possible agenda (The report of NRU HSE). Voprosy ekonomiki=Voprosy Ekonomiki, 2018, no. 6, pp. 5–28 (in Russian).

- Kucera D., Jiang X. Structural transformation in emerging economies: Leading sectors and the balanced growth hypothesis. Oxford Development Studies, 2019, vol. 47, pp. 188–204.

- Lukin E.V., Uskova T.V. Mezhregional’noe ekonomicheskoe sotrudnichestvo: sostoyanie, problemy, perspektivy [Interregional economic cooperation: status, problems and prospects]. Vologda: ISEDT RAS, 2016. 148 p.

- Mel’nikov A.E. Investment processes and structural changes in the economy of old industrial regions of the Northwestern Federal District. Ekonomicheskie i sotsial’nye peremeny: fakty, tendentsii, prognoz=Economic and Social Changes: Facts, Trends, Forecast, 2019, vol. 12, no. 2, pp. 91–102. DOI: 10.15838/esc.2019.2.62.5 (in Russian).

- Birch K., Mackinnon D., Cumbers A. Old industrial regions in Europe: A comparative assessment of economic performance. Regional Studies, 2010, vol. 44, pp. 35–53.

- Henderson S.R. Transforming old industrial regions: Constructing collaboration within the Black Country, England. Geoforum, 2015, vol. 60, pp. 95–106.

- Ilyin V.A., Morev M.V. The disturbing future of 2024. Ekonomicheskie i sotsial’nye peremeny: fakty, tendentsii, prognoz=Economic and Social Changes: Facts, Trends, Forecast, 2018, vol. 11, no. 3, pp. 9–24. DOI: 10.15838/esc.2018.3.57.1 (in Russian).

- Lukin E.V., Uskova T.V. Structural transformation issues in regional economy. Ekonomicheskie i sotsial’nye peremeny: fakty, tendentsii, prognoz=Economic and Social Changes: Facts, Trends, Forecast, 2018, vol. 11, no. 6, pp. 26–40. DOI: 10.15838/ esc.2018.6.60.2 (in Russian).

- Eicher T.S., Schreiber T. Structural policies and growth: Time series evidence from a natural experiment. Journal of Development Economics. 2010, vol. 91. pp. 169–179. DOI: 10.1016/j.jdeveco.2009.05.003

- Ivanter V., Porfir’ev B., Shirov A. Structural aspects of long-term economic policy. Problemy teorii i praktiki upravleniya=International Journal of Management Theory and Practice, 2018, no. 3, pp. 27–34 (in Russian).

- Aganbegyan A. Why is the Russian economy making no headway? Problemy teorii i praktiki upravleniya=International Journal of Management Theory and Practice, 2018, no. 3, pp. 11–27 (in Russian).

- Lukin E.V. Structural shifts in the regional economy (materials of the Vologda Oblast). Voprosy territorial’nogo razvitiya=Territorial Development Issues, 2018, no. 5 (45). DOI: 10.15838/tdi.2018.5.45.2 (in Russian).

- Fagerberg J. Technological progress, structural change and productivity growth: A comparative study. Structural Change and Economic Dynamics, 2000, vol. 11, no. 4, pp. 393–411.

- Peneder M. Industrial structure and aggregate growth. Structural Change and Economic Dynamics, 2003, vol. 14, no. 4, pp. 427–448.

- Sukharev O.S. Structural policy in the Russian economy: Formation conditions. Natsional’nye interesy: prioritety i bezopasnost’=National Interests: Priorities and Security, 2014, no. 3 (240), pp. 2–8 (in Russian).

- Suspitsyn S.A. New techniques for measuring spatial transformation of economy. Region: ekonomika i sotsiologiya=Region: Economics and Sociology, 2007, no. 4, pp. 3–18 (in Russian).

- Prebisch R. Periferiinyi kapitalizm: est’ li emu al’ternativa [A Critique of Peripheral Capitalism]. Moscow: ILA RAN. 1992. 76 p.

- Krasil’nikov O.Yu. Strukturnye sdvigi v ekonomike: teoriya i metodologiya [Structural Changes in the Economy: Theory and Methodology]. Saratov: Nauchnaya kniga, 1999. 74 p.

- Kharin Yu.S., Malyugin V.I. Statistical analysis and forecasting of macroeconomic processes using the PPP PEMP. Aktual’naya statistika=Current Statistics, 2000 vol. 2, pp. 13–20 (in Russian).

- Köves P. Teoriya indeksov i praktika ekonomicheskogo analiza [Index Theory and Economic Reality]. Moscow: Finansy i statistika, 1990. 303 p.

- Zamaraev V., Marshova T. Investment processes and the Russian economy restructuring. Voprosy ekonomiki=Voprosy Ekonomiki, 2017, no. 12, pp. 40–62 (in Russian).

- Shevchenko I.K., Razvadovskaya Yu.V. Model analysis of structural shifts: Specific features and parametric. Izvestiya YuFU. Tekhnicheskie nauki=Izvestiya SFedU. Engineering Sciences, 2013, no. 6, pp. 153–159 (in Russian).

- Isаrd W. Methods of Regional Analysis: an Introduction to Regional Science. M.I.T. Press, 1960. 784 p.

- Uzyakov R.M. Metrics of structural changes and the necessity of considering interindustry relationships. Problemy prognozirovaniya=Studies on Russian Economic Development, 2020, no. 2, pp. 25–35 (in Russian).

- Lukin E.V. Sectoral and territorial specifics of value-added chains in Russia: The input-output approach. Ekonomicheskie i sotsial’nye peremeny: fakty, tendentsii, prognoz=Economic and Social Changes: Facts, Trends, Forecast, 2019. vol. 12, no. 6, pp. 129–149. DOI: 10.15838/esc.2019.6.66.7 (in Russian).

- Sidorov M.A., Rumyantsev N.M. Stimulation of growth of the payroll fund on the basis of development of economic industries. Ekonomika. Sotsiologiya. Pravo=Economics. Sociology. Law, 2020, no. 2, pp. 42–51 (in Russian).

- Sukharev O.S. Teoriya strukturnoi dinamiki ekonomiki: monografiya [The Theory of Structural Dynamics of the Economy: Monograph]. Moscow: LENAND, 2020. 200 p.

- Making Public Investment more Efficient. Staff Report of IMF. International Monetary Fund, 2015. 67 p.