Best Practices of Oil and Gas Companies to Develop Gas Fields on the Arctic Shelf

Автор: Brodt L.E.

Журнал: Arctic and North @arctic-and-north

Рубрика: Social and economic development

Статья в выпуске: 44, 2021 года.

Бесплатный доступ

The development of the hydrocarbon potential of the Arctic shelf is one of the priority tasks for Russia, forming the conditions for its strategic presence in the region. Russia's official energy documents stipulate the need to increase oil and gas production in the Arctic, including offshore production, to ensure the stable operation of the country's oil and gas complex in the long term. However, the development of hydrocarbon fields on the Arctic shelf is a serious technological challenge for the domestic oil and gas industry. While offshore oil production in the Russian Arctic is already underway, natural gas production remains a promising future target. The article analyses the current gas projects on the Arctic shelf in terms of their technological complexity and unique solutions, and the strategies of operators to attract foreign participants to the project. We consider these in the contexts of technological issues, organizational features, securing foreign investment. The author believes that the provisions and conclusions of this study will help add to the comprehensive picture of the foreign oil and gas companies experience engaged in natural gas production on the Arctic shelf, which will minimise the errors and risks in the development of hydrocarbon resources on the Russian Arctic seas shelf.

Arctic shelf, foreign oil company, offshore hydrocarbon production, joint venture, risk

Короткий адрес: https://sciup.org/148322042

IDR: 148322042 | УДК: [338.3:622.2](98)(045) | DOI: 10.37482/issn2221-2698.2021.44.30

Текст научной статьи Best Practices of Oil and Gas Companies to Develop Gas Fields on the Arctic Shelf

The development of offshore oil and gas fields in the Arctic identified as an important longterm objective in official documents of the Russian Federation at the federal, regional and sectoral levels. Thus, the Energy Strategy of the Russian Federation for the period up to 2035, approved in June 2020, notes that “the development of the hydrocarbon resource potential of the continental shelf of the Arctic seas and northern territories is the most important geopolitical and technological challenge for the oil and gas complex of the Russian Federation, and an appropriate answer to it is to ensure sufficient production of hydrocarbon raw materials in the country beyond the 2035 time frame, compensating the inevitable decline in their production from traditional deposits” 1.

One way or another, the development of the Arctic shelf and the development of hydrocarbon projects, apart from the economic interest of the country, is a necessary component of its strategic presence in the region. At the same time, many experts today believe that natural gas as a cleaner fuel has great prospects in the long term. Analysis of energy documents of the country shows that among the main trends, for example, in the Strategy for Development of Mineral Resource Base of the Russian Federation up to 2035, it is emphasized that the global fuel and energy balance will gradually change, the share of oil use will gradually decrease, and the share of gas will

increase 2. The Energy Strategy of the Russian Federation also predicts that “in terms of growth in demand in considered perspective gas will be the leader — a fossil fuel with the lowest greenhouse gas emissions”.

The purpose of this article was to study a set of best practices (technological, organizational, financial) for the development of gas fields in the Arctic shelf. The article analyses what technological challenges foreign companies face when developing gas and gas condensate fields on the Arctic shelf, what forms of participation of foreign partners companies are considering when implementing projects, and what factors are taken into account in the long term.

It is important to understand that the issues listed above reflect only a part of the problems faced by oil and gas companies operating on the Arctic shelf, but they should be taken into account at the first stages of planning activities and launching projects on the Arctic shelf.

Is there any activity on the Arctic shelf?

Two gas projects are being fully implemented on the Arctic shelf today — the Norwegian Ormen Lange and Snøhvit, and one oil project — the Russian Prirazlomnoye project. The Goliat oil project in the Norwegian sector of the Barents Sea, launched in March 2016, is operating with interruptions and a number of restrictions: since the start of the Goliat FPSO operation, oil production at the field has been interrupted several times 3. In the year the project was launched, production at Goliat was planned at 110.000 barrels of oil per day. However, according to the Norwegian Petroleum Directorate (NPD), production in 2018 was only 64.000 barrels of oil per day, and in the last two years it has completely decreased by half — 38.000 barrels of oil per day in 2019 and 2020, respectively. Such low production rates are explained by the fact that during 2017–2019 work on the platform was underway to eliminate defects that were discovered by the Norwegian Oil and Gas Production Safety Authority (Petroleumstilsynet) inspections. More than 30 defects were found on the platform, the most serious of which were damages of the hose used to transfer oil from the platform to tankers and release of chemicals into the Barents Sea. However, the operator of the Goliat project, VårEnergi, plans to increase production to 350.000 barrels of oil per day by 2023 4, and is also considering the possibility of exporting gas contained in the field.

The implementation of these projects is technologically very difficult: Arctic conditions require unique knowledge and special technologies in construction of production units, in creation of transportation systems of hydrocarbons from shelf to shore. Along with technological problems, there is a range of issues related to the involvement of partners in the project and the distribution of risks between the participants. Each project that is currently being implemented in the Arctic requires a long preparatory period before the start of production at the field. For example, the construction of the Prirazlomnaya offshore ice-resistant stationary platform started back in the 1990s, but was delayed for more than 20 years. This was due to numerous changes in the design and constant replacement of parts of the installation, which did not pass the regular construction checks. The Norwegian projects Snøhvit and Goliat faced similar problems. It can be said that offshore projects in the Arctic always have much longer implementation periods: to search for and create new technologies specifically for each project, to refine these technologies after field operation, to develop allied industries in parallel and to prepare the infrastructure on the shelf and onshore [1, Brutschin E.]. There are frequent cases of business interruption and delayed project launch dates in the Arctic fields.

In this study, the analysis was based on the idea of expanding the number of comparable gas projects being implemented today on the Arctic shelf. The analysis included Shell's Ormen Lange, Snøhvit and Aasta Hansteen, operated by the Norwegian oil and gas company Equinor. The listed gas projects were considered in terms of the following features:

-

• natural (climatic conditions, depth of hydrocarbons occurrence, remoteness from the coast);

-

• technological (field development, presence of underwater complexes, type of natural gas transportation);

-

• organisational (project implementation, partnership with other companies, expansion of activities taking into account the built infrastructure, sharing of risks between participants).

The stages of the offshore gas projects implementation and the strategies of operators to attract partner companies were also analyzed.

Natural gas production on the Arctic shelf

Gas production projects on the Arctic shelf were launched just over 10 years ago, despite the fact that some fields and their reserves were known for a long time. The development of gas fields on the shelf requires the creation of a complex set of subsea and onshore installations, a multi-stage gas transportation system (laying an underwater pipeline, building a liquefied natural gas plant) and therefore, as a rule, is extremely capital-intensive and multi-stage.

Table 1 provides information on existing gas projects on the Arctic shelf. The analysis of these projects focused on such key characteristics as volume of recoverable reserves, production intensity, technological features, project launch date, and selection of participating companies. The strategies of the operators of the Ormen Lange, Snøhvit, Aasta Hansteen gas projects and the conditions for attracting foreign partners to these projects were analyzed.

Existing gas projects on the Arctic shelf 5

Table 1

|

"о |

Geographical coordinates |

Reserves; daily production |

Year of field discovery; Production start year |

Technological uniqueness |

Participating companies |

|

|

ф Ы) с го с ф Е О |

(63° N; 5° E), Norwegian Sea, depth up to 1200 m , 140 km from the coast |

400 billion m³ of gas, 29 million m³ of condensate 70 million m³ gas / day |

1997 |

2007 (10 years) |

Difficulty in developing because of the depth. Unique solutions for laying underwater gas pipelines |

Shell (operator, 17.8%), Petoro AS (36.5%), Equinor Energy AS (25.3%), INEOS (14%), Vår Energi (6.3%) |

|

*> .с ■ а с СП |

(71° N;21° E), Barents Sea, depth 340 m , 160 km from the coast |

193 billion m³ of gas, 113 million barrels of condensation 17 million m³ gas / day |

1984 |

2007 (24 years) |

First project in the Barents Sea. Northernmost LNG plant |

Equinor (operator, 36.8%), Petoro AS (30%), Total (18.4%), Neptune Energy Norge AS (12%), Wintershall Dea Norge AS (2.81%) |

|

с ф ф с го т го го < |

(67°4'N;7°E), Norwegian Sea, depth 1300 m , 300 km from the coast |

55.6 billion m³ of gas; 353 million barrels of condensate 23 million m³ gas / day |

1997 |

2019 (22 years) |

The deepest oil and gas project on the Norwegian shelf |

Equinor (operator, 51%), Wintershall Dea (24%), OMV (15%), ConocoPhillips Scandinavia (10%) |

Ormen Lange project(practice of changing the operator at different stages of the project)

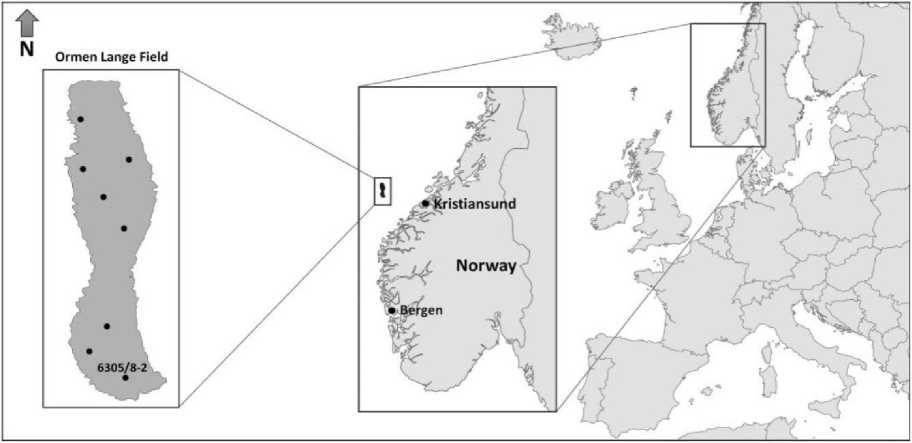

The first gas project on the Arctic shelf was the Ormen Lange project. The Ormen Lange field, discovered in 1997, has reserves of 400 billion m3 of natural gas and 29 million m3 of condensate, the second largest deposit after the Troll field in Norway. The Ormen Lange deposit is located in the Norwegian Sea, 140 km west of Kristiansan (Fig. 1). The development plan was approved by the Norwegian authorities in 2004, and the King of Norway personally launched a gas terminal on the Nyhamna gas terminal in October 2007 6. Gas production at the field began in 2007 and is planned to continue for over 40 years. Today, the technological complex of the Ormen Lange project consists of rigs that drill the world's longest gas wells, as well as subsea modules, the Nyhamna plant and the Langeled pipeline, which runs from the field to the British gas terminal in Easington 7.

Fig. 1. Location of the Ormen Lange gas field.

It should be noted that the Ormen Lange project became a real technological challenge for the gas industry at the time, primarily due to the depths of the reserves and the complexities of building a gas transportation system:

-

• firstly, the sea depth in the area of the field is about 1200 m; therefore, the arrangement of the seabed was complicated by a number of natural features. The main and, at first glance, insurmountable difficulty was the laying of the gas pipeline: in addition to the great depth, the bottom of the Norwegian Sea has an extremely uneven surface (due to the Støregga underwater landslide 8 that descended on the continental shelf about 8200 years ago). In order to lay pipelines on uneven seabed, special support blocks up to 60 m high were built so that the gas pipeline crosses the rocks with an inclination of up to 40 degrees [2, AMAP];

-

• secondly, hydrates, which are formed due to low temperatures and reduce the efficiency of the gas flow in the pipe, making it difficult to transport the gas, have become a problem. In order to solve this problem, another pipeline was laid to supply a hydrate inhibitor. Methylene glycol is injected into the gas stream and acts on hydrate deposits, after which the gas is transported to the shore;

-

• thirdly, the transportation process is periodically complicated by ice formation, which is why, for example, in January 2010, production at the field was temporarily suspended 9.

Of course, the creation of the entire underwater and coastal infrastructure and the solution of the above-mentioned problems required significant investments. The Nyhamna processing plant was built in a remote and undeveloped region, where all construction materials were shipped in from other locations. Total investments in the project reached $5.2 billion, making it one of the most expensive projects on the Norwegian shelf. However, it is important to note that the Ormen Lange project has become strategically important primarily in terms of maintaining one of the major markets and export levels: since 2009, natural gas exported from the Ormen Lange field to Europe has provided a stable 20% of total gas consumption in the UK [3, Hall M.].

Technological complexity of the Ormen Lange project and its capital intensity exclude the option of implementing the project by one company, therefore, five companies are involved in the field development. The project operator today is Shell (A/S Norske Shell) with a 17.3% share, and the remaining shares are distributed:

-

• Petoro AS (36.485%). It is a fully state-owned company, the main task of which is to represent the interests of Norway in joint oil and gas projects implemented on the continental shelf;

-

• Equinor Energy AS (25.3452%). A state-owned company, the activities of which are actually controlled by the Ministry of Petroleum and Energy of Norway;

-

• INEOS E&P Norge AS (14.0208%). A private company, the main activity of which is focused on the implementation of projects on the shelf of the Norwegian and North Seas. The company operates the Forties pipeline system that supplies gas to the UK;

-

• Vår Energi AS (6.3356%). It is a joint venture between the Italian oil company ENI and the Norwegian private investment company HitecVision.

It is possible that the Ormen Lange project implementation scheme and the comprehensive approach of Shell and Equinor may be of interest to Russian oil and gas companies when planning the development of gas fields on the Arctic shelf. At first, Shell considered the Ormen Lange project as a high-risk project, since most of the offshore technologies for such depths and temperatures were developed for the first time. Therefore, the Norwegian oil and gas industry in general and local companies in particular assumed all the risks, and foreign partners were attracted to the project only later. At the same time, despite the scale of the Ormen Lange project and the presence of a number of technological difficulties, it was launched according to plan, which took 10 years, and which became a record-breaking minimum time for the commissioning of gas fields on the shelf [4, Henderson J., p. 37]. Thus, the Norwegian experience has demonstrated that close cooperation of oil and gas companies can significantly accelerate the commissioning of even technologically very complex projects on the Arctic shelf. It is possible that some elements of the Or-men Lange implementation, such as the practice of changing the operator at different stages of the project, can be used in the development of large and unique gas fields on the shelf of the Russian Arctic.

Snøhvit project(practice of technological integration with future sales markets)

The second gas project launched on the Norwegian Arctic shelf is the Snøhvit project by Equinor (formerly Statoil). Located on the shelf of the Barents Sea, 160 km north-west of Hammerfest, the Snøhvit project is half the size of Ormen Lange in terms of reserves, but this project is no less progressive in terms of technology. It is developing three fields: the Snøhvit field of the same name, which accounts for 50% of the reserves, and two neighboring ones — Albatross and Askeladd. The total reserves of all three fields are 193 billion m3 of gas and 113 million barrels of condensate. Natural gas reserves in this area were discovered in the early 1980s, but the process of preparation for their exploitation took more than 20 years [5, K. Jakobsson, p. 226–230]. The Norwegian government approved Statoil's development plan only in 2002, and the project started in 2007.

The peculiarity of the development process is the absence of stationary and floating installations and the use of a completely underwater exploitation system, controlled remotely from the shore. The technological component of the Snøhvit project today is a system of pipelines from the field to the coast, a plant for liquefied natural gas on Melkoya Island and LNG tankers. At the first stage of the project, two fields were brought into production — Snøhvit and Albatross. Production at the third field, Askeladd, commenced seven years after the start of the project. The operator plans to launch the second phase of Snøhvit project: several additional wells are to be drilled at the Askeladd field. However, the project is temporarily suspended at the moment. At the same time, T. Rød, Equinor's Vice President for Project Management, has repeatedly emphasized the importance of this step: “This is the next important step in the development of the Snøhvit project. The Askeladd field will help to maintain stable production and LNG plant operation in Hammerfest up to 2023, and now it is a profitable investment that will help keep jobs in the region.” 11 The Snøhvit project can be considered a successful Arctic project in terms of local community engagement. The people of Hammerfest followed the project development from the very beginning and participated in its implementation. The people of this Arctic region of Norway are now strongly supporting the development of the Snøhvit project primarily due to the employment opportunities as well as the financial benefits from its implementation. For example, after completion of the LNG plant construction, the local authorities introduced property taxes, the total amount of which brought 155 million NOK per year to the regional budget [4, Henderson J., p. 48], which were aimed at the development of the region.

The controlling stake in the Snøhvit project is held by the state through the state-owned companies Equinor (36.8%) and Petoro AS (30%). The rest of the project shares are distributed among foreign partners as follows:

-

• Total E&P Norge AS has a share of 18.4%. The company has been present on the Norwegian continental shelf for over 50 years and also has a stake in the Troll project;

-

• The British company Neptune Energy owns 12% 12;

-

• The German company Wintershall DEA Norge AS holds a 2.8% minority stake in the Snøhvit project.

The main focus in selecting partners for Snøhvit project was not only on technological competencies, but also on strategically important regions as importers of Norwegian natural gas. As the second largest natural gas exporter to Europe 13, Equinor has been able to attract partners from France, the UK and Germany to the Snøhvit project. Thus, the three main European importers of natural gas in Norway are now represented by Total, Neptune, and Wintershall DEA companies. Spain is also the main importer, in particular, of Norwegian liquefied natural gas. In the Spanish port of Cadiz (at the Izar offshore plant in Ferrol), Equinor decided to build a floating liquefaction plant. It was planned to take advantage of the parallel engineering at several shipyards. As a result, the floating barge, which is the centerpiece of the LNG plant, was completely built in Spain and transported as a single module to the pre-built dock on Melkoya Island 14. This approach was expected to provide a number of advantages, such as the possibility of manufacturing individual structures in favorable weather conditions and accelerating the commissioning of capacities. But as a result, construction work in Spain fell behind the main schedule of the Snøhvit project, which led to a shift in the Norwegian offshore work schedule to a less comfortable winter time. Nevertheless, the project was successfully launched despite the increase in overall costs.

The experience of the Snøhvit project implementation shows that, despite the many difficulties associated with the organization of parallel engineering on the shelf, such bilateral cooperation between Norway and Spain is a good example of technological integration on the Arctic shelf. Such agreements, when part of the work is carried out at the southern shipyards of future consumers, should be taken into account by Russian companies when implementing offshore projects in the Russian Arctic. The Snøhvit project was successfully launched and became a production project on the most offshore section of the Arctic shelf with a fully underwater production complex during those years. When comparing Snøhvit with Ormen Lange in terms of recoverable reserves and daily production, it is obvious that Snøhvit is a medium-sized project (Table 1). For example, in 2019, production at Ormen Lange amounted to 12.6 billion m3 of gas, while at Snøhvit — 6 billion m3. In 2020, Ormen Lange produced 12 billion m3 of gas, while Snøhvit produced less than 4 billion m3. From the given data, it can be seen that that Snøhvit is actually half the capacity of Ormen Lange, which in turn is not considered Norway's largest gas project. But, despite the fact that Snøhvit is a small production project, at the initial stages of its implementation it was important that it would become the basis for future activities on the shelf of the Barents Sea. Equi-nor plans to combine the technological capacity of the Snøhvit project with the nearby Goliat oil field, which also has natural gas reserves, and the Johan Castberg field, which is scheduled to start production in 2022 (Fig. 2).

NORWAY BARENTS SEA FIELDS

Fig. 2. Norwegian offshore oil and gas projects in the Barents Sea 15.

Aasta Hansteen project

(practice of phased advancement to the north and linking the project to previously created facilities)

The Norwegian experience demonstrates a successful integrated approach to the development of the Arctic shelf with record-breaking short start-up time for gas projects. Thus, in December 2018, the next Arctic gas project, Aasta Hansteen, was launched, which is also operated by the state-owned company Equinor with a 51% share. In the project, foreign partners are:

Source: Norwegian Petroleum Directorate data.

-

• Wintershall Norge AS with a 24% share, which regards the Aasta Hansteen project as an important part of Wintershell DEA's commitment to supply the European market with natural gas 16;

-

• OMV (Norge) AS (15%) is an Austrian oil company with a presence in Norway. OMV is also a partner in the Wisting field in the Barents Sea (Fig. 2) 17;

-

• ConocoPhillips Skandinavia AS owns 10% in the project. This American oil company has been present on the Norwegian shelf since the discovery of the Ekofisk field in 1969. The company considers its participation in the Aasta Hansteen project as an important step in expanding its competencies in the Arctic.

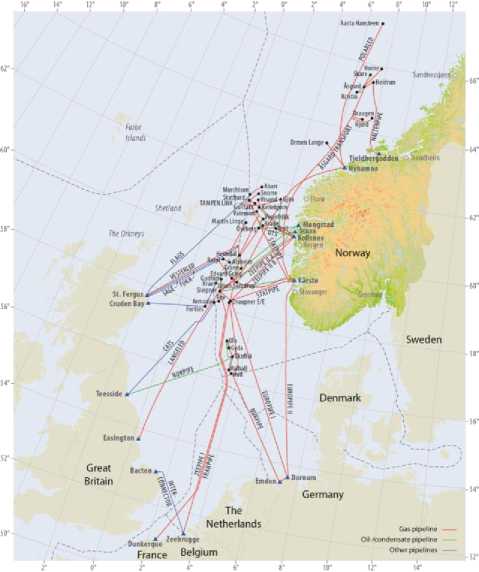

Equinor CEO, A. Upedal, notes: “Aasta Hansteen is a very complex project and a big cha l-lenge that requires new technological steps that we must take together with our partners Wintershall, OMV and ConocoPhillips, as well as our suppliers.” 18 Indeed, Aasta Hansteen is currently the deepest offshore development project in the Arctic Circle 19. Gas is transported through the Polarled pipeline, which runs from the field to the Nyhamna processing plant. Thus, Equinor intends to combine technologically all new northern fields of the western shelf with the Ormen Lange capacities and a system of gas pipelines to continental Europe and Great Britain (Fig. 3). The Aasta Hansteen project was launched at the end of 2018, as production at Ormen Lange was projected to reach its plateau by then. The project operator, Equinor, expects Aasta Hansteen to supply at least 6–7.5 billion m3 of gas per year [3]. It is interesting to note that despite the long experience of the Norwegian oil and gas industry on the Arctic shelf, the design and construction of the SPAR platform for the Aasta Hansteen project was carried out at the South Korean shipyards (as for the Goliat project). Today, the Aasta Hansteen platform is the world's largest offshore SPAR platform.

Fig. 3. Norwegian offshore gas and gas-condensate development projects on the Barents Sea shelf 20.

Norwegian experience in the implementation of gas projects on the Arctic shelf

Analyzing the successful practices of oil and gas companies in the development of gas fields on the Norwegian shelf, a number of interesting solutions can be identified. For example, it is known that the Ormen Lange and Aasta Hansteen fields were discovered at the same time, in 1997. But that year, Equinor decided to develop the Ormen Lange field first. At the same time, construction of the onshore gas terminal Nyhamna began. The decision to transfer operator functions to Shell in the second phase of the project allowed Equinor to focus on developing the technologically more complex Aasta Hansteen project. When the Aasta Hansteen plan was approved by the government in 2013, it was decided in 2013 to proceed with the third phase of Ormen Lange, which included expanding the Nyhamna plant and increasing its receiving capacity.

Thus, it is possible to trace the strategy of the Norwegian national oil companies on the Arctic shelf in the implementation of gas projects. Initially, Equinor, as a project operator, takes most of the risks, and when production at the fields reaches a plateau, transfers some of the functions to foreign partners, “moving further to north”, where, due to high risks, foreign participants are not ready to work in the first stages. Indeed, the implementation of such complex multi-stage projects in the Arctic is impossible without a “multilateral and even multi-country approach” [6, Pilyasov A.N., Putilova E.S., p. 24] and the participation of a number of partners at all stages.

Moreover, it is not uncommon for Arctic offshore projects to be temporarily suspended for climatic, technological and financial reasons. For example, in May 2020, Equinor shut down the

-

20 Source: Equinor data.

LNG plant in Hammerfest for two weeks due to a drop in gas demand 21. On September 28, 2020, there was a serious fire at the LNG plant 22. The inspection found that the scope of repair work at the Hammerfest plant required a shutdown of the LNG plant for at least 12 months. According to the director of the LNG plant A. Sandvik, “Safety is our top priority and we will not start up the plant until we are sure that it is completely safe.” 23 Equinor plans to use the downtime period for other works on maintenance, which were planned for 2021. At the same time, the Snøhvit example indicates another important component of the project implementation: Equinor often takes on most of the technological risks and further enriches its Arctic competencies with the acquired experience. For example, the unique carbon dioxide storage technology that the company developed for the Snøhvit project is now being adopted, scaled up and used by other offshore companies.

Conclusion

The development of gas and gas condensate fields in high latitudes is a complex task and, of course, a challenge for the global gas industry. An important feature of offshore gas projects is their technical and technological uniqueness at each stage of development: exploration, development, design and construction, operation and transportation. Therefore, a prerequisite for their implementation is close technological cooperation with partner companies. Thus, the experience of Norway shows that long-term and sustainable activities on the shelf are possible with the participation of a number of companies in the project, some of which are foreign participants with relevant competencies. Good practices such as technological integration with future sales markets and inviting key partners at different stages of project implementation make the development of offshore fields in the Arctic more resilient to risks in the long term.

When implementing projects on the Arctic shelf, it is necessary to take into account the fact that their investment has been carried out continuously for decades, since “Arctic shelf projects are classic long-term enterprises” [7, Yergin D., p. 48]. Another feature of projects on the Arctic shelf is the duration of operation (at least 40–50 years), which requires operators and participating companies to think about alternative ways of developing associated infrastructure at the earliest stages of an offshore project (example of the Nyhamna terminal).

Speaking about the prospects for the gas industrial development of the country's Arctic shelf, it should be noted that the size of the fields, huge reserves of resources and even more severe natural and climatic conditions will add a new level of complexity for the domestic oil and gas industry. The implementation of such projects will require some degree of technological integra- tion and careful selection of participants in the partnership. It is important to study the best practices of oil and gas companies for the development of Arctic deposits on the shelf, when most of the technologies were created specifically for each project. The analysis made it possible to identify a number of successful practices of foreign oil and gas companies in the implementation of offshore gas projects in the Arctic, which can be useful for Russia. Namely, such successful solutions as the phased development of neighboring fields, expanding activities and linking existing capacities with new projects, changing the project operator at a time when the risks for the invited company are significantly reduced, parallel design in different geographic locations, can be applied by Russian oil and gas companies when planning long-term activities on the Arctic shelf.

Список литературы Best Practices of Oil and Gas Companies to Develop Gas Fields on the Arctic Shelf

- Brutschin E., Schubert S. Icy Waters, Hot Tempers, and High Stakes: Geopolitics in the Arctic. Energy Research & Social Science, 2016, no. 16, pp. 147–159. DOI: https://doi.org/10.1016/j.erss.2016.03.020

- AMAP Assessment. Arctic Monitoring and Assessment Programme. Oil and Gas Activities in the Arc-tic — Effects and Potential Effects. Oslo, 2007, vol. 1, 40 p.

- Hall M. Norwegian Gas Exports: Assessment of Resources and Supply 2035. Oxford Institute for En-ergy Studies Paper: NG 127, 2018, 27 p. DOI: https://doi.org/10.26889/9781784671037

- Henderson J., Loe J. The Prospects and Challenges for Arctic Oil Development. Oxford Institute for Energy Studies. Working Paper, 2014, 60 p.

- Jakobsson K.H. A History of Exploration Offshore Norway: the Barents Sea. Geology Society. London. Special Publications, 2018, no. 465 (1), pp. 219–241. DOI: http://dx.doi.org/10.1144/SP465.18

- Pilyasov A.N., Putilova E.S. New Projects for the Development of the Russian Arctic: Space Matters! Arktika i Sever [Arctic and North], 2020, no. 38, pp. 20–42. DOI: 10.37482/issn2221-2698.2020.38.21.

- Yergin D. The Quest: Energy, Security and the Remaking of the Modern World. New York, Penguin Books, 2011, 804 p.

- Morgunova M. Why is Exploitation of Arctic Offshore Oil and Natural Gas Resources Ongoing? A Multi-Level Perspective on the Cases of Norway and Russia. The Polar Journal, 2020, no. 10:1, pp. 64–81. DOI: 10.1080/2154896X.2020.1757823