Budget crisis of the regions in 2013 - 2015: a threat to Russia's security

Автор: Ilyin Vladimir Aleksandrovich, Povarova Anna Ivanovna

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Development strategy

Статья в выпуске: 6 (24) т.5, 2012 года.

Бесплатный доступ

The article continues the series of publications on the issues of budgetary sufficiency of the territories. Judging by the main budget parameters, the 2013 - 2015 period will be a serious challenge to the strength of sub-national budget systems. In the conditions of an acute debt crisis, Russian regions have to take up the bulk of public obligations of the Russian Federation concerning the implementation of the President’s election programmes. Of special concern is the reduction of federal financial support, which creates additional risks for the territorial budgets burdened with loans. However, despite the gravity of the situation, there still exist the reserves for implementing the President’s assignments and stabilizing the country’s budgetary system. The main of them concern the necessity of conducting the state policy in the sphere of business capital exports.

Budgets of the subjects of the russian federation, federal budget, national debt, implementation of the decrees of the president of the russian federation, export of capital

Короткий адрес: https://sciup.org/147223414

IDR: 147223414 | УДК: 336.144.1

Текст научной статьи Budget crisis of the regions in 2013 - 2015: a threat to Russia's security

On 7 May 2012, immediately after the inauguration, Vladimir V. Putin signed 13 decrees, which determined the main guidelines of Russia’s development in the nearest and medium-term perspective: the longterm state economic policy; the activities on implementing the social policy; the improvement of policy in health care; the measures for implementing the state policy in education and science; the provision of citizens with affordable housing and enhancement of the quality of housing and utilities services. It was particularly stressed that all the decrees were signed by Putin in the framework of his election programme.

The execution of the President’s decrees will require about 5 trillion rubles, including the decrees on raising the salaries of public sector employees – 2.6 trillion rubles, out of which 1.5 trillion rubles should be provided by the subjects of the Russian Federation, mainly from their own revenues. Additional financial support, envisaged in the federal budget for these purposes, does not compensate even for the one-third of the territorial budgets’ expenditures (fig. 1) .

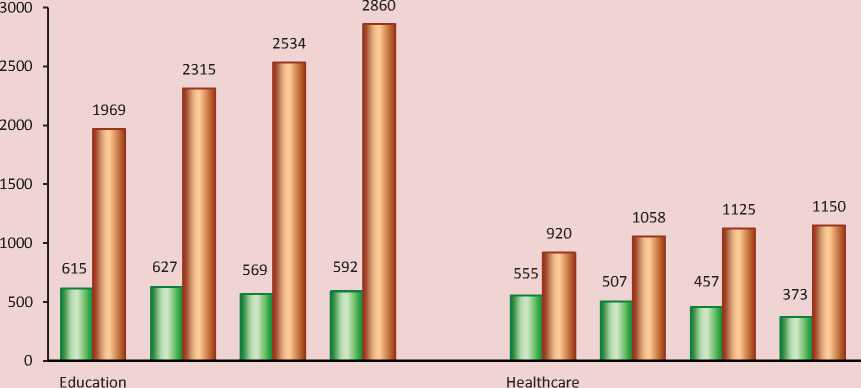

The data on the education and health expenditures in the country’s consolidated budget for 2013 – 2015 prove that the greater share of social obligations funding is shifted to the subjects of the Russian Federation (fig. 2).

As you can see, the forecast for the consolidated budget envisages the reduction of the federal budget’s expenses and the increase in the regional budget expenditures on the main funding streams in the social sphere.

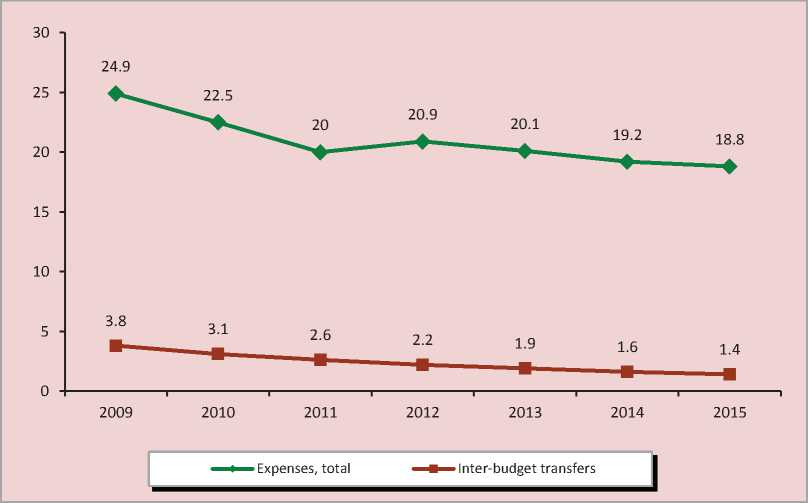

In general, government expenditures of the federal budget will reduce to 19% of GDP in 2015, compared with 25% of GDP at the peak of the crisis in 2009, including inter-budget transfers to the RF subjects – up to 1.4% of GDP against 3.8%, respectively (fig. 3) .

According to A. Belousov, the Head of the RF Ministry of Economic Development, “on such a scale, fiscal consolidation is carried out only by the countries, which are experiencing significant financial difficulties or are willing to avoid them” 2 .

Figure 1. Funding sources allocated for increasing the salaries of public sector employees, billion rubles

□ Federal budget □ Budgets of the RF subjects □ Financial aid from the federal budget

Source: data of the RF Finance Ministry.

Figure 2. Forecast education and health care expenditures of the RF consolidated budget* in 2012 – 2015, billion rubles

2012 2013 2014 2015 2012 2013 2014 2015

□ Federal budget о Budgets of the RF subjects

* Without the expenses of state extra-budgetary funds. Sources: data of the RF Accounts Chamber.

Figure 3. Dynamics of the federal budget expenditures in 2009 – 2015, % to GDP

Sources: data of the RF Finance Ministry; the RF Ministry of Economic Development; ISEDT RAS calculations.

The forecast parameters of the budgets of the RF subjects show a growth in tax and nontax revenues, however, the need for the implementation of the presidential decrees will result in an almost 4-fold increase of the deficit already in 2013 (tab. 1) .

The problems of sub-federal budgets are aggravated by a significant debt load, which has exceeded 20% of the volume of own revenues since 2009 (fig. 4) 3 .

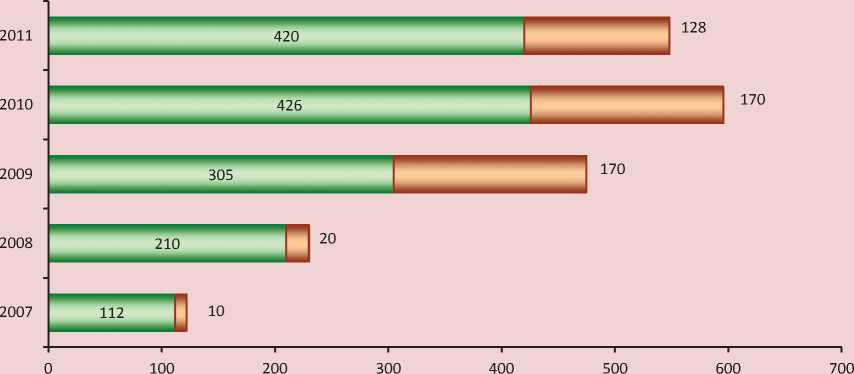

The main reason for the increase of the debt load of the overwhelming majority of the RF subjects was the fall of the profit tax, which led to the deficit of territorial budgets. In this situation, the strict fulfillment of undertaken social commitments required the involvement of external funding sources in the form of commercial bank loans and loans from the federal budget. The borrowings of the RF subjects have grown almost twice by the end

Table 1. Main parameters of consolidated budgets of the RF subjects, billion rubles

|

Parameters |

2012 |

2013 |

2014 |

2015 |

2015 to 2012, % |

|

Revenues, total |

8074.3 |

9061.7 |

9839.1 |

10958.3 |

135.7 |

|

Tax and non-tax revenues |

6716.5 |

7764.8 |

8654.4 |

9789.6 |

145.8 |

|

Share in the revenues, % |

83.2 |

85.7 |

88.0 |

89.3 |

+6.1 p.p. |

|

Inter-budget transfers |

1357.8 |

1296.9 |

1184.7 |

1168.7 |

86.1 |

|

Share in the revenues, % |

16.8 |

14.3 |

12.0 |

10.7 |

-6.1 p.p. |

|

Expenditures |

8106.8 |

9182.5 |

9925.1 |

10958.3 |

135.2 |

|

Deficit |

32.5 |

120.8 |

86.0 |

0 |

|

|

Sources: data of RF Accounts Chamber; ISEDT RAS calculations |

|||||

Sources: data of the RF Finance Ministry; the Treasury of Russia; ISEDT RAS calculations.

Figure 4. Dynamics of the public debt of the RF subjects in 2008 – 2012.

I----1 Billion rubles —•— In % to own budget revenues

of 2008 in comparison with 2007, and in 2011 – 4.5-fold (fig. 5) .

According to our estimates, the state debt of the RF subjects increased to 30% in the volume of own revenues in January – September 2012 against 24% at the beginning of the year. Besides, the number of regions with a debt load over 50% increased from 15 to 25 in this period. Therefore, in the coming years, these regions will have to spend more than half of their own revenues on the discharge of the state debt.

The critical level of debt load in the Vologda (91.3%), Saratov (96.2%), Penza (93.6%) and Kostroma (108.4%) oblasts, the republics of Mordovia (181.3%) and Tatarstan (103.4%) challenges the implementation of V. Putin’s election programmes without substantial financial support from the federal centre.

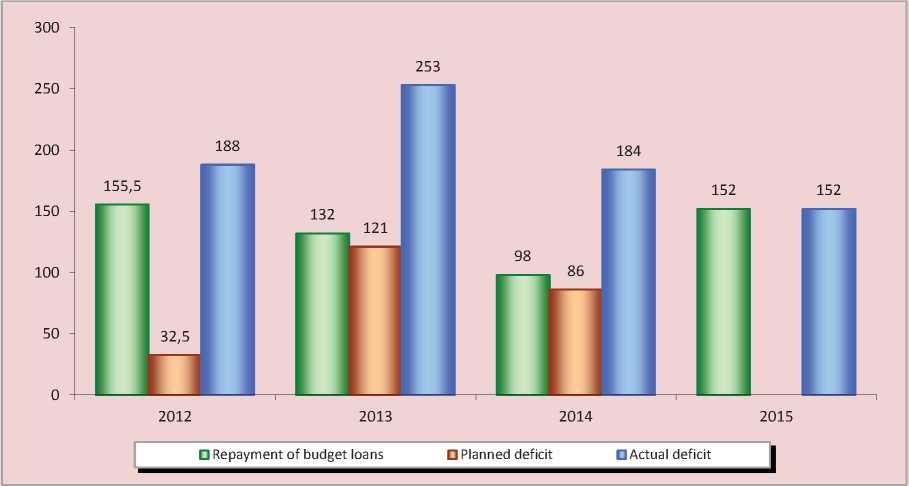

According to the RF Finance Ministry’s forecasts, the consolidated regional budgets are to be balanced by the beginning of 2016. Actually, the achievement of the deficit-free budget is unlikely. So, according to our calculations, the return of the loans, received only from the federal budget in 2008 – 2011, will require the use of the regions’ own revenue sources amounting to 400 billion rubles4. As a result, the real deficit of sub-federal budgets will amount to 152 billion rubles in 2015 (fig. 6) , which yet again proves the impossibility of implementing the RF President’s social initiatives to the fullest. Meanwhile the 2013 – 2015 federal budget envisages the reduction of inter-budget transfers by nearly 200 billion rubles, which is comparable to the actual volume of budget deficit in the regions.

Figure 5. Dynamics of credit borrowings of the RF subjects in 2007 – 2011, billion rubles

□ Loans of commercial banks □ Loans from the federal budget

Source: data of the Treasury of Russia.

Figure 6. Forecast of the actual budget deficit in the RF subjects in 2012 – 2015, billion rubles

Source: ISEDT RAS calculations based on the RF Finance Ministry data.

The forecasts of the RF Ministry of Economic Development concerning the regions’ budget deficit are more pessimistic: for 2013 – 2015, the deficit of the territorial budgets will increase 7-fold – up to 330 billion rubles in 2015 vs 50 billion rubles in 2012, and it will be about 2 trillion rubles in 20185, which exceeds 2-fold the planned expenses for 2018 for the implementation of the RF state programme “Development of education for 2013 – 2020”.

The leading Russian economic publicist A.N. Privalov concludes that “...no more that a dozen of the most powerful regions will be able to make the promised contribution to the social sphere, the others will have to make a choice: whether to postpone the construction of roads, or the heating season, or the increase in the salaries of doctors or teachers” 6 .

In order to fulfill the President’s election promises, the regions will have to increase their debt. This is proved, in particular, by the forecast parameters of the regional budgets in the majority of constituent entities in the North-West of the Russian Federation, as well as the Lipetsk and Chelyabinsk oblasts (tab. 2) .

The debt crisis of the sub-national budgets will become the main factor causing the investment costs reduction, the weakening of support to domestic demand and the ability to confront new challenges in the budget sphere.

Table 2. Forecast of the state debt of the RF subjects in 2013 – 2015, billion rubles

|

Subject |

2012* |

2013 |

2014 |

2015 |

2015 to 2012, fold |

|

Republic of Kareila |

8.5 |

13.5 |

15.5 |

17.1 |

+2.0 |

|

Republic of Komi |

7.6 |

16.9 |

22.7 |

27.9 |

+3.7 |

|

Arkhangelsk Oblast |

15.9 |

26.2 |

33.0 |

40.4 |

+2.5 |

|

Kaliningrad Oblast |

12.0 |

16.2 |

17.7 |

19.7 |

+1.6 |

|

Leningrad Oblast |

4.1 |

10.8 |

14.1 |

17.5 |

+4.3 |

|

Murmansk Oblast |

4.0 |

16.5 |

24.9 |

34.5 |

+8.6 |

|

Novgorod Oblast |

9.0 |

10.5 |

10.0 |

9.2 |

+1.0 |

|

Pskov Oblast |

4.6 |

9.6 |

12.3 |

15.2 |

+3.3 |

|

Saint Petersburg |

6.9 |

43.6 |

65.6 |

84.6 |

+12.3 |

|

Vologda Oblast |

25.6 |

28.0 |

23.9 |

17.2 |

-1.5 |

|

Lipetsk Oblast |

9.3 |

14.3 |

17.0 |

19.6 |

+2.1 |

|

Chelyabinsk Oblast |

14.2 |

28.0 |

26.6 |

25.6 |

+1.8 |

|

* As of 1 November 2012 Sources: RF Finance Ministry; Laws (draft laws) of the RF subjects on the regional budgets for 2013 and the planned period of 2014 – 2015. |

|||||

Provision of social security has become an urgent problem in Russian society. The difficulties in solving social issues are usually explained by the limited revenues of the state budget. At that, the responsibility for the execution and financing of social obligations is being shifted more and more to the regional level without an adequate redistribution of revenue sources.

Meanwhile, Russian authorities do not fully use the existing opportunities to increase budget revenues, primarily by limiting the outflow of capital. The country lacks the state system of regulating the export of business capital, the state policy in the sphere of exports of capital hasn’t been formed and even the very concept of this policy doesn’t exist.

As is known, in recent years, the large amounts of Russian capital have been accumulating abroad, when the economy is in the need of internal investments for the implementation of its structural reconstruction. It became possible in many aspects when Russian authorities lifted the restrictions on cross-border capital movement. The transfers of funds by natural persons from Russia increased 3.5-fold, up to 44 billion dollars in

2011 vs 12.5 billion dollars in 2005. The net outflow of capital over this period has increased from 0.1 billion dollars to 80.5 billion dollars.

Academician D.S. Lvov criticized the abolition of restrictions on foreign exchange regulation as follows: “Pushed by the rightwing liberals, the law on the liberalization of foreign economic activity is not only scientifically ungrounded, but also extremely dangerous for the country according to its socio-economic consequences... The very fact is surprising that at the adoption of a new currency law, the interests of a dozen of the richest oligarchs outweighed the interests of the multi-million population of Russia” 8 .

Unfortunately, the scale of capital outflow from the Russian Federation continued to expand in 2012.

According to the data of the Bank of Russia, the net export of capital was 58 billion dollars for 9 months of 2012; this figure exceeds that of the similar period of 2011 by 12.4 billion dollars (tab. 3) . This amount 35 times exceeds the revenues of an average regional budget of the Russian Federation.

Table 3. Net export of the capital and cross-border transactions of individuals, billion dollars

|

Indicators |

January – September 2011 |

January – September 2012 |

Changes (+, -) |

|

Net export of the capital, total |

45.5 |

57.9 |

+12.4 |

|

- by banks |

17.4 |

5.3 |

-12.1 |

|

- by other sectors |

28.1 |

52.6 |

+24.5 |

|

Transfers of funds by individuals from the RF, total |

31.8 |

34.6 |

+2.8 |

|

- to far abroad states |

20.1 |

20.9 |

+0.8 |

|

- to CIS states |

11.7 |

13.7 |

+2.0 |

|

Inflows for the benefit of individuals into the RF, total |

9.1 |

10.2 |

+1.1 |

|

- from far abroad states |

7.2 |

7.9 |

+0.7 |

|

- from CIS states |

1.9 |

2.3 |

+0.4 |

|

Net transfers of funds by individuals from the RF, total |

22.7 |

24.4 |

+1.7 |

|

Sources: data of the Bank of Russia; ISEDT RAS calculations. |

Table 4. Shady transactions on the export of capital from Russia

|

Indicators |

January – September 2011 |

January – September 2012 |

|

Shady transactions, billion dollars |

23.0 |

25.8 |

|

In % to the net capital outflow |

50.5 |

44.6 |

|

Pure errors and omissions |

4.2 |

12.9 |

|

In % to the net capital outflow |

9.2 |

22.3 |

|

Sources: data of the Bank of Russia; ISEDT RAS calculations. |

||

The overwhelming majority of the money is exported not by banks, but by enterprises of the real sector, the owners of which, trying to minimize taxation, are registered, as a rule, in offshore territories. If in January – September 2012, the banks withdrew 5.3 billion dollars out of the country, the enterprises withdrew 52.6 billion dollars.

For the 9 months of 2012, the individuals have transferred 35 billion dollars abroad, while the inflows in Russia have accounted for only 10 billion dollars, which is 3.4 times less. Accordingly, the volume of transfers to the CIS countries has amounted to almost 14 billion dollars. According to our calculations, income tax amounting to 1.8 billion dollars and insurance fees – 4.1 billion dollars (about 180 billion rubles) should be paid out of the transferred amount of money. Unfortunately, the information on the taxes paid out of the transferred funds, is not published officially.

The export of private national capital is carried out by opening the time deposits in foreign banks, purchasing the low-yielding securities of foreign issuers and real estate abroad. At that, the certain forms and methods of capital export can emerge that may violate the interests of the national economy development and inflict a destabilizing effect on it. Such forms include: non repayment of export revenues; concluding fictitious contracts on the delivery of production; carrying out the fictitious transactions with securities; withdrawal of assets to offshore zones, etc. Banking statistics consider these forms as shady transactions.

The total amount of funds, that hadn’t been received due to the shady transactions, have increased by 2.8 billion dollars for the 9 months of 2012 compared to the same period of 2011, and it amounted to 25.8 billion dollars or 45% of the volume of the exported capital (tab. 4) .

Besides, the Bank of Russia carries out the statistics of unrecognized operations (pure errors and omissions), the number of which is increasing as well. If for the 9 months of 2011, this item of Russia’s balance of payments amounted to 4.2 billion dollars, then by the results of the 9 months of 2012 it was 13 billion dollars or more than 22% of the exported funds.

These facts indicate that, despite the liberalization of capital export from the Russian Federation, its exporters carry out transactions with the violation of accepted standards, transferring abroad the so-called “shadow” or unrecorded capital.

As a rule, the export of capital, primarily by the large exporters, is carried out using the offshore schemes in order to minimize taxation. Our research and the analysis of works of Russian scientists studying the issues of offshore companies revealed the following most common schemes.

-

1. Transfer of ownership rights for a large Russian enterprise to a company, registered in offshore territories. This provides the opportunity to leave a part of the taxes at the disposal of the owners, the information about which is not disclosed.

-

2. Understatement of contract prices as compared with the world prices. According to the RF Accounts Chamber data, in 2008 over 80% of coal (72 million tons) produced in the Kemerovo and Rostov oblasts were exported under the contracts concluded with the contracting parties registered in offshore zones. The level of contract prices for coal was about 30 – 54% lower than the level of sale prices for coal in the world markets. The estimated revenue, formed in offshore zones, which is not subject to Russian taxation, amounted to 3.6 billion dollars, or about 105 billion rubles.9 Conditional profit tax for this revenue is estimated at 25.2 billion rubles, including in the federal budget – 6.8 billion rubles, in the budgets of the Kemerovo and Rostov oblasts – 18.4 billion rubles or more than 35% of the profit tax actually received by the consolidated budgets of these regions10.

-

3. Tolling schemes11. As Doctor N.A. Krichevskiy points out, “the tolling schemes are used by almost all the factories of the Russian aluminum monopolist O. Deripaska” (UC RUSAL). The application of this scheme allows the company to retain up to 90% of the profit. In 2008 the RF Accounts Chamber assessed the tolling losses of the budget for profit tax only at 11.5 billion rubles. And there also exist other taxes and levies”12.

-

4. Insurance schemes. A holding company creates an offshore insurance company to insure the risks, according to which the insurance event won’t happen, and transfers some of the profits for insurance premiums, and then these funds in the form of loans are transferred to the main holding company again13.

-

5. Unrecorded export of capital, in particular, the investments in foreign financial and non-financial assets, upon the purchasing of which the exporters cease to pay taxes to the Treasury of Russia or pay the token amounts14.

The use of such schemes indicates the purposeful use of entrepreneurial potential in the interests of the private capital, which goes against the national interests.

So, according to the Boston Consulting Group15, in 2011 Russia moved from the 11th to the 4th position in the world according to the number of dollar millionaires. While the number of oligarchs, whose fortune is estimated at 100 million dollars, decreased in the West, in Russia it increased from 607 in 2010 to 686 in 2011.

The real incomes of the population grew only by 1% in 2011. The narrow circle of superrich citizens accounts for a total of 500 billion dollars and all the 143 million citizens of Russia – for 800 billion dollars.

According to the estimates of N. Shaxson, an English economist and famous researcher of the offshore zones, there are about 60 secret jurisdictions in the world, and through these tax havens more than half of all the banking assets are transferred and more than half of the world trade is done. In his book “Treasure islands: tax havens and the men who stole the world” N. Shaxson makes a conclusion that the main cause of the global economic crisis lies in a network of offshore companies, spreading throughout the world. The author assesses the losses of Russian budget at about 200 billion dollars of taxes16.

Russian researchers come to similar conclusions. A team of authors, including such prominent scientists as RAS Academician R.I. Nigmatulin, Doctor of Economics N.A. Krichevskiy, Doctor of Economics V.A. Kashin, etc., in their work “Russia’s Modernization Programme” point out that “offshores, i.e. the transfer of Russia’s economic assets under foreign jurisdiction, pose a threat to Russia’s national security. Even according to the official data, at present up to 50% of the capital of all the largest RF companies are directly owned by foreign firms. In fact, there are Russian owners behind the majority of these foreign companies. And to what degree are these owners “Russian”? Many of them long ago got a residence permit in some Western country, or were even granted the citizenship of that country. They still preserve the citizenship of the Russian Federation. And now imagine that from 1 January 2013, after the election of the new President of Russia, they would all together renounce their Russian citizenship.

And the interests of the owners of Rosstal and Roschugun, Rosnickel and Rosaluminium and all the rest of the “Ross’es” would be protected against Russian government with the sudden support from the presidents of the United States, France, Germany… And just one more thing. Russian oligarchs’ children have long been living abroad, they studied in these countries, they have absorbed their culture and, obviously, there will create their families there. In other words, Russia is nothing to them. So, here you have a clear and obvious fact: after 5 – 15 years, the control over Russia’s economy would pass into the hands of its open enemies (at best – its haters)17”.

The problem of capital flight from Russia with the use of low-tax jurisdictions requires establishing the system of state regulation and regulatory restrictions of these processes, which have an increasing negative impact on the national development.

I.G. Kalabekov in the book “Russian reforms in figures and facts”18 writes: “In 2010, our deputies adopted a record-breaking number of laws – 452. How did these laws influence the development of the economy... the quality of our lives? And where is just one law consisting of only two points, introducing a complete ban on the export of our raw materials to offshore zones and the sale of raw materials at prices below the world level?”

Speaking 19 December 2011 at the session of the Governmental Commission on the Development of Electric Power Industry, V. Putin declared the withdrawal of national economy out of an offshore shadow as a priority issue: “If we want to create a favourable investment climate in the country, then the possibility of offshore schemes, should be, no doubt, eliminated. The withdrawal of financial resources from the industry turnover through dummy firms is unacceptable and it is vital to put an end to the offshore legacy of the uncontrolled privatization era, otherwise a good business climate in the country and its credibility are out of the question. The withdrawal of national economy, its strategic branches out of the offshore shadows is our priority for the near future”.

Will Russian authorities be able to reveal the large number of illegal methods of tax evasion, first of all by the largest owners? If they can, then, according to our approximate calculations, the budget system of the Russian Federation will regain the annual losses of around 4 – 6 trillion rubles19. It will allow solving the problem of the deficit of not only federal, but also regional budgets and the budget of the Pension Fund, as well as the lack of funds for infrastructure development.

Список литературы Budget crisis of the regions in 2013 - 2015: a threat to Russia's security

- Speech by the Deputy Minister of Economic Development A. Klepach at the seminar of the heads of legislative power bodies of the RF subjects on 20 November 2012. Official website of the information group Interfax. Available at: http://www.interfax.ru/ifx.asp?id=9005a80a-bbeb-224e-8538-dba879d35cea

- Gazeta.ru. Available at: http://www.gazeta.ru/financial/2012/09/20/4781377.shtml

- Demin V. A. Offshores -a real threat to Russia’s economic security. Official website of the expert-analytical centre Modernization. Available at: http://www.modern-rf.ru/

- Ivanter A. Accounting crossbow. Expert. 2012. No. 39. P. 25.

- Ilyin V.A., Povarova A.I., Sychev M.F. The influence of the metallurgical corporation owners’ interests on the socio-economic development: preprint. Vologda: ISEDT RAS, 2012.

- Nicholas Shaxson’s interview in the newspaper Arguments and Facts Arguments and Facts. 2012. 18 July. Available at: http://www.aif.ru/money/article/53548

- Kalabekov I.G. Russian reforms in figures and facts. Available at: http://kaig.ru/reform.pdf

- Katasonov V.A. Russia on the threshold of WTO. Soviet Russia. 2012. No. 3.

- Krichevskiy N.A. Corruption through the return. Moskovsky Komsomolets. 2011. No. 25715. Available at: http://www.mk.ru/politics

- Lvov D. The moral economy. Svobodnaya mysl -XXI. 2004. No. 9.

- Report on the research work “Russia’s Modernization Programme”. Moscow, 2011. Official website of the expert-analytical centre Modernization. Available at: http://www.modern-rf.ru/

- Report on the results of control activity “Examination of customs control organizations while moving coal and coal products across the customs border of the Russian Federation, the formation of contract prices, correctness of calculation, completeness and timeliness of payment of customs payments in 2008”. Official website of the Accounts Chamber of the Russian Federation. Available at: http://www.ach.gov.ru/ru

- Official website of the Boston Consulting Group. Available at: http://www.bcg.ru/

- Privalov A. About an ostrich budget. Expert. 2012. No. 47. P. 14.

- Reznikova A. “Putin’s plan” devastates the regions. RBC daily. Available at: http://www.rbcdaily.ru/2012/10/17/focus/562949984941455