Budget parameters of metropolises and their impact on the economic development of regions

Автор: Levina V.V.

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Public finance

Статья в выпуске: 4 т.18, 2025 года.

Бесплатный доступ

Currently, metropolises are making a great contribution to the development of regions. It is assumed that the development of urban finance is a prerequisite for accelerating regional development. The study focuses on such tasks as comparing the budget parameters of metropolises, assessing the interrelationships of transferring tax regulations beyond the mandatory minimum to city budgets, receiving large amounts of targeted transfers and the level of economic development of regions. The budget indicators of 14 Russian million-plus cities are analyzed. It is revealed that the level of development of the region, which was assessed based on the indicators of the gross regional product and ratings of scientific and technological development, has no stable relationship with the structure of tax revenues of the administrative center. At the same time, there were practically no significant changes in this area over the five-year period. The receipt of intergovernmental transfers is also largely determined by the established patterns of interaction between authorities at various levels, rather than economic expediency. In this case, the “rut effect” is clearly manifested, when the established practice is repeated throughout the period under consideration. As a result, it was concluded that large cities do not receive sufficient budgetary incentives to promote the economic, scientific and technological development of the regions, the potential for budgetary interaction with these cities is underutilized, and it is affected by the “rut effect”. It seems advisable in future studies to pay attention to the formation of recommendations to federal authorities and authorities of constituent entities of the Russian Federation on improving budgetary cooperation with local governments of cities that are drivers of innovative development of territories.

Territorial development, city budget, tax revenues, incentives, administrative center of the region, regions

Короткий адрес: https://sciup.org/147251831

IDR: 147251831 | УДК: 332.146, 336.5 | DOI: 10.15838/esc.2025.4.100.5

Текст научной статьи Budget parameters of metropolises and their impact on the economic development of regions

Urban development is a prerequisite for the development of the regions as a whole. A large city, in fact, forms an innovative environment, has great opportunities for generating tax revenues, and is developing faster than other territories. At the same time, in Russian practice, there is a situation when large cities (with the exception of those with the status of cities of federal significance) are municipalities, namely urban okrugs or urban okrugs with intra-urban divisions. Consequently, budget revenues are generated in such a way that only a small part of the tax revenues generated by the urban economy goes directly to the city budget. As a result, the budgets of even the largest innovatively developing cities are characterized by low tax revenues and dependence on intergovernmental transfers, which reduces the interest of authorities in expanding the tax base as a result of more efficient and innovative use of the resources available in the territory.

Due to the instability of recent years, these problems have remained unresolved, and the potential for improving budget policy in large cities has not been fully realized.

The authorities of RF constituent entities have certain opportunities in redistributing tax revenues and providing intergovernmental transfers to municipalities, including large cities. In our opinion, the level of centralization of budget revenues in the region and the incentive system created for local governments within the framework of budget policy are important and influence the development of territories.

Theoretically, our research is based on two scientific directions: concepts of territorial development, in particular, studying the development processes of large cities and agglomerations, and the theoretical foundations of public finance.

In modern conditions, the role of large cities continues to grow, and the innovative development of territories is associated to a great extent with socio-economic processes in large cities (Goffe, 2014). The heterogeneity of the development of territories is influenced by both migration processes and the more active formation of horizontal ties in them, the entrepreneurial community, and professional communities in the field of creative industries, which forms the basis for the innovative development of the respective cities (Mellander, Florida, 2008).

In the context of our study, the provisions of the center-peripheral paradigm (Friedmann, 1966) are relevant, based on which it is possible to achieve better results in the development of regions by concentrating resources in a large central city (Fujita et al., 2001; Fujita, Thisse, 2013), and then create conditions for the spread of innovations across the territory of a region as a whole, which happens in accordance with certain patterns. Studying these processes in the context of Russian realities indicates the predominant role of the two metropolitan agglomerations and the need to develop other regional centers, which, of course, requires efforts on the part of regional and federal authorities (Kuznetsova, 2019). Large cities have potential for development. As early as 2010, the share of people employed in large cities (Omsk, Samara, Novosibirsk, Volgograd) exceeded two-thirds of the total number of people employed in the region (Zubarevich, 2010), and the share of investments in large cities reached from 40 to 80%, and this indicator is constantly increasing (Leksin, Porfiryev, 2017). Thus, the importance of large cities for the development of regions as a whole has been considered in both Russian and foreign studies and is beyond doubt.

Scientific and technological development of the regions as one of the important and relevant areas of economic development in general has been widely studied by Russian scientists in recent years. In particular, much attention is paid to the issues of an adequate assessment of the level of development of territories, the choice of indicators for assessment, and the methodology for compiling appropriate ratings (Kuznetsova, 2023). There is an opinion about the need for a differentiated approach to the implementation of scientific and technological policy, depending on the characteristics of the region. In particular, its success is related to the extent to which the events are adequate to the type of region and the degree of its development that has already been achieved (Byvshev et al., 2024).

However, the interrelationships between the budget parameters of the administrative center of the region and the prospects for its economic development have not yet received enough attention.

To a certain extent, the ideas of decentralization as a prerequisite for regional development follow from Oates’ theorem, according to which decentralized decision-making on the provision of regional public services is more effective than centralized, provided government costs are reduced (Oates, 1999). A similar conclusion has been drawn in a number of Russian studies on the impact of decentralization on the effectiveness of fiscal and economic policy (Yushkov et al., 2017; Pechenskaya-Polishchuk, 2021). Nevertheless, the increasing complexity of intergovernmental relations and more active financing of the municipal level of government does not always lead to the formation of sustainable incentives for development (Wildavsky, Caiden, 2004).

The emphasis in modern budget policy on studying the finances of large cities and intergovernmental relations directly with them follows from the concept of “Hourglass Federalism” formulated by Courchene (Courchene, 2004). According to this theory, it is not the regions that become the “narrowed center” of the hourglass that are more important for territorial development, but large cities that are growth points in terms of the country’s innovative development, due to the quality of human capital, the prerequisites created by the developed social sphere and education. A similar position is held by T. Herrschel, who notes that the effective realization of the potential of large cities requires active participation of city authorities in spatial management (Herrschel, 2014). However, in Russian practice, more attention has traditionally been paid to budget interaction between federal and regional levels of government, and municipalities, regardless of their scale and innovative capabilities, are considered as a less significant level of the budget system. At the same time, the alignment of regional and municipal interests is an obvious prerequisite for territorial development (Levina, 2019).

The state’s attention to large cities usually manifests itself as a desire “to increase its influence in the economy, in particular in the processes of urbanization; and the objects of its regulation are agglomerations as municipal clusters, losing their independence, hoping to receive certain preferences from the state in return” (Shvetsov, 2023), and budget relations with them are being built in such a way that the tasks of financial support for higher-level budgets are being solved to a greater extent, which manifests itself as an increase in the centralization of budget revenues (Pechenskaya-Polishchuk, 2021).

Russian scientists have studied regional and municipal finance, including the budget policy of large cities, in recent years in the context of the impact of crises on it and the possibility of an adequate response to external challenges using budget tools (Zhikharevich et al., 2020). Based on the study of the general features of mechanisms for maintaining shock resistance, studies were conducted on the ability of the budgets of large cities, in particular Moscow and Saint Petersburg, to function in conditions of turbulence and the implementation of new projects in the public sector. It is shown that the two largest megacities not only cope with the challenges, but also demonstrate active development of their own budget policy (Klimanov, Mikhailova, 2023). Obviously, in other cities, even with a population of about a million people, there are clearly fewer such opportunities. Thus, the analysis of city budgets conducted by V.V. Klimanov and A.A. Mikhailova, made it possible to draw conclusions about the insufficiency of own budget revenues and the need to form recommendations for budgetary development based on resource availability and the quality of municipal financial management (Klimanov, Mikhailova, 2024). Studying the budget policy of cities, researchers point to the problem of redistribution of tax regulations (Timushev, Mikhailova, 2024). The authors have different approaches regarding the standards preferable for local budgets. In studies based on 2018 data, it was shown that “a wide range of taxes does not fully indicate the autonomy of urban okrugs, but a high standard of personal income tax deductions can” (Bukharsky, Lavrov, 2020). When considering the impact of regulations on the budget policy of municipalities, researchers also highlight income transfer according to uniform and differentiated tax standards; each approach has its advantages and disadvantages from the perspective of recipients (Arlashkin, 2020).

Along with assessing the impact of regulations on transferred tax revenues, much attention is paid in modern research to a comprehensive assessment of the impact of the level of budgetary and tax intraregional decentralization on incentives for economic development of territories (Bukharsky, 2021; Timushev, 2021).

Continuing the topic of evaluating the effectiveness of using various budget tools and incentives to promote territorial development, approaches to evaluating effectiveness should be considered. Changes do not always occur in one direction, in accordance with the original idea (Leonov, 2023). This may be due to insufficient stimulating effects, the presence of antistimuli, or other reasons. The formation of methodological approaches in this area is important for assessing the development of large cities under the conditions of regulation by regional and federal authorities.

Thus, the importance of urban budget policy and the need to improve it to ensure the development of territories is an important scientific problem.

Based on this, the objectives of our research are to identify the main trends and problems characterized by the budget parameters of large cities, compare million-plus cities in terms of tax revenues, their structure, and education expenditures; how the types of taxes whose revenues are transferred to the budgets of megacities, and the values of the standards used correlate with the pace of economic development; to identify the main features and problems of intergovernmental relations in the most economically developed regions of the Russian Federation in the context of coordinating the interests of regional and local levels of government, assessing the correlation of these relations with the level of economic development of the territory; to substantiate recommendations for improving approaches to the distribution of tax revenues and intergovernmental transfers between the budgets of regions and their administrative centers, which are million-plus cities.

The object of the study is megacities, namely the cities – administrative centers of RF constituent entities with a population of one million people or more, having the status of municipalities. Based on this, the two largest megacities, Moscow and Saint Petersburg, which are cities of federal significance and, accordingly, RF constituent entities, rather than municipalities, were not considered in our study due to the disparity in the budget parameters of cities – RF constituent entities and cities – municipalities.

The hypothesis of the study is that large cities, the administrative centers of RF constituent entities, do not receive sufficient budgetary incentives to promote the economic, scientific and technological development of the regions, and the potential for budget interaction between the regions and large cities is underutilized.

Methods

To assess the level of economic development of RF constituent entities, data on the gross regional product (GRP), population, average salary provided by the statistics service, as well as ratings of regions on innovative and scientific and technological development for 2021–2023 were used. These ratings were taken into account because the innovative development of the territory is part of its economic development and determines its future prospects. The research mainly considered national ratings of scientific and technological development, and innovative development ratings compiled using various methods1.

As a result, the regions with the best characteristics in terms of economic development in general were identified. In most of them, the administrative centers are cities with a millionplus population. Thus, cities with a population of one million were chosen as the basis for comparing budget indicators. Cities that are more prosperous in terms of GRP as a basic criterion of economic development (Granberg et al., 1998) and the level of innovative development as one of the relevant characteristics of the economic development of territories were singled out separately. By aggregating data from various ratings, we can identify a list of leading regions. These are Moscow, Saint Petersburg, the Moscow Region, the Republic of Tatarstan, the Sverdlovsk Region, the Samara Region, and the Republic of Bashkortostan, followed by the remaining regions of the Russian Federation, whose administrative centers are million-plus cities. Based on their status, Moscow and Saint Petersburg cannot be objects for comparing budget parameters with other cities (Kuznetsova, 2018). Another exception for our study was the Moscow Region, which is part of the Moscow agglomeration and is developing according to different principles in terms of implementing the center-peripheral development paradigm. The Khanty-Mansi and Yamal-Nenets autonomous areas, where the level of GRP is significantly higher than in many other regions, due to resource availability, became obvious exceptions in the analysis of the economic development of the regions. The population of their administrative centers is small, so the consideration of these constituent entities in our study is not entirely correct.

The Republic of Tatarstan, the Perm and Krasnoyarsk territories, the Sverdlovsk and Samara regions were considered as regions that are characterized by a higher level of economic development, based on GRP per capita indicators ( Tab. 1 ).

In most of the RF constituent entities listed in Table 1, the GRP value both as a whole and per capita exceeds the average values, which is due, among other things, to the presence of a large, economically developed administrative center. This is evident throughout the period in question and can be considered as a steady trend. In particular, the Krasnoyarsk Territory, the Sverdlovsk Region, the Republic of Tatarstan, and the Krasnodar Territory should be highlighted, where the most significant level of GRP was observed.

Such regions as the Republic of Tatarstan, the Novosibirsk Region, the Nizhny Novgorod Region, the Republic of Bashkortostan, the Sverdlovsk and Samara regions, and the Perm Territory were considered as leaders in innovative development, in which the administrative centers are millionplus cities. These two sets of regions overlap, which is due to the obvious link between the scientific, technological and industrial development of the territories; nevertheless, they do not coincide.

Table 1. GRP per capita in regions with administrative centers that are million-plus cities, 2010–2022, billion rubles

|

Region |

2010 |

2020 |

2022 |

2022/2020 |

2022/2010 |

|

Omsk Region |

193 |

407 |

514 |

1,262899 |

2,663212 |

|

Volgograd Region |

166 |

388 |

491 |

1,265464 |

2,957831 |

|

Voronezh Region |

148 |

457 |

601 |

1,315098 |

4,060811 |

|

Novosibirsk Region |

181 |

484 |

694 |

1,433884 |

3,834254 |

|

Perm Territory |

235 |

540 |

796 |

1,474074 |

3,387234 |

|

Republic of Bashkortostan |

186 |

412 |

549 |

1,332524 |

2,951613 |

|

Nizhny Novgorod Region |

197 |

507 |

739 |

1,457594 |

3,751269 |

|

Chelyabinsk Region |

188 |

464 |

674 |

1,452586 |

3,585106 |

|

Rostov Region |

154 |

406 |

556 |

1,369458 |

3,61039 |

|

Samara Region |

216 |

508 |

754 |

1,484252 |

3,490741 |

|

Krasnoyarsk Territory |

372 |

950 |

1164 |

1,225263 |

3,129032 |

|

Sverdlovsk Region |

243 |

584 |

816 |

1,39726 |

3,358025 |

|

Republic of Tatarstan |

264 |

658 |

1045 |

1,588146 |

3,958333 |

|

Krasnodar Territory |

197 |

459 |

739 |

1,610022 |

3,751269 |

|

Average for the Russian Federation* |

194 |

481 |

687 |

1,428274 |

3,541237 |

|

* Excluding the Khanty-Mansi Autonomous Area, Yamal-Nenets Autonomous Area, Moscow Region and Saint Petersburg. Compiled according to official statistics. |

|||||

Table 2. Basic indicators of city budget revenues

|

City |

Population, thousand people |

Tax revenues per inhabitant, thousand rubles |

Income per inhabitant, thousand rubles |

|

Volgograd |

1019 |

6,61 |

42,22 |

|

Voronezh |

1046 |

11 |

40,63 |

|

Yekaterinburg |

1 536 |

17,95 |

47,9 |

|

Kazan |

1318 |

14,89 |

33,26 |

|

Krasnodar |

1138 |

23,14 |

67,85 |

|

Krasnoyarsk |

1205 |

23,34 |

46,6 |

|

Nizhniy Novgorod |

1213 |

15,69 |

52,01 |

|

Novosibirsk |

1633 |

18,49 |

51,14 |

|

Omsk |

1104 |

10,65 |

36,94 |

|

Perm |

1028 |

20,05 |

55,4 |

|

Rostov-on-Don |

1136 |

17,9 |

54,02 |

|

Samara |

1164 |

16,68 |

35,53 |

|

Ufa |

1129 |

13,22 |

41,48 |

|

Chelyabinsk |

1177 |

15,46 |

47,94 |

|

Compiled according to official statistics and budget execution reports. |

|||

The analysis of the budgets of 14 million-plus cities was carried out according to the approved budget performance reports for 2019–2023. The study assessed the structure of the revenue side of city budgets, including the detailed structure of tax revenues and intergovernmental transfers. When analyzing the structure of the expenditure side of budgets, attention was focused on education expenditures, as the main ones for local budgets and directly related to the development of the territory’s innovation potential.

The basic indicators and their values according to the results of budget execution for 2023 are presented in Table 2 , compiled with the use of official statistics and reports on the execution of city budgets for 2023.

Thus, these cities are characterized by a 1.6-fold difference in population, which makes it possible to consider them as comparable and similar objects in terms of this parameter. Budget revenues per inhabitant in the cities under consideration also do not differ very significantly, namely 1.6-fold. At the same time, tax revenues are characterized by greater differentiation; when calculated per inhabitant, this indicator varies 3.5-fold, which confirms the importance of analyzing the formation of budget revenues as a source of financing.

Thus, the methods of descriptive statistics, system-structural and dynamic analysis were used in the course of the study. In addition, the institutional approach to the assessment of budget policy and territorial development was taken into account, which was reflected in the identification of formal and informal institutions significant for budget policy, and the assessment of the impact of the “rut effect” (Auzan et al., 2022). In particular, the importance of this effect and the influence of informal institutions in the budget policy of the territories was shown.

Results

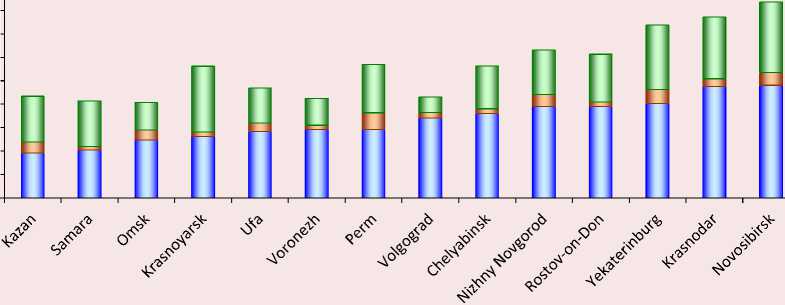

The development of the region is concentrated in its administrative center, and this center determines the potential of the territory for development and the degree of use of this potential. To assess the resource capabilities of cities, we considered the revenues of their budgets ( Fig. 1 ).

Intergovernmental transfers are the main source of budget revenue in million-plus cities. Only in the budgets of Kazan and Krasnoyarsk do tax revenues slightly exceed the amount of intergovernmental transfers. In other city budgets, the contribution of intergovernmental transfers is greater than tax revenues. Moreover, in the budgets of five cities, the amount of transfers exceeds the amount of tax revenues by two or more times. In Volgograd, this gap is maximum – five times. This indicates the impossibility of self-financing, due to the structure of the distribution of revenue sources between budgets of different levels.

It should be borne in mind that targeted transfers make up the main part of intergovernmental transfers in city budgets. The contribution

Figure 1. City budget revenues, 2023, million rubles

90000,00

80000,00

70000,00

60000,00

50000,00

40000,00

30000,00 20000,00

10000,00

0,00

□ Tax □ Non-tax □ IGT

Compiled according to the data from reports on the execution of budgets of municipalities.

of subsidies and subventions is commensurate, and their importance for the development of territories is fundamentally different. Subsidies show how much the territory is “embedded” in the implementation of various projects and programs at the regional and federal levels, which usually has a positive effect on the development indicators of the territories. Subventions characterize the amount of powers transferred to the municipal level and are not directly related to the development of territories, reflecting to a greater extent the prevailing practice of distributing powers between levels of government in the RF constituent entity.

Analyzing the distribution of specific types of intergovernmental transfers, we can note that their ratio is quite different. It is possible to identify regions where subsidies and subventions are allocated in significantly smaller amounts compared to the average values. For example, in Tatarstan, the budget of Kazan is formed in this way. This suggests that Tatarstan’s budget system is characterized by a higher level of centralization, with resources concentrated in the regional budget.

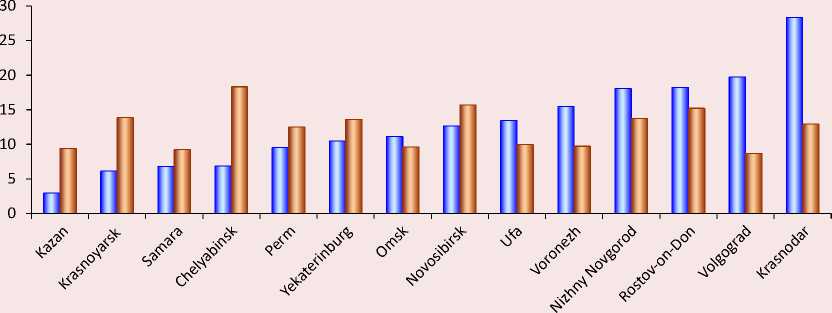

The regions where co-financing of municipal budget expenditures is more active, that is, local governments are more actively involved in various national, federal and regional projects and programs, include the Nizhny Novgorod, Rostov and Volgograd regions, as well as the Krasnodar Territory. The local governments of Kazan, Krasnoyarsk, Samara and Chelyabinsk are the least actively involved in such co-financing (Fig. 2).

The regions where powers are most actively transferred to the city level are the Chelyabinsk, Novosibirsk and Rostov regions.

Thus, the budgets of all the cities under consideration receive significant amounts of subsidies and subventions. Moreover, the total amounts of subsidies and subventions per inhabitant in the budgets do not differ as significantly (with the exception of Kazan and Samara) as the ratio of these two types of transfers among budget revenues. Subsidies are significantly less represented in the budgets of Kazan, Samara, Krasnoyarsk and Chelyabinsk, which may be due to the high level of centralization of management and the predominance of financing expenditures directly from the regional budget. The opposite situation characterizes the budget policy of Krasnodar, Volgograd, Rostov-on-Don, Nizhny Novgorod, and

Figure 2. The volume of subsidies and subventions per inhabitant in 2023, thousand rubles

□ subsides per inhabitant □ subventions per inhabitant

Compiled according to the data from budget execution reports.

Table 3. Groups of cities based on the receipt of targeted intergovernmental transfers

|

Level |

Low level of subventions |

High level of subventions |

|

High level of subsidies |

Ufa, Voronezh, Volgograd, Omsk |

Novosibirsk, Nizhny Novgorod, Rostov-on-Don, Krasnodar |

|

Low level of subsidies |

Kazan, Samara |

Krasnoyarsk, Chelyabinsk, Perm, Yekaterinburg |

|

Source: own compilation. |

||

significant amounts of funds are transferred from higher budgets to the budgets of these cities to cofinance expenditures. The specifics of the budgets of Chelyabinsk, Krasnoyarsk and Novosibirsk are that large amounts of government authority have been transferred to the city level, and, consequently, large amounts of subventions.

Based on this, all cities can be divided into groups depending on the structure of intergovernmental transfers in the local budget ( Tab. 3 ).

Interestingly, the regions in which administrative centers receive relatively low levels of subsidies and subventions from the budget of the RF constituent entity are characterized by the highest rates of innovative and scientific and technological development. These are the Republic of Tatarstan and the Samara Region. We can assume that the high level of centralization is due to the fact that the development of these territories is carried out mainly through the organizational and financial efforts of regional authorities. However, given the concentration of human capital and other resources in the administrative center, we can assume that the potential of local government participation in territorial development is not fully utilized.

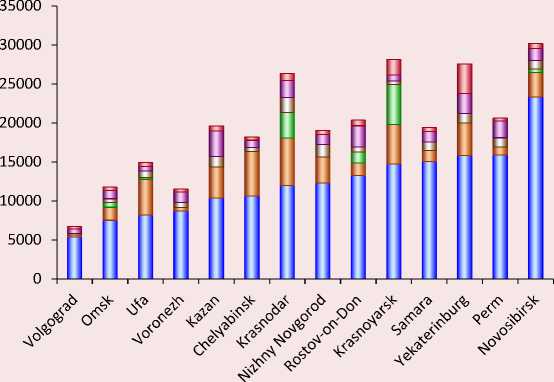

When considering city budgets, the structure of budget tax revenues is of particular importance. Tax revenues are more closely related to the parameters of the economic development of the territory. Personal income tax is the main tax source for Russian local budgets. The amount of this tax revenue is related to the level of economic development of the territories, since the tax base is compiled mainly by the income received by residents in the form of wages. Figure 3 shows the structure of city budgets depending on the amount of personal income tax receipts.

Figure 3. The structure of tax revenues of city budgets, 2023, million rubles

-

□ Other taxes

-

□ Land tax

-

□ Personal property tax

-

□ Transport tax, corporate property tax, income tax

-

□ STS

-

□ Personal income tax

Compiled according to: data from budget execution reports.

A certain diversity in the structure of tax revenues is related to which tax sources are additionally transferred to the city budget on the initiative of regional authorities. Most often, these are tax receipts under the simplified taxation system (STS), but there are examples when income tax, transport tax, and other sources are transferred.

The share of personal income tax varies from 0.52 to 0.8 of the total tax revenues of budgets. The minimum share of personal income tax is observed in Krasnodar, Kazan and Krasnoyarsk, and the maximum is in Volgograd. This is due not so much to differences in income levels, but rather to the transfer standards of the relevant source and the diversification of tax revenues in the local budget.

In Kazan, tax revenues are largely made up of the tax receipts under the STS and land tax receipts; Krasnodar and Krasnoyarsk experience the strong impact of the transfer of income tax regulations. Only these two million-plus cities have a similar practice of transferring tax revenues from regional budgets.

Samara, Perm, Novosibirsk, and Krasnoyarsk have the highest personal income tax rates in local budgets (30% or more). With the exception of Krasnoyarsk, the share of personal income tax in these three cities is 77–78%, which is significantly higher than the average for cities with a million-plus population. This indicates that it is the standards according to which tax revenues are transferred that are the main factor determining the amount of revenue from the tax source and their contribution to the formation of tax revenues of the city budget.

The most significant factor determining differences in personal income tax amounts is receipt standards, but wage levels also have a significant impact. Obviously, the personal income tax rate is slightly higher in those million-plus cities that are developing faster in the innovation sector.

The largest amounts of personal income tax during 2019–2023 were observed in the budgets of Perm and Novosibirsk, the lowest levels were found in the budgets of Ufa, Omsk and Volgograd. All leading cities receive personal income tax at aboveaverage rates, reaching and exceeding 30%.

The influence of wage levels as a factor that can ensure revenue growth even at low tax rates was observed in Kazan. Compared to other cities with comparably low standards (for example Omsk, Volgograd), the amount of personal income tax receipts in Kazan’s budget was significantly higher.

The increase in personal income tax receipts in the five-year period under review was most noticeable in Kazan and Perm, with the total amount of receipts increasing 1.8 times. The reasons for the increase differ in Kazan, where it was associated with a constant increase in wages, in Perm – due to an increase in the standard and an increase in wages mainly in 2022–2023. In addition, in terms of the dynamics of budget receipts of personal income tax, Chelyabinsk can be singled out, where there was a significant increase in revenues in 2022–2023: due to the increase in wages, the revenues of this tax source in the local budget also increased.

Based on whether the city budget has relatively high personal income tax receipts and taxes transferred under additional regulations, all cities can be divided into the following groups ( Tab. 4 ).

Table 4. Groups of cities based on their tax revenues

|

Level |

Low level of transferred taxes (STS, corporate property tax, etc.) |

High level of transferred taxes (STS, corporate property tax, etc.) |

|

High level of personal income tax |

Perm, Samara, Rostov-on-Don, Novosibirsk |

Krasnoyarsk, Yekaterinburg, Nizhny Novgorod, Krasnodar |

|

Low level of personal income tax |

Volgograd, Voronezh, Omsk |

Ufa, Kazan, Chelyabinsk |

|

Source: own compilation. |

||

The high level of transferred taxes and personal income tax is more typical for economically developed regions, which are among the leaders in terms of GRP per capita (the administrative centers – Krasnoyarsk, Yekaterinburg, Krasnodar and Nizhny Novgorod). On the contrary, the low level of receipts is generally more typical for the regions located in less economically developed territories. However, it cannot be said that this rule has no exceptions; Kazan has become the most striking one. Thus, even if we are guided by GRP per capita as the most universal criterion characterizing the economic development of regions, we can note significant differences in the structure of tax revenues of their administrative centers.

Based on the results presented in the matrix, it can be argued that the volume of personal income tax receipts and taxes transferred according to the standards is most significantly influenced by two factors: the standard established by the authorities of the RF constituent entity, and the tax base. The first factor for local governments is external and uncontrollable, the second one, on the contrary, is internal and manageable.

Tax revenues were transferred most massively in Krasnodar, where additional income was transferred for profit tax, corporate property tax, STS. As for personal income tax, the highest percentages of deductions (30% or more) are established in Krasnoyarsk, Novosibirsk, Perm and Samara. The lowest personal income tax standards were used throughout the period under consideration in Yekaterinburg (16%) and Kazan (16.9%). In both of these cities, the STS was used as an additional tax source, the standard was average compared to other cities (30 and 22.3%, respectively). The maximum level for this tax was applied in Chelyabinsk and was 60%, the minimum in Voronezh and Volgograd – 5%. In Yekaterinburg, additional excise tax deductions for beer (50%) were transferred. This is an atypical practice for the cities in question.

Thus, it can be argued that the regional budget system is quite centralized in the Republic of Tatarstan and the Sverdlovsk Region. However, due to the high level of economic development, even small standards of tax revenues, which are established for city budgets, give such a significant return that the level of budget revenues exceeds the average. This is especially noticeable in relation to personal income tax receipts in Yekaterinburg and receipts under the STS in Kazan.

We should note the experience of the Krasnodar and Krasnoyarsk territories, where additional profit tax standards are transferred to local budgets. For the cities – administrative centers of RF constituent entities, this provides a significant return to the municipal budget. These revenues reach 10–15% of the total tax revenues of city budgets.

Analyzing the standards for the transfer of tax revenues, we should note their stability. In most budgets, there have been no significant changes in the composition of transferred tax revenues and the size of the standards over the five-year period. In cases where regulations have changed, they have increased, which indicates that the regional authorities perceive this tool of budget regulation and incentives as effective. For example, in Krasnoyarsk, the STS began to flow into the local budget only in 2021, in Voronezh – in 2022, and in Samara, the standard for this tax was increased from 2% to 15%. The only example of a reduction in tax regulations is the experience of the Perm Region, where the transport tax was transferred in full until 2023, and since 2023 this practice has been suspended, but at the same time the amount of personal income tax transferred has increased slightly.

A special type of revenue for city budgets is revenue from local taxes. Land tax and personal property tax are introduced by local regulations, and the conditions for them may differ in different regions. Given the large degree of freedom of local governments, the analysis of budget returns for these types of revenues is important in terms of studying the impact of budget policy on territorial development. The amounts of personal property tax and land tax receipts in large cities vary quite a lot.

In general, there was a direct correlation between the level of economic development of the region and the influx of local taxes to the budget of its administrative center. The exceptions are the budgets of Krasnoyarsk and Ufa, where low local tax rates are set. In particular, in Krasnoyarsk, a land tax rate of 0.1% is used for a number of objects with a possible maximum of 0.3%, and in Ufa – in a similar case it is 0.18%. In other cases, it is possible to trace the relationship between the amount of local taxes per inhabitant and the level of economic development of the territory. Krasnodar and Kazan have become leaders in local tax revenues. A lower level of tax revenues was observed in Volgograd, Chelyabinsk and Omsk, which corresponds to the comparative level of economic and innovative development of the regions.

It is important to note that Samara and Chelyabinsk differ organizationally in that they are urban okrugs with intra-urban divisions, that is, inner-city districts have the status of municipalities on their territory, which means they have their own budget and corresponding revenue sources. Based on this, the revenue sources of the budgets of these cities are slightly smaller, since part of the funds is allocated to the district level. In particular, in Samara, local taxes are divided into 50:50 personal property tax and 90:10 land tax. Therefore, local tax revenues in the territory as a whole are slightly higher than it is shown based on the analysis of the city budget. Consequently, Samara can also be considered as one of the leaders in this budget parameter among million-plus cities.

Thus, the analysis of budget revenues showed that the tax provision of the city – administrative center of the RF constituent entity is not directly related to the budget provision of the regional budget. In this case, we can talk about the influence of the degree of centralization and the principles of organization of regional budget systems.

5000 0

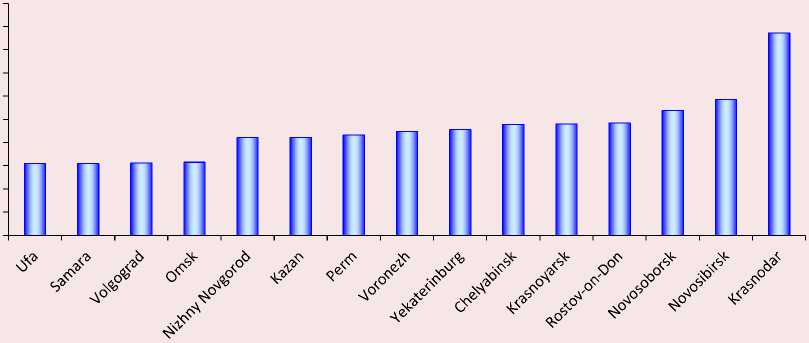

Figure 4. Education expenses per inhabitant in large cities, rubles

Compiled according to: data from budget execution reports.

The analysis of city budget expenditures has confirmed that education costs are the main ones. The costs of preschool, school, and additional education differ by less than two times per inhabitant in the cities under consideration. This is significantly less than the differentiation by other types of expenses, including housing and communal services. Differences in the financing of education are mainly related to the allocation of appropriate targeted transfers from regional budgets ( Fig. 4 ). The exception is the budget of Krasnodar, where significant expenditures on education are due to a different demographic structure and a larger relative number of children. In Krasnodar, in 2023, spending on education increased more than 1.5-fold. According to the budget execution reports for 2021–2022, the amount of education expenses per inhabitant in Krasnodar did not fundamentally differ from their value in other million-plus cities.

There is no correlation between the amount of education expenditures carried out from local budgets and indicators of scientific and technological development of territories. This is due to the nature of educational expenses assigned to the municipal level of government. Based on this, it can be recommended to integrate expenses focused on scientific, technological and innovative development into educational programs of additional education for high school students.

Thus, the parameters of city budgets are largely determined by the established practices of implementing budget policy and interacting with the authorities of RF constituent entities. It is possible to highlight the influence of formal institutions, laws on the budget process and intergovernmental relations adopted in a constituent entity of the Russian Federation, decisions on the allocation of intergovernmental transfers of a specific type, on delegation of powers and informal institutions related to established practices of interaction between authorities of RF constituent entities and local governments, their interaction with large businesses, small and medium enterprises.

The general conclusion for the analyzed cities is that the practices of budget interaction are rather inert and repeatable in successive budget cycles. To increase the effectiveness of interaction, it is necessary to evaluate the effectiveness of the use of various budget tools and adjust their use based on the results obtained.

Conclusion

The analysis of the budget parameters of large cities for 2019–2023 led to the conclusion that the parameters of city budgets, unlike regional ones, are not directly related to the level of economic and innovative development of RF constituent entities. This suggests that the budget potential of cities is not being fully utilized and it is necessary to focus on the formation of a system of incentives for local governments of large cities, which is aimed at their more active involvement in the processes of territorial development.

The main factors determining the amount of tax revenues of budgets have been identified. These include the list of transferred tax revenues from the regional budget; the amount of the standard used for revenue transfer; wage level, average for a particular city; extent of development of small business in the city.

The influence of factors related to tax regulations is manifested in the fact that the best results in terms of tax revenue generation are observed in the budgets of Krasnodar, Krasnoyarsk, Yekaterinburg and Novosibirsk. In these cities, the influence of these factors is most pronounced. It is important to keep in mind that only in Krasnoyarsk and Krasnodar is an additional income tax standard transferred to the local budget, and this leads to tangible positive results. In Yekaterinburg, excise taxes on beer and beer-based beverages are additionally increased according to regulations, which increases the level of tax revenues by 10% or more. Novosibirsk is characterized by a high level of personal income tax transfer, which also makes an obvious positive contribution to the revenue structure of the city budget.

At the same time, all the listed cities are characterized by a high level of wages. Thus, the tax revenues of the budget are simultaneously influenced by the factors such as a high tax base and high standards.

Of particular note is the experience of Kazan, where, despite the low standards for the transfer of tax revenues, large-scale returns from their application are achieved. When transferring 30% of the STS to the city budget, this makes it possible to raise its revenues by 20% or more throughout the period under review. This is more than in other cities where this revenue source is being transferred. In our opinion, the experience of Kazan demonstrates the manifestation of “rut effect”, since the historically highly centralized budget system in the region does not allow realizing the possible benefits of transferring additional standards to the local budget and increasing the corresponding receipts not only to the budget of the city itself, but also to the consolidated budget of the region. Based on the high tax base and high rates of economic development, this area seems promising for a more detailed theoretical study, and then the formation of methodological recommendations for improving the distribution of tax revenues and their increase by stimulating and coordinating the interests of participants in the budget process.

In terms of future research, it seems promising to analyze the optimal proportions of increasing personal income tax standards as the most stable type of income and other tax sources, taking into account the potential for the development of small and medium businesses, as well as large industrial enterprises and industries. Based on such studies, it is possible to recommend the formation of methodological recommendations on the selection of specific sources of taxes that should be transferred to large cities based on forecasting the growth of tax revenues from urban and consolidated regional budgets.

A relationship has been established between the amount of local taxes and the level of economic development of territories. It is in large cities that an increase in local tax rates gives a noticeable return to the city budget. In those cities where local tax revenues are higher, in most cases the pace of economic development is higher. The exceptions to the general pattern are Krasnoyarsk and Ufa, where relatively lower land tax rates are used, but, nevertheless, positive trends in economic development are observed. This is due to the fact that local taxes are not the only and not the most significant factor in the area under consideration.

The general trend substantiates the importance of local taxes and the positive impact of these sources as budget incentives for the authorities of large cities. Expanding the list of local taxes and assigning additional tax sources to local authorities are important areas for further improving the budget policy of large cities.

It is concluded that the impact of regulation by handing intergovernmental transfers over to the municipal level has no direct connection with the level of economic development of the territory and its innovative potential. Moreover, among the regions leading in terms of GRP per capita, some are characterized by relatively low levels of transferred subsidies and subventions (the budgets of Kazan and Samara), one is characterized by a high level of both types of transfers (the budget of Krasnodar), two are characterized by a high level of subventions with a relatively low level of subsidies (Krasnoyarsk and Yekaterinburg). In this case, the contradictory results for Krasnoyarsk and Kazan are most indicative, since the two corresponding regions have particularly high values of GRP per capita.

Similarly, the regions that are leaders in innovation, scientific and technological development do not have obvious similarities in terms of distribution of intergovernmental transfers and their volumes in city budgets. The predominance of subsidies or subventions among targeted intergovernmental transfers, a higher or lower total level of these revenues do not have a direct and unambiguous impact on the level of economic development of the city.

In our opinion, the intraregional distribution of intergovernmental transfers is more determined by the established patterns of interaction between authorities at various levels, rather than by economic expediency. In this case, the “rut effect” is clearly manifested, when the established practice is repeated throughout the period under review, and changing the rules of interaction requires efforts greater than the effects expected by the participants in the interaction. Nevertheless, when the external environment changes, it is possible that the benefits of changes in intergovernmental fiscal regulation schemes will exceed the costs, and then it will be possible to optimize the use of this tool, which has obvious prospects in terms of influencing the economic development of territories.

When analyzing the level of scientific and technological development, much attention is paid to expenses not only in the field of research, but also in the field of education. However, no relationship has been established between the level of budget expenditures of large cities on education and the level of scientific and technological development of the regions, and these expenditures differ insignificantly in the reviewed city budgets per inhabitant. This is mainly due to the nature of the distribution of education costs between budgets of different levels. At the local level, preschool, school, and continuing education costs prevail. As further areas of research and practical recommendations, we can propose the formation of mechanisms for municipal budgetary support for additional education for high school students, aimed at involving them in the development of innovative products and technologies, and the popularization of scientific activities.

In general, the most promising practices for budget regulation of interaction between regional authorities and local governments in million-plus cities can be identified as those practices where a larger number of tax sources are transferred, higher personal income tax transfer rates are applied, and the transfer of the STS and income tax is implemented as sources with potential as incentives for the development of large cities.

Thus, it can be argued that the influence of budget relations between the authorities of RF constituent entities and local governments of million-plus cities on the economic development of territories is currently not strong enough. Some progress has been achieved only in using tax regulations as incentives, but even here, further improvement and development of appropriate budgetary mechanisms are required. The influence of institutional factors is strongly evident when budget interaction is implemented inertially, based on the repetition of past experience without sufficient critical reflection, the search for more effective schemes of intergovernmental fiscal interaction and budget policy in general. However, budget tools are quite effective for regulating territorial development; therefore, it can be recommended to use them more actively in the future in stimulating economic development centers, which is aimed at increasing the effectiveness of socio-economic policy at the regional level.