Budget provision of municipal entities in the Vologda region: state, problems and improvement ways

Автор: Povarova Anna Ivanovna, Uskova Tamara Vitalevna

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Regional economy problems and directions of perfection of local government

Статья в выпуске: 1 (9) т.3, 2010 года.

Бесплатный доступ

The article is a continuation of a series of studies on the problems of sustainable development of regional socio-economic systems. The main results of the analysis of the budgetary provision of municipal entities of the Vologda region in the period from 2004 to 2009 are presented. Factors affecting the state of the budgetary provision are identified; options to improve its level are shown.

Budget provision, local government reform, revenue base of municipalities, intergovernmental relations, development of municipal finance

Короткий адрес: https://sciup.org/147223173

IDR: 147223173 | УДК: 336.143(470.12)

Текст научной статьи Budget provision of municipal entities in the Vologda region: state, problems and improvement ways

The problem of sustainable development does not lose its relevance and urgency for many decades. Its theoretical and methodological aspects are reflected in a number of publications of the authors [6, 7, 8 and others].

In practice, the principles of sustainable development of territories are implemented, if there is a strong socio-economic mechanism that ensures long-term balance between nature and society, between the living standards and quality of life, i. e., when there is not only improving and maintaining the level of real consumption, but also accessibility and high quality of educational systems, health, employment, social protection, etc. [9]. This, in turn, can be achieved by enhancing the internal financial sources in the region, which primarily include:

-

• budgetary funds;

-

• extra budgetary funds;

-

• means of credit and banking institutions;

-

• funds of insurance companies;

-

• funds of enterprises and organizations;

-

• funds of the population.

It is obvious that the leading role in this process belongs to the budgetary resources, an important characteristic of which is budgetary provision, which is understood as the amount raised in the budget system resources allocated for state and municipal services and obligations provided in the region in per capita terms.

However, one of the adverse effects of market reforms on the economy of Russia was the growing problem of asymmetry of regional economic development. The imbalance of economic development had its impact on the budget sphere, a problem of scarcity of financial resources appeared, which is particularly acute at the level of local budgets. The consequence of this situation was a disparity in the budgetary provision of municipal formations, which means different financial capabilities of local governments to implement effectively its constitutional powers in order to meet the needs of the local community in goods and services.

Budget provision of municipal formations in the Vologda region is significantly differentiated by the existing structure of the region’s economy, the size and number of the resident population, as well as infrastructure provision.

The distribution of economic potential – the basis of budget revenues – is characterized by its high concentration in the two urban districts and low level of settlements’ development. In the cities of Vologda and Cherepovetz 90% of industrial output is produced, 97% of profitable enterprises’ profit, 72% of the wage fund, and almost 60% of the working population is concentrated.

As a result, more than 70% of tax and nontax revenues of local budgets are mobilized in the urban districts, while half of the region's population lives in 26 municipalities that do not have sufficient tax base. Consequently, variations in the availability of own budget of income sources per capita is extremely high. During 2004 – 2009 variation coefficient was greater than unity, indicating a high dispersion of the indicator. The average difference between the wealthiest and the least provided municipality in terms of their own revenues per capita to budgetary alignment was more than 5 times (tab. 1) .

As can be seen, more than 90% of the region’s municipalities in 2009 had a budget provision below the region-average level. However, local budgets are assigned the main burden of financing the social sphere: almost 100% of the cost of preschool and general education, housing and utilities, 60% – the maintenance cost of cultural and health care institutions, and half the cost of social security and welfare services. It is obvious that the vast majority of the Vologda region’s municipalities are not capable to provide the budgetary resources needed to meet expenditure responsibilities through their own revenues.

In this situation, the regional government is compelled to carry out the alignment of the municipalities’ financial capacity to implement within their designated authority by transferring financial assistance in the form of subsidies that reduce the gap in the budget provision of municipalities to an average of 2 times. However,

Table 1. Providing budgetary resources per capita in the municipalities of the Vologda region in 2004 – 2009 (before alignment) *

|

Indicators |

2004 |

2005 |

2006 |

2007 |

2008 |

2009 |

|

Minimum level, rub. |

1941 |

2587 |

1002 |

2114 |

3778 |

1959 |

|

Maximum level, rub. |

11463 |

12183 |

8793 |

11568 |

11656 |

10259 |

|

The gap, times |

6.0 |

4.7 |

8.8 |

5.5 |

3.1 |

5.2 |

|

Region-average budget provision per capita, rub . |

6304 |

7055 |

4697 |

7149 |

9045 |

6549 |

|

Proportion of municipalities with budgetary support below the region-average, % |

78.5 |

71 |

93 |

89 |

86 |

93 |

|

– including less than 50% (critical level), % |

32 |

21 |

68 |

46 |

18 |

60 |

|

* Calculated on the basis of decisions of representative bodies of local self-government of the Vologda region on financial performance for 2004 – 2008 and the Act approving the budgets for 2009 // Reference retrieval system “ConsultantPlus”. |

||||||

Table 2. Providing budgetary resources per capita in the municipalities of the Vologda region in 2004 – 2009 (after alignment)

From table 2 it follows that the inter-governmental alignment can overcome extremely low level of budgetary provision of a number of municipalities, but after giving the financial assistance up to 2/3 of municipalities have a budget provision per capita below the regionaverage indicator. It is easy to see that the share of municipalities with a budget lower than the region-average has increased with the introduction of a new system of local government (from January 1, 2006) compared with the period of preparation of the municipal reform in 2004 – 2005.

What is the reason for this situation?

First of all it is a new system of local finance organization, during which there was a major correction of both the structure of tax sources of local budgets, and mechanisms for intergovernmental fiscal relations.

One of the basic conceptual principles of local government reform is a clear definition of an exhaustive list of local issues with the appropriate distribution of revenue sources and spending obligations. However, this trend came into conflict with the processes of centralization of power in the country. The ongoing federal government policy aimed at preserving and strengthening the subordination of local authorities, with the gradual consolidation of resources’ impact on the higher levels of government. As a result, in the RF constituent regions the funds were actually concentrated in the hands of regional authorities; local authorities were also largely devoid of incentives and opportunities for effective management and inclusion in the processes of economic modernization.

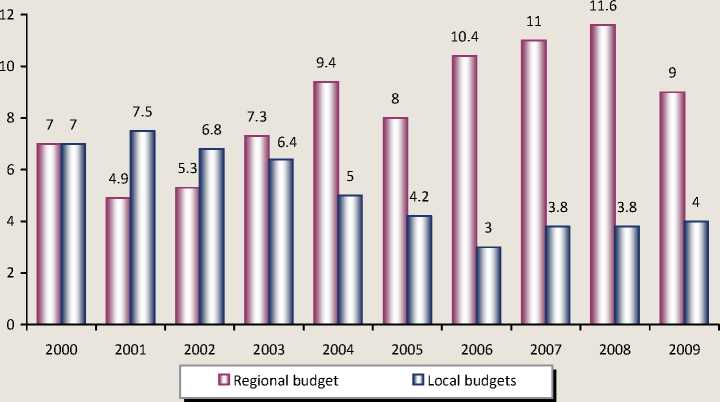

Figure 1 shows the distribution of revenues between levels of budget system of the Vologda region for the period 2000 – 2009. This distribution, taken as a percentage of GRP, characterizes the share of own revenues of each level of the budgetary system in GRP and, accordingly, the place of municipal budgets in the consolidated budget of the region.

Apparently, municipal reform has not changed, but rather strengthened the already established by the beginning of its implementation the scheme of revenues allocation between regional and municipal budgets. The share of own revenues of local budgets is continuously decreasing, which shows the distribution of revenue sources between levels of public authority in such a way that municipalities had the lowest portion of the GRP growth. Practically, this means that the municipalities did not receive any positive effect in terms of income changes of their budgets on the region’s economic growth. The above trend of decreasing share of local budgets’ income in the GRP is due to two main factors.

The first is the macroeconomic situation, which affects the distribution of income among the budgets of different levels. As is known, metallurgical sector of the economy, which is the main source of the regional budget’s profitable part capacity usage, has a significant influence on the dynamics of the Vologda region GRP. Because of the very uneven distribu-

Figure 1. The distribution of income between the levels of budget system of the Vologda region in 2000 – 2009, % of GRP

tion of productive forces on the territory of the region the centralization of revenues from this sector is at the regional level.

Secondly, the distribution of income over the levels of budget system has changed as a result of local government reform and fiscal reform. Only land tax and property tax for individuals have been identified as local taxes. As for income from federal and regional taxes and fees received by the municipal budgets, the list of these taxes and assignments on them has been steadily declining (tab. 3) .

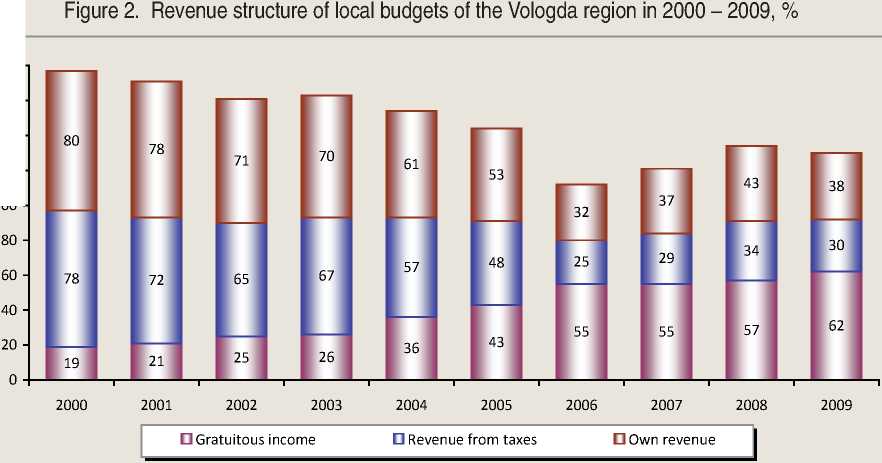

Thus, as a result of taxes centralization in the regional budget sources of tax revenue in local budgets have been significantly reduced, which directly affected the structure of their income. If the pre-reform period, tax revenues formed the revenue base of municipalities by 60 – 80%, currently these charges provide only a third of all leveraged resources. In turn, a sharp reduction in tax revenues has reduced the capacity usage of local budgets with their own revenue sources with the rapid increase of gratuitous income (fig. 2).

It should be noted that this situation was envisaged in the reform initially on the strength of very uneven levels of economic development and earnings potential of individual

Table 3. Assignments standards from the federal and regional taxes and fees to the local budgets of the Vologda region, %

|

Tax revenues |

Before the reform (2003 – 2004) |

After the reform (2005 – 2009) |

|

Income tax (rate) |

7 |

0 |

|

Tax on personal income |

50-70 |

30-40* |

|

Tax on gambling |

50 |

0 |

|

Excise taxes on vodka |

35 |

0 |

|

Property tax |

50 |

0 |

|

Tax on personal property |

100 |

100 |

|

Land tax |

50 |

100 |

|

Payments for the use of natural resources |

65-80 |

0 |

|

* Since 2006, the budgets of settlements credited 10% of personal income tax, in the budgets of municipal districts – 20%, in the budgets of urban districts – 30%. Besides, the law of the Vologda region is enshrined in addition at least 10% of personal income tax revenue for municipalities. |

||

territories. In order to align the budget of the regions and municipalities there has been a reassignment of a significant amount of tax revenue. In addition, the need to provide a relatively equal citizens’ access to the budget services throughout the country was the reason that in the course of municipal reform involves a significant degree of dependence of most municipalities from intergovernmental transfers from higher budgets.

Describing the structure of the income of municipal budgets of different types, it may be noted that the budgets of municipal districts are the most stable among the municipal budgets of all three types, as their supply of own revenue sources accounted for 51 – 60% in 2007 – 2009. Dependence of the budgets of municipal districts and settlements on intergovernmental transfers is highest and amounts to 65 – 82% of their total income. In fact, one can conclude that in the course of municipal reform a model of “transfer-dependant” municipal region with a high level of both grants to equalize fiscal security, and subventions to the performance of delegated state powers was consolidated (tab. 4).

In connection with the reduction of tax sources of local budgets, almost all municipalities of the Vologda region have become subsidized. Of the 372 municipalities, which operate across the region, only 5 did not receive grants budgetary provision leveling: two

Table 4. Revenue structure of municipal budgets of different types in the Vologda region for 2006 – 2009, %

Structural analysis of the tax revenue of municipal budgets shows that the most significant revenue in local budgets was provided by the income tax, whose share in tax revenues increased from 34% in 2000 to 70% in 2009 (tab. 6) .

Since the beginning of the reform of local government and a change in tax law the value of the profit tax in the structure of tax revenues of local budgets has sharply reduced: if in 2000 – 2004 income tax provided the third of all leveraged tax resources, in the subsequent years, its share declined to 11%, and this tax entered mainly in the budgets of municipal districts with additional statutory transfers.

The situation is similar to the income tax on organizations property, their share in tax revenues declined from 7 – 11% in the pre-reform period up to 5% in 2007 – 2008, and in 2009 payments from this resource did not come in local budgets, even for additional regulations.

Such changes in the structure of tax revenues, a significant increase depending on the income tax revenue in the period 2005 – 2009 indicate a decline in the diversity of the tax component of the revenue part of local budgets.

Table 5. Sources of budgets cost covering of settlements in the Totma rural area in 2008

|

Settlement |

Costs, thousand rubles |

Sources of costs covering |

|||||||

|

Tax revenues |

Non-tax revenues |

Gratuitous income |

Income from business |

||||||

|

thousand rubles |

% |

thousand rubles |

% |

thousand rubles |

% |

thousand rubles |

% |

||

|

Velikodvorskoye |

3837 |

687 |

18.0 |

66 |

1.7 |

3180 |

82.9 |

33 |

0.9 |

|

Vozhbalskoye |

3776 |

435 |

11.5 |

68 |

1.8 |

3204 |

84.8 |

23 |

0.6 |

|

Kalininskoye |

6873 |

1160 |

17 |

590 |

8.5 |

4854 |

70.6 |

94 |

1.4 |

|

Medvedevskoye |

6084 |

194 |

3.2 |

207 |

3.4 |

5641 |

92.7 |

88 |

1.4 |

|

Moseevskoye |

5020 |

447 |

7.0 |

56 |

1.1 |

4530 |

90.2 |

0 |

0 |

|

Pogorelovskoye |

11081 |

5214 |

47.0 |

4385 |

40.0 |

688 |

6.2 |

35 |

0.3 |

|

Pyatovskoye |

18353 |

3187 |

17.4 |

1605 |

8.7 |

11959 |

65.2 |

0 |

0 |

|

Tolshmenskoye |

7300 |

804 |

11.0 |

88 |

1.2 |

6439 |

88.2 |

90 |

1.2 |

|

Totma |

23776 |

12329 |

51.8 |

1760 |

7.4 |

9822 |

41.3 |

0 |

0 |

|

Total |

86100 |

24457 |

28.4 |

8825 |

10.2 |

52455 |

61.0 |

363 |

0.4 |

Table 6. Structure of tax revenue of municipal budgets in the Vologda region for 2000 – 2009, %

|

Income items |

2000 |

2001 |

2002 |

2003 |

2004 |

2005 |

2006 |

2007 |

2008 |

2009 |

|

Total tax revenues |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

|

Including: – income tax |

32.2 |

27.1 |

17.4 |

23.0 |

31.0 |

14.0 |

5.3 |

13.7 |

11.0 |

0 |

|

– personal income tax |

34.0 |

43.3 |

50.6 |

50.0 |

43.5 |

53.3 |

74.3 |

60.0 |

67.0 |

70.8 |

|

– excise |

9.7 |

6.1 |

7.6 |

6.2 |

5.0 |

5.0 |

0 |

0 |

0 |

0 |

|

– tax on gross income |

4.0 |

5.2 |

4.5 |

1.6 |

2.5 |

4.3 |

9.8 |

8.5 |

8.3 |

7.2 |

|

– tax on personal property |

0.3 |

0.3 |

0.5 |

0.5 |

0.6 |

0.8 |

1.8 |

2.7 |

3.3 |

10.0 |

|

– property tax |

6.7 |

6.0 |

11.1 |

9.8 |

8.4 |

11.3 |

0 |

5.0 |

5.0 |

0 |

|

– land tax |

2.0 |

2.0 |

2.6 |

2.7 |

4.2 |

8.3 |

9.3 |

8.0 |

6.5 |

10.0 |

|

– payments for the use of natural resources |

1.5 |

2.2 |

5.1 |

5.1 |

0 |

0 |

0 |

0 |

0 |

0 |

|

– government charges |

0.2 |

0.3 |

0.3 |

0.3 |

1.0 |

1.1 |

2.3 |

1.8 |

1.5 |

2.0 |

Other taxes; 7.2

Land tax; 6.5

Income tax; 11

Tax on gross income; 8.3

Personal income tax ; 67

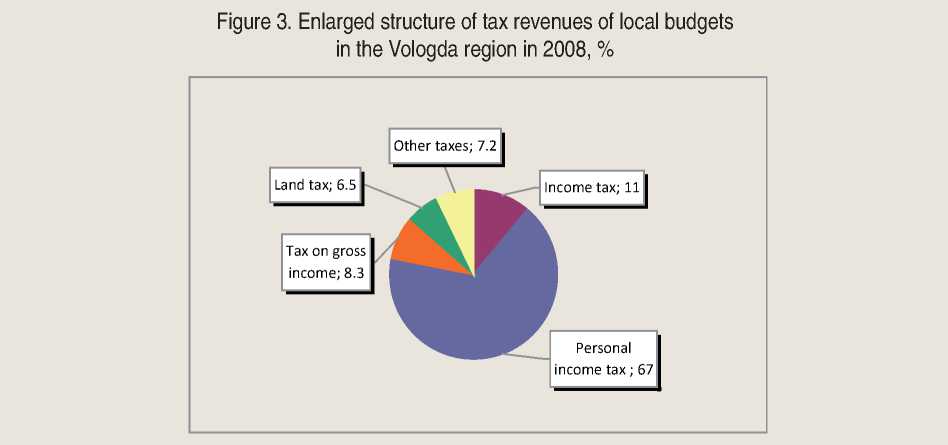

Figure 3. Enlarged structure of tax revenues of local budgets in the Vologda region in 2008, %

As can be seen from the figure 3 below illustrating the enlarged structure of the tax revenue of municipal budgets, in 2008 2/3 of tax revenue sources provided for personal income tax, 25% – for tax on profit, tax on gross income and land taxes, and the remaining charges account for only 7%.

The current structure of tax revenue does not encourage municipalities to develop their own economy, increase tax base. Moreover, since the income tax and profit tax are federal taxes, municipalities have little effect on their collection. In fact, the only levers of influence on the size of their tax revenue currently available to the municipalities are the few options for land tax and property tax on individuals who can determine the local government in accordance with the RF Tax Code. However, local taxes do not play a significant role in the incomes of local budgets. The combined share of incomes from local taxes in total revenue of municipalities in 2009 was estimated below 18%, and in 2005 – 2008 it averaged 10% (tab. 7) .

Unlike most other taxes, the role of income in local taxes in the budgets of municipalities is highly diversified in the context of types of municipalities. Thus, if in the budgets of municipal districts local taxes are presented only by one payment – a tax on personal property, whose role in the revenue base’s capacity usage is very insignificant, in the budgets of settlements local taxes provide for up to 20% of their revenue sources.

Speaking on local taxes, it is important to note that drafting the Law on local government it was supposed that the land tax and property tax for individuals will be the main revenue sources, primarily settlement budgets. However, local governments cannot provide full income from both land tax and property tax on individuals. The main problems with the collection of these payments are in the field of accounting the tax base on them. So, as a result of weak study of procedure of cadastral land valuation, the information on many plots of land is not reflected in the account, which

Table 7. The share of local taxes in personal income budgets of municipalities of different types in the Vologda region for 2006 – 2009, %

Consolidation in the federal legislation of voluntary registration of ownership rights to immovable property, lack of modern methods of assessment of its inventory value hamper a precise definition of the tax base on property tax on individuals. As a result, a large number of objects of taxation remains unaccounted for, the data on the inventory value of the property owners today is outdated and several times different from real market prices.

Income from non-tax revenues of municipalities in 2004 – 2009 were characterized by positive dynamics, but their share remains small – only 8% of the local budgets income.

Non-tax revenues were primarily composed of incomes from the municipal property rent (tab. 8) .

Since 2005, the diversified structure of nontax revenues of local budgets increased slightly due to increase in the proportion of income from the sale of tangible and intangible assets. This trend is a direct consequence of the entry into force of the law, binding list of property in the municipal property, with a list of issues to be addressed by local governments. Before January 1, 2012 municipalities have to dispose alienation or restructuring of property not conforming to the requirements. However, this approach to the definition of municipal property is not fully justified, since the sale of assets undermines the long-term economic fundamentals of local government. In addition, in the areas with low socio-economic development it is very difficult to ensure the population with public services by private enterprises.

Given that the revenue from the use of municipal property brings more than 12% of own revenues of local budgets, it is useful to consider revising the list of assets that can be owned by local governments. The extension of the list should be based on assessing the effectiveness of municipal enterprises and institutions.

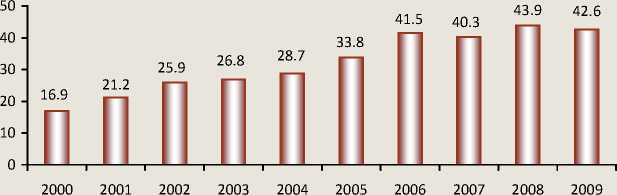

The state of the municipal entities budget provision was affected not only by large-scale redistribution of local authorities’ revenue powers, but also by changing the system of budgetary cooperation at the sub national level, especially the system of intergovernmental grants. Confirmation of these processes is the progressive increase of the regional budget costs to provide financial assistance to municipal budgets (fig. 4) .

Analysis of theoretical principles and international practice of the local government’s functioning suggests a large variability of ways to organize a system of intergovernmental fiscal relations. At present there is no single universal model of budgetary interaction in the state. However, the fundamental principles which are the basis of the relations between state and local government, are the primary distribution of spending powers to ensure which revenue sources are formed in the future, as well as the need for vertical and horizontal balance of territorial budgets.

It should be recognized that, in general due to the reform of regional and municipal finances sufficiently coherent and workable

Table 8. Structure of non-tax revenues of municipal budgets in the Vologda region for 2004 – 2009, %

|

Income items |

2004 |

2005 |

2006 |

2007 |

2008 |

2009 |

|

Total non-tax revenues |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

|

Revenues from the use of property in municipal ownership |

73.5 |

57.3 |

42.5 |

55.1 |

44.3 |

42.5 |

|

Payments for use of natural resources |

0 |

6.7 |

2.5 |

3.3 |

2.7 |

3.3 |

|

Revenues from paid services provision |

0 |

0.3 |

0.2 |

0.6 |

14.4 |

20.6 |

|

Revenues from the sale of assets |

0 |

14.6 |

44.2 |

30.6 |

26.2 |

19.6 |

|

Fines |

16.8 |

14.1 |

6.4 |

7.9 |

9.8 |

12.8 |

Figure 4. The share of budgetary transfers in total expenditures of the regional budget of the Vologda region in 2000 – 2009, %

system of intergovernmental fiscal relations is generated, which includes the general alignment of the earnings potential of territorial budgets and alignment of the earnings potential taking into account the current expenditure needs differentiation. Methodological aspects of the intergovernmental transfers’ distribution, forming the financial assistance funds, are rather mature and consistent with international best practices in the use of such instruments of budgetary alignment.

However, there are some problems in the field of inter-budgetary relations.

First, it’s the lack of the local governments’ real needs assessing to address local issues.

Methods of regional funds’ financial support distribution and funds for co-financing costs, which are the main tools of the horizontal alignment of municipal formations, contain, basically, only the calculation of shares of stock, due to each municipality. The local authorities’ financial requirements assessment is based on the established structure of budget expenditures and does not reflect the real need for financial resources. The gap in budgetary funds redistribution principles and methods for determining the necessary financial resources for the execution of powers remains today one of the main problems of budgetary interaction and financial support of local government reform. To resolve this problem such a mechanism as the financial standards is used in the world practice.

The standards for the expenditure responsibilities evaluation to municipal entities have been developed in the Vologda region since 2005, which allowed establish the expenditure base of local budgets in the allocation of intergovernmental transfers rather objectively. However, to assess the value of expenditures a method of calculating the standards requirements for the implementation of authority approved at the federal level is required.

Secondly, the issues of clear distribution of authority in the spheres of government bodies and local authorities have not been resolved. These powers include the public transport services, agricultural support, prevention and management of emergencies, etc. As a consequence, a problem of financing of these powers primarily appears during their implementation in practice.

With the reduction of the municipalities’ own revenue sources the amount of authority delegated to municipalities with the federal and regional level is increasing annually. Federal Center, having declared independence of local self-government, did not create management systems, distribution of power and properties, allowing those bodies perform their functions. Under these conditions, the responsibility for all the problems that cannot be solved by the Federation and the regions is shifted to the municipalities. In the years 2006 – 2009 third of the cost of municipal budgets was spent on the implementation of the delegated powers, which of course, complicates the enforcement of its expenditure responsibilities of local governments (tab. 9) .

The multiplicity of forms of intergovernmental transfers (only in 2008 more than 200 kinds of subventions and subsidies have been

Table 9. Correlation of own and delegated authority of the Vologda region municipalities’ costs in 2000 – 2009, %

That is not grants, spending trends of which are determined by the municipalities, but targeted transfers – grants and subventions – are becoming increasingly important in the structure of intergovernmental transfers, which means equity in the regional budget expenditures, which regional authorities consider as necessary (fig. 5) . For this reason, municipalities are not yet able to start actively working to optimize their spending and abandonment of inefficient spending, which is one of the main objectives of budgetary reform. Prerequisite for such changes should be a known municipalities’ independence in prioritizing budget expenditures and the availability of incentives to develop its revenue base.

Thirdly, there are limitations in terms of budgetary control.

In order to increase the revenue base of municipalities the existing legislation gave the regions the right to establish local budgets in common norms of deductions from federal and regional taxes. In the Vologda region there was introduced a single standard tax deductions on personal income in the budgets of municipal districts in the amount of 10% and uniform standards on vehicle tax deductions for all types of municipalities. However, the regional authorities cannot fully take advantage of this right and expand the list of common standards due to significant differences in economic and fiscal capacity of municipalities. One solution to this problem may be the provision of legal entities to establish uniform standards according to the types of municipalities.

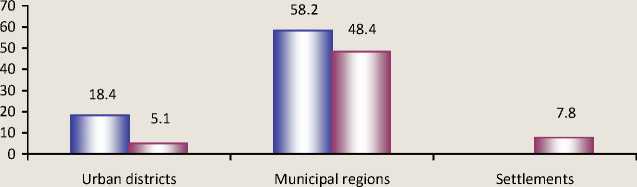

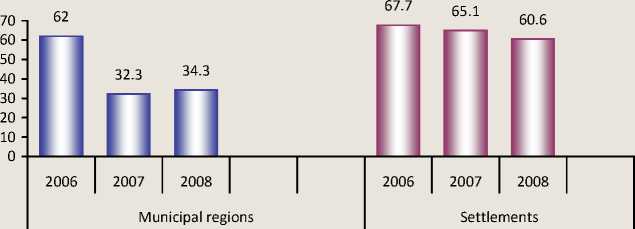

In order to encourage local authorities to build the tax base replacement of grants by additional statutory transfers from the federal and regional taxes is widely used in the region since 2007. Taxes assigned to the budgets of municipal districts of differentiated standards form on the average half of their own income (fig. 6) .

Such practices contributed to a significant reduction in municipalities’ subsidies, especially at district level. The share of subsidies in their own revenue budgets of municipal

Figure 5. The structure of intergovernmental transfers to local budgets of the Vologda region in 2004 – 2009, %

D

■О

76.4

-O-

77.5

—D

80.4

■□

23.4

O-

22.8

21.7 0—

18.1

17.5 o—

—□—Subsidies, subventions

Figure 6. The share of taxes received though additional regulations, in own income of local budgets of the Vologda region in 2007 – 2008, %

□ 2007 □ 2008

Figure 7. The share of subsidies in the personal income of municipal budgets of the Vologda region in 2006 – 2008, %

districts fell from 62% in 2006 to 33% in 2007 – 2008. There is a tendency to reduce subsidies to rural settlements (fig. 7) . We must assume that the continuation and development of this form of financial support will help to improve budgetary management.

Issues and trends identified above indicate the need for adjustment of financial assistance to local authorities.

Inconsistency in the existing system of intergovernmental fiscal relations and the real needs of municipalities raised the problem of so-called “hidden” deficit of local budgets. In general, the budgets of municipalities of the Vologda region in the years 2000 – 2009 were performed with a small deficit or surplus (on average less than 3% of total income), indicating the apparent balance of the financial system of local government (tab. 10).

However, from a position of fiscal autonomy of local budgets it is important to assess the balance of municipalities’ own resources, i.e. the ratio of their revenue powers and expenditure responsibilities in terms of ability to determine the amount and direction of funding legislatively defined list of functions and services to the public through their own revenues independently (tab. 11) .

The table shows that the key changes in the level of financial sustainability of municipalities

Table 10. The balance of local budgets of the Vologda region for 2000 – 2009, mln. rub.

|

Indicators |

2000 |

2001 |

2002 |

2003 |

2004 |

2005 |

2006 |

2007 |

2008 |

2009 |

|

Revenues |

5689 |

6350 |

7773 |

9790 |

12999 |

15161 |

18883 |

24860 |

26235 |

22981 |

|

Expenditures |

5557 |

6511 |

7708 |

10240 |

12919 |

15494 |

18558 |

24069 |

26412 |

23575 |

|

Deficit -, surplus + |

+132 |

-160 |

+65 |

-450 |

+80 |

-333 |

+325 |

+791 |

-177 |

-594 |

|

% of revenue |

+2.3 |

-2.5 |

+0.8 |

-4.5 |

+0.6 |

-2.2 |

+1.7 |

+3.2 |

-0.7 |

-2.5 |

Table 11. The dynamics of the balance of the Vologda region municipalities’ own resources for the years 2000 – 2009

|

Indicators |

2000 |

2001 |

2002 |

2003 |

2004 |

2005 |

2006 |

2007 |

2008 |

2009 |

|

Own revenues, mln. rubles |

4566 |

4943 |

5496 |

6906 |

7919 |

8071 |

6082 |

9392 |

11393 |

8728 |

|

Expenses net of subventions, mln. rubles |

5282 |

5822 |

6715 |

9158 |

10200 |

12265 |

13290 |

17303 |

19135 |

15893 |

|

Balance indicator, % |

86.4 |

85.0 |

82.0 |

75.4 |

77.6 |

65.8 |

45.5 |

54.3 |

60.0 |

55.0 |

Table 12. The dynamics of the balance of municipalities’ own resources of different types in the Vologda region in 2006 – 2009

More correct results can only be obtained when assessing balance of the municipal entities’ budgets of different types (tab. 12) .

From these data we can conclude that achieving a balance of own resources of local budgets in the region in tote at the level of 55 – 60% in 2007 – 2009 was achieved only at the expense of urban districts. In municipal regions and settlements the ratio of own income for own expenses amounted to fewer than half (average 35%).

Reducing balance of municipalities’ own resources indicates an increase in dependence of local government financial assistance on higher levels of budget system.

Concluding the analysis of the budgetary provision of municipal entities, we can conclude that the capacity of local government is now little used; the territories exist mainly due to regulation and balancing of higher-level budgets. Therefore, economic incentives and financial autonomy of municipalities are the most problematic issues of municipalities’ transition to the regime of sustainable and integrated socio-economic development.

The movement towards fiscal self-sufficiency of local government should be a key area of municipal policy. Strategic benchmark here is the substitution in the budgets of municipalities with a relatively high level of socio-economic development of the financial aid budgets of higher revenues from their own revenue sources.

It seems that the efforts of governments promoting financial and economic foundations of local self-government at all levels should be focused on the following directions.

-

1.Strengthening the revenue base of local budgets.

-

2.The formation of municipal property.

-

3.I mproving fiscal relations at the sub national level.

The first priority in this direction is the redistribution of income between the federal, regional and local levels of government, consolidation of local budgets additional revenue sources, enabling municipalities to work on their own tax base. At the same time for urban districts as the most secured type of municipalities, norms of deductions from federal and regional taxes should be fixed in an amount sufficient to release their self-reliance.

It is necessary to strengthen the role of local taxes in the formation of a profitable part of local budgets. According to the financial executive authorities of the constituent territories of the Federation, practically a consensus today is a proposal to impose a local tax on real estate, assigned to the towns and urban districts, subject to a system of tax deductions in order to preserve the tax burden on low income citizens. It possible to consider an issue of giving the status of local to some other taxes (transport tax, taxes with the use of special tax regimes).

The reform of property taxes requires prompt completion, which should make these taxes in the real revenue sources of the municipalities. In respect of the land tax there should be improving the order of separation of state ownership of land in order to establish more reasons to assign land to municipal ownership. It seems appropriate to return to the old order of property tax payment that is at the location of the property. To increase the collection of property tax on individuals the initial step is legislative changes with regard to establishing a mechanism to attract owners to responsibility for evasion of registration of property rights to the property.

An important factor in determining the revenue potential of municipalities is the development of small and medium businesses. Local authorities are to promote it removing all the infrastructural and administrative restrictions to the development of these forms of entrepreneurship.

To increase the territories’ earnings potential from the use of property one must abandon strict regulation of the property, which may be owned by the municipalities. In world practice currently is dominating an approach in which management of municipal assets - real estate, land, borrowing, etc. - is considered in comparison with the practice and methodology of management of private assets. This methodology involves a complete inventory of assets, as well as maintaining the register of property and asset management on a portfolio basis.

It is important to ensure full payment of land utilization and municipal property, for which it is necessary to develop the entire legal framework on management of property, greater engagement with tenants and other measures to increase the collection of non-tax payments.

As long as there are significant differences in the budgetary provision of municipalities, the level and quality of services to the population should not be made dependent on the finan- cial capacities of local budgets. Therefore it is necessary to continue improving the budgetary interaction. In this context, a systemic review of the current scheme of intergovernmental fiscal relations by consistently moving towards a reasonable decentralization seems justified. Implementation of this approach is seen through the debugging control mechanism with clear division of competencies between the three levels of government and the relevant distinction between public responsibilities. Local authorities should be exempted from participation in the decision of inappropriate administrative tasks without financial guarantees from the state.

To address the issue of local budgets’ vertical balance it is necessary to implement the mechanisms of equalization schemes of municipalities based on the definition of basic principles for the formation of standards for the provision of municipal services and the minimum estimated budget security.

In order to improve the efficiency of the intergovernmental grants system it is necessary to exclude the practice of non-productive counter financial flows. The consolidation of numerous types of transfers from the federal budget to regional and municipal level also seems justified.

Of course, the problems of budgetary provision of municipal entities are national in scope. However, it is this local authority on which directly depend the possibility of the territories’ innovation and development, and quality of services to the population. Therefore, local government needs in the most serious attention and support from the state. A qualitatively different approach to the differentiation of policies for different types of municipalities is required. Municipalities which are points of growth (especially urban districts) should receive effective incentives for development, and depressed territories – assurance of state support. Urban districts should be allowed to expand their list of critical issues of local importance. With regard to rural settlements, on the contrary, the state must increasingly take responsibility for financial security and compliance with basic standards of service delivery.

Список литературы Budget provision of municipal entities in the Vologda region: state, problems and improvement ways

- Budget Code of RF . -M.: Prospekt, 2006. -216 p.

- On Regional Budget for the years 2000 -2009 : laws of the Vologda region//Reference retrieval system “ConsultantPlus”.

- On the performance of the regional budget for the years 2000 -2008 : laws of the Vologda region//Reference retrieval system “ConsultantPlus”.

- The regional target program “The reform of regional finances in the Vologda region in 2008 -2010” : the decision of the Legislative Assembly of the Vologda region from 07.12.2007, № 1091//Reference retrieval system “ConsultantPlus”.

- On the main directions of tax and budget policy in the Vologda region in 2010 and until 2012: resolution of the Government of the Vologda region from 14.09.2009, № 1397//Reference retrieval system “ConsultantPlus”.

- Uskova, T.V. Managing sustainable development of the region /T.V. Uskova. -Vologda: ITSED RAS, 2009. -318 p.

- Uskova, T.V. Stability of regional socio-economic systems /T.V. Uskova//Bulletin ENGECON. -2009. -№ 6 (33). -Pp. 273-276.

- Uskova, T.V. Budget provision as a factor for sustainable development of the region /T.V. Uskova, S.S. Kopasova//Financial management. -2009. -№ 1. -Pp. 93-104.

- Modeling of sustainable development as a condition for enhancing the territory’s economic security/A.I. Tatarkin, D.S. Lvov, A.A. Kuklin, A.L. Myzin, L.L. Bogatyrev, B.A. Korobitsyn, V.I. Yakovlev. -Ekaterinburg, 1999. -276 pp.

- Public finance of the region: state, factors, perspectives //ed. by V.A. Ilyin and M.F. Sychev. -Vologda, VSCC CEMI RAN, 2000. -157 p.

- Proceedings of seminars with the financial authorities of the RF subjects //Official website of the Ministry of Finance of Russia. -Access mode: http://www1.minfin.ru/ru/budget/regions/seminars

- Problems of improving the budgetary policy of regions and municipalities : proceedings of the Seventh scientific conference, Petrozavodsk, May 30 -June 1, 2007. -Petrozavodsk: PetrGU, 2007.

- Tugarin, V.S. Experience of fiscal reform implementing in the Vologda region //Challenges and prospects of budget reform in Russia: All-Russia forum, Vologda, November 1, 2008. -Access mode: http://www.sfr.krd.ru

- Fiscal decentralization in countries with transition economies . -M.: Editorial URSS, 2007. -160 p.

- Ensuring financial sustainability of local budgets in modern conditions : recommendations of the All-Russia conference, Moscow, November 17, 2009. -Access mode: http://www.sfr.krd.ru

- Rukina, S.N. Municipalities’ budget revenues management in terms of reform /S.N. Rukina//The journal “Finansovye issledovaniya”. -2008. -№ 3. -Pp. 47.

- Bezhaev, O.V. Local budgets in the new legislative conditions /O.V. Bezhaev//Budget. -2008. -№ 6. -Access mode: http://budget.ru/article/40054.php

- Borovikova, E.V. Municipal financial management /E.V. Borovikova//Financial management. -2006. -№ 5. -Access mode: http://www.finman.ru/articles/2006/5/4240.html.

- Hodzhabiyan, O.M. Financial aspects of the local government reform in Russia /O.M. Hodzhabiyan//The journal “Finansovye issledovaniya”. -2004. -№ 9. -Pp. 58.

- Batov, G. Problems of local government organization /G. Batov//The journal “Ekonomist”. -2008. -№ 3. -Pp. 81.

- Kiselev, I. The transfer of additional and differentiated tax regulations to municipalities and strengthening their financial independence /I. Kiselev//The journal “Federalizm”. -2009. -№ 1. -Pp. 217.

- Likhachev, D.A. Problems of financial support of municipalities in terms of the municipal reform /D.A. Likhachev//The journal “Federalizm”. -2009. -№ 3. -Pp. 209.