Characteristics of currency swaps in abroad and in Uzbekistan

Автор: Khatamov K.

Журнал: Экономика и социум @ekonomika-socium

Рубрика: Основной раздел

Статья в выпуске: 4 (71), 2020 года.

Бесплатный доступ

The article analyses the specifics of swap transactions abroad and in Uzbekistan, focusing on currency swaps. Attention will be paid to the growth in the number and volume of such currency transactions in the international market, the regulation of currency swaps in Uzbekistan.

Swap, currency swaps, interest rate swap, fx swap, currency swap transaction, derivatives

Короткий адрес: https://sciup.org/140251923

IDR: 140251923 | УДК: 08.00.01

Текст научной статьи Characteristics of currency swaps in abroad and in Uzbekistan

In international banking practice, swap transactions are often carried out.

The currency swap operation is aimed at maintaining the liquidity of banks in national or foreign currency, diversifying foreign currency assets and minimizing and hedging currency risk (risk of losses due to exchange rate fluctuations), as well as placement of temporarily vacant funds can be done for profit purposes.

A currency swap transaction is a bilateral transaction for the simultaneous purchase and sale (exchange) of currencies on the terms of settlement (reexchange) at the term and exchange rate specified in the agreement.

The currency swap operation consists of two parts:

-

- initial currency exchange (spot deal),

-

- re-exchange (forward agreement) and closing of the swap agreement.

Swap agreements are made to use the required currency over a period of time, while another currency is provided as collateral. A swap transaction is made in the form of two interrelated currency transactions. Its exchange rate is calculated on the basis of the current exchange rates prevailing at the time of the swap agreement and the exchange rates of the forward agreement.

Currency swap transactions by banks of the Republic of Uzbekistan are regulated by the Regulation “On the procedure for currency swap transactions by banks of the Republic of Uzbekistan” registered with the Ministry of Justice on 24.07.2008 No. 1839. Currency swap operation in accordance with this Regulation can be done:

-

- between the Central Bank and commercial banks;

-

- interaction between commercial banks;

-

- between bank customers and commercial banks.

According to the latest amendments to the Regulation, when conducting currency swap transactions, the base rate of the swap agreement is not at the rate set by the Central Bank, but at the discretion of the parties when concluding a swap agreement.

It was also stipulated that the parties may use any foreign currency as a foreign currency in the conduct of currency swap transactions.

Currency swap transactions between the central bank and commercial banks, also commercial banks, are made and performed in the Trading System of the currency exchange.

Currency swap transactions between commercial banks and their customers are carried out directly in banks in accordance with this Regulation.

Currently, the volume and scale of transactions in the global foreign exchange market continue to grow and their range is expanding.

Among the various foreign exchange transactions in the global foreign exchange market, swap transactions can be distinguished.

By 2019, among other types of international currency transactions, currency swaps took first place, and in general, the international swap market is considered to be fully formed in the 1980s due to the growing global economic relations.

The first currency swap was a multi-currency exchange agreement between IBM and the World Bank in August 1981. This date is the birthday of currency swaps.

To date, the regulation of the international derivatives market at the level of national structures and self-governing bodies has already developed.

These are the International Swap and Derivatives Association (ISDA) and Bank for International Settlements (BIS).

These organizations perform the following functions:

-

- creation of market infrastructure;

-

- regulation of the global market;

-

- consolidation of contracts and terms of derivative agreements;

-

- collection and analysis of market data;

-

- monitoring of market participants.

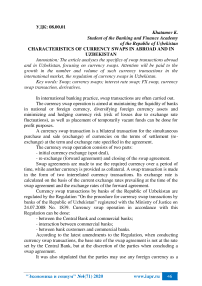

Picture 1. Daily world currency swap turnover, mln. USD Source: Foreign Exchange Market Turnover 2019. Bank for International Settlements, 2019.

URL:

To analyse the structure of the currency swap market by the criteria of currency composition, we refer to the specifics of currency swaps in the international currency market. Currency swaps are derivatives in which simple currency transactions act as a “underlying asset”. Picture 1 shows the structure of the international swap market for individual currencies based on the latest generalized statistics of the Bank for International Settlements.

Thus, we can see that the main currencies involved in currency swap transactions in the international currency market are the US dollar and the euro. It is one of the most widely traded currencies in the world. In turn, the currency swap market in general repeats the trends in the international currency market, determined by global changes in the international financial architecture.

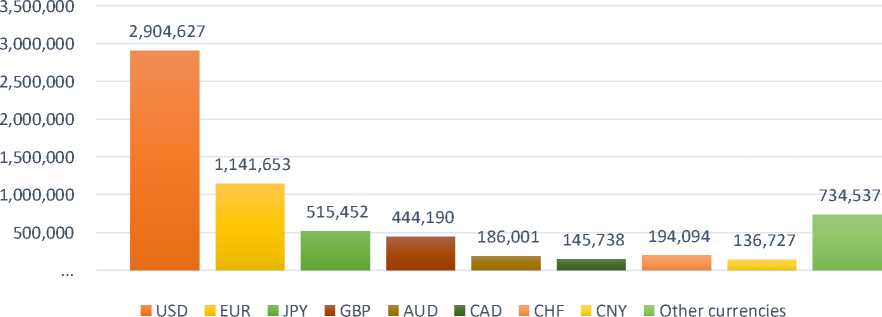

Picture 2. Daily currency swap turnover, mln. USD

Source: Foreign Exchange Market Turnover 2019. Bank for International Settlements, 2019.

URL:

We will now look at which countries are more likely to use currency swaps. Based on the statistics of the Bank for International Settlements, we compile an average currency conversion scheme per day (Picture 2).

The size of the UK swap trade is remarkable, as we can see that the UK is trying to remain a major financial centre in Europe and the world.

■ Seven days or less

■ Over 7 days and up to 1 month

■ Over 1 month and up to 6 months ■ Over 6 months

CHINA FRANCE GERMANY RUSSIA SINGAPORE UNITED UNITED

KINGDOM STATES

Picture 3. Currency swap term distribution (in percent) Source: Foreign Exchange Market Turnover 2019. Bank for International Settlements, 2019.

URL:

It is also advisable to consider currency swaps over time. (Picture 3).

From the visual data obtained, we can see that the majority of currency swap transactions are short-term and last no more than 7 days. Transactions of up to 1 months and 1 to 6 months are also large, but transactions over 6 months are very rare, even in developed countries.

The global currency and interest market is the largest segment of the over-the-counter derivatives market.

This market is several times larger than the volume of transactions in terms of global GDP and financial market size. Therefore, we can estimate the demand for currency swaps in the international market due to these trends to hedge currency risks.

Table 1

The average daily turnover of currency swaps, bln. USD

|

1995 |

1998 |

2001 |

2004 |

2007 |

2010 |

2013 |

2016 |

2019 |

|

|

United |

244 |

372 |

300 |

428 |

899 |

775 |

1127 |

1161 |

1 646 |

|

United States |

83 |

166 |

114 |

183 |

239 |

267 |

341 |

391 |

579 |

|

Japan |

89 |

61 |

90 |

125 |

112 |

168 |

170 |

206 |

195 |

|

Hong Kong |

53 |

44 |

44 |

61 |

122 |

147 |

174 |

276 |

417 |

|

Singapur |

58 |

75 |

58 |

72 |

116 |

122 |

173 |

248 |

335 |

|

France |

30 |

50 |

38 |

46 |

87 |

104 |

135 |

137 |

118 |

|

Switzerland |

34 |

42 |

41 |

49 |

116 |

173 |

132 |

116 |

161 |

|

Total |

777 |

1052 |

934 |

1329 |

2250 |

2352 |

2947 |

3209 |

4 233 |

Source: Foreign Exchange Market Turnover 2019. Bank for International Settlements, 2019.

URL:

The role of these tools in overcoming the crisis is difficult to assess, although they are rarely singled out. The European Central Bank (ECB) and the U.S. Federal Reserve System (FRS) established the first dollar/euro swap lines in late 2007 for European banks to settle their mortgage-backed securities. The global financial crisis, which began in 2008 with the collapse of the American investment bank Lehman Brothers, has affected the economy of the entire continent. By the end of June 2011, foreign partners (primarily the Bank of England and the Federal Reserve) had borrowed about $ 600 billion from the Federal Reserve under contracts. The ECB also took advantage of the euro/dollar currency swap in May 2010 in connection with the onset of the debt crisis in Greece. At the time, the European Central Bank borrowed about $ 9.2 billion from the Federal Reserve System in just one week.

Until 2011, swaps between central banks were open for seven days. However, in the fall of 2011, the Federal Reserve System, the European Central Bank, and the central banks of Canada, Switzerland, the United Kingdom, and Japan (the “Big Six”) began coordinating operations to ensure global liquidity. According to a press release posted on the websites of these regulators, the aim of the coordination was to alleviate the crisis in the financial market and thereby reduce the negative effects of this crisis by providing loans to households and businesses to stimulate economic activity.

This decision was due to the fact that the financial crisis in the global financial system is increasingly manifesting itself in the signs of the second wave.

The monetary authorities of the United States, the European Union, the United Kingdom, Japan, Switzerland, and Canada have agreed:

-

a) reduction of the cost of providing dollar liquidity under currency swaps (by linking the indexes of swaps in the national currency in the US by the banking system);

-

b) extension of currency swaps for three months;

-

c) removal of restrictions on dollar liquidity (the size of currency swaps is determined by the needs of the banking system of the country);

-

d) The Federal Reserve reserves the right to apply to the central partner bank for foreign currency, if necessary.

In December 2011, the FRS supported the ECB lending program. This meant an additional issue of around € 500 billion.

In part, this amount could be exchanged for U.S. currency in the amount of a 3-month swap ($ 100 billion in total).

Without a currency swap agreement, euro could depreciate, resulting in unnecessary financial, economic and political tensions between Brussels and Washington.

It is known that since 2010 the US monetary authority has been implementing quantitative easing programs, which, in fact, means an increase in the money supply of the dollar. There is scientific debate as to whether such quantitative easing should be carried out by the U.S.’s closest partners, such as the European Union, the United Kingdom, Japan, and Canada. But despite all the actions of the banks of these countries, the money supply is growing, and the coordination of these actions is very important. In the developed countries after the financial crisis of 2007-2009, they realized this and began to create such a coordination mechanism, and currency swaps became an important part of this mechanism.

In the next phase, the above-mentioned regulators (as well as after the return of the Bank of Japan to the "elite" club) agreed to accept temporary currency swap agreements as a permanent procedure (until October 31, 2013) and to regulate liquidity in countries if market conditions worsen. (or when there is a serious turmoil in the foreign exchange market) they created an international currency unit in order to respond more quickly. It turns out that a small group (but leading) of the world’s central banks are creating a global currency management mechanism. Some see this as the emergence of a global currency cartel of central banks and the consolidation of the foundations of international financial administration.

It is already clear that central banks are stepping up the coordination of their actions. Analysts say the corridor of exchange rate fluctuations in the "big six"

has narrowed and difficult times have come for currency speculators. In the Big Six, the idea of a freely convertible currency with a fixed exchange rate is conditional. The G6 has already strengthened its position on countries that are not members of this “elite” club, and sceptics now believe it is futile to discuss the possibility of creating a single monetary policy mechanism for the G20.

Signs of joint issuance by the FRS, ECB and other central banks of the Big Six are emerging, which allows them to consider their national currencies as a single currency. Indeed, given the stability of exchange rates between the U.S. dollar, the pound sterling, the euro, the Swiss franc and the Canadian dollar, and the Japanese yen, we can now assume that they are not different currencies, but different forms of a single global currency.

After analysing the international market of currency swaps, it can be noted that this is one of the important segments for over-the-counter derivatives in the world market. The main currencies in this market are the US dollar and the euro.

According to statistics, swap deals up to 7 days are the most common, and as the contract period increases, the demand for them from market participants decreases, as this swap becomes less risky.

By 2019, the global currency swap market has shown steady growth, lending and foreign exchange transactions have grown and continue to grow. At the same time, the international currency swap market repeated the dynamics of the global derivatives market.

However, it should be noted that more and more currencies are emerging for currency swaps.

In order to develop the economy of our country, special attention is paid to the use of financial instruments used in the best international practices. The Decree of the President of the Republic of Uzbekistan "On additional measures to further develop the economy and increase the effectiveness of economic policy" provides for the development of the market of derivative financial instruments in the country. Swap transactions make up the bulk of the derivatives market.

It should be noted that in 2019, for the first time in Uzbekistan, Asaka Bank conducted interbank currency swap transactions through the automated electronic system of the Republican Currency Exchange.

It is obvious that in the near future in our country the use of derivative financial instruments and swap operations, which are an integral part of them, will increase and their market will develop.

Список литературы Characteristics of currency swaps in abroad and in Uzbekistan

- Regulation "On the procedure for currency swap operations by banks of the Republic of Uzbekistan" registered by the Ministry of Finance of the Republic of Uzbekistan dated 24.07.2008 No. 1839.

- M.A. Eskindarova, E.A. Zvonovoy. "World finance" M.: Knorus, 2017. 424 p.

- Shegoleva N.G., Khabarov V.I. Types of operational swaps and realization technology // Finansy i kredit. 2012., 37. P. 33-42.

- Shegoleva N.G., Khabarov V.I. Obzor mezhdunarodnogo svop-rynka // Finansy i kredit. 2012., 41. P. 2-13.

- Vasileva I.P., Xmyz O.V. Theoretical aspects of functional currency market // Finansovyy biznes. 2009. № 2. B. 23-33.

- Zvonova E.A., Juravleva Yu.A. International currency wars at the end of 2010: positions of individual countries // International Economics. 2011. № 3. B. 31-36.

- https://www.bis.org/statistics/rpfx19.htm?m=6%7C32%7C617

- https://gazeta.norma.uz/publish/doc/text116001_svop_operaciyasi_u_nima_uzi_va_u_qanday_hisobga_olinadi.