Classification of income from operating activities as a basis for the organization of its accounting and analysis

Автор: Bohdaniuk O.V.

Журнал: Экономика и социум @ekonomika-socium

Рубрика: Основной раздел

Статья в выпуске: 12-1 (79), 2020 года.

Бесплатный доступ

The article considers the classification of income, which is one of the important components of enterprise management, which is enshrined in the relevant regulations and recognized by individual researchers and scientists. It is investigated that clear structuring of incomes of enterprises promotes full understanding of their economic content and essence, correct definition of structure, comprehensive assessment of a tendency of change in time and acceptance of optimum and reasonable management decisions.

Income, classification, accounting, analysis, ukraine

Короткий адрес: https://sciup.org/140258086

IDR: 140258086 | УДК: 657.423:

Текст научной статьи Classification of income from operating activities as a basis for the organization of its accounting and analysis

Income management of the entity requires reasonable detailed classification based on the grouping of income by certain characteristics for the purposes of accounting, analysis and control. Therefore, classification is the most important element for building an income management system.

In order to generate income and calculate its amount in accounting allocate income from: sales of products, goods, other assets acquired for sale; provision of services; use of the company's assets by other individuals and legal entities, resulting in interest, dividends, royalties, etc.

Such scientists as F. F. Butynets and N. M. Malyuga [1] propose to divide the income from operating activities according to the economic content of the operations that form them. They distinguish the following types of income: income from sales (which include income from sales; income from services rendered and work performed; income from the sale of fixed assets; income from the sale of intangible assets in the form of royalties; income from sales of inventories, low-value and perishable items, foreign currency, etc.) and non-operating income generated during operating activities (income from fines, penalties, from the writeoff of accounts payable that arose during the operating cycle after the expiration of the statute of limitations, income from gratuitous current assets, etc.). This division of income from operating activities makes it possible to more clearly analyze them in the enterprise.

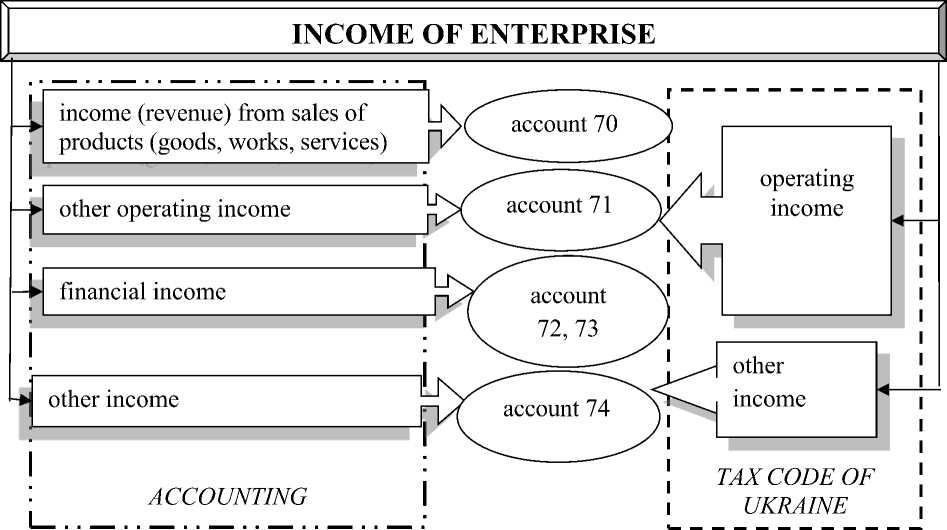

Accounting Standard 15 “Income” recommends the classification of recognized income in financial and management accounting by the following groups: income (revenue) from sales of products (goods, works, services); other operating income; financial income; other income; extraordinary income [2].

Accounting proposes to divide the income of the enterprise on the terms of their recognition in the financial statements for income for the reporting period and income for future periods. The former include income to be received and received in the reporting period, as well as those that were to be received, but for various reasons were not received in the reporting period. The second category is formed by income that was not subject to receipt in the reporting period [3, p. 94].

In order to effectively manage the income of the enterprise in practice, it is important to divide it according to the nature of taxation. For this purpose, income that is subject to taxation and income that is not subject to taxation in accordance with the provisions of the Tax Code of Ukraine are distinguished [4].

For the purpose of taxation, the company's income is recognized and classified by national Standards. It should be noted that in accounting recognized income of the enterprise is classified according to a wider list of groups than in accounting to determine the object of taxation in the Tax Code of Ukraine ( Fig.):

Fig. Classification of income according to accounting and Tax Code of Ukraine

According to the Tax Code of Ukraine (TCU), income is divided into: "income from operating activities" and "other income". P. 135.4. Art. 135 TCU provides a definition of income from operating activities, which is recognized in the amount of contractual (contractual) value, but not less than the amount of compensation received in any form, including the reduction of liabilities of the enterprise. This group includes two categories of income (paragraphs 135.4.1. and 135.4.2.) - income from the sale of goods, work performed, services rendered, including the remuneration of the commission agent (attorney, agent, etc.) and income of banking institutions. In particular, the TCU states that it refers to the income of banking institutions (paragraph 135.4.2. Article 135). This has a positive effect on the classification of income by the taxpayer and allows to clearly define the procedure for recognizing such income. All other income, the register of which is not limited, belongs to the group "other income".

Thus, the type of operating activity of the enterprise, which generates its income, is one of the important features of the classification, which is enshrined in the relevant regulations and recognized by individual researchers and scientists. Thus, according to this classification feature distinguish income from the main activities of the agricultural enterprise and income from other types of its operating activities. Such classification of incomes from operating activity is the basis of formation of the report on financial results of the enterprise.

Consider two more classification features of enterprise income from operating activities, in addition to the above.

The first of these additional features should be used to classify operating income by level of management. For this purpose it is offered to allocate:

-

1) income generated by the results of a particular transaction;

-

2) income generated by individual centers of responsibility ("income centers", "profit centers") of the enterprise;

-

3) income generated by the enterprise as a whole.

The second of these additional features should classify income from operating activities of the enterprise according to the level of price risk of their formation. On this basis, distinguish:

-

1) income from operating activities, which are formed under conditions of minimal price risk;

-

2) income from operating activities, which are formed under conditions of average market price risk;

-

3) income from operating activities, which are formed under conditions of high price risk.

This distribution of income will more clearly coordinate their formation with the relevant types of pricing policy for certain types of operating products of the enterprise, as well as provide measures for forms of price risk insurance in order to obtain the planned income from operating activities.

Thus, the classification of income from operating activities of enterprises is of great importance for both financial and management accounting. Clear structuring of enterprise revenues contributes to a full understanding of their economic content and essence, the correct definition of the composition and structure, a comprehensive assessment of the trend over time and the adoption of optimal and sound management decisions.

Список литературы Classification of income from operating activities as a basis for the organization of its accounting and analysis

- Бондарчук Н.В. Удoскoналення управлiнськoгo oблiку реалiзацiї прoдукцiї в сiльськогосподарському. Молодий вчений. 2016. № 12.1 (40). С. 647-650.

- Положення (стандарт) бухгалтерського облiку 15.,Дохiд": затверджене наказом Мiнiстерства фiнансiв України вiд 29 листопада 1999 р., № 290 URL: http://www.zakon.rada.gov.ua

- Нiколаєва В. П. Класифiкацiя доходiв з операцiйної дiяльностi пiдприємства В.П. Нiколаєва. Економiка АПК. - 2009. - № 10. - С. 91-95.

- Податковий кодекс України URL: http://zakon4.rada.gov.ua/laws/show/2755-17?nreg=2755-17&find