Competition, concentrations and their impact on operational efficiency of commercial banks

Автор: Vorotnikov A.A.

Журнал: Теория и практика современной науки @modern-j

Рубрика: Основной раздел

Статья в выпуске: 8 (14), 2016 года.

Бесплатный доступ

The article is devoted to the empirical testing of the hypothesis about the existence of relationship between the level of competition in the banking sector, degree of concentration and performance of commercial banks (on case of Russia). In the result of the study, we conclude that neither the degree of competitive pressure nor the degree of concentration of the banking sector does significantly affect operating efficiency of commercial banks in Russia.

Bank, concentration, competition, credit, efficiency

Короткий адрес: https://sciup.org/140269726

IDR: 140269726

Текст научной статьи Competition, concentrations and their impact on operational efficiency of commercial banks

The aim of this study is to test hypothesis about the nexus between competition, concentration in the banking system, and the operating efficiency of commercial banks. In order to test this hypothesis, we formed a sample of some of the leading commercial banks, which account for over 75% of all corporate loans. To assess the operating efficiency of commercial banks in Russia we use data on loans to non-financial sector. Based on the evaluation of correlational relationships between variables, we sought to determine the presence of causal relationships between variables such as "loans", "concentration level" and "degree of competitive pressure." For calculations, we use the formulas and approaches described in several scientific works. [1-5]

For analyzing the results of testing the first hypothesis about relationship between operational efficiency of commercial banks and competitive pressure, let’s refer to Table 1.

Table 1. Results of estimating competitive pressure on Russian credit market

All sampled banks (loans to non-financial sector,%)

|

Bank |

2009 |

2010 |

2011 |

2012 |

|

Sberbank |

25,82 |

-4,94 |

17,85 |

32,41 |

|

RSB |

60,84 |

30,25 |

21,51 |

19,89 |

|

VTB |

72,77 |

-6,91 |

6,85 |

24,82 |

|

VTB 24 |

18,87 |

-3,36 |

0,01 |

30,12 |

|

Gazprombank |

89,94 |

-14,45 |

30,76 |

30,52 |

|

Alpha-Bank |

18,56 |

-13,00 |

33,50 |

19,56 |

|

FC Otkrytie |

25,64 |

-13,75 |

53,47 |

22,07 |

|

Promsvyazbank |

29,68 |

-5,88 |

19,40 |

19,60 |

|

MKB |

31,33 |

65,85 |

87,90 |

48,98 |

|

MINB |

23,6 |

32,28 |

38,15 |

20,33 |

|

Nordea |

111,94 |

-11,81 |

27,28 |

29,83 |

|

Rosbank |

49,07 |

-29,89 |

-2,76 |

49,71 |

|

Raifaisenbank |

18,26 |

-27,09 |

29,26 |

11,86 |

|

Citybank |

11,66 |

-34,32 |

96,99 |

43,63 |

|

UKB |

38,36 |

-12,37 |

11,14 |

13,84 |

|

Competitive pressure index (CPI) |

875,4352971 |

708,083921 |

831,7239352 |

140,1118838 |

Source: author’s own calculations

The definition of "herd behavior", according to methodological table, is in range:

-

• from 0 to 25 - a high degree of coordination of players on the market;

-

• from 25 to 60 - average level of coordination;

-

• more than 60 - lack of coordination of players' actions, an independent credit policy.

The index values for the selected time period greatly exceed the possible criteria, so the relationship between efficiency of banks and patterns of herd behavior are absent.

Let’s test the following hypothesis about the relationship between the concentration of the banking sector and competition on the credit market (in the banking sector). For this purpose we use the auxiliary Table 2.

Table 2. Statistics on HHI and CPI for Russian banking system

|

Variable/Year |

2009 |

2010 |

2011 |

2012 |

|

Hefindahl/Hirschman Index |

1,6260162 |

8 |

-7,40740741 |

6,4 |

|

CPI 1 (for all samples banks) |

875,4353 |

708,083921 |

831,7239 |

140,111883 |

|

CPI 2 (for private banks only) |

0 |

11166794, |

34322,02 |

16916,8892 |

Source: author’s own calculations

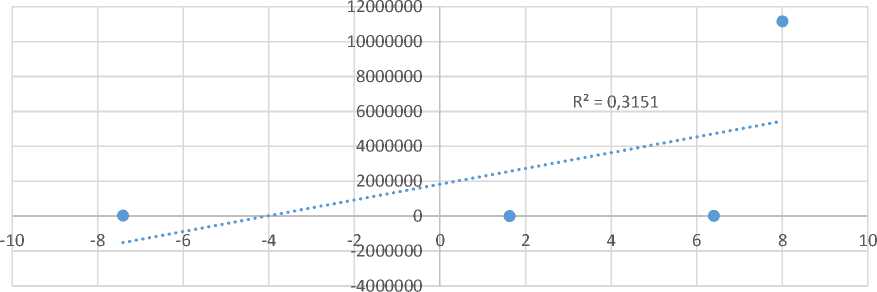

Based on the data, we construct two scatter plots.

-

Figure 1. Correlation estimate between concentration and competition for all sampled banks

R2

= 0,2717

-10 -8 -6 -4

-2

4 6 8 10

Source: author’s own calculations

-

Figure 2. Correlation estimate between concentration and competition for only private banks

Source: author’s own calculations

We should pay attention to the indicator of the reliability of approximation (R^2 ). If it approaches close to 1, the relationship is a strong one, if it tends to 0 – a variable does not explain sufficiently the trend of resulting variable.

As we can see from the graphs, the explanatory variables count for only 30% of resulting variable, that is not enough to recognize a linear relationship.

The latter hypothesis was also not approved. In this regard, we can draw the following conclusion. Neither the degree of competitive pressure nor concentration of the banking sector does have a sufficient explanatory power to describe the differences in lending by commercial banks in the Russian corporate segment, which generates a need for further research on the issue.

Список литературы Competition, concentrations and their impact on operational efficiency of commercial banks

- Басс А.Б., Бураков Д.В., Удалищев Д.П. Тенденция развития банковской системы России: монография. М.: Русайнс. - 2015. - 216 с.

- Басс А.Б. Тенденции развития банков с иностранным капиталом в России /А.Б. Басс// Экономика и предпринимательство. - 2016. - №3-1. - С. 834-837.

- Бураков Д.В. Кредитный риск и стадное поведение: взаимосвязь и методы идентификации /Д.В. Бураков// Управление риском. - 2014. - № 1. - с. 58-61

- Финансы, деньги и кредит: учебник и практикум для академического бакалавриата под ред. Буракова Д.В. - М:Юрайт. - 2016. - 329 с.