Corporate bonds as a source of financing Russia

Автор: Ammaev M.K.

Журнал: Экономика и социум @ekonomika-socium

Рубрика: Основной раздел

Статья в выпуске: 3 (58), 2019 года.

Бесплатный доступ

At the present stage of development of the securities market of the Russian Federation, corporate bonds traded on this market are the most important element of financing the economy of our country. This study examines the main concepts, significance and dynamics of corporate bonds circulation in the Russian Federation. In addition, current problems of corporate bonds are being studied and measures are being taken to eliminate them.

Bond, bond market, corporate bonds, stock market, issue, investments

Короткий адрес: https://sciup.org/140241775

IDR: 140241775

Текст научной статьи Corporate bonds as a source of financing Russia

A bond is an issuance debt security that reflects a loan relationship between an investor and an issuer. Its holder has the right to receive from the issuer over time its nominal value in cash or in the form of any other property equivalent with interest. The issuance of bonds is one of the ways to raise funds for the development of their business. The most important feature of bonds is the payment of interest on them.

Corporate bonds have such parameters as profitability, liquidity, reliability and other investment qualities. Investors who invest in ruble securities bear risks, since the devaluation of the national currency may occur and the market interest rate may change. One of the advantages of corporate bonds is to minimize this risk, since coupon payments are introduced with a floating interest rate, depending on changes in the exchange rate, and which are indexed at certain time intervals [6, с.35].

The most promising segment of the securities market is the corporate bond market. The corporate bond market is the most active part of the Russian bond market, which is characterized by a rapidly developing infrastructure, a significant degree of sectoral diversification of issuers and increasing liquidity of issues.

In recent years, among economists there has been an increase in the attention paid by the government to this instrument. So, during the speech with the message of the President to the Federal Assembly, Putin V.V. expressed suggestions for improving the corporate bond market. Additional impetus to the market will help give measures to transform the order of issue of debt securities, and increase in the eyes of investors their attractiveness will help the removal of coupon income from taxation [1, с.2].

Since 1999, the period of formation of the corporate debt market, and up to the current point in time, the Russian corporate bond market as a segment of the financial market is developing dynamically. Consistency in simplifying the procedure for issuing and improving the legislation of this debt instrument guarantees the inflow of new issuers and, in turn, stimulate more and more actively to resort to the issue of corporate bonds already having experience in borrowing issuers.

Large Russian issuers, in addition to issuing bonds in national currency, also practice borrowing money through Eurobonds. Companies in the non-financial sector of the Russian Federation, banks, and other financial institutions can issue both in dollars or euros, and in several currencies specific to the Russian market, such as Czech krona (CZK), pounds sterling (GBP), Australian dollars (AUD) , Turkish Lira (TRY), Chinese Yuan (CNY), Israeli Shekels (ILS), Swiss Francs (CHF) and other currencies, depending on the specifics of the activity and the need for a certain currency [1, с.3].

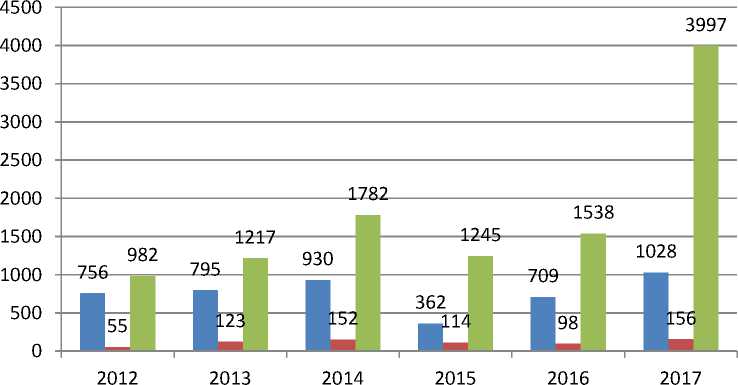

Figure 1 shows the dynamics of the volume of the primary bond market in 2012-2017.

-

■ federal

-

■ sub

federal

-

■ corporate

Fig. 1 Dynamics of the volume of the primary bond market in 2012-2017

Note: baseline data based on reporting data from the Central Bank of the Russian Federation, Moscow Exchange and Rosstat of the Russian Federation.

There are three groups of participants on the primary corporate bond placement market: issuer, underwriter and investor. Placement can be held in the form of an auction or in the mode of negotiation transactions.

Consider the Russian corporate bond market today. Table 1 presents data on the volume of the primary bond market in 2012-2017.

Table 1

Объем первичного рынка облигаций в 2012-2017 гг., трлн.руб.

|

Name of the bond |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

|

Federal |

756 |

795 |

930 |

362 |

709 |

1028 |

|

Subfederal |

55 |

123 |

152 |

114 |

98 |

156 |

|

Corporate |

982 |

1217 |

1782 |

1245 |

1538 |

3997 |

|

Total |

1793 |

2135 |

2864 |

1721 |

2345 |

7198 |

Source: source data based on the reporting data of the Central Bank of the Russian Federation, Moscow Exchange and Rosstat of the Russian Federation.

Thus, in the dynamics of 2012-2017. It should be noted that the volume of the primary bond market grew from 1,793 billion rubles. in 2012 to 3372 billion rubles. in 2017 for 1206 billion rubles. in absolute terms and by 122.81% in relative terms. The share of corporate bonds in 2012 accounted for 54.77% of the total market volume. By 2017, this value increased to 64.89%, which indicates an expansion of the corporate bond market. On average, the corporate bond market has increased since 2012 by 2,459 billion rubles. or 14.28% for each year and in 2017 amounted to about 3997 billion rubles.

There are 3 levels of corporate bonds on the stock market of the Russian Federation. The first level bonds are bonds of Gazprom, Russian Railways, Vneshtorgbank and others.

It should be noted that the largest share in the corporate bond market in 2017 was held by the oil and gas sector (26.7%). In the second largest position is the banking sector with a share of 19.9%. The third position is occupied by the financial sector (18.9%), represented by bonds of mortgage agents, as well as bonds of leasing, insurance and other financial companies. It should also be noted that the position of other industries, which occupies 14.3% in the total structure, is represented by the largest borrowers, including Rosneft (with a share of 20.7%), Russian Railways (5.8%), FGC UES (3 , 5%), VEB and AIZHK (2.3% each), Transneft (2.2%), etc. [2, с.15].

Despite the positive dynamics, showing the corporate segment of the stock market over the years, a number of problems remain, the solution of which has not yet been found.

Over the past few years, the desire of issuers to invest money in the Eurobond market is reduced by reducing the placement of new issues. This is due to the lack of interest in Russian securities from investors due to the unstable economic situation in the remaining country, as well as the unwillingness of Russian issuers to borrow in conditions of exchange rate uncertainty, which is associated with strong fluctuations in energy prices on the world market and the weakening of the ruble.

In Russia, among other problems of the corporate bond market, there is a lack of information to investment companies about the activities of an enterprise that an investor can receive when purchasing bonds of an enterprise.

Based on this, it can be concluded that the effects of economic sanctions imposed by the United States, the EU and some other countries on the Russian Federation had a significant negative impact on the current state of the Russian economy, which ultimately led to a drop in the capitalization of Russian enterprises and an increase in capital outflow reducing the investment attractiveness of the national financial market and financial instruments [4, с.27].

If we refer to the experience of the leading economies of the world, the corporate bond market is a significant source of funding for issuers in both developing and developed countries.

Therefore, in many respects the state of the market determines the prospects for the level of investment as the main direction of stabilization of the country in the post-sanction period. Nevertheless, corporate bond issuers are taking a series of measures to increase the attractiveness of their securities among buyers. For example, some enterprises that carry out financing through bond issues increase their profitability and create a secondary market for them. And issuers themselves or through underwriters undertake to redeem these corporate bonds at a predetermined price every three to six months.

In my opinion, there is a demand for Russian Eurobonds, but the supply of new issues is limited, since Western investors cannot acquire issues of Eurobonds of companies that are under sanctions. Therefore, a decrease in the yield of Eurobonds is expected due to a structural supply shortage, which is observed in Russia as a result of currency oversupply and a shortage of “long and fresh” money in the domestic market, due to the “freezing” of pension savings, which continues in 2017. [5, с.7].

In our opinion, the Russian stock market has long been a part of global finance and for many years has been an inseparable segment of the global financial system. And bonds are attributed to one of the most competitive investment instruments that have certain possibilities of ensuring maximum profitability in the form of capital gains and interest. The development of the corporate bond market will help ensure progress in the development of the domestic financial market, as well as strengthen its competitiveness in the global capital market. Today there are a number of weaknesses in the corporate bond market. One of them is the presence of a brokerage commission for debt-purchase-sale transactions that reduce its profitability. Also significant is the small number of bond issues that are subject to the new law on exempting legal entities and individuals from paying personal income tax on coupon income on ruble bonds in the period from January 1, 2017 to December 31, 2020 and the high degree of popularity of deposits due to safety due to insurance in the amount of up to 1.4 million rubles. and availability of guaranteed return [5, с.8].

It should also be noted the necessary conditions for the motivation of growth of the corporate bond market. This is primarily the possibility of borrowing for the long term. In addition, the increase in the money supply in Russia, the trend of lower interest rates, maintaining competitiveness in the capital market and the possibility of placing short-term bonds in a simplified manner will be very effective.

In the Russian economy, further development of the situation will in most cases depend on changes in external economic conditions and the speed with which the domestic economy adapts to them. A reduction in debt burden, a gradual weakening of domestic financial conditions, and an improvement in business sentiment in the second half of 2018 can create prerequisites for restoring production and investment activity in 2019-2020.

Список литературы Corporate bonds as a source of financing Russia

- Alekseeva I.A. Russian corporate bond market: trends and development prospects//News of the Baikal State University. -2017. -№3. -with. 1-9.

- Antonov R.A. Problems and prospects of development of the corporate bonds market in the Russian Federation//Management of the reform of the socio-economic development of enterprises. -2017. -p. 15-18

- Edunova PI State and development trends of the Russian corporate bond market//Managing the reform of the socio-economic development of enterprises. -2017. -p. 1-5.

- Kornienko M.N. Corporate bond market in the Russian Federation//IEAU Bulletin. -2017. -№15. -with. 51-56.

- Kryachkova L.I. Features of the functioning of the corporate bond market in Russia//European Studies. -2017. -p. 7-8.

- Morozenko N.D. Problems and prospects of development of the corporate bond market in Russia//New Science. -2017. -p. 35-36.