Creating competitive strategies of industrial enterprises from the standpoint of corporate social responsibility

Автор: Romanova Olga Aleksandrovna, Berg Dmitrii Borisovich, Matveeva Yana Andreevna

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Industrial economics

Статья в выпуске: 6 (54) т.10, 2017 года.

Бесплатный доступ

Socially responsible activity, corporate social responsibility, competitive behavior strategy, competitive advantages, enterprise competitiveness, investment, non-financial assets

Короткий адрес: https://sciup.org/147223994

IDR: 147223994 | УДК: 339.137.2 | DOI: 10.15838/esc.2017.6.54.9

Текст статьи Creating competitive strategies of industrial enterprises from the standpoint of corporate social responsibility

Amid neo-industrialization, the techno-economic paradigm is characterized by increased attention to building social progress and forming a relatively new phenomenon such as impact investing [11]. The concept of social progress is being actively developed not only in sociology but also in economics and public administration. The level of countries’ social development is characterized by the so-called social progress index – a composite indicator of the international research project “The Social Progress Imperative”, which measures countries’ achievements in terms of their social development [7]. The social progress index which does not take into account any cost parameters including GDP, is estimated using more than 50 indicators grouped in three categories taking into account human needs, foundations of their well-being and development opportunities. According to the ranking of world countries by level of their social progress 2014, Russia ranks 80th out of 132. Such low rates were the consequence of poor quality of healthcare, personal security, personal rights and tolerance [4]. By the end of 2017, Russia rose to the 67th position out of 128 possible [7]. Responsible conduct of business, especially large corporate structures, is a mandatory precondition for the social progress of the society. The establishment of a new techno-economic paradigm which takes into account the changing foundations of economic development and the increasing tensions of competition inevitably determines the evolution of corporate social responsibility. Its area of responsibility includes new noneconomic factors; the spatial aspect of social responsibility is expanded. Companies are now responsible not only for the results of production and economic activity, but also for other aspects such as environment, social programs, education, healthcare etc., i.e. they are forced to be socially responsible. The development and strengthening of civil society institutions amid globalization of the world economy demands that domestic business practices meet the requirements of international standards, which raises the issue of ensuring competitiveness of industrial enterprises of a qualitatively new level.

The evolution of the social responsibility of separate companies and the entire business environment goes through a series of development stages of development, starting from simple forms and ending with full integration of social responsibility into the activities of economic entities. The introduction of the principles of corporate social responsibility (the principles of consistency, comprehensiveness, specificity, hierarchy, information security, etc.) [5, pp. 138–139] into the practice of Russian companies expands the range of opportunities for the formation of long-term competitive advantages within the philosophy of “Industry 4.0”. The following main factors in “Industry 4.0” development are distinguished [6, 21, 23]: digitalization, Internet of everything, additive technology, fully automated cloud storage.

Experts from industrialized countries, primarily the USA and Germany, believe that the Fourth industrial revolution will provide many advantages. However, negative changes are expected associated with the disappearance of blue-collar occupations, increased unemployment in developing countries and increased gender disparity. According to the report published for the 46th World Economic Forum in Davos, Switzerland [26], these changes have already begun since 2015.

Within the new industrial paradigm intellectual resources become the main resources of companies, changing competitive advantages [2, 16]. Future structural changes in the industry stimulated by the transition to the new techno-economic paradigm lead to the fact that amid neo-industrialization a major role in shaping the competitiveness of a modern company will belong to intellectual capital. There are empirical studies confirming the influence of intellectual capital on the company’s performance. Examples of these studies are presented in Table 1 .

Despite the increasing role of intellectual resources, key decisions of owners, managers and investors are made based on company’s financial statements; this leads to underestimation of risks and benefits related to

Table 1. Empirical studies of the impact of intellectual capital on company’s performance

|

Authors |

Research results |

Sampling features |

|

N. Bontis, W.C.C. Keow, S. Richardson, 2000 [18] |

The link between intellectual capital and company’s performance is significant and positive regardless of the industry. |

107 Malaysian companies in various industries |

|

М. Subramaniam, M.A. Youndt, 2005 [24] |

A positive impact of intellectual capital on innovation activity |

93 US companies |

|

C.J. Huang, C.J. Liu, 2005 [22] |

Non-linear positive dependence of capital returns on intellectual capital. |

297 companies in Taiwan |

|

E.V. Popov, М.V. Vlasov, 2006 [10] |

A positive impact of investment in generation of new knowledge on enterprise’s profitability. |

Large enterprises of the Urals region |

|

А.А. Bykova, М.А. Molodchik, 2011 [3] |

Positive link between the value of intellectual capital and enterprise’s revenue growth rate. |

401 enterprises in Perm Krai |

Table 2. Comparative analysis of the traditional theory of company’s competitiveness and competitiveness in the framework of the concept “Industry 4.0”

Global competition implies consideration of the company’s activities in the context of the socio-ecological environment based on the increasing importance of intangible resources; it aims to create long-term competitive advantages. This is evidenced by the results of research of foreign authors. The research revealed that intangible assets serve as a mediator in relation to the social and financial efficiency as an enterprise’s competitive advantage.

The research objects were 599 industrial companies. As a result, we confirmed the hypothesis that intangible assets such as intellectual capital, reputation and culture have a positive impact on financial results. The authors point that there is no direct link

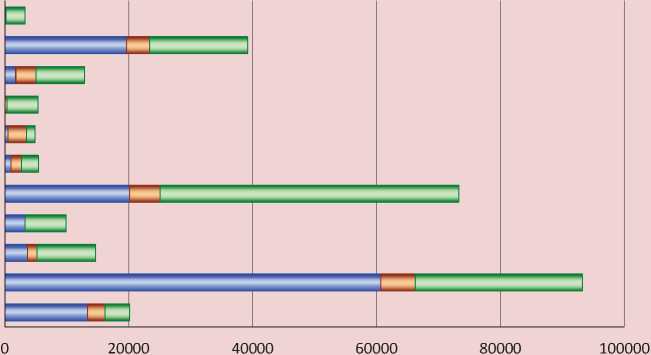

Figure 1. Companies’ cost of CSR activities in 2015, million rubles

PAO Inter PAO

ОАО Mining and Metallurgical Company Norilsk Nickel

РАОNLMK

ОАО MMK

РАО Uralkali

РАО Nizhnekamskneftekhim

РАО Lukoil

РАО Tatneft

PAO Bashneft Joint-Stock Oil

Company

РАО Rosneft Oil Company PAO

Gazpromneft

Internal CSR External CSR Environment and environment protection activities between corporate social performance and company’s financial performance, describing it as mediated, regulated by company’s intangible assets [25].

The concept of corporate social responsibility (CSR) has undergone significant transformations: from the normative contradictory definition of H. Bowen – the “father of corporate social responsibility”, defining the social responsibility of a businessman as “the implementation of policy, decision making or conduct which would be desirable from the standpoint of goals and values of the society” [19], and ending with the core universal standard ISO26000:2010 “Guidance on social responsibility”.

Despite the fact that in Russia, CSR is in its infancy, in recent years, public interest to assessing corporate social responsibility of domestic enterprises has increased. This is explained as follows: more and more Russian companies enter international markets where they face the fact that at the global level there are standards of social responsibility for economic entities. The costs of financing activities promoting corporate social responsibility of domestic industrial companies, which are the carriers of the best practices, are presented in Figure 1.

The distribution of funds reflects company’s CSR priorities. For example, PJSC LUKOIL, PAO Bashneft Joint-Stock Oil Company, and PAO NLMK Group prioritize costs of financing activities aimed at protecting the environment. PAO Rosneft Oil Company, OAO Mining and Metallurgical Company Norilsk Nickel, PAO Gazpromneft give preference to measures of internal CSR, and PAO Uralkali – aims to develop the region where it operates – external CSR.

The data from Figure 1 highlight companies of the fuel and energy complex as leaders in financing CSR activities. We identified the distinguishing features of running a socially responsible business (hereinafter SRB) from the standpoint of sustainable development of a business entity. The essence of the SRB concept should be considered through social, environmental, economic, and political aspects [13] accounting for interaction of all stakeholders. The structure of SRB including production, management and investment components should be analyzed at micro-, meso-, macro - and mega-levels.

-

• At the micro-level, socially responsible business includes economic efficiency of enterprise’s activity, considering the quality of products and competence of labor resources, and clearly realizes its responsibility to its employees.

-

• At the meso-level (sectoral level), partnership relations are established based on analysis of external and internal environmental factors.

-

• At the macro-level, socio-economic relations are formed: they concern the conduct of business at the state level when interacting with various business structures and public organizations.

-

• At the mega-level, conditions for creating transnational corporations are created, which increases the country’s competitiveness at the international level.

At the same time, CSR in Russia is complicated by the volatility of the national economy and imperfect regulatory framework regulating socio-economic relations. In particular, the problem resides in public reporting and slow progress from free reporting to systematic reporting (including international standards), as well as in changing environmental reporting to comprehensive reporting in the sphere of sustainable development [15].

It should be noted that CSR provides the evolutionary transition from socially responsible investing to impact investing, which involves solving both social and environmental issues through new investment tools in investments areas [14].

The role of CSR and its impact on the company’s performance is quite ambiguous. American experts express contradictory views on the impact of CSR on competitiveness [13]. Some authors believe that CSR tools will undoubtedly have a positive effect on the enterprise’s techno-economic indicators, others hold the opposite opinion. The third group of experts relies on the fact that social activities are managed by departments and offices of one type, while industrial, economic and technical tasks are regulated by other units. Moreover, the goals and objectives of these units should not interfere [17]. It is worth noting that the disagreements between researchers are due to the fact that the concept of “competitiveness” in modern conditions loses its purely economic value and acquires a broader meaning reflecting the impact of business on the civil society.

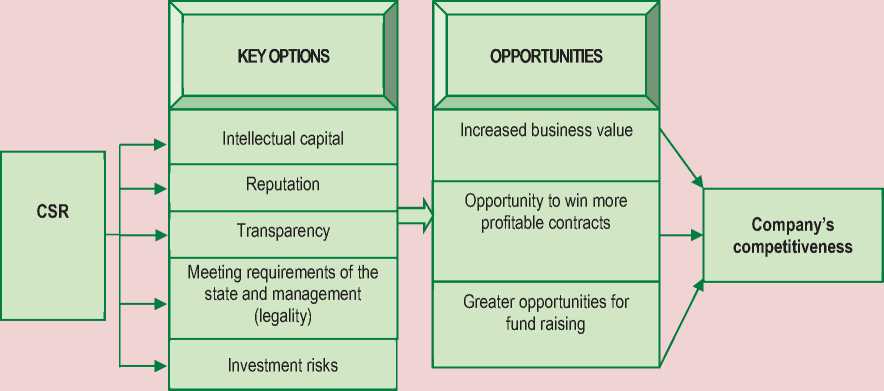

We attempted to determine the effect of social responsibility on company’s competitiveness through designing a conceptual model of the impact of corporate social responsibility on competitiveness ( Fig. 2 ).

The model presents five key features of the impact of corporate social responsibility: intellectual capital, reputation, transparency, legality and investment risks, which creates additional opportunities for creating competitive advantages with the aim of increasing company’s competitiveness. However, it is necessary to mind that the costs of CSR are ambivalent since their influence

Figure 2. Conceptual model of impact of CSR on company’s competitiveness

is indirect and recoverability of investments in CSR can only be reached during a prolonged period which defines long-term competitive advantages.

The formation of company’s competitive advantages from the position of CSR creates additional opportunities for the development of the strategic potential:

-

– strengthening company’s position in socio-economic issues to ensure company’s image;

-

– increased productivity and efficiency, innovative activity, etc.;

-

– management of financial and nonfinancial risks in terms of CSR;

-

– attracting qualified personnel, ensuring their professional growth, introduction of material and moral incentives;

-

– increasing market share and opportunities to attract new consumers;

-

– creating sustainable partnerships with regional bodies, local communities, trade unions, civil institutions, the media;

– implementation of best practices demonstrating great civil and social responsibility to the state and the society [1, 8, 12].

The comparison of the above mentioned advantages offered by the use of CSR and components of strategic potential affecting company’s competitiveness indicates that they largely coincide or interfere. However, for social costs in realization of opportunities provided in CSR to fully become an effective investment they need to be actively promoted by the state as business social projects affect both enterprise’s performance indicators and the society as a whole. Only the state along with businesses can bring social focus to the economy; that is why the state should stimulate, regulate, and determine the vector of priorities for social investment. Thus, these features are the basis for the formation of a new strategy of enterprise competitiveness in the framework of corporate social responsibility.

To assess the increment of company’s competitive advantages and form the strategy of competitive behavior we propose a CSR competitive index (IC.CSR ) . It is an integrated indicator presented as the geometric mean of the product of reasoned metrics. The indicators reflect the areas of GRI (“Global reporting initiative”) and, in turn, are comprised of three metrics selected using principal component analysis. The metrics of the economic indicator are as follows: revenues (R), profit (P), market capitalization (MC). The metrics of the social indicator are as follows: cost of personnel training and development (PT), work safety and industrial security (WS), and social package (SP). The metrics of the environmental indicator are as follows: cost of atmosphere protection (AP), cost of water protection (WP), cost of land protection (LP).

We present local indices in dynamics, which reflects the change in metric values:

I _ metric ( X )

X metric ( X 0)

(1),

where IX – index of change of the chosen metric (X) of the indicator;

metric ( X ) – the chosen metric of the indicator;

metric ( X0 ) – the selected metric of the indicator in the previous period;

-

(X) metric can be any metric of the proposed economic (P, R, MC), social (PT, WS, SP) and environmental (AP, WP,LP) indicators.

To describe competitive strategies we used the method of competitive strategy analysis characterized by high information content and visual expression [9, 20]. According to this method, the enterprise uses all of its efforts (I) to resist three types of external effects: stress ( S – stress-tolerant), violations ( R – ruderal), and competitors ( C – competitive):

IS + IC + IR = 100% , (3)

where I – intensity of efforts to implement S , R and C .

Table 3. CSR competitive index

|

Companies |

2011/2010 |

2012/2011 |

2013/2012 |

2014/2013 |

2015/2014 |

|

PAO Gazpromneft |

- |

0.966 |

4.066 |

1.485 |

1.493 |

|

ОАО Rosneft Oil Company |

1.353 |

1.157 |

1.290 |

1.320 |

0.949 |

|

PАО Tatneft |

1.289 |

1.297 |

0.942 |

1.210 |

0.609 |

|

PАО Bashneft Joint-Stock Oil Company |

1.384 |

2.141 |

2.201 |

1.111 |

1.575 |

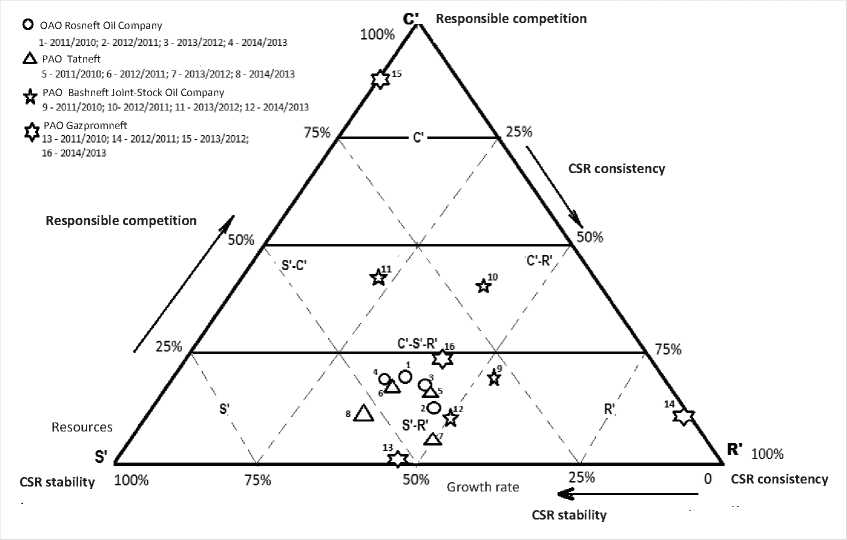

Figure 3. Classification chart of competitive strategies of fuel and energy sector in 2010–2015

′ 100 ( I - I )

C .CSR C .CSR - 1

.CSR = ,

On order to analyze the competitive behavior of companies in terms of socially responsible activities, we propose amending the classification structure of strategies for competitive behavior which would reflect the performance of their positions relative to each other focusing on the characteristics of socially responsible behavior as an element of both external and internal environment of the company. Identification of the proposed strategies for competitive behavior of the companies in CSR and the variety of combinations of its secondary strategies are presented in Table 4.

The figure ( Fig. 3 ) demonstrates the distribution of values of the CSR competitive index in the dynamics for enterprises of PAO Bashneft Joint-Stock Oil Company, PAO Tatneft, OAO Rosneft Oil Company, PAO Gazpromneft.

The scale of the figure corresponds to the range of annual values of IC.CSR and its increment IC.CSR’ . The obtained index values and its increment are measured on respective axes of the chart; the intersection of these values defines the location of the analyzed companies according to their competitive behavior strategy in terms of C’R’.

Table 4. Identification of strategies for competitive behavior of companies in CSR

|

Traditional methodology |

Modified methodology |

||

|

Strategy |

Strategy for companies’ competitive behavior |

Strategy |

Strategy for companies’ competitive behavior in CSR |

|

R (ruderals) |

Monopoly on production and sale of innovative goods or significant outrunning of competitors in both development of new products and their market launch. Such a strategy helps obtain high return on invested capital even with a small market share. |

S S О- Q |

Ensuring the effectiveness of the implementation of CSR functions and directions based on the principles of integrity, accountability, targeting, and transparency. |

|

C (competitors) |

Effective mechanisms of resource locking and production intensification. Finding ways of producing a unit of commodity consuming less labor and materials. |

Е g о |

Prevention of violation of the rights of other economic entities or unfair competition. |

|

S (stress-tolerants) |

They survive because they avoid frontal price competition by creating their own unique niche inaccessible to others. They are adapted to existing in conditions of considerable resource scarcity. |

^ "оо СС О |

To preserve and maintain social stability and economic security. |

|

C-R (competitors-ruderals) |

Adapting to markets with low impact of stress and competition restricted to medium-intensive violations. |

b || | |

Adapting to markets with low stability in the implementation of CSR. |

|

R-S (ruderals-stress-toterants) |

Adapting to non-productive medium-violated markets. |

^ GO ~О к ^ S £ 5 м Е |

Adapting to markets with a relatively low degree of responsibility in CSR. |

|

C-S (competitors-stress-tolerants) |

Adapting to relatively violated markets with medium-intensive stresses. |

6 g. S |

Adapting to markets, implementing non-systematic events in CSR. |

|

C-S-R (competitors-stress-tolerants-ruderals) |

Adapting to markets where the competition is limited to medium-intensive stress and violation. |

=? S 81 о g" 03 Е |

Adapting to markets with responsible competition restricted to mediumintensive stability and consistency. |

According to the figure, almost all enterprises mainly implement the R’-S’ strategy, thereby showing resistance to stress, i.e. they use their monopoly on production. Companies adapt to markets with a relatively low degree of responsibility in CSR, in other words, they demonstrate consistently moderate social activity.

According to the chart, this is most evident for OAO Rosneft Oil Company. The implementation of this strategy for companies of OAO Rosneft Oil Company takes place in terms of consistency and stability in spite of changing economic conditions. The low rate of implementation of investment programs explains the accumulation of points mainly in the lower part of the chart closer to the R’-S’ axis. For example, for lack of data on expenditures on environmental protection for PAO Tatneft, its competitive strategy tends to moderate social stability. This presumably indicates insufficient financial resources for the implementation of the company’s non-core activities.

In 201 1, according to the chart, PAO Gazpromneft was implementing a systematic CSR strategy (point 14) characterized by high instability in the external environment compensating it by intense activity in the company’s internal environment. It should be noted that this strategy carries high risks. For example, the company had to pay heavy fines for violating environmental management; the company’s activities probably were carried out bypassing environmental standards, however, it made it possible to leave many competitors behind. In 2013, PAO Gazprom implemented its C’ strategy – responsible competition (point 15), having effective mechanisms for locking resources and production intensification. Thus, in the framework of the Year of Ecology declared by the company, 300 diverse environmental activities were implemented, which exceeds the average number of such events and initiatives 10 times compared to the previous year. PAO Bashneft Joint-Stock Oil Company in 2011–2013 (points 10, 11) demonstrated socially responsible competitive behavior characterized by medium-intensive stability and consistency, i.e., the wish to achieve a responsible competitive position. The most successful socially responsible competitors will to the right of the dashed lines, least successful – to the left.

The difficulty in plotting the chart of identification of competitive strategies of fuel and energy companies lies in the heterogeneity of data contained in company’s non-financial company reports. The modified methodology for identifying competitive strategy of an industrial enterprise helps assess the competitive status of an economic entity in dynamics and make necessary changes to the structure of the company’s investment policy taking into account both social and environmental sphere.

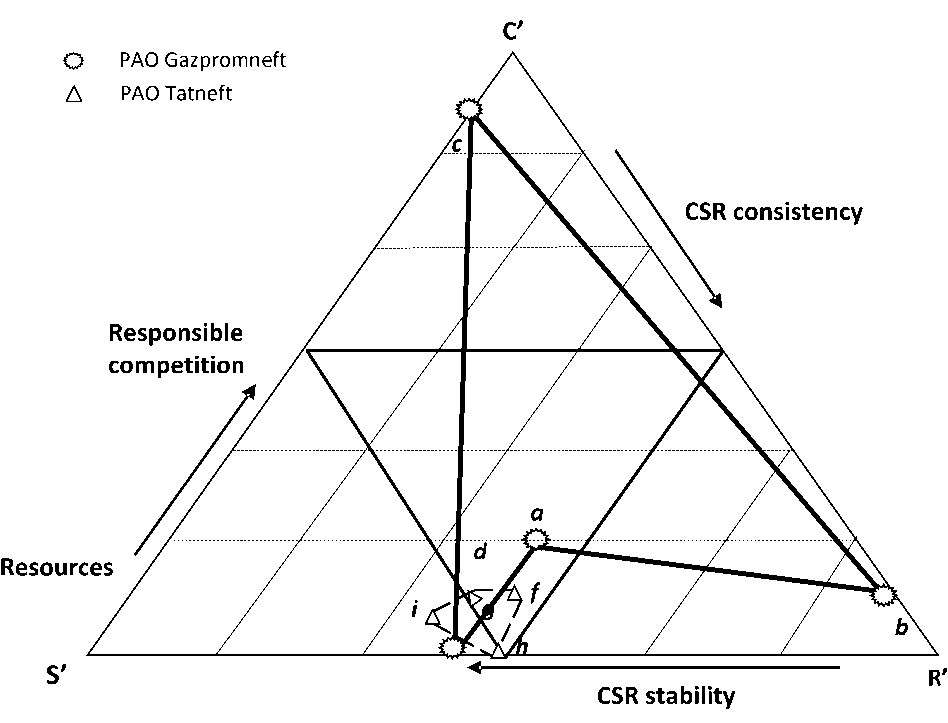

Considering the figure for identifying competitive strategies of companies of PAO Tatneft and PAO Gazpromneft during 2010– 2014 (trajectories abcd and gfhi ( Fig. 4 ), there are two diametrically opposed strategies of competitive behavior. PAO Tatneft mainly implements the S’R’ sub-strategy. All points, gfhi , reflecting the position of PAO Tatneft in the chart are concentrated in a certain zone which occupies a small area. This confirms the fact that the company does not significantly change its competitive strategy for 2010–2015 in the part of socially responsible behavior.

Figure 4. Trajectory of change in model competitive behavior of fuel and energy companies*

* PAO Gazpromneft: a – 2011/2010; b – 2012/2011; c – 2013/2012; d – 2014/2013. PAO Tatneft: f – 2011/2010; g – 2012/2011; h – 2013/2012; i – 2014/2013.

Regarding PAO Gazpromneft, it is fair to say that the abcd trajectory occupies a significant part of the graph S’C’R’ on the right. This suggests that the company is dramatically changing its competitive behavior within the framework of socially responsible behavior of a business, in particular, this concerns measures for environmental protection, as noted earlier. This emphasizes the growing importance of real investment in the company’s non-tangible assets.

Thus, using the modified method of identifying the competitive strategy of an industrial enterprise in the framework of their socially responsible behavior, we can determine its weak and strong points and assess the competitive status of the economic entity in dynamics. Identification of competitive strategies of leading fuel and energy companies in the context of CSR financing, which takes into account the reaction of the company’s internal environment to the impact of environmental factors, makes it possible to position companies relative to each other.

The establishment of a new techno-economic paradigm and “Industry 4.0” necessitates the formation of company’s competitive advantages based on its intellectual capital in the framework of socio-environmental responsible activities, which in the long term becomes the foundation for an enterprise’s sustainable development. The developed conceptual model of the impact of CSR on company’s competitiveness demonstrates the influence of CSR on five key options, creating additional opportunities for creating competitive advantages. The ambivalent nature of investing in CSR implies only a long-term repayment, which defines long-term competitive advantages. Integration of CSR in the company’s strategic management reinforces the importance of socially responsible business in the process of competition.

The obtained results can be used by regional and municipal authorities and heads of companies implementing the modern concept of social responsibility, as legitimate elements of the mechanism of competitiveness in the context of corporate social responsibility, as well as control and analytical tools to justify the actual behavior of economic entities based on the natural laws of competition. Analysis of retrospective data in dynamics helps assess the company’s position against competitors with the purpose of amending companies’ development strategy. For example, theoretical and methodological provisions of the research were applied in the practice of PAO Gazprom in the development of proposals aimed at implementation of the plan for the socioeconomic development of PAO Gazprom for three years. In the interests of investors, the research results can be used as ranking tools to rank companies according to the degree of their investment attractiveness.

Список литературы Creating competitive strategies of industrial enterprises from the standpoint of corporate social responsibility

- Aktual'nye voprosy razvitiya korporativnoi sotsial'noi otvetstvennosti . Pozitsiya Komiteta Assotsiatsii Menedzherov po korporativnoi otvetstvennosti v 2007 g . Moscow: Assotsiatsiya menedzherov, 2007. Available at: www.peopleinvestor.ru/uploads/analythics/position_cr_2007_rus.pdf..

- Akhtyamov M.K., O.U.Yuldasheva, N.A. Innovatsionnoe razvitie predprinimatel'stva v ekonomike znanii . Moscow: Kreativnaya ekonomika, 2011. 320 p..

- Bykova A.A., Molodchik M.A.Vliyanie intellektual'nogo kapitala na rezul'taty deyatel'nosti kompanii . Vestnik Sankt-Peterburgskogo universiteta. Seriya 8. Menedzhment , 2001, no. 1. Available at: http://cyberleninka.ru/article/n/vliyanie-intellektualnogo-kapitala-na-rezultaty-deyatelnosti-kompanii-1..

- Gumanitarnye tekhnologii. Informatsionno-analiticheskii portal . The social progress imperative: reiting stran mira po urovnyu sotsial'nogo progressa 2014 goda . Available at: http://gtmarket.ru/news/2014/04/14/6688..

- Korsunov P.P., Voronov D.S., Krivorotov V.V., Matveeva T.V. Otsenka i planirovanie konkurentosposobnosti predpriyatii toplivno-energeticheskogo kompleksa . Ekaterinburg: UrFU, 2016. 178 p..

- Medvedev O. Chetvertaya Promyshlennaya Revolyutsiya . Available at: https://politota.dirty.ru/chetviortaia-promyshlennaia-revoliutsiia-984132/..

- Mezhdunarodnyi issledovatel'skii proekt . 2017 Social Progress Index. Available at: http://www.socialprogressindex.com/overview..

- Morozova I.A., Kabanov V.A., Reshetnikova I.I., Shakhovskaya L.S. Gosudarstvenno-chastnoe partnerstvo: sotsial'no-ekonomicheskii effekt vzaimodeistviya v rynochnoi ekonomike: monografiya . Volgograd: VolgGTU, 2012. 210 p..

- Popkov V.V., Berg D.B., Kuznetsov R.O. Evolyutsionnoe izmerenie strategicheskogo bankovskogo menedzhmenta . Ekaterinburg: Ural'skii rabochii, 2002. 320 p..

- Popov E.V., Vlasov M.V. Institutsional'nyi analiz protsessov proizvodstva novykh znanii . Montenegrin Journal of Economics, 2006, no. 4, pp135-146..

- Romanova O.A., Akberdina V.V., Bukhvalov N.Yu. Obshchie tsennosti v formirovanii sovremennoi tekhniko-ekonomicheskoi paradigmy . Ekonomicheskie i sotsial'nye peremeny: fakty, tendentsii, prognoz , 2016, no. 3, pp. 173-190..

- Sergeev A.A. Partnerstvo gosudarstva i biznesa kak strategicheskii resurs razvitiya predprinimatel'skoi deyatel'nosti: dis. na soisk. uch. step. k.e.n. 08.00.05 . Volgograd State Technical Institute. Volgograd: B.i., 2012. P. 27..

- Tatarkin A.I., Romanova O.A., Tkachenko I.N. Formirovanie norm i korporativnogo povedeniya i tendentsii ikh razvitiya na predpriyatiyakh Ural'skogo regiona . Ekonomicheskaya nauka sovremennoi Rossii , 2002, no. 4, pp.82-97..

- Khachaturyan K. S. Sushchnost' i funktsii sotsial'no-otvetstvennogo biznesa . Vestnik Voennogo universiteta , 2011, no. 1 (25), pp. 108-111..

- Elektronnyi zhurnal "Kommercheskii director". Professional'nyi zhurnal kommersanta . Available at: http://www.kom-dir.ru/article/1460-sotsialnaya-otvetstvennost-biznesa?ustp=W.

- Yuldasheva O.U., Orekhov D.B. Metodologiya biznes-modelirovaniya: postroenie strategicheskikh . Korporativnoe upravlenie i innovatsionnoe razvitie Severa: Vestn. nauch.-issled. tsentra korporativnogo prava, upravleniya i venchurnogo investirovaniya Syktyvkarskogo gosudarstvennogo un-ta. , 2014, no. 1, pp. 78-91..

- Benioff M., Southwick K. Compassionate Capitalism. N.Y.: Career Press, 2004. Pp. 128-139.

- Bontis N., Chua W., Keow Ch., Richardson S. Intellectual capital and business performance in Malaysian industries. Available at: http://www.business.mcmaster.ca/mktg/nbontis/ic/publications/JIC1-1Bontis.pdf

- Bowen H. Social responsibilities of the businessman. N.Y.: Harper&Row, 1953. 276 p.

- Grime J.P. Plant strategies and vegetation processes. Chichester: Whiley and Sons, 1979. 222 p.

- Hinks J. 5 things you should know about Industry 4.0. TechRadar. Available at: http://www.techradar.com/news/world-of-tech/future-tech/5things-you-should-know-about-industry-4-0-1289534.

- Huang C.J., Liu C.J. Exploration for the relationship between innovation, IT and performance. Journal of Intellectual Capital, 2005, vol. 6, no. 2, pp. 237-252.

- IBR The Indiana Business Review: Publication of the Indiana Business Research Center at IU's Kelley School of Business. Available at: http://www.ibrc.indiana.edu/ibr/index.html.

- Subramaniam M., Youndt M.A. The influence of intellectual capital on the types of innovative capabilities. Available at: http://www.bc.edu/content/dam/files/schools/csom_sites/faculty/pdf/intellectualcapitalamj2005paper.pdf

- Surroca J., Tribó J.A., Waddock S. Corporate responsibility and financial performance: the role of intangible resources. Strat. Mgmt. J., 2010, no. 31, pp. 463-490.

- The Future of Jobs. Employment, Skills and Workforce Strategy for the Fourth Industrial Revolution. Available at: http://www3.weforum.org/docs/WEF_FOJ_Executive_Summary_Jobs.pdf.