Creation of the conditions for self-development of the northern territories: budget aspect

Автор: Barasheva Tatyana Igorevna

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Public finance

Статья в выпуске: 6 (24) т.5, 2012 года.

Бесплатный доступ

The article analyzes the reasons for and consequences of the low level of financial self-sufficiency in the Northern regions, it describes the approaches to the improvement of budget and tax regulation mechanisms in order to increase budgetary self-sufficiency in the territories and enhance their self-development. In addition, the article substantiates the proposals for increasing the share of tax revenues in the regional and municipal budgets and improving the redistribution of budget funds.

Fiscal policy, financial independence, self-development of the northern territories

Короткий адрес: https://sciup.org/147223408

IDR: 147223408 | УДК: 332.1

Текст научной статьи Creation of the conditions for self-development of the northern territories: budget aspect

The RF subject’s self-development capabilities are to a considerable extent determined by its financial self-sufficiency and independence. Financial self-sufficiency is based on a high economic potential, forming the capacious revenue base of the territory, which is the source of the RF subject’s own funds.

The Northern regions, possessing a diversity of natural-resources, have the largest enterprises of ferrous metallurgy, oil and gas and mining industry, energy sector, etc., their production provides for about 11% of Russia’s national income and accounts for 23% of total Russian exports. The Northern territories submit over 32% of taxes, levies and other obligatory payments to Russia’s budgetary system (tab. 1).

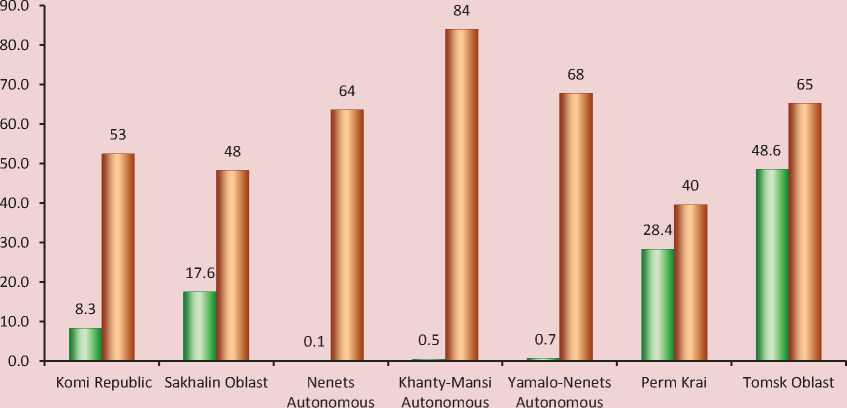

About a half of the Northern regions in RF have become donors of the federal budget: 9 regions in 2008, 11 – in 2009, 7 – in 2010 (fig. 1) . In 2011, the Irkutsk and Tyumen oblasts and Krasnoyarsk Krai joined the ranks of the 7 donor regions that obtained this status in 2010.

Table 1. Taxes, levies and other obligatory payments transferred by the Northern regions to Russia’s budgetary system [2]

|

Year |

Million rub. |

In % to the outcome for Russia in general |

|

2006 |

1 931 166.8 |

35.4 |

|

2008 |

2 648 014.1 |

33.2 |

|

2009 |

1 935 271.8 |

30.6 |

|

2010 |

2 475 941.5 |

32.1 |

Figure 1. Donor regions in 2010.

Okrug Okrug Okrug

□ Inflow from the federal budget to the region, in % to the total amount of revenues in the territory □ Inflow from the region to the federal budget, in % to the total amount of revenues in the territory

Consequently, we may assume that the donor regions (as well as other Russia’s Northern subjects in case of creating favourable conditions there) possess significant revenue potential, which determines the opportunities for the territories’ development at the expense of their own funds.

Meanwhile, the research shows that, at present, the tax potential of the Northern regions is not used sufficiently due to the flaws in the current taxation system. For instance, the gaps in legislation allow the tax base of large enterprises to be brought outside the regions, providing the shifting of taxes from one region to another.

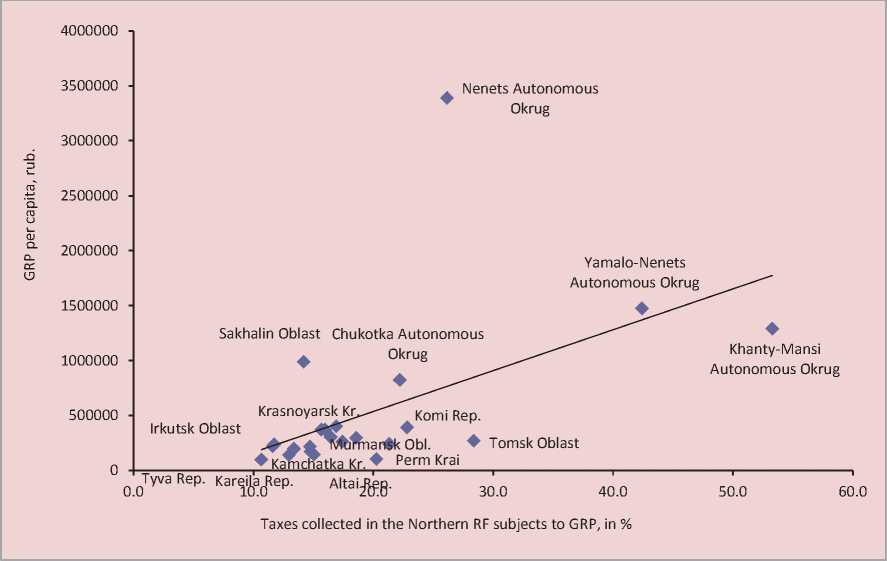

As a rule, the territories with a high economic potential, can collect more tax payments as compared to economically underdeveloped regions. However, it is not always like that in practice. It can be illustrated, in particular, by the activities of such RF subjects as the Nenets Autonomous Okrug, Yamalo-Nenets Autonomous Okrug and so on. (fig. 2). Despite the fact that they have the highest volume of GRP per capita among the Northern regions, the volumes of tax payments, which they transfer to the budgetary system, are understated and comparable with the contributions of the regions with a low economic potential. Correlation ratio calculated for the volume of taxes collected in the Northern RF subjects to the GRP and the value of per capita GRP was 0.51. This proves that the correlation of the indicators is positive, however, the regions’ capabilities to transfer tax payments are not being implemented in full.

Probably, the recently adopted Law “On introducing the amendments to certain legislative acts of the Russian Federation in connection with the improvement of principles of price determination for taxation purposes” No. 227-FZ will prevent big companies from the illegal shifting of their tax base outside the territory and from tax evasion and will promote the accumulation of large volumes of own funds in the regional budgets.

Figure 2. The scattering of Northern subjects of the Russian Federation according to the volume of taxes collected on the territory to the value of GRP per capita in 2010

Besides, the shortfall of taxes to the budget system is also connected with the existing differences between the regions in the amount of applied rates, exemptions, the ratios of taxable to non-taxable incomes, provision of deferments, installments and investment tax credits to enterprises. In addition, the inefficient fiscal performance in the Northern regions takes place due to the low efficiency of administration procedures conducted by tax authorities.

Furthermore, amendments to the tax legislation are made not in favor of the Northern regions concerning their tax selfsufficiency. In recent years there has been a significant reduction in the list of local taxes, and the status of some taxes has been transferred from regional to federal. In this regard, it can be argued that the current system of Russian fiscal legislation initially implies the low level of regional and local budgets’ own revenues.

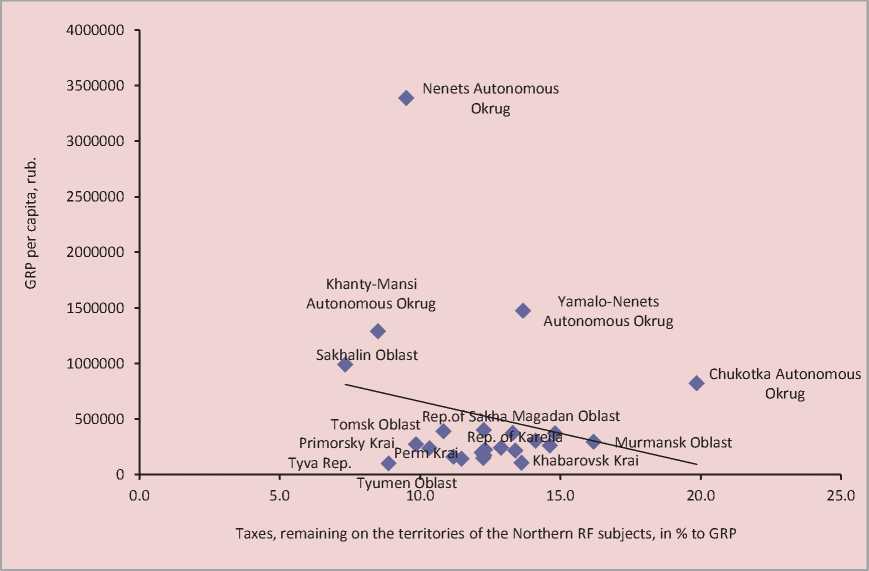

This is proved by the correlation between the amount of taxes, remaining in the Northern regions after the transfer of the legally established part of tax payments to the federal budget, and the value of per capita GRP. The correlation coefficient calculated for the analyzed indicators has a negative value (-0.21). This testifies to the fact that the economic potential of the developed Northern regions doesn’t contribute much to the budget system of these territories; i.e. a large part of the taxes, levies and other obligatory payments by leading enterprises is taken to the federal budget (fig. 3) .

The negative correlation between the volume of taxes collected in these subjects and GRP and the value of GRP per capita in the Northern regions was observed from the beginning of 2006, when the new provisions of the Budget and Tax codes entered into force and it has been preserved up to the present time. That is, until 2006, most part of tax

Figure 3. The scattering of Northern regions of the Russian Federation according to the ratio of the volume of taxes remaining there to GRP and the value of GRP per capita in 2010

revenues remained in the regions, and today, as the statistics show (tab. 2) , over 50% of tax revenues collected in the Northern territories, are transferred to the federal level.

The low level of tax payments remaining in the territories is compensated by non-repayable transfers from the federal centre. And the poorer the region, the greater is the share of federal transfers in the budget revenues (tab. 3) . In these respect, federal transfers become the main source of fulfilling the social obligations of the authorities at the sub-federal level.

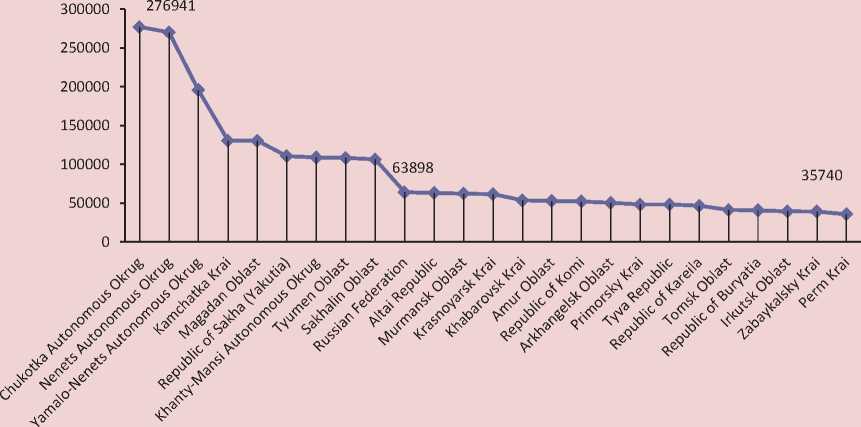

The current system of budget funds redistribution between the levels of the budgetary system can’t be considered an optimum one, because it leads to the increase in the number of Northern regions where fiscal capacity does not reach the average Russian level. The share of such Northern subjects amounted to 55% in 2009, while in 2010 it was 62%

(fig. 4) . This group includes not only the economically underdeveloped Northern subjects of the Russian Federation, but also the most developed regions (the Murmansk and Irkutsk oblasts, the Perm and Krasnoyarsk krais), including donor regions (the Tomsk Oblast, the Komi Republic).

Ultimately, the conducted policy will result in a situation, when the economically developed RF subjects have the low level of population’s living standard. So, in the regions, where the value of GRP per capita is higher than the national average level (the Tomsk and Murmansk oblasts, the Krasnoyarsk Krai and the Komi Republic), the ratio of wages to the subsistence level does not reach the average Russian indicator (fig. 5) , and the share of population with monetary incomes below the subsistence level is much higher than the national average level (fig. 6) .

Table 2. Revenues transferred to the federal budget by the Northern subjects of the Russian Federation [2]

|

Year |

Million rub. |

In % to the total volume of territory’s revenues |

|

2006 |

1 262 043 |

65.4 |

|

2008 |

1 667 214.5 |

62.9 |

|

2009 |

1 052 202.6 |

54.4 |

|

2010 |

1 415 011 |

57.2 |

Table 3. Distribution of the RF Northern subjects according to the share of transfers (except for subventions) in the total volume of consolidated budgets in 2010

Intervals RF Subjects Under 10 4 Khanty-Mansi Autonomous Okrug, Yamalo-Nenets Autonomous Okrug, Krasnoyarsk Krai, Perm Krai 10–20 6 Republic of Kareila, Murmansk Oblast, Nenets Autonomous Okrug, Khabarovsk Krai, Irkutsk Oblast, Tomsk Oblast, Republic of Komi 20-30 5 Arkhangelsk Oblast, Sakhalin Oblast, Zabaykalsky Krai, Amur Oblast, Tyumen Oblast, 30–40 2 Chukotka Autonomous Okrug, Primorsky Krai 40–50 3 Republic of Sakha (Yakutia), Magadan Oblast, Republic of Buryatia 50–60 2 Kamchatka Krai, Altai Republic 60–70 1 Tyva Republic Over 70 – – Source: author’s calculations based on the information-analytical report “On the socio-economic situation and the execution of the budgets of the subjects of the Russian Federation that are fully or partially considered as the Northern territories” for the relevant years. Available at:

Figure 4. Budget sufficiency of the Northern subjects of the Russian Federation in 2010, rub./pers.

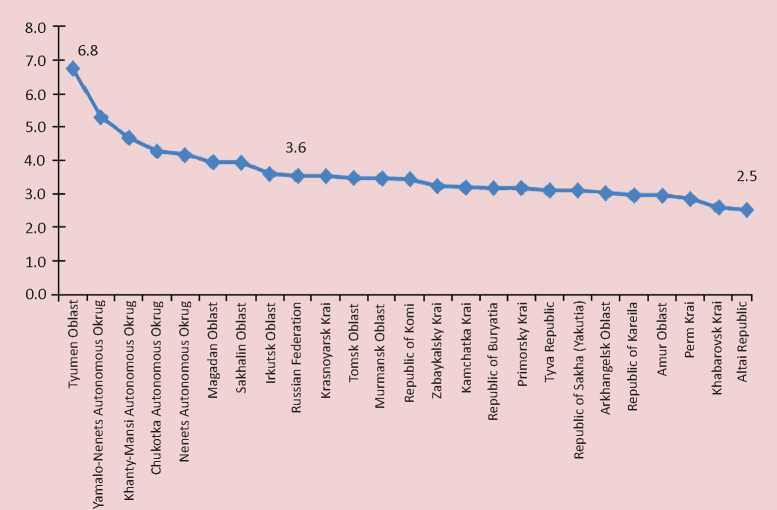

Figure 5. Ratio of accrued wages and the subsistence level in 2010, fold

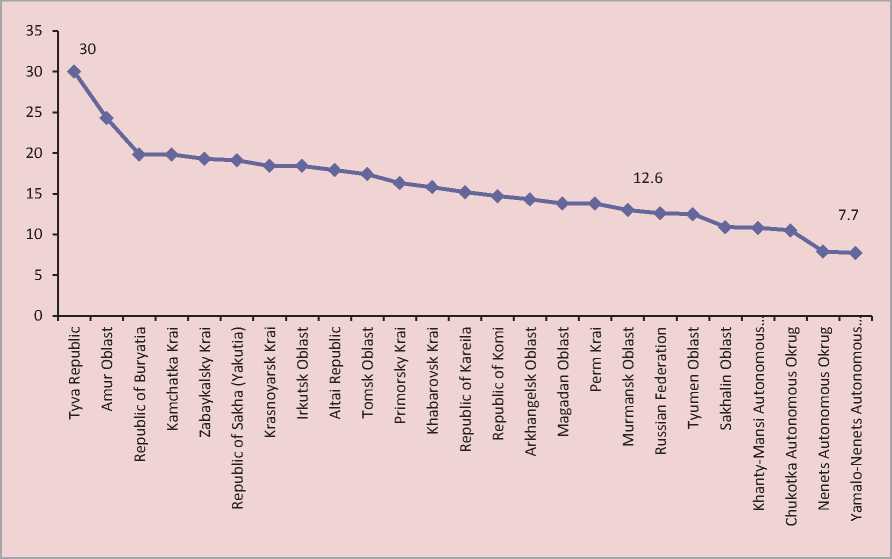

Figure 6. The number of population with monetary incomes below the subsistence level in 2010 (in % of the total population)

Summing up the above, it can be noted, that the state policy in the sphere of fiscal relations leads to the discrimination of economically developed and initially financially wealthy territories. They are provided with lower budget revenues in comparison with the regions having a low earning power, which negatively affects the population’s living standard and hampers the development of such territories at the expense of their own funds.

In this connection, it becomes necessary to adjust the system of inter-budget regulation to raise the level of tax self-sufficiency by providing the regional and local authorities with the rights to introduce additional taxes on their territory, as well as by changing the proportions of tax deductions from the regulatory tax sources in favor of the RF subjects.

The first approach is not envisaged by modern Russian tax legislation. But even if it were possible, then the introduction of new taxes would make the tax system even more complicated and cause the increase of tax pressure on business entities.

The implementation of a new approach to the division of federal taxes between the centre and the regions will not affect the business sector negatively. In particular, many experts propose to divide VAT between the federal and regional levels. So, A.B. Gusev and M.A. Shilov assume that one of the most powerful tax instruments promoting subsidies for the regions is VAT and its fullest inflow to the federal budget. The experts point out that, actually, VAT directed to the federal budget by the regions’ enterprises, is a demand tax in the RF subject. At the same time, it might be that the federal centre doesn’t have anything to do with the region’s demand itself [5].

International experience also shows that VAT and its analogues, as a rule, work in favor of regional rather than federal budgets. In Germany, which is a federation, the VAT revenues are distributed almost equally between the federal budget and the budgets of the lands: 50.5% goes to the federal budget, 49.5% – to the budgets of the lands. Austria conducts a similar fiscal policy. In Canada, some regions receive VAT, and some – sales tax [1].

The viewpoint of D.A. Tatarkin and Ye.N. Sidorova also speaks in favour of using VAT as the source for the lower levels of the budgetary system. Analyzing the experience of Germany, Austria and Australia, they conclude that the distribution of VAT between the levels of the budgetary system will enhance transparency and objectivity of the territories’ budget sufficiency equalization by reducing the volumes of counter financial flows [3].

Tax theory, which considers taxes from the viewpoint of their impact on economic entities, has another convincing argument in favor of VAT distribution. Direct (regulatory) taxes, which include profit tax, individual income tax and other income and property taxes, are responsible for investment and innovation processes. By changing the rates and setting privileges according to these taxes, authorities can influence the economic entities in order to enhance their investment and innovation activity. At that, the indirect (revenue) taxes (VAT, excises, customs duties, etc.) do not perform regulatory functions, they serve only as a budget replenishment source. Currently, Russian budget system is inefficient, since the balance between fiscal and regulatory taxes is disrupted: the federal budget accumulates mainly fiscal taxes (their share in tax revenues exceeds 70%), and the budgets of territories are formed mainly by direct taxes (over 90% of all tax revenues). In this respect, we point out that the revenue sources of regional budgets should include not only regulatory, but also fiscal taxes.

The experts consider various approaches to VAT distribution. The essence of the one proposed by D.A. Tatarkin and Ye.N. Sidorova consists in the fact that 50% of VAT on goods (works, services), produced (performed, rendered) in the Russian Federation, will be transferred to the federal budget. 25% of VAT will be directed to the Federal Foundation for Regions’ Support (FFRS) (i.e. the original order of FFRS replenishment, functioning since 1994, is being restored). The remaining 25% of VAT will be redistributed between the consolidated budgets of the RF subjects in proportion to the population number [3]. I.E. Umarova proposes to set the clearly fixed equal share for all the regions, or to treat the set normative with a correction coefficient, calculated on the basis of the fiscal capacity of the region’s population [4]. This implies the use of a differentiated approach for the purposes of budget regulation.

Thus, it can be noted that scientists propose different approaches to VAT distribution. However, the following position is commonly recognized: the budgetary funds redistribution mechanisms should provide a significant increase in the share of tax revenues in the regional and municipal budgets, they should also take into account regional and northern peculiarities, and facilitate the development of their own tax base. Implementation of these principles will create the conditions for the formation of self-developing territories.

Список литературы Creation of the conditions for self-development of the northern territories: budget aspect

- Balatsky E., Ekimova N. Financial unprofitable regions and budget relationships. Society and economics. 2010. No. 7-8. P. 114.

- Information-analytical report “On the socio-economic situation and the execution of the budgets of the subjects of the Russian Federation that are fully or partially considered as the Northern territories” for the relevant years. Available at: http://www.severcom.ru

- Tatarkin D.A., Sidorova Ye.N. Fiscal federalism in the system of promotion of the regions’ self-development. Judicial practice on tax and financial disputes. Taxes and financial law. 2010. No. 4. P. 14-347.

- Umarova I.E. Prospects for increasing tax burden in the Russian Federation. International accounting. 2012. No. 26. P. 42-50.

- Shilov M.A, Gusev A.B. Artificial subsidization of regions, as a guarantee of Russia’s unity. Capital of the country. 27 January 2009.

- Gusev A.B., Shilov M.A. Artificial subsidization of regions -a guarantee of Russia’s unity. Urban-Planet.org. Available at: http://www.urban-planet.org/, 15.12.2008.