Determinants of the Russian banking sector development as the drivers of economic growth

Автор: Voronova Natalya Stepanovna, Miroshnichenko Olga Sergeevna, Tarasova Anna Nikolaevna

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Public finance

Статья в выпуске: 4 (46) т.9, 2016 года.

Бесплатный доступ

The paper substantiates the relationship between the situation in the national banking sector and Russia's economy. Using the data provided by the Bank of Russia [8; 9; 10], Federal State Statistics Service [2], IBM SPSS Statistics software product, the authors have carried out a regression-correlation analysis of the main indicators of the Russian banking sector in 2005-2015 and GDP. It has been found that there is the strongest positive correlation between GDP and aggregate banking risks and also the profit of credit institutions; the correlation between GDP and aggregate financial result of the banking sector is weaker; the return on equity has no significant relationship with major indicators of banking activities, except for a moderate negative relationship with the aggregate value of regulatory capital; the return on equity in the Russian banking sector is affected adversely by subordinated debt in the structure of capital. In a stable economic situation (2005-2007, 2010-2013) the authors point out a correlation between capital and the profit of the banking sector; in a crisis situation (2008-2009, 2014-2015), there is a correlation between capital and the profit of profitable credit institutions alone...

Banking, capital adequacy, profitability, business cycles, capital portfolio

Короткий адрес: https://sciup.org/147223853

IDR: 147223853 | УДК: 336.71 | DOI: 10.15838/esc.2016.4.46.9

Текст научной статьи Determinants of the Russian banking sector development as the drivers of economic growth

Progressive economic development requires an adequate banking system that would meet the needs of economic agents in banking.

The banking system and other economic sectors are interrelated and interdependent; when studying the mutual influence of the most important characteristics of the state of the economy and the banking system the methodological approach is applied, it assesses links between economic performance indicators, prudential rules and indicators of the banking system – the banking sector presented by credit institutions and various kinds of banks (except for the Central Bank).

To assess the development of the banking sector it is necessary to use variables reflecting the state of the economy, and variables reflecting the most important characteristics of banking activities.

Materials and methods

Assessment of the impact exerted on the banking sector by various parameters characterizing the state of the economy and the rules regulating banking activities is considered in the works of domestic and foreign researchers.

When characterizing the state of the Russian banking sector, Bank of Russia Chairman Elvira Nabiullina uses the following indicators that can be estimated: capital, asset quality, risk, profitability of banks, correlation between banking sector indicators and GDP [4]; other authoritative domestic researchers assess economic growth also with the use of GDP, profit, bank profitability, and capital [1; 6; 11; 21; 22; 25]. However, various studies provide a somewhat fragmented assessment of development of the banking sector on the basis of profit, profitability, capital and risks in the banking sector in their relation to gross domestic product in dynamics with the use of econometric tools.

Similar approaches to the choice of indicators to assess the state and prospects of development of the banking sector are applied by foreign researchers as well. For instance, J. Goddard, H. Liu, P. Molyneux, and J.O.S. Wilson consider the profit of the banking sector, the stability of its receipt in relation to GDP as an indicator to assess competition. The authors come to the conclusion that the higher the GDP growth, the less stable is the profit margin of the banking sector in different periods of time [19].

The relationship between GDP and banking profit is considered in the works of W.J. Hippler, and M.K. Hassan [20]. The authors come to the conclusion that the more pronounced the crisis manifestations in an economy, the lower the profitability of all firms including financial ones. According to B. Williams, the Australian banking sector is characterized by increasing profits when GDP is growing [27].

Relationships between profitability, capital, profit and risk in the national banking sector and the country’s GDP, and the business cycle are also assessed by other foreign researchers [see, e.g., 12; 13; 15; 16; 17; 18; 24; 26].

C.-C. Lee and M.-F. Hsieh study the effect that the value of banking capital has on its profitability (return on equity – ROE) and on the aggregate amount of risks; they also study the influence of GDP on the profitability of banking capital using the data on Asian countries. These authors come to conclusions about the difference of the impact depending on the dynamics of GDP in different countries [24]. Significant influence of the value of capital on ROE is typical of the countries with a low GDP growth; as for the banks in the countries of Central Asia, they show the greatest opposite effect of the amount of capital on the aggregate amount of risks. According to C.-C. Lee and M.-F. Hsieh, the more profitable the activity of banks, the less stable is the value of the growth rate of profit; for the countries whose GDP level is low, it has been found out that that the greater the amount of banking capital, the higher is profitability, the effect is strong. K. Djalilov and J. Piesse come to a similar conclusion about the amount of capital and the exposure to credit risk as factors in determining the profitability of banking capital [17]. M. Kosak, S. Li, I. Loncarski, and M. Marine studied the relationship between the structure of capital and the profit of banks [23]. Having studied the relationship between banking capital, the sources of its increase and bank risks, B. Camara, L. Lepetit, and A. Tarazi draw a conclusion concerning the increase in the risks taken by banks when the share of subordinated debt in the portfolio of capital increases [14].

In order to carry out a retrospective assessment of the Russian banking sector the present study choses the indicators that reflect the dynamics of economic development of the country, first of all, GDP, in conjunction with the most important indicators characterizing the banking sector, such as revenue, aggregate amount of risks assumed by the banking sector, the bank’s capital base (capital) and its structure.

GDP is used to describe the situation in the economy in most countries, and it largely determines economic policy of the state [5; 21].

The Concept for long-term socioeconomic development of the Russian Federation for the period till 2020 is one of the most important regulatory and legal strategic documents of national importance, it defines the targets of economic policy and the banking system. The document sets out the following goals in the development of the financial system: increase in the contribution of the banking sector in the funding of investments in fixed capital, increase in the level of bank lending to the economy from 40% of GDP in 2007 to 70–75% of GDP in 2015 and 80–85% of GDP in 2020 [7].

The data on the main indicators characterizing the development of the Russian banking sector over the past 10 years are presented in Table 1 .

Based on the data of the table, a conclusion can be made concerning the development of the scope of activities of the Russian banking sector. However, in order to identify significant factors in this development, it is necessary to conduct an additional analysis of the relationship between GDP and profits of the banking sector as a financial result of its activities in dynamics, which is reflected in the studies by foreign as well as domestic authors.

Table 1. Major indicators characterizing the development of the Russian banking sector at the beginning of the year, %

Indicator 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 End of 2018 (forecast) Ratio of banking sector assets to GDP 51.9 60.5 67.9 75.8 73 69.7 74 80.8 99.7 103.2 120-125 Ratio of capital to GDP 6.3 8 9.2 11.9 10.2 8.8 9.1 9.9 10.2 11.2 11.5 Ratio of loans in economy to GDP 29.8 37 40 41.5 39.2 39 41.4 45.7 52.5 54.7 70 Compiled with the use of the following sources: O Kontseptsii dolgosrochnogo sotsial’no-ekonomicheskogo razvitiya Rossiiskoi Federatsii na period do 2020 goda: rasporyazhenie Pravitel’stva RF ot 17 noyabrya 2008 g. № 1662-r [On the Concept for long-term socio-economic development of the Russian Federation for the period till 2020: Resolution of the RF Government of 17 November 2008 No. 1662-R]. SPS “Konsul’tantPlyus”: Zakonodatel’stvo: Versiya Prof. [“Consultant plus” reference and search system: Legislation: Prof. Version]. Available at: ; Osnovnye napravleniya razvitiya finansovogo rynka Rossiiskoi Federatsii na period 2016–2018 godov [Major directions of development of the financial market of the Russian Federation for 2016–2018]. Available at:

Forecasting the profit of the banking sector depending on the changes in key indicators affecting the banking business is conditioned by several reasons. Besides the fact that a goal of credit organizations is to make profit (formally, it is possible to disagree with it and say that the purpose of a commercial organization is to increase its value); nevertheless, the value of profit cannot be underestimated. Profit forms a country’s GDP; carries out a fiscal function in the sense that it is a financial source of obligatory payments, generates budget revenues; acts as an important source of capitalization of the banking sector, a source of the value of individual credit institutions, contributes to the sustainability of credit intermediaries. Profit performs a social function to some degree, because it contributes to the enhancement of welfare of households through financial incentives for bank employees and charitable activity of banks. In this regard, it is highly advisable to develop a model that would define the dependence of profit of the banking sector on other economic indicators.

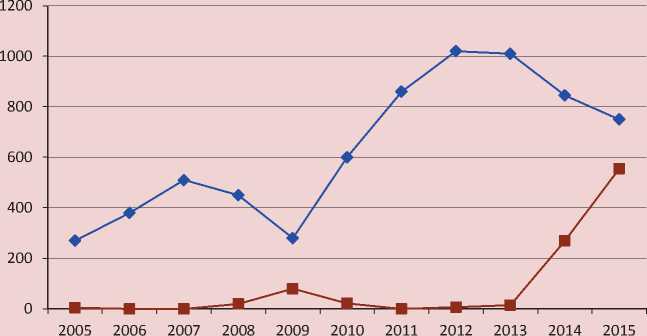

Data on the profit of the Russian banking sector is shown in Figure 1 .

As the first hypothesis to be tested as part of this study, we put forward a hypothesis about the correlation between GDP and the profit of the banking sector. According to

Figure 1. Dynamics of profit of the Russian banking sector in 2005–2015

— ■ — Profit of profitable credit organizations of Russia, billion rubles

— ♦ — Losses of unprofitable credit organizations, billion rubles

Source: Obzor bankovskogo sektora Rossiiskoi Federatsii – 2005–2016 [Overview of the banking sector of the Russian Federation 2005–2016]. Tsentral’nyi bank Rossiiskoi Federatsii (Bank Rossii) [Central Bank of the Russian Federation

(Bank of Russia)]. Available at:

theoretical provisions and the findings of other studies, the dynamics of these two indicators must be comparable, i.e. in the conditions of progressive development of the economy characterized by a relatively high GDP growth rate, the profit of the banking sector should increase, and vice versa.

Besides profit, the most important indicators used to assess the activities of the banking sector include sufficient own funds (capital base), and return on equity (ROE).

On the one hand, capital determines the possibility of obtaining profits and increasing the value of the bank. On the other hand, profit affects capital by increasing bank capitalization and strengthening the capital base of the bank.

The modern theory of banking distinguishes several models of bank equity, and the profit in each model is considered as a source of own funds.

The balance capital model in determining the value of balance capital uses the amount of profit reflected in bank balance. Balance capital of the bank in modern conditions is used neither in the regulation nor evaluation of the bank (regulatory or market assessment), its value, in connection with which the amount of balance capital should not be used as a variable in the model that determines the profit of the bank and banking sector.

The economic capital model, which considers economic capital as an aggregate total amount of risks accepted by the bank, views profit as a source of available domestic capital, which must exceed economic capital. The economic capital model is fairly new in the Russian banking practice; there are no statistics on the amount of available internal capital and the share of profit in the value that does not allow the amount of available internal capital to be used as a variable model that determines the profit of the banking sector.

The bank’s market capital model, which became widespread in foreign countries and which implies the valuation of the bank through the value of the bank’s own funds by a rating agency, independent appraiser or other participant of the financial market, is used applied to Russian conditions with restrictions. The amount of market capital is generally identified in the circulation of bank shares on the market as well as in transactions of sales of the bank, mergers and accessions. In Russia, the circulation of bank shares on the financial market is very limited, and the available information cannot be used in the model that determines the profit of the banking sector. As for the transactions in the sales and mergers of banks, the official information about the market valuation of the bank in such cases is unavailable. It is inexpedient to use information about market capital of banks when designing the model also due to the isolated nature of such transactions.

Regulatory capital of the bank, if it is used as a variable in the model that determines the profit of the bank and banking sector, has a number of advantages compared to balance capital, market capital and available internal capital. Regulatory capital and its adequacy ratio are determined uniformly for all national banks and are, with some errors, comparable with the same indicators for foreign banks and banking sectors. The basis of uniformity is the unification of regulations of banking activities in accordance with the recommendations of the Basel Committee on Banking Supervision.

A disadvantage of applying regulatory capital and its adequacy ratio as independent variables in the regression model lies in the different techniques of their calculation in different time intervals in the analyzed period. In order to compensate for this drawback, we complete the developed model with variables such as indicators of the structure of regulatory capital. When calculating the structure of regulatory capital we use an approach that aggregates the elements of capital depending on the source or the uniformity of capital instruments without dividing the capital into levels (primary, secondary, basic, and additional). The structure of the value of regulatory capital of the bank on the basis of homogeneity of capital instruments is represented by equity capital, share premium, reserve fund, undistributed profit, positive revaluations of property, subordinated loans (deposits, loans, bonded loans), revaluation of property, immobilization of capital, under which we mean the aggregate amount of items that reduce capital; thus, we understand passive immobilization as the reduction of capital caused by management errors, and active mobilization – as the reduction of capital due to the presence of assets that bring profit to the bank, but that are not approved by the regulator [for more details, see 3]. When constructing a model that determines the profit of the banking sector, we identify the significance of various elements in the structure of regulatory capital in the formation of bank profit.

In addition to regulatory capital, it is appropriate to use the aggregate amount of risks as a variable. The aggregate amount of risks of the regulatory model, according to the Basel agreements on capital and the requirements of the Bank of Russia, includes the credit, market and operational risks and, in accordance with the theory of banking, defines the bank’s ability to obtain income and generate profit. This theoretical provision is seen as the next hypothesis and its verification is viewed as one of the objectives of the present study. The use of the aggregate value of risk as a variable of the developed model has its advantages and disadvantages compared to other variables, such as the value of the loan receivables, data on overdue loans, investments in securities of third party issuers, the amount of reserves formed. We consider that the advantage of the aggregate value of risk as a variable model that allows bank profit to be assessed is the fact that the specified variable covers a wide range of the risks most important from the point of view of the regulator: the risks on balance sheet and off-balance sheet operations of banks. Another advantage of the aggregate value of regulatory risks as a variable in the developed model can be a presumably high likelihood of obtaining reliable models, because the study is based on official statistics, there are no expert assessments, therefore, the errors and inaccuracies in the model are minimized. We believe that the drawback of using the aggregate value of regulatory risks as a variable to identify the main determinants of bank profits, is the most important drawback, which is inherent in the overall regulatory model of bank capital: the aggregate value of risks is determined by only three risks and does not take into account possible losses and possible cash inflows from other activities of the bank. In addition, the calculation of the very aggregate value of banking risks is strictly formalized by the requirements of the regulator and does not take into account differences in terms of functioning and the scope of activities of various credit institutions.

Results

Based on data for the period from 2006 to 2015, the calculation of the Pearson correlation coefficient – GDP indicator – performance of Russian banks (profit, aggregate risk (Ar), total capital (C) and its structure) was carried out, the results are presented in Table 2 .

The presence of correlation dependence shows the existence of a relationship, but does not show a causal relationship; i.e. judging only by the coefficient, it is impossible to say whether the activities of

Table 2. Correlation between performance indicators of the Russian banking sector and GDP

|

Indicator |

GDP in Russia (in current prices, thousand rubles) |

GDP from financial activities in Russia (in current prices, thousand rubles) |

||

|

Pearson correlation |

Value (2-sided) |

Pearson correlation |

Value (2-sided) |

|

|

Total capital of the banking sector, billion rubles |

0.973** |

0.000 |

0.565 |

0.113 |

|

Adequacy ratio of regulatory capital in the Russian Federation, N1 (N1.0 since 2015) |

-0.421 |

0.299 |

-0.427 |

0.292 |

|

Aggregate amount of risks in the banking sector, Ar, billion rubles |

0.986** |

0.000 |

0.713* |

0.031 |

|

Profit of the banking sector of the Russian Federation, billion rubles |

0.841** |

0.001 |

0.876** |

0.000 |

|

Profit for only profitable credit organizations of the Russian Federation, billion rubles |

0.935** |

0.000 |

0.920** |

0.000 |

|

Authorized share capital of credit institutions, billion rubles |

0.974** |

0.000 |

0.715* |

0.013 |

|

Share premium, billion rubles |

0.964** |

0.000 |

0.731* |

0.011 |

|

Reserve fund and undistributed profit, billion rubles |

0.987 ** |

0.000 |

0.794** |

0.003 |

|

Subordinated debt, billion rubles |

0.934** |

0.000 |

0.625 |

0.040 |

|

Revaluation of property, billion rubles |

0.897** |

0.000 |

0.569 |

0.068 |

|

Immobilization of capital, billion rubles |

0.984** |

0.000 |

0.783** |

0.004 |

|

* Correlation is significant at the level of 0.05 (2-sided). ** Correlation is significant at the level of 0.01 (2-sided). |

||||

banks influences GDP or GDP determines the performance of banks. Repeated measurements of correlation coefficients were carried out for shifted time series. The results show that if we take the current performance of the banking sector and the previous values of GDP, then the correlation between GDP and the total capital of banks increases (with the shift of one period, the correlation coefficient between the indicators is 0.0994) and the relation to the profit of credit institutions decreases. Thus, the state of the economy in terms of GDP determines the ability of banks to generate capital in the coming year; the capitalization of the banking sector depends on GDP; in a complex, crisis situation (which corresponds to a decrease/slowdown in GDP growth) if it is necessary to increase capital, the banking sector needs additional mechanisms and relevant measures of governmental support (state funds).

If the time series are displaced in the current values of GDP and past performance of the banking sector, then the repeated measurements of the correlation coefficients indicate the strengthening of relations with banking profit (at a one-period shift, the correlation is 0.920 for all credit institutions and 0.943 – for profitable ones) and the simultaneous weakening of relationship between capital and its structure. This leads to a conclusion about a positive impact of profit of the banking sector on GDP and the creation of prerequisites for growth/ reduction of GDP in the coming year.

Evaluation of the relationship was conducted with both Russia’s GDP as a whole, and with the share of GDP derived from financial activities. The strongest correlation can be observed with GDP in Russia as a whole; GDP from financial activities correlates significantly only with the profit of the banking sector. The result fully corresponds to theoretical concepts, since GDP from financial activities is determined by the difference between revenues and material costs, and the profit of the banking sector is determined largely in a similar way – as the difference between revenues and expenditures.

From this we can conclude that the relationship between the indicators is not equal. The volume of GDP in the whole country determines the total capital of banks and its structure, sets the initial conditions of activities and opportunities for obtaining profit. At the same time, the financial result received (the profit of credit institutions) forms GDP from financial activities in Russia and, consequently, increases GDP of the country as a whole. Schematically, the above relationships can be represented as follows:

GDPn-1 → (C1+C2+C3+…)n → Prn → GDPn+1, where n is the current period, n-1 – the previous period, n+1 – the future period,

-

(C1+C2+C3+...) – the total capital of the banking sector and its structure, Pr – the profit of the banking sector.

As can be seen in Table 2, except for the regulatory capital adequacy ratio (N1), all the other indicators are linked to GDP, and the correlations are maximum important. The correlation is the highest between GDP and sources of bank capital such as reserve fund and retained earnings (correlation coefficient = 0.987) and equity capital (0.974) and share premium (0.964), the correlation coefficient with the aggregate capital of banks is 0.973. There is a strong correlation with the immobilization indicator.

Assessment of the internal interconnections between the performance indicators of the banking sector (Tab. 3) allows us to conclude that the most significant relation exists between the total capital and the aggregate value of risks of the regulatory model (Ar), which is quite natural.

Noteworthy is the fact that return on equity appears to be related to almost nothing. There is a moderate inverse relationship with total capital (-0.723), i.e. it turns out that the higher the total aggregate capital of banks, the lower is the return on equity. This regularity indicates a decline in the attractiveness of the banking sector for investors; a moderate character of the relationship suggests that it is typical of the industry in general, while it may not occur likewise for individual credit institutions. In the conditions when legislation gradually raises the minimum capital for an operating bank, in 2010–2015 small banks increased their capital to 300 million rubles by the beginning of 2015 at a higher rate compared to profit-generating assets, which had a negative impact on the profitability of their capital.

Table 3. Pearson correlations between performance indicators of the banking sector of the Russian Federation

|

Indicator |

Aggregate capital of the banking sector, billion rubles |

N1 for Russia as a whole (N1.0 since 2015) |

Аr, billion rubles |

ROE for Russia as a whole, % |

Profit of the Russian banking sector, billion rubles |

Profit only for profitable organizations of Russia, billion rubles |

|

Aggregate capital of the banking sector, billion rubles |

1 |

-0.518 |

0.976** |

-0.723* |

0.180 |

0.684* |

|

N1 for Russia as a whole (N1.0 since 2015) |

-0.518 |

1 |

-0.684* |

-0.128 |

-0.413 |

-0.731* |

|

Аr, billion rubles |

0.976** |

-0.684* |

1 |

-0.602 |

0.205 |

0.727* |

|

ROE for Russia as a whole, % |

-0.723* |

-0.128 |

-0.602 |

1 |

0.399 |

-0.035 |

|

Profit of the Russian banking sector, billion rubles |

0.180 |

-0.413 |

0.205 |

0.399 |

1 |

0.871** |

|

Profit only for profitable organizations of Russia, billion rubles |

0.684* |

-0.731* |

0.727* |

-0.035 |

0.871** |

1 |

|

* Correlation is significant at the level of 0.05 (2-sided). ** Correlation is significant at the level of 0.01 (2-sided). Correlation coefficients not marked with an asterisk are not significant (<0.05). |

||||||

The assessment of correlation indicators (see Tab. 3) shows the difference in the nature of the relationship between bank profit and other indicators for the banking sector as a whole and for profitable credit institutions. In general, the domestic banking sector does not show a direct significant correlation between profit and other major indicators of activity; this is not consistent with the theoretical provisions. We see the reason in considerable differences between the internal factors influencing the formation of the profit of individual banks, which requires additional research. For profitable credit institutions we not a moderate correlation between profit and the capital adequacy ratio (N1), aggregate value of risks of the regulatory model (Ar) and aggregate capital. We highlight the following reasons for the dependencies identified:

– profitable credit institutions have a sound financial policy that helps generate revenues and profit with an acceptable level of risk, while the gross nationwide profit in Russia is affected by the total loss of loss-making credit institutions, which confirms the theoretical position about the imbalance of their policy, manifested in the violation of relations between critical banking indicators;

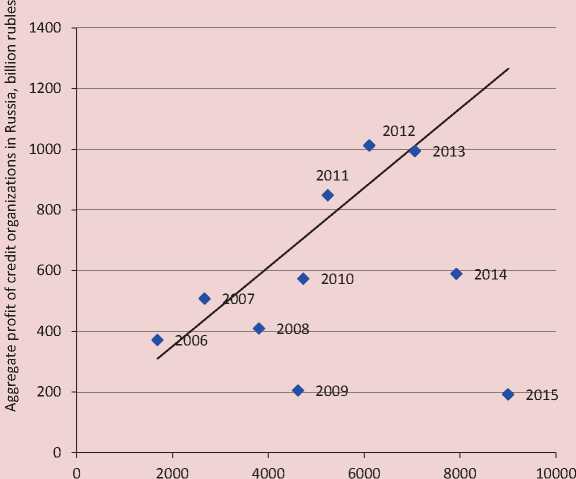

– in the Russian banking sector as a whole we do not observe a clear dependence between profit and the amount of capital and its structure, but there is a connection with the bank’s size, i.e. large banks (in terms of capital value) are more profitable than small ones. To check this assumption, we built a scatter chart of the total profit of credit organizations in Russia and the aggregate capital (Fig. 2). In general, the assumption is corroborated (an approximate trend on the chart is marked with a line); an exception is noted in 2008–2009 and 2014–2015. The situation in 2008–2009 shows that the profit is influenced by a crisis macroeconomic situation, deterioration of assets quality, reduction in revenues and profits, the need to increase reserves, and it justifies the feasibility of implementing measures of state support of the financial sector. In 2014–2015, in addition to the impact of adverse macroeconomic and global factors, the banking sector incurred additional costs associated with the transition to Basel II and Basel III standards, which requires not only the increase in capital and improvement of its quality, but also significant expenditures on the establishment and functioning of internal banking risk and capital management systems. When the indicator of the aggregate profit of the banking sector is replaced with the profit of only profitable credit institutions (excluding total losses), then the identified deviations are leveled. The high concentration of assets, capital and profit of the banking sector [see 10] leads to the conclusion that the largest banks, having received government support, in contrast to others, adapted more successfully to the influence of negative macroeconomic and global factors.

Figure 2. Aggregate profit and aggregate capital of the Russian banking sector

Aggregate capital, billion rubles

Evaluating the interconnection between the structure of capital and the indicator of profit of credit organizations in Russia (assessment in absolute values), we can note the lack of significant links (Tab. 4); at the same time, there exists a relationship with profit of only profitable credit institutions. Thus, profitable banks capitalize the profits gained, and strengthen their capital base. Of greatest significance (0.866) are the links to the active immobilization of capital, which confirm the theoretical premise that active immobilization, although not encouraged by the Central Bank of the Russian Federation, is economically justified, since it contributes to the generation of profits. The links to the reserve fund and retained profits (0.843) are also significant, because this helps strengthen the capital base, indicates its ability to absorb losses without significant reductions in the sources of capital, and, to some degree, helps obtain profit in the subsequent periods.

Aggregate capital and the indicator of aggregate risk (Ar) are also connected by correlation dependence with all the structural elements of capital. The correlation is the strongest with the size of the reserve fund and retained profit, equity capital and subordinated debt;

Table 4. Interrelation between the structure of capital and the rate of profit of the Russian banking sector

|

Indicator |

Profit of the Russian banking sector, billion rubles |

Profit only for profitable organizations of Russia, billion rubles |

|

Authorized share capital, billion rubles |

0.263 |

0.714** |

|

Share premium, billion rubles |

0.540 |

0.843** |

|

Reserve fund and undistributed profit, billion rubles |

0.455 |

0.843** |

|

Subordinated debt, billion rubles |

0.202 |

0.650* |

|

Revaluation of property, billion rubles |

0.491 |

0.775** |

|

Other increase, billion rubles |

-0.431 |

-0.640* |

|

Immobilization, billion rubles |

0.242 |

0.708* |

|

Including active immobilization |

0.498 |

0.866** |

|

passive immobilization |

-0.184 |

0.347 |

|

* Correlation is significant at the level of 0.05 (2-sided). ** Correlation is significant at the level of 0.01 (2-sided). Correlation coefficients not marked with an asterisk are not significant (<0.05). |

||

i.e., profitable banks get an excellent opportunity to generate profits having a certain capital; the capital and all its elements are used to generate income and obtain profit rather than to meet the regulatory requirements to the minimum amount of capital, which is typical of small banks.

The relationship between the structure of capital and profit was estimated in absolute terms (billion rubles); in order to assess the relationship with the indicators of capital adequacy (N1) and return on equity (ROE) the relative data were used (the shares of structural elements of capital). The results are presented in Table 5 .

Table 5. Relationship between the structure of capital of the banking sector of Russia and adequacy ratios (N1) and return on equity (ROE) of own funds

|

Elements of the capital of the Russian banking sector |

N1 for Russia as a whole (N1.0 since 2015) |

ROE for Russia as a whole, (%) |

|

Authorized share capital, % |

0.056 |

0.489 |

|

Share premium, % |

0.313 |

0.083 |

|

Reserve fund and undistributed profit, % |

-0.935** |

0.061 |

|

Subordinated debt, % |

0.090 |

-0.879** |

|

Revaluation of property, % |

0.578 |

-0.121 |

|

Immobilization, % |

0.571 |

0.651* |

|

* Correlation is significant at the level of 0.05 (2-sided). ** Correlation is significant at the level of 0.01 (2-sided). Correlation coefficients not marked with an asterisk are not significant (<0.05). |

||

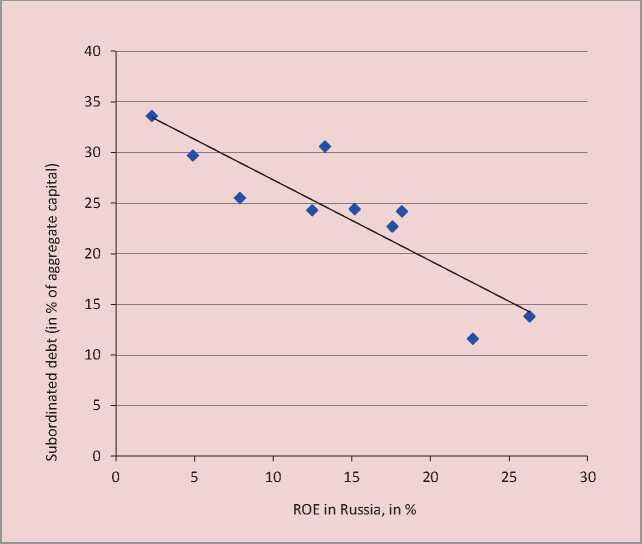

According to the data in Table 5, a significant inverse relationship between the index N1 and the share of the reserve fund and retained profit is noted; i.e. banks, having a capital of high quality (profit and the reserve fund mostly the elements of the base and fixed capital), pursue a more risky policy and take on more risks. Return on equity (ROE) and the share of subordinated debt in the aggregate capital are also linked by reverse correlation dependence (Fig. 3) .

Subordinated debts are initially treated by the theory of banking as a crisis management tool, their provision within the framework of the measures of state support of the Russian banking sector in 2008–2009 and then in 2015 aimed to absorb excessive pressure of the risks of bad debts on capital, and their negative impact on profit shows a hidden underlying issue: the crisis impact of the macroeconomic situation on the banking system have not been overcome, the quality of the requirements that generate the income and, therefore, profit of banks, is low. In a situation when the banking requirements are of high quality, all the elements of capital ensure the adequacy of assuming economically viable risks and the allocation

Figure 3. Relationship between the return on equity and the share of subordinated debt in the aggregate capital of the banking sector of the Russian Federation

of capital to cover bad debts is minimal. However, the fact of the significant inverse relationship between the return on equity of the banking capital and the share of subordinated debts in its structure suggests a dangerous situation: technically subordinated debts strengthen the capital base; the analysis has revealed that return on equity of the Russian banking sector is influenced negatively by the increase in the share of subordinated debt in the capital.

Identification and substantiation of relationships between the assessed indicators of Russian banking sector development allows us to proceed to the justification of a forecast model of the aggregate profit of Russian credit organizations.

Having determined as a target variable the total profit of the Russian banking sector, we include in the analysis the following variables as the GDP variables: the aggregate bank capital, capital adequacy ratio N1 (N1.0 from 2015) for the Russian banking sector, the return on equity (ROE), the aggregate value of risks of the regulatory model of capital (Ar) and all the indicators of the structure of capital (share capital, share premium, reserve fund and retained earnings, subordinated debt, revaluation of property, other increase of capital and immobilization). Then we use the step-by-step selection to choose variables to build the regression model. At that, the independent variables that have the highest partial correlation coefficients with the dependent variable, were matched step by step in the regression equation. As a criterion of the step-by-step selection we use the probability of F-statistics (0.05 – for inclusion and 0.1 – for exclusion). The inclusion of variables in the calculation is performed in six iterations (Tab. 6).

Table 6. Introduced or deleted variables*

|

Model |

Variables included |

Variables excluded |

Method |

|

1 |

Russia’s GDP, in billion rubles |

Step-by-step (criterion: probability of F-inclusion <= .050, F-exclusion>= .100). |

|

|

2 |

Authorized share capital |

Step-by-step (criterion: probability of F-inclusion <= .050, F-exclusion>= .100). |

|

|

3 |

Revaluation of property |

Step-by-step (criterion: probability of F-inclusion <= .050, F-exclusion>= .100). |

|

|

4 |

ROE for Russia as a whole |

Step-by-step (criterion: probability of F-inclusion <= .050, F-exclusion>= .100). |

|

|

5 |

N1 for Russia as a whole (N1.0 since 2015 ) |

Step-by-step (criterion: probability of F-inclusion <= .050, F-exclusion>= .100). |

|

|

6 |

Revaluation of property |

Step-by-step (criterion: probability of F-inclusion <= .050, F-exclusion>= .100). |

|

|

* Dependent variable: aggregate profit of the Russian banking sector. |

|||

As a result, the variables in the regression model include GDP, the authorized share capital of credit institutions, return on equity (ROE), and capital adequacy N1 (N1.0 since 2015) of the Russian banking sector.

A measure of precision of the model obtained is the coefficient of determination, which for our model is equal to 0.998 (adjusted 0.996).

Table 7 presents the obtained coefficients of the regression model. As a result of assessing the strength of influence of each of the factors included in the regression model, the assessment having been performed according to the standardized coefficients, it has been revealed that the greatest influence on the total profit of the banking sector is effected by GDP (2.449), then – by ROE (1.191) and N1.0 (0.969). The authorized share capital of banks has the least impact (-0.692). Consequently, in order to provide an opportunity to gain profit, the owners of banks increase capital with the help of various sources, with the exception of authorized share capital.

The non-standardized coefficients of regression equation are used to forecast the target variable, i.e., knowing the values of independent factors and substituting them in the model, one can calculate the total profit of the Russian banking sector. In addition to the forecasting, the model can be used for evaluating the results already existing, i.e. to analyze the discrepancies (and identify the causes of these discrepancies) between the actually received profit and its forecasted value.

Conclusions

The study of the interrelation between GDP and the major indicators that assess the performance of the Russian banking sector provided the following conclusions.

The Russian banking sector has significant relationships between macroeconomic indicators and profit, capital, and aggregate

Table 7. Coefficients of regression equation*

|

Model |

Non-standardized coefficients |

Standardized coefficients |

t |

Value |

|

|

B |

Standard error |

Beta |

|||

|

(Constant) |

-3439.589 |

209.425 |

-16.424 |

0.000 |

|

|

Russia’s GDP (in current prices, in billion rubles) |

0.056 |

0.003 |

2.449 |

21.216 |

0.000 |

|

Authorized share capital of the Russian banking sector, billion rubles |

-0.494 |

0.098 |

-0.692 |

-5.062 |

0.007 |

|

ROE for Russia as a whole |

49.869 |

3.134 |

1.191 |

15.912 |

0.000 |

|

N1 (N1.0 since 2015) for Russia as a whole |

104.704 |

6.881 |

0.969 |

15.217 |

0.000 |

* Dependent variable: aggregate profit of the Russian banking sector.

risks of Russian credit organizations; this fact confirms the relevant theoretical propositions and is not contrary to the similar conclusions obtained by foreign researchers based on the data from other countries.

In assessing the factors that affect banking profit and the return on equity (ROE), the differences have been revealed in the significance of impact of the same factor on the corresponding figures of the Russian banking sector as a whole and on profitable credit institutions separately. Identifying and evaluating the relationships between bank profits and GDP, as well as authorized share capital, profitability and adequacy of regulatory capital, allowed us to build a forecast model of profit of the Russian banking sector, the accuracy of which is evaluated according to the coefficient of determination (0.998). The specifics that have been revealed in the Russian banking sector development in different periods of macroeconomic conditions determine the direction of further research for the purpose of strengthening the drivers of economic growth.

Список литературы Determinants of the Russian banking sector development as the drivers of economic growth

- Aganbegyan A.G. Razmyshleniya o finansovom forsazhe . Den'gi i kredit , 2015, no. 8, pp. 5-10..

- Valovoi vnutrennii produkt Rossiiskoi Federatsii v 2005-2015 gg. . Available at: https://www.fedstat.ru/indicator/33379.do..

- Voronova N.S., Miroshnichenko O.S. Podkhody k strukturirovaniyu ponyatiinogo apparata teorii bankovskogo kapitala . Finansy i kredit , 2013, no. 34, p. 9..

- Vystuplenie predsedatelya Banka Rossii E.S. Nabiullinoi na XXIV Mezhdunarodnom bankovskom kongresse 4 iyunya 2015 goda . Available at: http://www.cbr.ru/Press/print.aspx?file=press_centre/Nabiullina_04062015.htm&pid=st&sid=ITM_10904..

- Ilyin V.A., Shabunova A.A. O nekotorykh tendentsiyakh v ekonomicheskom razvitii Rossii i regiona . Sotsiologicheskie issledovaniya , 2015, no. 8, pp. 34-41..

- Mau V. Antikrizisnye mery ili strukturnye reformy: ekonomicheskaya politika Rossii v 2015 godu . Voprosy ekonomiki , 2016, no. 2, pp. 5-33..

- O Kontseptsii dolgosrochnogo sotsial'no-ekonomicheskogo razvitiya Rossiiskoi Federatsii na period do 2020 goda: rasporyazhenie Pravitel'stva RF ot 17 noyabrya 2008 g. № 1662-r . SPS “Konsul'tantPlyus”: Zakonodatel'stvo: Versiya Prof. . Available at: http://base.consultant.ru..

- Obzor bankovskogo sektora Rossiiskoi Federatsii -2005-2016 . Tsentral'nyi bank Rossiiskoi Federatsii (Bank Rossii) . Available at: http://cbr.ru/analytics/?Prtid=bnksyst..

- Osnovnye napravleniya razvitiya finansovogo rynka Rossiiskoi Federatsii na period 2016-2018 godov . Available at: http://www.cbr.ru/finmarkets/files/development/onrfr_2016-18.pdf..

- Otchet o razvitii bankovskogo sektora i bankovskogo nadzora -2005-2015 . Tsentral'nyi bank Rossiiskoi Federatsii (Bank Rossii) . Available at: http://www.cbr.ru/publ/archive/root_get_blob.aspx?doc_id=9883..

- Sukhov M.I. Sovremennaya bankovskaya sistema Rossii: nekotorye aktual'nye aspekty . Den'gi i kredit , 2016, no. 3, pp. 3-6..

- Albertazzi U., Gambacorta L. Bank profitability and the business cycle. Journal of Financial Stability, 2009, vol. 5, no. 4, December, pp. 393-409.

- Arnold B., Borio C., Ellis L., Moshirian F. Systemic risk, macroprudential policy frameworks, monitoring financial systems and the evolution of capital adequacy. Journal of Banking & Finance, 2012, no. 36, pp. 3125-3132.

- Camara B., Lepetit L., Tarazi A. Ex ante capital position, changes in the different components of regulatory capital and bank risk. Applied Economics Letters, 2013, vol. 45, no. 34, pp. 4831-4856.

- Demirguc-Kunt A., Detragiache E., Merrouche O. Bank capital: lessons from the financial crisis. Journal of Money, Credit and Banking, 2013, vol. 45, no. 6, pp. 1147-1164.

- Dietrich A., Wanzenried G. The determinants of commercial banking profitability in low-, middle-, and high-income countries. The Quarterly Review of Economics and Finance, 2014, vol. 54, no. 3, August, pp. 337-354.

- Djalilov K., Piesse J. Determinants of bank profitability in transition countries: What matters most? Research in International Business and Finance, 2016, vol. 38, September, pp. 69-82.

- Gander J.P. Integrating bank profit and risk-avoidance decisions for selected European countries: A micro-macro analysis. Economic Modelling, 2013, vol. 31, pp. 717-722.

- Goddard J., Liu N., Molyneux R., Wilson J.O.S. The persistence of bank profit. Journal of Banking & Finance, 2011, vol. 35, no. 11, November, pp. 2881-2890.

- Hippler W.J., Hassan M.K. The impact of macroeconomic and financial stress on the U.S. financial sector. Journal of Financial Stability, 2015, vol. 21, December, pp. 61-80.

- Ivanter V.V. et al. The new economic policy -the policy of economic growth. Studies on Russian Economic Development, 2013, vol. 24, no. 6, pp. 501-510.

- Klaas J., Vagisova V. Tools for assessing and forecasting stability of the commercial bank under conditions of instability. Investment Management and Financial Innovation, 2014, vol. 11, no. 4, pp. 157-163.

- Košak M., Li S., Lončarski I., Marinč M. Quality of bank capital and bank lending behavior during the global financial crisis. International Review of Financial Analysis, 2015, vol. 37, pp. 168-183.

- Lee C.-C., Hsieh M.-F. The impact of bank capital on profitability and risk in Asian banking. Journal of International Money and Finance, 2013, vol. 32, February, pp. 251-281.

- Mazikova E.V., Yumanova N.N. Investment of banks in securities: the essence and development trends under current conditions. Economic and Social Changes: Facts, Trends, Forecast, 2015, no. 6 (42), pp. 185-202.

- Shim J. Bank capital buffer and portfolio risk: The influence of business cycle and revenue diversification. Journal of Banking & Finance, 2013, vol. 37, pp. 761-772.

- Williams B. Domestic and international determinants of bank profits: Foreign banks in Australia. Journal of Banking & Finance, 2003, vol. 27, no. 6, June, pp. 1185-1210.