Development of Organizational and Financial Tools for Innovative Technological Eco-Projects in the Regions of the Arctic Zone of the Russian Federation

Автор: Golovina T.A., Matveev V.V., Avdeeva I.L.

Журнал: Arctic and North @arctic-and-north

Рубрика: Social and economic development

Статья в выпуске: 60, 2025 года.

Бесплатный доступ

The current macroeconomic and geopolitical situation, combined with the current measures of state support, increasingly stimulate domestic business structures to implement new investment initiatives, which are designed, according to government officials and parliamentarians, to improve the socio-economic situation of the localization sites of such projects. In practice, however, such developments are associated with certain environmental risks such as pollution of water, air, soil, destruction of other key elements of the environment. Such negative impacts are particularly devastating for unique ecologically clean territories, one of which is the Russian part of the global Arctic zone. In this regard, the aim of this study is to develop relevant scientific and practical recommendations for activating and scaling up the investment activity of business structures implementing environmentally-oriented investment projects within the boundaries of the AZRF. The essence of these innovations is based on a combined approach. In particular, it is proposed to introduce up to seven new direct measures of financial incentives for eco-investments by businesses, up to five changes to regional and federal legislation, up to three direct financial injections into the public sector, as well as a significant adjustment of tax legislation into the national economy. From a practical point of view, this will create new preferential conditions for business and stimulate eco-oriented investment thinking, as well as eliminate accumulated environmental damage, restore and rehabilitate most natural sites, preserve biological diversity, develop a comprehensive eco-monitoring system, and take a new significant step towards creating a renewable resource economy.

Environment, environmental safety, Arctic zone of the Russian Federation, investments, investment processes, ESG projects, tools for activating entrepreneurial structures, renewable resource economy

Короткий адрес: https://sciup.org/148331889

IDR: 148331889 | УДК: [332.1:338.2:330.322](985)(045) | DOI: 10.37482/issn2221-2698.2025.60.42

Текст научной статьи Development of Organizational and Financial Tools for Innovative Technological Eco-Projects in the Regions of the Arctic Zone of the Russian Federation

DOI:

The study was supported by the grant of the Russian Science Foundation No. 23-28-00659,

The national heritage of the Russian Federation includes many elements, among which its objective spatial advantage deserves special mention. In particular, one of the most striking territorial “gems” of the Russian space is the domestic part of the so-called global belt of the Arctic zone.

In practice, for our country, this territory is characterized by the geographical unification of some subjects of the Russian Federation according to certain natural and climatic features, for example, in terms of the duration of the cold period, the area of snow cover and the concentration of ice masses, as well as the presence of a unique natural ecosystem characterized by unique living organisms, their distinctive habitat and mineral resources that are critical to the national economy (but limited in quantity).

In this regard, the Government of the Russian Federation, together with the legislative branch of power, pays close attention to issues of socio-economic development of the territories of the subjects that are part of the national Arctic zone. According to available historical data, legislators first addressed this issue back in 1998 (the draft Federal Law “On the Arctic Zone of the Russian Federation” 1). However, at that time, there were simply no additional federal financial resources available for the development of this territory, and the government was unable to properly support this initiative. This financial “insolvency” lasted for quite a long time for the country. Therefore, the next step towards the formation of a modern Arctic zone came only in 2008 with the approval by the President of the Russian Federation of a strategic document on the “Fundamentals of the State Policy of the Russian Federation in the Arctic for the Period until 2020 and beyond” 2. This legal act is notable as it was the first time in modern Russia that an actual list of regions and their territories included in the zone under consideration was approved. Subsequently, numerous representatives of regional and federal government structures carried out substantial work to clarify the existing land and sea borders for this territory. This work continues to this day.

As for providing the resident regions with any specialized expanded tools to achieve the desired accelerated socio-economic development, since November 2015, the Russian Government, together with federal legislators, has resumed work on formulating unique preferential (organizational, tax, property and other) conditions for business activities. According to the developers of the updated bill, strengthening entrepreneurial activity will contribute not only to the growth of new business units, but also to filling the budget system with new tax revenues, strengthening the investment flow, increasing employment and income of the population, which are indirect signs of the socio-economic development of the subjects of the Arctic zone under consideration.

In general, the work done by government authorities and parliamentarians resulted in the adoption of the Federal Law No. 193-FZ “On State Support for Entrepreneurial Activity in the Arctic Zone of the Russian Federation” 3. On the one hand, it regulates general organizational issues in terms of defining territorial boundaries, creating a special economic and legal regime, assigning relevant management and control and supervisory powers, and establishing other features of the functioning of the preferential zone itself. On the other hand, this legal act regulates special (preferential) conditions for entrepreneurial activity, including investment activity, as well as the procedure and conditions for obtaining them. In particular, residents of the AZRF can take advantage of federal, regional and local tax breaks, reimburse part of their insurance contributions, and receive subsidies to offset interest rates on loans and subsidies to offset the cost of paying coupon income on bonds. At the same time, the combination of these preferences is partly the best practice of the state regulatory policy of similar territories, since it has no analogues either in Russia or abroad.

At the same time, even a simple overview analysis of all the subordinate legislation adopted shows that there are virtually no additional incentives for investment projects that are entirely or even partially aimed at improving the environmental situation in the Arctic regions. The following are conditional exceptions: firstly, the current restrictions related to the provision of the specified preferences for projects in the field of mineral extraction; secondly, local initiatives by investors to implement environmentally-oriented tourism projects; and thirdly, projects by individuals and public associations aimed at persuading the business community to work in accordance with environmental standards. However, in practice, this is objectively insufficient to mitigate the accumulated negative consequences and correct the current environmental situation.

At the same time, despite the absence of direct measures to stimulate the attraction of private “green” investment capital, it should be noted that these regions have their own regional state programs and are implementing national (federal) projects related to ensuring environmental safety. In addition, a certain part of the business community independently pays close attention to the issues of preserving natural resources and minimizing environmental damage in order to ensure a positive image and create a favorable socio-economic environment. Thus, Table 1 shows the dynamics of expenditures by entities in the Arctic zone on environmental protection.

Table 1

Dynamics of expenditures by entities of the Arctic zone on environmental protection, billion rubles 4

|

Subjects of the Arctic zone |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

Absolute deviation |

|

Murmansk Oblast |

5.92 |

6.58 |

6.72 |

6.86 |

7.76 |

7.50 |

1.58 |

|

Nenets Autonomous Okrug |

0.39 |

0.31 |

0.39 |

0.44 |

0.39 |

0.41 |

0.02 |

|

Chukotka Autonomous Okrug |

n/a |

0.27 |

0.26 |

0.79 |

0.66 |

0.75 |

0.48 |

|

Yamalo-Nenets Autonomous Okrug |

5.62 |

7.22 |

8.11 |

9.24 |

10.42 |

10.77 |

5.15 |

|

Arkhangelsk Oblast |

4.18 |

4.14 |

5.14 |

5.39 |

6.38 |

6.21 |

2.02 |

|

Komi Republic |

n/a |

n/a |

n/a |

n/a |

n/a |

n/a |

х |

|

Sakha Republic (Yakutia) |

9.07 |

11.59 |

10.58 |

10.02 |

12.45 |

16.90 |

7.83 |

|

Krasnoyarsk Krai |

25.73 |

30.12 |

27.36 |

23.64 |

37.49 |

43.28 |

17.56 |

|

Republic of Karelia |

n/a |

1.91 |

2.06 |

2.40 |

2.52 |

2.84 |

0.93 |

|

Total costs for the AZRF subjects 5 |

50.91 |

62.12 |

60.62 |

58.77 |

78.08 |

88.65 |

37.75 |

4 According to data from territorial bodies of state statistics of the subjects of the Russian Federation.

Analysis of the information presented indicates that the Russian Federation entities under study have experienced moderate but rapid growth in the amount of financial resources spent on improving the environmental situation. In particular, the total increase for the entire six-year period under review is recorded at 74.13%, or 37.75 billion rubles. At the same time, the Krasnoyarsk Krai, the Republic of Sakha (Yakutia) and the Yamalo-Nenets Autonomous Okrug have the greatest impact on the formation of this value. Their combined influence reached more than 80% in 2023.

In such circumstances, the lack of data in 2018 from two regions (Chukotka Autonomous Okrug and the Republic of Karelia), due to the relatively modest indicators of socio-economic development in these entities, is unlikely to have a critical impact on the trends under consideration. A similar situation, only with a complete lack of data, can be observed for the Komi Republic. In this case, according to statistical data, the influence of the republic’s indicators on the overall national development is also extremely small, which means, in our opinion, that an identical trend can be observed for the dynamics of environmental protection costs in the Arctic zone under study.

The Nenets and Chukotka Autonomous Okrugs, as well as the Republic of Karelia, had the least impact on improving the environmental situation in the macro-region under consideration. Their combined impact on the overall structure of environmental costs is only 4.5%. Consequently, priority attention should be given to these regions for the development of the environmental component of the Arctic zone.

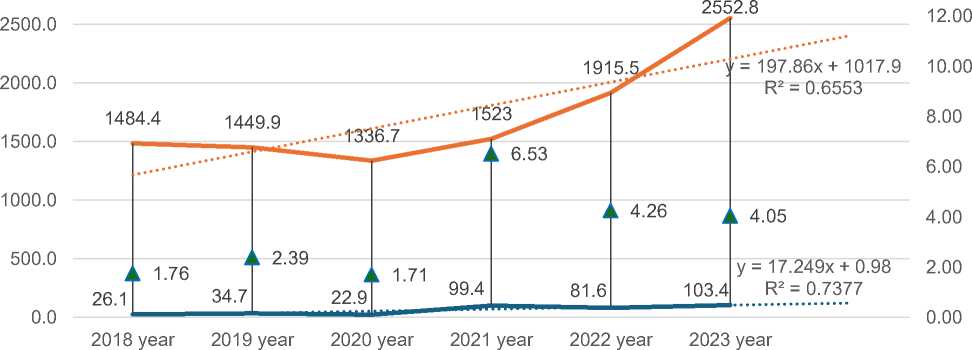

As for the study of the dynamics of the share of environmental protection costs of the Arctic zone subjects in the overall structure of environmental costs of all subjects of the Russian Federation (Fig. 1), such an analysis allows asserting the presence of very ambiguous trends for the factor components of this indicator. In particular, the graph shows, on the one hand, a decline in the growth rate of national costs in 2020–2022, and on the other hand, negative dynamics of costs of the Arctic Zone subjects in 2020 and 2021. In practice, this situation is conditioned by the negative consequences of the unfavorable sanitary and epidemiological situation and a significant increase in unjustified sanctions pressure on the national economy as a whole.

-

5 Without the costs of the Komi Republic throughout the entire study period and the costs of the Chukotka Autonomous Okrug and the Republic of Karelia in 2018.

600.00

500.00

400.00

300.00

200.00

100.00

0.00

^^^^^^^в Total costs in the Russian Federation, billion rubles.

■ Share of AZ subjects in the cost structure of the Russian Federation, %

Fig. 1. Dynamics of the share of costs of the Arctic zone subjects directed at environmental protection in the overall structure of similar costs of all subjects of the Russian Federation 6.

In addition, in the context of the noted changes, the following trend is also noteworthy: a significant increase in national environmental costs in 2023 against the background of a relatively small increase in the total amount of similar expenses for the subjects of the Arctic Zone of the Russian Federation during this period. In such circumstances, the following conclusions can be made: firstly, there is a need to significantly strengthen control over the current state of the environmental situation in the constituent entities of the Russian Federation that are national part of the Arctic zone; secondly, there is a real need to find both extra-budgetary and state sources of financing for new “green” investments.

In this regard, it seems appropriate to study the dynamics of private investments of business structures aimed at environmental protection and rational use of natural resources (Table 2).

Table 2 Dynamics of private corporate investments in fixed assets aimed at environmental protection and rational use of natural resources, subjects of the Arctic zone, billion rubles 7

|

Subjects of the Arctic zone |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

Absolute deviation |

|

Murmansk Oblast |

n/a |

19.5 |

5.9 |

3.5 |

3.7 |

5.4 |

-14.1 |

|

Nenets Autonomous Okrug |

n/d 8 |

0.3 |

n/d |

n/d |

n/d |

n/d |

х |

|

Chukotka Autonomous Okrug |

n/a |

n/a |

n/a |

n/a |

n/a |

n/a |

х |

|

Yamalo-Nenets Autonomous Okrug |

10.4 |

11.2 |

6.0 |

60.6 |

28.7 |

36.6 |

26.3 |

|

Part of Arkhangelsk Oblast |

0.8 |

0.9 |

6.0 |

8.3 |

1.3 |

0.9 |

0.1 |

|

Komi Republic (Yakutia) |

9.6 |

5.1 |

6.4 |

3.3 |

1.4 |

n/a |

-8.2 |

|

Sakha Republic |

9.8 |

6.2 |

4.2 |

4.8 |

8.4 |

10.7 |

1.0 |

|

Krasnoyarsk Krai |

0.05 |

0.08 |

0.12 |

0.17 |

0.22 |

0.26 |

0.2 |

6 Source: compiled by the authors on the basis of Rosstat data.

7 Ibid.

8 n/d — statistical observation bodies do not disclose actual statistical data in accordance with clause 5 of Article 4 and clause 1 of Article 9 of Federal Law No. 282-FZ of 29 November 2007; n/a — the data in question is not available in the materials of the territorial body of state statistics.

|

Republic of Karelia |

n/a |

n/a |

n/a |

n/a |

n/a |

0.55 |

х |

|

Total “green” investments of the AZRF subjects, billion rubles. |

26.1 |

34.7 |

22.9 |

99.4 |

81.6 |

103.4 |

77.3 |

Thus, according to the data presented in Table 2, the overall change in this indicator for all subjects of the Arctic Zone of the Russian Federation for the entire six-year period under review is characterized by an increase of almost 4 times compared to the level of 2018 and reaches more than 77 million rubles. At the same time, the objective leaders are the Yamalo-Nenets Autonomous Okrug and the Sakha Republic (Yakutia). However, their combined impact on the overall result of corporate eco-investment in 2023 is 45.8%, which is significantly higher than the share of these regions in the total volume of eco-expenses of the subjects of the Arctic zone (31.2%, Table 1). The current situation is determined by the critically small share of participation of the business community of the Krasnoyarsk Krai (the leader in Table 1) in ensuring environmental protection and rational use of natural resources through private investment (in comparison with the data in Table 2).

Besides, the fact that only 52.7% of all private “green” investments are subject to official disclosure in accordance with the provisions of Federal Law No. 282-FZ of 29 November 2007 deserves special attention 9. The remaining part, i.e. more than 49.8 billion rubles or 47.3%, according to 2023 data, falls mainly on the Nenets and Chukotka Autonomous Okrugs. This situation can be partly explained by the presence of the largest representatives of business structures engaged in large-scale extraction of minerals, logging, subsequent processing and, accordingly, compensating for the damage caused to the environment (investing in environmental protection and rational use of natural resources) on the territory of these subjects.

As for the study of the dynamics of “green” investments in the total volume of investments of residents of the Arctic zone, Figure 2 shows the corresponding mathematical relationship between these indicators. Thus, despite all the geo-economic and geopolitical changes, over the past three years the share of eco-investments within the boundaries of the territory under consideration has increased at least twofold (in 2021, it increased almost fourfold). In practice, the current situation is mainly due to the “downfall” of the total investment flow in 2020-2022, which is partly confirmed by graphical and mathematical visualization (using the equation compiled and the trend line constructed on its basis). In addition, the increase in the share is associated with the previously noted multiple growth in private capital investments in environmental protection and rational use of natural resources. At the same time, even at its peak, the level of “green” investments reaches only slightly more than 6.5%, which, in our opinion, is still critically low for full compensation for the environmental damage caused to the regions of the Arctic Zone of the Russian Federation.

Total “green” investments of AZ subjects, billion rubles.

Total investments of AZ subjects, billion rubles.

Share of “green” investments, %

Fig. 2. Dynamics of the share of investments of the Arctic zone subjects aimed at environmental protection and rational use of natural resources in the overall structure of investments of the subjects of this territory 10.

Thus, summarizing the entire set of analytical studies conducted, it can be rightly asserted that currently, in domestic practice, at the level of individual territorial entities, constituent entities of the Russian Federation and the national space as a whole, both business structures and representatives of state (municipal) authorities are paying increasing attention to issues of ensuring and enhancing environmental safety. The socio-economic regions under study, which are the Russian part of the international Arctic zone, are no exception. In particular, according to the analytical data presented, the following facts can be objectively stated: firstly, there has been moderate and relatively steady growth in the total expenditure on environmental protection by the relevant entities of the Russian Federation; secondly, there is growing organizational and financial interest in investing in environmental protection and the rational use of natural resources on the part of the business community. At the same time, it should be noted that the share of these indicators in the domestic economy as a whole and in the total investment volumes of the most prominent subjects of the Russian Federation is, unfortunately, relatively low and insufficient to fully compensate for the environmental damage caused.

Research aim and objectives

In such circumstances, in our view, additional research is required on issues related to the identification, systematization, analysis, “defect detection” of existing and generation of updat-ed/new state support measures both for business structures — residents of the Arctic zone, and directly for the constituent entities of the Russian Federation that are part of this socio-economic space. In the context of this study, special attention should be paid to the preferential conditions for the implementation of the so-called “green” investment projects.

In this regard, the aim of the article is to develop relevant scientific and practical recommendations for activating and scaling up the investment activity of business structures imple-

SOCIAL AND ECONOMIC DEVELOPMENT

Tatyana A. Golovina, Vladislav V. Matveev, Irina L. Avdeeva. Development … menting environmentally friendly investment projects within the boundaries of the domestic part of the international Arctic zone of the Russian Federation. In order to achieve this goal, it will also be necessary to formulate and solve the following scientific and applied tasks: firstly, related to the study of modern issues of stimulating investment flows, including ESG projects; secondly, to formulate relevant objective and effective proposals for the constituent entities of the Russian Federation that are part of the Arctic zone; and thirdly, to assess the economic potential of integrating these tools in real conditions.

Literature review

Intensification of investment flows is a key component of socio-economic policy for any modern economy in the world, as well as for individual territorial entities. This significance is due to the ability of new investment inflows to increase not only the amount of private capital invested in the modernization of existing production facilities in the region, but also to maximize the quantity and quality of products manufactured there, create new jobs and, as a result, fill the budget system at all levels with new tax revenues, which in turn guarantees the achievement of sustainable socio-economic development both for the given territorial entity and for the country as a whole.

For this reason, according to B.H. Vashaev, “the investment sector is increasingly becoming the focus of attention” of representatives of various levels of domestic executive authorities, business structures, the media and the scientific community [1, p. 63]. A fundamentally similar position is also noted at the international level. In particular, according to a group of Chinese researchers led by Professor Li Chao, in modern realities, scientists and representatives of the political establishment are showing maximum interest in studying the impact of increasing macroeconomic uncertainty on current investment processes and corporate investment behavior [2].

As a result, corporate investment is a key driver of economic growth for the entire country and the local corporate success of private business structures [3]. At the same time, from the viewpoint of the Indian government, a slowdown in investment growth, on the one hand, is detrimental to the development trajectory of the national economy, and on the other hand, can sometimes be asymmetrical to the growth rates of corporate profitability of individual business structures [4]. In practice, the latter formulation signals to officials that businesses may periodically refuse investment inflows in order to minimize the diversion of their own capital, and reduce the costs of using attracted and/or borrowed resources to minimize cost and maximize profitability. In such circumstances, in order to achieve balanced national and regional development, government authorities, together with parliamentarians, should pay close attention to the dynamics of investment indicators, as well as take a proactive position and effectively stimulate the business community to increase its investment potential [5, Polyanin A.V., Matveyev V.V., p. 187].

Moreover, in the course of developing an effective investment policy for the regions that are part of the Arctic zone, government officials need to identify the actual root causes of business structures’ refusal to invest. For example, according to researcher A.I. Sadykov, a key component of the region’s investment strategy is not only investing in the production capacities of business structures, but also investing in the development of regional infrastructure [6, Sadykov A.I.]. This position is based on the fact that the infrastructure potential available to businesses in almost all constituent entities of the Russian Federation is either at the limit of its capabilities or is not even sufficient for the current level of entrepreneurial activity. In this regard, from our point of view, it can be directly assumed that the disclosure of the investment potential of the studied preferential territory, including in terms of the integration of the noted resource-saving technologies (“green” investments), is associated not only with direct subsidization of certain types of entrepreneurial activity, but also with the development of supporting (electricity, gas, water supply and drainage), transport and logistics (road, industrial, development, logistics) and even, to some extent, social (educational institutions, places for recreation and leisure for staff/citizens) and other related infrastructure.

A group of researchers led by O.B. Ugurchiev shares a similar opinion. In particular, in their research, they emphasize that the key “stumbling block” in the development of domestic investment activity is “the deterioration of existing networks and infrastructure facilities, as well as the presence of objective restrictions on connecting to them” [7, Ugurchiev O.B., Ugurchieva R.O., p. 6]. This means that the position we have noted has at least some scientific and practical validity.

Another “basic” problem in matters of increasing “green” investment flows is the relatively low profitability of projects involving the creation of standard (non-unique, already widely available on the market) products, works and services. The international community holds a similar opinion. In particular, a group of Chinese researchers led by Jinfang Tian is studying the problem of reducing the profitability of “green” investments in the conditions of changes in the terms of “green” lending [8]. This situation is due to the presence of a directly proportional relationship between the volume of eco-investments and the level of corresponding state support.

At the same time, according to Arabian and Turkish scientists, in practice, the effectiveness of “green” investments can be justified mainly in case of existence of energy and environmental security risks for the state in question [9]. However, on the scale of our national economy and in the context of the resource potential accessible to domestic business, the issue of integrating “green” investments in the energy sector is currently less relevant than the development of alternative energy resources for other countries. This means that the creation of an effective investment policy in the regions of the Arctic zone is also associated with the risks of business structures refusing to search for and use more environmentally friendly energy resources.

Thus, summarizing the above, it can be stated with a certain degree of accuracy that the creation of a “green” investment policy has quite a lot of hidden difficulties, which are mainly associated with the refusal of businesses to shift their target goals from basic profitability (return on investment) in favor of implementing environmental innovations and increasing environmental safety. In such circumstances, in our opinion, when formulating the investment policy for the Arctic regions under consideration, the relevant state authorities, together with regional parliamentari- ans, need to provide for a high-quality and varied set of state support measures for business structures that make environmental investments.

Materials and methods

The essence of the research is based on the study of accumulated scientific and empirical experience both in terms of organizing the activities of foreign preferential territories and in terms of domestic practice of providing businesses with preferential conditions for conducting economic activities. The implementation of this study is based on the application of the following methods: analytical comparison and abstraction (to identify promising practices for simulating investments, including in the sought-after ESG projects); modeling and graphical interpretation (to compile the obtained results and to form the author’s model for activating investments of business structures — residents of the Arctic zone of the Russian Federation).

The information sources used include the works of domestic and international researchers, current regulatory and legal documents, regional and federal statistical data, as well as the results obtained by the authors in the course of this study.

Research results

As already noted, business entities implementing or planning to implement environmental investment projects face a number of specific problems. In this regard, at the initial stage of this study, it is necessary to detail the identified problems with the aim of their consistent leveling and creation of unique preferential conditions for residents of the Arctic zone of the Russian Federation. Thus, in Fig. 3, we present an up-to-date list of difficulties arising during the implementation of environmental investment projects in domestic practice.

One of the first risks that should be eliminated in the case of the formation of the desired updated investment eco-agenda is the lack of a sustainable understanding of the need to preserve and increase environmental safety in our country among both the population and representatives of the business community. Currently, the Russian Federation ranks 84th out of 180 countries in the world by the Environmental Performance Index (EPI in 2024) 11.

The problems of implementing ESG projects in domestic practice

|

Cultural risks |

Regulatory risks |

Infrastructure risks |

Economic risks |

||||||

|

=> |

— lack of an established environmental culture among the population and businesses — low level of creation of domestic resource-saving technologies |

=> |

|

=> 4 |

|

4 4 |

— relatively high costs for the purchase and implementation of ESG technologies — comparatively low efficiency of eco-investments |

Fig. 3. The system of risks hindering the implementation of eco-investments by Russian business structures 12.

At the same time, it should be noted that, in accordance with the current Passport of the national project “Ecology” 13, starting in 2019, a set of federal, regional and municipal state programs has been in effect in the country, aimed not only at the actual protection of the environment, but also at ensuring the ecological awareness of the entire Russian society. Unfortunately, the interim results obtained in practice indicate that these desired changes are only beginning. For example, today in the Russian Federation there is a reduction in the number of unauthorized landfills and objects of accumulated damage, the modernization of heat, gas and electricity supply networks, the transition to resource-saving and more environmentally friendly technologies for business and the public sector, as well as a qualitative improvement in the environmental living conditions of citizens in general. In this regard, the project plans also include large-scale tasks to eliminate all accumulated damage, restore most natural sites, preserve biological diversity, develop a comprehensive environmental monitoring system and the country’s transition to a renewable resource economy.

However, the implementation of these measures is neither theoretically nor practically possible without the adoption of decisions by the authorities and parliamentarians regarding direct action (organization of a continuous information campaign, propaganda) of environmental protection. Obviously, this will require a huge amount of financial, human, informational, and other resources without any compensation (except for changes in the environmental situation). For this reason, resources for this area are actually provided on a residual basis.

Another partially ideological (cultural) risk is the situation with a relatively low level of creation of domestic resource-saving technologies. In our opinion, the main reason for this circumstance lies not even in the lack of financing, government support, specialists and/or breakthrough scientific and practical ideas, but in the absence of key production capacities. In particular, during the crisis of the 1990s, the industrial cluster for the creation of equipment, machine tools, ma- chines and other essential business equipment was almost completely destroyed in Russia. Today, this cluster is slowly beginning to revive. However, in the context of the advanced technological initiative of Western and European countries, as well as the extremely low-cost (and maximally subsidized by the state) Chinese capabilities, it is very difficult to develop the noted types of production. This is especially true when it comes to preserving and enhancing environmental safety both during the development and use of the desired technological innovations.

The next (no less important) group of risks restraining domestic investment in ecodevelopment is the issue of national and international regulatory policy. For example, under the current sanctions pressure from the Western and European communities, a huge number of risks are emerging in the Russian economy, requiring both close attention from government authorities and maximum resource support in order to mitigate actual and potential negative consequences. In such circumstances, the environmental component of the country’s overall socio-economic policy cannot be adequately ensured.

The complete absence of specialized forms of support for relevant investment initiatives at both the federal and regional levels also has a critical impact on the growth of eco-investments. In practice, the only exception is the previously noted events provided for in the framework of the Passport of the national project “Ecology”. However, even a preliminary analysis of these management decisions indicates that they are focused exclusively on budgetary financing of the minimization of global environmental issues (mainly without the participation of private investment capital).

The third group of problems is infrastructure risks, which can also be divided into two components:

-

• firstly, issues related to the lag of existing infrastructure capacities behind the actual needs of business; in practice, this means that investors need to make private investments in infrastructure that enables the localization and implementation of the project, which effectively increases the amount of capital investment and minimizes opportunities for investing in “green” technologies;

-

• secondly, the problem of the low level of development and use of resource-saving infrastructure capacities (for example, solar, wind, gas turbine power plants); in particular, given the huge reserves of oil, coal, gas and other similar energy resources in our country, the serious development of any alternative energy sources and corresponding resource-saving technologies is neither practically nor even theoretically possible.

Economic risks are also critical factors in investment-based eco-development. In particular, all the previously noted negative factors are somehow linked to the rising cost of investment projects due to investments in environmental improvement. In other words, financing of capital investments in “green” innovations at both the state and corporate levels is carried out on a residual basis.

At the same time, the purchase and implementation of ESG technologies cannot be carried out using the company’s last remaining funds. In practice, this is a very expensive initiative, which in turn has a negative impact on the environmental aspirations and real opportunities of investors. Moreover, not only the purchase and installation of such equipment is very expensive, but also its subsequent operation in the form of mandatory service (dealer) maintenance. In reality, however, the observed growth is not simply due to the “mercantile” desire of manufacturers to obtain excess marginality from their products, but also to the objectively high costs of developing simultaneously advanced, efficient and environmentally friendly technologies in the context of increased competition.

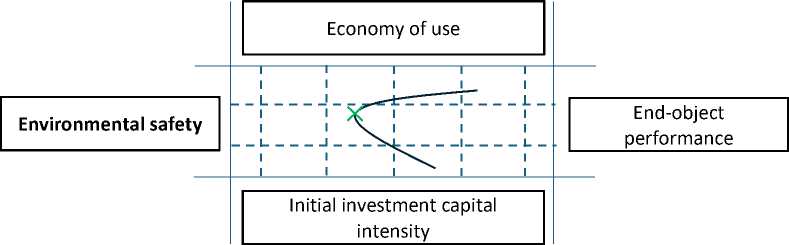

It should also be noted that the creation of environmentally friendly innovations is usually associated with relatively low production results. In practice, the manufacturer always faces a choice between at least four key factors, the dependence of which is presented in Fig. 4.

Fig. 4. Interrelations of factors affecting the environmental safety of a technological innovation 14.

According to the presented parameters, the creation (integration) of any innovation is always associated with an alternative choice between environmental safety and the final productivity of the technology, as well as fine-tuning of related parameters in terms of savings on operating costs and initial capital investments. Therefore, it can be rightfully stated that the use of “clean” technologies/attraction of “green” investments has a relatively reduced economic efficiency compared to ordinary quantity-oriented projects (technologies, machinery and other equipment).

Thus, we have objectively determined that the implementation of environmentally-oriented investment projects is accompanied by numerous problems. At the same time, the detailed 6 risks are certainly crucial, but they are far from being the only ones. For example, one of the issues is related to obtaining permits for both the construction and commissioning of “green” facilities (due to the lack of relevant specialists and experience).

It should also be noted that the identified risks are, to one degree or another, representative for almost all subjects of the Russian Federation, including the regions under consideration that are part of the Arctic zone of the Russian Federation. Therefore, in the course of further research, it is necessary to pay special attention to the issues of formulating private scientific and practical recommendations for leveling the existing problems.

Thus, at the second stage of the research, we propose to search for the most promising approaches to stimulating the investment activity of business structures implementing environmentally-oriented projects in the territorial entity under consideration. In particular, Table 3 shows a list of key areas for stimulating business activity, generated on the basis of addressing the problems identified earlier.

Table 3 List of organizational and management instruments for activating investment activity of business structures implementing environmental projects within the boundaries of the Arctic zone of the Russian Federation

|

No. |

Essence of the problem |

Suggested solutions |

Level and volume of funding |

Type of influence on the activation of ecoinvestments |

|

1 |

Lack of an established environmental culture among the population and business |

- increasing the number of mass environmental events involving not only representatives of the budgetary sphere, but also corporate structures |

Regional budget, small funding volume (compensation for transport and expendable materials) |

Indirect |

|

- creating more environmental teams among young people and increasing their funding |

Regional budget, moderate funding volume (compensation for transport and expendable materials) |

|||

|

- creating and distributing specialized social videos in the media |

Federal budget with regional co-financing, moderate funding volume (subsidies for specialized companies) |

|||

|

- strengthening control over the environmental activities of business structures |

Federal budget with regional co-financing, moderate funding volume (installation and maintenance of environmental monitoring stations) |

Direct |

||

|

2 |

Low level of creation of domestic resourcesaving technologies |

- strengthening state funding of the domestic scientific and production complex |

Federal budget with regional co-financing, moderate funding volume (subsidies to businesses for development and creation of equipment, tools, machinery and other basic equipment, including resourcesaving) |

Direct |

|

- stimulating the influx of foreign innovative ideas and technologies into the national economy |

Federal budget, moderate funding volume (subsidies for businesses for the purchase of foreign patents, including resource-saving) |

Direct |

||

|

3 |

Lack of macroeconomic and geopolitical stability |

- stabilization of the system of measures to support business investment activity, including ecoinvestments |

No funding required, Russian legislation needs to be adjusted |

Indirect |

|

4 |

Lack of a system of state incentives for the integration of ESG technologies |

- development and implementation of financial measures to stimulate ESG projects |

Federal budget with regional co-financing, moderate funding volume (subsidies to businesses |

Direct |

|

for the implementation of ESG projects, including working capital financing) |

||||

|

- extension of the Federal Law "On the Protection and Promotion of Capital Investments in the Russian Federation" 15 to ESG projects, regardless of the volume of investment |

No funding required, Russian legislation needs to be adjusted |

Direct |

||

|

5 |

Lagging behind existing infrastructure capacity compared to actual business needs |

- enshrining in legislation the obligations of resource supplying companies to build energy facilities for the future, including at the request of businesses and regional executive authorities without maintaining capacity utilization |

No funding required, Russian legislation needs to be adjusted |

Indirect |

|

6 |

Low level of development and use of resource-saving infrastructure capacities |

- development and implementation of financial measures to stimulate the construction of alternative energy facilities |

Federal budget with regional co-financing, moderate funding volume (subsidies to businesses for the construction of alternative energy facilities) |

Direct |

|

- removing barriers for alternative energy facilities (companies) in terms of “dumping” free capacity into the general energy network |

No funding required, Russian legislation needs to be adjusted |

Direct |

||

|

- extension of the Federal Law "On the Protection and Promotion of Capital Investments in the Russian Federation" to the construction of alternative energy facilities |

No funding required, Russian legislation needs to be adjusted |

Direct |

||

|

7 |

Relatively high costs of purchasing and implementing ESG technologies |

- reducing business costs for technological connection of eco-projects to energy infrastructure facilities |

Federal budget with regional co-financing, moderate funding volume (subsidies to businesses for technological connection of eco-projects) |

Direct |

|

- minimizing the cost of credit capital for ESG projects |

Federal budget with regional co-financing, moderate funding volume (subsidies to banking sector for co-financing of ESG projects lending) |

Direct |

||

|

8 |

Relatively low efficiency of eco-investments |

- adjustment of the Russian Federation tax legislation to stimulate the inflow of eco-investments |

Direct financing is not required, but lost revenues of the budgets of the Russian Federation are assumed. Russian legislation needs to be adjusted (minimization to zero in the first 5 years of income tax, property tax, land |

Direct |

|

tax, as well as a reduction in the amount of deductions for social needs to 7.6% for 5 years) |

This table propose a whole range of specific examples of management decisions that can be used by representatives of federal and regional executive authorities to activate and scale up the practice of investing by business structures not only in purely economic projects, but also in initiatives to preserve and enhance national (regional) environmental security, including the regions of the Arctic zone of the Russian Federation under consideration. Moreover, the essence of these measures is entirely aimed at levelling out the previously noted (in Fig. 4) socio-economic imbalance between profitability and environmental obligations of business.

In particular, we propose the introduction of up to seven new direct measures of financial incentives for business eco-investments into the national economy (for the promotion of “green” projects, for the development and creation of resource-saving equipment, for the purchase of relevant foreign patents, for priority technological connection, for the construction of alternative energy facilities, for co-financing of loans and full financing of the implementation of ESG projects), up to five changes to regional and federal legislation (in terms of aligning the system of measures to support investment activity, protecting and encouraging capital investments, building energy facilities for the future, eliminating barriers for alternative energy facilities), up to three direct financial inflows into the public sector (compensation of expenses of public organizations, including the construction of an eco-monitoring station), as well as a significant adjustment to tax legislation (a practical example of tax breaks for residents of the Arctic Zone of the Russian Federation was presented by us earlier in the course of a similar study [10, Golovina T.A., Matveev V.V., Avdeeva I.L.]).

At the same time, as for the practical aspects of applying this toolkit, most of it can be tested by officials and parliamentarians both independently in conditions of limited budget financing, and systematically in the case of sufficient resources. In addition, in the absence of financial resources, their use may be limited to individual (local) territorial entities that require special attention in terms of preserving and enhancing environmental security, for example, as in the case of the regions of the Arctic zone of the Russian Federation under consideration.

In such circumstances, in order to assess the real prospects for integrating all of the proposed management solutions into the Russian economic space, it is necessary to additionally assess their economic efficiency at the next, third stage of this study. For this purpose, we have calculated the potential budget costs, lost revenues and, in part, potential additional revenues in Table 4.

Table 4

Economic efficiency of the proposed instruments for activating the investment activity of business structures implementing environmental projects within the boundaries of the Arctic zone of the Russian Federation

|

No. |

Instrument |

Per the AZRF subject |

||

|

Level of the expected volume of financing 16 from the average level of expenditures of the AZRF subjects on environmental protection in 2023 |

Regional budget |

Federal budget |

||

|

1 |

Increasing the number of mass environmental events with the involvement of corporate structures |

Up to 0.5% |

9.85 bln rub. х 0.005 = 49.3 mln rub. |

49.25 mln rub. / 5 * 100 = 0.97 bln rub. |

|

2 |

Creating more environmental groups among young people and increasing their funding |

|||

|

3 |

Creation and distribution of specialized social videos in the media |

Up to 0.2% |

9.85 bln rub. х 0.002 = 19.7 mln rub. |

19.7 mln rub. / 5 * 100 = 394 mln rub. |

|

4 |

Strengthening control over environmental activities of business structures |

0.015 |

annual maintenance of the air pollution control station costs 1.5mln rub. |

construction of the station costs 6.25mln rub., technological connection costs 0.25 mln rub. |

|

5 |

Strengthening state funding for the domestic scientific and production complex |

Up to 1% |

9.85 bln rub. х 0.01 = 98.5 mln rub. |

98.5 mln rub. / 5 * 100 = 1.97 bln rub. |

|

6 |

Stimulating the influx of foreign innovative ideas and technologies into the national economy |

Up to 0.5% |

9.85 bln rub. х 0.005 = 49.3 mln rub. |

49.25 mln rub. / 5 * 100 = 0.97 bln rub. |

|

7 |

Development and implementation of financial measures to stimulate ESG projects |

Up to 2% |

9.85 bln rub. х 0.02 = 197 mln rub. |

197 mln rub. / 5 * 100 = 3.94 bln rub. |

|

8 |

Development and implementation of financial measures to stimulate the construction of alternative energy facilities |

Up to 0.1% |

9.85 bln rub. х 0.001 = 9.85 mln rub. |

9.85 mln rub. / 5 * 100 = 197 mln rub. |

|

9 |

Reducing business costs for technological connection of eco-projects to energy infrastructure facilities |

Up to 0.01% |

9.85 bln rub. х 0.0001 = 9.85 mln rub. |

9.85 mln rub. / 5 * 100 = 197 mln rub. |

|

10 |

Minimizing the cost of credit capital for ESG projects |

Up to 1.5% |

9.85 bln rub. х 0.015 = 147.8 mln rub. |

147.8 mln rub. / 5 * 100 = 2.96 bln rub. |

|

Total |

Up to 5.825% |

573.8 mln rub. |

11.48 bln rub. |

|

|

12.05 bln rub. |

||||

Thus, we have calculated additional costs that the regions of the Arctic zone of the Russian Federation are potentially capable of directing to activating various investment processes by business structures that contribute to the preservation and increase of environmental safety of the territorial entity under consideration. However, these calculations are only conditional, since the ex- act volumes of financing are directly proportional to both the current development problems of each individual region and the current macroeconomic challenges at the federal (national) level. Nevertheless, their scientific and practical value lies in the possibility of forming at least an approximate estimate of the cost of integrating a proactive stimulation system for eco-investments into domestic economic policy, as well as the initial stage of creating the so-called renewable resource economy.

In particular, according to the data provided, on average, approximately 12 billion rubles will be required per AZRF entity, which means that up to 108 billion rubles will be required for the entire preferential territory, which, on a national scale, amounts to approximately 0.41% of the total federal revenue of the Russian Federation’s budget system. As for the organization of the proposed support system for all subjects of the Russian Federation, such an initiative will cost the domestic economy more than 1 trillion rubles.

It should also be noted that the practical implementation of the proposed improvements is associated with a huge number of risks. For example, with threats of relatively low commercial profitability of projects; and/or low budget efficiency; and/or creation of facilities which actually reduce the level of environmental safety; other identical negative consequences for people, business and the state as a whole. In this regard, the actual integration of each of the proposed instruments should be linked at the legislative level with the creation of a specialized monitoring system, the establishment of appropriate indicators and continuous control over the final socioeconomic performance.

Conclusion

Despite all the organizational and economic difficulties and risks mentioned above, the essence of the tools proposed in this study is aimed exclusively at creating comfortable and environmentally safe living conditions for citizens and the functioning of business structures within the boundaries of the Arctic zone of the Russian Federation. Moreover, all “proposals are fully consistent with the goals and objectives of the national project “Ecology”, and therefore can potentially be included in its Passport” [11, Kharitonova G.N.] as a viable measure for the development of this preferential territory, as well as comprehensively for ensuring the environmental safety of the country as a whole. At the same time, a distinctive feature of this approach, compared to “classical” budget inflows, is the activation of eco-oriented investment thinking among private corporate structures and the creation of an ecological culture for all entities.