Development of Small and Medium-Sized Business in the Arkhangelsk Oblast

Автор: Sergeeva K.I., Mironenko K.A.

Журнал: Arctic and North @arctic-and-north

Рубрика: Social and economic development

Статья в выпуске: 48, 2022 года.

Бесплатный доступ

The article examines the dynamics of the number of small and medium-sized businesses in the Arkhangelsk Oblast from 2017 to 2021. The main reason for the sharp decrease in the number of subjects in 2020 is determined. The most vulnerable and affected areas of small and medium-sized businesses are listed. The measures of support for these areas of entrepreneurship at the federal level are reviewed. The measures taken by the Arkhangelsk regional government to regulate the situation are studied. The specific organizations that give support directly in the territory of the Arkhangelsk Oblast are given. The reasons why it is necessary to support and develop small and medium business in the Arkhangelsk economy are given. The methods used in this paper are an analysis of the number of small and medium-sized enterprises, drawing conclusions about the economic situation in the Oblast on the basis of this analysis, and researching support measures. This article might be useful for entrepreneurs in the Arkhangelsk Oblast to study the support measures. The information described in the article could be useful for scientific research, for statistics and analysis of small and medium business in the Arkhangelsk Oblast.

Small and medium-sized business, gross domestic product, entity, microloan, rate, tax

Короткий адрес: https://sciup.org/148329246

IDR: 148329246 | УДК: 330.33(470.11)(045) | DOI: 10.37482/issn2221-2698.2022.48.44

Текст научной статьи Development of Small and Medium-Sized Business in the Arkhangelsk Oblast

The development of small and medium-sized businesses is an essential trend in a market economy. This topic is highly relevant at present, since the rate of economic growth of small and medium-sized entrepreneurship is important for the regions of Russia. These types of businesses generate large tax revenues for the local budget, provide jobs, and produce a variety of goods and services for the population [1]. The development of small and medium-sized entrepreneurship (SME) is considered important not only for the regions, but also for the country’s gross domestic product as a whole [2]. That is why it is necessary for the state to promote its development and expansion.

The scientific novelty of this article is a review of SMEs in the Arkhangelsk Oblast over the past five years against the backdrop of a coronavirus infection, which entails difficulties in development and expansion for business.

In this regard, the aim of this article is not only to study the dynamics of the number of SMEs, but also to examine the state support measures that can help entrepreneurs in the Arkhangelsk Oblast.

∗ © Sergeeva K.I., Mironenko K.A., 2022

This goal is achieved by collecting information, analyzing it and drawing up conclusions about the situation in the Oblast and support measures.

Overview of small and medium-sized businesses

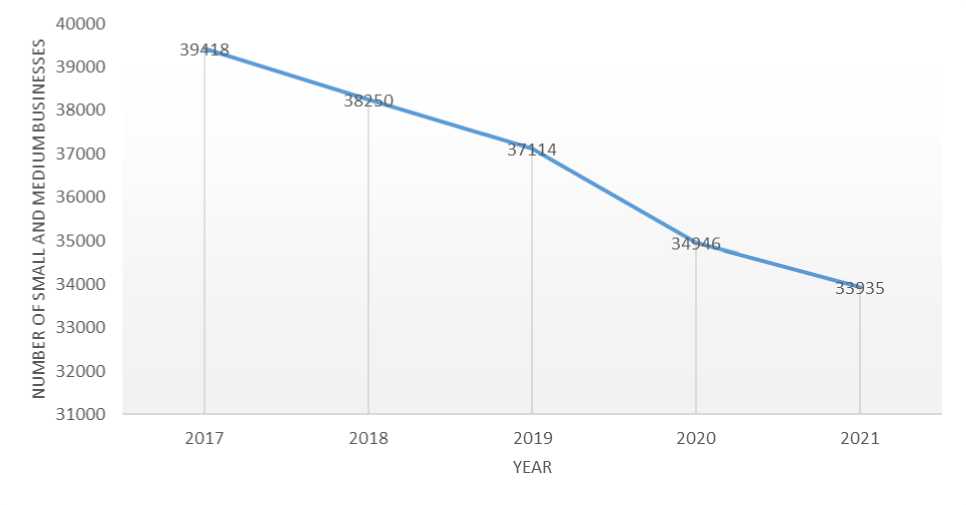

As of December 10, 2021, the number of SMEs in the Arkhangelsk Oblast is 33935 1. Figure 1 shows the statistics for the last five years.

Fig. 1. Number of SMEs from 2017 to 2021.

Figure 1 shows that the number of SMEs is decreasing over time, with the largest decrease in 2020 and 2021.

In 2018, compared to 2017, and in 2019, compared to 2018, the number does not differ much: there is a decrease by 1168 and 1136 units of economic entities, respectively, or by 3%, as shown in Table 1.

Table 1

Change in the number of SMEs

|

Year |

Number of SMEs 2 |

Absolute change 3 |

Growth rate, % |

Rate of increase, % |

|

2017 |

39 418 |

|||

|

2018 |

38 250 |

-1 168 |

97.0 |

-3.0 |

|

2019 |

37 114 |

-1 136 |

97.0 |

-3.0 |

|

2020 |

34 946 |

-2 168 |

94.2 |

-5.8 |

|

2021 |

33 935 |

-1 011 |

97.1 |

-2.9 |

The largest decrease is observed in 2020 — almost 6% (2168 units of economic entities). In

2021, the decrease is already less than in 2020 — by 2.9% (1011 units of economic entities), but at the same time, the lowest number of SMEs in five years is recorded.

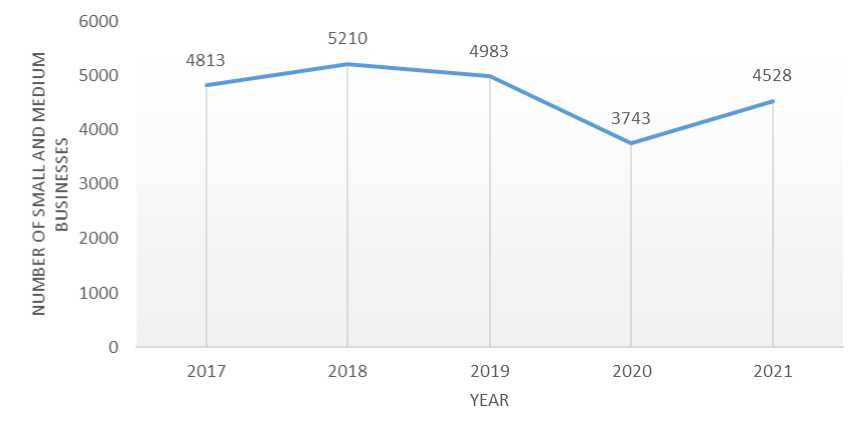

New businesses are being opened in small numbers. Figure 2 shows how many new SMEs are created each year between 2017 and 2021 in the Arkhangelsk Oblast.

Fig. 2. Newly created SMEs.

The figure shows that the smallest number of newly created SMEs is in 2020 (3743 units).

Table 2 shows the change in the number of newly created SMEs.

Table 2

Change in the number of newly created SMEs

|

Year |

Number newly created SMEs 4 |

Absolute change 5 |

Growth rate, % |

Rate of increase, % |

|

2017 |

4 813 |

|||

|

2018 |

5 210 |

397 |

108.2 |

8.2 |

|

2019 |

4 983 |

-227 |

95.6 |

-4.4 |

|

2020 |

3 743 |

-1 240 |

75.1 |

-24.9 |

|

2021 |

4 528 |

785 |

121.0 |

21.0 |

As can be seen from table 2, for all the five years under consideration, there is the largest reduction in newly created entities in 2020 (decreased by almost 25% or by 1240 units of economic entities).

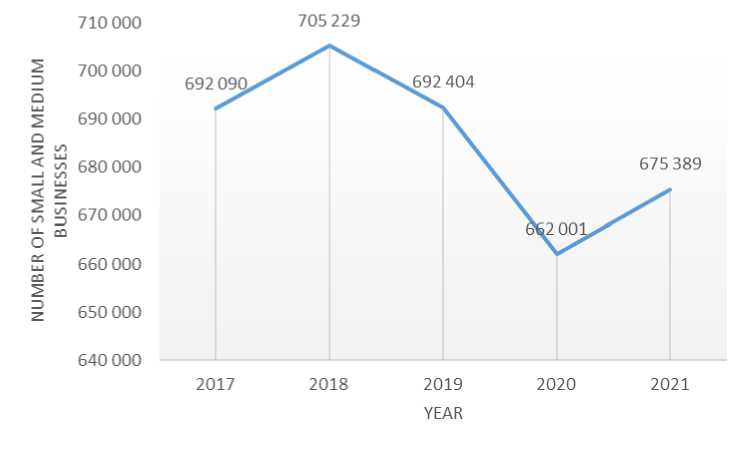

The Arkhangelsk Oblast is part of the Northwestern Federal District of Russia (NWFD). From 2018 to 2021, the share of SMEs in the Arkhangelsk Oblast remains unchanged and amounts to 5% of the total number of subjects of the entire district.

The largest number of SMEs in the NWFD is in St. Petersburg: from 2018 to 2021, the share of SMEs there remains unchanged and amounts to half of the total number of subjects of the district, or 52%.

Figure 3 shows statistics on the number of SMEs in the NWFD.

Fig. 3. Number of SMEs in the Northwestern Federal District from 2017 to 2021.

Figure 3 shows that the lowest indicator of the number of SMEs in the NWFD for the last five years is in 2020. The situation is similar in the Arkhangelsk Oblast: there is a decrease in the number of SMEs in 2020.

The reason is that the COVID-19 pandemic started on January 31, 2020. Small and mediumsized businesses were affected by the spread of the coronavirus.

Professional areas of SMEs were significantly impacted, as shown in Table 3.

Table 3

Areas of SMEs significantly affected during the pandemic [3]

|

Areas of economic activity |

OKVED codes |

|

Activities in the field of transport services |

49.3, 49.4, 51.1, 51.21, 52.21.21, 52.23, 49.10.1, 50.1, 50.3 |

|

Activities in the field of culture and entertainment |

90, 59.14, 91.02, 91.04.1 |

|

Activities in the field of sports, activities of sanatoriums and resorts |

93, 96.04, 86.90.4 |

|

Activities in the field of tourism |

79 |

|

Hospitality industry |

55 |

|

Activities in the field of catering |

56 |

|

Activities in the field of additional education |

85.41, 88.91 |

|

Activities in the field of organizing conferences and exhibitions |

82.3 |

|

Activities in the field of personal services |

95, 96.01, 96.02 |

|

Dental activities |

86.23 |

|

Non-food retail activities |

45.11.2, 45.11.3, 45.19.2, 45.19.3, 45.32, 45.40.2, 45.40.3, 47.19, 47.4, 47.5, 47.6, 47.7, 47.82, 47.89, 47.99.2 |

|

Activities for the production of folk art crafts |

32.99.8 |

|

Activities in the field of media and production of printed products |

60, 63.12.1, 63.91, 18.11, 58.11, 58.13, 58.14 |

Support measures for SMEs

The state needs to have information about the difficulties faced by small and medium-sized businesses and the reasons for their liquidation. Based on these data, support measures for these activities are developed [4].

Federal support measures for SMEs during the pandemic are the following:

-

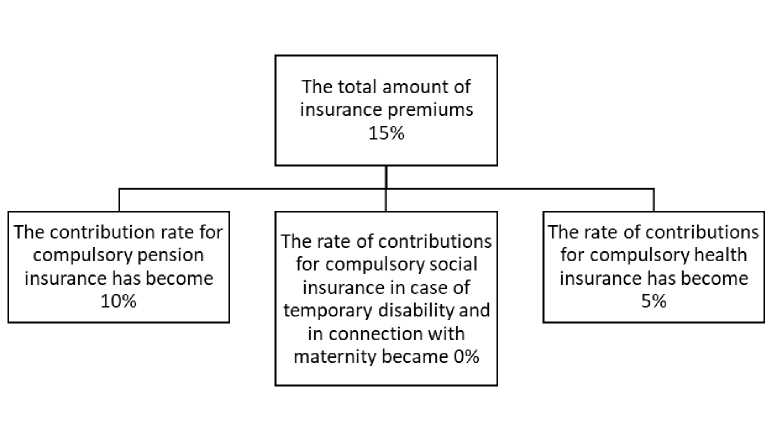

1) The government has reduced the total insurance premiums to 15% from April 1, 2020, which is shown in figure 4.

Fig. 4. Interest rates of insurance premiums [7].

The support measure covers only the part that exceeds the minimum wage each month.

-

2) An opportunity to reimburse the commission for financial operations with individuals is provided for the period from July 1, 2021 to December 21, 2021. This support is provided by the fast payment system 6.

-

3) Prohibition of annual scheduled inspections for small businesses for 2021. Exceptions are provided. Small businesses that have been prosecuted for an administrative offence in the form of suspension of professional activity or if less than three years have elapsed following an

audit that revealed the offence, will not be exempt from the audit. Small businesses with high-risk assets are also not exempt from audits 7.

-

4) Ability to purchase software at half price. The support measure is executed by the Russian Fund for the Development of Information Technologies.

-

5) Exemption and deferrals on penalties in public procurement.

-

6) Opportunity to take a loan on favorable terms at 3% from November 1, 2021 to December 30, 2021.

-

7) Opportunity to receive a one-time subsidy in 2021 on non-working days for SMEs most affected by the spread of coronavirus infection in the amount of one minimum wage multiplied by the number of employees.

In addition to federal support measures for SMEs, there are also regional support measures that may vary depending on the region [4].

Support measures for SMEs in the Arkhangelsk Oblast during the pandemic are the following:

-

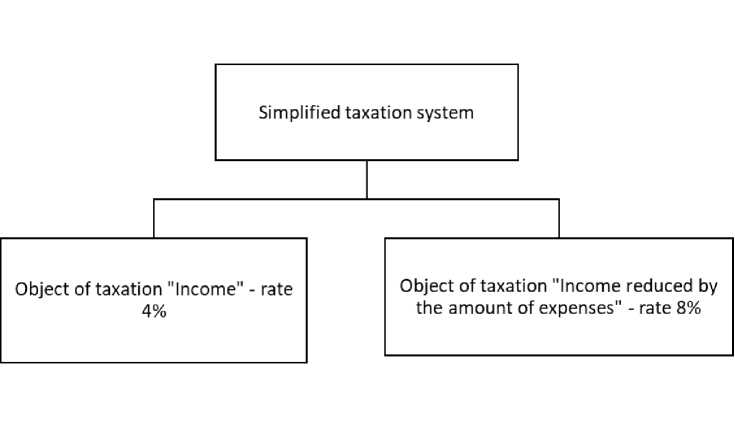

1) Reduced interest rates have been established for SMEs for 2020 and 2021, using the simplified taxation system (STS), as shown in figure 5.

Fig. 5. Interest rates for the simplified tax system.

-

2) For organizations using special tax regimes, the government reduces the tax base for certain real estate objects (retail, non-residential areas and areas intended for public catering) for 2020 8.

-

3) For 2020, reduced real estate tax rates for SMEs are applied in the following amounts:

-

• 1.2% for the general tax regime;

-

• 1% for special tax regimes, if the total area of real estate does not exceed 900 m2;

-

• 1% for special tax regimes. The rate applies only to residential premises, which are not

considered as fixed assets in accounting;

-

• 0.2% for consumer cooperatives that apply special tax regimes for rural real estate in

the Arkhangelsk Oblast, which are not administrative centers. It does not apply to real estate objects that are rented out.

-

• 0.2% for consumer cooperatives that apply special tax regimes, provided that they op

erate in premises where at least 40% of the area is allocated for personal services. Applies only to classes 13–15, 31, 85 (group 41), 93 (groups 12, 13 and 19) OKVED.

-

5) The government has adopted the value of the potential annual income, which is equal to 1 ruble, for individual entrepreneurs (IEs) who switched to the patent taxation system in 2020 (the only exception is for individual entrepreneurs who acquired a patent before April 28, 2020 9.

-

6) Possibility of postponing the payment of advance payments and taxes for SMEs that are included in the list of industries most affected by the spread of coronavirus infection 10. The government of the Arkhangelsk Oblast extended the payment deadlines, which are indicated in Table 4.

Table 4

Tax payment deadlines

|

Type of tax |

For the period |

Extended until / for |

|

Corporate property tax |

For the first and second |

Extended until the end of |

|

Transport tax |

quarters of 2020 |

2020 |

|

Tax paid under the simplified |

For 2019 |

Extended for 6 months |

|

tax system |

For the first quarter of 2020 |

Extended for 9 months |

|

Tax paid under the patent tax system |

For the second quarter of 2020 |

Extended for 4 months |

-

7) The Government of Arkhangelsk Oblast provides SMEs with the opportunity to conclude additional agreements under state property lease agreements, which provide for the deferral of rent payments until 1 October, 2020. Thereafter SMEs will be required to pay the debt from Janu-

ary 1, 2021 and no later than January 1, 2023. The debt is paid in stages, once a month. The amount of payment should be made in equal installments and may not exceed half the amount of the monthly rent under the agreement.

-

8) The Government of the Arkhangelsk Oblast has set a rent for SMEs in the amount of 1 ruble per 1 m2 of area under lease agreements for real estate and land plots owned by the region until March 1, 2021 11.

Support measures provided to SMEs during the spread of the coronavirus infection are not basic, but special ones. Outside of this situation, the state has always tried and is still trying to support SMEs by developing strategies for financial, guarantee, property, information and consulting support.

The Ministry of Economic Development, Industry and Science of the Arkhangelsk Oblast provides support to SMEs.

Infrastructural support measures for the Arkhangelsk Oblast are listed below:

-

1) Microcredit company Arkhangelsk Regional Fund “Razvitie”. The main goal of the company is to increase the availability of borrowed funds for SMEs.

The company provides financial assistance to SMEs in the Arkhangelsk Oblast in the form of microloans.

Special benefits:

-

• absence of commissions and hidden payments;

-

• grace period depending on seasonality and business environment;

-

• possibility to repay the debt ahead of time. No additional costs are required.

Table 5

Table 5 shows annual interest rates, range of amounts and terms for microloans 12.

Annual rates for microloans at MCC “Razvitie”

|

Programs |

Program participants |

Terms |

|||

|

Amount |

Rate |

Period |

Benefit period |

||

|

"Anti-crisis measures" |

SMEs most affected by the spread of coronavirus infection |

Up to 500 thousan d rubles. |

1% |

Up to 24 month s |

Up to 23 months |

|

"Arktika-SME" |

SMEs registered in the municipalities of the Arkhangelsk Oblast |

Up to 5 million rubles |

4,25% |

Up to 24 month s |

Up to 23 months |

|

"Leasing-SME" |

SMEs that have entered into a |

Up to 5 |

8,25% |

Up to |

Up to |

11 Postanovlenie Pravitel'stva Arkhangel'skoy oblasti ot 14.04.2020 N 199-pp «O razmere arendnoy platy malogo i srednego predprinimatel'stva po dogovoram arendy gosudarstvennogo nedvizhimogo imushchestva Arkhangel'skoy oblasti» [Decree of the Government of the Arkhangelsk Oblast, April 14, 2020 N 199-pp “On the amount of rent for small and medium-sized businesses under lease agreements for state-owned real estate in the Arkhangelsk Oblast”]. URL: (accessed 08 December 2021).

12 Agency for Regional Development of the Arkhangelsk Oblast. URL: (accessed 10 December 2021).

|

leasing agreement or received a conclusion from a leasing company on the approval of a leasing transaction |

million rubles |

24 month s |

23 months |

||

|

"Local Producer" |

SMEs engaged in manufacturing (not engaged in the production and sale of excisable goods) |

Up to 5 million rubles |

8,25% |

Up to 24 month s |

Up to 23 months |

|

"Monocity-SME" |

SMEs implementing their business activities in the territories of single-industry towns of the Arkhangelsk Oblast |

Up to 5 million rubles |

4,25% |

Up to 24 month s |

Up to 23 months |

|

"Refinancing-SME" |

SMEs that have open credits and loans taken for entrepreneurial activities |

Up to 5 million rubles |

8,25% |

Up to 24 month s |

Up to 23 months |

|

"Recycling" |

SMEs whose main activity belongs to group 38 OKVED, with the exception of subgroups 38.32.2, 38.32.3, 38.32.4 |

Up to 5 million rubles |

7% |

Up to 24 month s |

Up to 23 months |

|

"Self-Employed Citizens" |

Individuals who are engaged in entrepreneurial activities, provided that they practice the tax regime "Tax on professional income" |

Up to 500 thousan d rubles. |

4,25% |

Up to 24 month s |

Up to 23 months |

|

"Agricultural Producer" |

SMEs operating in the agricultural sector |

Up to 5 million rubles |

8% |

Up to 24 month s |

Up to 23 months |

|

"Social Entrepreneurship" |

SMEs with the status of a social enterprise in the Arkhangelsk Oblast |

Up to 5 million rubles |

7% |

Up to 24 month s |

Up to 23 months |

|

"Standard" |

SMEs |

Up to 5 million rubles |

8,5% |

Up to 24 month s |

Up to 23 months |

|

"Tourism" |

Tourism entrepreneurs |

Up to 5 million rubles |

4,25% |

Up to 24 month s |

Up to 23 months |

|

"Express Loan" |

Individual entrepreneurs |

Up to 100 thousan d rubles |

8,5% |

Up to 12 month s |

Not |

Microloans up to 500 thousand rubles are granted without collateral or guarantee.

-

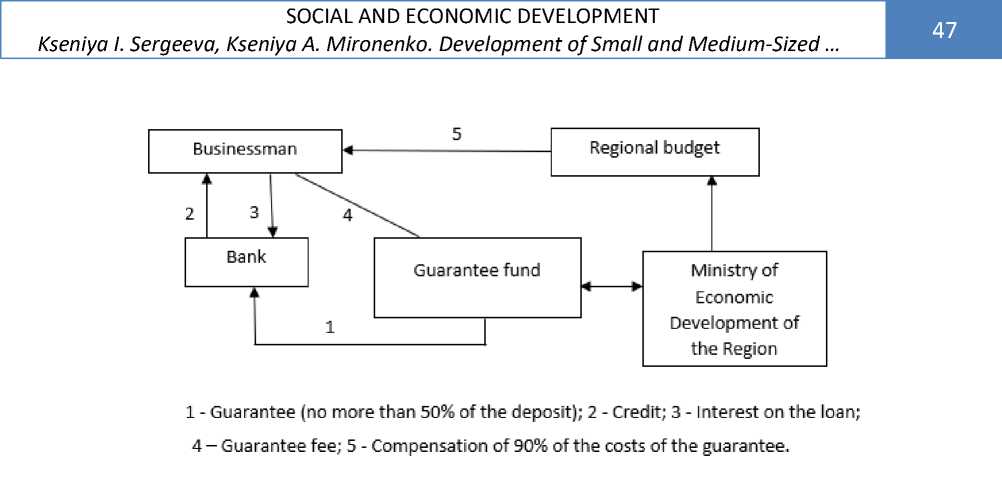

2) Guarantee support is provided by SUE JSC Investment Company “Arkhangelsk”, which provides guarantee services to SMEs.

When a borrower (SME subject) applies for a loan, the credit institution needs guarantees for the return of funds. Not all enterprises and have such guarantees: financial resources or property. In this case, a guarantee fund acts to support SMEs, providing a guarantee service [6].

Figure 6 shows the scheme of operation of the guarantee fund.

Fig. 6. Scheme of work of the guarantee fund [8].

The Fund has set the annual guarantee fee for borrowers, which ranges from 1 to 1.5% of the guaranteed amount.

-

3) JSC Guarantee Organization of the Arkhangelsk Oblast introduced a preferential guarantee for residents of the Arctic zone from 06.12.2021. The annual cost of the guarantee is 0.5% of the sum guaranteed. The payment of fees can be made by installments according to an agreed schedule.

-

4) Entrepreneurs of the Arkhangelsk Oblast can apply for information and consulting support to the ANO “Regional Development Agency”.

-

5) The State Unitary Enterprise of the Arkhangelsk Oblast “Property and Investment Fund” provides the property lease, consults on the issues of the real estate valuation, investment activities and procedure for management and disposal of the state property in the territory of the Arkhangelsk Oblast.

Conclusion

This article analyzes the dynamics of the number of SMEs, as well as investigates the state support measures for SMEs in the Arkhangelsk Oblast.

The development of small and medium-sized businesses in the Arkhangelsk Oblast is currently at a low level, and the indicators are declining every year (in 2021, the lowest number of SMEs over the past five years is recorded). In this regard, the economic competitiveness of the region is affected, jobs are closed, and tax revenues to the budget are reduced [5].

When considering the negative dynamics of the number of SMEs in the Arkhangelsk Oblast, it is difficult to talk about the significant impact of support measures from the state. If we consider the number of newly created SMEs in the Arkhangelsk Oblast, it is clear that after the lowest rates in 2020 (a decrease of almost by 25%), there is an increase in newly registered entrepreneurs by 21% in 2021. This positive effect was due to the support measures taken by the state.

If we compare the number of entities of the Arkhangelsk Oblast with the NWFD, it can be seen that government support measures for entrepreneurs in the NWFD had a much greater positive im- pact on business than in the Arkhangelsk Oblast. Thus, after the negative impact of the spread of the coronavirus infection in 2020, an increase in the number of SMEs is observed in the North-West Federal District a year later.

One of the important priorities of the state is the expansion and strengthening of SMEs. Small and medium-sized enterprises are the most vulnerable in modern conditions and need the support. The government, both at the federal and regional levels, needs to develop areas of support for SMEs.

Список литературы Development of Small and Medium-Sized Business in the Arkhangelsk Oblast

- Akimov O.Yu. Malyy i sredniy biznes: evolyutsiya ponyatiy, rynochnaya sreda, problemy razvitiya: monografiya [Small and Medium Business: Evolution of Concepts, Market Environment, Develop-ment Problems]. Moscow, Finansy i statistika Publ., 2014, 192 p. (In Russ.)

- Vasilyeva A.S. Osobennosti razvitiya malogo predprinimatel'stva v Arkhangel'skoy oblasti v sov-remennykh usloviyakh [Features of Development of Small Business in the Arkhangelsk Region in Modern Conditions]. Sovremennye tekhnologii upravleniya [Modern Management Technology], 2015, no. 3 (51), pp. 16–22.

- Vasilyeva A.S. Rol' malogo biznesa v razvitii ekonomiki Arkhangel'skoy oblasti: Sovremennoe sos-toyanie, problemy i puti resheniya [The Role of Small Business in the Development of the Economy of the Arkhangelsk Region: Current State, Problems and Solutions]. Saarbrücken, Palmarium Aca-demic Publishing, 2016, 73 p. (In Russ.)

- Zakoretskaya O.S., Sergeeva K.I. Analiz sostoyaniya i razvitiya malogo biznesa v Arkhangel'skoy ob-lasti [Analysis of the State and Development of Small Business in the Arkhangelsk Region]. Ekonomicheskiy analiz: teoriya i praktika [Economic Analysis: Theory and Practice], 2013, no. 46 (349), pp. 43–51.

- Glukhov K.V., Solovev I.A. Antikrizisnye resheniya dlya razvitiya malogo i srednego predprini-matel'stva kak faktor povysheniya ekonomicheskoy bezopasnosti gosudarstva [Anti-Crisis Solutions for the Development of Small and Medium-Sized Businesses as a Factor in Improving the Economic Security of the State]. Vestnik Universiteta, 2020, no. 11, pp. 83–89. DOI: 10.26425/1816-4277-2020-11-83-89

- Musinova N.N., Sergienko N.S. Gosudarstvennaya podderzhka malykh i srednikh predpriyatiy v usloviyakh pandemii: zarubezhnaya i rossiyskaya praktika [Government Support for Small and Me-dium-Sized Enterprises in the Context of the Pandemic: Foreign and Russian Practice]. Vestnik Uni-versiteta, 2021, no. (2), pp. 5–12. DOI: 10.26425/1816-4277-2021-2-5-12

- Savinova O., Afrikanova E. Impact of the Coronovirus Pandemic on Small and Medium-Sized Busi-nesses in Russia. In: Process Management and Scientific Developments. Melbourne, AUS Publishers, part 2, 2021, pp. 24–30. DOI 10.34660/INF.2021.66.77.003

- Malinao C.W.M., Ebi R.G. Business Management Competencies as the Driver of Small-Medium En-terprises' Survival during COVID-19 Pandemic. Puissant, 2022, no. 3, pp. 296–315.