Drivers of concentration of economic activity in Russia's regions

Автор: Rastvortseva Svetlana Nikolaevna, Ternovskii Denis Sergeevich

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Spatial aspects of territorial development

Статья в выпуске: 2 (44) т.9, 2016 года.

Бесплатный доступ

The uneven distribution of economic activity in Russia promotes the differentiation of its constituent entities by level of development. Regions are independent participants of economic relations, and they often act as competitors rather than partners. Agglomeration effects arise in more successful regions and contribute to the concentration of resources, manufacturing enterprises, service providers, skilled workers, and scientific and technological knowledge. The aim of the study, the results of which are reflected in the paper, is to identify the factors and assess their impact on the concentration (dispersion) of economic activity on the basis of Russia's regions. The paper describes the benefits of agglomeration processes from the standpoint of economic geography, allocation theory and international trade theory. The concentration of economic activity in Russia's regions is estimated by the Herfindahl-Hirschman index of industrial production taking into consideration the volume of investments in fixed capital and the number of people employed in the economy in Russia's regions in 1990-2013...

Concentration of economic activity in the region, regional specialization, new economic geography, distribution of productive forces

Короткий адрес: https://sciup.org/147223815

IDR: 147223815 | УДК: 332.13 | DOI: 10.15838/esc.2016.2.44.9

Текст научной статьи Drivers of concentration of economic activity in Russia's regions

Introduction. Recent years witness an increasing interest in the study of productive forces location and the modern scientific area – new economic geography. Primarily, this is connected with the rapid development of integration processes in the countries and regions of the world. The ongoing liberalization of trade facilitates the convergence of economies and, hence, the revision of the system to locate production in regions. The important task here is to form an institutional environment that would enable regions to gain maximum benefits from integration and reduce possible risks.

The second reason for the growth in a number of the studies mentioned above is that the processes of economic activity concentration (agglomeration processes1) are traditionally accompanied by strengthened differentiation of regions by level of social and economic development. Regions are independent subjects of economic relations and in most cases are not partners of each other, but competitors. Regions compete for limited resources, such as labor, investment, budgetary financing, obtaining public contracts and attracting technologies. In more successful regions we observe processes of economic activity concentration; organizations can get agglomeration effects from production location. Some regions are leaders in the competition, others – outsiders.

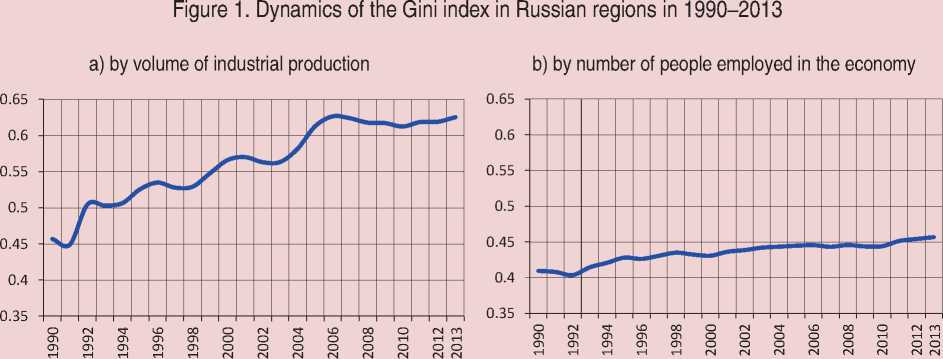

The inequality of Russian regions in terms of socio-economic development has recently intensified. Thus, the Gini index by volume of industrial production, which in 1991 (the minimum value) amounted to 0.45 and in 2000 – 0.57, peaked in 2006 – 0.627 and in 2013 was equal to 0.625 (the authors’ calculations). If we analyze the index by number of people employed in the economy, we can see that in 1990 it was equal to 0.41, in 2000 – 0.431, in 2005 – 0.445 and reached its maximum in 2013 – 0.457 (the authors’ calculations). The Gini index by volume of capital investment in 1990 amounted to 0.41, in 2000 – 0.61 (the maximum value for the period), and in 2013 – 0.55 (fig. 1).

The growth in differentiation of Russian regions is largely caused by the stiff competition for limited resources. Five regions concentrate 24.52% of the labor force (in 2002, according to the authors, the share of these regions in total employment amounted to 22.73%). Five regions, leaders by volume of capital investment, had 64.53% of such investment in 2013 (to compare: in 2002, as estimated by the authors, 5 regions, leaders by this indicator, concentrated 66.1% of the investment). Thus, we can assume the presence of high concentration of resources and economic activity in certain regions of the country.

Possible oversaturation of the region, which leads to the dispersion of economic activity, is the third reason for careful study of agglomeration processes.

с) by volume of capital investment

These processes are influenced by different factors. Some attract firms and labor resources in the region – they are called centripetal forces. Other factors, on the contrary, stimulate processes of dispersion and withdrawal of production from the region – centrifugal forces. It is important to understand under what conditions and at what point the effect of these forces will be balanced in the economy of a particular region and the reverse process can begin.

The application of new theoretical and methodological approaches to the research in the factors of spatial concentration is of great scientific and practical interest. The provisions of new economic geography are widely used in foreign practice, but have little application in domestic theoretical and empirical studies.

The aim of the study, which results are reflected in the article, is to identify the factors and assess their impact on the processes of concentration (dispersion) of economic activity on the basis of Russian regions.

Extent of the problem elaboration . New economic geography is considered a relatively young scientific field. The preconditions for its emergence and development appeared long time ago. So, A. Lesh identifies 3 key benefits of the agglomeration process:

-

1) possibility of joint use of infrastructure objects for business: “single railway station, streets, sewers, cheaper water and electricity” [21, pp. 75-76];

-

2) common labor market of larger size, which allows companies to quickly and efficiently find the necessary specialists and workers to be employed;

-

3) accumulation of tacit knowledge: in terms of the economic activity concentration the most skilled employees have the opportunity to work together, increasing joint achievements.

In addition, he stresses concentration advantages for enterprises, whose activity is seasonal; notes that the association of sellers of goods allows consumers not only to make purchases in one place, but also choose from a wider selection; determines that the region where the agglomeration process is observed find it easier to cope with structural shifts in the economy.

-

A. Lesh singles out the following key factors in the agglomeration process: relation to a capital city, to main roads, a relative distance between cities of equal size [21, p. 77].

Spatial organization of economic activity has traditionally been a subject of research of two scientific directions: location and international trade theories. The location theory defines border regions as rather “fragile and endangered” [13, p. 11]. When we talk about the location of economic activity in closed systems, we do not find competitive advantages for border regions as they become peripheral. There are some disadvantages of the presence of a boundary: 1) existence of tariffs divides economically complementary market areas; 2) language difficulties and differences in mentality create the effect similar to customs duties; 3) transactions under government contracts cannot cross the border; 4) existence of the threat of a military invasion [21, p. 200]. The boundary effect for example, from selling industrial goods accounts for 44% of the total price premiums for FOB [5, p. 692].

The situation is different in the process of integration (or liberalization of foreign economic relations). Border regions can have advantages from economic activity focused on the border: storage of goods, customs control and other related services. In this case, border regions gain new perspectives for economic growth [4].

In the days B. Olin believed that the theory of international trade is part of a more general theory of location; however, it has been recently studied in such a way in the framework of a new trade theory [20] and new economic geography [10; 30]. The models of these 2 trends present increasing benefit from a scale, differentiated products and trade costs as derived from the location of economic activity. Let us consider some approaches to the identification of factors in the concentration of economic activity in the region (tab. 1).

There are Russian studies of the economic activity concentration, focused not on foreign economic aspects. The work of E. Kutsenko defines the dependence on foregoing development: specialized productive forces; growth in foreign savings together with increasing concentration of productive forces; quasi-inconsistency of primary territorial distribution; uneven growth in foreign economy [37]. E. Kolomak proves that the

Table 1. Some approaches to the identification of factors in the concentration of economic activity in the region*

|

Factors |

Authors |

|

Trade liberalization leads to increased industrial concentration in the region |

P. Krugman, 1991 [18] |

|

Reduction in trade costs only at the initial stage rises the concentration and then diffuses the production** |

R. Forslid, I.Wootton, 2003 [9] |

|

Prior location of industrial production is close to sales markets |

C. Harris, 1954, [15, pp. 217-319] |

|

Possibility of free trade allows producers to more fully take advantage of economies of scale, leading to the concentration of economic activity only in a number of regions, located close to international markets. |

L. Resmini, 2003 [27] |

|

Impact of foreign direct investment typically occurs through technical factors (technology transfer, skills, and knowledge and management schemes), creates direct and indirect relations between local and foreign forms, stimulates proliferation of positive effects in the domestic economy. |

L. Resmini, 2003 [27] |

|

Stimulating export policy and improvement of transport infrastructure lead to weakening of the agglomeration process |

A. Gelan, 2008 [11] |

|

An export center has a positive impact on the concentration of economic activity in the region. This observation is especially true for enterprises in the sphere of high technologies. |

Trade integration..., 2010 [28] |

|

Factors in the dependence (interdependence) of specialized productive forces on previous development; growth in foreign savings with the increase in the concentration of productive forces; quasi- inconsistency of primary territorial location; uneven growth in external savings) |

E. Kutsenko, 2012 [37] |

|

For Russian regions population density, a size and accessibility of markets, a degree of economy diversification (only for the western part of the country) |

E. Kolomak, 2013 [2] |

|

* In more detail the factors influencing the emergence and development of agglomeration processes in the region are considered in [3]. ** In more detail the impact of changes in the degree of foreign trade liberalization on the economic indicators of regional development are presented in [22]. |

|

significant factors in the economic activity concentration in the region are as follows: population density, size and accessibility of markets, degree of economy diversification (for the western part of the country) [2].

Study method . The concentration of economic activity2 is assessed by means of indicators, such as dynamics of population density of the region, Herfindahl–Hirschman index, Gini index, index of geographical agglomeration of manufacturing industries with modifications, Kibble peripherization index and others3. When building econometric models the authors use some other measures of the economic activity concentration.

To assess the economic activity concentration degree, the economic literature, in addition to the Gini index, quite often use the Herfindahl–Hirschman index (HHI) . The higher the index, the higher the concentration level. The Herfindahl–Hirschman index of economic activity concentration is calculated by the formula:

HHI = 2 ’ . , xi , (1)

where xi is a share of the indicator of an region i in the federal district (by specific indicator).

To estimate the Herfindahl–Hirschman index (1990–2013) we using 3 basic indicators: industrial production (according to the Federal State Statistics Service of the Russian Federation – “Volume of shipped goods of own production, rendered works and services by economic activities – manufacturing”, for 1990–2004 “Volume of industrial production”); volume of capital investment and an average annual number of the employed in the economy.

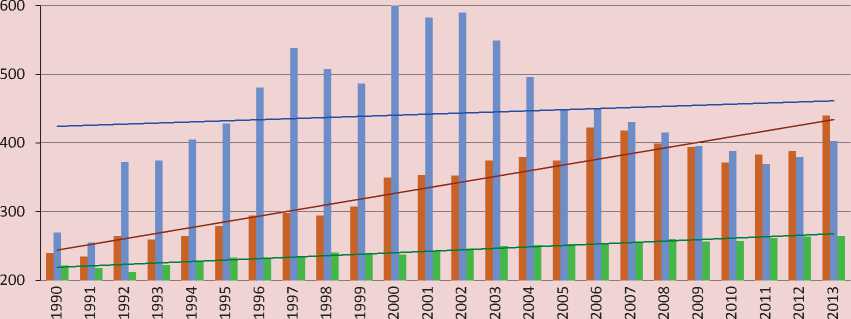

Geographical concentration of economic activity in Russian regions . Let us consider the dynamics of the Herfindahl–Hirschman index, calculated by volume of industrial production, volume of capital investment and average annual number of the employed in the economy in Russian regions in 1990– 2013 ( fig. 2 ).

We can see that the greatest degree of concentration is characteristic of investment in fixed capital, as the Herfindahl–Hirschman index has high values. At the same time, by the indicator of investment the concentration dynamics is unstable: in 2000 this index reached a maximum value (604.08), declining by 2011 to 369.68 and by 2013 to 402.95. This means that investment in fixed assets in 2000 was concentrated in a small number of regions, and by 2011 – evenly in a large number of regions.

The significant rise in the concentration is observed for the indicator, such as volume of industrial production. The Herfindahl– Hirschman index for this indicator peaked in 2013 – 439.91. Earlier we conducted a deeper analysis by types of industrial production and determined that the low degree of concentration is characteristic of food production and manufacture of other non-metallic mineral products. The high degree of concentration is recorded in the production of leather, goods from leather and footwear, wood processing and manufacture

Figure 2. Dynamics of the Herfindahl–Hirschman index, calculated by volume of industrial production, volume of capital investment and average annual number of the employed in the economy in Russian regions in 1990–2013*

^^ Volume of industrial production

^^ Volume of capital investmnet

^^е Number of people employed in the economy

Linear (Volume of industrial production)

Linear (Volume of capital investmnet )

Linear (Number of people employed in the economy)

y = 8.2535x + 235.95; R² = 0.8836 y = 1.61x + 422.53; R² = 0.0156 y = 2.1334x + 216.66; R² = 0.9504

* Calculated on the bases of data of the Federal State Statistics Service of the Russian Federation.

of wood products. There is a decreased level of production concentration in pulp and paper production, publishing and polygraph activities, manufacture of rubber and plastic products, metallurgical production and manufacture of finished metal products [33].

The steady but slight increase in the economic activity concentration in the regions is observed for average annual employment in the economy.

Model construction. Let us determine the factors affecting the agglomeration pro-cess development in Russian regions. The centripetal forces of agglomeration the process of direct impact traditionally include transportation costs, labor migration and increasing benefit from a scale. Other centripetal forces are indirect and influence agglomeration processes only through forces of direct impact. However, in our view, when carrying out socio-economic development policy in the region it is indirect impacts that are influenced by economic actors.

As a basis for constructing a model of the concentration (dispersion) of economic activity on the basis of Russian regions we propose to use the approach of Laura Resmini. She used it for the countries of Central and Eastern Europe – new member-states of the European Union [27]. Thus, the main factors in the concentration (dispersion) of economic activity in Russian regions are the following: 1) growth in relative wages (wages in the region relative to national levels); 2) distance to large cities (assuming the orientation of key producers on foreign markets, a degree of liberalization and trade development); 3) foreign direct investment through spillovers and ties; 4) road density; 5) degree of service sphere development in the region. For all indicators we use values of their natural logarithm ([12]):

W t - 1

ln ⎜ ⎛ Eit ⎟ ⎞= α + β ln ⎛ Wit - 1 ⎞+ β ln ⎝ Et ⎠ it i 1 ⎝ W t - 1 ⎠ i 2

⎜ DIST ic ⎟ ⎜⎝ ∑ i ω it DIST ic ⎟⎠

+

+ β i 3 ln ( FDI it - 1 ) + β i 4 ln ( ROAD it ) + β i 5 ln( SER it ) + ε it

The resulting indicator of the economic activity concentration degree is defined as a region’s share in total employment in the economy:

E it – a share of the region i in total employ-Et ment in manufacturing in the country for the time period t;

Eit – a number of people employed in manufacturing in a region i for the time period t ;

Et – a number of people employed in manufacturing in the country for the time period t .

To calculate this indicator we use data of the Federal State Statistics Service of the Russian Federation – “Distribution of an average annual number of the employed in the economy by types of economic activity (thousand people) – manufacturing”.

This specification allows us to take into account the effects of a country’s scale and aggregate demand.

Let us consider the model components in more detail:

W

-

it - 1 – a ratio of average wages in a region i W t - 1

to average wages in the country for the previous time period t ;

Wit - 1 – average wages in a region i for the previous time period t ;

W t - 1 – average wages in the country for the previous time period t .

The level of salary and qualification of workforce are important factors in the agglomeration process. In case of making entrepreneurial decisions to locate production in a particular region the availability of labor resources with the required qualifications and at low cost comes to the fore. However, during the development of the agglomeration process the level of wages increases. The research of E. Glaeser and D. Mare shows that the level of economic activity affects wages strongly. In the cities with population over 500 thousand people wages are by 33% higher than that of the workers employed outside the city [34]. Let us note that the significant rise in the level of wages in the region of economic activity concentration becomes a centrifugal force and can eventually lead to the process of dispersion.

To avoid the existence of synchrony in the regressions, the variable of wage is taken for the last period. More or less the indicator reflects market conditions; and we believe that the region’s share in total employment in industry varies synchronously with the relation of wages in the region to the national level. To calculate this indicator we use data of the Federal State Statistics Service of the Russian Federation – “Average monthly nominal accrued wages of organization employees”.

The second term in the formula represents a measure of geographical distance from the capital (for Russia, given its territorial vastness, we considered a distance to the nearest major city with a population of over 1 million people), which we regard as an economically isolated industrial center. In new economic geography agglomerations are discussed in terms of the theory of location and trade. A market is a center (core) of the economy. The home market effect occurs when the companies of sectors with imperfect competition organize their production nearby a large market and then deliver their products to small markets (involving transport costs) [38]. The home market effect creates a centripetal (gravitational) force for the concentration of economic activity in certain areas. A large domestic (home) market is as important for economic development of the region, as export orientation.

In this context the model of new economic geography introduces a distance variable – the closer the broad market to the region, the greater the likelihood of the agglomeration process. The distance variable should correlate with the index of relative employment in that case, if the liberalization and trade development will refocus primary production on foreign markets. Otherwise, the correlation of this variable with an indicator of relative employment will be negative, as the distance increases trade costs:

DIST ic ∑ i ω it DIST ic

a ratio of the road distance

from a region i to a country’s capital to the average weighted distance to a large city;

DISTic – road distance from a region i to a large city;

ω it – a share of the road distance from a regio n i to a capital in the total sum of distances.

The third term of the equation reflects the role of direct foreign investment in the region. It appears that the agglomeration process development is influenced by factors that increase a degree of openness of the national economy and promote growth of trade flows and foreign direct investment4. Foreign direct investment plays a positive role in regional development through spillovers and ties. Relative employment in the region increases with the inflow of foreign direct investment. However, this impact can be negative, since foreign firms are actively involved in the restructuring of economic activity, especially at the initial stage of development (Resmini, 2003). To calculate this indicator, we use data of the Federal State Statistics Service of the Russian Federation – “Foreign investment in the economy of the Russian Federation – investment received – direct”.

FDIit - 1 – amount of incoming foreign direct investment in a region i for the previous time period t .

The availability of one or another economic entity (in terms of transport costs) is an important factor in the process of economic activity concentration. It is possible to use density of roads with hard surface as an indicative parameter. It is assumed that relative employment is higher in those regions where road density is higher. To calculate this indicator, we use data of the Federal State Statistics Service of the Russian Federation – “Density of public roads with hard surface”.

ROADit – road density in a region i for the time period t .

There is an important factor in the economic activity concentration process, such as a degree of services development in the region, which can be measured as a region’s share in total employment in the service sector of the country. For this indicator we use data of the Federal State Statistics Service of the Russian Federation – “Distribution of an average annual number of the employed in the economy by types of economic activity – hotels and restaurants, transport and communication, real estate transactions, rent and provision of services, education, healthcare and social services, provision of other utility, social and personal services”.

SERit – a region’s share in total employment in the service sector of the country for the time period t .

Since the service sector makes a positive contribution to the economic activity concentration process in the region, we believe that it has a positive correlation with production location.

аЛв 2 в з . P i a A s - Р б - equation coefficients obtained by the least squares method;

ε it – a measurement error.

The assumption about endogeneity of the SER variable is tested with the use of the Durbin–Wu–Hausman test. It is established that to reject the null hypothesis of weak exogeneity of SER to E is impossible at an acceptable level of significance.

To build a model of factors influence on the processes of concentration (dispersion) of economic activity in Russia, we use panel data of 83 regions for 2010–2014. The calculation is conducted by the pooled method of least squares.

Analysis of results.

⎛⎞ ln ⎜ it ⎟ =

E

⎝ t ⎠ ⎛

- 0 , 081 ln

. (W. ,

- 1 , 7 - 0 , 529 ln ⎜⎛ Wit - 1 ⎝ W t - 1

-

DISTic

⎞

⎟⎟ + 0 , 054 ln ( FDI it - 1 ) + (3)

⎜⎝ ∑ i ω it DIST ic

+ 0 , 094 ln ( ROADit ) + 0 , 951 ln(SERit) + ε it

R 2 = 0.82.

Thus, the model of the factors influence on the processes of concentration (dispersion) of economic activity constructed for Russian regions allows us to draw some conclusions. So, the increase in the relative wage in the region affects the economic activity concentration process (-0.529 with a standard error of 0.146)5. As noted earlier, the wage growth is a centrifugal factor in the agglomeration process development; that is, it actually prevents the concentration of economic activity and the receipt of effects from crowding production. The resulting factor of the model shows that this thesis is confirmed in Russian regions – the more the inter-regional gap in wages, the higher the occurrence of the economic activity dispersion process and the withdrawal of enterprises from more successful regions to the neighboring ones. This assumption is proved by the results presented above in figures 1b and 2. Low labor mobility in Russia and sufficient territorial sparsity will facilitate the movement of firms to regions with low wages. This will involve changes in the current location of production forces6.

The growth in direct foreign investment and road density promotes agglomeration processes in Russian regions (0.054 with a standard error of 0.009 and 0.094 and with a standard error of 0.034, respectively). Among centripetal forces, the service sector development in the regional economy (0.951 with a standard error of 0.053) has the greatest impact on the concentration processes.

Indeterminate results are obtained from the estimation of the impact of geographical distance from the region (the regional center is considered as a starting point) to the nearest big city (with a population of over 1 million people). This variable correlates with an index of relative employment in that case, if liberalization and trade development refocus key markets on foreign ones. Otherwise, the correlation of this variable with an indicator of relative employment will be negative as the distance increases trade costs. When constructing models on the basis of Russian regions, we can see that this factor affects the agglomeration process slightly7.

The absolute term of the equation is equal to -1.7 (with a standard error of 0.396).

Influence of boundaries on the distribution of productive forces and agglomeration processes . To conduct more detailed analysis by the model of factors influence on the economic activity concentration, we divide RF regions into 4 groups: regions bordering with post-Soviet countries (24); regions bordering with far-abroad countries (12); regions with maritime borders (8); internal regions (35). The study reveals that the number of regions has mixed borders (land and sea). In this case, the preference is given to the indicator of a land border; therefore, the regions, such as the Astrakhan Oblast, the Tyumen Oblast and the Arkhangelsk Oblast are identified as the ones bordering with post-Soviet states, and Chukotka Autonomous Okrug, the Murmansk Oblast,

Khabarovsk Krai and Primorsky Krai – the ones bordering with far abroad countries.

The Kaliningrad and Leningrad oblasts and the Altai Republic have borders both with post-Soviet countries and far abroad countries. It is decided to refer them to the group of regions bordering with far abroad countries by direction of foreign trade (the share of far abroad countries in foreign trade turnover of regions in 2010 amounted to 97.2, 97.5 and 99.3%, respectively). The developed model of factors influence on the processes of concentration (dispersion) of economic activity is constructed for each group of Russian regions ( tab. 2 ).

The analysis of the model of factors influence on the concentration processes by groups of Russian regions shows that for the

Table 2. Coefficients of the model of factors influence on the processes of concentration (dispersion) of economic activity by groups of Russian regions in 2010–2014

|

Factor |

BPSC |

BEX |

BM |

INT |

|

Relative wage β i 1 |

0.685 (0.353) |

1.316 (0.363)* |

0.306 (0.675) |

-0.721 (0.166)* |

|

Nearest large city β i 2 |

-0.109 (0.029)* |

-0.020(0.037) |

-0.002 (0.081) |

-0.181 (0.020)* |

|

Foreign direct investment β i 3 |

0.060 (0.012)* |

-0.088 (0.043)* |

0.027 (0.035) |

0.004 (0.013) |

|

Density of roads with hard surface β i 4 |

0.343 (0.086)* |

0.361 (0.075)* |

-0.122 (0.159) |

-0.042 (0.032) |

|

Region’s share in total employment in the service sector β i 5 |

0.754 (0.107)* |

1.462 (0.082)* |

1.374 (0.192)* |

0.705 (0.056)* |

|

Free term α i t |

-3.837 (0.756) |

1.512(0.788) |

1.304(1.502) |

-1.748 (0.391) |

|

Number of observations |

96 |

48 |

32 |

140 |

|

Determination coefficient |

0.84 |

0.94 |

0.86 |

0.84 |

|

Legend: BPSC – regions bordering with post-soviet countries; BEX – regions bordering with far-abroad countries; BM – regions with a maritime boundary; INT – internal regions. * The parenthesis presents values of a standard error. |

||||

regions having a common border with the countries of post-Soviet space the centripetal factors are the following: development of services (0.754 with a standard error of 0.107), density of roads with hard surface (0.343 with a standard error of 0.086), and foreign direct investment (0.060 with a standard error of 0.012). The change in wages in this group of regions is not statistically significant for the agglomeration process encouragement.

For the regions bordering with far-abroad countries the centripetal factors are as such: development of services (1.462 with a standard error of 0.082), wages (1.316 with a standard error of 0.363), and density of roads with hard surface (0.361 with a standard error of 0.075).

For the regions with a maritime external border only the service sector development (1.374 with a standard error of 0.192) has such a nature. Changes in wages and foreign direct investment in this case are not significant for the agglomeration process promotion.

The country’s internal regions are characteristic of a centripetal factor, such as service sector development (to a lesser extent than in other regions, but statistically significantly – 0.705 with a standard error of 0.056), and a centrifugal one, such as relative wages (-0.721 with a standard error of 0.166).

We can see that the growth in remuneration already contributes to the dispersion of economic activity in the internal regions of Russia, but stimulates the concentration in the regions bordering with far abroad countries. The distance to a nearest major market

(city with population over 1 million people) in accordance with the provisions of new economic geography has a negative impact on the agglomeration process development. We will note only that relations are statistically significant for the regions bordering with the former Soviet states and the internal regions. To some extent, this allows us to make a conclusion about higher openness to foreign trade of the regions bordering with far-abroad countries or having a sea border.

Foreign direct investment has a significant influence on the agglomeration process promotion in the border regions. Moreover, in the regions neighboring with former Soviet republics it is positive and in the regions bordering with far-abroad countries – negative. The density of hard surface roads is important for the development of border regions.

The service sector positively correlates with the regional share in total employment in the country’s industrial production. It is not contrary to any provisions of economic science: the accelerated development of industry stimulates the service sector expansion, as companies prefer to locate production facilities in those regions where the service sector is already relatively well developed.

Conclusion. The research in the distribution of productive forces and the agglomeration process is important in the context of economic integration (change in the market, possibility of additional effects), strengthening of inter-regional differentiation (due to the constriction of resources in some regions)

and dispersion due to possible occurrence of a reverse process. It is important to understand the action and correctly evaluate the forces that affect agglomeration processes in the region. Scientists identify key factors, such as region’s orientation on a capital city and a national border, a degree of trade openness, a level of wages, foreign direct investment, quality of road infrastructure, a degree of economic diversification, development of service activities. These factors are included in the author’s econometric model.

The analysis of geographical concentration of economic activity in Russian regions (by means of the Herfindahl–Hirschman index calculation) in 1990–2013 reveals that investments in fixed capital are more sensitive to changes in economic environment. They tend to focus in several regions. In recent years the high concentration is observed in industrial production. Labor resources are dispersed in different regions of Russia, characterized by low mobility; the Herfindahl–Hirschman index has an upward trend.

Modeling of influence factors on the agglomeration process development shows that the service sector has the most significant effect on the economic activity concentration and direct foreign investment and density of hard surface roads have a positive impact. The article confirms the thesis of new economic geography about the importance of access to large markets for economic development. The growth in wages stimulates the diffusion of economic activity, that is, a centrifugal factor. The division of Russian regions into four groups in relation to a national border makes it possible to supplement the findings.

Список литературы Drivers of concentration of economic activity in Russia's regions

- Alaev E.B. Sotsial'no-ekonomicheskaya geografiya: ponyatiino-terminologicheskii slovar' . Moscow: Mysl', 1983. 350 p.

- Kolomak E.A. Neravnomernoe prostranstvennoe razvitie v Rossii: ob”yasneniya novoi ekonomicheskoi geografii . Voprosy ekonomiki , 2013, no. 2, pp. 132-150.

- Rastvortseva S.N. Upravlenie razvitiem protsessov kontsentratsii ekonomicheskoi aktivnosti v regione: podkhody novoi ekonomicheskoi geografii . Moscow: EkonInform, 2013. 131 p.

- Ryzhova N.P. Prostranstvennye effekty mezhdunarodnoi ekonomicheskoi integratsii (sluchai rossiiskikh regionov) . Prostranstvennaya ekonomika , 2012, no. 4, pp. 28-48.

- Anderson J.E., van Wincoop E. Trade Costs. Journal of Economic Literature, 2004, vol. 42, no. 3, September, pp. 691-751.

- Avery G., Cameron F. The Enlargement of the European Union. Sheffield: Sheffield Academic Press, 1998.

- Baldwin R., Francois J., Portes R. EU Enlargement -Small Costs for the West, Big Gains for the East. Econ. Policy, 1997, no. 24, pp. 125-176.

- Combes P.-P., Mayer T., Thiss J.-F. Economic Geography. 2008. 346 p.

- Forslid R., Wooton I. Comparative Advantage and the Location of Production. Review of International Economics, 2003, vol. 11, no. 4, September, pp. 588-603.

- Fujita M. Krugman P., Venables A.J. The Spatial Economy. Cities, Regions and International Trade. Cambridge, MA: MIT Press, 2000.

- Gelan A. Trade Policy and City Primacy in Developing Countries. Review of Urban & Regional Development Studies, 2008, vol. 20, no. 3, November, pp. 194-211.

- Hallet M. Regional Specialisation and Concentration in the EU. EC Economic Papers 141. Brussels, 2000.

- Hansen N. Border Regions: a Critique of Spatial Theory and a European Case Study. The Annals of Regional Science, 1977, vol. 11, pp. 1-12.

- Hansson A.M., Olofsdotter K. FDI, Taxes and Agglomeration Economies in the EU15. Applied Economics, 2013, no. 45, pр. 2653-2664.

- Harris C.D. The Market as a Factor in the Localization of Industry in the United States. Annals of the Association of American Geographers, 1954. Pp. 315-348.

- Hoekman B., Djankov S. Intra-Industry Trade, Foreign Direct Investment, and the Reorientation of Eastern European Exports. World Bank Working Paper 1652. Washington, DC, 1996.

- Kaminski B. How Accession to the European Union Has Affected External Trade and Foreign Direct Investment in Central European Economies. World Bank Working Paper 2578. Washington, DC, 2001.

- Krugman P. Increasing Returns and Economic Geography. Journal of Political Economy, 1991, no. 99, pp. 483-99.

- Krugman P. Scale Economies, Product Differentiation, and the Pattern of Trade. Am. Econ. Rev, 1980, no. 70, pp. 950-959.

- Krugman P. Venables A. Integration and the Competitiveness of Peripheral Industry. Unity with Diversity in the European Community. Cambridge: Cambridge University Press, 1990. Pp. 56-77.

- Lösch A. The Economics of Location. New Haven: Yale University Press, 1954. Available at: http://archive.org/details/economicsoflocat00ls (accessed July 28, 2013).

- Melitz M.J. Ottaviano G.I. P. Market Size, Trade, and Productivity. Review of Economic Studies, 2008, vol. 75, no. 1, pp. 295-316.

- Naudé W. Matthee M. The Location of Manufacturing Exporters in Africa: Empirical Evidence. African Development Review, 2010, vol. 22, no. 2, June, pp. 276-291.

- Poelhekke S. van der Ploeg F. Growth, Foreign Direct Investment and Urban Concentration: Unbundling Spatial Lag. Are Cities More Important Than Countries? Conference in Celebration of the 50th Anniversary of the Institute of Housing and Urban Development Studies, Erasmus University, Rotterdam, The Netherlands, 30-31 October 2008.

- Resmini L. Economic Integration, Industry Location and Frontier Economies in Transition Countries. Economic Systems, 2003, no. 27, pp. 205-221.

- Resmini L. The Determinants of Foreign Direct Investment in the CEECs: New Evidence from Sectoral Patterns. Economics of Transition, 2000, vol. 8, no. 3, pp. 665-689.

- Resmini L. The Implication of European Integration and Adjustment for Border Regions in EU Accession Countries. The Emerging Economic Geography in EU Accession Countries. Aldershot: Ashgate Publishing, 2003. Pp. 334-360.

- Trade Integration, Industry Concentration and FDI Inflows: The Experience in Central and South Eastern Europe. CEFTA Issues Paper 3. November 2010.

- Traistaru I., Nijkamp P., Resmini L. The Emerging Economic Geography in EU Accession Countries. Aldershot: Ashgate Publishing, 2003.

- Venables A. The Assessment: Trade and Location. Oxford Review of Economic Policy, 1998, vol. 14, no. 2, pp. 1-6.

- Volpe M.C. Do Mercosur and Fiscal Competition Help to Explain Recent Locational Patterns in Brazil? Paper Presented at the 7th Annual Meeting of LACEA, Madrid, 2002.

- Wandel C. Industry Agglomerations and Regional Development in Hungary: Economic Process during European Integration. Hamburg: Peter Lang, 2009.

- Rastvortseva S. Analyses of Regional Specialization and Geographical Concentration of Industry in Russia. SGEM2014 Conference on Political Sciences, Law, Finance, Economics and Tourism, 2014, September 1-9, vol. 3. pp. 25-32.

- Glaeser E.L., Mare D.C. Cities and Skills. Journal of Labor Economics, 2002, vol. 19, no. 2, pp. 316-342.

- Lutz V. Italy -a Study in Economic Development. London: Oxford University Press, 1962.

- Regional'naya ekonomika i prostranstvennoe razvitie: v 2 t. T. 1: Regional'naya ekonomika. Teoriya, modeli i metody: uchebnik dlya bakalavriata i magistratury . Under the general editorship of L.E. Limonov. Moscow: Yurait, 2014. 397 p.

- Kutsenko E.S. Klasternyi podkhod k razvitiyu innovatsionnoi ekonomiki v regione: avtoreferat dis. … kand. ekon. nauk . Moscow, 2012.

- Helpman E., Krugman P. R. Market Structure and Foreign Trade. Increasing Returns, Imperfect Competition, and the International Economy. Cambridge, MA: MIT Press, 1985.