Economic and ecological balance and the development of the forest product industry in Arctic countries

Автор: Sushko Olga P.

Журнал: Arctic and North @arctic-and-north

Рубрика: Social science. Political science. Economics

Статья в выпуске: 19, 2015 года.

Бесплатный доступ

Instability of production and the decline of the export share in the world commodity turnover show increasing problems in the forest industry of Nordic countries. The article represents the retrospective analysis of the Northern forest industry development in Norway, Finland, Sweden, Canada and Denmark. The obtained results give us an opportunity to identify the main economic and environmental problems of the Northern forest industry and its development prospects.

Northern forest industry, the export share, timber production volumes

Короткий адрес: https://sciup.org/148318729

IDR: 148318729 | УДК: 338.12.017

Текст научной статьи Economic and ecological balance and the development of the forest product industry in Arctic countries

The world community has become more and more concerned with preservation of ecological stability in terms of economic development and increase in the use of renewable and non--‐renewable natural resources. The interest in the use of resources, communications and space of the Arctic region has increased significantly. In the Arctic, particularly active countries are Russia and other industrialized countries, such as Norway, the United States (Alaska), Canada, Denmark, Sweden and Finland. Resource challenges in the Arctic require not just awareness of the threats and risks to the environment, but also the balance between strict adherence between economy and ecology and use of innovative, safest technology in the near future [1, p. 47--‐50].

The first condition for the timber industry (TI) of the northern territories, in my opinion, should be the use of innovative biotechnology of development and resource processing and, at the same time, active measures to protect the Arctic and Subarctic areas from technological and urban impacts in order to maintain environmental stability. The importance of prudent and optimal economic and environmental approach to the development of the Arctic and northern territories is determined by significant fluctuations in the Arctic climate due to global warming [2, p. 179--‐217]. Ecological relationship and communication between the Arctic and the world human activities prejudge the importance of environmental conservation mechanism for northern forests. They become a protective zone for the Arctic and the North, because forests play a crucial role in carbon sequestration 1. Forest zone of the Arctic is widening and changing due to the climate changes and global warming. According to scientists the forest area in the Arctic might become twice bigger by the year 2050 than it is now 2. But on the other hand, territories close to the Arctic are experiencing the other processes: growing economic and environmental problems of forest use, because despite the protective role played by forests, Nordic countries have industrial services and provide their own and global need for wood materials of excellent quality compared to other materials. Wood is environmentally friendly and after long--‐term use is suitable for recycling, which makes it indispensable in terms of resource depletion and climate change. Forest industry in Norway, Sweden, Finland and Canada until 2000 showed stable results and taken on the world market leading position, determining trade policy for import--‐dependent countries. Past decade, the traditional forest industry leaders were experiencing the backlog in the production and export of forest materials.

The relevance of the issues discussed above identified the objective of the study, which is to analyze the present state of the forest industry in the Nordic countries and to identify the main problems of balancing economic and environmental conditions and development of the forestry industry based on analysis of historical data and statistical indicators in recent years.

Objects and research methods

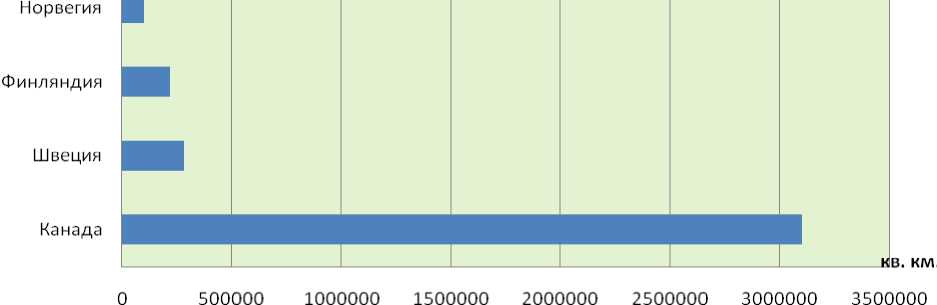

The object of study is the forest industry in the Nordic countries. North forests cover the territories of Norway, Finland, Sweden and Canada, with a predominance of coniferous wood that is harvested and delivered in the form of round wood and is processed into logs, pulp, wood--‐based panels, paper and other timber materials. The volume of forest areas of the leading manufacturers of forest products (excluding Denmark) reaches 3.7 mln m2, representing 11.7% of the world forest area (Pic. 1). And, despite the widespread decline in forest areas, as noted above, these forests could be a source of economic support for the needs of these countries and a significant position in the world markets of forest materials for a long time. In Iceland and Denmark scarce natural forests are associated with geographic location and climatic features. For example, in Iceland most of the territory is covered by tundra shrubs and almost 15% of it is glaciers 3. A variety of tree species in Iceland is limited to three and, for comparison, in Brazil it is 7780. In Denmark it is common to see artificial coniferous forests and some of t e deciduous areas suitable for industrial processing. Small forest reserves in these countries are not conducive to the development of the forest industry, and it makes them dependent on the world market of timber4.

Picture 1. Forest area. January 2015, thousands of km2 // Лес--‐Онлайн: Лесная промышленность. URL: (Accessed: 21.01.2015).

In this article we do not show the timber industry in Russia and the US, which are the subject of a separate examination by virtue of a significant spread of forest and, hence, the magnitude of the industry throughout the territory of these countries [3, p. 126--‐134]. It is necessary to emphasize the importance of the great northern forests to the competitiveness of the forest industry in Russia and the United States due to an advantageous geographical location, “connected by a perfect network of convenient waterways to the sea and to the global forest market” [4, p. 25--‐45]. Among other factors supporting the advantage of the northern forest industry we should mention higher chemical and technological characteristics of the northern wood products compared to the fast--‐growing tropical timber. Northern forests “grow slowly and do not reach large sizes, in contrast to large--‐scale southern forests” 5. The longest process of growth provides the forests with the necessary quality of the wood, which, according to technical experts, determines the quality parameters of manufactured products and makes it more expensive on the world market compared to the timber products made from the southern wood 6.

Methodological aspects of the study are presented with the use of the methods of empirical research (observation, comparison, measurement and modeling). For the processing of statistical data and identification of patterns we applied mathematical and statistical methods that

allowed us to draw valid conclusions and present the results in the form of graphs, charts and tables.

Research results

Despite of a large forest resources and a number of other advantages, at present, as noted above, competitiveness is reducing. This is due to the general economic situation, which remained difficult in many countries after the crisis of 2008--‐2009, and the increase of political and economic instability in 2014—2015. The economic instability causes fluctuations in the demand for timber and paper products and, accordingly, the uncertainty in the commodity markets. Among the reasons for reducing the competitiveness of the Nordic timber merchants we could mention the reduction of natural forest areas, first and foremost, this process affected long growing northern forests. Thus, according to economists, the area of forest for two hundred years was reduced almost 2 times 7, as earlier the productivity and forest reserves were determined by natural reforestation and climatic conditions of the environment. The current situation of exploitation of natural resources is changing and now the productivity and reforestation are closely related to the technical level of production. In the Nordic countries with their developed timber industry, reforestation lagged from commercial timber production, which led to a decrease in accessible and usable forest areas. Another determinant of declining competitiveness of northern forest industry was the intensification of the timber production in economically developing countries, working in the fast--‐growing southern woods. Traditional leaders, thanks to large reserves of wood and fast--‐growing low--‐cost manufacturing [3, p.126—134], which makes production more cost--‐ effective and attractive in the global market [5, p.111—120], are pressed more and more by Latin America (Brazil and Chile), as well as Indonesia and South Africa. Analytics predict the increasing generation capacity of eucalyptus pulp, which will lead to even greater intensification of competition due to an increase of fiber production 8. The same analytics say that the moderate increase could be observed for next couple of years due to timber production in Latin America and Asia 9. Moreover, the increase in the volume of production in Latin America and Asia will be offset by a decline in North America and northwestern Europe. According to the UN researchers, in the future development of the market for forest products with high added value will be uneven, with some increase in the US imports and low levels of production and exports in Europe 10. With the growth of world consumption of forest products (Table 1), and shifting the focus of wood harvesting and processing to the southern forest zone, where logging and wood processing is carried out not at the expense of innovations and intensification of production but, mainly, due to the extensive use of forest resources. But there is a conditional positive point for the northern areas in reducing the competitiveness of the northern forest industry, which manifests itself in a weakening of pressure on forest reserves, as well as the time to upgrade logging, wood industries and pulp and paper industry.

Table 1

World production of timber in 1980 and 2013 11

|

Products |

1980 |

2013 |

Increase, % |

|

Total (thousands, m3) |

1 968 195 |

2 291 659 |

116.4 |

|

Lumber (thousands, m3) |

420 868 |

413 975 |

98.4 |

|

Fiberboard, MDF, isolation boards (thousands, m3) |

16 961 |

112 392 |

662.6 |

|

Veneer, plywood, particleboard (thousands, m3) |

84 370 |

203 007 |

240.6 |

|

Wood, wood chips, waste (thousands, m3) |

144 959 |

1 381 792 |

953.2 |

|

Fiber and waste paper (thousands, t.) |

183 470 |

497 114 |

271.0 |

|

Paper and cardboard (thousands, t.) |

169 357 |

396 901 |

234.4 |

So, for countries like Norway, Finland, Sweden and Canada the forest industry has become a significant branch of international specialization and a source of foreign exchange earnings from the supply for the world market (Table. 2) and therefore forests are harvested in large areas [5, p.

26--‐44].

Table 2

Total production of lumber in 1980 and 2013 in Norway, Finland, Sweden, Canada and Denmark

|

Products |

1980 |

2013 |

Increase, % |

|

Lumber (thousands, m3) |

217 859 |

254 871 |

123.5 |

|

Fiberboard, MDF, isolation boards (thousands, 3 |

1 029 |

1 719 |

117.0 |

|

m) Veneer, plywood, particleboard (thousands, m3) |

7 602 |

12 757 |

167.1 |

|

Wood, wood chips, waste (thousands, m3) |

88 663 |

120 769 |

167.8 |

|

Fiber (thousands, t.) |

39 527 |

47 718 |

136.2 |

|

Paper and cardboard (thousands, t.) |

27 089 |

34 374 |

120.7 |

In spite of the increase in timber production in the Nordic countries, there is growth in rates from 1980 to the present period, below the pace of global output of the PPI (Table. 1 and 2), indicating that structural changes in forestry production and wood industries, as well as reducing competitiveness of the pulp and paper industry. In 1980the five Nordic countries had 16.1% of the global timber production, and in 2013 — 17.0%. As you can see, the overall share of timber production in the last forty years has not changed substantially and is not indicative for certain industrial products. Nevertheless, the background of the growth of world output contains a significant decline in the share of the production of specific wood materials (more than 7 times) and wood building materials (Table. 3). Also, the negative trend is observed in the production of deep processing products. Thus, the share of world production of fibers, paper and cardboard decreased a half. The equity growth in the global production is about 10% for thirty years.

The leader in timber production and export is Canada with volume of timber production equal to 265 mln m3 in 2013 (in 1980 — 188.4 mln m3). In 2013 production of fibers and paper amounted at 20.7 and 11.1 mln tons respectively (in 1980--‐ 20.8 and 13.4 mln tons).

Table 3

Share of Norway, Finland, Sweden, Canada and Denmark in the world timber production in 1980 and 2013 12

|

Products |

Share in the world production, % |

|

|

1980 |

2013 |

|

|

Lumber (thousands, m3) |

51.8 |

61.6 |

|

Fiberboard, MDF, isolation boards (thousands, m3) |

6.1 |

1.5 |

|

Veneer, plywood, particleboard (thousands, m3) |

9.0 |

6.3 |

|

Wood, wood chips, waste (thousands, m3) |

61.2 |

8.7 |

|

Fiber (thousands, t.) |

21.5 |

9.6 |

|

Paper and cardboard(thousands, t.) |

16.0 |

8.7 |

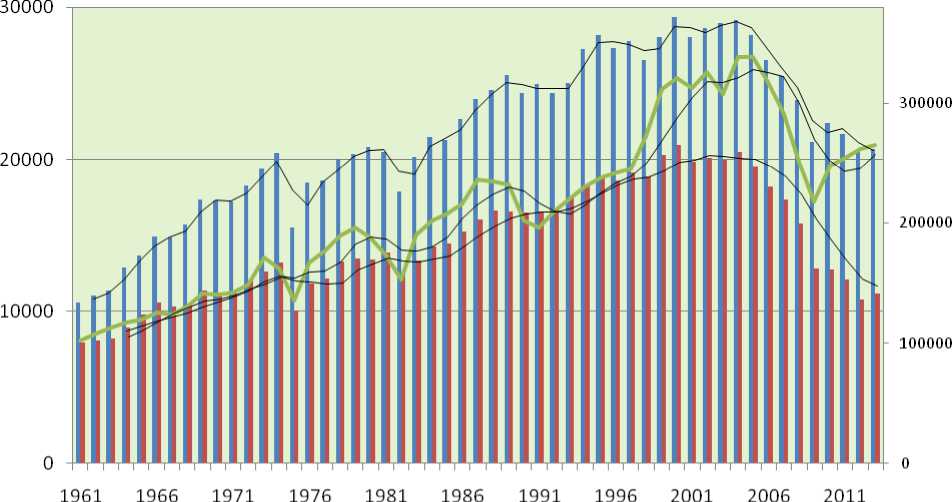

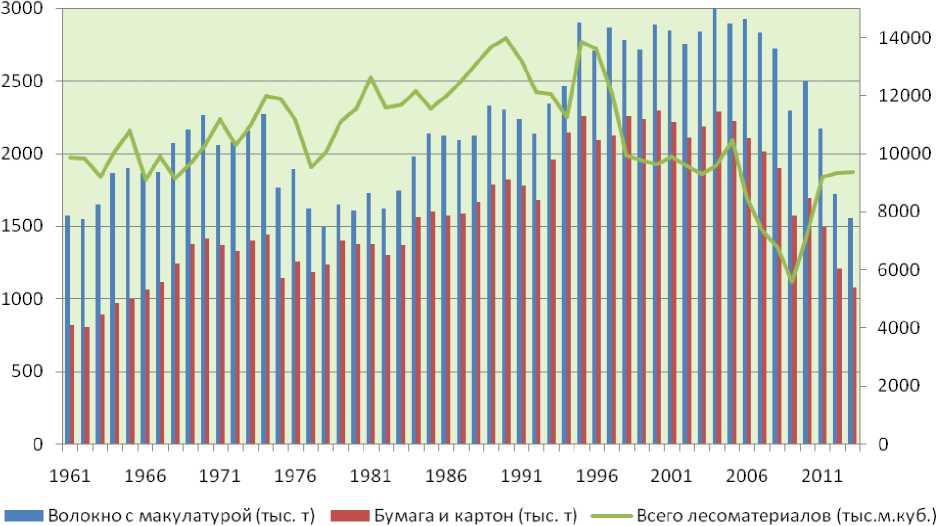

The dynamics of timber production industry of Canada revealed its synchronous nature of the development of the trend for different types of products before the 2008--‐2009, before the large--‐scale economic crisis (Pic. 2).

The timber production is going up 2013, but Canada failed to reach the pre--‐crisis volumes of production. A more significant decrease was observed in the production of paper and board, where in 1999--‐2004 the decrease was replaced by stagnation downtrend. In addition, it is important to highlight a cyclical trend component in the time series of manufacturing of wood, fiber and paper.

^^е Волокно с макулатурой (тыс. т) ^^е Бумага и картон (тыс. т)

— Всего лесоматериалов (тыс.м.куб.) -----2 линейный фильтр (Волокно с макулатурой (тыс. т))

-----4 линейный фильтр (Бумага и картон (тыс. т)) -----4 л инейный фильтр (Всего лесоматериалов (тыс.м.куб.))

Picture 2. The dynamics of the timber production in Canada in 1980—2013.

URL: (Accessed: 21.01.2015).

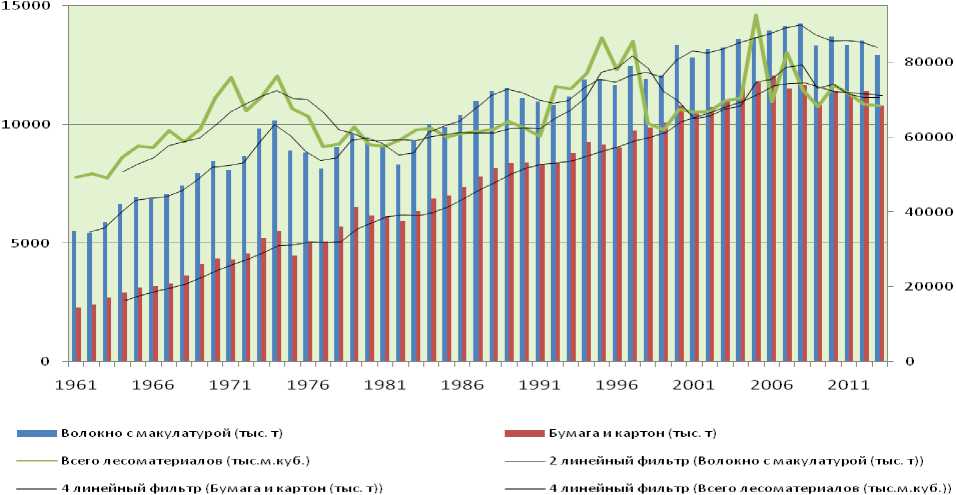

Significant volumes of production are concentrated in Sweden (Pic. 3). In 2013 it amounted to 68.4 mln m3 that is 18% more than the indicators recorded in 1980. But the past fifty years of timber production show unstable dynamics with a small positive trend, and irregular cycles (Fig. 3). Significantly higher growth rates were achieved by Sweden in 2013. It was 39% compared to 1980, and paper and cardboard production — 74% (in 2013 the production amounted to 12.9 mln t. and 10.8 mln t. respectively). So, the dynamics of paper and cardboard production represents a positive trend.

Picture 3. The dynamics of the timber production in Sweden in 1980—2013. URL: (Accessed: 21.01.2015).

The third leading manufacturer and exporter of wood products is Finland with the volume of timber production of 45.5 mln m3; fiber production — 11.9 mln tones; paper and cardboard — 10.8 mln tons. As for Sweden, there are uneven movement in forestry production and (Pic. 4). But the pulp and paper production has positive dynamics in crisis years 2008 and 2009, after which the Finnish manufacturers were trying to increase volumes of production up to the maximum set out in 2005--‐2007 (13.9 mln tones of fiber; paper and cardboard — 14.3 mln m3) with no result.

Picture 4. The dynamics of the timber production in Finland in 1980 —2013. URL: (Accessed: 21.01.2015).

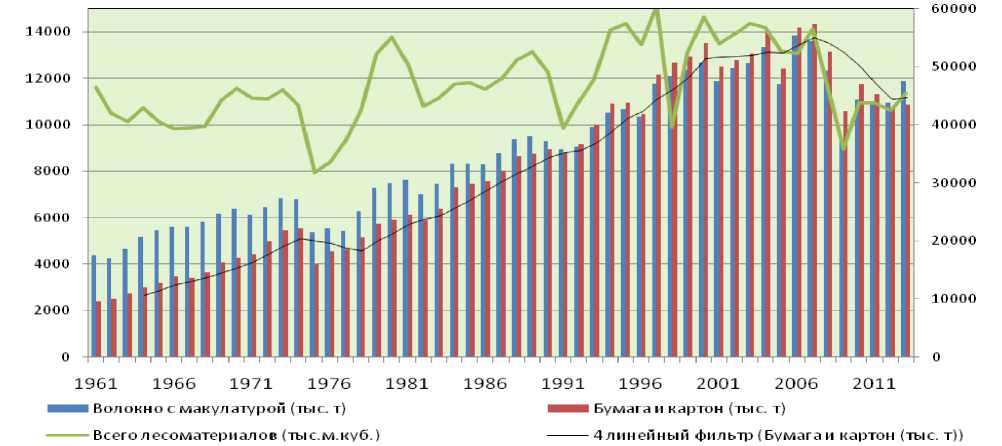

Respectively smaller timber production has Norway, especially if we compare it with Canada, Sweden and Finland. In 2013 the volume of timber production was 9.3 mln m3; fiber — 1.6 mln tones; paper and cardboard — 1.1 mln tones (Pic. 5).

Picture 5. The dynamics of the timber production in Norway in 1980 —2013. URL: (Accessed: 21.01.2015).

Dynamics of timber production in Norway differs from Canada, Sweden and Finland, which manifests itself in an earlier decline (since 1995). The same is observed in the dynamics of paper and cardboard production with its maximum capacity reached by 2004 (2.3 mln tons) and shifted to a currently ongoing decline. A similar tendency is observed in the fiber production (Pic. 5). These trends began after a large--‐scale development of the southern forest industry that has damaged less competitive, countries like Norway, due to the small volumes of production and exports there.

The place of the northern forest industry in the global market depends not only on production volumes, but export and its ability to meet the needs of other countries. Leading exporter of timber materials to be analyzed first is Canada, but Sweden and Canada are prevailing in the supply of paper and cardboard in the world market (Table. 4). These countries also supply the world market with a large volume of chemical fiber intermediates.

Table 4

|

Export |

Canada |

Sweden |

Finland |

Norway |

|

Total (thousands, m3) |

28417,9 |

11611,5 |

7139,0 |

513,8 |

|

Lumber (thousands, m3) |

624,0 |

9,4 |

3,6 |

34,4 |

|

Fiberboard, MDF, isolation boards (thousands, m3) |

5489,1 |

74,7 |

37,7 |

126,6 |

|

Veneer, plywood, particleboard (thousands, m3) |

7967,0 |

1036,0 |

1740,8 |

2665,1 |

|

Wood, wood chips, waste (thousands, m3) |

267,0 |

231,9 |

531,1 |

1136,1 |

|

Fiber and waste paper (thousands, t.) |

11975,0 |

3885,0 |

3210,6 |

842,6 |

|

Paper and cardboard (thousands, t.) |

8366,0 |

10132,4 |

9862,8 |

984,1 |

Export of timber products in Norway, Finland, Sweden and Canada in 2013 13

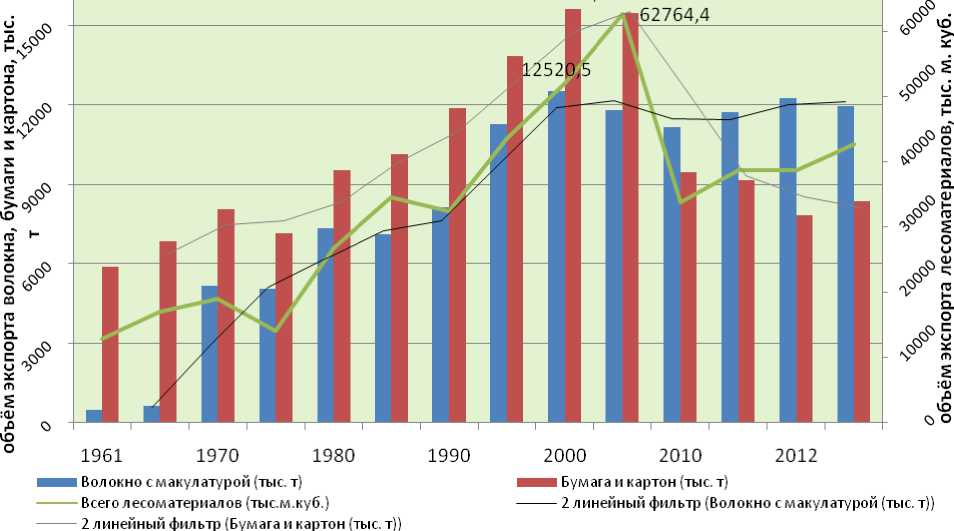

Dynamics of export supplies of wood and paper materials in Canada from 1961 shows a positive trend and the cyclical over time (Figure 6). The maximum level of deliveries to foreign markets reached Canada by 2005, after which there is a decrease from the critically low volume of deliveries during the global economic crisis.

Picture 6. The dynamics of export of timber products in Canada in 1961 --‐ 2013 URL: (Accessed: 21.01.2015).

Finland, Sweden and Norway had the same situation with the timber products export in 2008--‐2009 and t en — a decline.

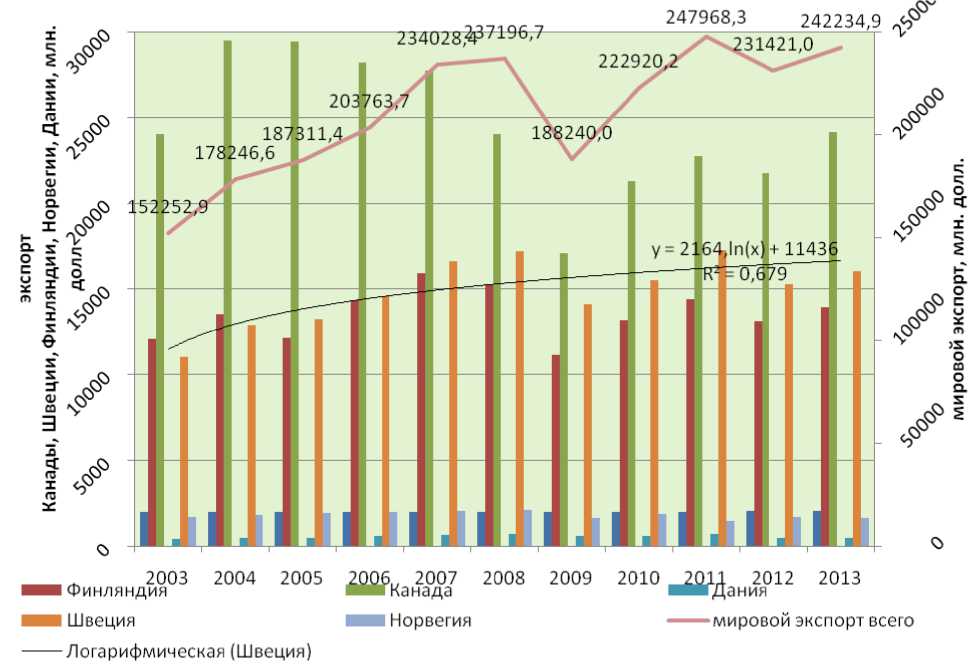

picture 7. the dynamics of value of the timber products export in 2003—2013// faostat. URL: (Accessed: 21.01.2015).

A more positive tendency and 45% growth occurred in Sweden over the past decade. Despite the stability of exports of Scandinavian countries and Canada and the growth of commercial timber supply in Sweden, the total share of world timber trade balance since 2003 has been steadily decreasing since the production and consumption of forest products in the world increases. Thus, the total share of the circumpolar countries in exports in 2013 amounted to 23.2% of world exports of forest products, and decreased by almost 9% since 2003. Only Sweden was increasing the export of timber and was able to reach the pre--‐crisis volume of export by 2011.

Results of our study show an increase of problems in the forest industry of the Arctic states, due to the shortage of raw materials for the northern forest industry, difficult conditions for reforestation and logging, which has transformed into “acute crisis in meeting the needs in the forest raw material for pulp and paper industry” [6, p.26--‐44]. Demands for forest raw materials are increasing not only for the northern timber merchants, but also for companies operating in the southern wood harvesting as the world timber production grows (2 billion m3 in 1965 and 3.8 billion m3 in 2013 14). According to the forest inventory conducted by the United Nations, nearly half of the total volume of timber harvested is used as fuel wood, which, in terms of innovative development, should be unacceptable. Therefore, the main task of forest management in the

North becomes the “persistence and sustainable use of forests, combined with the possible extraction of the highest income” [5, p. 111--‐125]. Another important area for the northern forest industry is their need in innovative use of forest raw materials; and this implies a full structural and technological modernization, taking into account environmental factors; it is possible with a large--‐scale investment by not only private corporations, but the state too, as today about 84% of the world forests are in the public (state) property. It should be noted that an innovative development of global forest industry is going on and some success has been achieved. New, more sophisticated and cheap methods of production are developed, using such methods as pyrolysis, gasification of biomass and hydrolysis, which increase the efficiency of production technology15. Improved production methods allow obtaining new composite materials and modified products of wood. Innovative development of the timber industry and the maintenance of ecological stability could be ensured only by effective financial activity. Therefore, it is important to increase the competitiveness of the Northern timber production in the world market. Development of the northern forest industry would not only contribute to their cost--‐effectiveness, but would help to ensure the stability of the socio--‐demographic situation in the Arctic.

Conclusion

This article attempts to uncover the underlying causes and problems of the northern forest industry, negatively affecting the economy of the countries and the ecological mechanism of equilibrium use of forest resources in the region.

Results of our research show the presence and strengthening of the economic and environmental balance problems in the Nordic forest industry, solution of which can motivate members of the forestry sector to conduct a large--‐scale modernization. Arctic Ecological interdependence with the planetary processes, balanced ecological and economic development of northern industry would, in our opinion, have a positive effect on the sustainability of the Arctic region. Also, there are some other issues of sustainable and balanced development of ecology and economy in the Arctic regions that require further research.

Список литературы Economic and ecological balance and the development of the forest product industry in Arctic countries

- Lukin Y. F. Sovremennaya situatsiya v Аrktike v kontekste global'nykh trendov [Modern situation in the Arctic in the context of global trends]. Arctic and North, 2014, no. 16, pp. 41—71. Available at: http://narfu.ru/upload/iblock/b1f/5-‐_-‐lukin.pdf (Accessed 28 December 2014).

- Klimenko V. V., Аstrina N. А. Dokumental'nye svidetel'stva sil'nykh kolebanij klimata rossijskoj Аrktiki v XV—XX vv. [Documentary evidence of strong climate variations in 15th-‐ 20th centuries]. Istoriya i sovremennost' [History and modernity], 2006, no. 1, pp. 179— 217.

- Sushko O.P. Sovremennoe sostoyanie lesopromyshlennogo kompleksa v usloviyakh globalizatsii mirovogo rynka [Modern state of the timber industry in the global market]. Vestnik Severnyj (Аrkticheskij) federal'nyj universitet imeni M.V. Lomonosova [Journal of the Northern (Arctic) federal university named after M.V. Lomonosov], 2014, no. 6, pp. 126—134.

- Makarenko А. Lesnoe khozyajstvo Severnogo kraya i lesoehkspluatatsiya [Timber industry in the North and the forest exploitation]. Arkhangelsk, Northern Reg. Publ., 1931. 140 p.

- Preshkin G.А. Аnaliz ehkonomicheskikh faktorov formirovaniya stoimosti lesnykh resursov [Analysis of the value drivers of forest resources ]. Lesnoj zhurnal [Forestry Journal], 2011, no. 1, pp. 111—125.

- Blam Y.S., Mashkina L.V., Babenko T.I., Ermolaev O.V. Lesopromyshlennyj kompleks v kontekste mirovogo sektora [The forestry sector in the context of the global sector]. EKO [ECO], 2013, no. 11, pp. 26—44.