Economic features of projects on the hydrocarbon shelf deposits development

Автор: Fadeev Alexey Mikhailovich, Cherepovitsyn Alexey Evgenevich, Larichkin Fedor Dmitrievich, Egorov Oleg Ivanovich

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Environmental economics

Статья в выпуске: 3 (11) т.3, 2010 года.

Бесплатный доступ

The article shows a spectrum of economic issues of hydrocarbon marine deposits projects' development. Basic risks at stages of projects development are analyzed and risks mitigation actions are provided. Analysis of investment expenses of marine oil and gas fields in various environmental conditions is provided; resource indicators of hydrocarbon raw materials of Russia and states of Caspian region are given. Considerable attention is paid to management of projects development taking into account foreign experience of natural resources development. The article also considers safety and environment issues at development of shelf deposits.

Oil and gas industry, risks, arctic shelf, caspian sea, project management, hydrocarbon recourses

Короткий адрес: https://sciup.org/147223206

IDR: 147223206 | УДК: 553.98(470.21)

Текст научной статьи Economic features of projects on the hydrocarbon shelf deposits development

Analysis of the situation regarding the status and projections of raw hydrocarbons both in Russia and abroad reveals the following threats to sustained and balanced development of oil and gas industry worldwide:

-

• annual production in most oil producing regions is not compensated by increases of stocks;

-

• exhaustion terms of active exploited reserves are imminent;

-

• the share of hard-produced and hard-developed deposits in reserves structure is rapidly growing;

-

• there are virtually no reserve facilities on land, on which it is possible to obtain significant reserves growth;

-

• the structure of new discoveries has sharply deteriorated: almost all of them belong to the category of small and very small accumulations of hydrocarbons.

In this regard, trends in the global oil and gas production are likely to be associated with an increased share of oil and gas from offshore fields. At present, according to experts, on the continental shelf there is 30% of world production of hydrocarbons (shelf – aligned area of the continental margin adjacent to the land having a common to it geological structure)1.

Development and exploitation of offshore deposits by oil community is relatively recent. Since the XIX century it is California, XX Century – Mexican Gulf, North Sea, and Sakhalin Island.

The most favorable conditions for the formation of offshore oil and gas deposits are formed in shallow water, in the initial stage of formation of sedimentary rocks (the so-called sedimentation process). As an example one can give the North Sea the bottom of which is a series of huge oilbearing provinces. Approximately 150 million years ago, in the waters of the sea percentage of oxygen was much lower than today, and it slowed the decomposition of organic substances. Organics gradually transformed into hydrocarbons under appropriate temperature, pressure, and also due to the bacteria.

Involvement of marine oil and gas resources of Russia in the industrial turnover is one of the alternative directions of development of oil and gas industry.

The area of Russia's continental shelf is 6.2 million km2, which corresponds to 21% of the world's oceans. Total oil and gas potential of the Russian shelf, according to experts is comparable with the largest oil and gas provinces of the world. Approximately 4.3 million km2

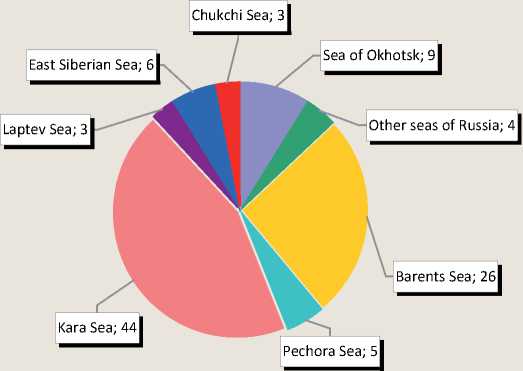

of this area and 0.4-0.5 million km2 of deep water are promising for oil and gas. Of these, about 2.2 km2 belong to the Western Arctic. According to experts’ estimates, the geological oil and gas resources on the Russian shelf reach nearly 100 billion tons of standard fuel from which recoverable oil is around 12 billion tons 2. In Russia the development of oil and gas deposits on the shelf is only beginning. More than 20 major oil and gas basins are revealed, 32 fields are discovered, including the giant ones – Shtokmanovskoye, Rusanovskoye, Leningradskoye. Analysis of the distribution of the initial aggregate resources according to water areas (fig. 1) shows that the largest proportion (about 67%) is in the Western Arctic seas – the Barents, the Pechora and the Kara Seas 3.

Several authors have advanced the development of offshore fields in one line with space exploration, nanotechnology and electronics – the implementation of future projects on the shelf would require from science and industry the development and production of large quantities of complex technical equipment: from ships and drilling platforms to the geophysical equipment and devices, navigational and other destination. The process of oil and gas offshore fields developing is notable for large capital intensive projects, the need to use the advanced marine technology, high-risk investments. Apart from the purely technological difficulties the professionals have to solve a number of problems associated with the stringent requirements for environmental protection.

To create the competitive conditions of shelf deposits’ development it is necessary to identify the main risks associated with oil and gas projects, and assess their impact on the economic efficiency of the projects.

Figure 1. Distribution of the initial aggregate resources according to water areas of Russia, %

Thus, the geological risks associated with geological surveys are due to insufficient study of the shelf, as well as the high cost of drilling. These risks are manifested in oil and gas absence and reserves being unconfirmed.

To align these geological risks a number of economic tools can be applied. These tools include a reallocation of financial costs of subsoil users on the economic benefits from other activities, reducing the tax burden on the entire amount of costs incurred in carrying out geological exploration work (GEW). In addition, a consortium of several investors can be created, which significantly reduces costs and risks of GRW phase for each individual investor. Along with these instruments, in some cases, the state may assume a greater part of geological risks by funding GEW.

It must be pointed out that in modern Russian conditions such mechanisms of reduction geological risks are either absent altogether or their use is difficult. Thus, the Tax Code allows carrying the costs of GEW for other activities of the organization, but the transfer of losses is limited to the volume and terms and is not possible between juridical entities within the holding structure.4

If the state assumes a part of geological risks by funding GEW, the main problem becomes the task of determining the optimal level of costs. So, while implementing the works of regional geological study before drilling exploratory wells in the localized structures the geological risks are reducing, but the costs are increasing. The sooner the state gives the license to the subsoil user, the less money it costs. However, to compensate for higher risks it is necessary to create a more flexible tax environment. Conversely, if a license is issued for the already explored deposits, the geological risks will be largely removed, and tax environment can be quite harsh, but that the state would have to go to considerable expense. Determining the degree of state participation in GEW is a task that is complicated by the low offshore exploration.

The development phase is also characterized by high economic risks associated with high capital intensity and duration of the shelf development projects. Thus, even a slight increase in costs may lead to a substantial increase in payback periods and lower returns on invested capital. In order to reduce economic risks the contractual relationship between the investor and the state are applied in international practice, which excludes the impact of changing the current tax system on economic results of the project. In addition, rental taxes tied to the over profit and efficiency indexes are applied which reduce the tax burden in the period of falling prices and contribute to achieving the desired return on invested capital. For the purposes of risk sharing between investors in the initial development consortiums are also created.

The use of rent taxes in Russia is complicated due to problems with their administration.

Under the current tax system one can offer tax differentiation according to the stages of development (tax holidays for start-up and tax incentives for developed fields), the kind of the extracted raw material (oil / gas), shelf depth, etc.

In addition, to enhance the attractiveness of shelf projects, it is possible to set reduction coefficients to the rates of export duties, the use of accelerated depreciation.

Technology and transportation risks of the development phase, characteristic for the shelf of northern seas, are linked to the complexity (and sometimes with a lack of) technology, high probability of equipment failure (especially in arctic conditions), lack of experience in transportation of hydrocarbons in significant amounts, lack of tankers and icebreakers, etc. The choice of technology and technical means for the transportation of resources is determined by the influence of several factors: the geographical position of water, the depth of the sea, the volume of transported goods, the transportation distance, etc.

Prospects for development of the resources of deep-water areas with mild and moderate ice conditions (most areas of the Barents Sea) are associated primarily with the giant deep-water gas deposits, such as the Shtokmanovskoye and Ledovoye. Transportation of production from the deposits of this size can be achieved through pipelines. The big problem is that of the control and maintenance of the pipeline, located in waters which are covered with ice within six months. Here are three possible technical solutions: the first – the creation of icebreaking-class service ships which are capa- ble to provide a year-round access to the pipe; the second – the construction of autonomous underwater technologies; and the third – duplication of the pipeline part, located in the ice part of the water area, which will provide an opportunity to maintain and repair in the most favorable period of the year.

Considering the problem of creating a transport system for these areas, it is necessary to take into account that the value of a thoroughfare is not confined to one particular object, it can serve as a basis for creating the infrastructure for the development of a number of other fields.

The areas with relatively shallow depth of seas, heavy and very heavy ice conditions (the shelves of the Okhotsk, Pechora, Kara, and East-Arctic Seas), are characterized by specific problems of pipelines laying, associated mainly with overcoming rather long, freezing shallow zone and the pipelines output on land in permafrost conditions. The complexity of this problem is aggravated by the fact that at small depths there is ice “plow-out” of the bottom5. This phenomenon can be observed on the bathymetric elevations up to 40 – 50 m. It is the most intensive at depths less than 20 – 30 m where the depth of “plow-out” may exceed 5.5 m. As a result, there is a need for substantial penetration of the pipeline and the installation of additional automatic valves in case of its damage.

The pipelines’ output to the shore is complicated in permafrost areas, where it is necessary to take special measures to protect the environment. Such measures include the excavation of trenches and the creation of a gravel berm, into which the pipeline is laid or the construction of pile-trestle bridge.

Very topical is the issue of year-round monitoring and maintenance of pipelines on the shallowest areas of ice water-areas.

-

5 Grigorenko Yu.N., Mirchink I.M. Hydrocarbon potential of the continental shelf of Russia: state and problems of development // Mineral Resources of the Russian shelf. Special issue. – 2006. – P. 15.

Prospects for development of shelf deposits in Russia are also associated with areas that are characterized by severe and very severe ice conditions and the relatively shallow seas. These include the Pechora Sea, the Sakhalin shelf, the Kara Sea and the Eastern Arctic waters. Between these areas there are significant differences in the conditions for the establishment of transport infrastructure. The Sakhalin shelf is particularly marked out because of a short distance of production transportation to the shore. In addition, on the coast of Sakhalin, adjacent to the offshore fields, there is a developed infrastructure for oil and gas production. In such conditions, it seems appropriate for the deposits of the Sakhalin shelf to focus on the laying of pipelines from each deposit to the shore, followed by joining them to shore pipelines. In this case there appears a full range of technical and technological problems, applicable to shallow pipelines. The only fundamental difference is the absence of permafrost in Sakhalin.

In other parts of the Arctic the situation is fundamentally different. Here there is either no communication with coastal zone, or it is underdeveloped. To solve the problem of oil transporting in these conditions it is necessary to construct loading terminals for oil tankers. At the same time to ensure year-round transportation of oil, for example, from the fields of Eastern Arctic seas, where the duration of ice-free period is limited with 1.5 – 2.0 months it will be necessary to use such non-traditional vehicles such as tankers-icebreakers.

In order to reduce the technological and transportation risks a system of insurance, the mechanism of special economic zones, concessions, reduction or exemption of the investor from import duties on imported equipment are widely used in the world practice.

Thus, the magnitude of transportation costs is mainly influenced by natural climatic and geographical and economic factors, i.e. availability of infrastructure, distance to consumers. The maximum value of transportation costs from 20 – 60 USD / t for oil and 40 – 50 USD per thousand m3 for gas is observed in the Arctic seas, which are in heavy ice conditions and in a considerable distance from potential markets. The minimum unit costs for the Baltic and Black seas are 10 – 15 USD / t for oil.

The development phase is also characterized by environmental risks associated with the possibility of causing serious harm to the environment and the subsequent costs of its liquidation and compensation.

Environmental concerns are that the Arctic region has a fragile ecosystem, and even a slight leakage of the extracted hydrocarbons, especially on the shelf which is covered by ice of considerable thickness most of the year, lead to irreparable environmental damage and will require huge penalty payments. For example, in Alaska in 1989 sinking of the tanker Exxon Valdez filled with oil led to the largest environmental disaster at sea. The spill caused a sharp decrease in populations of fish, including salmon, and the restoration of some habitats of sensitive nature of the Arctic will require at least 30 years. The court ordered the company Exxon to pay a compensation of 4.5 billion doll.

Even a more large-scale environmental catastrophe on the shelf occurred in 2010 in the Gulf of Mexico. Controlled by British Petroleum (BP) platform Deepwater Horizon sank at the coast of Louisiana on April 22 after a 36-hour fire, which followed after a powerful explosion. Oil spill, which started after it, had caused damage in Louisiana, Alabama, and Mississippi. Actual economic damages is yet to be determined, since the methods used to eliminate the releases of oil from wells have not yet led to any positive result. The possibility of building discharging wells by August 2010 remains questionable because of the upcoming season of storms in the region. The costs of BP at eliminating the consequences of the oil platform in the Gulf of Mexico are threatening to make the amount of 37 billion doll., as predicted by Swiss bank Credit Suisse Group AS (03.06.2010).

Thus, the ecological disaster in the Gulf of Mexico dealt a severe blow to the economic system and the company's reputation and led to the fact that in the near future, British Petroleum may be absorbed by a stronger competitor. Among the corporations that are able to acquire BP, the British company Royal Dutch Shell and the U.S. Exxon are called 6.

To reduce environmental risks the liability for damage and compensation to the investor in insurance costs of production sharing are used in the world. In Russia, the practice of environmental liability insurance is not in widespread use, largely because of the underdeveloped Russian insurance market. In general insurance risks in the development of shelves, perhaps, there would have been created a transnational pool of insurance companies, which would secure insurance cover for high-cost offshore projects 7.

When approaching the completion of deposits operations there appear the risks associated with deterioration of equipment and infrastructure. On the one hand, this leads to increased environmental risk of the investor, as there increases the probability of equipment failure and serious harm to the environment. On the other hand, after the completion of the project the state remains with the objects which are either not suitable for further use, or require substantial funds to maintain them in working condition.

There are liquidation risks, manifested in the possible lack of subsoil users and state funds for the implementation of works on liquidation. The United Kingdom and Norway which have been for a long time engaged in oil and gas production, in particular, have already faced this problem. To reduce this risk liquidation funds are created, and there is a deduction of cost of funds for the elimination of the tax base. Under Russian law the formation of a liquidation fund, the most reliable mechanism for reducing the risk of liquidation, is only possible when using the regime of production sharing.

In world practice of shelves development the principle of “one window” is often used to reduce the risks, which is implemented through a special government agency or company. Its involvement in the shelf development allows negotiating successfully with potential customers and coordinating sales of products from all shelf projects on a reciprocal basis for all investors. Such an organization or company will also assume all the problems on the investors’ relations with executive and legislative governments, and through its participation in the process of preparing and implementing of the shelf projects development time approvals and hidden costs are reduced.

In addition to the organizational functions, a special company can bear the costs of the project, i.e. to be the real investor.

There are various schemes of participation of such companies in shelf projects. Thus, if the state-owned company takes part of the GEW costs, geological risks are removed, therefore, the State may require a large stake in the project or profit in its section. When the state company is not investing its own funds, the investor requires a greater return on invested capital.

Each country creates its own rules of the game, taking into account the specificity of shelf development. For example, in Brazil, where there is the lowest rate in the world of commercial success, the state-owned company Petrobras assumes the bulk of geological risks in shelf development – it conducts geological study at the expense of the state and provides geological information to investors acting under contractor's agreement.

In China, “the Chinese National Oil and Gas Company” (СNOGC) is the subject of state regulation of the shelf development project; it is involved in each of the PSA, and conducts GEW and mining on their own.

In Norway in 1972 to implement the state administration Norwegian Petroleum Directorate was established, and to implement commercial activity on the shelf in the interests of the state – a Statoil company.

Table 1. Results of the investment costs evaluation, million doll.

|

Name |

ARCTIC REGION |

Caspian region |

||

|

Transshipment transportations |

Direct transportations |

|||

|

Shuttle gas carrier – shipload 155 thous. m3 |

Shuttle gas carrier – shipload 80 thous. m3 |

|||

|

Gas platform |

650 |

650 |

650 |

400 |

|

Underwater pipeline |

200 |

200 |

200 |

100 |

|

LNG with infrastructure and fleet ships |

2,100 |

2,100 |

2,100 |

2,020 |

|

Linear gas carriers – shipload thous. m3 / ice class – number, units cost |

155/ЛУ-26 1,320 |

155/ЛУ-26 1,320 |

155/ЛУ-88 2,800 |

155/ЛУ-28 1,760 |

|

Shuttle gas carriers – shipload thous. m3 / ice class – number, units cost |

155/ЛУ-83 1,050 |

155/ЛУ-86 1,320 |

||

|

Terminal station – shipload, thous. m3 cost |

310 300 |

230 240 |

||

|

Multifunction ice-breaking supply ship – number, units cost |

2 160 |

3 240 |

2 160 |

|

|

Safety ship |

- |

- |

- |

7 |

|

Supply ship |

- |

- |

- |

9 |

|

Total, million doll. |

5,780 |

6,070 |

5,910 |

4,296 |

In the UK the shelf is characterized by a high degree of study, low prospects of commercial discoveries, developed infrastructure and is at the stage of declining production. As a consequence, government regulation is aimed at GEW stimulating and development of small deposits. The tool of state-owned companies is no longer used here.

In general, state participation in the process of shelf development is subject to very precise regularity. At the initial stage, when the shelf is poorly studied, there is lack of transport infrastructure and technology, the overwhelming number of states creates a specialized national company. This company participates in all stages of projects preparation and implementation. Subsequently, with the development of production, state-owned companies are gradually losing some of their powers and become privatized.

It is known that the development of shelf deposits require huge investments. This circumstance makes the management of the development of oil and gas offshores of special attention.

Thus, according to experts, long-term investment costs for the development of existing hydrocarbon fields of the Arctic shelf are projected at 5.78-6.0 billion doll.8 At the same time the index return on investment is expected to reach 1.3, indicating the investment attractiveness of gas fields’ projects development in the continental shelf in the Arctic.

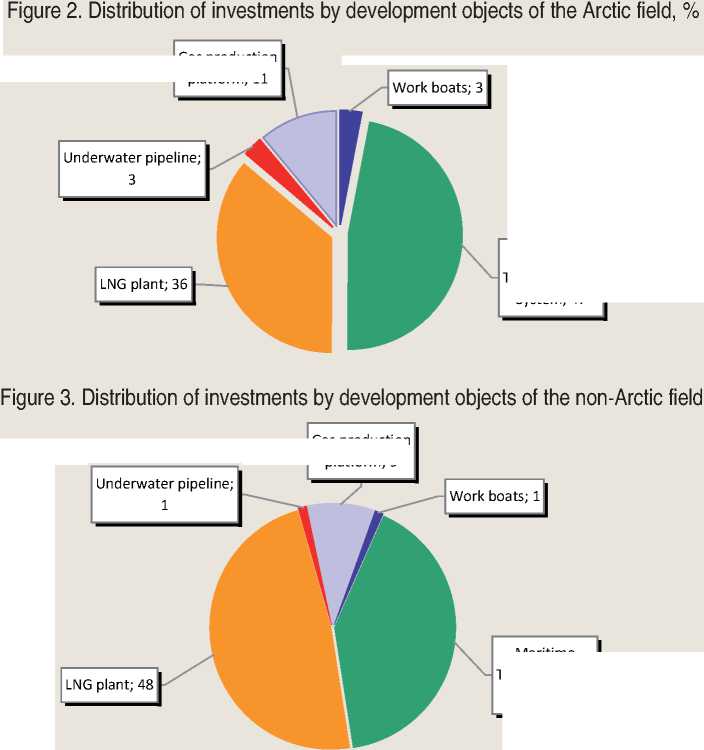

Analysis of the investment costs of setting up offshore gas fields in the Arctic held by Federal State Unitary Enterprise “Central Research Institute named after acad. A.N. Krylov”, shows that the implementation of offshore gas fields’ development projects will require substantially more investment than those that are spent on field development in the less severe climate (ice) conditions. Table 1 shows the results of the comparison ratings of investment costs, and figures 2 and 3 are their structure in the Arctic and Caspian regions.

World experience shows that the average cost of the underwater pipeline for ice-free conditions is about 1 million dollars per kilometer. For the Arctic seas that value increases about two times. This fact is explained by increased costs of both the pipeline and the cost of its construction in difficult ice conditions.

Maritime Transportation System; 47

Maritime

Transportation System; 41

Gas production platform; 11

Gas production platform; 9

As noted in the materials of CRI named after acad. A.N. Krylov, field development, located in the Arctic seas, can increase investment by about 40% compared with the deposits developed in the less severe climatic conditions. However, the organization of the transit transport schemes for liquefied natural gas may provide some reduction in investment costs, for example, by 3-4% with the ratio of ice and non-ice sites.

It is noteworthy that, in accordance with the statistical data research, the cost of gas liquefaction plants insignificantly depends on the region in which it is located. Thus, the cost of liquefaction plant of 10 billion cubic meters of gas is about 2100 million dollars (including the costs of shipping terminal in the gas storage and shipping dock, as well as fleet ships).

At the same time in the development of offshore hydrocarbon deposits in the Arctic gas liquefaction plant (taking into account the cost of shipping terminal and fleet ships) is no longer a prevailing article of investment costs. Despite the fact that the cost of the plant remains unchanged, its share in total costs decreases sharply (from 48 to 36%). However, the costs of all other objects in the field development, such as offshore gas production platform, the marine transportation system, underwater pipelines, work boats, are substantially increasing.

According to the estimation of CRI named after acad. A.N. Krylov, unit investment cost for 1 thousand cubic meters of gas produced would amount to 23 dollars in the extraction of the Arctic shelf. The level of profitability is expected to equal 1.3, indicating high investment attractiveness of such projects.

Currently, large-scale development of the Arctic shelf is a strategic direction for the Russian Federation.

Successful exploitation of hydrocarbon deposits on the Arctic shelf will make it possible:

-

- to create a new oil and gas producing region in the Barents Sea;

-

- to create an infrastructure for production and transportation of liquefied gas in the North-West of Russia;

-

- to create new and adapt to the arctic conditions the existing advanced technologies of integrated offshore oil and gas production (underwater mining complexes, multiphase transport of products over long distances, etc.);

-

- to create a regulatory framework that ensures production of hydrocarbons on the shelf;

-

- greatly stimulate the development of industrial science and the domestic industry to develop high technologies development of shelf deposits.

With the construction of offshore oil and gas installations on the Arctic shelf it is important that these activities were carried out within the economic, environmental regulations in accordance with the safety standards required when using modern technologies.

Oil companies operating in the Republic of Kazakhstan also proceeded to the development of the Caspian Sea. In its territory more than 200 deposits of hydrocarbons were found, 77 of which are being developed. In western Kazakhstan there are 90% of deposits are explored and 98.2% of them are at different stages of field operation.

The largest explored reserves are Tengiz, Karachaganak, Zhanazhol, Zhetybay, Kenbay, Kalamkas, Karazhanbas, Kumkol, Uzen. Their total extracted reserves are: oil – 1.565 billion tons, gas condensate – 650 million tons. Only on the Karachaganak project production of oil and gas condensate is provided in the amount of 12 million tons per year, of gas – 25 billion m3 per year, amounting to not less than 48 billion doll. of income, including taxes and other payments to the budget.

In addition to the explored reserves the Republic of Kazakhstan has considerable expected reserves. Notable among the identified oilfields in the republic is the shelf of the Caspian Sea, where large structures are discovered – Kashagan, Kairan and Aktoty. Expected reserves of only one reservoir in the eastern part of the Kashagan field are preliminarily estimated from 25 to 60 billion barrels of extracted oil volumes. The program of stock assessment of this structure, which includes the development of geological models, options of wells constructions, technological scheme of operation will take between 3 to 5 years.

The first stage of new oil projects implementation related to the development of the Caspian Sea shelf zone, the expected reserves of oil and gas bearing structures which are able to bring Kazakhstan in the number of major world powers on stocks, and later on oil and gas production, has shown keen interest of foreign companies in their implementation, as evidenced by their direct participation in the activities carried out by a consortium “Kazakh-stancaspishelf” 9.

Based on the understanding of the importance of facing challenges in the region, which as a rule, have strategic importance not only for Kazakhstan, but for all the Caspian states, the main priority should be given a comprehensive and environmentally sound development of all structural parts of the economy. The range of its aims is quite wide: the justification of economically and environmentally acceptable volumes of the annual production of various types of minerals, the depth of their processing, qualitative changes in the structure of industry.

A concrete fact, related to the conduct of large-scale works on the evaluation of oil and gas in this area is the adoption of a presidential decree № 1095 of the State program of development of Kazakhstan's shelf. It identifies three

Table 2. Oil and gas resources of the Caspian region, billion tons of equivalent fuel

|

Countries |

Oil |

Gas |

||||

|

Proved resources |

Possible resources |

Total |

Proved resources |

Possible resources |

Total |

|

|

Azerbaijan |

0.7-2.0 |

5.4 |

6.1-7.0 |

0.4 |

1.3 |

1.7 |

|

Iran * |

0 |

2.4 |

2.4 |

0 |

0.4 |

0.4 |

|

Kazakhstan |

2.0-3.2 |

17.0 |

19.0-20.0 |

2.0-3.1 |

3.3 |

5.3-6.4 |

|

Russia * |

0.04 |

1.0 |

1.0 |

|||

|

Russia ** |

0.2 |

1.2 |

1.4 |

0.9 |

1.5 |

2.4 |

|

Turkmenistan |

0.3 |

6.4 |

6.7 |

3.7-5.8 |

5.9 |

9.6-11.7 |

|

Total in all countries of the Caspian Sea region |

3.2-5.9 |

32.4 |

35.6-37.5 |

7-10.2 |

12.4 |

19.4-22.6 |

|

The same, except Russia |

3.0-5.7 |

31.2 |

34.2-36.1 |

6.1-9.0 |

10.9 |

17.0-20.2 |

Source: Energy Information Administration, USA.

* Only the Caspian areas are taken into account.

** Based on the survey of the company “Lukoil” in recent years: reserves (categories ABC1+C2); resources (C3, D1, D2).

phases: first, for 2003 – 2005, provides production of 500 thous. tons of oil a year; in the second stage – 2006 – 2010 – its size will be increased to 40 million tons per year and the third phase is associated with stabilization of production at the level of 100 million tonnes per year. However, it should be noted that the postponement of the commissioning of the Kashagan field in 2013 radically changed the assessment of all the parameters set forth in the Program.

Oil production determined in the Program was oriented to those expected reserves of hydrocarbons, which with some probability are identified to date (tab. 2) .

The current situation in Kazakhstan's Caspian Sea shelf resembles the process of development of oil and gas deposits of the country in previous years to some extent. Intensive increase of hydrocarbon resources production is not a reliable security in the form of contracts for the construction of new facilities to process them, companies of productive and social infrastructure.

The lag in the formation of the processing industries, transport systems (oil, gas and products pipelines), infrastructure (power lines, the enterprises of the construction industry) and social and household sector in aggregate evidence of the continuing practice of resources development by narrow depart- mental methods. Therefore, when designing the development of oil or gas fields the main problem is solved, namely, extracting as much as possible hydrocarbons within the shortest possible time, while forgetting about its quality characteristics, specific physicochemical parameters, potential for getting a large range of vital products.

Until recently, the resource potential of the Russian sector of the Caspian Sea was estimated as very moderate (see tab. 2). However, large-scale exploration work conducted in the past 10 years by oil company “Lukoil”, which included a significant amount of seismic studies of 2D and 3D and Deep Drilling (9 exploratory wells in the 6 structures with common footage of 26.5 thous. m2), have radically changed the attitudes and the evaluation of the NDS only of licensed blocks of “Lukoil” rose to 2 billion tons of VT. In general, in the Russian sector, they are estimated at 4–5 billion tons.

In recent years, significant amounts of hydrocarbons were discovered here. Thus, according to “Lukoil” (October 2006), proved reserves only in three fields (Khvalinskoye, Korchagin’s and Filanovskiy’s) exceed 570 million tons of standard fuel, but the total reservoir volume of industrial categories C1+C2 in the fields opened by the company are up on oil not less than 190 million tons (including about 30 million tons of gas condensate), on gas – 676 billion m3.

North Caspian CED combines six fields, five of which (Filanovskiy’s, Korchagin’s, Sarmatskoye, “170 km”, Khvalynskoye) are oil-gas condensate, one (Rakushechnoye) is gas condensate. Prospective area of the center is more than 6 km2 in extent of 120 km and width of 45 – 70 km. The total reserves of natural gas deposits in the center on 01.01.2006 are as follows: category A+B+C1 – 285.3 billion m3, C2 – 390.9 billion m3. Prospective and expected resources of category C3 – D are estimated in 1230 billion m3. Three gas fields of the center are large marine deposits of Russia, supplies of which are about 4% of proven reserves of the Russian shelf. The degree of exploration of the central NDS is 56.4%.

Large-scale exploitation of hydrocarbon resources of the Caspian Sea should be a very important direction in the economic development of the states located in the zone of the region. In this regard, of priority importance becomes the joint implementation of projects of exploration, mining, transportation and utilization of oil and gas resources.

Assessing the overall situation in the Caspian Sea basin as a critical, and also, taking into account the uniqueness and climate significance of the Caspian Sea, the need to preserve the diversity of wildlife and prevent the negative effects of technological development, we believe that it is time to address major problems jointly by the Caspian states.

The feasibility of the most important aspects is to establish a regional integrated program, the main blocks of which were the issues of environmental management and environmental protection.

Within the scope of the regional program one could address such topical issues as:

-

• establishment of common principles of relations between states and oil companies on the basis of unification of the most important conditions for issuing licenses for exploration and extraction of mineral resources for the region;

-

• development of a legal regime of laying and operation of subsea pipelines, conduct geophysical, geological prospecting and drilling works in the shelf zone;

-

• creating a legal framework for cooperation among riparian states in the field of environmental protection, conservation of biological diversity of the Caspian Sea, conducting research in the sea area, co-financing major projects for joint development of oil and gas fields located on the border of national sectors.

One of the key issues of successful implementation of the development process deposits on the shelf is its implementation management. Effective project management ensures that rational offshore structures will be designed, prepared, assembled and will be operated in the optimal way.

The main functions of shelf projects management are:

^ selection of partners for cooperation in various stages of project implementation;

^ solution of technical issues, including determination of the reliability of design solutions;

^ taking into account the requirements of economic efficiency in the new field of shelf exploration in the absence of infrastructure;

^ focusing on safety and environmental protection.

The choice of partners includes:

– recruitment for the operating companies of shelf deposits development, using the appropriate authority or experience;

– selection of advisers and consultants working in the Russian academic institutes and industry, as well as foreign consultants;

– selection of design institutes working in the early stages of the project;

– selection of design institutes and engineering companies to perform work on the detailed design phase;

– selection of a place for platform construction, given that the shelf development industry is new to Russia;

– selection of companies to carry out construction works on the sea;

– selection of companies to carry out work quality control at various stages of the project.

The technical problems include:

-

- reliable analysis of ice data for the maximum possible length of the period for determining the extreme values of ice loads;

-

- realistic analysis of ice loads (range of results shows that some design formulas give too high values of loads from ice action);

-

- consideration of technological novelty of shelf for Russian oil and gas industry;

-

- optimal choice of methods of transport and storage of hydrocarbons in the arctic conditions, including ice and permafrost;

-

- selection of optimal model of field development and technology of hydrocarbons preparation preventing the formation of paraffin;

-

- selection of optimal technologies, agreed to by all parties of the contract, as well as government authorities.

The high level of management quality is the key to effective technical, technological and economic management decisions for the project. This circumstance is particularly important because shelf is a space (first of all the Arctic) which is a new untapped area, and the construction of offshore oil and gas facilities in it is a new technology for Russian industry.

Thus, shelf deposits have great hydrocarbon potential which can provide a significant portion of the country’s energy needs and bring a huge economic impact. However, their effective and safe development requires solving several problems of economic, regulatory, technical, technological and environmental nature.

Список литературы Economic features of projects on the hydrocarbon shelf deposits development

- Grigorenko, Yu.N. Hydrocarbon potential of the continental shelf of Russia: state and problems of development/Yu.N. Grigorenko, I.M. Mirchink//Mineral Resources of the Russian shelf. Special Issue. -2006. -P. 15.

- Donskoy, S. Shelf, money and risk. It is due to create conditions for the development of shelf deposits In Russia/S. Donskoy //Oil and Capital. -2005. -№ 10.

- Egorov, O.I. Oil and gas complex of Kazakhstan: problems of development and effective operation/O.I. Egorov, O.A. Chigarkina, A.S. Baymukanov. -Almaty: Atymura, 2003. -535 p.

- Zolotukhin, A.B. Basics of development of shelf oil and gas deposits and marine construction in the Arctic: a tutorial/A.B. Zolotukhin, O.T. Gudmestad, A.I. Ermakov . -Moscow: Oil and Gas; RSU of Oil and Gas named after I.M. Gubkin, 2000. -770 p.

- Romanyuk, A. Lucrative place/A. Romanyuk//North-West Marine Business. -2007. -№ 9. -P. 57.

- Offshore mirages: oil and gas of Russia's continental shelf//Oil and gas vertical. -2002. -№ 9. -P. 85.