Escrow accounts as a new transaction instrument

Автор: Yudin A.V.

Журнал: Экономика и бизнес: теория и практика @economyandbusiness

Статья в выпуске: 4-3 (62), 2020 года.

Бесплатный доступ

The article deals with the modern instrument of transactions - escrow account taking into account its development in the real estate market. The result of using the escrow system is researched. The main tasks are to consider the escrow mechanism of accounts and comparing it with other banking instruments. The research includes the study of the consequences of the transition to a new system in the real estate market. Advantages and disadvantages of using escrow accounts are defined.

Escrow, banking, developer, real estate, housing

Короткий адрес: https://sciup.org/170182648

IDR: 170182648 | DOI: 10.24411/2411-0450-2020-10363

Текст научной статьи Escrow accounts as a new transaction instrument

Escrow accounts appeared in the legal space of the Russian Federation recently (July 1, 2014). Due to its advantages and legislative initiatives by the government, this tool has become an integral part of the real estate market.

The new (for Russia, in Western countries has been operating for more than 15 years) banking instrument is intended for use in paying for expensive purchases, most often in the purchase and sale of primary housing in the real estate market.

The purpose of the study is to analyze the mechanism of functioning of the escrow system, to understand the key features and justification (reasonableness) of its mandatory implementation in order to identify the main trends for the formation of practical recommendations.

The study is relevant because it can help interested parties to assess the benefits and effectiveness of the escrow system in order to further use of it in practice (for example, when buying an apartment not in the primary market).

Let's focus on the concept of escrow account. This is a specially organized conditional account on which funds, documents or property are taken into account under the conditions specified in the contract until specific obligations are fulfilled or there appear certain circumstances. Services for opening escrow accounts in the world practice can be provided primarily by banks, specialized organizations and law firms, or other escrow agents.

Legally, the instrument in question is a contract regulating the relationship between the account holder (depositor), payee (the beneficiary) and the escrow agent (for example, a bank).

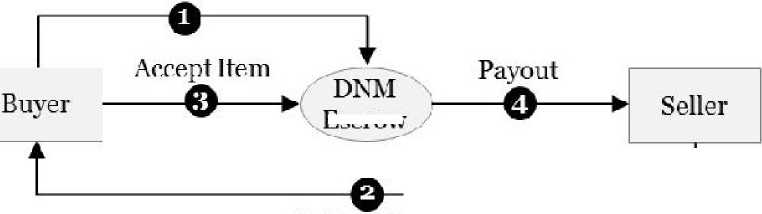

The mechanism of the escrow account (fig. 1) is according to the contract the Bank opens a special escrow account for blocking of funds, transferred to it by the account holder for the purpose of subsequent transfer to a third party upon the occurrence of events specified in escrow account agreement.

Payment

Escrow

Deliver Item

Fig. 1. Escrow mechanism [6]

The rights to the transferred funds remain and belong to the depositor until the date of the occurrence of the events defined in the contract, after this date the rights pass to the other party – the beneficiary.

The main purpose of escrow is to minimize the risks that accompany a commercial transaction: its party has a confirmation of the availability of funds in the Bank account of its counterparty or itself provides such confirmation. In case of non-fulfillment or improper fulfillment by one of the parties of at least one of the points of the agreement on time, the money will be returned by the bank from the escrow account to the depositor.

The escrow account resembles a Bank letter of credit. The main differences of these tools should be considered:

-

1) The escrow will be closed only with the direct participation of all parties of the trans-

- action, which reduces the risk of fraud and increases guarantees;

-

2) The form of the letter of credit is limited by a set of rules which are registered in normative documents that sometimes does its use not absolutely convenient;

-

3) There is also a difference in the scope of liability of the parties. When making payments in the form of escrow, the bank is fully responsible for careful checking the fulfillment of all the conditions in transactions.

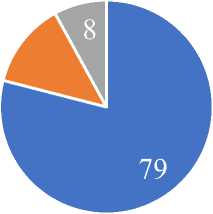

In order to analyze the real indicators and consequences of the implementation of the escrow accounts system, it is advisable to refer to the Analytical note of the Central Bank of Russia on Housing construction. The structure of financing shared housing construction deserves special attention (fig. 2).

Equity holders' funds Bank loans to developers Own funds of developers

Fig. 2. Structure of financing of shared housing construction in 2018, % [4]

It should be noted that at the end of 2018 equity construction was financed mainly directly from equity holders. But with the introduction of the new system, it is easy to under- stand that Bank loans will take a leading position. Should we expect an increase in loan prices for the developer? The Central Bank assures that the interest rate will remain in the range of 10-12%. This is possible due to the fact that less risk on loans will contribute to lower mortgage rates.

The situation is already actively beginning to change. At the end of August 2019 more than 10000 escrow accounts were opened. This indicates the first results of the shared construction reform.

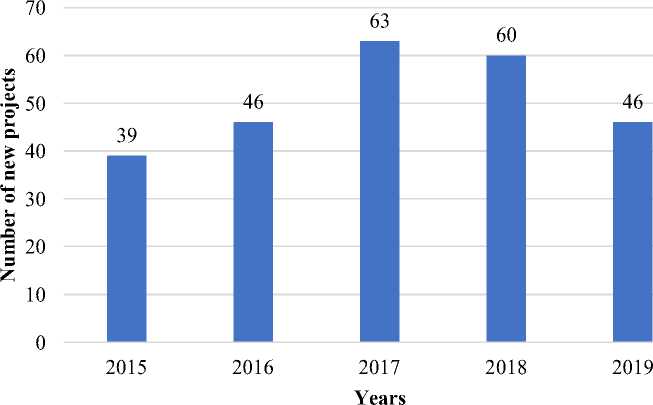

Analyzing the first results of the mandatory transition to escrow, it is important to mention the negative consequences. So, in Mos- cow, the growth of supply of new buildings slowed down (fig. 3). Since the beginning of the year, the capital's market has received projects by 23% less (46 vs. 60) than in the same period last year. The situation was worse only in the crisis year of 2015 (39 projects). Then there was an increase: 46 in 2016, 63 in 2017 and 60 in 2018. The main reason was the unavailability of developers to transition to escrow.

Fig. 3. Dynamics of the number of new projects in the Moscow real estate market in 2015

2019 [5]

The analysis of thematic literature and statistical indicators allows to finally form the author's position and, on its basis, to offer the following recommendations to interested persons:

– For developers who have not switched to escrow accounts: to create alternatives, for example, to develop a guarantee mechanism.

– Since the banks selected by the Central Bank for escrow will benefit and will be able to dictate their terms, it is necessary to create a competitive environment so that the reduction of risks due to escrow can lead to a proportional reduction in interest rates on bank loans to developers.

It is necessary to identify the positive and negative aspects of the use of escrow accounts. Among the positive points worth noting following:

-

1) Simplicity of non-cash turnover.

-

2) Opening an escrow account can be cheaper than to issue a letter of credit or a deposit box. Along with a mortgage for housing, you can open it for free.

-

3) Money in escrow accounts is protected by the Deposit insurance system.

-

4) The developer will not receive the buyers' money until the house is completed. The situation of completion of old objects at the expense of new shareholders is excluded. If people do not get the apartment, they will immediately have access to the escrow account and will return all their money.

Negative consequences of using escrow accounts include:

-

1) The maximum amount of insurance payment on escrow accounts from the state is 10 million rubles.

-

2) With the growth of the transaction amount, you need to carefully choose a bank

or conduct a transaction through the opening of several escrow accounts.

-

3) Now only a few banks can open an escrow account.

-

4) This scheme is poorly protected from fraud by corrupt bank employees.

-

5) The rise in the cost of construction.

Thus, an escrow account is a new banking instrument for Russian practice, which has received government support. A special type of account in banking, based on a contractual basis, regulating two legal relations at once (agent-depositor, agent-beneficiary) and designed to minimize risks in transactions for the purchase and sale of expensive objects (for example, apartments under the contract of shared construction).

Список литературы Escrow accounts as a new transaction instrument

- Bagandova L.K. Problems of application of escrow account: Russian and foreign practice // Vestnik of Moscow state University. Series: Jurisprudence. - 2018. - №1.

- Efimova L.G., Alekseeva D.G. Banking law. 2nd edition. Textbook for bachelors. - M.: "Prospect", 2018.

- Tarasenko O.A., Khomenko E.G. Banking law. Theory and practice of application of banking legislation. 2nd edition. The textbook for the masters. - M.: "Prospect", 2016.

- Analytical note of the CBR on Housing construction (October 2019). - [Electronic resource]. - URL: https://www.cbr.ru/Content-/Document/File/84168-/analytic-note_20191004ddkp.pdf (accessed 05.04.2020)

- Due to escrow accounts in Moscow, the number of new buildings decreased record (Info24, 08.10.2019). - [Electronic resource]. - URL: https://info24.ru/news/iz-za-schetov-eskrou-v-moskve-rekordno-snizilos-kolichestvo- novostroek.html (accessed 10.04.2020)

- Federal law № 214 (in the edition of 27.06.2019)