Estimating econometric model for the analysis of consumption function in Russia 2004-2013

Автор: Трегуб И.В., Бакакин Р.Н.

Журнал: Экономика и социум @ekonomika-socium

Статья в выпуске: 4-4 (13), 2014 года.

Бесплатный доступ

Most of the economists describes consumption as the use of goods and services to meet the needs by households. The characteristics of consumption function are important for many questions in both macroeconomics and microeconomics. Kleins model contains three structural equations and three identities. Equations include consumption function, investment function and function of wages but we used only the first one. In this work we constructed an econometric model for the analysis of consumption function in Russia. It shows the influence of two variables that are GDP and taxation on consumption. The main problem of this research is to find out if this model can be used for our estimation of the Russian economy.

Короткий адрес: https://sciup.org/140109930

IDR: 140109930

Текст научной статьи Estimating econometric model for the analysis of consumption function in Russia 2004-2013

Most of the economists describes consumption as the use of goods and services to meet the needs by households. The characteristics of consumption function are important for many questions in both macroeconomics and microeconomics. Kleins model contains three structural equations and three identities. Equations include consumption function, investment function and function of wages but we used only the first one.

In this work we constructed an econometric model for the analysis of consumption function in Russia. It shows the influence of two variables that are GDP and taxation on consumption.

The main problem of this research is to find out if this model can be used for our estimation of the Russian economy.

All the data that was used for construction econometric model was taken from World Bank. We used two variables such as:

-

- GDP(X1)(current US$) - a GDP component as it is, consumption has an immediate impact on it. An increase of consumption raises GDP by the same amount, other things equal. Moreover, since current income is an important determinant of consumption, the increase of income will be followed by a further rise in consumption: a positive feedback loop has been triggered between consumption and income;

-

- Taxation(X2)(%) - taxation has the direct effect on consumption so if tax increase it causes disposable income of households to decrease, so they have less income to spend and thus consumption deceases.

The function of consumption looks like this:

Ct = a 0 + a 1 Yt + a 2 Tt+ εt

-

So, our general model is:

Ct = a 0 + a 1 Y t + a 2 T t + ε

E(εt) =0

∂(εt) =constant

Analyzing our general model, we can say, that Consumption is endogenous variable(Y) and it’s determined by two exogenous variables, GDP(X1) and Taxation(X2).

Correlation matrix of Russia

|

Russia |

Consumption |

GDP |

Taxes |

|

Consumption |

1 |

||

|

GDP |

0,990869135 |

1 |

|

|

Taxes |

-0,058198656 |

0,024022456 |

1 |

The correlation matrix is calculated through the sample variance of the data variables and we can identify the relations of our variables. As we can see, the relation of GDP and consumption are relatively high, because their correlation is almost 1.

We can also find out that in the relationship with taxes and consumption is negative and with GDP is relatively small. It can be explained in economic sense that if taxes raise, consumption seems to be lower and simultaneously GDP is going down as well.

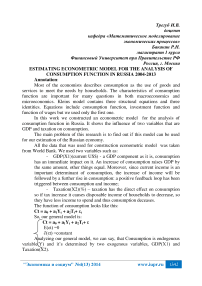

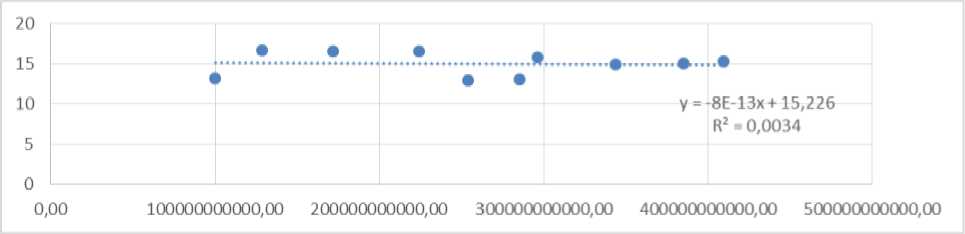

Scatter diagrams

What about relations between consumption and taxation in Russia, actually they are not very connected as we can see it on the graphs. R² is close to 0 and we can say, that there is very poor linear relation between taxation and consumption.

Regression analysis and testing

As the next step we can analyse our problem by regression analysis. Regression explores the linear relationship between the dependent and independent variables. We know that Consumption is dependent variable(Y) and it’s determined by two independent variables, GDP(X1) and Taxation(X2).

We discovered that in Russia 98% of variance of Yt can be explained by our independent variables included in the model. This indicator seems to be high, only 2% is the result of variance of other factors, that were not taken into account. R² Russia = 0,988.

As the next step, we should estimate the significance of R², so we do the F-test.

Russia: Fstat (263,1) > Fcrit (3,46). We can conclude, that that our R² square is not random and our model is specified properly.

After calculating F test, we do the T test, which shows us, if estimated coefficients are significant or not.

Russia

|tstat(Ct)|= (1,869) < Tcrit (1,943) – this means our coefficient is not significant

|tstat(Yt)|= (22,8) > Tcrit (1,943) – this means our coefficient is significant

|tstat(Tt)|= (2,278) > Tcrit (1,943) – this means our coefficient is significant

To conclude, not all coefficients are significant. However, we could try to replace insignificant variables.

Goldfeld-Quandt and Durbin-Watson test

The result for Russia is lower than Fcritical, so we can conclude, that our residuals are homoscedastic and we can use ordinary square technique in order to estimate an econometric model. Also, the second Gauss-Markov condition is confirmed, as the standard deviation of disturbance term is constant - a(P t) = const.

Conclusion

After all of the work we did, we can make a conclusion that is based on our results.

We found out, that for Russia our model is adequate, so we can predict future changes using it, because the real consumption of the year 2013 is within the confidence.

We can’t be sure is there is autocorrelation in the residuals or not because DW statistics lays in the interval of uncertainty but however it doesn’t mean the third Gauss-Markov condition is rejected, so we can assume this model passed all tests, except it has one insignificant coefficient, considering this fact, we can advice to increase time period of investigated variables and recalculate the model but in our work it gave best results, so Kleins consumption function is most suitable for Russia, so we confirmed all Gauss-Markov conditions and finally could make close to proper predictions with small error.

Список литературы Estimating econometric model for the analysis of consumption function in Russia 2004-2013

- Трегуб И.В. Применение математической системы MATHCAD 2000i Professional для прогнозирования динамики цен на фондовых рынках//Математические и инструментальные методы экономического анализа: управление качеством: Сборник научных трудов. -Тамбов: ТГТУ, 2003. -Вып. 6. -С. 12-15.

- Tregub I.V. "Имитационное моделирование", учебное пособие, М.: Изд-во ФА, 2007

- Tregub I.V. Алгоритм проведения вычислительного эксперимента при исследовании стохастических экономических систем//Современные проблемы прикладной математики и математического моделирования. Сборник научных трудов международной научной конференции (12-17 декабря 2005г.)/Воронежский гос. ун-т. -Воронеж: 2005

- http://www.worldbank.com/