EU response to the crisis caused by the COVID-19 pandemic

Автор: Novović Milan, Lukić Aleksandar

Журнал: Ekonomski signali @esignali

Статья в выпуске: 2 vol.17, 2022 года.

Бесплатный доступ

The appearance of the pandemic in the form of the new disease COVID-19 greatly influenced global trends and caused a wider economic recession. Due to unusual factors that generated the crisis, it is specific and different from all previous ones. As the crisis continues, estimates of future economic trends vary depending on the health situation in individual countries, as well as the measures applied by state authorities to mitigate it. Due to the topicality of the crisis and its extraordinary impact on global trends, this paper attempts to examine the effects of the pandemic on the economy of the European Union, as well as to answer the question of the scope of economic policy measures in overcoming recessionary effects.

COVID-19, European Union, pandemic, crisis, economic measures

Короткий адрес: https://sciup.org/170204027

IDR: 170204027 | DOI: 10.5937/ekonsig2202131N

Текст научной статьи EU response to the crisis caused by the COVID-19 pandemic

The CO4ID-19 pandemic in Europe appeared in January 2020 and is still going on. The global health crisis has radically changed the functioning of society and, among others, caused numerous economic consequences. The different intensity of the decline in economic activity in individual countries is due to numerous reasons, economic policies in times of crisis.

From the very beginning of the health crisis in the European Union, it was clear that there was no single reaction from the member states. It differed both in the health measures against the pandemic and in the measures of the economic policy of the states in the fight against the recession. European countries have applied a wide range of short-term discretionary fiscal and monetary measures in response to the health and economic crisis. Most of these state aid measures are aimed at preserving Gobs and maintaining the liquidity of companies.

1. The impact of the CO4ID-19 pandemic on the global economy

In 2020, the world faced a health crisis that left immeasurable health, social and economic consequences. The pandemic caused by the CO4ID-19 virus has seriously changed the world, endangered national economies and dealt a blow to the health and safety of the population. The health, social and economic crisis has found countries at different levels of preparedness to function in extraordinary, emerging circumstances. In response to the crisis, states have taken certain restrictive measures to prevent, control and stop the pandemic. Measures ranged from closing borders, restricting interstate traffic, restricting the operation of certain facilities, to quarantine and curfew. The global spread of the pandemic, in addition to great consequences for human health and increased mortality, caused a global economic recession and a shock for which the world was not ready. [Kamberović et al., 2020, 9]

What can be said with certainty is that the shock of the pandemic hit the economy both from the side of aggregate demand and from the side of aggregate supply, which is atypical and which makes the situation and overcoming the crisis especially difficult. Demand has been affected by a significant reduction in all its components, investments in the economy and capital expenditures of the state have been reduced. 1n even more drastic example is the impact of the pandemic on aggregate supply. The aggregate supply is affected by the fact that many economic entities have temporarily reduced or completely stopped their work, because many parts of the world have been quarantined due to the requirement to maintain social distance and reduce contacts. This has caused problems in the modern world when it is characterized by global supply and production chains. [Praščević, 2020, 10]

The direct impact of the pandemic on the economy was manifested through a sharp decline in GDP in 2020, which covered all regions of the world. The decline in world GDP in 2020 was 3.1%. [International Monetary Fund, 2021b, 5] In addition to the restrictions result- ing from the application of non-pharmacological epidemiological measures, the decline in economic activity was affected by the decline in investment and consumption, which led to a further decline in demand, especially for durable consumer and investment goods. The coronavirus pandemic has triggered a negative spiral in which a drop in supply caused by epidemiological measures leads to a drop in demand, and then a drop in demand due to it leads to an additional drop in supply. However, in 2021, there was a partial recovery of the world economy, although the pandemic is still going on. GDP growth is proGected to be 5.9% in 2021 and 4.9% in 2022. Growth of 5.2% and 4.5% is expected for developed economies, and 6.4% and 5.1% for developing economies, respectively. (Table 1)

Table 1. Status andproGections ofworld realproduction in the period from 2019 to 2022 (%)

|

2019 |

2020 |

2021 |

2022 |

|

|

World Output |

2.8 |

-3.1 |

5.9 |

4.9 |

|

1dvanced Economies |

1.7 |

-4.5 |

5.2 |

4.5 |

|

Emerging Market and Developing Economies |

3.7 |

-2.1 |

6.4 |

5.1 |

|

World Trade 4olume (goods and services) |

0.9 |

-8.2 |

9.7 |

6.7 |

Source: 1uthor’s representation based on [IMF, 2021b, 6]

When it comes to GDP per capita, its decline was 4.3% in 2020. 1s a result of the global recovery, GDP per capita is expected to grow by 4.8% in 2021 and 3.8% in 2022.

Growth proGections for developed economies are 5.0% and 4.3%, and for developing economies 5.1% and 4.0% in the observed years. ( Table 2 ).

Table 2. Status andproGections ofworld realproduction per capita in the period from 2019 to 2022(%)

|

2019 |

2020 |

2021 |

2022 |

|

|

World Output |

1,7 |

-4,3 |

4,8 |

3,8 |

|

1dvanced Economies |

1,3 |

-4,9 |

5,0 |

4,3 |

|

Emerging Market and Developing Economies |

2,3 |

-3,4 |

5,1 |

4,0 |

Source: 1uthor’s representation based on [IMF, 2021b, 42]

This state of world real production is a consequence of falling investment, private consumption and international trade. Investments in the period of crisis, by the way, have a sharp decline, while their recovery after the crisis is gradual. The decrease in investments was caused by the deterioration of the liquidity of the economy and risks that are growing significantly, while the dynamics of recovery is uncertain. The decline in private consumption in the current crisis is largely due to delays in the purchase of non-existent goods, as well as reduced opportunities to purchase various services. One of the specifics of the current crisis is the extremely uneven decline in economic activity by economic activities.

However, thanks to the exceptional support of national governments and central banks, even greater consequences for the world economy have been avoided. Thus, in 2021, there will be a gradual global economic recovery, regardless of the emergence of new strains of the virus. 1ccording to OECD proGec-tions, recovery will be uneven and exposed to a large number of risks, both in developed and developing economies. Countries emerge from crises with various challenges, often reflecting their strengths and weaknesses before CO4ID-19, as well as their approaches policies during the pandemic. [OECD, 2021, 12]

-

2. Economic developments and consequences of the crisis on European Union countries

The impact of the pandemic on the countries of the European Union is similar to that on the global world economy. This means that the crisis has affected both aggregate demand and aggregate supply, causing a significant decline in economic activity, rising unemployment, rising corporate bankruptcies, declining liquidity, falling stock prices and falling energy prices. However, not all European Union countries are affected equally. Those countries that had a more serious health crisis and more significant measures of "locking" the economy also had a greater economic decline. The targets were primarily those sectors that imply significant social closeness that cannot be avoided. Thus, tourism, entertainment industry, transport, sports, some industries (eg production of durable consumer goods, luxury goods, etc.), which are especially important for European economies, are particularly affected.

Table 3. Realgross domestic product in the countries ofthe European Union in the period from 2019 to 2022 (%)

|

2019 |

2020 |

2021 |

2022 |

|

|

European Union |

1,7 |

-5,9 |

5,1 |

4,4 |

|

Spain |

2,0 |

-10,8 |

5,7 |

6,4 |

|

Italy |

0,3 |

-8,9 |

5,8 |

4,2 |

|

Portugal |

2,2 |

-8,4 |

4,4 |

5,1 |

|

Malta |

4,9 |

-8,3 |

5,7 |

6,0 |

|

Greece |

1,9 |

-8,2 |

6,5 |

4,6 |

|

France |

1,5 |

-8,0 |

6,3 |

3,9 |

|

Croatia |

2,9 |

-8,0 |

6,3 |

5,8 |

|

Sweden |

1,3 |

-2,8 |

4,0 |

3,4 |

|

Poland |

4,5 |

-2,7 |

5,1 |

5,1 |

|

Denmark |

2,3 |

-2,1 |

3,8 |

3,0 |

|

Luxembourg |

2,3 |

-1,3 |

5,5 |

3,8 |

|

Lithuania |

3,9 |

-0,9 |

4,7 |

4,1 |

Source: 1uthor’s representation based on [IMF, 2020, 17; IMF, 2021a, 10]

Some countries of the European Union are especially endangered because they depend on tourism, and at the same time they are significantly affected by the pandemic. Namely, the group of countries with the largest estimated decline in GDP includes Spain, Italy, Portugal, Malta, Greece, Croatia and France, most of which are typical tourist destinations. On the other hand, Sweden, Poland, Denmark, Luxembourg and Lithuania are among the countries with the mildest economic consequences of the CO4ID-19 pandemic. (Table 3) Sweden, for example, has benefited from positive net exports, as well as significantly less restrictive measures to combat the pandemic. In the case of Poland, this is mainly due to low reliance on hard-hit sectors and diversified economic structures. Denmark has high exports of pharmaceuticals and agricultural products, and these are the sectors most affected by the pandemic. [Kamberović et al., 2020, 23] Lithuania is the country least affected by the pandemic. The reason for that is the existence of a longterm investment plan and increased consumption of citizens. Even before the crisis, it was one of the three European Union countries with the fastest growth in gross domestic product. The pillars of its economy are similar to Germany's: a positive government budget and balance of payments, sustainable and balanced growth, driven by household consumption, exports and investment.

When looking at the real gross domestic product per capita, it fell by 6.1% in 2020 at the level of the European Union. Of the countries, the largest decline was in Spain 11.2%, Malta 10.8%, Greece 9%, Italy 8.7%, Portugal 8.6% and Croatia 7.7%. In contrast, the smallest decline was recorded in Sweden 3.6%, Finland and Latvia 3%, Poland 2.5%, Denmark 2.3% and Lithuania of only 0.2%. [World Bank, 2021]

It is estimated that about 6 million Gobs in the European Union were lost due to the pandemic, with a large drop in income in tourism. Hotels recorded a decline of 85%, tour operators 85%, train transport 85%, cruise travel and air travel as much as 90%. [Praščević, 2020, 16]

1 survey by the European 1ssocia-tion of Craftsmen, Small and Medium-sized Enterprises found that more than 90% of small and medium-sized enterprises in the European Union saw a drop in traffic due to the pandemic and measures to combat it. 1bout 20% of SMEs lost all turnover in a few weeks. Two-thirds of SMEs said they had delayed investment decisions or reduced investments. [SMEUnited, 2020]

The pandemic had a special negative impact on labor market developments, which led to an increase in the unemployment rate. The unemployment rate in the European Union in 2020 reached 9%. It is also high in 2021, but slightly lower at 7.1%. 1mong European countries, Greece and Spain currently have the highest unemployment rates of 15.1%, followed by Italy with 9.7%, Sweden with 9.5%, Latvia with 8%, while Poland, the Netherlands and the Czech Republic have the lowest unemployment rates, with 3.6%, 3.2% and 2.8%, respectively. [Statista, 2021]

In addition to open unemployment, there is also the problem of insufficient employment, which refers to workers who are still employed, but work significantly shorter than they could, or work remotely. Estimates for Italy indicate that as many as 50-60% of workers work remotely or do not work at all. [Praščević, 2020, 17] The situation is similar in other economies, where states generally try to prevent companies from laying off workers through various aid programs, linking aid to businesses with the condition that they did not lay off workers, or directly paying reduced wages to workers in these companies.

In the countries of the European Union, the decline in production in agriculture, financial services, real estate and government services was small, while informatics and telecommunications grew. Industrial production in the European Union has decreased significantly, with the decline at the level of individual countries depending on the share of production of existential goods, such as food, beverages, pharmaceuticals, household chemicals and the like, and the number of non-existent goods such as durable consumer and investment goods. In general, the decline in industrial production was smaller in less developed countries, where the production of subsistence products has a higher share, compared to developed countries. [1rsić, 2021, 59]

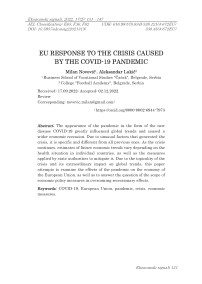

In December 2020, the European Union developed a comprehensive financial package of €1,824.3 billion for the following years, in order to mitigate the socio-economic consequences of the CO4ID-19 pandemic and take into account its long-term priorities. It covers € 1,074.3 billion for the Multiannual Financial Framework (MFF) for the period 2021-2027 and € 750 billion for the Next Generation EU (NGEU) recovery instrument. [European Council, 2020a] The Multiannual Financial Framework is a longterm budget to fund almost 40 EU spending programs over the sevenyear period. It covers seven areas Figure 1: [European Council, 2020b]

-

1) Single Market, Innovation and Digitalisation,

-

2) Cohesion, Resilience and 4alues,

-

3) Natural Resources and Environment,

-

4) Migration and Border Management,

-

5) Security and Defense,

-

6) Neighborhood and World and

-

7) European Public 1dministration.

For the implementation of the EU's Next Generation Recovery Instrument, all Member States have, in accordance with their constitutional provisions, given the green light for spending in order to recover from the effects of the CO4ID-19 pandemic crisis.

1074,3 (MFF) + 750 (NGEU) = 1824,3 (Total Budget)

-

■ Single Market, Innovation and Digital

-

■ Cohesion, Relilience and Values

-

■ Natural Resources and Environment

Migration and Border Management

■ Security and Defence

■ Neighbourhood and the World

■ European Public Administration

■ Next Generation EU

Figure 1. Multiannual financial framework 2021-2027 and Next Generation EU (billion €) on European Union

Source: 1uthor’s representation based on [European Council,2020a]

3. EU measures in the fight against the CO4ID-19 pandemic

This financial package enables the European Union to provide the largest amount of funds for recovery from the CO4ID-19 disease pandemic in the coming years. It is expected that the real gross domestic product at the level of the European Union will increase in 2021 compared to 2020 by about 5%, while it will continue to grow in 2022 and approximately 4.4%, when it will reach the level before the crisis. This scenario is, to a greater or lesser extent, envisaged for EU member states as well (see Table 3 ). 1lso, real gross domestic product per capita will increase by 4.9% in 2021 and 4.3% in 2022.

[World Bank, 2021] 1s can be seen, the European Union and its members are ready to face the crisis and mitigate its devastating effects. The coordination of measures in the field of social, health and economic policies has contributed to that.

In the fight against the CO4ID-19 pandemic, the governments of most European countries have imposed strict restrictions on the movement of people and taken significant monetary and fiscal measures. The combination of national fiscal policy measures and bond purchases by the European Central Bank (ECB) is aimed at mitigating the economic impact of the pandemic. EU and ECB officials are pushing for a coordinated fiscal response from the eurozone and the wider EU. The EU is considered to have entered the largest economic recession in its history.

European Union countries, as well as other non-EU countries, have taken three key actions in the fight against the pandemic: [Colić, 2021, 247]

-

1. The so-called "locks", ie quarantine. Italy is the first country in Europe to introduce quarantine throughout the country, which referred to the closure of companies and the ban on movement. Other countries have also introduced similar restrictions. 1l-most all European countries closed schools and some companies, but also limited them to public gatherings. European governments have mobilized military forces to help citizens, including their involvement in building temporary hospitals to house patients. Public transport was reduced and curfew was introduced.

-

2. Economic incentives. The governments of the EU countries have taken a number of measures that have certainly mitigated the economic downturn. These measures relate to loans and credit guarantees for companies, subsidies to companies in the form of payment of income to workers, deferral of tax payments and deferral of debt. The European Central Bank has adopted the Pandemic Emergency Purchase Program (PEPP) worth 750 billion euros for all member states, aimed at calming the financial market and stopping the debt crisis in the Eurozone. [European Council, 2020c] Eurozone leaders agreed on a 540 billion-euro bailout package. This package covered: (1) access to the European Stability Mechanism (ESM) credit lines to cover health and other costs of €240 billion, (2) the creation of a €200 billion European Investment Bank fund to support businesses and the unemployed euros and (3) 100 billion euros for the European Commission's unemployment reinsurance plan. [European Stability Mechanism, 2020]

-

3. Closing borders. The governments of European countries have made a decision on border

-

4. 4accination. In mid-2020, the European Commission presented the EU 4accination Strategy with the aim of accelerating the development, production and implementation of the CO4ID-19 vaccine. The obGectives of the strategy are as follows: to ensure a quality, safe and effective vaccine; ensure timely access to vaccines for the people of the Member States and at the same time be a leader in solidarity at world level; ensure fair access to affordable vaccines for all EU citizens. [European Commission, 2020]

control, and some countries have restricted entry only to their citizens. These measures restrict the free movement of goods and services and the free movement of people, which are key elements of the EU's single market. Bearing in mind that the highly integrated economy of the European Union rests on these key elements of the EU single market, it can certainly be concluded that closing the borders is disastrous for the economy. The temporary ban on entry into the EU for most foreign nationals is also considered a partial measure to preserve freedom of movement within the EU.

In addition to these activities, EU member states have taken a wide range of measures to alleviate the CO4ID-19 pandemic. These are: 1. Government support measures, 2. Central bank measures, 3. Prudential measures and 4. 1ctivities aimed at ensuring the normal functioning of the market. [Financial Stability Board, 2020]

Government support measures were the first line of defense and were implemented through the following activities:

-

- state guarantees on loans granted to the economy, primarily to small and medium enterprises;

-

- direct state support through state funds and schemes;

-

- restructuring of loans granted to companies and citizens, by introducing a moratorium, ie delays in repayment of liabilities for a certain period of time;

-

- subsidies on employee income and deferral of tax and other fiscal obligations.

Simultaneously with the measures of the government, the central banks of most European countries within their monetary policies acted first through the policy of reducing interest rates, and then through new or intensifying existing securities repurchase programs. In order to adequately support the economy and citizens, central banks have provided additional sources of liquidity to banks since the beginning of CO4ID-19, both through the approval of longer-term bank loans and extension of refinancing operations and by reducing required reserves. 1lso, the central banks, in cooperation with commercial banks, provided easier financing to companies both through stimulative bank loans and through the purchase of company bonds.

Since the beginning of the coronavirus pandemic, central banks' approaches have mainly involved similar activities: reduction of reference and other interest rates, quantitative easing, extension of maturities of refinancing opera- tions, activities aimed at uninterrupted lending to banks and other financial institutions. These measures are aimed at supporting the national and global economy, with the aim of absorbing the shock of the current crisis, providing affordable lending, increasing bank lending capacity, supporting access to credit for businesses and households and preserving financial stability through international cooperation.

Table 4 shows the measures taken by some European countries in order to combat the negative economic consequences of the pandemic.

Table 4. Measures taken by individual countries to combat the coronavirus

|

Measures |

Countries |

|

Government loans or credit guarantees to companies |

Germany, France, Italy, Great Britain, Spain |

|

Income subsidies for affected workers |

Germany, France, Italy, Spain |

|

Deferred tax payments |

Germany, France, Great Britain, Spain |

|

Social security subsidies |

Germany, France, Spain, Great Britain |

|

Debt refinancing |

Italy, Great Britain, Spain |

Source: [Colic, S.,2021, 249]

In response to the coronavirus pandemic, the ECB has introduced a new repo facility (Eurosystem repo facility for central banks - EUREP), with the aim of providing repo lines as a precaution to central banks outside the Eurozone. EUREP is addressing the possible liquidity needs of the euro in the event of market dysfunction resulting from the CO4ID-19 shock, which could adversely affect the monetary policy mechanism. [European Central Bank, 2020]

1long with the mentioned measures, the member states of the

European Union had to prepare a plan for economic recovery and ensuring the normal functioning of the market. The European Commission has set priorities for the recovery plan that member states should adhere to, such as: Gob creation, economic and social resilience of member states and GDP growth. The plan envisions more than a third of the allocations to support the green transition. The

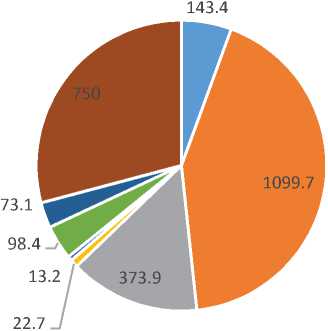

Figure 2. Currency breakdown ofgreen bond issuance (%)

-

□ Euro

-

□ US Dollar

-

□ Other currencies

Source: [Janse & Tsanova, 2020]

at green recovery and sustainable production in the coming period will contribute to the fight against climate change, as well as overcoming the consequences of the economic crisis caused by the CO4ID-19 pandemic.

Based on all the above, we can conclude that the European Union has taken measures not only to mitigate the economic consequences of the pandemic, but also to preserve the ideas of multilateralism and solidarity. Because of the way it has protected its citizens, businesses and member countries, it is showing global leadership in the best interests of humanity.

Conclusions

The ongoing coronavirus pandemic has a significant impact on the real economy not only in the European Union but also around the world. 1s a result, the global financial economy is experiencing maGor market turbulence. Financial markets are currently very volatile and under pressure. This brings challenges to trade institutions. In addition, the need for credit and liquidity among bank customers around the world is increasing.

Many believe that the European Union has entered, so far, the biggest economic recession in its history. The changes in the economy caused by the CO4ID-19 pan- demic are not only temporary but also structural. This will leave significant consequences for the productivity of the service sectors, and some activities of the economy will need a longer period to return to the pre-crisis level. How much these structural changes will affect the economy and deepen the already existing differences between European countries will depend on the economic policies that will be the response to the pandemic. In this regard, it seeks a coordinated response to monetary and fiscal policies in both developed and developing countries across Europe. The monetary policy of the European Central Bank and the central banks of European countries has a key role in combating the negative economic consequences of CO4ID-19. Central banks have built significant capital and liquidity funds in recent years. They are also prepared for difficult situations that can affect the economy as a whole. They have the task of keeping the financial sector liquid, ensuring the implementation of measures related to financing and assistance to all sectors of the economy, above all, those on which future economic growth and inflation rate depend. Central banks have responded to the crisis with an expansionary monetary policy, through more favorable borrowing conditions, in- creased banking capacity and the application of quantitative easing. On the other hand, fiscal policy measures were aimed at direct financial assistance to citizens and the economy, primarily small and medium enterprises, subsidies for employees, as well as the introduction of delays in the payment of tax liabilities.

The CO4ID-19 pandemic, which caused a shock in the economy of

Список литературы EU response to the crisis caused by the COVID-19 pandemic

- Arsić, M. (2021) Globalne ekonomske posledice pandemije COVID-19. u: X Naučna konferencija sa međunarodnim učešćem: Jahorinski poslovni forum 2021, Pale, Republika Srpska, BiH: Ekonomski fakultet Pale, str. 57-66

- Colić, S. (2021) Uticaj pandemije COVID-19 na finansijsko tržište Evrope i mere Evropske centralne banke. u: IV Međunarodna naučna konferencija: Regionalni razvoj i prekogranična saradnja, Pirot, Srbija: Fakultet za menadžment Zaječar, 243-258

- European Central Bank (2020) Our response to the coronavirus pandemic. Accessed on 09.07.2022, https://www.ecb.europa.eu/home /search/coronavirus/html/index.e n.html

- European Commission (2020) EU Strategy for COVID-19 vaccines. Accessed on 04.07.2022, https://eur-lex.europa.eu/legalcontent/EN/TXT/PDF/?uri=CEL EX:52020DC0245&from=EN

- European Council (2020) Longterm EU budget 2021-2027 and recovery package. Accessed on 28.06.2022, https://www.consilium.europa.e u/en/policies/the-eu-budget/longterm-eu-budget-2021-2027

- European Council (2020) Multiannual financial framework for 2021-2027 adopted. Accessed on 28.06.2022, https://www.consilium.europa.e u/en/press/pressreleases/2020/12/ 17/multiannual -financial-framework-for-2021-2027-adopted

- European Council (2020) Report on the Comprehensive Economic Policy Response to the COVID19 Pandemic. Accessed on 14.06.2022, httpsV/www.consilium.europa.e u/en/press/pressreleases/2020/04/09/report-onthe-comprehensive-economicpolicy-response-to-the-covid-19pandemic

- European Stability Mechanism (2020) EIB and ESM lead discussion on how to connect capital markets with a post-coronavirus sustainable recovery. Accessed on 30.06.2022, https://www.esm.europa.eu/pres s-releases/eib-and-esm-leaddiscussion-how-connect-capitalmarkets-post-coronavirus-sustainable

- Financial Stability Board (2020) COVID-19 Pandemic Financial Stability Implications and Policy Measures Taken. Accessed on 14.06.2022, https://www.fsb.org/wpcontent/uploads/P 150420.pdf

- International Monetary Fund - IMF (2020) Regional economic outlook: Europe whatever it takes: Europe's Response to COVID-19. Washington, DC

- International Monetary Fund - IMF (2021) Regional economic outlook: Europe the European recovery' policy recalibration and sectoral reallocation. Washington, DC

- International Monetary Fund-IMF (2021) World economic outlookk recovery during a pandemic: Health concerns, supply disruptions, price pressures. Washington, DC

- Janse, A.K., Tsanova, I. (2020) What we can learn from Europe's response to the COVID-19 crisis. Accessed on 10.07.2022, https://www.weforum.org/agend a/2020/08/europe-responsecovid-19-coronavirus-economiccrisis-euro-fiscal-monetarypolicy-green-deal

- Kamberović, S., Mitrović, S., Behrens, A. (2020) GAP analiza mogućnosti za ekonomsko jačanje primenom održivih poslovnih modela nakon pandemije COVID-19 u Republici Srbiji. Beograd: Misija OEBS-a u Srbiji

- Milić, D., Anđelković, N. (2021) Ekonomske mere protiv pandemije u EU. u: IV Međunarodna naučna konferencija: Regionalni razvoj i prekogranična saradnja, Pirot, Srbija: Fakultet za menadžment Zaječar, str. 381-395

- OECD (2021) OECD Economic Outlook. Paris: OECD Publishing, Volume 2021 Issue 2-Preliminary version, No. 110

- Praščević, A. (2020) Ekonomski šok pandemije COVID 19 - prekretnica u globalnim ekonomskim kretanjima. Ekonomske ideje i praksa, 37, 7-22

- SMEUnited (2020) The economic impact of COVID-19 on SMEs in Europe. Accessed on 14.06.202, https://www.smeunited.eu/admi n/storage/smeunited/200630covidsurvev~results.pdf

- Statista (2021) Unemployment rate in selected European countries as of June 2021. Accessed on 14.06.2022, https://www.statista.com/statisti cs/1115276/unemplovment-ineurope-by-countrv

- World Bank (2021) GDP per capita growth (annual %) - European Union. Accessed on 14.06.2022, https://data.worldbank.org/indic a.tor/NY.GDP.PCAP.KD.ZG?l ocations=EU