Evaluating Impact of Quality of Work Life Factors on Job Satisfaction: Structural Equation Modelling based Data Analysis in Banking

Автор: N. Usha Deepa Sundari, Lakshmi Narayanamma Poli

Журнал: International Journal of Information Engineering and Electronic Business @ijieeb

Статья в выпуске: 4 vol.17, 2025 года.

Бесплатный доступ

The service sector, particularly banks, has undergone a significant shift in recent years. This has resulted in increased pressure and stress for bank employees who strive to provide timely and efficient services while meeting management objectives and ensuring customer satisfaction. This research employs a comprehensive methodological approach to examine the Quality of Work Life (QWL) and Job Satisfaction (JS) within the banking sector in Andhra Pradesh. The research focuses on confirming the construct validity of QWL and JS through Confirmatory Factor Analysis (CFA) and assessing the reliability of the measurement model using Cronbach's Alpha. Discriminant validity is examined to ensure that these constructs represent distinct concepts. The research employs Structural Equation Modeling (SEM) to explore the correlation between QWL and JS, as well as their interactions with factors such as Motivation and Compensation, Work Factors, Safety and Welfare, Relationship and Support, Nature of Job, and Career Growth and Development. The outcomes of this research offer valuable insights into the banking industry in Andhra Pradesh. By validating the QWL and JS constructs and understanding their relationships, the research serves as a foundation for organizations to enhance employee well-being and job satisfaction. The study provides practical recommendations, tailored to the specific needs of bank employees in Andhra Pradesh, to improve work-life balance, career development, compensation, safety, relationships at work, and overall employee well-being.

Job Satisfaction, Banking Sector, Public and Private Sector Employees, Quality of Work Life (QWL), Mediation Analysis

Короткий адрес: https://sciup.org/15019915

IDR: 15019915 | DOI: 10.5815/ijieeb.2025.04.06

Текст научной статьи Evaluating Impact of Quality of Work Life Factors on Job Satisfaction: Structural Equation Modelling based Data Analysis in Banking

Published Online on August 8, 2025 by MECS Press

The banking sector has experienced significant changes in recent years, affecting the work and responsibilities of bank employees. Factors such as increased technology usage, changing customer preferences, economic shifts, and regulatory changes have heightened work-related stress and reduced bank employees' Quality of Work Life (QWL) [1]. QWL is focused on creating a positive work environment for employees. It involves providing fair wages, a safe and comfortable workspace, job satisfaction, and opportunities for professional and personal growth. The objective of QWL is to integrate the goals of employees and the organization, encouraging cooperation and participation while ensuring job satisfaction and work-life balance [2].

The characteristics of QWL include encouraging human dignity and growth, consideration for personnel, job, and organization, work changes such as job rotation and enrichment, integration of objectives of employees and organization, work and cooperation including satisfactory working conditions, fair compensation, participative management, job satisfaction, and work with cooperation to prevent conflicts [3]. Elements contributing to QWL include fair pay, secure and safe working environments, chances to enhance skills, avenues for career advancement, social inclusion at work, balance between work and personal life, empowerment at work, and the social significance of work alongside corporate ethical responsibilities [4]. The concept of QWL may vary for different employees based on their individual preferences and needs. Ultimately, it's about improving the work environment and ensuring that employees are satisfied, motivated, and productive.

The importance of QWL cannot be overstated. Nowadays, employees are seeking more than just wages – they desire job satisfaction, which can be achieved through a conducive working environment, involvement in decisionmaking, and understanding the significance of their role [5]. When businesses focus on QWL, employees tend to stay longer, reducing turnover rates, and absenteeism is also reduced due to an improved work environment and cooperation among workers. Management's effort to enhance QWL leads to increased productivity, higher morale, improved product quality, and cost reductions. Job enrichment in QWL reduces employee fatigue and enhances their enthusiasm, which contributes to employees' overall development [6]. Satisfied employees reduce the likelihood of strikes or lockouts and improve the standard of living. Companies that prioritize QWL gain prestige, and their employees become advocates for the organization. Workgroups and cooperation foster social integration among employees, reducing envy and promoting cooperation [7].

The principles of QWL aim to humanize work and include ensuring job security and a safe working environment, fair wages and benefits based on effort and skill, encouraging employees to develop to their full capacity, and greater employee involvement in decision-making [8]. Job satisfaction (JS) is vital for organizational commitment and success and is influenced by factors such as wages, the nature of work, promotion opportunities, management, workgroup, working conditions, and organizational policies. Effective Human Resource Management is crucial for banking, emphasizing the significance of efficient people management in the industry [9]. Customer satisfaction is a critical aspect in the banking sector, where QWL and JS play a pivotal role. These elements highlight the significance of maintaining a healthy work environment, emphasizing the importance of job satisfaction and quality of work life in the banking sector [10].

The objective of this research is to highlight the significance of a good work environment in promoting employee well-being, and its impact on service quality. The study examines how QWL affects employee performance, trust, and commitment, particularly in the banking industry where employees play a critical role. The study aims to compare the QWL, job satisfaction, and its impact on organizational commitment in selected Public and Private sector banks in Andhra Pradesh. By analyzing these factors, the research aims to provide insights into improving QWL and its benefits. The study focuses on the importance of QWL in shaping employee personality, performance, and commitment to their organization and society. It also explores the relationship between job satisfaction, QWL, and organizational commitment. In today's highly demanding banking industry, providing a good QWL is crucial to keep employees satisfied. Additionally, organizational commitment plays an important role in employee retention and performance.

The research has been carried out by gathering data from employees working in both private and public sector banks in Andhra Pradesh using a well-structured questionnaire. The questionnaire underwent validity and reliability testing, ensuring its effectiveness. A pilot study involving 400 bank employees was conducted to test the questionnaire's validity and reliability, which were proven to be satisfactory. Several hypotheses were proposed, including the absence of significant differences between QWL factors in selected banks, the relationship between QWL and demographic factors, and the correlation between QWL and job satisfaction among banking units. The research employed a descriptive and analytical approach, targeting bank employees in Andhra Pradesh. It employed a questionnaire with itemized ranking and Likert scale questions and used statistical tools like correlation, ANOVA, T-test, regression, and factor analysis.

The study focused on selected banks in Andhra Pradesh, specifically in four major cities. It assessed the quality of work life, job satisfaction, and their effects on employee trust and commitment. The study explored various variables, including factors related to job satisfaction, QWL, trust, and commitment. The research was significant for banks in terms of understanding how QWL affects job satisfaction and performance. It helped improve employee satisfaction, reduce attrition, lower absenteeism, and enhance a bank's competitiveness. Academically, it contributed to the literature on organizational behaviour and human resources management by examining the impact of QWL on job satisfaction and performance in the banking sector. Accordingly, this study has the following objectives:

-

i. Evaluate the internal consistency and reliability of the measurement model by calculating Cronbach's Alpha for latent constructs. Establishing high construct reliability indicates that the selected items consistently measure the latent constructs, ensuring that the measurements are dependable and provide trustworthy results.

-

ii. Investigate the discriminant validity of the constructs (QWL and JS) in the banking sector using the Heterotrait-Monotrait (HTMT) ratio and the Fornell-Larcker criterion. Demonstrating discriminant validity will confirm that each construct represents a distinct concept. This ensures that the research accurately captures the unique aspects of QWL and JS, preventing ambiguity in interpretations.

-

iii. Conduct a structural equation modelling (SEM) analysis to examine the relationships between QWL and JS and assess direct and indirect relationships. Identifying these relationships will provide a comprehensive understanding of how QWL and JS are interconnected, offering insights into potential mediating factors. This knowledge can inform strategies to enhance employee well-being and job satisfaction.

-

iv. Determine the impact of various factors (e.g., Motivation and Compensation, Work Factors, Safety and Welfare) on Organizational Factors in the banking sector. The research will reveal critical determinants of

organizational success in the banking sector. Analysing the influence of these factors can guide organizations in making informed decisions to improve workplace conditions and employee satisfaction.

v. Provide recommendations for improving work-life balance, career development, compensation, safety, relationships at work, and employee well-being in Andhra Pradesh's banking industry, based on research findings. These practical, actionable recommendations can enhance the quality of work life and job satisfaction for banks in Andhra Pradesh, leading to a more motivated and content workforce, ultimately benefiting both employees and organizations.

vi. Offer insights into potential mediating factors related to QWL and JS in the banking sector. This knowledge can inform strategies to enhance employee well-being, job satisfaction, and organizational success in the banking sector.

2. Literature Review

3. Methodology

The research compares QWL and JS across public and private banks. It refines the objectives to target key factors, such as how organizational culture and job characteristics differ between these sectors, influencing employee satisfaction and well-being.

This literature survey explores the existing research to recognize factors influencing Job Satisfaction and QWL in the banking industry. Moreover, it delves into mediating and moderating variables that come into play. Various studies indicate that job satisfaction is positively associated with QWL. This means that when employees experience a higher quality of work life, their job satisfaction tends to increase [11]. QWL comprises factors like work environment, job security, work-life balance, and stress management, all of which impact job satisfaction [12].

The banking sector is known for its challenging work environment. Research findings suggest that QWL in the banking industry is influenced by factors like job security, workload, the role of supervisors, and work-family balance. These factors, in turn, affect job satisfaction [13]. Despite the demanding nature of banking jobs, a positive work culture, fair compensation, and flexible work arrangements are linked to improved QWL in the sector [14]. Numerous studies have identified factors affecting job satisfaction and QWL. Some key findings include that employee perceptions of leadership, organizational culture, and job security are pivotal in shaping QWL and job satisfaction. Job satisfaction is negatively impacted by conflict between work and family, and organizational support can mediate this association. In the banking sector, job stress is a significant factor influencing job satisfaction, emphasizing the need for stress management measures [15]. Happiness at work is linked to improved job satisfaction, indicating that creating a positive and enjoyable work environment can enhance employee contentment [16].

To understand the complex relationship between job satisfaction, QWL, and several other dependent factors, researchers have explored mediating and moderating variables. Employee self-efficacy has been identified as one of the mediating factors between job satisfaction and other organizational outcomes, highlighting the significance of selfbelief in job contentment [17]. The work atmosphere fully mediates the association between supervisor cooperation and job satisfaction, underscoring the role of the workplace environment [18]. The leadership approach has a mediating impact on job satisfaction and employee commitment, showing how management practices can shape satisfaction levels [19].

The study revealed that there are various factors that influence an employee's job satisfaction and quality of worklife in any sector. The quality of work-life and job satisfaction are crucial in determining an employee's organizational commitment, job performance, occupational stress, intent to stay, and loyalty. The major factors that influence job satisfaction and quality of work-life are salary, compensation benefits, work conditions, work environment, relationship with supervisor and support, working hours, career development, and learning opportunities. It is crucial for organizations to maintain a high level of job satisfaction for their employees as it directly affects job performance, organizational commitment, and turnover intentions. Work-family conflict, job stress, workplace spirituality, employee self-efficacy, work atmosphere, and other factors mediate and moderate job satisfaction and quality of work-life.

SEM offers a deeper understanding of the relationship between several factors that affect QWL and JS, such as work-life balance, workload, and job security. It provides accurate insights by modeling complex, interdependent relationships. However, there is limited literature on using SEM in the banking sector due to the complexity of simultaneously measuring multiple interacting variables in this sector.

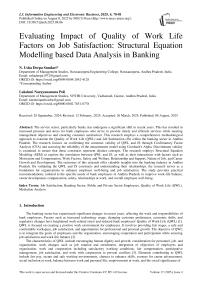

The study uses both descriptive and analytical research methods to investigate the QWL and JS of bank employees in Andhra Pradesh's four major cities. The population in this study consists of employees from private and public banks in Andhra Pradesh. A purposive sampling method (non-probabilistic) is used to select the sample. Specifically, one public and one private bank is chosen randomly from each city, and 50 employees are selected from each bank. The total sample size is 400 (50 x 8 banks), with 200 respondents from public sector banks and 200 from private sector banks. Both primary and secondary data sources are used in this study. A structured questionnaire and interviews with bank employees are used to collect the primary data. The questionnaire uses a five-point Likert scale [20] and itemized ranking questions to measure QWL and JS. The study also uses secondary data from previous articles, journals, and other published studies from the preceding ten years. To test the validity of the questionnaire, Polit's test is used to check content and criterion validity [21]. The Cronbach alpha technique [22] is used to test reliability. Finally, statistical tools such as correlation, ANOVA, t-test, regression, and factor analysis [23] are used to analyze the data. Figure 1 describes the process flow.

Fig. 1. Process flow diagram

-

3.1 Participants

-

3.2 Procedure

-

3.2.1 Confirmatory Factor Analysis

A sample population of 150 people (N=150) is considered for analysis from the information gathered from 400 people to optimize performance. Regarding gender distribution, 61.3% were male (92 individuals), while 38.7% were female (58 individuals). The age breakdown showcases a diverse spread, with 1.3% (2 individuals) being under 20, 21.3% (32 individuals) falling within the 20-30 age range, 42.7% (64 individuals) in the 31-40 bracket, 17.3% (26 individuals) aged 41-50, 12.0% (18 individuals) between 51 and 60 years, and 5.33% (8 individuals) aged 61 and above. Educational qualifications vary, with no individuals at the graduate level, 11.5% (13 individuals) at the postgraduate level, 58.6% (88 individuals) with professional qualifications, and 32.66% (49 individuals) holding a Ph.D. Current employment was divided between private banks (54%, 81 individuals) and public banks (46%, 69 individuals). Marital status ranged from 76.7% (115 individuals) being married, 20% (30 individuals) unmarried, 3.3% (5 individuals) as widow/er, and 0% divorcee. The distribution of work experience included 15.3% (23 individuals) with 1-2 years, 49.3% (74 individuals) with 2-4 years, 22.6% (34 individuals) with 4-6 years, 8.4% (13 individuals) with 6-8 years, and 4% (6 individuals) with more than 8 years. In terms of monthly income, 2% (3 individuals) fell within the 10,000 – 30,000 range, 14.7% (22 individuals) between 30,001 and 50,000, 22% (33 individuals) from 50,001 to 70,000, 28.7% (43 individuals) between 70,001 and 80,000, 21.3% (32 individuals) from 80,001 to 90,000, and 11.3% (17 individuals) earned more than 90,000. Finally, in the context of designations, 27.3% (41 individuals) were Bank Tellers, 25.4% (38 individuals) were Probationary Officers, 10.7% (16 individuals) were Branch Managers, 21.3% (32 individuals) were Loan Officers, and 15.3% (23 individuals) served as Clerical Staff.

The partial least squares structural equation modelling (PLS SEM) methodology is employed for analysing the collected data.

Confirmatory Factor Analysis (CFA) [24] is a statistical technique used in social sciences, psychology, and other fields for assessing the validity of a measurement model. It is a subset of Structural Equation Modelling (SEM) and is specifically useful for validating theories and constructs. CFA tests whether the observed variables (indicators) accurately reflect the latent constructs they are supposed to measure. It evaluates the measurement model, which is the relationship between observed variables (indicators) and the latent variables (factors or constructs) they represent. It helps determine whether the observed variables are suitable for measuring these constructs.

This study focuses on two key concepts, QWL and JS, which are unobservable. To validate these concepts, one may use CFA (Confirmatory Factor Analysis) to assess how well the observed indicators align with and accurately represent the underlying constructs. These indicators may comprise multiple survey questions or items that capture different facets of the concepts, such as job security, work-life balance, relationships with colleagues, fulfilment, motivation, and contentment. CFA also enables assessment of the model fit and determination of whether the proposed structure fits the data well. A good model fit indicates that the observed variables are reliable and valid indicators of the latent constructs, thus confirming the validity of the research.

Moreover, the analysis is extended to SEM to investigate the relationship between QWL and JS and evaluate how well the latent constructs are interrelated. SEM includes CFA as a part of the model, allowing examination of the direct and indirect relationships between these constructs and possibly identifying mediating factors. In case the initial model does not fit well, CFA can provide insights into which indicators are not contributing effectively to the latent constructs, guiding model refinement and potentially leading to better-fitting models that more accurately represent the quality of work life and job satisfaction in the banking sector.

Confirmatory factor analysis was conducted by this study to determine if the items best described the constructs. Items with low factor loadings were removed. This is a standard and critical practice to refine the measurement model and ensure that the items in use effectively represent the constructs being investigated. This is important to ensure that the items used in a measurement model are strong and reliable indicators of the concepts being measured. If an item has a low factor loading, it may not effectively measure the latent constructs and should be removed. This process enhances the construct validity of the measurement model and results in a better model fit.

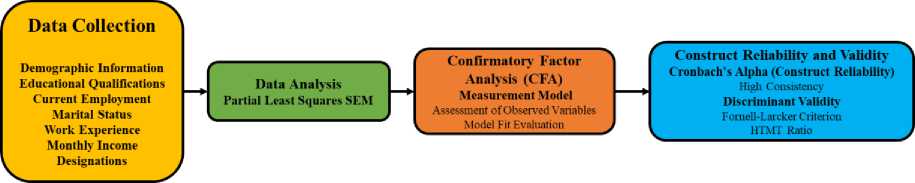

By eliminating items that don't load well, it is possible ensure that the model remains concise and conceptually clear. This reduces noise in the data analysis and minimizes the chances of erroneous conclusions or misinterpretations of the data. Additionally, removing low-loading items streamlines the data collection process, reduces respondent burden, and ultimately saves time and resources. In the current model, there are eight constructs. Organizational factors (OF) and job satisfaction (JS) represent the two endogenous constructs. Safety and welfare (SW), motivation and compensation (MC), nature of job (NJ), work factors (WF), relationship and support (RS), and career growth and development (CGD) are exogenous constructs. In the present study, CGD is also considered as a moderator between organizational factors, safety and welfare, and work factors. Figure 1 represents the measurement model using CFA containing 47 items.

3.3 Construct Reliability and Validity

3.4 Discriminant Validity

4. Findings and Results

The reliability of a construct gauges how reliably its components correlate with each other. Cronbach's alpha, a statistical tool, reveals how well the selected elements align to capture the singular underlying concept. High construct reliability means that the selected items consistently measure the latent construct. If the reliability is low, it might indicate issues with item wording, the need to remove unreliable items, or a potential problem with the overall construct definition. Construct validity is the degree to which a latent construct accurately represents the theoretical concept it is intended to measure. It is important to ensure that the construct genuinely captures what the study is supposed to do. For content validity, it is necessary to ensure that the items used to measure each construct are relevant and comprehensive in assessing the aspects of quality of work life and job satisfaction within the banking sector. This might involve expert reviews and qualitative assessments. For convergent validity, the constructs QWL and JS are assessed to check if they are distinct from each other. Low correlations between these constructs would indicate discriminant validity. Establishing construct validity ensures that your measurements accurately represent the theoretical concepts you are investigating. If construct validity is weak, it is necessary to refine the items or revisit the construct definitions.

To measure the reliability of a scale or survey items, analysts employ Cronbach's Alpha, a statistical tool gauging how strongly elements within a category (such as QWL or JS) are interconnected. A substantial Cronbach's Alpha score signals strong coherence among items, implying they reliably capture the shared essence of the construct. The statistical techniques employed in this research were t-tests, analysis of variance (ANOVA), and regression and factor analysis. These techniques help analyze the data and draw meaningful conclusions. T-tests were utilized to compare the means of two distinct groups, such as male and female employees or employees with varying levels of experience. By analyzing differences in QWL and JS between these groups, potential disparities caused by certain demographic factors that significantly affect QWL and JS in the banking sector were identified. ANOVA helped evaluate the impact of multiple factors on QWL and JS simultaneously. This allowed us to assess differences in QWL and JS among employees in different departments or branches of a bank. By examining which specific factors or groups contributed significantly to variations in QWL and JS, a more comprehensive understanding of these relationships was gained.

Regression analysis was used to identify relationships between dependent and independent variables. By examining how various factors, such as motivation and compensation, work factors, safety and welfare, and others, predict or influence QWL and JS, interventions could be prioritized accordingly. For example, changes in compensation affecting job satisfaction were assessed, providing insights into which factors have the most significant impact on QWL and JS. Factor analysis employs statistical techniques to explore the fundamental framework within a group of variables. The main objective was identifying latent constructs that could explain the relationships among observed variables. In the banking sector, factor analysis helped confirm the construct validity of QWL and JS. This helped to determine how well the observed indicators aligned with and represented these latent constructs. Factor analysis is also used to identify other unobservable factors that may have influenced QWL and JS.

The application of factor analysis provided a deeper understanding of the complexities of these constructs. It helped to identify the existence of unobservable factors that impact QWL and JS, which ultimately provided a comprehensive analysis of the relationships between various factors and the constructs of QWL and JS in the banking sector. By combining various statistical techniques, including factor analysis, a more comprehensive analysis of the relationships between different factors, demographic variables, and the constructs of QWL and JS is obtained. This approach enables making well-informed conclusions and actionable recommendations.

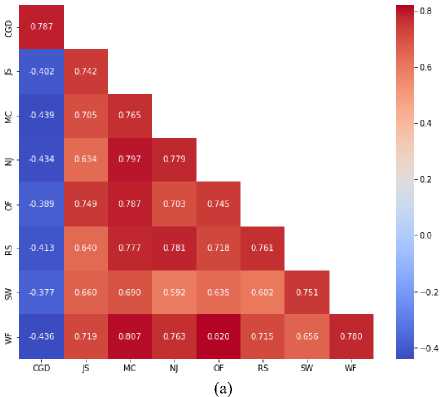

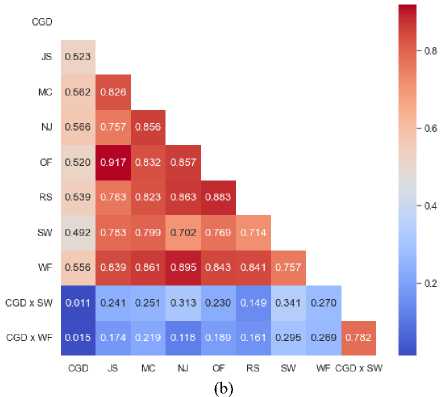

When conducting research on multiple constructs, it is essential to ensure that each construct represents a distinct concept and is not just a variation of another construct. Discriminant validity is the technique used for this purpose. The Fornell-Larcker criterion and the Heterotrait-Monotrait (HTMT) [25] ratio are frequently employed techniques for assessing distinctiveness in research. To verify discriminant validity, the Fornell-Larcker criterion contrasts the square root of the Average Variance Extracted (AVE) for each element with its correlations with other elements in the model. If the square root of the AVE for a specific element exceeds its correlations with other elements, it fulfills the Fornell-Larcker criterion, signifying discriminant validity. The HTMT ratio, on the other hand, compares the correlations between different constructs to the correlations between items measuring the same construct. A small HTMT value (usually under 0.85) indicates clear separation between constructs, whereas a large value may signify problems with how different constructs are distinguished. Following Fornell and Larcker's advice, to ensure that constructs are distinct, the diagonal components of the square root of AVE for each construct should surpass the related correlation coefficients.

This investigation utilizes the Fornell-Larcker criterion and HTMT ratio to evaluate the distinctness between various elements, like QWL and JS, within the banking industry. To confirm the uniqueness of QWL, its square root of AVE is compared against its relationships with other factors like Job Satisfaction, Present Employer, and Experience. When the square root of QWL's AVE surpasses its associations with other elements, it fulfills the Fornell-Larcker criterion, signifying its distinct identity. Similarly, discriminant validity for job satisfaction was assessed by comparing its AVE with its correlations with other constructs, ensuring that it was separate from other variables in the model.

Based on the confirmatory factor analysis, figure 2 displays the measurement model. Out of the 47 items, five items did not meet the threshold of 0.708 for outer loading, and hence were removed from the model. These items are OF3, MC4, WF6, CGD1, and CGD3. Despite some items having outer loading less than 0.708, they are still included in the model as they contribute to the standard AVE of 0.50. All the constructs in the model are reflective in nature, and their AVE is above 0.50.

Fig. 2. CFA measurement model

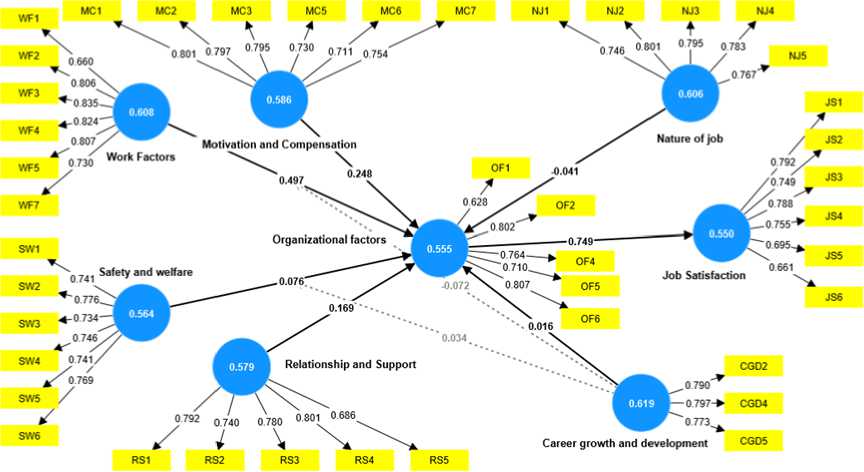

The next step involves evaluating the convergent validity and composite reliability. Convergent validity is said to be achieved when multiple components combine to measure the same concept [26]. This was determined by assessing factor loading values, composite reliability (CR), and AVE. Ideally, factor loadings should be greater than 0.7, although the usual value of 0.6 is also acceptable [27]. In addition, the CR value of a construct should be higher than 0.7. Lastly, the AVE should be greater than 0.5.

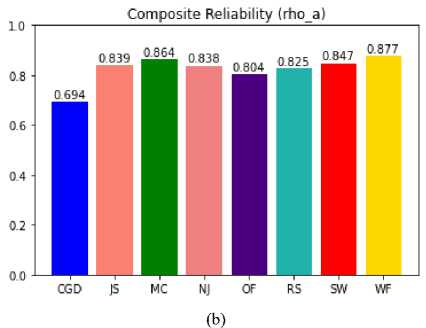

Figure 3 provides the values of Cronbach's Alpha, rho_A, Composite Reliability (rho_C), and Average Variance Extracted. All the constructs meet the threshold limit of 0.70, except Career Growth and Development's alpha value of 0.693 and rho_a value of 0.694, which is still acceptable and retained in the model. In Smart PLS, all constructs meet the standard threshold of rho_a (0.70), and the AVE of all constructs is greater than 0.50. Career Growth and Development has the highest AVE (0.619), while Job Satisfaction has the lowest AVE (0.550).

(a)

(d)

(c)

Fig. 3. Representation of (a) Croanbach’s alpha (b) rho_a, (c) rho_c and (d) AVE of different constructs

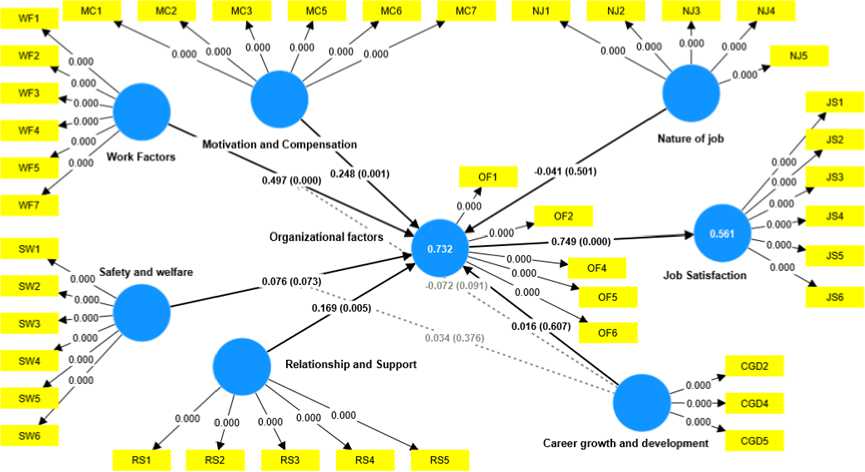

After confirming the reliability and validity of the results through confirmatory factor analysis, this study employed structural equation modelling to examine the impact of Safety and Welfare, Motivation and Compensation, Relation and Support, Nature of Job, Work Factors, and Career Growth and Development on Job Satisfaction. Table 1 provides the current research structural model. In this model, R2 represents the expected latent variable and the endogenous variable. For the dependent variable Job Satisfaction, R2 is 0.561 and the adjusted R2 is 0.560. This indicates that Organizational Factors can predict 56.1% of the endogenous variable Job Satisfaction. For the dependent variable Organizational Factors, R2 is 0.732 and the adjusted R2 is 0.528. This shows that all the exogenous constructs together can predict 73.2% of the endogenous variable Organizational Factors.

Table 1. R2 and adjusted R2

|

R-square |

R-square adjusted |

|

|

Job Satisfaction |

0.561 |

0.560 |

|

Organizational factors |

0.732 |

0.728 |

Table 2 demonstrates the sample's ability to predict outcomes beyond models. Q²predict is a measure of predictive relevance that indicates how well a model predicts the observed data. PLS-SEM_RMSE and PLS-SEM_MAE are the root mean square error and mean absolute error, respectively, for the PLS-SEM (Partial Least Squares Structural Equation Modeling) method. LM_RMSE and LM_MAE are the corresponding values for the LM (linear model) method. All Q2 predict values are greater than zero, which indicates the construct's strongest ability to predict outcomes outside of models. These values range from range from 0.231 to 0.458.

Table 2. PLS predict Q2 statistics

|

Q²predict |

PLS-SEM_RMSE |

PLS-SEM_MAE |

LM_RMSE |

LM_MAE |

|

|

JS1 |

0.323 |

0.952 |

0.751 |

0.982 |

0.745 |

|

JS2 |

0.329 |

0.856 |

0.668 |

0.873 |

0.674 |

|

JS3 |

0.369 |

0.884 |

0.687 |

0.89 |

0.686 |

|

JS4 |

0.317 |

0.919 |

0.703 |

0.845 |

0.636 |

|

JS5 |

0.271 |

0.891 |

0.694 |

0.899 |

0.69 |

|

JS6 |

0.231 |

0.871 |

0.669 |

0.921 |

0.7 |

|

OF1 |

0.267 |

0.873 |

0.678 |

0.882 |

0.679 |

|

OF2 |

0.458 |

0.779 |

0.599 |

0.817 |

0.615 |

|

OF4 |

0.437 |

0.824 |

0.632 |

0.843 |

0.641 |

|

OF5 |

0.389 |

0.821 |

0.654 |

0.822 |

0.654 |

|

OF6 |

0.423 |

0.743 |

0.574 |

0.775 |

0.597 |

The table displays various criteria to judge the quality of the model fit. It compares the saturated model (a hypothetical model with all free parameters) and the estimated model (the model under consideration). The SRMR (Standardized Root Mean Square Residual) is used to measure the difference between observed and model-implied covariance matrices, with lower values indicating that the model fits better. The d_ULS and d_G are measures of the goodness of fit, where smaller values are preferred. Chi-square is another measure of goodness-of-fit; however, in the context of PLS-SEM, it is typically less emphasized. Lastly, the NFI (Normed Fit Index) measures the relative fit of the model, with values closer to 1 indicating a better fit. The estimated model demonstrates good overall model fit based on these criteria, although the SRMR for the estimated model is slightly higher than for the saturated model. The d_ULS and d_G values are close, indicating that the model's goodness of fit is reasonable. While the chi-square value is higher for the estimated model, it is often less emphasized in PLS-SEM. The NFI, while slightly lower for the estimated model, still suggests good relative fit. The threshold limit is 0.085, and Table 3 shows that the estimated model values are 0.067, confirming that the model is fit as per the threshold limits.

Table 3. Model fit - Quality Criteria

|

Saturated model |

Estimated model |

|

|

SRMR |

0.059 |

0.067 |

|

d_ULS |

3.128 |

4.04 |

|

d_G |

1.057 |

1.092 |

|

Chi-square |

1015.32 |

1027.61 |

|

NFI |

0.943 |

0.927 |

Fig. 5. PLS Structural Equation Model

Figure 5 represents the PLS structural equation model. During the investigation, the bootstrapping option is used to calculate the t-values and statistical significance of the path coefficient. PLS-SEM was employed to assess significance through resampling and bootstrapping with 5,000 sub-samples, as suggested by Hair et al. (2016). Table 4 presents the path coefficients (Beta coefficients) and significance (p-value) of various factors towards organizational factors, including Motivation and compensation, Work factors, Safety and welfare, Relationship and support, Nature of job, Career growth and development, and Organizational factors towards Job satisfaction. It's worth noting that Career growth and development was deemed a moderator for Safety and welfare towards organizational factors and Work factors towards organizational factors.

Table 4. Path Coefficients

|

Original sample (O) |

Sample mean (M) |

Standard deviation (STDEV) |

T statistics (|O/STDEV|) |

P values |

|

|

Career growth and development -> Organizational factors |

0.016 |

0.014 |

0.031 |

0.514 |

0.607 |

|

Motivation and Compensation -> Organizational factors |

0.248 |

0.247 |

0.072 |

3.472 |

0.001 |

|

Nature of job -> Organizational factors |

-0.041 |

-0.038 |

0.06 |

0.673 |

0.501 |

|

Organizational factors -> Job Satisfaction |

0.749 |

0.751 |

0.025 |

29.776 |

0 |

|

Relationship and Support -> Organizational factors |

0.169 |

0.164 |

0.06 |

2.8 |

0.005 |

|

Safety and welfare -> Organizational factors |

0.076 |

0.077 |

0.042 |

1.793 |

0.073 |

|

Work Factors -> Organizational factors |

0.497 |

0.499 |

0.058 |

8.6 |

0 |

|

Career growth and development x Safety and welfare -> Organizational factors |

0.034 |

0.034 |

0.038 |

0.886 |

0.376 |

|

Career growth and development x Work Factors -> Organizational factors |

-0.072 |

-0.07 |

0.043 |

1.69 |

0.091 |

From table 4, it is observed that career growth and development has no significant impact on organizational factors, with a path coefficient of 0.016. Motivation and compensation have a significant positive impact on organizational factors, with a path coefficient of 0.248. The nature of the job does not significantly impact organizational factors, with a path coefficient of -0.041. Organizational factors have a very significant positive impact on job satisfaction, with a path coefficient of 0.749. Relationship and support have a significant positive impact on organizational factors, with a path coefficient of 0.169. Safety and welfare does not significantly impact organizational factors, with a path coefficient of 0.076. Work factors have a significant positive impact on organizational factors, with a path coefficient of 0.497. The combined effect of career growth and development and safety and welfare, as well as career growth and development and work factors, do not significantly impact organizational factors.

Table 4 also shows the strength of relationships between different constructs. In this study, a significance level of α = 0.05 was chosen to determine statistical significance. This level was considered appropriate for the research objectives and is commonly used in the field. The p-value less than the chosen significance level of 0.05, indicates statistical significance. The confidence interval used is 10%. The analysis reveals that there is a highly significant relationship (p=0.00) between organizational factors and job satisfaction. This indicates that organizational factors have a substantial impact on job satisfaction. A strong relationship (p=0.00) is also observed between work factors and organizational factors. In addition, motivation and compensation have a significant relationship (p=0.001) with organizational factors, suggesting that they impact organizational factors. Furthermore, the study finds a significant relationship (p=0.005) between relationship and support and organizational factors. However, safety and welfare exhibit a less significant (p=0.073) relationship with organizational factors, and work factors act as a moderator (p=0.0914) between career growth and development and organizational factors.

Table 5. Hypothesis testing results

|

S. No |

Hypothesis |

Path Coefficient |

t-value |

p-value |

Inference |

|

1 |

Career growth and development -> Organizational factors |

0.016 |

0.514 |

0.607 |

Not Supported |

|

2 |

Motivation and Compensation -> Organizational factors |

0.248 |

3.472 |

0.001 |

Supported |

|

3 |

Nature of job -> Organizational factors |

-0.041 |

0.673 |

0.501 |

Not Supported |

|

4 |

Organizational factors -> Job Satisfaction |

0.749 |

29.776 |

0 |

Supported |

|

5 |

Relationship and Support -> Organizational factors |

0.169 |

2.8 |

0.005 |

Supported |

|

6 |

Safety and welfare -> Organizational factors |

0.076 |

1.793 |

0.073 |

Supported |

|

7 |

Work Factors -> Organizational factors |

0.497 |

8.6 |

0 |

Supported |

|

8 |

Career growth and development x Safety and welfare -> Organizational factors |

0.034 |

0.886 |

0.376 |

Not Supported |

|

9 |

Career growth and development x Work Factors -> Organizational factors |

-0.072 |

1.69 |

0.091 |

Supported |

From table 5, it is observed that the research identifies certain variables with insignificant relationships. Career growth and development lack significance (p=0.607) concerning organizational factors, possibly due to variations in the provision of career growth and development across organizations. The relationship between the nature of the job and organizational factors is also insignificant (p=0.501), as organizational factors may vary across different job types. Similarly, safety and welfare do not act as a moderator between career growth and development and organizational factors (p=0.376). These findings highlight the nuanced nature of the relationships between these variables within the context of the study. The positive impact of motivation and compensation on organizational factors suggests that investing in competitive salary packages and performance-based incentives can lead to higher employee engagement and productivity. By prioritizing these factors, organizations can foster a motivated workforce essential for long-term success and overall organizational performance. This research specifically uses purposive sampling as the target employees are exclusively from the banking sector in Andhra Pradesh. This method ensures relevant insights are gathered from the employees with direct experience in the context of this study. While this may introduce some bias, a focused examination of factors that affect QWL and JS can be examined in this industry with this technique.

-

4.1 Recommendations

Based on the study, the following recommendations can help improve the work-life balance, career development opportunities, compensation and benefits, safety and welfare, relationships at work, feedback mechanisms, employee recognition, workload and job stress management, mentorship and coaching, diversity and inclusion, QWL, JS, leadership, employee assistance programs (EAPs), employee well-being, and community engagement and social responsibility of bank employees in Andhra Pradesh:

• Provide flexible work arrangements to employees.

• Offer training and development programs to enhance employee skills.

• Regularly review compensation and benefits to ensure employees are rewarded fairly.

• Create a safe and healthy work environment for employees.

• Foster a culture of collaboration, teamwork, and open communication among employees.

• Establish clear feedback channels to ensure employees' voices are heard.

• Create formal recognition programs to acknowledge employees' efforts and achievements.

• Effectively manage workload and job stress to avoid employee burnout.

• Implement mentorship and coaching programs to support employees' career growth.

• Recognize the importance of diversity and inclusion to create an inclusive work environment.

• Conduct periodic assessments of Quality of Work Life (QWL) and Job Satisfaction (JS) to improve employee well-being.

• Provide training to managers and leaders to enhance their leadership skills.

• Offer Employee Assistance Programs (EAPs) to support employees' physical and mental well-being.

• Encourage the physical and mental well-being of employees through various initiatives.

• Involve employees in community engagement and social responsibility initiatives to promote a sense of purpose.

5. Conclusion

It is important to customize these recommendations to the specific needs of bank employees in Andhra Pradesh. Regularly evaluate their impact and be open to adjusting strategies based on feedback and changing circumstances.

This study analyzes the QWL and JS of bank employees in Andhra Pradesh. A combination of research methods is used and both private and public bank employees are considered. The findings revealed that factors such as Motivation and Compensation, Work Factors, Relationship and Support, and Organizational Factors have significant positive impacts on Job Satisfaction. The critical role of organizational factors in employee satisfaction is highlighted. Career Growth and Development acted as a moderator between Organizational Factors and Safety and Welfare and between Organizational Factors and Work Factors. The research provides valuable insights into the factors affecting the Quality of Work Life and Job Satisfaction of bank employees in Andhra Pradesh and can inform HR policies and practices to enhance employee satisfaction and well-being, contributing to improved employee retention and overall organizational success within the banking industry. To enhance the well-being of bank employees, future research in the banking sector should focus on conducting longitudinal studies, comparative analysis, and sector-specific analysis. Additionally, exploring employee turnover and retention, implementing employee well-being programs, considering technological advancements, and examining job design and redesign are all important avenues for future research. Leadership styles, employee engagement, generational differences, cross-cultural studies, and the impact of external factors should also be taken into account. Stratified random sampling and other such rigorous sampling techniques can be considered for future research to validate the findings of this research. Future research can also consider a broader demographic and organizational distribution, including employees from different states or countries, to enhance the generalizability of the findings.