Experience in supporting large families: an overview of successful practices

Автор: Kalachikova O.N., Shmatova Yu.E., Razvarina I.N.

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Scientific reviews

Статья в выпуске: 1 т.18, 2025 года.

Бесплатный доступ

A new protracted wave of depopulation in Russia, caused by birth rate decline and high mortality, poses serious risks to the labor potential, economic and social development of the country. In recent years, the government has been taking active measures to raise birth rate. Taking into account the fact that the growth potential of birth rate lies in an increase in the proportion of large families, it is necessary to update effective mechanisms for regulating the number of children in families. In this regard, it is interesting to study the tools for supporting families with children implemented by foreign governments in the context of the recorded population fertility dynamics. The aim of this study is to review government measures to stimulate fertility and support large families in countries around the world. The information was derived from electronic databases of Russian and international statistics, websites of foreign governments, and scientific literature on the research topic. In the course of the work we used general scientific and empirical research methods. The analysis showed that in most countries there are no measures to support large families as a special category, and demographic policy is limited to providing women with short-term paid maternity leave and monthly childcare benefits. Most of the aid goes to poor families. Some countries provide tax and pension benefits for large families, and childcare allowances that increase with the birth of a subsequent child. The demographic and family policy being implemented in Russia is focused to a greater extent on families with children, including those with many children, which has the status of state priority. The following formats of support for families with children are of practical interest from the point of view of potential application in Russia: Polish programs “500+”, “Big family card”, “Mother 4+”; programs implemented in some oil and gas exporting countries: “Marriage bonus (loan)”, allocation of housing to a young family, opening an account for a newborn and its regular replenishment, tuition fees; “maternity leave” for men and the opportunity to use parental leave for eight years in the Nordic countries; partial or full compensation for babysitting services, including for close relatives caring for a child; payment for preschool educational institutions, vacation clubs, etc. in a number of European countries. Practical significance of the work lies in the possibility of taking into account international experience in the development of federal and regional programs to support potential and actual families with many children

Depopulation, demographic policy, family policy, large family, government support measures, fertility

Короткий адрес: https://sciup.org/147251343

IDR: 147251343 | УДК: 314.15:338.2 | DOI: 10.15838/esc.2025.1.97.14

Текст научной статьи Experience in supporting large families: an overview of successful practices

The country’s demographic development has a significant impact on the economy and social processes. Depopulation and demogra- phic aging have a negative effect on socioeconomic development and change the demographic profile, which also affects the social structure. Therefore, in the 20th century, the concept and aim of Russia’s “demographic policy” are finally formed as a purposeful activity of state authorities and other social institutions in the sphere of regulating the reproduction processes1 to ensure its expanded or at least simple mode2.

Russia’s demographic problems are standard. Most countries in the Western world have also been searching for ways to improve the demographic situation against the background of depopulation and population aging for decades (Guzzo et al., 2019). Doctor of Sciences (Philosophy), a prominent specialist in the field of institutional sociology of the family and sociological demography, professor emeritus of Moscow State University, A.I. Antonov says that it is necessary that in the family structure about half of families should have 3–4 children, and every tenth – with five or more to get out of depopulation. According to the latest All-Russian Population Census (ARPC) of 2020, 55% of families with children are raising one child, 33% are raising two children, and 12% (about 1.7 million families) are raising three or more children. Most of the latter (1.3 million) are full families, 344 thousand with only a mother, and 60 thousand with only a father. Three quarters of large families have three children, and 13.5% have four children. Deputy Prime Minister of the Russian Federation Tatyana Golikova said that 24.5 million families with children live in the country (30 million children are brought up in them) during the presentation of the Year of the Family at the International Exhibition and Forum “Russia” at the VDNKh in Moscow in January 2024. The number of large families in Russia has reached 2.3 million, increasing by 27% over the previous five years3. Thus, large families account for only 9.3% of families with children, so the issue of stimulating the growth of the share of large families and their support remains open and highly relevant.

The “family crisis” has become a significant prerequisite for the reduced reproduction. Its vivid manifestations include high divorce rates, voluntary childfree, the spread of cohabitation, the legitimization of same-gender marriage in some Western countries (Regnerus, 2012), and the problems of having and raising children in such families (Andryushina, Lutsenko, 2020). The response to the challenges of the family’s socio-cultural crisis in Russia became measures to consolidate traditional values, including the constitutional enshrinement of the concept of marriage as the union of a man and a woman (Article 72 of the Constitution of the Russian Federation, edition of July 1, 2020) and the formation of the RF state policy to preserve and strengthen traditional Russian spiritual and moral values (approved by Presidential Decree 809, dated November 9, 2022).

Despite the existence of universal values declared in the UN fundamental documents, each state offers its own methods of supporting families with children, identifies the object of support, and implements specific mechanisms (Andryushina, Lutsenko, 2020). A specific set of measures of family policy and fertility promotion policy predetermines the type of family desired by the state (who exactly takes care of the child in the postpartum period, how many children in the family) (Zhuravleva 2016). It is clear that there is a group of countries where demographic policy is unformed due to objective circumstances or political position.

Nevertheless, the pool of countries that regulate population reproduction is representative, and their experience is interesting from both scientific and practical points of view.

Research on demographic policy in the area of fertility stimulation, support for families with children and its effectiveness

The effectiveness of measures to stimulate fertility and state policies to support families with children varies from country to country depending on different factors: from historical and sociocultural aspects of family policy and the characterization of family values in different societies to the level of socio-economic development and well-being of particular countries (Andryushina, Lutsenko, 2020).

Based on a meta-analysis of scientific studies, P. MacDonald proposed his own classification of the effectiveness of fertility stimulation measures (MacDonald, 2006). He distinguished the following:

-

• the Federal Republic of Germany’s (1976) set of pronatalist measures led to a 15–20% increase in fertility over a ten-year period (1977–1987) (Buttner, Lutz, 1990);

-

• arranging childcare (more than flexible working hours) contributes to fertility (Castles, 2003);

-

• it is easier for women to decide to have a child at a younger age in cities with developed childcare assistance systems (Kravdal, 1994);

-

• fertility increases by 20% if it is possible to place older children in preschools (Kravdal, 2001);

-

• addressing work-life balance, family life, and childcare increases the likelihood of having a second and third child for women with high education levels (Baizan, 2002; Ronsen, 2004; Hoem, 2000; Olah, 2001; Rindfuss, 1996); these findings are later confirmed by studies of pronatalist policies in Japan, South Korea, and Singapore (Sun, 2012);

-

• as the income level raises, the share of those who want to have a child, increases (Lovenheim, Mumford, 2013);

-

• a 10% increase in the state child allowance leads to a 25% increase in fertility (Adkins, 2003), and a one-quarter increase contributes 4% to the total fertility rate (Gauthier, 1997).

Similar data were obtained by other demographers in Israel (Cohen et al., 2013), Canada (Blac et al., 2013), and Spain. For example, the introduction of a child allowance of 2.5 thousand euro in Spain in 2007, contributed to a 6% increase in fertility (Gonzalez, 2013), and an increase in Canada of 1,000 Canadian dollars in the first year of a child’s life increased the probability of having a child by 17% (Milligan, 2005).

Thus, there is a link between fertility rates and support for families with children. However, to maintain and strengthen the effect of the policy, it is necessary to regularly check the “application points” of the impact in relation to the problems of families with children that need to be addressed.

The authors of a large number of works emphasize the changes in the living standards of families, the increase in the risk of poverty with the appearance of another child (Arkhangelskiy et al., 2019; Bobkov, 2019; Elizarov, Sinitsa, 2019; Surinov, Kuzin, 2023). Family capital becomes a resource for solving housing problems, providing education for children (Grishina, Tsatsura, 2017; Elizarov, Dzhanaeva, 2020). This measure can be considered one of the significant measures of demographic policy proper, as its receipt is determined only by a demographic event – the birth of a child, family income does not affect its receipt.

Legal aspects of social support of large families in Russia and abroad are considered in the works of K.S. Smirnova (Smirnova, 2009). N.A. Voskolovich and I.Ch. Askhabaliev emphasize the division of support measures for large families in Russia within the framework of approved legislative and legal provisions into real (provided to the family purely by the fact of its status as a large family regardless of other conditions) and potential (for example, in case of a decline in the standard of living as a low-income family). The authors promote the idea of forming a system of real measures to support large families (Voskolovich, Askhabaliev, 2021).

The search for features and factors concerning reproductive behavior of young people and opportunities for its regulation in Russia is carried out by the staff of the Institute of Demographic Studies of the Federal Research Center of the Russian Academy of Sciences (Rostovskaya, Vasilieva, 2021). The works of scientists from Vologda Research Center of RAS (Kalachikova, Gordievskaya, 2014; Leonidova, Kalachikova, 2016; Korolenko, 2019; Ilyin et al., 2021) are devoted to the management of reproductive behavior and the evaluation of measures of state support for large families on the example of the Vologda Region. The work conducted by the research team (Rostovskaya, 2022), devoted to the assessment of the demographic behavior in the context of Russia’s national security, leads to the conclusion that the potential of having many children as the main resource for achieving the regime of simple reproduction is available and in the current situation families are increasingly implementing it under favorable conditions.

A number of works are devoted to assessing the relationship between religiosity and fertility in Russia (Kalachikova et al., 2022), including against the background of other European countries (Prutskova et al., 2023). It is likely that this factor is indirect, affecting the marriage and reproductive behavior, and the severity of the influence depends on the degree of religiosity, the strength of faith, and the observance of its canons.

Researchers from the Novosibirsk State University of Economics and Management analyzed modern family policy measures in Russia in comparison with foreign ones. The authors conclude that the variety of measures to support families with children does not ensure the achievement of the desired fertility rates, does not provide a high standard of living for families, and does not solve the problem of effective combination of parental and professional responsibilities. All this requires the development and use of differentiated regional approaches to support motherhood and childhood in Russia (Volkova, Kudayeva, 2019).

In addition, in the context of the current demographic situation, it is of particular importance to support large families as a socio-demographic phenomenon and to ensure the well-being of large families. It is worth noting that in Russia, as well as in Western European countries and the United States, families with three or more children are considered to have many children. In some European and Latin American countries, the concept of “large families” is absent in principle, but social payments to families are provided in proportion to the number of children born (Voskolovich, Askhabaliev, 2021).

The aim of our study is to review the state instruments of fertility stimulation and measures to support large families in the countries of the world to identify potentially promising ones for implementation in the Russian demographic policy.

Methodology of the research

As a preliminary step, we analyzed the total fertility rate (TFR) in the world and for different countries using data from two main sources: the website of Swedish web developers “Database. Earth”4 (data for the period 1950–2024) and the World Bank website5 (TFR for the period 1960– 2021 with the possibility to download and process the information in Excel format). These resources include data from the UN Population Division (World Population Prospects: 2022 revision); census reports and other statistical publications of national statistical offices; demographic statistics of Eurostat; and the report on population and vital statistics (various years) of the UN Statistics Division.

As an object of research, it is necessary to determine the principle of selection of countries for analysis. It is logical to consider countries with expanded reproduction of population (conditionally, their TFR is equal to or more than 2.1). However, the vast majority of them are either poor developing countries (African, Asian), or countries with strong religious traditions and/or no demographic policy or too short a period of its implementation (e.g., Kyrgyzstan, where maternity benefits were only started to be paid in 2018). We excluded such countries from the analysis. However, taking into account fertility trends in developed countries with a long history of demographic policy, countries with TFR below 2.1, which includes Russia, should be included in the analysis.

Analyzing the available statistical data, we have additionally identified a number of countries in which positive (Tab. 1) and negative dynamics of the TFR indicator was noted in relation to 1980, 1990, 2000, 2010. As we can see, only a few of them have a fertility rate above the population reproduction rate. And stable positive dynamics of the indicator for the whole period is observed only in Kazakhstan.

For further analysis of demographic and family policies, we selected countries representing four groups: those with a TFR level above or below 2.1 in the last year available for analysis (in this case, 2021) and those showing positive (at least in one time period) or negative TFR dynamics in the period under review (Tab. 2) .

The subsequent main block of analysis included three stages. The first stage analyzed the key instrument of support for families with children – maternity leave. In the late stages of pregnancy, during childbirth and the postpartum period, a woman is objectively incapable of working and needs support and medical care. This is the most sensitive period of motherhood. It is important to check whether there is a relationship between fertility parameters and the characteristics of maternity leave (duration, payment, substitute instruments/ institutions, etc.). In the second stage, we carried out a review of support measures for families with children in the four selected groups of countries according to the level and dynamics of TFR. At the third stage, we implemented a systematization

Table 1. Countries with positive dynamics of total fertility rate (per 1 woman) in 2021 in relation to 1980, 1990, 2000, 2010

|

Country |

TFR in 2021 |

Growth, % |

|||

|

by 1980 |

by 1990 |

by 2000 |

by 2010 |

||

|

Kazakhstan |

3.320 |

114.48 |

122.1 |

184.44 |

128.19 |

|

Israel |

3.000 |

92.54 |

106.2 |

101.69 |

99.01 |

|

Kyrgyzstan |

2.890 |

68.53 |

79.6 |

120.42 |

93.23 |

|

Georgia |

2.081 |

89.43 |

90.2 |

129.98 |

108.44 |

|

France |

1.830 |

98.92 |

103.4 |

96.83 |

90.15 |

|

Czech Republic |

1.830 |

87.98 |

96.3 |

159.13 |

121.19 |

|

Romania |

1.800 |

74.07 |

98.4 |

137.40 |

113.21 |

|

Denmark |

1.720 |

110.97 |

103.0 |

97.18 |

91.98 |

|

Sweden |

1.670 |

99.40 |

78.4 |

108.44 |

84.34 |

|

Slovenia |

1.640 |

77.73 |

112.3 |

130.16 |

104.46 |

|

Estonia |

1.610 |

79.70 |

78.5 |

118.38 |

93.60 |

|

Germany |

1.580 |

109.72 |

109.0 |

114.49 |

113.67 |

|

Latvia |

1.570 |

84.41 |

77.7 |

125.60 |

115.44 |

|

Switzerland |

1.520 |

98.06 |

96.2 |

101.33 |

100.00 |

|

Russia |

1.493 |

78.99 |

78.9 |

124.94 |

95.28 |

|

Belarus |

1.483 |

73.05 |

77.5 |

112.60 |

99.26 |

|

Austria |

1.480 |

89.70 |

101.4 |

108.82 |

102.78 |

|

Greece |

1.390 |

62.33 |

100.0 |

111.20 |

93.92 |

Table 2. Countries – representatives of selected groups, chosen for demographic policy analysis

|

TFR |

TFR dynamics |

Countries |

|

More than 2.1 |

Positive |

Kazakhstan, Israel |

|

Negative |

Kuwait, Saudi Arabia |

|

|

Less than 2.1 |

Positive |

Germany, France, Austria, Sweden, Greece, Slovenia, Belarus, Latvia, Georgia, Russia |

|

Negative |

Japan, South Korea, USA, UK, Italy, Spain, UAE, Australia, China, Norway, Finland, Poland |

of all possible instruments of support for families with children and critically analyzed their applicability to Russian conditions. We collected the information in electronic databases of Russian and international statistics, on the foreign government websites. The work used general scientific (literature analysis; study and generalization of information; comparison; synthesis; induction; deduction; classification) and empirical methods of research.

Research results

Maternity leave in different countries of the world as a key tool to support families with children. For the first time in the world, maternity leave was introduced in Soviet Russia on November 27 (14), 1917. The Council of People’s Commissars adopted the Decree “On Maternity Allowance”. As a result, expectant mothers and women in labor received a cash benefit equal to 100% of their wages for 56 days before and 56 days after childbirth. Employers were fined heavily for allowing women to work during maternity leave. Breastfeeding mothers were also entitled to 25–50% of their earnings for nine months after childbirth; and a break of at least half an hour every three hours. Specially equipped facilities were provided for breastfeeding the infant. A nursing mother’s working day (for nine months after childbirth) did not exceed six hours a day6.

At the beginning of 2025, paid maternity leave in Russia is 4 weeks longer and amounts to 20 weeks (70 days before and 70 days after childbirth), and in case of multiple pregnancies – 84 days before and after childbirth. The maternity allowance is 100% of the woman’s wage. From the 21st week until the child reaches 1.5 years of age, a childcare allowance is paid, 40% of the wage of the parent who will provide care. As a rule, this is the mother.

The maximum amount of childcare allowance for children up to 1.5 years of age is set annually. Based on its amount set, for example, for 2025 (68,995 rubles 48 kopecks7), the average wage of a mother or father should be slightly more than 172 thousand rubles in the last two years. In 2024, the maximum benefit amount was 49,123 rubles 12 kopecks8, and the median wage was about 62 thousand rubles, i.e. half of the working population could count on benefits from the minimum 9 thousand to 25 thousand rubles, i.e. from 50 to 70% of the subsistence minimum (17,733 rubles). Without retaining this type of allowance, there is an opportunity to continue caring for a child up to 3 years of age, while the parent will retain his or her job.

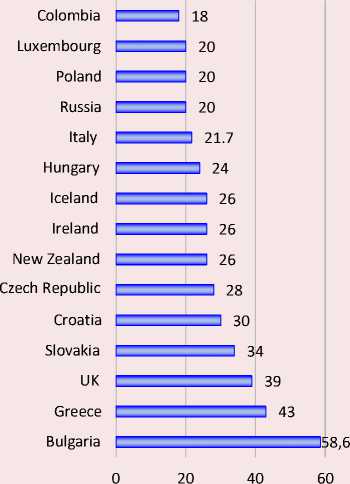

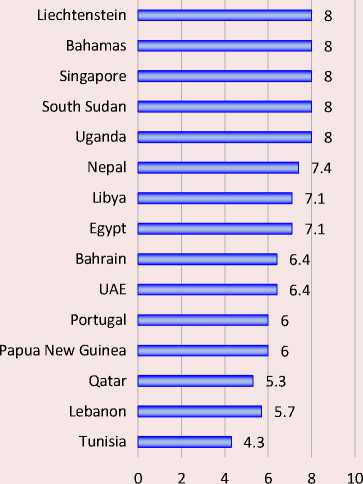

The longest maternity leave is taken in Bulgaria (58.6 weeks), Greece (43), and the United Kingdom (39). Russia shares tenth place with Poland and Luxembourg (20 weeks; Fig. 1 ). Tunisia has the shortest maternity leave among 152 countries surveyed, with only 4.3 weeks. The second and third places belong to Lebanon and Qatar (slightly more than 5 weeks).

On average, one-third of States (47 out of 152) grant women maternity leave of about 3 months (12.0–12.9 weeks), or 3.5 months (25 States – 14 weeks), or about 4 months (12 States – 18 weeks)9. In the United States, a woman has the right to leave the workplace for the birth or adoption of a child for 12 weeks.

Of the 15 countries with the longest maternity leave, only half (Bulgaria, Greece, Slovakia, Croatia, Czech Republic, Hungary, Russia) had positive dynamics of the TFR indicator in some periods of recent history.

Figure 1. Top 15 countries with longest and shortest maternity leave, weeks

According to: Paid maternity, parental and home care leave available to mothers, in weeks, 2022. Parental Leave Systems. Available at:

The longest paid total leave for childbirth and childcare is provided in Slovakia (164 weeks; Tab. 3 ), Finland (161) and Hungary (160). At the same time, we find that the total fertility rate in Slovakia has increased by a quarter in the last 20 years, in Hungary by 27% in the last 10 years, and Finland has also seen some growth in the last 5 years (from 2019 by 4%).

Estonia and Slovenia are the only countries on this list where all (82 and 52, respectively) weeks of total leave (maternity and childcare) are paid in full (100% of wages) to maternity women. It is worth noting that in both countries we observe positive changes in the TFR indicator: it increased by 30% in Slovenia and by 18% in Estonia compared to 2000.

The United States, along with countries such as the United Kingdom, New Zealand, Colombia, Malta, Malta, Cyprus, Costa Rica, the Netherlands, Spain, Turkey, Israel, Switzerland, and Mexico, do not provide paid parental leave to women who give birth at all.

We can assume that the length of maternity leave combined with a high level of wage compensation to women during this period are important in terms of regulating reproductive behavior and stimulating fertility.

Other measures to support families with children in general and families with many children in particular

I GROUP: TFR above 2.1 / Positive TFR dynamics

As we have previously noted, Kazakhstan is the only country with progressive TFR growth in the period under consideration. Despite this, scientists state that demographic policy in the country is fragmented, its goals are practically not voiced within the framework of state programs or concepts, and its implementation takes place within the framework of other directions of socioeconomic policy (Panzabekova, Khalitova, 2021). Nevertheless, the state stimulates fertility through a system of state benefits, social payments, measures

Table 3. Paid maternity, parental and home care leave available to mothers, 2022, weeks

In addition to maternity and childcare payments (up to one year), the system of social support for families in Kazakhstan provides for a progressive birth allowance (for the first, second and third child, it is 110.8 thousand tenge, for the fourth and more children – 183.8 thousand tenge), subsidization of mandatory pension contributions for women engaged in caring for a child up to one year of age in the amount of 10% of average monthly income. In 2020, a new type of allowance was introduced, which is assigned without regard to income in a differentiated amount depending on the number of children in the family (for families with 4 children it is 16.03 monthly calculation index (MCI), with 5 children – 20.04 MCI, with 6 children – 24.05 MCI, with 7 children – 28.06 MCI, with 8 and more children – 4 MCI for each child)10. There is also a state IVF program for families wishing to have children.

Israel is among the developed countries. The population has undergone a “second demographic transition” and the birth rate should be decreasing every year. However, the TFR rose from 2005 (2.842) to 2016 (3.278). There has been a steady decline only since 2019 (3.215), and in 2023, the TFR is 2.91711, which also corresponds to “expanded reproduction”. Israelis manage to contain the factors that determine the global dynamics of fertility decline against the backdrop of increased socioeconomic well-being (Sitkovskii, 2023). Scholars emphasize the following reasons for Israel’s fertility success (Haivry, 2018):

-

• Awareness of the imminent end of civilization due to low birth rates and the continuous broadcasting of this message through the media by government and media figures;

-

• cultural and historical features of Jews (combination of values of individualism and many children);

-

• High birth rate among ultra-Orthodox Jews serves as a model for less religious families;

-

• Lack of psychological attitudes toward a certain number of children;

-

• Highly developed and free infertility medicine (first place in the world in terms of treatment per capita);

-

• Child-centered culture allows single women to use assisted reproductive technologies, which is also encouraged by religious society (Sitkovskii, 2023; Haivry, 2018).

Families with at least four children in Israel are considered large families. State economic measures to support them include allowances and tax benefits.

Monthly payments for children under 18 in Israel are small, not even covering 1/10th of the cost of a child (in 2023, 167 shekels per month for the first child, 207 for the second, third and fourth, and again 167 shekels for the fifth and subsequent children12). Nevertheless, parents of five children can afford not to work, receiving child allowances and additional payments to ensure a living wage13. In ultra-Orthodox families (in which, as a rule, half of the fathers and three-quarters of the mothers work), they amount to an average of 24% of the family budget, while in the rest – 9%14. In addition, families with many children receive a one-time allowance each year (usually in August and September) to help each child prepare for school.

In addition to cash benefits, large families are entitled to substantial tax exemptions (including VAT refunds), which are the main way to equalize their financial situation. Nevertheless, having many children in Israel also leads to a decrease in the standard of living and quality of life (Sitkovskii, 2023).

II Group: TFR more than 2.1 / Negative TFR dynamics

This group includes some Gulf Arab countries as oil-exporting states with mono-industry economies but high per capita GDP and levels of social guarantees, education and health care.

In Saudi Arabia , it is customary to have large families (8–10 children). Childbirth is supported by the state in every possible way. Giving birth and raising children is considered a woman’s primary task. However, Saudi women are given only 10 weeks of fully paid maternity leave. The father can take 3 days of maternity leave. Women who have children with special developmental needs are entitled to 1 month of additional paid leave after the end of the main parental leave, as well as an additional unpaid month15. The state pays a lump sum of 3 thousand U.S. dollars to a pregnant woman and 200 U.S. dollars every month, and 300 U.S. dollars to an unemployed mother16.

Kuwait. One tenth of the government’s revenues is allocated to a special fund for future generations. Support measures are the following17:

-

1. Wedding Loan (240 thousand U.S. dollars). Only a token amount of about 20 dollars is deducted from the newlywed’s paycheck each month.

-

2. Housing loan for construction of a house up to 1 million U.S. dollars. Depending on oil prices (when they rise), the state, using its excess revenues, partially or fully pays for the population’s loans.

-

3. For the birth of a child, the state opens a regularly replenished deposit in the bank in the amount of 3 thousand U.S. dollars until the child’s adulthood.

-

4. In case the second and subsequent children reach the age of 6 years, the state doubles the amount of funds (up to 6 thousand U.S. dollars). This is justified by the high level of child mortality in the country.

-

5. If there are 5 children, each child is paid 200 U.S. dollars monthly until they start working18. And non-working mothers with many children are entitled to financial incentives in the amount of 300 U.S. dollars monthly19.

-

6. Every child has the right to free education, including in other countries at the expense of the “fund for future generations”.

-

7. Free medical care is provided, if necessary, it is in foreign clinics.

Despite active state support for families with children and high living standards of citizens, fertility in these countries is steadily declining.

-

III GROUP: TFR less than 2.1 / Positive TFR dynamics

In general, the European Union countries record a 5.5% increase in the fertility rate in 2021 (1.520) compared to 2000. Let us focus on the countries determining the favorable trend.

For children residing in Germany, parents receive allowance until the age of 18, and in case of further education – until the age of 25. The amount of child allowance is almost half of the minimum wage (for the first and second child – about 210 U.S. dollars monthly) and increases for each subsequent child. At the birth of the third child the allowance increases by 15 U.S. dollars, starting from the fourth child the monthly payment will be about 250 U.S. dollars. At the same time, the amount of income per child that is not taxed increases, as well as the amount of money for child care, education, or training. Parents can benefit from child allowances or exempt from tax the portion of income planned for children (Voskolovich, Askhabaliev, 2021).

Germany is one of the few European countries where care allowance is paid even to mothers who have never worked. We should remember that parental leave can last until the child reaches the age of three.

In addition, there are compensations for education and extracurricular activities (up to 140 U.S. dollars per month), subsidies and various social packages. For example, if you have a low financial status, you can get clothes for pregnant women and newborns20.

In France , one in five families with children is a large family (Voskolovich, Askhabaliev, 2021). They receive 46% of the total target budget allocated to families with children. The system of encouraging parents to childbearing in this country is quite diverse and complex and is characterized by special attention to families with many children.

Most family allowances in France are based on the number of children in the family, without taking into account the parents’ income. With the appearance of the second child there is an additional allowance up to the age of three, assigned to the parent regardless of their employment. There is a separate allowance for single mothers, state support for mothers who are unable to receive alimony, and others. The feature of French legislation in the field of family support is that parents with two dependent children under the age of 20 can claim family allowances, regardless of the parents’ income level. For the second child they pay 150 U.S. dollars, for the third – 250 U.S. dollars, each next child adds about 200 U.S. dollars to the family budget. At the same time, the amount of benefits increases when a child reaches the age of 14 (Voskolovich, Askhabaliev, 2021).

An important tool for supporting families with children in France are various kinds of allowances that compensate for the costs associated with paying nannies to parents who have returned to work.

For low-income families with children aged 6 to 18, an allowance is available to cover part of the high costs of starting the school year. It is paid every year in August. In 2022, the amount of assistance provided was 376.98 euro for children aged 6 to 10, 397.78 euro for children aged 11 to 14, and 411.56 euro for those aged 15 to 1821.

Another instrument of family support in France is the additional family allowances for families with three or more children. These payments are synchronized with the level of income, but only 17% of large families are deprived of them. They are paid in the amount of about 200 U.S. dollars after the third, fourth and subsequent child reaches the age of three22.

Large families receive pension benefits – an additional 10% to the basic pension for women who have raised three children and another 5% for each subsequent child, as well as pension insurance for housewives with children (for low-income families).

If a large family decides to change its place of residence, the state provides a subsidy (in the amount of 1,200 U.S. dollars) for moving23. Tax benefits are also significant in France: parents of four children are exempt from paying taxes.

Family and population policy in France is considered to be one of the most effective, which has led to an increase in the birth rate in its time.

In Austria , the amount of child benefits increases in proportion to the order of birth and the age of the child (after the age of 10)24. The amount of allowance increases arithmetically with the third and subsequent children. A gift of 3 thousand U.S. dollars is provided for each newborn child. If triplets or more children are born at the same time, this amount is paid to the family annually until the children reach the age of 16. Childcare allowances can be received not only by parents, but also by grandparents and nannies. This amount does not exceed 212 U.S. dollars per week. Schoolchild care is 15% cheaper25 .

In addition to the allowance until the age of 19 for all children, students are incentivized in Austria: up to the age of 27, university students receive additional subsidies, reducing the financial burden of parents.

Sweden confidently holds the second place in childbirth among all European countries. It happens not only due to allowances and material assistance, but rather due to a long-paid childcare leave (18 months). It can be taken in installments up to the child’s 8th birthday, and the father is obliged to spend at least 3 months with the child. Various types of social assistance and services for parents increase the comfort of motherhood and fatherhood for Swedes. The state also supports families with four or more children (payment per child is 615 euro for 4 children, 858 euro for 5 and 1101 euro for 6) (Andryushina, Lutsenko, 2020).

For a long time, Greece lacked a systematic state policy to stimulate fertility, as traditional Orthodox values were strong, with an orientation towards multi-generational, large families. However, modern research proves that the country is facing an outflow of young people as a result of the economic crisis, and those left behind are having fewer and fewer children. More than a quarter of Greece’s population is over 65 years old, and the national statistics agency Elstat predicts that by 2030 the country will be the most aging in Europe. In this regard, a separate Ministry of National Cohesion and Family was established in 2023. The aim of the new structure is to implement a long-term program to create conditions for increasing the birth rate. The new Ministry of Family Affairs will work to provide jobs for young families, provide low-interest housing, encourage fertility through higher child allowances and provide places in public kindergartens and schools.

In 2020, the Greek authorities introduced a maternity allowance of 2,000 euro. And in January 2024, its amount for the first newborn in the family was increased to 2,400 euro, the second – to 2,700 euro, the third – to 3,000 euro, the fourth and subsequent – to 3,500 euro. The announced measure of social support will affect about 300 thousand families in the next two years. The state allocates about 90 million euro for the payment of benefits this year26.

Slovenia has a family policy aimed at creating favorable conditions for both professional and family responsibilities and horizontal redistribution of income in favor of families with children. Slovenia is still one of the countries with one of the highest employment rates of mothers with young children and a small gender pay gap in the EU. The country provides benefits for parents, assistance at the birth of a child, childcare allowance, allowances for large families, additional allowance in case a parent leaves his or her job fully or partially to raise children. The amount of child allowance for a child from 3 to 12 years of age is 8–9% of the average wage in Slovenia (Andriushina, Lutsenko, 2020).

One of the parents has the right to work parttime until the child reaches the age of three. This period may be extended until the youngest child reaches the age of six if there are two or three children in the family. If there are four or more children in the family, one of the parents has the right not to work. If a child has a disability, the right to work part-time for a parent may be extended until the child reaches the age of 18. In all these cases, the employer guarantees payment for the time actually worked and insurance compensation is paid for the remaining part of the full-time work.

Since 2007, Slovenia has encouraged employers with tax incentives when they comply with “family principles at work”: 1) having flexible working hours; 2) granting leave for the adoption of a child; 3) part-time work for employees with an incapacitated family member and assistance in caring for him/her; 4) providing childcare services by the company (e.g., partial payment for babysitting), etc. (Andryushina, Lutsenko, 2020).

Slovenia provides benefits for low-income families with many children – an annual allowance for families with three or more children under the age of 18 or 26 (if the child is a full-time student), if the income per family member is below 64% of the average monthly income in the country. The amount of the allowance for families with three children is 395 euro and for families with four or more children 480 euro27.

In Belarus, the lump-sum benefit for the birth of the first child will amount to 4476.4 Belarusian rubles (more than 120 thousand Russian rubles) in 2025, and at the birth of the second and subsequent children, it is by 30% more: 6266.96 Belarusian rubles (about 170 thousand Russian rubles). Child care allowances for children under 3 years of age will also increase by 11% on average in 2025 and will amount to 861.42 Belarusian rubles (23.3 thousand Russian rubles) for the first child, 984.48 Belarusian rubles (26.7 thousand Russian rubles) for the second and subsequent children, and 1107.54 Belarusian rubles (30 thousand Russian rubles) for a disabled child28.

In 2015, the country introduced an additional measure of state support for large families – a lumpsum provision of non-cash funds (family capital) to families upon the birth or adoption of the third or subsequent children. From January 1, 2025, it amounted to 31,480 Belarusian rubles (853 thousand Russian rubles). Family capital funds are provided to families for use in the Republic of Belarus in full or by installments in a non-cash procedure in accordance with the legislation in one or more areas: improving housing conditions; receiving education; receiving medical care; purchasing goods intended for social rehabilitation and integration of disabled persons into society; receiving services in the sphere of social services; formation of accumulative (supplementary) financial support for families with many children29.

In Latvia, parents are entitled to a payment of about 500 U.S. dollars for each newborn child. Childcare allowance is calculated on the basis of salary, but you can choose the method and duration of its receipt: either until the child is one year old (in the amount of 60% of the average salary), or until the child is one and a half years old (in the amount of 43.75%). “Children’s money” is paid monthly until the child is 15 years old or until the child is 20 years old (if the child is studying but has not had time to marry). The payment increases in proportion to the order of birth. However, the amount does not change after the fourth child. The age of older children does not affect the amount of allowance for the next child, even if they have grown up and become parents themselves. For large families, payments are made for each child from 1 year to 20 years of age30.

The impact on mentality, on value orientations has shown its effectiveness in Georgia by the example of the so-called “Georgian demographic miracle”. When Patriarch Ilia II publicly stated that he was ready to personally baptize every third Georgian child, the birth rate in the country increased by more than 25% and the number of abortions was halved31. The patriarch has over 40,000 godchildren32.

In September 2021, the Mortgage Loan Subsidy Program for Large Families was launched in Georgia33. It provides a subsidy for interest accrued on mortgage loans taken out by large families and families with newborns, single or widowed parents for 60 months after the loan is issued. Within a year after the birth of a child, a family can apply to a bank, take out a mortgage loan and buy a new apartment or secondary housing, or build a private house.

From January 1, 2023, every third and subsequent newborn in Georgia will be provided with a lump sum of 1,000 GEL34. School teachers will receive full salary during maternity and postnatal leave. From 2025, the Georgian authorities plan to start financing artificial insemination procedures for everyone.

Systematizing the key support measures for families with children in Russia , based on current

Russian legislation35, as well as information from the Russian Ministry of Labor, the Federal Tax Service, the FIS and the state services portal, we can distinguish two groups of benefits and payments for children: lump-sum and monthly. The former include:

– birth allowance;

– maternity (family) capital (associated with it is a monthly payment in connection with the birth (adoption) of a child until the child reaches the age of 3 years, which is paid from the maternal capital funds);

– temporary disability allowance for child care;

– allowance when a child is placed in foster care;

– pregnancy allowance for the wife of an active-duty soldier.

The second group consists of:

– maternity allowance;

– lump-sum allowance at the birth of a child.

This type of benefit is available to families residing in the country, regardless of income level and number of children;

– child care allowance for children up to 1.5 years of age;

– single allowance for children under 17 and for pregnant women;

– payment in connection with the birth (adoption) of the first child;

– allowance for the child of a serviceman performing conscripted military service;

– allowance for non-working able-bodied persons caring for a disabled child under the age of 18 or a disabled person from childhood of group I36.

Table 4. Basic child benefit amounts in 2024 and for 2025

Benefit 2024 2025 Maternal capital For the first child 630380.78 rubles 690266.95 rubles For the second child 833024.94 rubles 912162.09 rubles Additional payment for the second child to those who received maternity capital for the first child 202643.96 rubles 221895.14 rubles Lump-sum benefits for children At the birth or adoption of a child 24604.30 rubles 26941.71 rubles When adopting a child 8 years of age or older, a disabled child, or multiple sibling children 187996.90 rubles 205856.61 rubles Pregnant wife of a conscripted serviceman 38.963.37 rubles 24665.0 rubles Monthly allowances for children Child care up to 1.5 years for non-working parents From 9227.94 to 18454.48 rubles From 10103.83 to 18454.48 rubles For the child of an enlisted serviceman 16698.63 rubles 18285.0 rubles Source: SFR website, Available at: https: ; KonsultantPlus, Available at:

Table 4 shows the amount of basic child benefits.

Russia has the following mechanisms of assistance to families with three or more children according to Presidential Decree 63, dated January 23, 2024, “On measures of social support for large families”37:

– families with three or more children are entitled to a free land plot or its monetary compensation;

-

– pension benefits: moms of three children retire at 57, four at 56, and five or more at 50;

-

– for a family with many children, the state is prepared to repay 450,000 rubles of mortgage debt;

-

– provides for an increase in the standard tax deduction for the third and subsequent children more (3,000 rubles);

-

– in addition to the general property tax deduction, large families are entitled to an additional deduction based on the number of children, for which an application should be submitted as for tax benefits;

-

– if a large family has a plot of land, the land tax should be paid not on the entire area, but less six acres;

-

– a parent of three children under the age of 12 may take vacation at any time, even against an approved schedule.

In addition to federal state support programs, there are allowances and subsidies at the regional level, such as free meals at school, free school uniforms or compensation for their purchase once every two years, subsidies for utility bills, exemption from transport tax, discounts on parking fees, free travel on public transport, benefits when visiting theaters and museums.

-

I V GROUP: TFR less than 2.1 / Negative TFR dynamics

Japan has an extremely low fertility rate of 1.39 children per woman. Specialists attribute this to the lack of state support, which, in turn, is due to the matrimonial culture of the country (Streltsov, 2007).

For instance, maternity leave of 14 weeks is provided with 60% of the mother’s previous salary, and nursing leave – 40%. At the same time, 30% will be paid directly during the leave, and the remaining amount – within 6 months after the mother returns to the workplace. It is only possible to receive a leave allowance if both parents are fully employed before the maternity leave. Temporary workers (even if it is the father) who work part-time are not entitled to benefits. At the same time, the specifics of the labor market in Japan are such that most often such a worker is a woman with a grownup child, which reduces the motivation to have a second child (Novikova, 2013).

For the birth of the third and subsequent child, the amount of the lump-sum benefit increases by more than 1.5 times compared to the first and second child38. In 2022, the Government of Japan decided to start paying a birth allowance of 100,000 yen to pregnant women39. In April 2023, it was increased from 420,000 to 500,000 yen40.

Japan’s parliament passed a bill to revise the law on child-rearing allowances in the summer of 2024. It was decided to abolish income limits on child allowances and extended the period of child allowances until the child reaches the age of 1841.

Only one in four Japanese families has a child, and more than 30% of children in orphanages are “abandoned”. Adoption is extremely uncommon in Japan42.

South Korea’s total fertility rate continued declining in 2022, decreasing by a further 0.03 to 0.78 (i.e., an average of 7–8 children per 10 Korean women) according to statistics this was the lowest among all developed countries in the Organization for Economic Cooperation and Development43.

The South Korean government is expanding financial incentives to increase the country’s birth rate. One of the country’s main birth benefits is the “childbirth and parenting allowance”. The amount of the payment depends on the number of children in the family and the parents’ income. Families are usually paid a one-time allowance, but there are also monthly payments for a year after birth. The amount of allowances depends on the family income and the number of children. For example, a child born in 2024 can receive a total of 29.6 million won (about 22,100 U.S. dollars) in cash support within eight years of birth. The financial support includes a lump-sum payment of 2 million won to parents at the birth of a child. The second child receives 3 million won, up 1 million won from last year44.

In addition, there are several other allowances in Korea to support families with children, such as college tuition allowance for children under 18 and secondary vocational education allowance for children under the age of 24. Their amount also depends on the family’s income.

The USA has no unified system of social support for families, subsidies can be received from the state, private companies, charitable organizations and the church. Parents are supported only by tax benefits (about 100 U.S. dollars). Everything else falls on the shoulders of the family budget. The state helps low-income families with food stamps, reduced-price housing, utility subsidies, limited medical care, priority for a place in free kindergarten, and family planning counseling. Public and private organizations can offer a range of services such as childcare, legal, psychological, educational and employment assistance for parents45.

The United Kingdom has a number of tools of financial and material assistance to families with children, tax benefits (presented on the government website46), which depend on the employment of the mother before pregnancy and the amount of total family income. Some categories of moms can be paid Start Maternity Grant, about 800 U.S. dollars at the birth of the first child. The size of “child” allowances is inversely proportional to the order of birth. There are food packages for pregnant women (up to 18 years old) and children up to 4 years old from low-income families. During pregnancy and until the child is a year old, the mother is entitled to free dental treatment. Also, part of the cost of attending kindergarten (up to 350 U.S. dollars a month) can be written off from the taxes paid by one of the parents. At the same time, they may also pay part of the cost of attending children’s clubs where children go during vacations47.

Caring for a child up to 12 years of age, if a woman does not work and devotes herself to her family, is included in the working record and is taken into account when calculating the pension. If the mother decides to work, then her position is retained for six months after childbirth, after 11 months they can offer another position in the same company, after a year the reserve of the workplace expires.

The UK government is working on new assistance programs to help offset up to 3,000 U.S. dollars of child costs per year with “child” vouchers, various compensation schemes48.

In Italy , the declining birth rate is a major concern for the state, as the current fertility rate is only 1.30149. The average age of “first-time” moms in Italy is 31, the highest in Europe. The main reason why women in Italy have no children is because they are financially unprepared to raise a child, as the government does not help pay for the cost of children50.

In Spain , motherhood is also expensive and is almost entirely the responsibility of the family. For this reason, there is a demographic decline among the indigenous population. It is only possible to give birth and raise a child without a drastic reduction in income if both parents are highly paid professionals. Childbirth allowance (1,650 euro) and childcare allowance (16 weeks, 200 euro per month) are only available to mothers who have been employed before the maternity. The child allowance is about 1% of the average wage in Spain (Andriushina, Lutsenko, 2020).

If the mother did not work or her income in the previous two years did not exceed a certain amount, there is no payment. Up to three years old children are entitled to about 60 U.S. dollars a month from the state, and if the mother decided to combine child care and full-time work, then plus another 115 U.S. dollars51. At the same time, attendance at kindergarten is three times more expensive. After the age of three, the state helps only single mothers: about 800 U.S. dollars a year until the child reaches the age of 652.

Let us consider a number of countries from this group with low fertility rates and negative fertility dynamics, but having, in our opinion, noteworthy family and demographic policy instruments that have demonstrated positive effects in certain periods in the past and may do so in the future.

The United Arab Emirates (UAE), one of the rich oil-producing countries with strong Muslim traditions, fell into this group. Only every third resident of this country is its citizen (only a child born to two citizens of this country can become a citizen) and has the right to enjoy all the benefits of social policy. Huge revenues from the oil and gas industry allow the state to pursue an active and generous demographic policy, encouraging potential parents to procreate with the following programs53.

-

1. All citizens planning to get married are given an interest-free loan from the UAE Marriage Fund (about 20 thousand U.S. dollars). It is automatically repaid by the state at the birth of the first-born child.

-

2. Parents are entitled from 50 thousand (for a newborn daughter) to 200 thousand U.S. dollars (for a son), and if it is necessary, it is given a small villa.

-

3. Opening of a newborn’s account and its regular replenishment at the expense of the state. As a result, about 100 thousand U.S. dollars is accumulated in the account by the child’s adulthood.

-

4. For infant care, UAE nationals working in private companies are entitled to a monthly allowance ranging from AED 800 to AED 3,20054.

Nevertheless, about 15% of citizens do not take advantage of interest-free loans and free houses due to a fairly high level of family income.

Maternity leave is unavailable in the UAE.

Each student who chooses to study abroad is paid a scholarship three times higher than ordinary students, and the graduate is entitled to a substantial payment (13 thousand U.S. dollars). Medicine and education in this country are free of charge. There are scholarships for UAE citizens55.

However, despite the national super incomes, high development level of the healthcare and education system and all the measures offered by the state to stimulate fertility, the citizens’ reproductive attitudes are changing for the worse. The TFR decreased progressively (by 3 times) from 1980 (5.30) to 2024 (1.46).

Australia has several active government support programs for families with children56:

At the birth of a child there is a lump sum payment of 4,000 Australian (3,000 U.S.) dollars, at the birth of triplets (and more children for one birth) parents the above payment is made annually until the 16th birthday of the twins;

-

• “Baby Bonus” – to help families after the birth or adoption of a child;

-

• family tax benefits (Family Tax Benefit program);

-

• Child Care Benefit (CCB) – helps pay for the cost of child care services (full-day kindergartens, family child care, before- and after-school care, vacation care; services provided by grandparents, relatives, friends, and babysitters (Andriu-shina, Lutsenko, 2020);

-

• Child Care Rebate, which covers half of the cost of approved services (educational, medical, etc.);

-

• Jobs, Education and Training (JET) Child Care fee assistance subsidy;

-

• Benefits for large families are paid only to families with four or more children as of July 1, 201557.

In China, the “One Family, One Child” policy began in 1974, with severe fines (of 4–8 salaries), forced abortion. A second child was allowed if the first girl was born in families from rural areas where both parents were only children. As a result, there is a pronounced gender disproportion (33 million more men than women) and the share of pensioners will amount to a quarter of the population in a few years. The sanctions program was abolished in 2015, and fines were retained for the birth of the third and subsequent children. However, the positive effect of the abolition of penalties was short-lived and lasted only a couple of years: the birth rate continued to fall and, for example, at the end of 2020, the number of births fell by 20% to 12 million newborns (the lowest figure since 1961)58. The Chinese have adopted a one-child mindset over the previous 35 years.

By allowing the younger generation to have a third child in 2021, the government has developed a number of additional “incentives” that could increase the country’s birth rate:

-

1) lump-sum allowance for the birth of a second child up to 2 thousand U.S. dollars;

-

2) large families are provided with express registration at the place of residence, enrollment of children in kindergartens, schools and universities, and when applying for a job;

-

3) the Government will consider granting a tax deduction for expenses for the maintenance of children up to the age of three;

-

4) when providing social housing, the number of minor children in the family is taken into account;

-

5) the share of expenditures on the provision of education at school has been revised, taking into account the number of children in the family, and control over pricing for educational services has been strengthened59.

In addition, the authorities introduced a ban on abortion. Nevertheless, despite all the measures taken, China’s population is declining for the second year in a row60. Demographers at Tsinghua University predict that in the next five years the rate of population decline in China will increase, and this process will noticeably accelerate by 2050. By the end of this century, China’s population will be below 800 million people, and its share of the global population will fall from the current 19% to around 7%. China will no longer be the world’s most populous country, falling to the third position after India and Nigeria61.

Norway has the following support measures for families with children:

-

1. Parents receive 150 U.S dollars per month for each child (up to the age of 18). Additional supplementary payments are provided for living in northern regions62.

-

2. An unemployed mother at the birth of a child receives a lump-sum payment of about 5 thousand U.S. dollars, and an employed mother (and such in Norway is the majority, as the age of the first birth is approaching 30 years) – depending on the total family income. For the next forty-two weeks, they receive full wage reimbursement. Alternatively, they are offered 80% of their wages, but for one year (Andryushina, Lutsenko, 2020).

-

3. Women are also provided with free medical care.

-

4. When a child reaches one year of age, he or she is allocated a place in a kindergarten. Parents who do not receive it are compensated for the care of the baby with a monthly payment (about 560 U.S. dollars). If the child enters kindergarten or reaches the age of three, the payments are stopped.

-

5. Maternity leave is provided for men. Thus, fathers can spend more time with their spouses and children63.

-

6. A woman is entitled to pension savings for each child born (Andryushina, Lutsenko, 2020).

We should say that free education and medical services are provided to all citizens in Norway.

Finland is a country that ranks right at the top two places in the world rankings of motherhood and childhood: in terms of convenience for mothers and the number of happy schoolchildren.

According to the Finnish Social Security website64, parental allowance for one child is paid for a total of 320 working days. However, if there are two parents, each parent can receive parental allowance for 160 working days. Approximately 70% of Finnish fathers take advantage of this opportunity. Fathers are also entitled to a separate small allowance for fathers who live together with mom and child. It is possible to give up to 63 working days of the quota of 160 days of parental allowance to another person who takes care of the child. One can also divide the parental allowance into even shorter periods or individual days, but use it during the first two years of the child’s life. If more than one child is born or adopted at the same time, you are entitled to an additional parental allowance for 84 working days for the second and each subsequent child. The rate of the allowance ranges from 311 euro to 105 euro per day, depending on income and salary. The tax-free child allowance for children up to the age of 17 increases as the family grows (94.88 euro for the first child, 104.84 euro for the second, 133.79 euro for the third, 173.24 euro for the fourth and 192.69 euro for the fifth and subsequent children)65.

In addition to financial incentives, the state offers a “maternity package” (a box of quality clothing and care products). Instead of it, it is possible to choose a monetary compensation of 170 euro. It is necessary to start visiting a gynecologist in the first 4 months of pregnancy to receive the box. Moreover, free baby rooms with babysitters in public places and equipped facilities for breast milk decanting at work are widespread in Finland.

Poland was out of the group of countries with positive ten-year dynamics of the RMS indicator. But it is worth mentioning that the country experienced a 13% increase in fertility rate in the periods 2003–2010 (from 1.23 to 1.41) and 2013–2017 (from 1.29 to 1.47). Serious measures to support families with children have played an important role66.

-

1. With the birth of a third child, the family’s mortgage debt is completely waived.

-

2. The “500+” program allows parents who decide to have a second and further child to expect an increase of 500 PLN (about 145 U.S. dollars) every month until the age of 18. The same allowance can be received for the first child if the income per family member does not exceed 200 U.S. dollars. The payments are tax-free and indexed according to inflation. Thus, it is possible to count on 30,000 U.S. dollars or more by the child’s 18th birthday67.

-

3. The tax benefit68 applies to each child up to the age of 18 or up to the age of 25 (if they are studying and their income does not exceed PLN 3,089) and is calculated based on the results of the annual tax return. The benefit is aimed at supporting families with many children. From the third child in the family the amount to be deducted increases. After the birth of the second child, the income from which the benefit can be deducted is not limited.

-

4. The “Big Family Card” is not cash assistance, but authorization to use discounts for families with three or more children. It is offered by public institutions and private companies (movie theaters, stores, banks). As a rule, these are discounts in the range of 7–10%. They include the use of rail transport, visits to museums, sports centers, hotels, tourist excursions, language school courses and shopping in retail chains69.

-

5. Allowance for hiring a nanny. It can be used by parents of children aged 20 weeks to three years who are not on maternity, paternity or teaching leave, regardless of the family’s living situation. The assistance consists in compensating the nanny’s services (not more than 50% of her minimum wage)70.

-

6. Since March 2022, the “Mama 4 plus” project has been in force in Poland, which guarantees women who have given birth to and raised four children a pension of PLN 1,000 upon reaching the age of 60 (provided that the woman does not work and has no other sources of income)71.

Having analyzed the experience of various countries in supporting families with children, including large families, we have summarized the obtained material and presented it in Table 5 .

Conclusion

Thus, it is possible to identify a wide range of financial and organizational instruments to stimulate fertility and support large families in various countries. However, taking into account the reduction practically all over the world of the indicator of children born per woman of fertile age, there are doubts about their effectiveness.

Measures of targeted support for large families are identified only in one third of the reviewed countries. The most developed policy in this area is implemented in Poland, Slovenia and France.

The study shows that Russia has the widest range of support measures for large families. However, there is a possibility of their refinement and revision. Most demographers rightly believe that modern family and demographic policy should be supplemented with a number of strategic measures in the sphere of work specifically with young people (up to 20–25 years old), including students, encouraging them to create a strong prosperous young family that will have time to give birth to three or more children (Andryushina, Lutsenko, 2020; Rostovskaya, 2022; Rostovskaya et al., 2023a; Rostovskaya et al., 2023b). In addition, they need to be updated, modified to maintain the effects of the implemented measures, since the new soon enough becomes commonplace and ceases to play the role of a motivator.

In our opinion, the following measures of support for large families in foreign countries deserve attention.

The prestige of large families and the “fashion of having many children” are elements of the necessary new “normality”, which is based on confidence in the future well-being of born children. Taking into account the experience of European countries, this will be facilitated by the transition from the use of tools to increase the birth rate to a wider implementation of measures of real and direct state support for each child before he or she enters adulthood. One striking example is the opening of an account, which is replenished by the state, for each newborn child.

Institutionally, family and demographic policy should be developed and implemented by competent structures, such as specialized ministries. Such a ministry has recently been established in Greece, and there is similar experience in the Republic of Bashkortostan, where the Ministry of Family, Labor and Social Protection has been created (Voskolovich, Askhabaliev, 2021).

Table 5. Fertility incentives and family policies around the world

|

> |

PUB|Od |

>• CD CD ^ 5 E GO О CO CD = CO co CD s |

4- |

4- |

4- |

4- |

||||||||

|

PUB|UH |

4- |

4- |

4- |

4- |

4- |

|||||||||

|

Xemjon |

4- |

4- |

4- |

4- |

4- |

|||||||||

|

eu^O |

4- |

|||||||||||||

|

EI|EJlSnV |

4- |

4- |

4- |

4- |

||||||||||

|

avn |

4- |

4- |

4- |

4- |

4- |

|||||||||

|

u|Eds |

||||||||||||||

|

Л|ЕЦ |

||||||||||||||

|

шорби!» рации |

4- |

4- |

4- |

4- |

||||||||||

|

vsn |

||||||||||||||

|

EBJO» ЩП05 |

4- |

4- |

4- |

4- |

||||||||||

|

UEdEf |

4- |

|||||||||||||

|

= |

ElSSny |

4- |

4- |

4- |

4- |

4- |

4- |

|||||||

|

EiBjoag |

4- |

4- |

||||||||||||

|

Е!Л1Ё-| |

4- |

4- |

4- |

|||||||||||

|

snjEieg |

4- |

4- |

4- |

|||||||||||

|

eiubaois |

4- |

4- |

4- |

4- |

4- |

|||||||||

|

eoeejg |

4- |

4- |

4- |

|||||||||||

|

иэрэмд |

4- |

4- |

4- |

|||||||||||

|

EiJisnv |

4- |

4- |

||||||||||||

|

aouEjg |

4- |

4- |

4- |

4- |

||||||||||

|

Лившиеэ |

4- |

4- |

4- |

|||||||||||

|

= |

ЦЕМП» |

4- |

4- |

4- |

4- |

4- |

||||||||

|

eiqeuv !Pnes |

4- |

4- |

4- |

4- |

4- |

4- |

4- |

|||||||

|

— |

|9EJS| |

4- |

4- |

4- |

4- |

|||||||||

|

UE1SP>|EZE)| |

4- |

4- |

4- |

4- |

||||||||||

|

co CD оз CD S |

^ CD CO 03 "о co F 1 |

CO § s £ = 2 03 |

О S o 03 CO О Л в S' CD s— CO "5 ° S’ q, E CD .^ co co s S ^ o. cd О co ^ |

CD 00 s E E co — E oo |

CD 00 s E Q_ ~ E °? E та о та —1 оз |

s E f s S1 co "cd CD CO |

CO "cd CD CD "co |

s "co CD o "^ — s -^ To 1 Ё |

CO co ^—, к s “ I ° co EL |

CO CO CD E co 1 ° co В Id co CD Sz? О TO U_ CD |

S CO E S CD ~ E £ о cd _q та _E "та "cd — \ CD та E о о 03 co ° та _ 55 co 35 E S.o S о ™ |

CO I ^ cd "B O ^ = Ё Ё -E3 В # 1 ^ C CD CD ^- CO s— CO —5 .E E S ~ 'cd та о oc cd |

||

Continuation of Table 5

|

PUB|Od |

4- |

4- |

|||||||||||||

|

PUB|UH |

4- |

4- |

|||||||||||||

|

Xemjon |

4- |

4- |

|||||||||||||

|

eu^O |

|||||||||||||||

|

EI|EJlSnV |

4- |

||||||||||||||

|

> |

avn |

4- |

4- |

4- |

|||||||||||

|

u|Eds |

|||||||||||||||

|

Л|ЕЦ |

|||||||||||||||

|

шорби!» рации |

4- |

4- |

4- |

||||||||||||

|

vsn |

4- |

4- |

|||||||||||||

|

EBJO» L|inOS |

4- |

4- |

|||||||||||||

|

UEdEf |

4- |

||||||||||||||

|

ElSSny |

4- |

4- |

4- |

4- |

4- |

4- |

4- |

4- |

|||||||

|

EIBjOSQ |

4- |

CO .2? Ё TO CD ст TO 0 co CD 3 co TO CD E 0 Q. Q. 3 СЛ |

4- |

||||||||||||

|

Е!Л1Ё-| |

4- |

||||||||||||||

|

snjEiag |

4- |

4- |

|||||||||||||

|

= |

eiubaois |

4- |

4- |

4- |

4- |

4- |

|||||||||

|

eoeejg |

4- |

||||||||||||||

|

иэрэмд |

4- |

4- |

|||||||||||||

|

EiJisnv |

4- |

4- |

|||||||||||||

|

aouEjg |

4- |

4- |

4- |

||||||||||||

|

AuEUjag |

4- |

4- |

|||||||||||||

|

ЦЕМП» |

4- |

4- |

4- |

||||||||||||

|

EiqEJv ipnes |

4- |

||||||||||||||

|

|9EJS| |

4- |

4- |

4- |

4- |

|||||||||||

|

UElSq^EZE» |

4- |

4- |

4- |

4- |

|||||||||||

|

co CD оз CD S |

4—< CO TO CD 03 -TO co 03 CD CD TO CD CD -TO E Г TO CD ч— TO cD "то to TO E TO 4— £ c 0 g ra CD TO CD CD О >> L± ^ ^ |

TO a? CD s "s E CD CD E CD О ii 5 |

co Ф CD X p |

CO 9? Ё TO CD E i |

co TO CD E -TO "to a |

CD C CO CD--"s— _£Z -0 CD _^ TO Q CD "2 E TO g CD ^ CD ^ ° ф to c E ° c ^ 0 ™ 0 TO g co g E "to CD _ CD 0 Q- |

CO co co .5? co TO ^ |

CD TO X co Z3 1 ^ 0 TO a 0 |

"to s' CD TO ^ |

CD TO CD CD |

Ш E TO CD CD CD U_ |

TO 09 "to to 03 E ? TO Q. CO 5 g ® H ~ ° g CD .TO TO ^ C TO--CD CD _O CO О CD -g -E ^ CO |

CO TO ^ CD CD E E CD >ч CO TO -g >1 ° то to II --CD CD CO ^ Й ® 2 TO -O |

||

End of Table 5

|

> |

PUB|Od |

4- |

4- |

4- |

4- |

|||||||||||

|

PUB|UH |

||||||||||||||||

|

Xemjon |

||||||||||||||||

|

e^O |

||||||||||||||||

|

EI|EJlSnV |

||||||||||||||||

|

avn |

||||||||||||||||

|

u|Eds |

||||||||||||||||

|

Л|ЕЦ |

||||||||||||||||

|

шорби!» рации |

||||||||||||||||

|

vsn |

||||||||||||||||

|

EBJO» mnos |

||||||||||||||||

|

UEdEf |

||||||||||||||||

|

= |

ElSSny |

4- |

4- |

4- |

4- |

4- |

4- |

4- |

4- |

4- |

4- |

4- |

||||

|

EIBjOSQ |

4- |

|||||||||||||||

|

Е!Л1Ё-| |

||||||||||||||||

|

sruEiag |

||||||||||||||||

|

eiubaois |

4- |

4- |

4- |

|||||||||||||

|

eoeejg |

||||||||||||||||

|

иэрэмд |

||||||||||||||||

|

EiJisnv |

||||||||||||||||

|

eouEjj |

4- |

4- |

4- |

|||||||||||||

|

Лившиэд |

4- |

|||||||||||||||

|

= |

ЦЕМП» |

4- |

||||||||||||||

|

eiqBJv !Pnes |

||||||||||||||||

|

— |

|9EJS| |

4- |

4- |

4- |

||||||||||||

|

UEIS^EZEJI |

||||||||||||||||

|

co CD оз CD S |

c TO 0 E 1 о ф £ E 25 c cd 2 f 0 |

CO E 03 n |

2 0 2d Ё 03 u_ |

CO Ф CD Ф E CD CD ОС |

§ co 00 0 ф 5 Ё CD — E Ё £ E |

CO Ф CD X |

О co" , CO CD TO ^ 0 " — 05 TO Ё to ^ ^ =* Ё ° E~ ст ^2 m 5 0 |

CO Ё E 03 co co ~ "cd 75 CD Ё CO 03 |

CO CD CD 05 .E to ^ co E 4 ^ -E CD CO -0 CD О CO c "О У CD ZE CD “ |

C CD CD E co CD 03 CO Q. CD 5 « 03 TO |

co CD 0 CO co co CO c E ^ « 0 O_ Ё |

Ё co TO co TO CD E CD CD U_ |

CO О ° Ё CO Ш c CD О ^ OO^

|

TO О CO E CD CO E co CD C CD О it: E |

co 0 CD TO E "to CD "aS |

|

With regard to the young family, we consider worthy of attention the measures applied in a number of Arab countries that contribute to the creation of the family base, namely the “marriage loan” or “marriage premium”, which will allow a young couple not to postpone the wedding and the official registration of the marriage. This measure is particularly effective if the loan is written off at the birth of a child, and the same loan can be aimed at solving the housing problem.

High-quality and affordable medical care and the opportunity to give children a good education are traditionally significant factors in families with children. In this regard, the issue of providing medical assistance to families with children (development of the institute of family doctors and family clinics) is acutely relevant. The experience of Germany in introducing additional educational subsidies, including for additional education for families with three or more children, and of South Korea for education at universities and colleges has been successful in increasing access to education. There may be other tools, such as the creation of a fund for vocational education of children from large families. The existing quota of budget places in higher education institutions for children from large families is a good tool, but it needs to be reconsidered in the light of the accumulated experience of its application. Scholarship support for students, especially from large families, who simultaneously (or sequentially) need to provide education for several children, including in educational organizations located outside the family’s place of residence, is of great importance.

Increasing opportunities for women to combine maternal and professional duties (which is extremely important for mothers with many children) in the form of compensation for babysitting services (including through the involvement of close relatives), which is also common in a number of countries, is, in our opinion, an effective measure to stimulate births of three or more children. In the UK childcare for a child up to 12 years of age is included in the mother’s employment record. In Russia – the first year and a half. We consider it necessary to increase this period at least for mothers with many children, who, as a rule, take care of several small children at the same time and do not have the opportunity to start a full-fledged labor activity.