Export Diversification of the Arkhangelsk Oblast’s Forestry Complex

Автор: Muraev I.G., Sushko O.P.

Журнал: Arctic and North @arctic-and-north

Рубрика: Social and economic development

Статья в выпуске: 58, 2025 года.

Бесплатный доступ

The decrease in the volume of exports of forest products from the Arkhangelsk Oblast is a significant problem for the region’s economy. This study aims to conduct a comprehensive analysis of the current situation and identify the prospects for development of forest products exports in the region. The export volume of forest products from the Arkhangelsk Oblast in 2023 significantly decreased compared to 2021. In the conditions of sanctions pressure, Russian forestry enterprises have to look for alternative markets. Despite the steps being taken to diversify exports, companies face difficulties in establishing business ties with foreign partners due to fears of secondary sanctions. This leads to a reduction in supply volumes and, as a result, a decrease in income from export activities. In addition, the domestic market is experiencing a negative impact due to a decrease in exports. Reduced external demand for wood creates an oversupply in the domestic market, which leads to a drop in prices. Such changes have a destructive impact on the financial well-being of enterprises in the Arkhangelsk Oblast, the economy of which depends on the forestry sector. In 2021, the Arkhangelsk Oblast exported timber to Asia, Europe, Africa, North and South America and even to the countries of Oceania. After the sanctions restrictions, the country structure of timber exports has changed dramatically. China became the main importer of timber from the Arkhangelsk Oblast. In the course of the study, the key directions of export diversification were identified and effective measures for their implementation were developed. Diversification of production and development of new markets will allow the Arkhangelsk forestry complex to overcome the negative consequences of export specialization and keep the leading positions in the Russian forestry sector.

Forestry complex of the Arkhangelsk Oblast, export of forest products, export structure, export diversification, export dependence, new sales markets

Короткий адрес: https://sciup.org/148330875

IDR: 148330875 | УДК: [338.45:630](470.11)(045) | DOI: 10.37482/issn2221-2698.2025.58.47

Текст научной статьи Export Diversification of the Arkhangelsk Oblast’s Forestry Complex

DOI:

The forestry complex of the Arkhangelsk Oblast is the core of the regional budget. Forest products account for 40% of the total industrial production of the Pomorye region. However, the forestry economy of the Arkhangelsk Oblast has long been associated with the export of products to European markets. The Arkhangelsk Oblast is famous for its vast forest areas, which provide raw materials not only to local enterprises, but also to export markets. Forestry products such as sawn timber, plywood, cellulose, cardboard are in high demand abroad. But the sanctions imposed on the Russian economy have had a significant impact on the entire forestry complex of the country, and especially on forest-producing regions. Under the conditions of limited export poten- tial and access to foreign markets, the forestry complex of the Arkhangelsk Oblast has faced and continues to face a number of serious challenges in the past two years. The export potential of the Arkhangelsk Oblast is determined by its favorable geographical location, richness of natural resources and developing infrastructure. Export orientation and high export specialization of some types of forest products of the Arkhangelsk complex negatively affected the results of 2022-2023.

Export diversification has become a strategic direction for the preservation of the forestry sector of the Arkhangelsk Oblast. This is a process that includes the search for new market segments within the country and on the international market, expanding the range of exported forest products in the direction of their deeper processing, which reduces export dependence and ensures the sustainable development of the forest complex of the Arkhangelsk Oblast. In the context of a constantly changing and increasingly complex global market, increasing competition in the world and domestic markets, where price fluctuations and changes in consumer preferences can significantly affect the economy, diversification of forest product exports of the Arkhangelsk Oblast is becoming critically important. However, export diversification requires significant efforts, including investments in innovation and infrastructure development. State support, well-planned tax policy and export promotion programs determine diversification processes. It is also important to take into account the increase in logistics costs, the emergence of market risks that may be associated with different product standards, consumer differences, environmental restrictions, legal barriers, etc.

Object and methods of research

The object of the study is the export of forest products of the Arkhangelsk Oblast in the context of sanctions pressure and limitations of a number of segments of the world market. The aim of the work is to assess the current state of forest exports, identify diversification opportunities and key areas for reducing the region’s export dependence.

Within the framework of this study, the analysis of available analytical materials, reports of specialized organizations and scientific literature was conducted. The analysis of the data obtained during the study in the context of previously conducted studies and existing theoretical concepts made it possible to clarify the interpretation of the results and identify the main factors stimulating the growth of the implementation of the export potential of the forest sector of the Arkhangelsk Oblast. The methodological foundation of the study was built on the integration of qualitative and quantitative approaches. Qualitative methods include: observation, interviews and expert assessments of specialists from forest industry enterprises. Among the quantitative methods, the methods of statistical analysis of customs database and data on exports and imports of the Russian Federation by goods were used. A set of methods was used to analyze heterogeneous data, including analysis and synthesis, comparative analysis, and empirical research.

Review of scientific research

The author V.D. Terentyeva [1] presented an analysis of foreign trade operations related to forestry products, including sawn timber, pellets, cellulose and sanitary paper in the scientific publication in 2022. The purpose of the analysis was to determine potential losses for exporters of forestry products in the context of current economic sanctions. In addition, the possibilities of diversifying sales markets by reorienting sales to the domestic market and countries with which Russia continues to develop active economic cooperation were studied. An analysis of timber exports showed that China’s share in the overall structure of forestry exports is quite significant. Based on the data obtained, it was concluded that the dynamics of prices for forestry products on the domestic market can be developed according to two main scenarios. Scientists A.I. Biryukova and D.V. Dzizinskaya [2] analyzed in 2023 the state and development prospects of the woodworking industry in the Irkutsk Oblast. The authors examined the issues of economic efficiency and export potential of wood processing products, identifying the key factors that determine the development of the industry in the region. Particular attention was paid to structural changes in the export of forestry products. A multifactor index model was used to assess the currency efficiency of exports, as well as the analysis of relative values of the export structure. N.M. Shum [3] presented an assessment of the efficiency of forestry complex exports. The author analyzed existing methods developed by various researchers, which rely on qualitative and quantitative criteria, as well as factor analysis, taking into account the specifics of the industry. The author identified both the advantages and disadvantages of each model and justifies the need for authorial adjustments. As an example of the application of the considered models, the export potential of the Khabarovsk Krai was assessed. In this paper, based on the models proposed by K. Pearson and C. Spearman, a new model for evaluating the export potential of the forestry complex was presented. P. Kondrashov [4] considered two main aspects of increasing the efficiency of using the export potential of the Russian forestry industry. Firstly, it is necessary to diversify the export structure by increasing the supply of products with a high share of added value. Secondly, it is necessary to optimize the distribution of export flows across various geographic areas. This direction can also be interpreted as structural diversification. O.O. Rezanova [5] analyzed the role of the forestry complex in the implementation of the export strategy of the Russian Federation. At present, the Russian forestry complex is focusing its efforts on developing the production of high added value products. This is facilitated by a number of factors, including significant reserves of raw materials, production of various exported products and the availability of modern production technologies. Despite this, the industry faces a number of problems that hinder its development: technological backwardness, insufficient diversification and weak government incentives. To ensure the effective development of the forestry complex, it is necessary to provide comprehensive state support at all stages of the production cycle, improve logistical accessibility and create a favorable infrastructural environment. In the course of the analysis, K. A. Fedorov [6] identified export opportunities for Russian companies operating in the forestry complex. Despite the extensive forest resources available to the Russian Federation, their economic potential has not yet been sufficiently realized. In order to overcome the existing problem, the Government of the Russian Federation developed and adopted the Strategy for the Development of the Forestry Complex until 2030. This strategy sets targets for replacing imported products with domestic analogues and expanding exports of timber and timber products. The study by I.V. Goncharuk [7] analyzed the impact of government regulatory measures on Russian timber exports from 2006 to 2016. The scientist assesses the effectiveness of the tariff policy. L.I. Ipatko [8] examined the current state and ways of further development of timber exports in Russia. The author presented the specifics and difficulties associated with timber and timber products exports in various historical periods, identified key factors influencing the current situation in timber exports, indicated promising areas for its development in a difficult political and economic environment, and concluded that it is necessary to improve the efficiency of timber product exports. L.V. Shubtsova [9] assessed the role of the timber complex in the socio-economic progress of the Russian Federation. The author analyzed the current situation in the forest industry in the context of the aggravation of the international situation and identified areas for the development of the forest sector, which is considered one of the priorities in the country’s economy. O.E. Noskova [10] showed that at the beginning of 2022, Russian forestry producers faced a number of serious challenges. Restrictions on the export of products to European and American countries, as well as disruptions in the logistics chains of sea, road and railway transport led to a significant reduction in sales markets. Attempts to reorient to the domestic market proved to be ineffective due to weak demand from key consumers. This led to a drop in prices for forest industry products and the formation of surpluses on the market. Low price conditions force producers to work with minimal profits, and in some cases to stop harvesting timber. Such a situation may provoke a shortage of raw materials on the market. O.E. Kosheleva and A.S. Pustovalova [11] examined the methods of state and customs regulation of timber exports from the Russian Federation and predicted the consequences of the proposed ban on the export of unprocessed timber. The findings of the study make it possible to develop recommendations for improving and increasing the efficiency of state and customs control over timber exports, which in turn will contribute to strengthening the economic security of the Russian Federation. I. Sun and E. Yu. Barmina [12] noted that Russia and China are currently significant economic partners demonstrating a steady increase in trade turnover. The authors analyzed the main factors that determine mutually beneficial cooperation between the two countries and examined the existing problems in the timber industry market.

Research results

Against the backdrop of sanctions, Russian forestry companies are faced with the need to look for new markets. However, despite efforts to diversify exports, companies are experiencing difficulties in establishing connections with foreign buyers, as many of them are afraid of secondary sanctions. This leads to a decrease in supply volumes and, as a result, a decrease in trade revenues. In addition, the domestic market is also feeling pressure due to the decline in export volumes. A decrease in demand for timber from abroad creates an oversupply within the country, which in turn leads to a drop in prices. These changes negatively affect the financial condition of companies operating in the forestry industry and threaten jobs in regions that depend on the forestry industry.

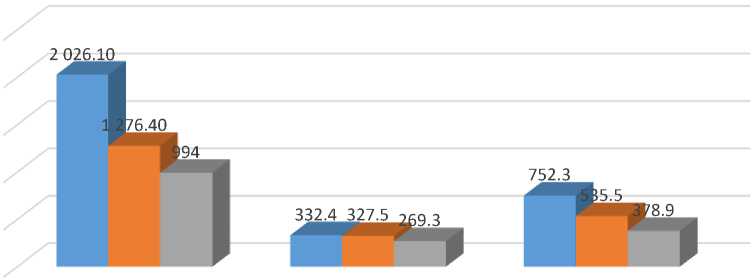

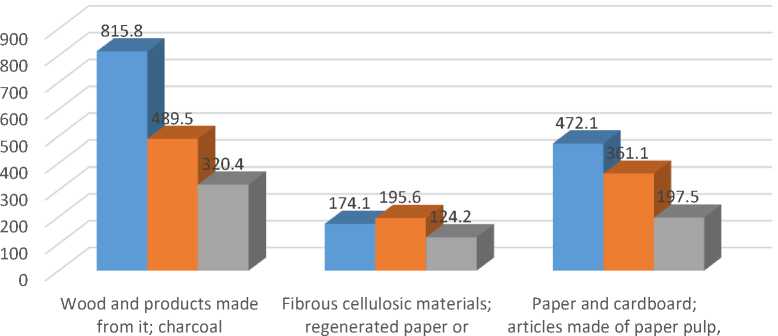

The export volume of forest products from the Arkhangelsk Oblast in 2023 has significantly decreased compared to 2021. The weight volume of exports has decreased by 50%, which is 1,032 thousand tons, over a two-year period (Fig. 1). The value volume of the Arkhangelsk Oblast exports in 2023 decreased more significantly — by 60% or by $495 million (Fig. 2).

2 500

2 000

1 500

1 000

Wood and products made from it; charcoal

Fibrous cellulosic materials; regenerated paper or cardboard (waste paper and waste)

Paper and cardboard; articles made of paper pulp paper or cardboard

Fig. 1. Arkhangelsk Oblast forest products exports in 2021–2023, thousand tons 1 .

Structural analysis of exports of forest products commodity groups of the Arkhangelsk Oblast

|

EAEU CN of FEA code |

Product |

2021 |

2022 |

2023 |

|||

|

.59 '(D |

О СП . ^ 3 CD О .У г Q. |

.59 *0) |

^ 3 CD О .У -с О. |

.59 5 |

^ 3 CD ° О. |

||

|

44 |

Wood and wood products; charcoal |

65.1 |

55.8 |

59.7 |

46.8 |

60.5 |

49.9 |

|

47 |

Pulp from wood or other fibrous cellulosic materials; recycled paper or cardboard (waste paper and scrap) |

10.7 |

11.9 |

15.3 |

18.7 |

16.4 |

19.3 |

|

48 |

Paper and cardboard; products made from paper pulp, paper or cardboard |

24.2 |

32.3 |

25.0 |

34.5 |

23.1 |

30.8 |

cardboard (waste paper paper or cardboard and waste)

Fig. 2. Arkhangelsk Oblast forest products exports in 2012–2023, million dollars 2.

The structural analysis of exports of forest products commodity groups shows a significant predominance of supplies of wood and wood products to the world market. In 2021, 65% of raw and processed wood, sawn timber, plywood, chipboard and fibreboard by weight were exported from the Arkhangelsk Oblast. In 2023, this figure was 60%. Despite the significant volume, the value share of this group of forest products in the region’s total exports remained relatively low, reaching 56% in 2021 and 51% in 2023. This is due to the relatively low price of the products sold. The export of cellulose materials (group 47) accounted for about 11% in 2021, and the share increased to 16% in 2023. The share of paper and cardboard exports has slightly changed over the past three years (by tonnage): 2021 — 24%, 2023 — 23%.

Table 1

Such a significant decrease in exports in 2022 and 2023 is due to the sanctions restriction of forest products supplies to the world market. As traditional supply routes became unavailable,

-

2 Source: compiled from data: Export and import of the

Russian Federation by goods.

URL:

https://customs.gov.ru/statistic (accessed 11 August 2024).

timber industry companies began to look for alternative routes, which led to the diversification of logistics routes. As a result, dependence on certain geographic regions decreased, which should ultimately ensure the stability of the timber business.

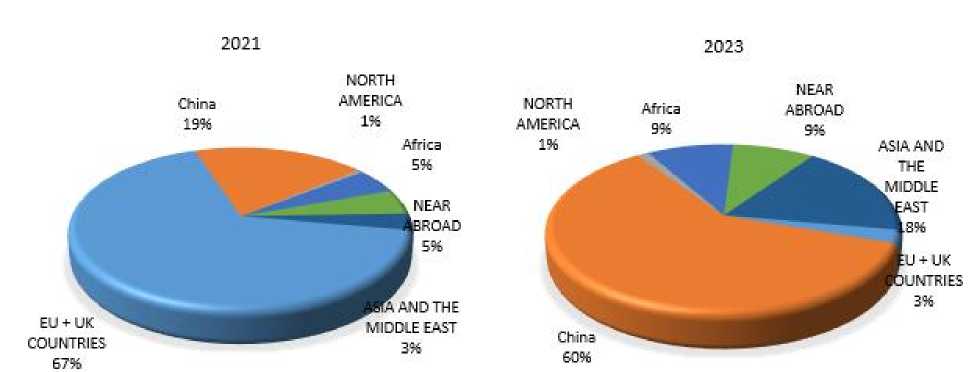

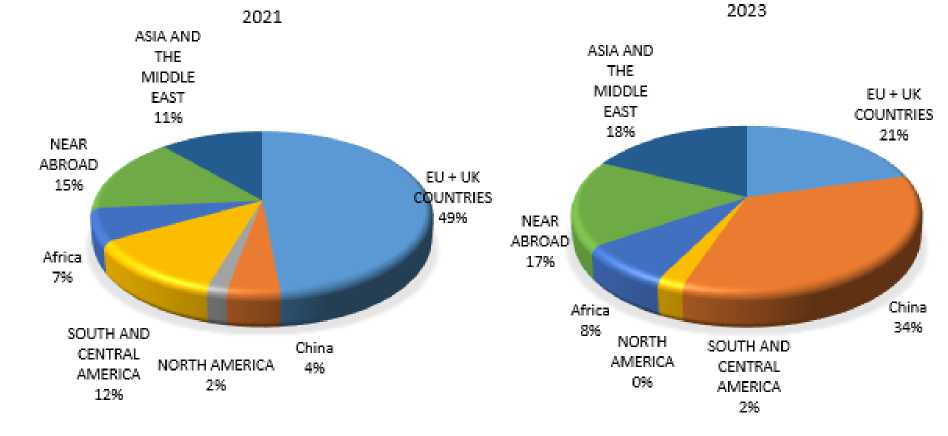

In 2021, the Arkhangelsk Oblast exported timber to Europe, Asia, Africa, North and South America, and even to Oceania (Fig. 3). Most of the timber was sold to European countries (67%). A fifth of Arkhangelsk timber was sold to China. After the sanctions restrictions, the country structure of timber exports changed dramatically. China became the main importer of timber from the Arkhangelsk Oblast, increasing its purchase volumes fourfold compared to 2021. China currently accounts for more than 60% of the region’s total timber exports. Export volumes to other countries in Asia and the Middle East, as well as to the countries of the Near Abroad, have increased significantly.

Fig. 3. Continental structure of timber exports (code 44) of the Arkhangelsk Oblast 3.

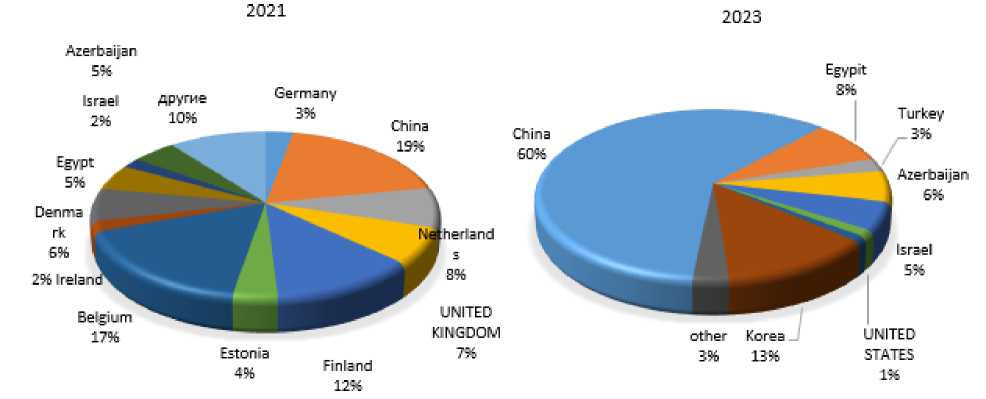

The Russian pulp market is characterized by a high dependence on external supplies. In the period from 2021 to 2023, the share of exports in the total volume of Russian pulp production amounted to 35%-40%. The main importer of Russian pulp is China, which purchased almost 90% of the total export volume in 2023. Pulp exports from the Arkhangelsk Oblast until 2022 were distributed evenly between the countries of the continent. The main consumers of Arkhangelsk pulp were not only countries with highly developed economies, countries of the Near Abroad, but also developing countries in Africa and Asia. A third of the pulp from the Arkhangelsk Oblast was supplied to Europe and North America. Pulp supplies to China until 2022 were insignificant — only 1% of total exports (Fig. 4). After 2022, there has been a significant reorientation of pulp exports. In particular, the volume of deliveries to the People’s Republic of China has increased more than 50 times over the past two years.

-

3 Source: compiled from data: Export and import of the

Russian Federation by goods.

URL:

https://customs.gov.ru/statistic (accessed 11 August 2024).

Fig. 4. Continental structure of pulp exports (code 47) of the Arkhangelsk Oblast 4.

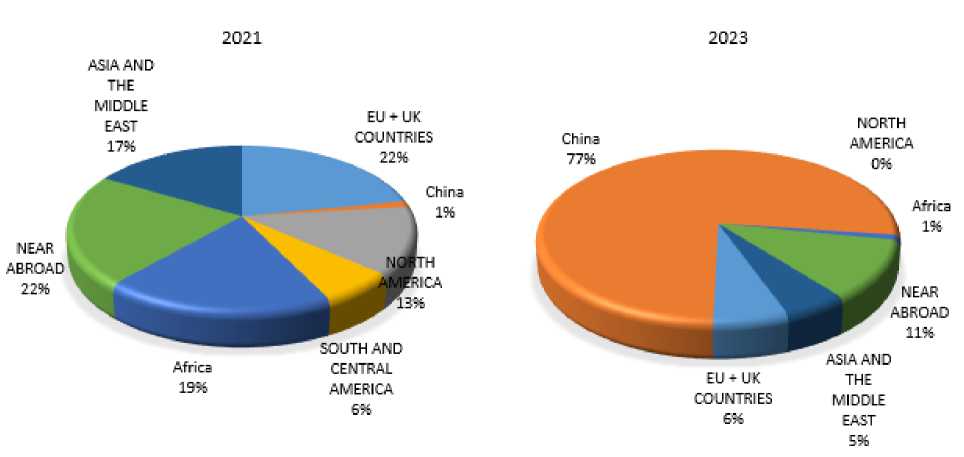

The introduction of external restrictions in 2022 led to significant changes in the logistics chains and geography of paper product exports. In the pre-sanction period, Europe was the main market for half of all paper and cardboard exports. In 2021, the Arkhangelsk Oblast sent 49% of its exports to Europe, 15% to Asia, 7% to Africa, and 12% to South and Central America (Fig. 5). Today, Turkey remains among the European importers of paper and cardboard, securing its position as a significant logistics center ensuring the implementation of foreign trade operations between Russia and European countries. Turkey accounts for 21% of Arkhangelsk paper and cardboard exports. Similar trade flows are also implemented through the United Arab Emirates and third-country jurisdictions. Paper and cardboard exports from the Arkhangelsk Oblast to other countries of Asia and the Middle East have increased. A significant portion of paper and cardboard exports is currently supplied to China (34%).

Fig. 5. Continental structure of paper and cardboard exports (code 48) of the Arkhangelsk Oblast 5.

-

4 Source: compiled from data: Export and import of the Russian Federation by goods. URL:

(accessed 11 August 2024).

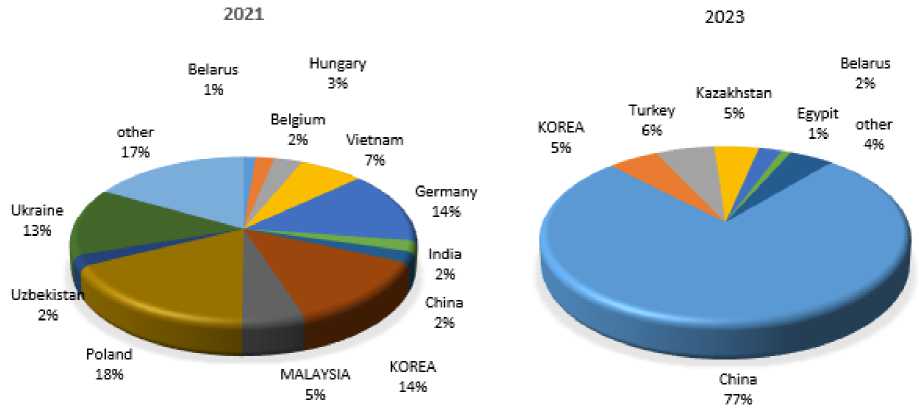

In addition to changes in the continental structure of forest product exports, there is not only a change in traditional partners, but also a reduction in the number of export partner countries. As a result, new markets require adaptation of forest products to their specific conditions. The number of partner countries for the export of raw and processed timber, sawn timber, plywood, chipboard and fibreboard has decreased by half. Whereas in 2021 there were up to 60 countries exporting wood products, in 2023 there were only 29 ones. The main exporter of wood and wood products in 2023 was China, which accounted for 60% of the volume (Fig. 6).

Fig. 6. Structure of timber exports (code 44) of the Arkhangelsk Oblast by countries 6.

A similar situation is observed in the supply of Arkhangelsk cellulose. In 2021, pulp was ex-

ported to 36 countries, and in 2023, the list of countries was halved. The main exporter of pulp from the Arkhangelsk Oblast was China (Fig. 7).

Fig. 7. Structure of pulp exports (code 47) of the Arkhangelsk Oblast by countries 7.

-

5 Source: compiled from data: Export and import of the Russian Federation by

goods. URL:

https://customs.gov.ru/statistic (accessed 11 August 2024).

-

6 Ibid.

-

7 Ibid.

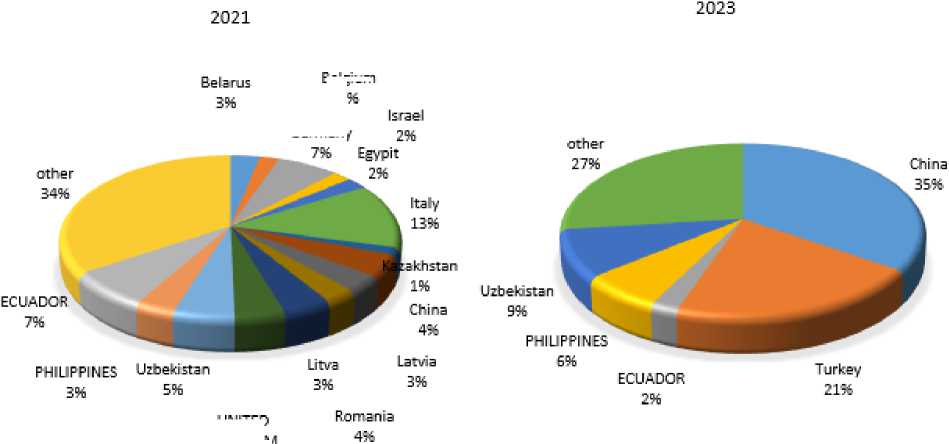

In 2021, the products of Arkhangelsk pulp, paper and cardboard enterprises were exported to 72 countries. In 2023, the number of importing countries decreased to 30. This may be due to the redirection of supplies through a logistics center in Turkey, as reported earlier. According to data for 2023, the main buyer of products from the Arkhangelsk Oblast was China (Fig. 8), whose share in import volumes previously did not exceed 4%.

Belgium

Germany

UNITED KINGDOM 4%

Fig. 8. Structure of paper and cardboard exports (code 48) of the Arkhangelsk Oblast 8.

Thus, the analysis of the Arkhangelsk Oblast forestry exports showed that against the backdrop of sanctions, the forestry business faced the need to diversify its export activities. Timber producers were forced to look for new market niches, new partners, and build new logistics chains. Establishing new logistics and new partnerships requires not only a technical base, but also trust between the parties. Unfortunately, the current international relations and the introduction of secondary sanctions complicate the restructuring of the export process, as new foreign buyers are afraid of new sanctions pressure.

Despite the negative forecasts after the loss of European markets, forestry enterprises managed to replace sales markets from European to Asian and neighboring countries. Nevertheless, the negative consequences for the forestry business were noticeable in 2022–2023. There was a decrease in export volumes, financial losses, and reputational risks for all market agents. At the same time, there was a reorientation of previously exported volumes to the domestic market, which created an excess supply of forest products and increased competition. The export restructuring with increased competition has a particularly significant impact on small and medium-sized forest industry companies, which are already facing high production costs, and some of them are at risk of leaving the market. Another side of increased competition may be a decrease in the quality of manufactured forest products, since companies will seek to reduce costs, which may nega- tively affect consumer preferences. The solution to this problem was the development of state support programs. The most important aspect of state support was the provision of subsidies for the transportation of forest products through the seaports of the Northwestern Federal District. According to the resolution, in 2023122024, exporters of forest industry products will be able to reimburse up to 80% of the costs (up to 50% of the volume of deliveries) for the transportation of their products if they use northern seaports. Another important direction is the need to further stimulate demand for forest products in the domestic market. A good example is the positive dynamics of the domestic sawn timber market in 2023, which grew from 101212 to 161217 million m³, which is due to the increase in housing construction.

Conclusion

Thus, with the increase of international trade restrictions, the geographic structure and composition of forest product exports from the Arkhangelsk Oblast have changed, which will continue in the future. Markets that were previously secondary began to acquire strategic importance. For example, China, East Asian and African countries have become new centers of attention for export deliveries, which created favorable conditions for the expansion of foreign economic activity and contributed to the development of new business partnerships. However, this transition has revealed a number of challenges associated with the need to develop new logistics chains. Increased transportation costs and difficulties in establishing interactions with new counterparties require additional time and resources.

The results of the analysis showed that in 2022–2023, the forestry complex of the Arkhangelsk Oblast was gradually adapting to difficult political and economic conditions, which can open up new horizons and ensure long-term growth in the context of a changing international market. The decrease in the volume of forestry product exports from the Arkhangelsk Oblast had a negative impact on the region’s economy. One of the main consequences of forestry product export restrictions since 2022 is a decrease in tax revenues to the regional budget, which in turn has a negative impact on the financing of social programs and infrastructure projects, and on the implementation of investment projects in the forestry complex in the region. In order to overcome the negative consequences in the region’s forestry complex, it is necessary to strengthen the directions for reducing the export dependence of the forestry complex of the Arkhangelsk Oblast (Fig. 9) and the system for ensuring the implementation of these directions (Fig. 10).

Market diversification of exports.

•It is necessary to look for new markets, including in Asia and Africa, where demand for wood remains high.

Technological development of timber production.

•Increasing the volume of deep processing of wood will create more valuable products, increasing added value and reducing dependence on exports.

Innovations in the forest complex.

•They are associated with the development of new types of forest products and the processing of low-grade wood and wood waste. One of the most promising areas is the production of bioplastics from wood waste, new building materials (wood-polymer composites), biofuels, biofertilizers, wood fillers, biochemicals, etc.

State support for the forest complex.

-

•It is necessary to ensure state support for the forestry sector, including through tax incentives, subsidies and investment programs.

Fig. 9. Directions for reducing the export dependence of the Arkhangelsk Oblast forestry complex 9.

|

Develop the scientific and technological base |

•It is necessary to invest in research and development in order to create new, high-tech production facilities. |

|

Create a training system |

•Highly qualified specialists are needed to work at modern deep processing enterprises. |

|

Ensure the availability of financing |

•The development of new industries requires significant investments, therefore it is necessary to ensure access to loans and grants. |

|

Create a favorable investment climate |

•This includes simplifying administrative procedures, reducing the tax burden and increasing the transparency of business processes. |

Fig. 10. Ensuring directions for reducing export dependence of the Arkhangelsk Oblast forestry complex 10.

-

9 Source: compiled by the authors.

-

10 Source: compiled by the authors.

Diversification of the Arkhangelsk forestry complex and development of new markets will allow overcoming the negative consequences of export specialization and maintaining leading positions in the Russian forestry sector.