Features of accounting processes of innovation and recommendations for its improvement

Автор: Urakova M.Kh.

Журнал: Теория и практика современной науки @modern-j

Рубрика: Основной раздел

Статья в выпуске: 5 (47), 2019 года.

Бесплатный доступ

This article discusses the features of accounting processes of innovation and recommendations for its improvement

Accounting processes, innovation, recommendations, improvement

Короткий адрес: https://sciup.org/140274660

IDR: 140274660

Текст научной статьи Features of accounting processes of innovation and recommendations for its improvement

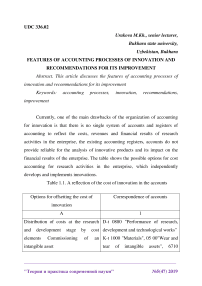

Currently, one of the main drawbacks of the organization of accounting for innovation is that there is no single system of accounts and registers of accounting to reflect the costs, revenues and financial results of research activities in the enterprise, the existing accounting registers, accounts do not provide reliable for the analysis of innovative products and its impact on the financial results of the enterprise. The table shows the possible options for cost accounting for research activities in the enterprise, which independently develops and implements innovations.

Table 1.1. A reflection of the cost of innovation in the accounts

|

Options for offsetting the cost of innovation |

Correspondence of accounts |

|

A |

1 |

|

Distribution of costs at the research and development stage by cost elements Commissioning of an intangible asset |

D-t 0880 "Performance of research, development and technological works" K-t 1000 "Materials", 05 00"Wear and tear of intangible assets", 6710 |

|

"Calculations on compensation", 6910 "Calculations on social insurance and providing", 6010"Calculations with suppliers" , etc. D-t 0400 "Intangible assets" K-t 0800 "Acquisition (creation) of intangible assets» |

|

|

Allocation of costs for research and development to the current costs of the enterprise |

D-t 2010 "Main production", 2310 "Auxiliary productions", 44 00"Expenses on sale" K-t 0880 "Performance of research, developmental and technological works» |

|

In the case of a negative result and the inability to use the results of innovation |

D-t 9120 "other expenses" K-t 0880 "Performance of research, development and technological works» |

In turn, due to the fact that there is no clear understanding of the innovative product as an object of accounting, the formation of the accounting system of costs of innovative activities should be focused on the implementation of the following principles that determine the direction of its development : -consideration of the innovative product as an object of accounting, taking into account the properties of its measurability and isolation; - reflection of innovation in the accounts of accounting as quantitatively defined and separate objects; - accumulation in the accounts of "innovative" costs on the stages of innovative activity; - expansion of the content and list of objects of "innovative" accounting by expanding the understanding of investments as investments not only in fixed capital and intangible assets, but also in research and development, in human capital. At the moment, the existing chart of accounts assumes only the accumulation of costs for innovation activities on sub-account 0880 "Implementation of research, development and technological works".

Cost accounting on one account does not allow the division of costs incurred by areas of innovation, which is certainly important to assess the effectiveness of the result. To ensure separate accounting of expenditures for innovation activities, which is part of the business, we offer open accounts of the second order to account 0880 "performance of research, developmental and technological works": 0881 "Expenses for performance of scientific researches" and 0882 "Expenses for performance of scientific research". These accounts are designed to accumulate costs associated with innovation. For the organization of cost accounting for the stages of development of an innovative product, we can assume the following group innovation costs: marketing research; research or development; innovative design; innovative production; commercialization of products; other expenses. To reflect the above cost groups, it is expedient to form analytical expenditure to the appropriate accounts "Expenses for performance of scientific research" and "Expenses for performance of scientific research". Analytical items of expenditure will allow to summarize information about the costs incurred at each stage of the formation of an innovative product, to analyze the composition, dynamics and structure of costs, to identify deviations of planned cost indicators from the actual at each stage of the formation of innovation.

In order to further detail the innovation cost groups can be divided into types of innovation costs based on the specifics of the organization and the need for analytical information. Evaluation of the market attractiveness of an innovative product is of paramount importance in the system of development and implementation of innovations. The analytical item of expenditure "Research or development" is intended to summarize information on the cost of generating ideas, study the feasibility and feasibility of the practical implementation of the selected ideas, evaluation of the acquired additional benefits from their implementation in practice, the search for ways to turn ideas into practice. According to the analytical item of expenditure "Innovative design" reflects the costs associated with the direct development of a clear action plan, the calculation of the planned indicators of the project, patenting of the invention. Analytical item of expenditure "Innovative production" is designed to reflect information on the cost of production of innovative product. The article "product Commercialization" accumulates the costs associated with bringing the created product to the consumer: the cost of advertising, marketing services, the cost of promotion and marketing of the product, other commercial expenses. Under the analytical item of expenditure "other expenses" it is possible to reflect costs of training and retraining of personnel, preparation and purchase of technological documentation (licenses, certificates). These analytical articles allow us to summarize information on direct costs that are directly related to the implementation of innovation. Thus, the considered analytical items of expenditure of synthetic accounts can gradually accumulate information about the costs carried out by the stages of formation of innovation, and in the aggregate reflect information about the cost of the innovative product produced. The given system of accounting of expenses for innovations allows to systematize and analyze information on innovative expenses, provides formation of the actual cost of an innovative product at the stages of its formation, promotes rational accounting of expenses for innovative actions that in a complex provides a reliable assessment of efficiency of innovations.

Список литературы Features of accounting processes of innovation and recommendations for its improvement

- Afuah, A. (2003). Innovation Management: Strategies, Implementation, and Profits, Second edn., Oxford University Press, New York.

- Drejer, A. (2002). "Situation for innovation management: towards a contingency model", European Journal of Innovation Management, vol. 5, no. 1, pp. 4-17.

- Goffin, K. & Mitchell, R. (2005). Innovation Management: Strategy and Implementation Using the Pentathlon framework, Palgrave Macmillan, New York.

- Storey, J. & Salaman, G. (2005). Managers of Innovation, Blackwell Publishing, UK.