Financial behavior of the population during the 2014-2015 economic crisis

Автор: Belekhova Galina V., Basova Elena A.

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Public finance

Статья в выпуске: 4 (64) т.12, 2019 года.

Бесплатный доступ

The article considers the changes in people’s financial behavior that occurred under the influence of the “structural recession” of the Russian economy. Any changes in the economic behavior of the population in the context of its individual types are caused by transformations taking place in society, proceed from people’s adaptation to new conditions and affect the duration and consequences of crisis processes. The goal of our study is to identify changes in people’s financial behavior caused by the economic crisis of 2014-2015. The paper uses official statistical data and materials of national and regional sociological surveys. We analyze manifestations of the 2014-2015 crisis, such as the changes in the level and use of monetary incomes, bank deposits and loan debt of the population. On the basis of regional sociological studies we reveal the changes in people’s financial behavior. We find out that during the crisis processes the growth rates of bank deposits and loan debt decreased, the structure of savings and credit purposes changed, and the violations in the regularity of loan payments became more frequent. In particular, at the regional level (in the Vologda Oblast), the share of inhabitants with savings has decreased significantly, the share of those who are saving money to use when they retire and the share of car loans have decreased; the share of savings for improving housing conditions, for recreation and travel, as well as the share of loans for urgent needs and unforeseen expenses have increased; the number of cases of overdue monthly payments on loans has increased. At the same time, some components of financial behavior turned out to be insensitive to the changing economic situation, among them - the reasons for refusal to form savings, the most common forms of accumulation, and the criteria for choosing a bank. We conclude that there are no mass deviant practices in the financial behavior of the population of the region in the crisis period; in general, people adapt to the changes that take place in the socio-economic situation. We recommend using the results of the monitoring studies of financial and other types of economic behavior in the activities of regional authorities in order to obtain timely information on current changes and make adequate management decisions.

Financial behavior, sociological survey, economic crisis, rationality of behavior

Короткий адрес: https://sciup.org/147224192

IDR: 147224192 | УДК: 330.59 | DOI: 10.15838/esc.2019.4.64.9

Текст научной статьи Financial behavior of the population during the 2014-2015 economic crisis

Economic crisis is an inevitable thing in the system of market economy. It is related to the abnormality in the current activity of economic system. It often leads to the disruptions of connected relations and financial agents’ behavior models. But crisis could be analyzed as the transitional period which also gives opportunities for growth and development, not only causes risks of adverse effects emergence. “According to the theory of crisis, active crisis conditions might last four-six weeks. In this period, economy and the society (including individuals) adapt and achieve new level of sustainability, or decompensate (do not adapt) and reach lower level of functioning” [1].

Since 1990s, Russia has gone through the financial-economic crisis of 1997–1998, the economic crisis of 2007–2009, the “currency crisis” of 2014-2015, all of which affected the most sensitive and numerous participant of economic relations – country’s population. It is possible to say that Russians always live in a “constant state of high alert” and adapt their economic behavior to new challenges of the world. Populations’ financial behavior is not an exception. It is one of the types of economic behavior related to mobility and usage of financial income; it also includes different types of financial activity [2, p. 2222]. Post-soviet transformations, on the one hand, strongly deepened regions’ differentiations and populations’ material stratification, strengthened disconnection between elite and masses, inside social groups [3, p. 54-56]. On the other hand, they opened new financial market opportunities for Russians. As a result, people’s affirmations and motives related to money and financial goals began to gradually change, differences in people’s financial actions, according to their social-demographic group affiliation, became more noticeable.

In the last 10–15 years, impact of people’s finances on country’s economy, as well as characteristics and directions of financial behavior promotion, is more actively discussed by authorities and researchers. A vivid example of that is an extensive work on increasing populations’ financial literacy (approval of the “Strategy to increase financial literacy in the Russian Federation for 2017–2023”, annual events “Russian savings week”, “Russian week of financial literacy”); propositions from the Central Bank of Russia, the Ministry of Finance, and the Ministry of Economic Development on including population’s funds into financial sector (release of “people’s bonds”, proposals for the introduction of individual pension capital, regulation of private investors’ activities); active promotion of the “insurance paradigm” in the relations between the government and people. Besides, significant investments are necessary for economic growth, sources of which are not only government, business, and foreign investors’ funds, but also people’s savings. The importance of the latter increases in the current environment of many domestic manufacturers’ unprofitability, high pressure on the state budget, problems with involvement of foreign investments.

Favorable conditions for people’s financial behavior are necessary for steady involvement of their funds in the country’s financial system and maintenance of acceptable levels of quality of people’s lives. Taking into account inevitability of crisis processes, we think that tracking and explanation of population’s financial behavior in unstable and crisis socioeconomic conditions are relevant. The way people use their money, allocate it between consumption and savings primary determines nature and duration of crisis processes in the economy. We think that 2014–2015 crisis is of particular interest for us for several reasons.

First of all, for the nature of it. The crisis of 1991–1995 was transformational, created by a transition from one political and economic regime to another, external and internal impact1. Financial crises of 1998 and 2008–

2009 became a part of global economic crisis. The first one of them is a brought one, it came from Asian economy; it deepened in Russia because of debts and serious market crush2. Its main consequence was a quarter decrease of people’s actual income and short-term production decline [4, p. 38]. The second crisis was global. It originated in USA, and at first it was a banking crisis. But it subsequently led to economic crisis, which worsened business climate, demand for services and supplies. It had an impact on Russian production sector3.

Economic crisis decrease was significant (GDP lowered by 7%) and recovery from it took a long time (the economy overcame decrease only in 2012), but people’s actual income grew [4, p. 38-39]. 2014–2015 crisis does not have any connections to global processes – it is completely internal. It is a crisis of old growth model collapse, which started because of the economy’s stagnation – it stopped growing in 20134. Later, it was additionally influenced by geopolitical factors (external sanctions, oil price drop, etc.). In this period of crisis, decrease of people’s actual income is noted.

Second, for the end of the crisis. All the previous crisis processes are definitely over by now, but it is not that certain in case of the last one. We stand with experts’ opinions, especially with Doctor of Geographic Sciences N.V. Zubarevich, and think that Russian economy is still in the “pit” of crisis’ consequences. If key problems of current institutional economic model remain (inefficient institutes, low investment rates, and oil price), post-crisis recovery will take long [4, p. 41].

Extent of the problem’s research

Certain aspects of population’s financial behavior have been studied since the beginning of the 20th century; this problem received theoretical documentation and broad empirical confirmation in 1960–1970s. The theme of financial behavior researches is diverse, and works studying connection of behavior to crisis processes are very important. In particular, a representative study of 2008–2010 financial crisis’ influence on the practices of managing finances in USA households was conducted by Taylor et al. (2010) [5]. This research examined changes of behavior models and affirmations which emerged during 2008–2009 recession. Authors used statistical data, accumulated by federal authorities, and data from special national survey conducted in May of 2010 in the form of phone surveys. 2967 people above 18 years old, who live in continental area of USA, participated. It was stated that crisis made more than half of Americans (60%) to cut general costs, one third of Americans (32%) could not put together the same amount of their pension savings, and almost half of Americans (48%) said that their financial situation was still below the pre-crises level.

The 2008–2009 crisis is studied in the works of Shim and Serido (2010) [6], who examined students’ reaction toward the change of financial situation, Bricker et al. (2011) [7], who compared financial behavior before and after the crisis (in 2007 and in 2009–2010).

2098 people from two groups were interviewed in Shim and Serido’s (2010) research: the first group – before crisis, in April of 2008, and the second one – after, in April of 2009. Their questions touched upon assessment of welfare, respondents’ families’ financial situation, financial education in high school, work experience, aspects of financial behavior. The work of Bricker et al. (2011) is based on data of national “Survey of Consumer Finances” (SCF) with samples from 2007 and 2009. It examines impact of changes of some assets’ prices and debts size on households’ standards of living. Earlier works (for example, Voydanoff, 1984 [8]; Varcoe, 1990 [9]) are also based on data received from sociological surveys of American households and examine practices of adaptation to stressful financial situations.

Many researches of domestic authors are devoted to the theme of financial behavior transformation under economic crises of 2000s as well. In the work by O.Yu. Dmitrieva and N.A. Dmitriev [10] conclusions about people’s financial behavior change are drawn on the basis of the analysis of governmental statistics and data from Russian surveys conducted by the National Agency of Financial Investigation (NAFI) in March of 2016. The research by O.E. Kuzina (2009) [11], explaining manifestations and groups of population 2008–2009 crisis touched upon, is based on comparative analysis of the results of national surveys of leading sociological services (NAFI, VTsIOM, FOM). Changes in Russians’ savings behavior from the point of view of used savings instruments and in relations between consumption and saving are examined in the works by M.A. Mosesyan (2010) [12], M.S. Shcherbal’ (2013) [13]. In particular, the latter is based on the materials of socio-economic VCIOM monitoring, conducted in January–March of 2009, and it contains the typology of savings behavior, built by using the two step method of cluster analysis (in SPSS package). It pointed out the most popular behavior models in the conditions of socio-economic instability. While building this typology, authors took into account the following parameters of behavior: availability of savings, forms of its storage, strategies of savings management.

The work by L.I. Nivorozhkina [14] is an example of extensive assessment of economic crisis impact on the level of welfare and financial behavior. It is based on the methods of economic-mathematical modelling. The author used data about incomes, spending, property status and financial behavior of Russian households gathered during Russian Longitudinal Monitoring Survey of NRU HSE population (RLMS). Examination periods were pre-crisis 2013 and 2015 which had an on-going recession of economy. The analysis was conducted by using multidimensional models of relative change in the level of current available household resources with nonobservant heterogeneity, shifting, caused by missed variables, and endogeneity [14, p. 86]. As a result, it was possible to identify factors which change financial behavior and level of population’s welfare in the period of economic crisis in the most significant way.

While analyzing the problem of human behavior in crisis, the issue of rationality appears (the subject of economic behavior rationality has been a discussed topic for many years). A classical theoretical model of human financial behavior is based on rationality, independence and freedom of choice [15, p. 95]. After the 1980s, when many economically developed countries began transition to innovative trajectories of development, which widely extended people’s material possibilities and possibilities of financial market, empirical researches started to show inconsistencies in observed and forecasted financial behavior of population. Many scholars see the source of this issue in the problem of behavior rationality A precise definition of rationality is not adopted. In general, a choice of understanding rationality is “not an issue of truth but purpose” [16, p. 359]. In wide sense, rationality (lat. ratio – reason) means awareness and calculation of actions, definition of goals and borders. Rationality of economic behavior is manifested on two sides: firstly, in the intention to control resources and minimize their spending and, secondly, in fulfilment of individuals’ interests, in the intention to achieve set goals [17, p.129].

Individual’s economic activity is defined by the framework of productive and distributive relations established in the society. Consequently, there are more options of financial strategy within market conditions. Because of it, in the times of crises, there is a higher chance of using financial behavior models which lead to exclusion of significant sum of money, potentially suitable for investments, from economic circulation and the danger of bankruptcy for certain citizens and their families.

Except for existing in the society socioeconomic relations and processes, individuals’ financial behavior is heavily affected by the impact from person’s psychological characteristics, his emotional state, because it is directly connected to the primary mean of survival – money. In other words, rationality of financial behavior is challenged by psychology.

For example, the founder of the behavioral finances theory – D. Kahneman and A. Tversky, who developed the idea of limited rationality, in the work “Prospect Theory: An Analysis of Decision under Risk” (1979) presented the results of experiments which proved that people cannot rationally assess amount of expected incomes and their probability. First, people have “asymmetrical reaction to welfare change. The man is mostly afraid to lose than to gain”. The degree of frustration after losing 100 dollars will significantly overcome the felling of satisfaction after gaining the same amount of money. Therefore, “people are ready to take risks to avoid loses, but not ready to do the same to gain something”. Second, “people make mistakes more frequently when they assess probability: they underestimate the probability of events which will, probably, happen, and overestimate much less possible events” [18, p. 184].

Socio-cultural impact on people’s financial behavior is also very important. The current content of behavior was formed in the context of the market transformation of Russian society, which largely did not take into account the historical and socio-cultural features of the previous development. In the USSR social policy was paternalistic in nature, i.e. “state structures determined the paradigm of life of every citizen and every family, “ensuring” satisfactory, from the dominant ideology point of view, level and corresponding way of life” [19, p. 159].

In a market economy of modern Russia, the level of state “guardianship” on social issues has significantly lowered, high-quality social services, available at the required time, turned out to be paid for. It largely contradicts the stereotypes of behavior gained during the years of Soviet authorities. The accomplished revolution, not only in the sphere of social guarantees, but also in public relations, now forces Russians to solve problems of acquiring educational, medical, and other social services “at their own expense”, naturally increasing the pressure on family budget and influencing other financial decisions. Taking into account mental characteristics and low level of trust of

Russians in financial institutions5, largely due to the negative experience in 90s, we can assume that in a situation of economic instability, there might be cases of destructive financial choice (for example, mass withdrawal of funds from the financial sector).

In this study we do not aim to come up with the “formula” of rational behavior in a crisis; we consider the aspect of rationality through the adaptation of behavior to changing conditions. If the population started to apply practices that can further lead to a decline in their standards of living, it is destructive behavior. But if the population began to apply practices that will preserve their standards of living, or lead to its increase in the future, it is constructive behavior.

Materials and methods

In this research the analysis of population’s financial behavior was conducted. It includes, first of all, the analysis of dynamic distribution series of statistical indicators, which characterize socio-economic situation in the country along with people’s actions on financial market and, secondly, assessment of the results of population’s sociological survey, which reveals content of financial behavior.

Financial behavior is studied here from the perspective of saving and credit behavior. The reason of it, first of all, is that they are implemented in the most developed sphere of national financial system – banking sector. Second, they provide consumers’ demand which impacts the level of people’s welfare and country’s economic situation6. Third, there is a large source of statistical data about these types of behavior available for free. We chose amount of deposits of natural persons (characterizes saving behavior) and credit debts, given to natural persons (characterizes credit behavior), as statistical indicators. The structure of money income usage is analyzed additionally. Dynamics of statistical indicators is given for 2013–2017 which will allow understanding of crisis manifestations of 2014–2015.

Content of saving and credit behavior is revealed with the help of sociological surveys of the Vologda Oblast population, which can be observed as the typical entity of the Russian Federation according to the most demographic and socio-economic indicators [20, p. 175]. The following surveys were conducted: “The research of saving behavior” (RSB; 2001– 2012), “Life quality” (LQ; 2014–2016), “Financial literacy” (FL, 2018), the Monitoring of Socio-Economic Situation and Perceptions of the Population (2013–2016). The RSB, LQ, FL surveys include several thematic blocks (“Socio-demographic information”, “Saving behavior”, “Credit Behavior”, “Other financial services”, “Financial literacy”, “Overall characteristic of life quality”); inflation expectations and populations’ consuming attitudes are tracked in the monitoring.

These sociological researches are conducted by the method of handout survey at the place of respondents’ living on the territory of two large cities and six regions of the Vologda Oblast. Overall amount of samples in the RSB, LQ, FL surveys – 1,500 people a year, in the monitoring – 9,000 people a year (1,500 people once in two months); respondents’ age – 18 and older.

Sampling error – 3% and less. Comparison of two sociological surveys conducted in 2014 and 2016 with a data for 2012 and 2018 will let us identify substantive changes of population’s financial behavior.

Overview of 2014–2015 crisis manifestations

National economy in 2014 was affected by serious problems which led to a slowdown of the development in real economy sector and worsening of significant part of households financial situation. Crisis negatively influenced the level of welfare and population’s standards of life [21, p. 7].

The 2008–2009 crisis was a consequence of Russian economy integration into global economy and involved changes of external trade conditions, capital outflow, and strict policy in external borrowings. Negative impact from 2014–2016 was related mostly to several domestic events. We are talking about economic structural imbalances, which led to a general economic downturn and deepened further because of increase of budget expenditures due to the accession of a new region, introduction of sanctions against Russia and the rapid decline of global oil prices. All these factors led to a sharp weakening of the national currency, which resulted in deterioration of population’s financial situation and transformation of its financial behavior. Because of the crisis, inflation rates grew – in 2014–2015 there was a major increase of the Consumer Price Index (CPI) across the country and in the Vologda Oblast ( Tab. 1 ). CPI decrease happened in 2016. According to people, high level of inflation is the main destabilizing factor of financial situation. That is why, according to the National Agency of Financial Investigation (NAFI), solution of inflation problem is more important than assistance to banking system [11, p. 34]. It might be connected to the confidence in the system of deposit insurance,

Table 1. Dynamics of socio-economic indicators in 2013–2017

|

Indicator |

Territory |

2013 |

2014 |

2015 |

2016 |

2017 |

|

CPI |

Russian Federation |

106.5 |

111.4 |

112.9 |

105.4 |

102.5 |

|

Vologda Oblast |

107.2 |

112 |

112.0 |

105.0 |

102.2 |

|

|

Average per capita financial income*, rubles |

Russian Federation |

35,229,8 |

33,866,4 |

32,911,9 |

31,515,7 |

31,422,0 |

|

Vologda Oblast |

27,601,8 |

27,393,3 |

27,439,0 |

27,947,6 |

26,489,0 |

|

|

Deposits*, million rubles |

Russian Federation |

23,015,067,5 |

22,787,888,2 |

25,125,978,9 |

24,911,009,6 |

26,092,571,0 |

|

Vologda Oblast |

126,391,3 |

122,982,0 |

129,857,3 |

132,113,9 |

137,849,0 |

|

|

Credit debts*, million rubles |

Russian Federation |

61,188,8 |

66,092,3 |

56,852,3 |

54,498,2 |

57,867,0 |

|

Vologda Oblast |

111,238,7 |

111,538,6 |

94,361,0 |

91,733,7 |

98,068,0 |

* In comparable 2017 prices.

Source: author’s calculations are based on: Regions of Russia. Socio-economic indicators. The Russian Federal State Statistics Service, 2014–2018.

which compensates for some funds at the “right” moment, and the hope for authorities’ actions efficiency. According to S.K. Dubinin, CBR and Government’s actions “countered a current thread and prevented cascaded banks’ bankruptcy” [22, p. 219]. On the background of ruble’s devaluation, stability of banking system was preserved without panic among Russians and exemption of funds from their accounts.

In pre-crisis 2013, actual average per capita income of Russian citizens increased by 5% in comparison to the previous period of time (the same happened in the Vologda Oblast). When economic crisis began, citizens’ incomes decreased: 4% drop across Russia and 1% drop in the Vologda Oblast in 2014. Average per capita incomes continued to drop: by 3% in 2015, на 4% in 2016, by 0.3% in 2017. In the Vologda Oblast, after a slight increase in 2015 (by 0.2%) and in 2016 (by 2%), average per capita incomes decreased by 5%.

Increased attention to the state of banking sector in 2014–2015 from supervisory authorities, because of its important role as “a driving gear of positive and negative impulses in country’s economy” [22, p. 221], prevented significant outflow of funds from deposits. Thus, extent of Russian population’s bank deposits was 22,787 trillion rubles in 2014: it is just 1% lower that in 2013; in the Volodga Oblast the decrease was a little bit more noticeable (3%). In 2015, an increase of natural persons’ deposits happened – by 10% across Russia and 5.5% in the Vologda Oblast (on a comparable basis). 2–4% growth of populations’ bank deposits extent continued in 2016–2017, but it was still below pre-crisis rates. Such decrease of growth rate can be explained by the transformation of population’s financial strategies in the environment of its material situation worsening.

Dynamics of the population’s credit debt indicator also shows changes in financial behavior: the level of debt increased in 2014 across Russia and in the Vologda Oblast (by 8 and by 0.3% respectively). Then, there was a sharp decrease of population’s credit debts – by 14% across Russia and by 15% in the Vologda Oblast. The rate of decrease slowed in 2016 (by 4% across Russia and by 3% in the Vologda Oblast), but increase of credit debts was again noticed in 2017 (by 6 and 7% respectively).

More detailed analysis of financial behavior of the Vologda Oblast population shows that in 2014–2015 there was, on the one hand,

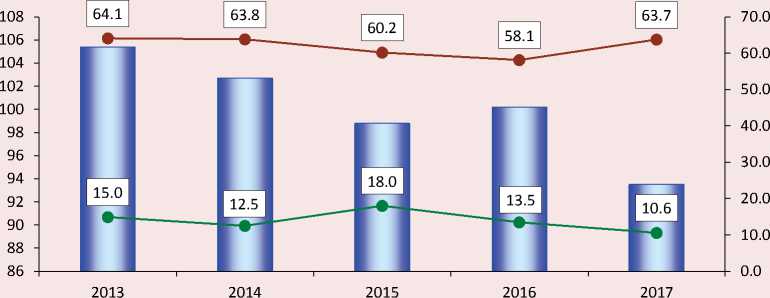

Figure 1. Dynamics of Vologda Oblast population’s financial activity in 2013–2017

। I Actual disposable income of population, % to previous year

—•— Propensity for consumption, %

Propensity for saving, % __________________________________

-

* Propensity for consumption is calculated as the ratio of purchasing consumer goods and services to the population’s financial income, %.

-

* * Propensity for saving (saving rate) is calculated as the ratio of savings to financial income of the population. In this case, savings include increase (decrease) of deposits, purchase of capital bonds, change of funds in the accounts of individual entrepreneurs, loan debts, property purchase, purchase of cattle.

Source: Official statistics. Level of welfare / The Vologda Statistics Service. Available at: connect/rosstat_ts/vologdastat/ru/statistics/standards_of_life/ decrease of incomes and propensity for consumption, but, on the other hand, growth of willingness to save money (Fig. 1). But then, since 2016, despite the unstable dynamics of money incomes, propensity for saving started to decline and propensity for consumption, previously decreasing in 2016, started to increase.

It is possible to explain this situation from several points of view. Firstly, there is a certain degree of disbelief in financial institutions existing in some part of population7. This fact, coupled with problems in the area of financial literacy, lead to the situation when people cannot choose tools suitable for them (i.e. reliable and quite profitable) for investing free funds [24, p. 70]. Secondly, purchasing activity decline in 2016 is probably related to population’s high inflation expectations8 and general prices increase. Thirdly, propensity for consumption, which increased in 2017, along with real incomes decrease, can be the realization of postponed, due to 2014–2015 crisis, demand for purchasing expensive goods and services.

Decrease of citizens’ real incomes caused the change in the structure of profits’ usage (Tab. 2). People primarily spend earned money on goods and services: in Russia this indicator was at the level of 70–75% in different years, in the Vologda Oblast – 60–64%.

Table 2. Structure of population’s financial income usage, % of total financial income

|

Indicator |

Territory |

Year |

||||

|

2013 |

2014 |

2015 |

2016 |

2017 |

||

|

Purchase of goods and services |

RF |

73.6 |

75.3 |

71 |

73.1 |

75.8 |

|

VO |

64.1 |

63.8 |

60.3 |

58.1 |

63.7 |

|

|

Payment of obligatory payments and various |

RF |

11.7 |

11.8 |

10.9 |

11.2 |

11.1 |

|

contributions |

VO |

13.3 |

13.1 |

11.6 |

11.3 |

11.6 |

|

Property purchase |

RF |

3.9 |

4.5 |

2.9 |

2.9 |

3.2 |

|

VO |

2.4 |

2.4 |

1.4 |

1.2 |

2.4 |

|

|

Growth of financial assets |

RF |

10.8 |

8.4 |

15.2 |

12.8 |

9.9 |

|

VO |

20.2 |

20.7 |

26.7 |

29.4 |

22.3 |

|

|

- from it, increase (decrease) of free people’s |

RF |

0.7 |

0.2 |

-0.4 |

0.7 |

1.3 |

|

money |

VO |

5.8 |

8.2 |

8.9 |

16.3 |

13.5 |

Source: Regions of Russia. Socio-economic indicators. The Russian Federal State Statistics Service, 2014–2018.

There was a growth of consumer activity which activated investment processes in the times of 2008–2009 crisis. But during 2014– 2015 crisis population started to spend less on goods and services – numbers decreased from 75.3 to 71% across Russia and from 63.8 до 60.3% in the Vologda Oblast. “Savings on goods and services became the most popular strategy of Russian families’ adaptation to economic shocks in the times of crisis” [22, p. 32].

Qualitative changes of financial behavior

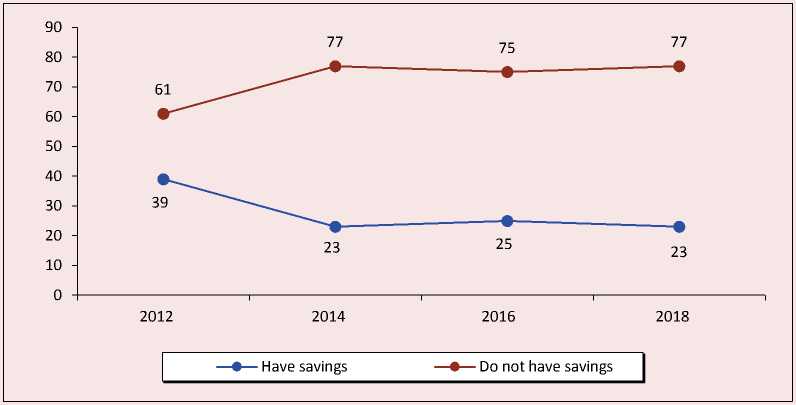

According to the results of sociological surveys of the Vologda Oblast population, one fourth of people had savings after 2014–2015 crisis ( Fig. 2 ).

In 2008–2012, savers noted that they managed to put aside something about 90–120 thousand rubles (average number for one individual who saves money). These numbers increased in 2013 – to 265 thousand rubles, sums of money households save also grew up – from 5,200 rubles in 2007 to 5,934 rubles in 2013. In 2014, in the conditions of unfavorable external circumstances and unclear future prospective of economic situation, people of the Vologda Oblast cut amounts of savings – average number was 124 thousand rubles, which is equal to nine monthly incomes of one family member9. In 2016, as a result of economic stabilization and halt of real income decrease, people gained opportunities to put aside money – amount of savings raised to the average number of 167 thousand rubles for one family (it is equal to 12 average monthly incomes of one family member)10.

“Money cannot buy happiness” – Russian proverb says. But economic realities argue: “Absence of money is the root of all evil”. It is impossible to put aside money without additional funds – it is confirmed by the results of surveys. The major obstacle for savings is financial limits – absence of free money due to low incomes. This reason was stated by 70% of the Vologda Oblast population (72% in 2012, 71% in 2014, 68% in 2016, 65% in 2018). It is relevant for respondents despite their gender, age, education level and amount of income. “Unstable economic situation” itself is less important for absence of savings – about 10–

Figure 2. Proportion of savers and non-savers of Vologda Oblast population, % from the number of respondents

15% of respondents name it (4% in 2012, 14% in 2014, 18% in 2016 and 2018). Circumstances related to populations’ consumption attitude (“it is better to spend now, not save” – 7% in 2012 and 2014, 16% in 2016, 11% in 2018), instability of financial system, and offered products (“absence of reliable means of money keeping and high risk of its loss” – 6–7% in 2012–2014 and 11% in 2016–2018) are not primary factors as well.

Recent economic decline had a certain impact on the structure of the Vologda Oblast population’ saving aims. In the previous postcrisis period (2012) reasons of buying apartment and motor transport (Tab. 3) significantly “decreased”. The constant primary motive of saving money is housing improvement (35% in 2014, 41% in 2016). After a decline in 2012, this aim is the most important once again. It could be explained by a gradual “natural” recovery

Table 3. Distribution of answers to the question: “Why do you (your family) have savings (or would you do it if you had the opportunity)?”*, % from a total number of respondents

|

Answer option |

2012 |

2014 |

2016 |

2018 |

|

To buy an apartment, improve living conditions |

17.3 |

35.2 |

41.1 |

32.8 |

|

“For old age” |

25.0 |

25.0 |

21.5 |

29.6 |

|

For vacation, entertainment, travel |

17.8 |

16.5 |

23.8 |

19.6 |

|

For medical treatment |

15.7 |

16.0 |

18.8 |

19.3 |

|

To leave it to children, help them in the future |

20.5 |

19.6 |

19.7 |

18.9 |

|

To buy a car |

10.2 |

14.8 |

19.2 |

16.9 |

|

To save just in case |

28.1 |

13.6 |

16.7 |

16.9 |

|

To buy other expensive things |

7.8 |

8.0 |

8.5 |

13.4 |

|

For education |

8.8 |

13.3 |

13.4 |

11.3 |

|

To purchase shares and capital bonds |

2.2 |

0.7 |

3.4 |

3.8 |

|

To open (expand) own business |

4.1 |

3.5 |

5.4 |

3.1 |

|

* Ranked according to 2018 data. |

Table 4. Distribution of answers to the question: “How do you and your family keep savings nowadays?”, % from the number of those who have savings

It is worth mentioning that “social” aims – savings for education, treatment, and children’s financial security were not affected by worsened conditions. It is interesting that unfavorable conditions in 2014–2015 contributed to “investment” intentions of population: aims of business start-ups and acquisitions of capital bonds became more popular. Besides, interesting but explainable fact is that Oblast’s population cut their savings for life after retirement (from 25% in 2012–2014 to 21,5% in 2016) and at the same time started to spend more money on “vacation, entertainment, travelling” (from 16.5 to 24% respectively). It seems that on-going changes of the pension system, long periods of pension funds “freezing” stop people from thinking that their old age will be prosperous and wealthy time. So people switch to satisfaction of their short-term and more pleasant needs.

While choosing the form of savings, region’s population pay attention to the criteria of reliability and time-verification (Tab. 4).That is why the most part of population puts their savings in a commercial bank (52% in 2012, 50% in 2016). Despite fluctuations of national currency, value of cash rubles increased after the crisis began – from 22% in 2012 to 41% in 201411. A small consistent part of savers keep their money in potentially investment but risky forms (capital bonds, investment units, contributions to non-state pension funds). 5% of respondents noted usage of these ways to keep their savings in 2010. Their number decreased in 2016 (to 4%).

Considering popularity of bank deposits it is necessary to understand the reasons of people’s selection of a commercial bank (Tab. 5). There are mixed trends: on the one hand, people’s reliance on bank’s popularity grows up (43% in 2014–2016 in comparison to 27% in 2012) along with experience in cooperation with financial institution. On the other hand, depositors focus less on the conditions of financial service provision (interest rate, convenience of funds management, other services). A number of people who pay attention to the security and bank reliability, guarantee of funds savings (i.e. bank’s participation in the system of deposit’s insurance) also decreases (by 7% in 6 years).

Table 5. Distribution of answers to the question: “What factor primarily influenced your selection of the bank to open a deposit”*, % from the number of those who have bank deposit

|

Criterion |

2012 |

2014 |

2016 |

2018 |

|

Bank’s popularity |

27.2 |

42.4 |

42.9 |

65.7 |

|

Close location of bank’s department |

12.8 |

20.3 |

17.2 |

29.4 |

|

The interest rate |

33.8 |

22.5 |

24.5 |

28.4 |

|

I already had a deposit in this bank |

20.0 |

29.7 |

27.1 |

17.6 |

|

Profitability of offered conditions** |

n.d. |

13.8 |

21.2 |

10.8 |

|

Ease of assets’ usage |

11.0 |

10.1 |

10.6 |

10.8 |

|

Participation of the bank in the deposit insurance system |

14.9 |

9.8 |

9.9 |

8.8 |

|

Decent quality of service ** |

n.d. |

10.5 |

8.8 |

7.8 |

|

Recommendations of friends, relatives |

11.3 |

7.2 |

8.1 |

6.9 |

|

Wide range of services provided |

8.8 |

5.1 |

2.6 |

5.9 |

|

Other reasons |

1 |

1.1 |

2.6 |

1 |

* Ranked according to 2018 data.

** These answer options have been included in the survey since 2014.

Together with savings, which provide “postponed” consumption, people use borrowed funds for current needs realization. Credit behavior12 includes about one third of region’s population: 28% of respondents had unsettled credit debts in 2016, 22%, in 2014, and 31% in 2013. As of 2016, average amount of borrower’s credit debt was 226,362 thousand rubles (equivalent to 5-times average income of household having a debt). Large cities population’s debt (Vologda and Cherepovets) is 1.5 times higher than debts of regional population (263,897 thousand rubles in comparison to 177,096 thousand rubles). An amount of approved loans does not exceed half of million rubles: less than 100 thousand rubles – 49%, from 100 to 500 thousand rubles – 41%13.

More than a half of people who have loans (68% in 2014, 65% in 2016) spend up to 30% of per month income on monthly payments, i.e. they do not exceed limits recommended by financial experts. But monthly payments of 30% of borrowers constitute more than a half of per month family income. Consequently they enter a risk zone and may wind up in a situation when they will have to save money in order to make another payment. Higher payments (50% or more of monthly family budget) are more typical for young people and those who have primary or unfinished secondary education.

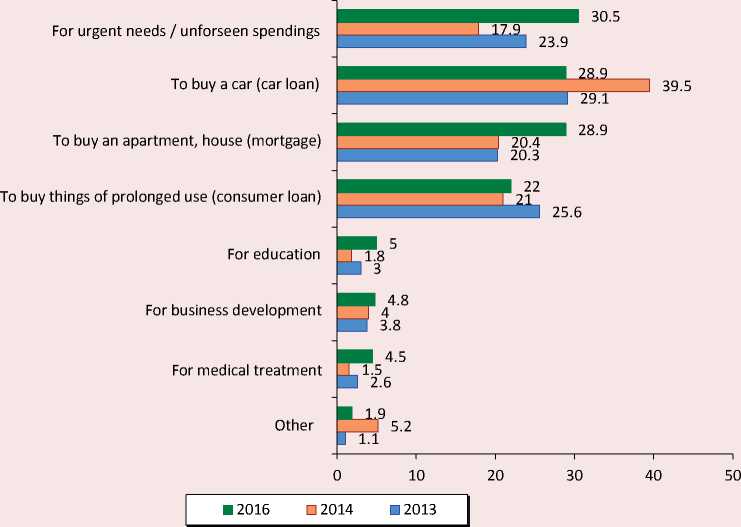

Bank loans are primarily taken by region’s population in order to buy a car, property, expensive things of prolonged use, and provision of urgent needs and unforeseen spending (Fig. 3). Loans are much less used for business development and solution of social problems (for education and treatment). 2014– 2015 crisis led to a significant reduce of loans for buying a car (from 39.5% in 2014 to 29% in 2016) with simultaneous raise of loans for urgent needs (from 18 to 30.5% respectively) and property purchase (from 20 to 29% respectively).

Figure 3. Reasons of bank loans of Vologda Oblast population, % from the number of those who have an outstanding bank loan

General deterioration of the financial situation in the times of crisis naturally affected borrower’s ability to fulfill loan commitments which led to increase of payment violation: only 21% of borrowers delayed their loan payments in 2014, but 2016 their number grew up to 30%. In this regard, women and people older than 30 are more disciplined. Also, a chance of non-payment decreases with an increase of disposable incomes and level of education.

Thus, the analysis of regional population’s financial behavior helped to identify certain changes in its savings and credit practices related to, first of all, savings and loans, forms of savings and compliance with credit discipline.

Conclusion

Financial strategies and population’s preferences are mostly determined by the nature of changes in country and region’s financial situation. At the same time, the research of strategies of financial behavior is a necessary condition for getting real assessment of social processes in the economy. “Households’ behavior … could be seen as an indicator of society’s transformation… it is a signal which shows well-being or ill-being of institutional environment” [24, p. 3].

Examination of strategies and population’s preferences within saving, shopping, credit behavior during critical times of economic system development is a relevant issue from the point of view of money and credit and investment policy toward improving citizens’ well-being and quality of life and growth of economy. Our analysis of population’s financial behavior with a focus on changes caused by 2014–2015 crisis gives the opportunity to highlight the following major points.

-

1. Federal institutes’ accumulated experience of overcoming crisis consequences and measures to support banking sector allowed avoiding serious complications in matters of population’s deposits and credits in 2014– 2015. In 2014, in comparison to 2013, amounts of Russians’ bank deposits decreased only by 1%, in the Vologda Oblast – by 3%. Natural persons’ deposits increased in 2015 and continued to grow in 2016–2017 but the rates of this process were below pre-crisis numbers. In case of population’s credit debt indicator, there is an uneven dynamics: level of debt increased in 2014 (by 8% in Russia, by 0.3% in the Vologda Oblast on a comparable basis) and then it sharply decreased in 2015 (by 14% across Russia and by 15% in the Vologda Oblast), in 2016 grow rates slowed and credit debt indicators raised in 2017 (by 6 and 7% respectively).

-

2. The Vologda Oblast population in 2014– 2015 crisis periods showed a trend of consumer activity decrease. People switched to the regime of a “forced” consumption primarily fulfilling their current needs in order to keep their capacity to pay by money on hand. This can be explained by worsened microeconomic indicators, decreased actual incomes, consideration of previous crisis periods experiences, and, possibly, expectation of a long period of instability. In particular, a number of those who have savings lowered by 15% (even in 2018 a share of savers still includes just one fourth of the Oblast population, and it is lower than pre-crisis numbers), a share of savings for “old age” and purchase of a car decreased. Proportion of loans for urgent needs and unforeseen spending has increased notably. Cases of late monthly credit payments happen more frequently.

-

3. During the 2014–2015 crisis, the Vologda Oblast population followed noninvestment strategies by accumulating the most part of saved money in cash and therefore creating a vicious circle. The withdrawal of a significant amount of money from circulation exacerbates the issue concerning deficit of reserve and investment potential in the region, which negatively affects the state of the economy, leading to a deterioration of citizens’ standards of living in terms of reducing their actual income, which, in turn, largely determines the scale of their consumer and savings activity. Taking into account the prolonged decline of monetary incomes (cumulative income losses of Russians reached 11.4% in the period of 2014–2017 in relation to the level of 2013), it can be assumed that the absence of solutions to Russian economy systemic problems and private problems of regional economic systems can lead to a degradation of economic, including financial and consumer, behavior of population (for example, an increasing widespread of survival strategies and “tightened belts”) [25, p. 151].

But some characteristics of financial behavior remained insensitive to crisis processes of 2014–2015: especially, criteria of selecting a bank and the most popular forms of savings. In general, results of sociological surveys showed that mass destructive practices did not occur in financial behavior of region’s population during the 2014–2015 crisis situation. The most people adapted to changes of socio-economic situation.

It should be remembered that a crisis is an integral stage of economic development, a “test of the strength” of the current system. Russian history has repeatedly proved that the country’s population is able to cope with crisis processes, not excluding, of course, significant losses in the level and standards of their lives. In such periods, the work on the operational study of population’s attitudes and behavior appears to be significant. It is sociological research methods (monitoring, surveys, etc.)

that allow obtaining this kind of information. Consequently, they should be at the disposal of managers.

Список литературы Financial behavior of the population during the 2014-2015 economic crisis

- O’Neill B., Xiao J.J. Financial behaviors before and after the financial crisis: evidence from an online survey. Journal of Financial Counseling and Planning, 2012, vol. 23, no. 1, pp. 33-46. Available at: https://my.afcpe.org/system/journals/v23_j3.pdf

- Belekhova G.V., Ustinova K.A., Gordievskaya A.N. Economic behavior of entrepreneurs and employees in the sphere of personal finance. Rossiiskoe predprinimatel'stvo=The Russian Journal of Entrepreneurship, 2016, vol. 17, no. 18, pp. 2221-2234. (In Russian).

- L'vova N.A., Pokrovskaya N.V., Voronova N.S. The concept of the financial paradoxes: preconditions of formation and development trajectory. EKO=ECO Journal, 2017, no. 6, pp. 164-177. (In Russian).

- Zubarevich N.V. Regional projection of new Russian crisis. Voprosy Ekonomiki=Economics Questions, 2015, no. 4. pp. 37-52. (In Russian).

- Taylor P., Morin R., Kochhar R. et al. A Balance Sheet at 30 Months: How the Great Recession Has Changed Life in America. Pew Research Center. Washington, DC, 2010. Available at: https://www.pewresearch.org/wp-content/uploads/sites/3/2010/11/759-recession.pdf

- Shim S., Serido J. Arizona Pathways to Life Success for University Students. Wave 1.5 Economic Impact Study: Financial Well-Being, Coping Behaviors and Trust among Young Adults. University of Arizona. Tucson, AZ, 2010. Available at: https://www.nefe.org/_images/research/APLUS-Wave-1.5/APLUS-Wave-1.5-Final-Report.pdf

- Bricker J., Bucks B., Kennickell A., Mach T., Moore K. Surveying the Aftermath of the Storm: Changes in Family Finances from 2007 to 2009. Federal Reserve Board. Washington, DC, 2011. Available at: http://www.federalreserve.gov/pubs/feds/2011/201117/201117pap.pdf

- Voydanoff P. Economic distress and families: policy issues. Journal of Family Issues, 1984, vol. 5, no. 2, pp. 273-288.

- Varcoe K. Financial events and coping strategies. Journal of Consumer Studies and Home Economics, 1990, vol. 14, no. 1, pp. 57-69.

- DOI: 10.1111/j.1470-6431.1990.tb00036.x

- Dmitrieva O.Yu., Dmitrieva N.A. Financial behavior of Russians in crisis: save or spend. Sovremennye tendentsii razvitiya nauki i tekhnologii=Modern trends of science and technology development, 2016, no. 8-6. pp. 21-25. (In Russian).

- Kuzina O.E. Impact of a financial crisis on Russians’ expectations and behavior. Monitoring obshchestvennogo mneniya: ekonomicheskie i sotsial’nye peremeny=Monitoring of Public Opinion: Economic and Social Changes, 2009, no.1, pp. 26-50. Available at: https://wciom.ru/fileadmin/file/monitoring/2009/89/2009_1(89)_3_Kuzina.pdf

- Mosesyan M.A. Transformation of population's savings behavior in a financial crisis. Vestnik Volgogradskogo gosudarstvennogo universiteta. Seriya 3. Ekonomika. Ekologiya=Science Journal of Volgograd State University. Global Economic System. Series 3. Economics. Ecology, 2010, no. 2 (17). pp. 102-107. (In Russian).

- Shcherbal' M.S. Population's saving behavior in unstable socio-economic environment. Sotsiologicheskij Zhurnal= Sociological Journal, 2013, no. 2, pp. 65-71. (In Russian).

- Nivorozhkina L.I. Current income and household financial behavior: who loses more in a crisis? Prikladnaya ekonometrika=Applied Econometrics, 2017, vol. 48, pp. 85-96. (In Russian).

- Orlova E.V. Transformations of financial behavior of human factor in a crisis. Vestnik RGGU= RSUH/RGGU Bulletin, 2010, no. 6 (49) /10, pp. 95-101. (In Russian).

- Kapelyushnikov R.I. Behavioral economics: several comments on rationality and irrationality. Zhurnal ekonomicheskoi teorii= The Russian Journal of the Economic Theory, 2018, vol. 15, no. 3. pp. 359-376. (In Russian).

- Pokrovskaya N.N. Rationality of economic behavior. Izvestiya Rossiiskogo gosudarstvennogo pedagogicheskogo universiteta im. A.I. Gertsena=Izvestia: Herzen University Journal of Humanities

- Zhelaeva S.E. Methodological principles of human behavior research in economics. Vestnik Tambovskogo universiteta= Tambov University Review. Series Humanities, 2011, no. 1, pp. 179-187. (In Russian).

- Rimashevskaya N.M. Chelovek i reformy: sekrety vyzhivaniya [Person and Reforms: Secrets of Survival]. Moscow: ISESP RAS, 2003. 392 p.

- Rossiiskoe obshchestvo: transformatsii v regional’nom diskurse (itogi 20-letnikh izmerenii) [Russian society: transformation in a regional discourse (the results of 20 years of assessments)]. Under the scientific supervision of M.K. Gorshkov, V.A. Ilyin. Vologda: ISERT RAN, 2015. 446 p.

- Voronin G.L., Kozyreva P.M., Kosolapov M.S. et al. Socio-economic behavior of Russian households. Vestnik Rossiiskogo monitoringa ekonomicheskogo polozheniya i zdorov'ya naseleniya=Russian Longitudinal Monitoring Survey, no. 6. Ed. By P. M. Kozyreva. Moscow: NRU HSE, 2016. 242 p. (In Russian).

- Dubinin S.K. The financial crisis of 2014-2015. Zhurnal Novoi ekonomicheskoi assotsiatsii= The Journal of the New Economic Association, 2015, no. 2 (26), pp. 219-225. (In Russian).

- Yusupova L.M., Nikonova T.V., Ivanov M.E. Factors determining the investment of household savings into the banking sector of the Russian Federation: current state. Setevoi nauchnyi zhurnal=Online Science Journal, 2017, vol.11, no. 5 (75), pp. 93-101. (In Russian).

- Kozyreva G.B., Morozova T.V., Belaya R.V. Socio-economic behavior of border region households as an indicator of the transformation of society. Regional'naya ekonomika: teoriya i praktika= Regional Economics: Theory and Practice, 2015, no. 22 (397), pp. 2-20. (In Russian).

- Rossinskaya G.M. Factors and regularities of households' consumer behavior in the conditions of transformational Russian economy. Uroven' zhizni naseleniya regionov Rossii= Living Standards and Quality of Life, 2016, no. 3 (201), pp. 147-156. (In Russian).