Financial Development Trajectories of the Russian Arctic Regions

Автор: Dyadik N.V., Chapargina A.N.

Журнал: Arctic and North @arctic-and-north

Рубрика: Social and economic development

Статья в выпуске: 47, 2022 года.

Бесплатный доступ

Priority development of the Arctic territories is particularly relevant in conditions of unstable environmental balance, significant climate change, and territorial vulnerability. The Arctic regions have common natural and climatic conditions, geographical location, the availability of natural resources on their territory, the level of technical and technological development of the branches of the national economy, however, they are characterized by heterogeneous conditions of socio-economic development, therefore, the imbalances in the functioning of these regions are manifested more clearly. Elimination or levelling of the emerging interregional imbalances is an objective necessity for the sustainable development of regions, ensuring their financial stability. The authors, on the basis of private financial indices (budget, economic, investment), carried out a pinpoint adjustment of the development of the Arctic territories and determined the trajectories for the implementation and expansion of potential financial opportunities, taking into account the identified threats and drivers that affect the economy of the region. This approach made it possible, firstly, to assess the financial capabilities of the regions in terms of different aspects (budgetary, economic, etc.,); secondly, to identify the dynamics of their financial development; and, thirdly, to rank the regions according to the level of financial solvency. As a result, three clusters were identified: regions with a high value of the economic index; regions with a high value of the investment index and regions with a high value of the budget index. For each group, a vector of financial development has been determined, which makes it possible to effectively use all the possibilities of the Arctic regions to ensure their both social and financial and investment development.

Russian Arctic, financial development, trajectory, threat, driver, financial resource, potential

Короткий адрес: https://sciup.org/148324395

IDR: 148324395 | УДК: 332.12(985)(045) | DOI: 10.37482/issn2221-2698.2022.47.26

Текст научной статьи Financial Development Trajectories of the Russian Arctic Regions

The Arctic is a priority of the Russian Federation’s state policy today, as it is a potential region with strong natural resource potential. However, the Arctic is not only mineral resources, but also people living in its territories. The Arctic regions are home to 19 small indigenous peoples (about 102 thousand people), and there are objects of their heritage and ethnicity that are of great historical and cultural value 1. Improving the quality and raising the standard of living in the Arctic regions, increasing the sustainability of the northern economy by enhancing the socioeconomic policy of resource use and ensuring the financial viability of regional budgets are the main tasks that need to be solved by the joint efforts of government, business and society. Never-

∗ © Dyadik N.V., Chapargina A.N., 2022

SOCIAL AND ECONOMIC DEVELOPMENT

Natalya V. Dyadik, Anastasiya N. Chapargina. Financial Development Trajectories … theless, it is impossible to solve these tasks without achieving the financial well-being of the regions, that is, the ability to independently execute the expenditure powers assigned to the subjects.

Under conditions of uncertainty, multidirectional trends in the financial development of regions and a fairly long planning horizon, an approach that makes it possible to assess development options and possible losses is needed. Such an approach can be the development of scenarios 2 [1; 2] or the construction of trajectories 3 of financial development of the territory.

There are many mechanisms and tools of strategic management used to solve various problems of regional development and management. For example, a cluster approach is used to ensure the competitiveness of territories, which involves the creation of integrated entities to solve the problems of innovative development [3, Tatenko G.I.]. In addition, the formation of clusters on the territory of individual regions helps to reduce the costs of local enterprises, thereby providing conditions for investment attractiveness [4]. In the context of this approach, the European method, based on the concept of “smart” specialization, seems interesting [5, Kalyuzhnova N.Ya., Violin S.I.; 6]. The essence of this approach is to identify the competitive advantages of specific territories based on the assessment of promising areas for the development of existing industries and the competitiveness of new ones.

When implementing a strategic document on the development of the Russian Arctic and ensuring its national security 4, the scenario approach is becoming increasingly popular. In the framework of this work, we will focus on building the trajectories of the financial development of the Arctic territories, leaving the framing of specific scenarios outside the scope of the study.

Research methodology

The financial development trajectories of the Arctic regions proposed below are based on the results of an earlier study [4]. Before fine-tuning the development of territories and determining their individual way of implementation and expansion of financial opportunities, it is necessary to pay attention to the background conditions of regional development, that is, the conditions that determine their uniqueness and spatial (Arctic) identification.

The background conditions for the development of the Russian Arctic regions include:

-

• extreme living conditions in these regions, many of which are absolutely discomfort zones for human life (Republic of Sakha (Yakutia), Yamalo-Nenets, Chukotka and Nenets Autonomous okrugs);

-

• infrastructural restrictions, primarily — inaccessibility; in some areas of the Arctic zone of the Russian Federation there is no access by land transport to neighboring territories and settlements throughout the year (for example, the Arctic regions of the Republic of Sakha (Yakutia));

-

• increased resource intensity, northern rise in price and high costs with a low competitive position of goods of local producers;

-

• ultra-dispersed population resettlement, which is caused by natural and climatic factors, features of economic development, market conditions of the regional economy, and the ethno-social structure of the population. The low level of social infrastructure (social, medical, educational and other services), the lack of developed transport accessibility (especially in the Arctic regions of the Republic of Sakha (Yakutia), Chukotka and Yamalo-Nenets Autonomous okrugs) slowly modernize the lifestyle of the Arctic population and worsen their adaptation to social and economic changes in vast intercity spaces, thus having a significant impact on their settlement centres [5, Fauser et al.];

-

• significant natural resource potential. The Russian Arctic is a geostrategic territory of the Russian Federation and is of great economic, military-strategic, transport and logistics importance. Colossal reserves of oil and gas are concentrated on its territory: almost a third of the world’s explored reserves of nickel and platinoids, over 90% of tin, diamonds, gold, mica, apatite, etc.;

-

• ecological pressure on the territory. The regions of the Russian Arctic are characterized by an increased techno- and anthropogenic load on nature and require consideration of the ecological capacity of the territory (the level of anthropogenic load that can sustain natural ecosystems without irreversible damage to their life-supporting functions), due to the fact that many potential environmentally hazardous enterprises and organizations are involved in the development, extraction and processing of natural resources [6].

Further, using the basics of cluster analysis, the studied set of regions was divided into groups of homogeneous objects by the level of financial solvency, taking into account the value of private indices; each group was defined by its own development trajectory. Clustering was conducted on the basis of the maximum values of the particular indices (Table 1).

Table 1

Private financial indices 5 for the period 2005–2019

|

Arctic regions |

Aggregated financial indices |

||

|

Budget index |

Economic index |

Investment index |

|

|

Republic of Karelia |

0.143 |

0.164 |

0.069 |

|

Komi Republic |

0.118 |

0.076 |

0.112 |

|

Nenets Autonomous Okrug |

0.124 |

0.051 |

0.179 |

|

Arkhangelsk Oblast (without AO) |

0.156 |

0.121 |

0.122 |

|

Murmansk Oblast |

0.206 |

0.130 |

0.150 |

|

Yamalo-Nenets Autonomous Okrug |

0.079 |

0.066 |

0.188 |

5 The calculation methodology is presented in detail in [7].

|

Krasnoyarsk Krai |

0.109 |

0.114 |

0.113 |

|

The Republic of Sakha (Yakutia) |

0.089 |

0.078 |

0.130 |

|

Chukotka |

0.174 |

0.227 |

0.181 |

As a result, the composition of the clusters was defined as follows:

-

• cluster 1 — regions with a high value of the economic index;

-

• cluster 2 — regions with a high value of the investment index;

-

• cluster 3 — regions with a high value of the budget index.

It should be noted that the formation of groups of regions included in a particular cluster, namely the distribution of regions by groups, was based on the ranking of values of the aggregated financial indices within each region. Due to the fact that Krasnoyarsk Krai has almost the same values of economic and investment indices, therefore, this region was included in clusters 1 and 2 with the possibility to assess the trajectory of its development on the basis of identified competitive advantages. Perhaps, the formation of clusters will be different in a larger sample of regions, but this is a matter of a separate study with a different object.

The trajectory of the region’s development with high values of the economic index

Trajectory context . Regions with a high economic index are characterized by a high share of raw materials (minerals) exports in the region’s foreign trade balance, low level of unprofitable enterprises in the overall structure of the gross regional product, dependence of the economy on the foreign trade activities of the region.

This is the trajectory of cluster 1 regions: Republic of Karelia, Krasnoyarsk Krai, Chukotka Autonomous Okrug.

Drivers:

-

• resource base;

-

• international cooperation;

-

• development of extractive industries.

The diversity of mineral, forest, aquatic, biological, land and other resources acts as a driver for the development of the Republic of Karelia. The mineral resources of the region are represented by more than 50 types of minerals. A significant part of the Republic of Karelia is covered by forests (approximately 53%), which forms the natural advantages of the region for the development of the timber industry. In addition, access to the basin of the Arctic and Atlantic Oceans to the Northern Sea Route through the Baltic and White Seas is a potential for the development of sea freight, fish processing, and can also be used for tourism (as the shortest route to the Solovetsky Islands) 6.

It should be noted that a sufficiently developed border infrastructure will not only strengthen existing international relations and cooperation between the Republic of Karelia and Finland, but also become the main driver for the development of this region.

The basis of the economic development of the Chukotka Autonomous Okrug is the coal industry and the extraction of ores of non-ferrous (precious and non-precious) metals, as well as industries of traditional economy of the small peoples of the North.

Chukotka is rich in non-ferrous and precious metals, coal, oil and gas, which is the main driver for the development of this region, attracting large industrial investors in the development and operation of deposits.

Reindeer herding and sea fur hunting in the Chukotka Autonomous Okrug, being a traditional sector of economy, provide its inhabitants with up to 50% of the needs in meat products 7.

The Chukotka Autonomous Okrug has a high export potential, as its extractive industry capacity is much greater than the region’s domestic market demand. Export logistics to the Asia-Pacific region is a more feasible option for entering the Russian market. The ASEZs are an effective tool for implementing an export-oriented model in relation to neighboring countries, with tax incentives created for them and support for the creation of the required infrastructures.

The basis of the economy of the Krasnoyarsk Krai is its industrial complex with three core industries (non-ferrous metallurgy, fuel and energy complex and oil and gas industry), which is the driver of regional development, since it provides a significant part of the gross regional product. Other drivers of the region are hydrocarbon resources and its geographical position in the context of the depletion of the resource base of Western Siberia and the European part of Russia 8.

In order to ensure employment and to maintain distribution of the population and productive forces in the region, timber and agro-industry play an important social role, although they are not considered basic ones.

Threats. The following threats should be highlighted for the regions of this cluster: depletion of minerals; instability of prices on world markets and volatility of currency markets; ecological situation.

In the Republic of Karelia, the forest complex and the mining industry form a monospecialization of the region. Recently, special attention has been paid to sectors oriented to the final consumer market (for example, food industry).

The Chukotka Autonomous Okrug, being one of the largest gold-mining regions in Russia, provides a high level of GRP, tax per capita income and investments, attracting additional labor force. Nevertheless, focusing on the development of one flagship industry causes monodependence and makes the regional economy vulnerable to external price conditions.

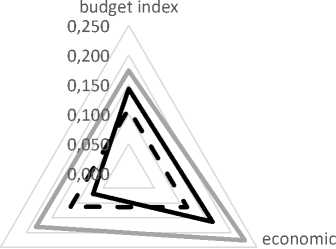

Vector of financial development . Taking into account the driving forces of the regional economy and the identified threats, the general orientation of their financial development trajectory should be focused on the increase of budgetary resources and development of investment potential (Fig. 1). The individuality of the development trajectory of each region from cluster 1 will depend on the specific features of the economic structure.

^^^^^^^^^ Karelia Republic investment index

index

Krasnoyarsk region

Chukotka AO

Fig. 1. Orientation of the financial development trajectory of the regions.

For example, the economy of Chukotka is based on the extraction of minerals (gold mining accounts for more than 40% in the structure of gross value added); therefore, the prospects for the development of this region are seen as increasing its investment attractiveness. Since 2016, the Beringovskiy ASEZ has been operating in the Chukotka Autonomous Okrug, which includes a significant part of the Anadyrskiy municipal district and the city district of Anadyr [8]. Within the framework of the ASEZ, it is possible to implement large investment projects on preferential terms, which will enable the region to attract additional investment and increase its budget revenue base. The economy of the Republic of Karelia, on the contrary, is quite differentiated, so the main vector of development should be aimed both at rebooting industrial policy and developing the potential of individual industries. A distinctive feature of this region is a significant number of cultural heritage objects of the federal level: the Valaam Archipelago, the Solovetsky Islands, the Alexander Svirskiy Monastery, the Muromskiy Svyato-Uspenskiy Monastery, the Uspenskiy Cathedral in Kem, the Germanovskiy Skete with the Church of Alexander Nevskiy, the Museum religious buildings of the ancient Saami, the museum “Martsial'nye vody”, the museum “Runopevtsy Kale-valy” and others (more than 1500) 9, which is the basis for the development of tourism in Karelia.

It should be noted that most of the recreational areas and cultural heritage sites are concentrated in the regions referred to the Arctic zone of the Russian Federation.

According to the results of the analysis, the Krasnoyarsk Krai turned out to be the most harmonious region in terms of financial development in the Russian Arctic, that is, the considered indices form an almost isosceles triangle (Fig. 1). The assessment of financial viability showed that this territory has a sufficient level of budgetary resources (the budget index is 0.113), a relatively high investment potential (the investment index is 0.114) and a strong foreign economic sector (the economic index is 0.109). Nevertheless, it is possible to outline the contours of the further development of this region. It is necessary to continue to stimulate investment activity by creating a comfortable business environment and providing investors with additional state guarantees and support measures. Changing the usual structure of the economy through advanced development of processing industries, introduction of innovative technologies and production of innovative products will diversify it. The region’s high resource potential makes it possible to develop existing enterprises and does not limit the possibility of locating new production facilities (including innovative ones), which would increase regional budget revenues. However, the extensive prospects for the creation of new industries, which the region possesses, are not a reason for locating ecologically dangerous and harmful enterprises there. Therefore, it is necessary to implement measures of state regulation on compensation of ecological damage, restoration of damaged natural ecological systems, which will lead to reduction of negative impact on the environment and will improve ecological living conditions.

The trajectory of the region’s development with high values of the investment index

Trajectory context . The level of financial solvency of the regions is determined to a greater extent by the investment index. Regions with a high investment index are characterized by high investment activity, as well as a high level of savings of the population and enterprises, which, under favorable financial conditions, can be transformed into investment resources of the region.

The development trajectory of the region with high values of the investment index is typical for regions from cluster 2, namely the Nenets Autonomous Okrug, the Yamalo-Nenets Autonomous Okrug, the Krasnoyarsk Krai, the Republic of Sakha (Yakutia).

Drivers:

-

• investment attractiveness;

-

• ethno-cultural potential of the territories.

The economy of the Russian Arctic is generally focused on the development and exploitation of the mineral resource base, taking into account the system-forming role of the Northern Sea Route, which primarily determines the investment attractiveness of these regions. For example, due to the high investment activity, the Krasnoyarsk Krai occupies a leading position among Russian regions, entering the “Top 10” regions in terms of investment in fixed assets. In the period 2002-2015, the volume of investments in the region increased by 4.5 times, which is twice as much as the Russian average. Investment activity in the region is supported by the implementation of major investment projects at the federal level: the Nizhneye Priangarye integrated development project, the Vankor cluster field development project, the construction of the Kuyumba-Tayshet main oil pipeline for transporting oil from the south of Evenkiya, and a development project for the Siberian Federal University 10.

An important driver for the development of territories in cluster 2 is their ethno-cultural potential, which is one of the main components for the development of ethno-cultural tourism in order to diversify the economy and create new jobs. For example, in some arctic regions of the Republic of Sakha, Evenks, Evens, Yukaghirs, Dolgans, Chukchis, northern Yakuts, and Russian old-timers (Russko-Usti and Pokhodchans) are actively engaged in traditional economic activities. This region is a leader among Russian regions in matters of protecting the rights and interests of small indigenous peoples; it has a law on ethnological expertise 11.

More than 49 thousand inhabitants of the Yamal-Nenets Autonomous Okrug belong to the indigenous peoples of the North who have preserved their life practices and a distinctive culture of economy. Today, the region has developed a network of trading posts along the main reindeer herding routes, which are becoming centers for providing various types of services to the tundra people: medical, educational, cultural, and social. The register of trading posts of the Yamalo-Nenets Autonomous Okrug has been approved, which includes 30 stations 12.

Threats:

-

• increased resource intensity and northern rise in the cost of all types of work and services, due to the geographical features of the territories;

-

• probability of failure to implement investment projects in case of low solvency;

-

• shortage of labor resources (active migration outflow, reduction in the number of able-bodied population);

-

• reduction of opportunities for traditional nature management of the indigenous peoples of the North due to climate change and industrial development.

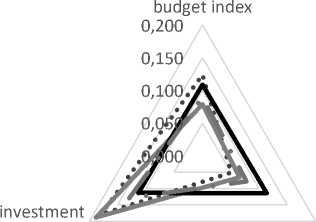

Vector of financial development. The main vector of financial development along this trajectory should be the strengthening of the budget and economic indices of the territories, thanks to the development of small and medium-sized businesses in alternative mining and manufactur- ing industries, the formation of an energy-efficient economy and the introduction of innovations, the provision of comfortable living conditions, cultural diversity for the population (Fig. 2).

index

economic index

Nenets AO

^^^^^^^^^ Yamalo-Nenets AO

^^^^^^^^^ Krasnoyarsk region

^^^^™ • Sakha (Yakutia)

Republic

-

Fig. 2. Orientation of the financial development trajectory of the regions.

In order to increase the financial viability of regions from cluster 2, it is necessary to use an integrated approach that takes into account not only their own financial investment resources, but also such fiscal incentives as subsidized lending, state guarantees, tax benefits and preferences.

Taking into account, that the Nenets Autonomous Okrug produces 0.4% of the total GRP of the Russian regions, the disproportions in budgetary security and in various amounts of revenue raise questions. In order to replenish budget revenues, the Nenets Autonomous Okrug needs to develop and diversify its economy and create high-paying jobs in micro- and small enterprises.

At the same time, geological exploration and development of minerals in these territories should be primarily aimed at additional budget revenues, socio-economic development, and improvement of the standard of living and quality of life of the population.

Strengthening the diversification of the economy of the Russian Arctic regions, supporting northern traditional activities and alternative forms of employment and self-employment, including the development of the tourism sector and infrastructure that enables the population to earn a decent income and a high level of social services, will help to increase the economic index.

The trajectory of the region’s development with high values of the budget index

Trajectory context . The regions with high values of the budget index are characterized by the following features of financial development: sufficiently balanced budget; average level of budget security; small amount of subsidies to equalize budgetary security; low level of public debt; effective level of tax administration. Regions with such characteristics form cluster 3: Murmansk and Arkhangelsk (without the Nenets Autonomous Okrug) oblasts, Komi Republic.

Drivers: high level of tax potential and economic diversification.

The issue of budgetary independence and self-sufficiency is currently debatable. Predominance of own revenues in the structure of consolidated budgets of the territories identified above, presence of effective tax administration and sufficiently diversified economy allowed them to form greater financial independence than in other Arctic regions. The exceptions are the autonomous okrugs — Yamalo-Nenets and Nenets (donor regions), so they were not included in this cluster as strongly distinguished regions. In addition, the indicators characterizing the fiscal system show that the level of tax potential of the Murmansk and Arkhangelsk oblasts and the Komi Republic is high compared to other Arctic regions (excluding donor regions) (Table 2).

The most important prerequisite for the regional development of this cluster is a diversified economy (Fig. 3). The greatest diversification of the economy of the three regions included in cluster 3 is observed in the Murmansk Oblast, where fishing, mining and processing of mineral resources, production and repair of machinery and equipment, and transport predominate. The economy of the Arkhangelsk Oblast and the Komi Republic is less diversified, and the share of hunting, agriculture and forestry practically corresponds to the average Russian level (for example, the Arkhangelsk Oblast — 4.3%, the Russian Federation — 5.0%), this is due to significant timber reserves in these regions (in the Arkhangelsk Oblast — about 3.2% of the total timber reserves of the country, in the Komi Republic — 3.6%) [9, Baklanov P. Ya., Moshkov A.V.].

Table 2

Indicators characterizing the financial independence of the territory, 2019 13 14

|

Arctic regions |

Budget security |

Equity level |

Level of tax burden |

Cost coverage ratio 15 |

|

Republic of Karelia |

0.540 |

0.501 |

0.102 |

0.629 |

|

Komi Republic |

0.970 |

0.902 |

0.130 |

0.799 |

|

Murmansk Oblast |

0.998 |

0.828 |

0.141 |

0.875 |

|

Arkhangelsk Oblast (without NAO) |

0.621 |

0.565 |

0.111 |

0.730 |

|

Krasnoyarsk Krai |

0.960 |

0.742 |

0.108 |

0.783 |

|

Republic of Sakha (Yakutia) |

0.511 |

0.516 |

0.168 |

0.632 |

|

Chukotka AO |

0.370 |

0.361 |

0.160 |

0.605 |

In the rest of the Arctic regions, the sectoral structure of the economy is represented mainly by mining and manufacturing (Table 3). For example, in the Yamalo-Nenets Autonomous Okrug, gas and oil production in the structure of gross value added is 67.3%, in the Nenets Autonomous Okrug — 83.2%. In the Krasnoyarsk Krai, the economy is based on the mining and manufacturing industries (25.6% and 31.8%, respectively). In the Republic of Sakha (Yakutia) and Chukotka, the basis of value added is the extraction of ores, non-ferrous and precious metals (40 – 50%).

Table 3

The structure of gross value added produced in the Arctic regions of Russia by industry in %, 2019 16

|

Arctic regions |

>^ "О cd сю О с с 2 об г ^ |

СЮ ‘с |

сю с В -с С с го — |

3 25 О о |

ГО 6 ° ш Е Е Ч- "О с го го го .У ^ $ о ф ^ О -о > 5-2 |

"О tj СЮ о й- ° С V) си н |

CD си О V) CD 45 "о С3 CD OJ CD _Е ±^ го > и — < га |

из CD _С б |

|

Republic of Karelia |

6.1 |

17.1 |

20.8 |

3.5 |

5.3 |

11.3 |

0.9 |

35 |

|

Komi Republic |

1.5 |

44.1 |

11.5 |

5.7 |

4.7 |

6.9 |

0.6 |

25 |

|

Nenets Autonomous Okrug |

0.7 |

83.2 |

0.2 |

3.5 |

0.7 |

5.8 |

0.1 |

5.8 |

|

Arkhangelsk Oblast without AO |

6.3 |

5.1 |

27.4 |

4.9 |

10 |

11.5 |

1.5 |

33.3 |

|

Murmansk Oblast |

14.4 |

12 |

11.5 |

7 |

9.1 |

10.7 |

1.7 |

33.6 |

|

Yamalo-Nenets Autonomous Okrug |

0.1 |

67.3 |

1.6 |

12.4 |

6.4 |

3.8 |

0.3 |

8.1 |

|

Krasnoyarsk Krai |

2.5 |

25.6 |

31.8 |

4.6 |

6 |

5.9 |

0.5 |

23.1 |

|

The Republic of Sakha (Yakutia) |

1.6 |

51.5 |

1.1 |

9.6 |

5.7 |

6.3 |

0.8 |

23.4 |

|

Chukotka Autonomous Okrug |

2.5 |

40.3 |

0.3 |

7.3 |

6.3 |

4.3 |

0.4 |

38.6 |

Threats: constant changes in federal legislation (within the framework of budget and tax policy) may cause a slowdown in the growth of own tax and non-tax revenues, an increase in the deficit of financial resources and public debt, which, in turn, may provoke the regions to exist in conditions of severe budget constraints and, as a result, will threaten the long-term sustainability and balance of the regional budget system.

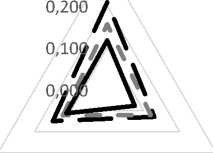

Vector of financial development . In general, the trajectory of the financial development of this cluster should be aimed at (Fig. 4):

-

• increasing investment attractiveness (development of legislative framework for the formation of a favorable investment environment, development of small and medium businesses);

-

• increasing the level of the economic index (expanding the volume of non-commodity non-energy goods).

^^^^в • Murmansk region investment index

budget index 0,300

economic index

Arkhangelsk region

1^^^^^^^™ Komi Republic

-

Fig. 3. Orientation of the financial development trajectory of the regions.

Moreover, the development strategy for each region will depend on the resource component and the structure of the regional economy. For example, in the Murmansk Oblast, the growth of export potential will be aimed at increasing the volume of exports of fish and seafood; in the Arkhangelsk Oblast (without the Nenets Autonomous Okrug) — at increasing the share of highly processed goods in the export structure of the timber industry complex [11, Vasiliev A.M., Lisuno-va E.A., 12, Myakshin V.N. et. al.]. The development strategy of the Komi Republic will focus on creating a favorable investment climate (organizing a system that ensures effective interaction between municipal authorities and participants in investment activities) and implementing major investment projects, in particular the formation of “transport corridors” 17 to create an optimal transport network for the European and Ural North of Russia due to “inclusion the Arctic ports Sabetta (under construction) and Indiga (promising) in the transport network of this territory” 18, as well as the development of the coal industry (development of the Usinskoye deposit, coal mining at the Verkhnesyaginskoye deposit, coal mine “Promezhutochniy”).

Conclusion

Attention to the previously established specific features and non-specific patterns allows us to take a more comprehensive look at solving the problems of the Arctic territories and develop a certain trajectory for the financial development of the region, indicating its individual path. The values of the integral indicator calculated by the authors served as the basis for developing the trajectories of the financial development of the Arctic territories. The authors tried to determine three possible trajectories of financial development taking into account obtained values of aggregated financial indices, as well as the results of the SWOT analysis (the drivers of the region and possible threats were identified).

The first trajectory is characterized by high economic potential of the regions; therefore the main strategy of development should be focused on budget resource increase and realization of accumulated investment potential. It is necessary to change conditions for large integrated structures, to expand regional tax privileges and to introduce various tax innovations that enhance investment potential.

The second trajectory is the development of the region with a high level of investment potential, which involves the development of a strategy focused on strengthening the budgetary and economic potential. Recommendations include supporting the development of state programs, expanding project-based management principles and applying a special economic regime in the Arctic zone in order to move towards a circular economy. In the context of measures to improve fiscal capacity, one can specify the improvement of tax revenue administration and the gradual formation of a unified information space in the budgetary and tax sphere.

The third trajectory of financial development characterizes a high level of budget independence of the regions with reduced indicators of their investment and economic activity, so the main vector of regional financial development should be aimed at increasing investment attractiveness and the level of export potential of non-commodity goods. According to the authors, this requires ensuring the effective implementation of investment projects through infrastructure support, subsidizing insurance premiums for new jobs and interest rates on investment loans. Improving export potential of non-resource commodities may also require a substantial boost to the investment process and introduction of innovative technologies in manufacturing and agriculture.

Thus, in the presence of a competent state policy, the outlined development trajectories will make it possible to effectively use all the advantages to ensure the livelihoods and dynamic social and financial development of the Arctic territories.

Список литературы Financial Development Trajectories of the Russian Arctic Regions

- Zvyeryakov M., Kovalov A., Smentyna N. Strategic Planning of Balanced Development of Territorial Socio-Economic Systems in the Conditions of Decentralization. Odesa, ONEU, 2017.

- David F. Strategic Management: Concepts and Cases (7th Edition), Upper Saddle River, NJ, Prentice Hall, 1999, 944 p.

- Atamas E.V., Kosinov D.V. Klasternyy podkhod v upravlenii ekonomikoy regiona [The Cluster Ap-proach in Managing the Economy of the Region]. Regional'nye problemy preobrazovaniya ekonomiki [Regional Problems of Transformation of the Economy], 2020, no. 11 (121), pp. 79–86. DOI: 10.26726/1812-7096-2020-11-79-86.

- Tatenko G.I. Evropeyskaya kontseptsiya strategicheskogo planirovaniya razvitiya territorii [European Concept of Strategic Planning for the Development of the Territory]. Evraziyskiy soyuz uchenykh [Eurasian Union of Scientists], 2017, no. 11–2 (44), pp. 68–72.

- Kalyuzhnova N.Ya., Violin S.I. Umnaya spetsializatsiya rossiyskikh regionov: vozmozhnosti i ograni-cheniya [Smart Specialization of Russian Regions: Prospects and Limitations]. Ekonomika, predprin-imatel'stvo i parvo [Journal of Economics, Entrepreneurship and Law], 2020, vol. 10, no. 10, pp. 2457–2472. DOI: 10.18334/epp.10.10.111061

- Carayannis E., Grigoroudis E. Quadruple Innovation Helix and Smart Specialization: Knowledge Pro-duction and National Competitiveness. Foresight and STI Governance, 2016, vol. 10, no. 1, pp. 31–42. DOI: 10.17323/1995-459x.2016.1.31.42

- Petrov A.N., Rozanova M.S., Klyuchnikova E.M., et al. Kontury budushchego rossiyskoy Arktiki: opyt postroeniya kompleksnykh stsenariev razvitiya Arkticheskoy zony Rossii do 2050 g. [Contours of the Russia’s Arctic Futures: Expereince of Integrated Scenario-Building till 2050]. Uchenye zapiski Ros-siyskogo gosudarstvennogo gidrometeorologicheskogo universiteta [Proceedings of the Russian State Hydrometeorological University], 2018, no. 53, pp. 156–171.

- Chapargina A.N., Dyadik N.V. Statisticheskiy analiz finansovoy sostoyatel'nosti regionov rossiyskoy Arktiki [Statistical Analysis of the Financial Solvency of the Russian Arctic Regions]. Voprosy statisti-ki, 2021, vol. 28, no. 1, pp. 28–37. DOI: 10.34023/2313-6383-2021-28-1-28-37

- Fauzer V.V., Lytkina T.S., Fauzer G.N. Rasselenie naseleniya v rossiyskoy Arktike: teoriya i praktika [Population Settling in the Russian Arctic: Theory and Practice]. Dinamika i inertsionnost' vospro-izvodstva naseleniya i zameshcheniya pokoleniy v Rossii i SNG: Sbornik statey VII Ural'skogo demo-graficheskogo foruma [Dynamics and Inertia of Population Reproduction and Replacement of Gen-erations in Russia and the CIS: Proc. the 7th Ural Demographic Forum], 2016, pp. 126–132.

- Denisenko T.V. Ekologicheskaya emkost' territorii: problemy otsenki i upravleniya [Ecological Capac-ity of the Territory: Problems of Assessment and Management]. Geo-Sibir' [Geo Siberia], 2007, vol. 6, pp. 238–241.

- Dyadik N.V., Chapargina A.N., eds. Finansovaya sostoyatel'nost' regionov rossiyskoy Arktiki: mono-grafiya [Financial Viability of the Regions of the Russian Arctic]. Apatity, Federal Research Center of the RAS, 2021, 150 p.

- Tarasova O.V., Sokolova A.A. Perspektivy kompleksnogo osvoeniya Chukotskogo AO [Prospects for the Chukotka’s Complex Development]. Mir ekonomiki i upravleniya [World of Economics and Man-agement], 2018, no. 2(18), pp. 69–85.

- Baklanov P.Ya., Moshkov A.V. Prostranstvennaya differentsiatsiya struktury ekonomiki regionov Arkticheskoy zony Rossii [Spatial Differentiation of the Structure of the Economy of the Regions of the Arctic Zone of Russia]. Ekonomika regiona [Economy of Regions], 2015, no. 1(41), pp. 53–63. DOI:10.17059/2015-1-5

- Badylevich R.V., Verbinenko E.A. Podkhody k postroeniyu sistemy finansovogo regulirovaniya razvitiya regionov Severa na osnove otsenki finansovogo potentsiala [Approaches to Building a Sys-tem of Financial Regulation of the Regions Development of the North Based on an Assessment of the Financial Potential]. Apatity, KSC RAS, 2019, 144 p.

- Vasiliev A.M., Lisunova E.A. Neobkhodimost' obosnovaniya dlya uvelicheniya eksporta rybnoy produktsii [A Necessity of Substantiation for Fishery Products Export Increase]. Rybnoe khozyaystvo [The Fisheries Journal], 2020, no. 1, pp. 28–32. DOI: 10.37663/0131-6184-2020-1-28-32

- Myakshin V.N., Petrov V.N., Pesyakova V.N. Tendentsii razvitiya vneshneekonomicheskikh svyazey regional'nogo lesopromyshlennogo kompleksa (na primere Arkhangel'skoy oblasti) [Development Trends in the Regional Forest Products Market (in the Case Study of the Arkhangelsk Region)]. Vest-nik Permskogo universiteta. Seriya Ekonomika [Perm University Herald. Economy], 2020, no. 1 (15), pp. 110–130. DOI: 10.17072/1994-9960-2020-1-110-130