Financial well-being of older adults: theoretical and methodological aspects and assessment issues

Автор: Belekhova G.V.

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Public finance

Статья в выпуске: 5 т.16, 2023 года.

Бесплатный доступ

The tasks to promote active ageing and a prosperous old age, laid down in Russia’s program and strategic documents (federal project “The Older Generation”, “Strategy of Actions in the Interests of Citizens of the Older Generation in the Russian Federation until 2025”, etc.), can be addressed effectively only if financial well-being has been achieved. The aim of the study is to reveal theoretical and methodological foundations of the financial well-being of older adults, reflected in foreign and domestic scientific discourse. The article presents a theoretical and methodological framework for the financial well-being of older adults, and provides its preliminary assessment in the case of older adults in the conditions of Russian reality. As a result of a critical analysis of the scientific literature, we show that the concept “financial well-being” is commonly used in foreign scientific discourse, but it is not widespread in Russian research. We highlight general aspects of financial well-being: good current financial situation; financial stability in relation to shocks; confidence in the security of the future. We put forward a set of indicators to assess the financial well-being of older adults based on data from the All-Russian Survey of Consumer Finance - 2022 (a survey conducted by the Ministry of Finance of the Russian Federation and the Bank of Russia). We apply sociological analysis methods (descriptive analysis, frequency distribution analysis using combination tables). It is revealed that older adults feel more prepared for possible financial shocks, which is facilitated by the orientation toward savings practices and low credit activity. We identify the following sore spots: older adults are more concerned about the likelihood of money shortage, and they also do not feel confident in the sufficient financial security of their future. At the end of the article, we outline promising areas for research.

Financial well-being, older adults, pension, sociological survey, income, planning

Короткий адрес: https://sciup.org/147242448

IDR: 147242448 | УДК: 314.17:330.59 | DOI: 10.15838/esc.2023.5.89.7

Текст научной статьи Financial well-being of older adults: theoretical and methodological aspects and assessment issues

The study was funded by the RSF grant No. 23-78-10128,

Currently, one of the main demographic trends observed not only in Russia, but also worldwide1, is the population aging, which is expressed in an increase in the share and number of older adults in its age structure. As of 2022, the share of Russians over working age was 25.2%. According to Rosstat demographic forecast, by 2036 it will be at least 24%, with a simultaneous reduction in the share of the population below working age to 14% (18.7% in 2022) and an increase in the share of working-age people to 62% (56.3% in 2022)2.

In Russia, the tasks of ensuring a high standard of living and quality of life for the older adults, comprehensive maintenance and development of its human potential form the basis of the most important program and strategic documents regulating the issues of socio-economic and demographic policy (federal project “The Older Generation”3, “Strategy of Actions in the Interests of Citizens of the Older Generation in the Russian

Federation until 2025”4, Presidential Decree 204, dated May 7, 2018 “On national goals and strategic objectives of development of the Russian Federation for the period through to 2024”, etc.). In these documents, the concept of “active aging” is the basis of the policy related to the older adults5. It is widely used in research and expert discourse along with such concepts as “successful aging”, “prosperous aging”, “productive aging”, “harmonious aging”, “healthy aging”, etc.6 (Kalachikova et al., 2023). According to the analytical report on the project “Concept of Active Aging Policy in Russia”, prepared by the HSE University, active longevity is “a state of social, economic, physical and psychological well-being of older adults, which provides them with the opportunity to meet their needs, inclusion in various spheres of society and is achieved with their active participation”7.

It is important to realize that “the development of the potential for successful and active aging is possible only under the condition of a socially acceptable standard of living of older adults”8. This standard of living implies the achievement of economic independence, financial freedom and resilience to shocks, the ability to fully and freely meet their own (current and future) needs. In the foreign scientific and expert field, these characteristics are often summarized in the category of “financial well-being” (Bruggen et al., 2017).

International surveys prove that people are seriously concerned about their own financial situation. According to the surveys, in 2020, on average across OECD9 countries, 66.5% of respondents were concerned to some degree about their household finances and overall economic well-being over the following two years. More than half of respondents (58.7%) were anxious about fully paying for all their expenses. In the long term (on the horizon of the following decade), risk perceptions are also financially centered – more than 70% of respondents were worried about financial security in old age10.

Nationwide sociological surveys conducted in Russia also reveal a high level of concern among the population about their own economic situation. According to FOM surveys11, for many years, in addition to fear for their children (grandchildren), for the health of their relatives and their own health, Russians have been experiencing great fears about the lack of money (34% in 2015, 31% in 2022). This assessment is more typical for the population of young and middle age (18–30 years – 35%; 31–45 years – 35%) than for older adults (over 60 years – 23%). In the country as a whole, concern about rising prices and impoverishment of people (39% in 2015, 40% in 2022) is at the top of the list, with the urgency of this problem being emphasized annually by representatives of all age groups.

Broadly speaking, the financial well-being of older adults is included in many concepts of active and healthy aging. In particular, the World Health Organization (WHO) concept of active aging, which is based on three pillars (health, social participation and security), is inextricably linked to the financial situation of the population through indicators of work activity and financial security12. The active ageing approach promoted by the Australian Department of Health and Ageing, in addition to social, mental and physical activity and participation in the workforce, also involves ensuring the financial security of older adults13. According to the UN Decade for Healthy Ageing 2020–2030, which continues the traditions of the WHO Global Strategy on Ageing and Health and the Madrid International Plan of Action on Ageing, the social and economic resources and opportunities available to people throughout their lives are important for living well into old age, as they influence the ability to make good health choices and help to maintain a full and active life in older age14.

Several international indices are used to monitor progress toward the goals of active and healthy aging. The best known of them are the Active Ageing Index, the Global AgeWatch Index, the Natixis Global Retirement Index, the Wellbeing in Later Life Index (WILL) (Pavlova et al., 2021). Measurement is carried out with the help of specially developed indicators and indicators that characterize various aspects of well-being of older adults. Economic (material) well-being is mainly assessed through quantitative indicators (retirement income, old-age poverty rate, credit burden, accumulated wealth, GDP per capita, relative income level of older adults, etc.) and indicators of sufficiency of available resources (e.g., the share of older adults who do not experience severe material deprivation when purchasing certain products, goods and services). Integral indices are convenient and effective measurement tools, and the better the components are developed, the more reliable the assessment will be.

Given the orientation of many program documents related to older adults on the successful and active aging, which implies, among other things, a secure and economically independent life in older age, we believe it is possible to use the category of “financial well-being” as an integral element in assessing the overall well-being and quality of life of older adults. The importance of measuring this category increases in the context of modern challenges for the economy and social sphere, manifested in the growth of expenditures on pensions, medical and social services; the increasing role of older adults in the sphere of consumption;

the expansion of opportunities for investing money; the development of formats for providing financial and social services in the context of widespread digitalization, etc.

The aim of the research is to reveal theoretical and methodological foundations of financial wellbeing of older adults, presented in foreign and Russian scientific discourse. We pay attention to theoretical and methodological aspects of studying the financial well-being. In particular, we consider the views on the essence of the category “financial well-being”; identify the factors promoting the formation of financial well-being and systematize approaches to its assessment; summarize the features of financial well-being of older adults, identified by foreign researchers. The second part of the article is devoted to empirical testing of the possibility to assess the financial well-being of older adults on the basis of Russian data. In the case of the All-Russian household survey on consumer finances, conducted on the initiative of the Ministry of Finance of the Russian Federation and the Bank of Russia, we assess how older adults perceive their financial well-being, how they plan expenditures, save and invest free funds, and how they cope with financial shocks.

Research methods and information base

In the research, we used a set of general and special methods of scientific knowledge. The solution of the problem related to the systematization of theoretical and methodological aspects of studying the financial well-being of population was based on the application of general scientific methods: generalization, comparison, analysis and synthesis of scientific literature, and open sources. The main pool was formed from English-language publications, since the search in the Russian bibliometric system (eLibrary) did not yield relevant results.

We carried out the realization of analytical tasks to assess the financial well-being of older adults using the methods of sociological analysis

(descriptive analysis, frequency distribution analysis using combinational tables).

The empirical basis for assessing the financial well-being of older adults was formed by the data of the All-Russian Household Survey on Consumer Finances – 202215. The project has been implemented since 2013 every two years. The first four waves were organized by the Ministry of Finance of Russia, and the fifth wave (the survey in 2022) was organized by the Bank of Russia. The coordination and implementation of all waves of the survey, including fieldwork, is carried out by OOO “Demoscope”. In 2022, 6,081 households were interviewed, including 12,162 respondents living in 32 constituent entities of Russia.

“Old age” is a static concept. The measure of “old age” is determined by some conventional age boundary. There are many age classifications, each of them distinguishes different periods and boundaries of stages of human life, including old age, but in most of them the lower boundary of old age is 60 years (Barsukov, Kalachikova, 2020). In this study, we will take into account not only the demographic criterion, but also the legal one. Taking into account that many strategic documents and measures of social support are differentiated by age, to identify older adults we will be guided by the retirement age, which in Russia in 2022 is 56.5 years for women and 61.5 years for men. Accordingly, the volume of the analyzed sample, including only older adults (women from 56 years, men from 61 years), is 4,331 people, and the volume of the sample of the rest of the population is 7,831 people. Data processing was performed in SPSS.

Financial well-being: conceptualization, operationalization, factors

In foreign scientific literature, the category of financial well-being is given much attention (Kaur et al., 2021), including in relation to the situation of older adults (Ching Yuen Luk, 2023; Xue et al., 2020). In Russian research practice, this discourse is virtually absent, and more traditional is the reference to the level and quality of life of older adults (Barsukov, Kalachikova, 2016; Aizinova, 2017; Shabunova, Rossoshanskii, 2018; Burtseva et al., 2019), their well-being (Pavlova et al, 2021), health status and labor activity of older adults (Korolenko, Barsukov, 2017; Barsukov, Shabunova, 2018), prevalence of active aging practices, motivations and barriers to their implementation (Korolenko, 2022), social policy in terms of ensuring high quality of life and well-being of older adults (Barysheva, Nedospasova, 2017; Dobrokhleb, 2021).

The concept of “well-being” includes elements that ensure an individual’s ability to live a full-on life (Ryazantsev, Miryazov, 2021, p. 6). Usually five aspects of well-being are distinguished: physical, material, social, emotional, development and activity. These aspects can be reformulated as physical health, income and well-being, social relations, work and free time, absence of depression (Kislitsyna, 2016). A similar approach is used in the Gallup-Healthways Global Wellbeing Index16, which includes five dimensions of well-being: 1) physical (good health and sufficient energy to carry out daily activities); 2) economic/financial (managing the economic situation to reduce stress and increase security); 3) social (feeling safe and proud to belong to a community); 4) social (having support and love); and 5) success (the relationship between daily activities and motivation to achieve goals). In this study we consider financial well-being as a constituent element of higher-level well-being – economic well-being.

The categories of standard of living, quality of life, socio-economic status, and well-being, which are adjacent to well-being, essentially characterize the same object – human life. In most “strategic documents, ratings, results of scientific research of social orientation, the terms “well-being” and “quality of life” are used interchangeably and considered as indicators for assessing the effectiveness of public policy on governance and development of society” (Burtseva et al., 2019, p. 6). These categories are complex, include a variety of elements (material provision, employment characteristics, health status, comfort and security of living, social relations, social activity, etc.), and to fully describe them, not only quantitative socio-economic indicators, but also non-material indicators (self-assessment of opportunities, satisfaction with aspects of life, happiness, wellbeing, etc.) are often used.

The results of the review of works by Russian authors show that the category of “financial wellbeing” has not been widely used in the study of the socio-economic situation of older adults ( Tab. 1 ). Usually, when assessing well-being, active aging or quality of life, Russian researchers operate with indicators that characterize the level of income

Table 1. Approaches of Russian researchers to assessing well-being of older adults

|

Authors |

Components of quality of life / well-being / longevity of older adults |

Indicators characterizing the economic situation |

|

T.A. Burtseva, N.Yu. Chausov, S.N. Gagarina (Burtseva et al., 2018) |

Quality of life of older adults:

|

The component “Level of well-being” is characterized by the following indicators:

|

|

E.V. Vasil’eva (Vasil’eva, 2022) |

Active aging index:

|

The component “Safety” is characterized by the following indicators: – ratio of the average pension to the pensioner’s subsistence minimum, times; – replacement rate |

|

G.L. Voronin, V.Ya. Zakharov, P.M. Kozyreva (Voronin et al., 2018) |

Subjective well-being of older adults:

|

The component “Financial means” is characterized by the following indicators:

|

|

I.A. Pavlova, E.A. Monastyrnyi, I.V. Gumennikov, G.A. Barysheva (Pavlova et al., 2018) |

Russian Elderly Well-being Index (REWI):

|

The component “Economic dimension” is characterized by the following indicators:

|

|

Source: own compilation based on scientific literature analysis. |

||

and consumer opportunities of older adults; slightly less often the assessment is supplemented with an indicator of satisfaction with the income received.

As we have already noted, foreign studies reveal a higher level of interest in the problems of financial well-being (Kaur et al., 2021; Wilmarth, 2021). Several terms are used, sometimes interchangeable with financial well-being – financial health, financial satisfaction, financial comfort, financial stability, but in most works the authors operate with the concept of wellbeing (Tab. 2). Initially, financial well-being was understood as general satisfaction with the financial situation, but later its interpretation went beyond the assessment of the current financial situation by including such aspects as perception of financial opportunities, feeling of economic sustainability, confidence in financial security in the future, etc. (Porter, Garman, 1993).

Table 2. Definitions of the category “financial well-being”

|

Authors |

Interpretation |

Comment |

|

N.M. Porter*; W. Vosloo, J. Fouche, J. Barnard (Vosloo et al., 2014) |

Financial well-being can be defined as objective and subjective aspects that allow forming a person’s opinion about their financial situation |

Financial well-being as a reflection of financial situation without specifying financial security, freedom and future |

|

United Nations SecretaryGeneral’s Special Advocate for Inclusive Finance for Development – UNSGSA** |

Financial health, or well-being, is a new concept that looks at the financial side of the ability of individuals and families to thrive in society |

|

|

R.G. Netemeyer, D. Warmath, D. Fernandes, J.G. Lynch (Netemeyer et al., 2018) |

Financial well-being includes:

|

A broader view of financial well-being than the previous one, as it is supplemented by an assessment of the financial future |

|

E. Kempson, A. Finney, C. Poppe (Kempson et al., 2017) |

Financial well-being determines the extent to which a person is able to comfortably meet all their current obligations and needs, and has the financial strength to sustain this in the future |

The most comprehensive view of financial well-being; these definitions include the parameters of current situation and day-to-day financial management, financial freedom and sustainability in the present, financial security in the future |

|

E.C. Bruggen, J. Hogreve, M. Holmlund, S. Kabadayi, M. Lofgren (Bruggen et al., 2017) |

Financial well-being is the perception of the ability to maintain a desired standard of living, maintain current economic potential, and increase one’s financial freedom in the future |

|

|

L. Riitsalu, R. Sulg, H. Lindal, M. Remmik, K. Vain (Riitsalu et al., 2023) |

– Feeling good about personal financial situation and being able to afford the desired lifestyle now and in the future; – maintaining one’s current lifestyle and achieving the desired lifestyle in the future, including being able to meet necessary expenses and obligations, ideally being able to afford whatever a person wants to do |

|

|

Consumer Financial Protection Bureau – CFPB*** |

Financial well-being is a state in which a person can fully meet current financial obligations, feels secure in the future, and is able to make choices that allow them to enjoy life |

The above opinions clearly show that there is no single approach or universal scientific concept of financial well-being in the foreign literature. However, we can emphasize some general aspects of its essence: good current financial position; financial stability to shocks; confidence in the security of the future . We should emphasize that in the literature we have studied there is no specific definition or approach to the conceptualization of financial wellbeing in relation to specific groups of the population (for example, large families, workers in any industry, older adults, etc.).

As Table 2 shows, with all the variety of interpretations of financial well-being, their semantic differences are minimized and mostly relate to the details. In most foreign studies, the definition proposed by the Consumer Financial Protection Bureau (CFPB) is taken as a basis, as it is convenient for operationalization and best reflects the elements of financial well-being of an individual: the ability to control daily and monthly finances (daily financial management); the ability to overcome financial shocks caused by unforeseen life events (financial stability); the ability to achieve financial goals and have financial freedom17. In this study, we also focus on the outlined approach.

Financial well-being, as a complex multidimensional phenomenon, is assessed through various objective and/or subjective indicators , which have both direct quantitative expression and are a projection of individual’s perception of his or her own financial situation. Objective indicators characterize quantitative aspects of financial situation (income, family size, amount of funds on bank deposit, credit load, etc.), and also allow describing financial knowledge and practices of the population (budgeting, planning purchases, knowledge of signs of financial fraud, etc.).

Subjective indicators , such as satisfaction with the amount of savings for old age, sufficiency of formed financial reserves, propensity to impulse purchases, etc., characterize personal and behavioral features of individuals. A number of authors prefer objective indicators, others use subjective measures determined by means of Likert scales, dichotomous variables, sociological indices, and others combine both variants of assessment (Riitsalu et al., 2023). On the one hand, the subjective approach is good as it reflects people’s perceptions and values better than objective indicators. On the other hand, the assessment by objective measures is more thorough and reasoned in terms of developing measures of financial well-being (Riitsalu et al., 2023). However, it is the subjective approach that researchers most often turn to, as it provides a more meaningful insight into the financial well-being ( Tab. 3 ).

The multidimensionality of the category “financial well-being” itself leads to the identification of a large list of factors affecting it, from external conditions (level of development of financial markets, state guarantees, economic and political stability in the country, social support system, inflation rate, cultural and religious traditions, etc.) to individual factors (sociodemographic characteristics of individuals, development of social contacts, behavioral characteristics: comparison with others, level of trust, openness and receptivity, etc.). The identification of factors largely depends on the research objectives and details of the survey instrument. Foreign publications most often track such factors of financial well-being as financial capability, financial knowledge (or in a broad sense – financial literacy) and financial behavior (as a record of experience of past behavior or behavioral intentions) (Kaur et al., 2021; Riitsalu, Murakas, 2019; Xiao, Porto, 2017).

A large body of research touches upon a variety of behavioral factors. In particular, the influence of a person’s attitude to money on the formation of

Table 3. Methodologies for assessing the financial well-being (within the framework of the subjective approach)

|

Authors |

Methodology description |

|

A. Gutman, T. Garon, J. Hogarth, R. Schneider (Gutman et al., 2015) |

Financial health is assessed by a broad list of questions on four different topics: managing daily finances, resilience, ability to capitalize on opportunities, financial attitude |

|

Consumer Financial Protection Bureau – CFPB* |

Financial well-being is measured by four components: – daily financial management; – financial stability; – ability to meet financial goals; – feeling of financial security about the future. The questions used are: “How well does this statement describe you or your situation?” (5-point scale from “completely” to none); “How often does this statement apply to you?” (5-point scale from “always” to “never”). Examples of statements are the following:

|

|

E. Kempson, A. Finney, C. Poppe (Kempson et al., 2017) |

Financial well-being is measured in three components: – financial obligations (active savings, spending limits, and plan monitoring), – financial comfort (freedom to spend, confidence to enjoy money instead of financial stress), – financial strength (the ability to cope with unforeseen circumstances without borrowing or selling assets at an unfair price). Examples of questions are:

|

|

O. Garcia-Mata, M. Zeron-Felix, G. Briano (Garcia-Mata et al., 2022) |

The Financial Well-Being Index is calculated according to nine components; the index is based on dichotomous variables; includes objective and subjective measures; does not take into account variables related to the emotional state caused by personal financial management The questions are:

|

End of Table 3

Authors Methodology description J. Fu (Fu, 2020) Financial well-being is measured by five components: 1) income and expense balance; 2) establishing and maintaining reserves; 3) debt management; 4) planning; 5) stability to financial shocks. Self-assessments on a Likert scale and binary questions (yes/no) are used. The composite measure of financial well-being is calculated by aggregating component scores. It is scaled from 0 to 100 for ease of interpretation. Panel A. Income and expense balance sheet. “I worry about paying for ordinary everyday expenses” (scale from “strongly agree” to “strongly disagree”). “Sometimes people find that their income does not quite cover their living expenses. In the previous 12 months, has this happened to you personally?” (yes, no, don’t know) Panel B. Creation and maintenance of reserves. “If you lost your main source of family income, how long could your family continue to meetliving expenseswithoutborrowingmoneyormovingtoanewhome?”(lessthanaweek;lessthanamonth; 1 to 3 months; at least 3 months but not more than six months; more than six months; difficult to answer) Panel C. Manages debt and access to resources. “I have too much debt right now” (scale from “strongly agree” to “strongly disagree”). “What did you do to make ends meet the last time your income did not fully cover your daily expenses?” (used an outside resource; paid expenses later or waived part of the expenses). Panel D. Planning and prioritization. “My financial situation limits my ability to do the things that are important to me” (scale from “strongly agree” to “strongly disagree”) “How confident are you that you have done a good job of making financial plans for retirement?” (scale from “very confident” to “not at all confident” and no retirement plan, difficult to answer). “How will you fund your retirement?” (unable to specify any method at all; plan to rely solely on partner/spouse/children; any other formal method). Panel E. Managing and recovering from financial shocks. “I am satisfied with my current financial situation” (scale from “strongly agree” to “strongly disagree”). “If you were personally faced with a major expense today (equivalent to your own monthly income), would you be able to pay it without borrowing money or asking family or friends for help?” (yes, no, don’t know). * CFPB Financial Well-Being Scale: Scale development technical report. (2017). Consumer Financial Protection Bureau. Available at: (accessed: August 28, 2023). Source: own compilation based on the scientific literature analysis. financial well-being is shown: people with a proactive approach (preference for savings rather than spending; avoidance or minimal use of loans, etc.) tend to be more financially satisfied (Joo, Grable, 2004). Other works reveal the relationship between financial well-being and an individual’s financial inclinations (such as materialism, willingness to take risks, delaying rewards, conscientiousness, time orientation, self-control). It has been found that individuals who are willing to sacrifice immediate gratification for future needs and emphasize long-term financial planning are more financially satisfied and experience less current stress from money management (Netemeyer et al., 2018). It has also been shown that a lack of self-control, manifested by impulsive behavior and deviation from plans, leads to undesirable financial behaviors (overspending, late credit card payments, etc.) with subsequent negative outcomes for financial well-being (Stromback et al., 2017).

Features of financial well-being of older adults (foreign experience)

Financial skills and needs change with age, so it is important to understand the characteristics of financial well-being in different age groups. Foreign publications present contradictory data on the relationship between age and financial well-being of the population. Some researchers have found that it has a U-shape: higher financial well-being among young people and older adults, lower in middle age (Riitsalu, Murakas, 2019; Xiao, Porto, 2017). Other authors have found that financial wellbeing increases with age (Fu, 2020), while others have found that it becomes lower in older age groups (Garcia-Mata et al., 2022).

Despite the ambiguous assessment of financial well-being at older ages, most foreign studies prove that older adults paradoxically experience higher financial satisfaction at relatively low income levels (Hansen et al., 2008). To elucidate the reasons for this, authors have examined the relationship of older adults’ financial well-being with factors such as labor and retirement trajectories (Palomaki, 2019), various income variables (Hsieh, 2004), life satisfaction, mental health, and retirement satisfaction (Wilkinson, 2016). For example, Fan and Lei’s work explored the relationship between objective and subjective aspects of financial wellbeing and symptoms of depression in elderly Chinese based on a longitudinal study in health and retirement. Objective financial well-being was measured by two indicators – expenditure to income ratio and financial assets ratio. The perception of money management difficulties was used to measure subjective financial well-being. According to the results of correlation analysis, the authors found that both objective and subjective financial well-being have an impact on the manifestation of depression symptoms: a high expenditure-to-income ratio and the perception of difficulties in money management increase the manifestation of depression, while the financial assets ratio has the opposite effect (Fan, Lei, 2023).

Life-cycle concept studies are widespread. In particular, Madero-Cabib and Fasang studied the financial well-being of German and Swiss retirees, taking into account work-family trajectories, early life trajectories, and the characteristics of individuals’ interactions with the pension system (Madero-Cabib, Fasang, 2016). The results show lower individual retirement income for all workfamily profiles that deviate from the standard male model of full-time employment combined with two children and stable family relationships. The authors also argue for the importance of studying longer periods of the life course, not only events close to the retirement transition, as determinants of financial well-being in old age.

Interesting results are presented in the work of Estonian scientists (Riitsalu et al., 2023), based on data from semi-structured interviews. It was determined that people of pre-retirement and retirement age understand financial well-being primarily as financial independence from others, a situation when all their needs are met (“Financial well-being is when there is enough money for all my needs. Let us say there is enough money for traveling, living and buying things”) (Riitsalu et al., 2023). The second mandatory component is the ability to financially support one’s close relatives. Another element some older interviewees mentioned was having “funeral money” (Riitsalu et al., 2023). The formation of financial well-being, as noted by respondents, is based on labor activity and options of medical and social security. The authors conclude that financial well-being in the perception of older adults is the ability to maintain their current lifestyle, which implies “making ends meet” without stress and a sense of confidence in their personal finances. For them, financial wellbeing does not imply wealth, but includes financial freedom and independence, interpreted as not needing someone else’s financial support for the rest of one’s life, including the ability to cover one’s own funeral expenses (Riitsalu et al., 2023).

As an example of research on the financial wellbeing of older adults at the national level, we can cite the work of the U.S. Consumer Financial Protection Bureau. Older Americans were found to have higher average financial well-being than younger adults. Low financial well-being is characteristic of those seniors who unexpectedly lost their jobs or significantly reduced their working hours, did not plan for retirement (did not participate in pension programs), live without other household members, provide financial support to close relatives, have debts on credit cards or for educational and mortgage loans, and have poor health. Higher rates of financial well-being among older Americans are correlated with having a defined contribution retirement plan, owning real estate or having low rent payments for housing, having financial support from family and friends, high levels of financial literacy, and regular savings and shopping planning18.

Financial well-being of older adults in Russia: preliminary assessment

In the framework of the study we follow the approach to the understanding of financial wellbeing presented in the reports of the U.S. Consumer Financial Protection Bureau (CFPB) and the works of some scientists (Riitsalu, Fu, Kempson, Stromback, etc.), as it is universal for any population group, suitable for operationalization and allows assessing not only the current financial situation, but also the possibilities of achieving financial security in the future and the perception of financial freedom. Accordingly, financial well-being is considered as a state in which a person can fully fulfill current financial obligations, freely achieve their financial goals, overcome financial shocks, and feel safe in the future.

In Russia, the most detailed and diverse in terms of the list of questions related to the financial activity of the population is the All-Russian

Household Survey on Consumer Finances – 2022 (Ministry of Finance, Bank of Russia, Demoscope). It is impossible to exactly copy any of the methodologies for assessing financial wellbeing studied in the foreign literature, so at this stage we will try to construct a set of indicators that will help to assess the financial well-being of older adults in the most comprehensive way. The proposed assessment design is of exploratory nature – it will allow assessing the completeness of the available database of sociological data on the financial well-being, to identify “stagnant” components and “nonworking” questions.

The assessment will be guided by the subjective approach and methodologies presented in the works of the U.S. Consumer Financial Protection Bureau (CFPB)19 and (Fu, 2020)20. Accordingly, the selected questions are designed to capture individuals’ perceptions of objective facts and actual financial practices (savings, credit, etc.; household budgeting), as well as feelings about the stability and security of their financial situation. The questions are organized into five components: 1) income and expense balance; 2) establishing and maintaining reserves; 3) debt management; 4) planning and prioritizing; and 5) managing and recovering from financial shocks. The highlighted components correspond to the key aspects of financial wellbeing identified above (daily financial management, financial sustainability; financial freedom in meeting needs; feeling financially secure about the future). A detailed list of assessed components of financial well-being and a set of indicators is given in Table 4 .

Table 4. Measuring financial well-being

|

Component of financial well-being |

Coding and question wording from the All-Russian Household Survey on Consumer Finances – 2022 |

Answers |

|

Component 1. Income and expense balance |

(K84) How stable was your monthly income during the year? |

Scale from 1 to 5 (1 – “Completely unstable”; 2, 3, 4 – no decoding given; 5 – “Completely stable”) |

|

(M7_1) How often do you personally buy things that are not necessary for you, and then find yourself running out of money for food or other urgent regular spending? |

Never; Rarely; Occasionally; All the time; Hesitate to respond |

|

|

(T12) Does your household keep a written record of income and expenses? |

No, no written records are kept; Hesitate to respond |

|

|

(L1_5) You are just making ends meet (How accurately the statement describes you or your life situation) |

Absolutely not; Only a little; To some extent; Quite accurately; Completely; Hesitate to respond |

|

|

Component 2. Establishing and maintain reserves |

(Y6_1) You try to save money for the future |

It is definitely about me; It is probably about me; It is more like not about me; It is definitely not about me; Hesitate to respond |

|

(Y6_2) You try to set aside money, even a small amount, on a regular basis |

||

|

(L1_6) You are concerned that you will not have enough money that you have or that you will save (How accurately does the statement describe you or your life situation) |

Absolutely not; Only a little; To some extent; Quite accurately; Completely; Hesitate to respond |

|

|

Availability: – cash savings (Р14_1), – account/deposit (Р10_1), – insurance policy (life Р41_1, ДМС Р41_3) |

Yes: No; Hesitate to respond |

|

|

Component 3. Debt management |

(P9_1) Do you personally have unpaid consumer loans? |

Yes: No; Hesitate to respond |

|

(P13_1) Do you currently owe any amount of money to private individuals? |

||

|

(С3_1) Do you personally currently have unpaid loans from a pawn shop or microfinance organization? |

||

|

Component 4. Planning and prioritization |

(L1_2) Do you personally currently have unpaid loans from a pawn shop or microfinance organization? |

Absolutely not; Only a little; To some extent; Quite accurately; Completely; Hesitate to respond |

|

(Y8) What time period do you mostly take into consideration when (you/you and your family) plan how much money to set aside and how much to spend? |

Not more than a month; Next few months; Next year; Next 5–10 years; More than 10 years; Timing is not important as we are not planning at all; Hesitate to respond |

|

|

(P9_7) Do you accumulate personal savings mainly to spend them in the next few months or for long-term purposes: as a “safety cushion”, for life after retirement, for children’s education, buying an apartment, etc.? |

For the next months; For long-term goals; No savings; Hesitate to respond |

|

|

Component 5. Managing and recovering from financial shocks |

(Y6_3) You always try to have at least some amount of money for unexpected expenses, just in case |

It is definitely about me; It is probably about me; It is more like not about me; It is definitely not about me; Hesitate to respond |

|

(K93) Do you think your financial situation is stable or could your financial situation easily be shaken, deteriorate? |

Steady; Could easily deteriorate; Hesitate to respond |

|

|

(L1_1) You can handle large unexpected expenses (How accurately does the statement describe you or your life situation?) |

Absolutely not; Only a little; To some extent; Quite accurately; Completely; Hesitate to respond |

|

|

Source: hereinafter – own compilation. |

||

Component 1: Income and expense balance ( Tab. 5 ). Older adults, unlike young and middleaged people, more often indicates high stability of income (which, among other things, is ensured by the regularity of various social payments), as well as more prudent approach to purchases, less often allowing unnecessary spending. However, such a fundamental aspect of financial literacy, and therefore financial well-being, as keeping records of income and expenditures in writing, is a neglected practice among all the groups under consideration. In addition, older adults have a slightly worse sense of current financial sustainability: one in five (20%) agree with the statement that they “make ends meet” (among young and middle-aged it is 16–17%).

Component 2. Establishing and maintaining reserves (Tab. 6). Older adults are more oriented toward saving practices, as evidenced by the high share of respondents stating that they try to save money for the future and regularly put aside even a small amount in savings. The role here is played not only by the narrowing of material opportunities or the motive of “saving for a rainy day” or for expensive medicines, but also by the stereotypical attitude about the narrowing of claims and needs in old age, and, consequently, the reduction in the volume of consumption of goods. Despite this, about one third of respondents in each age group are concerned about the probable lack of money at the right time.

In fact, the savings orientations of older adults are manifested in the formation of savings in cash (21% of respondents from this group noted the presence of this form of savings) and in the form of bank deposits (68%). In contrast to elderly, people of young and middle age to a greater extent prefer organized forms of savings (deposits – 75–78%, cash – 11–15%). Investment and insurance products

Table 5. Income and expense balance*, % of number of respondents in the respective group

|

Respond option |

Older adults |

Rest of the population |

|

|

Up to 30 years old |

Over 30 years to retirement age |

||

|

Income stability |

|||

|

Completely stable |

74.7 |

39.5 |

49.6 |

|

2 |

0.8 |

5.2 |

3.8 |

|

3 |

6.0 |

17.5 |

15.1 |

|

4 |

16.2 |

22.0 |

25.3 |

|

Not stable at all |

0.5 |

8.3 |

3.4 |

|

Thoughtless purchases leading to a shortage of money |

|||

|

Permanently |

1.5 |

2.5 |

2.0 |

|

Time to time |

8.8 |

21.9 |

15.8 |

|

Rarely |

24.8 |

30.2 |

32.9 |

|

Never |

62.8 |

41.3 |

47.4 |

|

Written accounting of income and expenses |

|||

|

Yes, a complete written record of income and expenses is maintained |

3.7 |

2.8 |

2.9 |

|

Yes, some kind of written record is kept, but it is far from complete |

8.5 |

8.8 |

9.3 |

|

No, no written records are kept |

86.3 |

84.9 |

86.7 |

|

“You are just making ends meet” |

|||

|

Absolutely not |

35.3 |

39.7 |

39.0 |

|

Only a little |

15.5 |

15.6 |

16.0 |

|

To some extent |

26.5 |

24.7 |

25.6 |

|

Quite accurate + Completely |

20 |

16 |

16.8 |

|

* Hereinafter the answer options “Hesitate to respond”, “No answer”, “Refuse to answer” are not given, which in total do not exceed 3%. |

|||

Table 6. “Establishing and maintaining reserves”, % of number of respondents in the respective group

|

Respond option |

Older adults |

Rest of the population |

|

|

18–29 years old |

Over 30 years to retirement age |

||

|

“You are trying to save money for the future” |

|||

|

It is definitely about me + It is probably about me |

65.8 |

42.4 |

54.5 |

|

It is more like not about me + It is definitely not about me |

32.5 |

55.9 |

43.9 |

|

“You try to set aside money on a regular basis, even a small amount” |

|||

|

It is definitely about me + It is probably about me |

61.9 |

40.5 |

52.5 |

|

It is more like not about me + It is definitely not about me |

36.2 |

57.2 |

45.9 |

|

“You’re concerned that you won’t have enough money that you have or that you will save” |

|||

|

Absolutely not |

14.1 |

13.0 |

11.2 |

|

Only a little |

16.7 |

17.7 |

18.4 |

|

To some extent |

34.9 |

37.5 |

37.2 |

|

Quite accurate + Completely |

30.8 |

27.5 |

29.9 |

(life insurance policy and VHI medical insurance policy) are used by no more than 2–3% of respondents in each group.

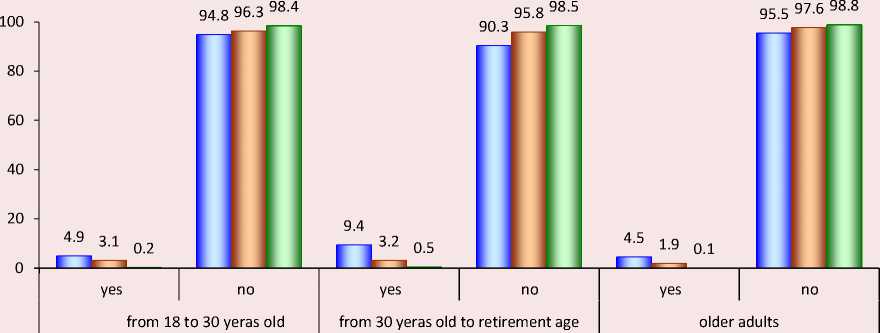

Component 3. Debt management (Figure). Older adults in Russia are usually less involved in debt relations due to various restrictions of banks and narrower consumer demands. However, the available survey data do not show any noticeable difference with the rest of the population, nor do they suggest that there is any critical situation with the use of credit, loans from private individuals or microfinance organizations by senior Russians.

Debt management, % of respondents in the respective group

□ Availability of unpaid consumer loans

□ Existence of debt to individuals

□ Availability of unpaid loans taken from a pawnshop or microfinance organization

Component 4. Planning and prioritization ( Tab. 7 ). Older adults, as well as people of young and middle age, do not feel strong confidence that they can secure their financial future. Probably, that is why financial planning practices are focused on the short-term period (for the nearest couple of months), and every fifth person in all age groups does not think through his/her actions in principle. However, among older adults, there is a noticeably higher share of those who form savings for the long term, rather than for soon-to-be acquisitions (26% compared to 9% among young people and 15% in the middle-aged group).

We should note that the all-Russian survey used, unfortunately, does not allow retrospectively assessing the strategies of preparation for life in retirement (nly those who have not yet reached retirement age answer the questions about the sufficiency of the state pension and possible sources of income at an older age).

Component 5. Managing and recovering from financial shocks ( Tab. 8 ). In terms of preparedness to financial shocks, older adults have the best characteristics. There is a higher share of people who have a reserve for unforeseen expenses (the insurance motive characteristic of older age groups), as well as those who consider their financial situation to be quite stable. However, in a hypothetical situation of large unforeseen expenses middle-aged people feel more confident.

Brief summary of the assessment . The proposed research design allows for a very detailed assessment of the financial well-being of older adults, and integrates the assessment of objective (availability of deposits and loans; budgeting) and subjective (feeling of stability and sufficiency of funds, etc.) indicators. Some questions on financial well-being proved difficult for respondents (the majority of respondents either found it difficult to answer or chose a neutral option). In addition, the database

Table 7. Planning and prioritization, % of number of respondents in the respective group

|

Respond option |

Older adults |

Rest of the population |

|

|

Up to 30 years old |

Over 30 years to retirement age |

||

|

“You are securing your financial future” |

|||

|

Completely + Quite accurate |

12.7 |

13.3 |

16.7 |

|

To some extent |

32.6 |

27.4 |

35.6 |

|

Only a little |

28.0 |

21.8 |

23.7 |

|

Absolutely not |

23.6 |

34.3 |

22.1 |

|

Financial planning interval |

|||

|

No plans at all |

18.3 |

20.3 |

17.8 |

|

No more than a month |

34.2 |

33.7 |

31.6 |

|

In the next few months |

31.6 |

25.6 |

30.2 |

|

The nearest year |

11.1 |

12.1 |

14.3 |

|

Next 5–10 years |

2.1 |

2.6 |

3.0 |

|

More than 10 years |

0.2 |

0.1 |

0.2 |

|

Expenditure period of accumulated savings |

|||

|

For the next few months |

16.2 |

17.6 |

17.7 |

|

For long-term goals |

26.1 |

9.2 |

14.9 |

|

No savings |

53.6 |

70.9 |

64.1 |

Table 8. Managing and recovering from financial shocks, % of number of respondents in the relevant group

Conclusion

Sustainable financial well-being is the ultimate goal of the OECD initiatives in the field of financial education21, as well as the target benchmark and “measure of success” of the Russian Government’s activities to improve financial literacy of the population within the framework of the Strategy of the same name22. Low financial well-being can have serious negative consequences for households and overall well-being. At the individual level, it is associated with an increased likelihood of material hardship, inability to fully meet needs, etc.23 At the macro level, it can manifest itself in a decrease in overall consumption, increased dependence of the population on social support, expansion of poverty in the country, etc. (Brenner et al., 2009). (Brenner et al., 2020).

Addressing the problem of financial well-being has shown that this category is familiar in foreign scientific discourse, but it is not widespread in Russian studies. At the same time, tracking the financial well-being of older adults, along with monitoring of financial literacy and financial behavior, is important for a number of reasons. First, financial well-being represents a comprehensive assessment of the financial situation of individuals, being the resultant outcome of their application of financial knowledge and skills to solve certain financial issues. Second, financial well-being can be considered as an element of the assessment of living standards and used as an indicator of the effectiveness of social policy. Third, financial wellbeing can be used to characterize the availability of financial instruments and identify problematic aspects of the population’s interaction with financial institutions.

The study shows that the financial well-being of the population is in many respects a synthetic, multidimensional category, which is characterized by some general aspects (good current financial position; financial stability to shocks; confidence in the security of the future). There is no specific definition and methodology for measuring financial well-being in relation to specific population groups (e.g., older adults, etc.). Financial well-being is assessed by means of objective and subjective indicators, which have both direct quantitative expression and are a projection of an individual’s perception of their own financial situation.

We substantiate that it is impossible to fully transfer foreign methods of assessing the financial well-being to the Russian data. We propose a set of indicators that allows conducting a preliminary (exploratory) assessment of financial wellbeing of older adults in comparison with other age groups. The selected indicators reflect individuals’ perception of objective facts and real financial practices (availability of savings, loans, etc.; family budgeting), as well as people’s feelings about stability and security of their financial situation.

The data of the All-Russian Household Survey on Consumer Finances – 2022 shows that older adults are more oriented toward savings practices; they are more prudent in their approach to pur- chases, less often making unnecessary expenditures; they are more responsible for the formation of financial reserves. At the same time, they save slightly more money in cash than young and middle-aged people; are more concerned about the probable shortage of cash at the right time, as well as do not feel confident in sufficient security of their financial future.

The scientific novelty of the work consists in clarifying the theoretical and methodological framework of financial well-being and the possibility of using this category to assess the standard of living of older adults in Russian conditions. The practical significance lies in identifying the peculiarities of financial well-being of older adults and determining their specific financial competencies and attitudes, so that it would be possible, first, to identify the vulnerable places in the financial well-being of this age group; second, to outline recommendations for the actors responsible for implementing policies in the field of financial education and improving the standard of living of older adults (which is planned to be implemented at the next stages of the research).

The main directions for further consideration of this issue are related to clarification of the content of the phenomenon under consideration, expansion of opportunities for its more detailed assessment (including in terms of differentiation of the constituent elements of financial wellbeing depending on the age group of older adults, since the costs of maintaining health, the level of income and opportunities for labor activity differ significantly between persons aged 65 and 80 years); identification of factors affecting the formation of financial well-being of the population.

Список литературы Financial well-being of older adults: theoretical and methodological aspects and assessment issues

- Aizinova I.M. (2017). Socio-economic problems of the older generation: Quality of life of the senior population. Problemy prognozirovaniya=Studies on Russian Economic Development, 4, 121–131 (in Russian).

- Barsukov V.N., Kalachikova O.N. (2016). Study of the quality of life of the older generation: A regional experience. Ekonomicheskie i sotsial’nye peremeny: fakty, tendentsii, prognoz=Economic and Social Changes: Facts, Trends, Forecast, 4, 88–107. DOI: 10.15838/esc/2016.4.46.5 (in Russian).

- Barsukov V.N., Kalachikova O.N. (2020). The evolution of demographic and social construction of the age of “old age”. Ekonomicheskie i sotsial’nye peremeny: fakty, tendentsii, prognoz=Economic and Social Changes: Facts, Trends, Forecast, 13(1), 34–55. DOI: 10.15838/esc.2020.1.67.2 (in Russian).

- Barsukov V.N., Shabunova A.A. (2018). The trends in changing labor activity of the older generation amid population aging. Problemy razvitiya territorii=Problems of Territory’s Development, 4(96), 87–103. DOI: 10.15838/ptd.2018.4.96.6 (in Russian).

- Barysheva G.A., Nedospasova O.P. (2017). Regional initiative to improve the well-being standard of the older generation: Evidence from the Tomsk Oblast. Regional’naya ekonomika: teoriya i praktika=Regional Economics: Theory and Practice, 15(4), 676–690. DOI: 10.24891/re.15.4.676 (in Russian).

- Brenner L., Meyll T., Stolper O., Walter A. (2020). Consumer fraud victimization and financial well-being. Journal of Economic Psychology, 76, DOI: https://doi.org/10.1016/j.joep.2019.102243

- Brüggen E.C., Hogreve J., Holmlund M. et al. (2017). Financial well-being: A conceptualization and research agenda. Journal of Business Research, 79, 228–237. DOI: https://doi.org/10.1016/j.jbusres.2017.03.013

- Burtseva T.A., Chausov N.Yu., Gagarina S.N. (2018). Life quality assessment for the aged seniors in Russia.

- Rossiiskii ekonomicheskii internet-zhurnal, 2. Available at: https://www.e-rej.ru/Articles/2018/Burtseva.pdf (in Russian).

- Burtseva T.A., Gagarina S.N., Chausov N.Yu. (2019). Quality of life assessment of the older population at the substation of active longevity strategies in the context of structural demographic changes. Vestnik universiteta, 2, 5–12. DOI: 10.26425/1816-4277-2019-2-5-12 (in Russian).

- Ching Yuen Luk S. (2023). Financial well-being of older adults. In: Healthy Ageing in Singapore. Social Policy and Development Studies in East Asia. Singapore: Palgrave Macmillan. DOI: https://doi.org/10.1007/978-981-99-0872-1_2

- Dobrokhleb V.G. (2021). Social state and the older generation of Russia: Stated and implemented principles. Ekonomika. Nalogi. Pravo=Economics, Taxes & Law, 14(2), 64–71. DOI: 10.26794/1999-849x-2021-14-2-64-71 (in Russian).

- Fan L., Lei S. (2023). Financial well-being, family financial support and depression of older adults in China. International Journal of Bank Marketing, 41(6), 1261–1281. DOI: https://doi.org/10.1108/IJBM-05-2022-0214

- Fu J. (2020). Ability or opportunity to act: What shapes financial well-being? World Development, 128, 1–20. DOI: https://doi.org/10.1016/j.worlddev.2019.104843

- GarcíaMata O., Zerón-Félix M., Briano G. (2022). Financial wellbeing index in México. Social Indicators Research, 163, 111–135. DOI: https://doi.org/10.1007/s11205-022-02897-7

- Gutman A., Garon T., Hogarth J., Schneider R. (2015). Understanding and Improving Consumer Financial

- Health in America. Center for Financial Services Innovation. Chicago. Available at: https://assetfunders.org/wp-content/uploads/CFSI_Consumer_Financial_Health_0415.pdf (accessed: August 28, 2023).

- Hansen T., Slagsvold B., Moum T. (2008). Financial satisfaction in old age: A satisfaction paradox or a result of accumulated wealth? Social Indicators Research, 89(2), 323–347. DOI: https://doi.org/10.1007/s11205-007-9234-z

- Hsieh Cm. (2004). Income and financial satisfaction among older adults in the United States. Social Indicators Research, 66, 249–266. DOI: https://doi.org/10.1023/B:SOCI.0000003585.94742.aa

- Joo S.H., Grable J.E. (2004). An exploratory framework of the determinants of financial satisfaction. Journal of Family and Economic Issues, 25(1), 25–50. DOI: https://doi.org/10.1023/B:JEEI.0000016722.37994.9f

- Kalachikova O.N., Korolenko A.V., Natsun L.N. (2023). Theoretical and methodological foundations of active longevity research. Monitoring obshchestvennogo mneniya: ekonomicheskie i sotsial’nye peremeny=Monitoring of Public Opinion: Economic and Social Changes Journal, 1, 20–45. DOI: 10.14515/monitoring.2023.1.2209 (in Russian).

- Kaur G., Singh M., Singh S. (2021). Mapping the literature on financial well-being: A systematic literature review and bibliometric analysis. International Social Science Journal, 71, 217–241. DOI: https://doi.org/10.1111/issj.12278

- Kempson E., Finney A., Poppe C. (2017). Financial well-being. A conceptual model and preliminary analysis. Consumption Research Norway – SIFO. Project Note No. 3. Available at: https://www.bristol.ac.uk/media-library/sites/geography/pfrc/pfrc1705-financial-well-being-conceptual-model.pdf. DOI: https://doi.org/10.13140/RG.2.2.18737.68961 (accessed: August 28, 2023).

- Kislitsyna O.A. (2016). Izmerenie kachestva zhizni / blagopoluchiya: mezhdunarodnyi opyt [Measuring Quality of Life/Well-Being: International Experience]. Moscow: Institut ekonomiki RAN.

- Korolenko A.V. (2022). Active aging in the life practices of the Vologda Oblast population. Sotsial’noe prostranstvo=Social Area, 8(1). Available at: http://socialarea-journal.ru/article/29201; DOI: 10.15838/sa.2022.1.33.2 (in Russian).

- Korolenko A.V., Barsukov V.N. (2017). Health status as a factor of labor activity of the retirement-age population. Vestnik Permskogo universiteta. Filosofiya. Psikhologiya. Sotsiologiya=Perm University Herald. Series “Philosophy. Sociology”, 4(32), 643–657. DOI: 10.17072/2078-7898/2017-4-643-657 (in Russian).

- Madero-Cabib I., Fasang A.E. (2016). Gendered work-family life courses and financial well-being in retirement. Advances in Life Course Research, 27, 43–60. DOI: https://doi.org/10.1016/j.alcr.2015.11.003

- Netemeyer R.G., Warmath D., Fernandes D., Lynch J.G. (2018). How am I doing? Perceived financial well-being, its potential antecedents, and its relation to overall well-being. Journal of Consumer Research, 45(1), 68–89. DOI: https://doi.org/10.1093/jcr/ucx109

- Palomäki L.M. (2019). Does it matter how you retire? Old-age retirement routes and subjective economic well-being. Social Indicators Research, 142(2), 733–751. DOI: https://doi.org/10.1007/s11205-018-1929-9

- Pavlova I.A., Monastyrnyi E.A., Gumennikov I.V., Barysheva G.A. (2018). The Russian elderly well-being index (REWI): Methodology, methods, approbation. Zhurnal issledovanii sotsial’noi politiki=The Journal of Social Policy Studies, 16(1), 23–36. DOI: 10.17323/727-0634-2018-16-1-23-36 (in Russian).

- Pavlova I.A., Nedospasova O.P., Gumennikov I.V. (2021). Assessment and monitoring of well-being of the old generation in Tomsk Oblast (on the materials of the Russian elderly well-being index).

- Vektory blagopoluchiya: ekonomika i sotsium=Journal of Wellbeing Technologies, 3(42), 89–115. DOI: 10.18799/26584956/2021/3(42)/1121 (in Russian).

- Porter N.M., Garman E.T. (1993). Testing a conceptual model of financial well-being. Financial Counseling and Planning, 4, 135–164.

- Riitsalu L., Murakas R. (2019). Subjective financial knowledge, prudent behaviour and income: The predictors of financial well-being in Estonia. International Journal of Bank Marketing, 37(4), 934–950. DOI: https://doi.org/10.1108/IJBM-03-2018-0071

- Riitsalu L., Sulg R., Lindal H. et al. (2023). From security to freedom – the meaning of financial well-being hanges with age. Journal of Family and Economic Issues. DOI: https://doi.org/10.1007/s10834-023-09886-z

- Ryazantsev S.V., Miryazov T.R. (2021). Demographic well-being: Theoretical approaches to definition and methodology of assessment. DEMIS. Demograficheskie issledovaniya=DEMIS. Demographic Research, 1(4), 5–19. DOI: 10.19181/demis.2021.1.4.1 (in Russian).

- Shabunova A.A., Rossoshanskii A.I. (2018). Assessment of subjective quality of life by the older generation. Problemy razvitiya territorii=Problems of Territory’s Development, 3(95), 7–19. DOI: 10.15838/ ptd.2018.3.95.1 (in Russian).

- Strömbäck C., Lind T., Skagerlund K. et al. (2017). Does self-control predict financial behavior and financial well-being? Journal of Behavioral and Experimental Finance, 14, 30–38. DOI: http://dx.doi.org/10.1016/j.jbef.2017.04.002

- Vasil’eva E.V. (2022). Active aging index of Russian regions: Alternative approach. Narodonaselenie= Population, 25(3), 128–143. DOI: 10.19181/population.2022.25.3.10 (in Russian).

- Voronin G.L., Zakharov V.Ya., Kozyreva P.M. (2018). Lonely old aged: Surviving or living an active life? Sotsiologicheskii zhurnal=Sociological Journal, 24(3), 32–55. DOI: 10.19181/socjour.2018.24.3.5992 (in Russian).

- Vosloo W., Fouche J., Barnard J. (2014). The relationship between financial efficacy, satisfaction with remuneration and personal financial well-being. International Business & Economics Research Journal (IBER), 13(6), 1455–1470. DOI: https://doi.org/10.19030/iber.v13i6.8934

- Wilkinson L.R. (2016). Financial strain and mental health among older adults during the Great Recession. The Journals of Gerontology. Series B, Psychological Sciences and Social Sciences, 71(4), 745–754. DOI: https://doi.org/10.1093/geronb/gbw001

- Wilmarth M.J. (2021). Financial and economic well-being: A decade review from journal of family and economic issues. Journal of Family and Economic Issues, 42(1), 124–130. DOI: https://doi.org/10.1007/s10834-020-09730-8

- Xiao J.J., Porto N. (2017). Financial education and financial satisfaction: Financial literacy, behavior, and capability as mediators. International Journal of Bank Marketing, 35(5), 805–817. DOI: https://doi.org/10.1108/IJBM-01-2016-0009

- Xue R., Gepp A., O’Neill T.J. et al. (2020). Financial well-being amongst elderly Australians: The role of consumption patterns and financial literacy. Account Finance, 60, 4361–4386. DOI: https://doi.org/10.1111/acfi.12545