Fiscal federalism and inter-budget relations in the Russian Federation

Автор: Avetisyan Ishkhan Artashovich

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Public finance

Статья в выпуске: 1 (13) т.4, 2011 года.

Бесплатный доступ

The article deals with the essence of fiscal federalism and its model in the world. Characterized by features inter-budget relations in Russia, their forms and methods of implementation. Represents an acting mechanism of formation and management of income and expenditure budgets of various levels and their relationship. Particularly detailed analysis of the problem of budgetary provision of local budgets, the ways of solving them. It is proved that the basis for the rationalization of inter-budget relations and real fiscal federalism is the progressive development of its economy, increase their own taxable capacity. The successful solution of problems of fiscal federalism, the author believes, depends largely on preserving the integrity of the Russian state, increasing its credibility in the international arena.

Fiscal federalism, model of federalism, inter-budget relations, management, revenues and expenditures of regional and local budgets

Короткий адрес: https://sciup.org/147223239

IDR: 147223239 | УДК: 336.12(470)

Текст научной статьи Fiscal federalism and inter-budget relations in the Russian Federation

The article deals with the essence of fiscal federalism and its model in the world. Characterized by features inter-budget relations in Russia, their forms and methods of implementation. Represents an acting mechanism of formation and management of income and expenditure budgets of various levels and their relationship. Particularly detailed analysis of the problem of budgetary provision of local budgets, the ways of solving them. It is proved that the basis for the rationalization of inter-budget relations and real fiscal federalism is the progressive development of its economy, increase their own taxable capacity. The successful solution of problems of fiscal federalism, the author believes, depends largely on preserving the integrity of the Russian state, increasing its credibility in the international arena.

Fiscal federalism, a model of federalism, inter-budget relations, management, revenues and expenditures of regional and local budgets.

Ishkhan A.

AVETISYAN

Problems of fiscal federalism are considered in close interaction with principles of federalism and a federal form of government. The concept of “federalism” and “fiscal federalism” are very complex and multidimensional phenomena. This explains the fact that there are too many disputes and disagreements among scientists and engineers disclosing the content of these concepts.

Federalism is a peculiar form of government called a “federal state”, which elements have begun traced from the beginning of the second millennium, having received a modern shape since the end of the XVIII century. However, until now there are no accepted common basic principles of federalism as a form of government. They are not fixed in any international act (which was, for example, applied to the local level of territorial arrangement of a state in “the European Charter of Local Self-Government”), and in different states, considering themselves as federal, these principles have many different interpretations.

Currently, each of ten countries of the world considers itself as federal and nominally consolidates an appropriate definition in higher legislative act, particularly in their constitutions. These states differ in spatial, economic and territorial respects in the tens and hundreds of times. Federations differ structurally. For example, Russia is arranged phenomenally with its compound constituent territories (members of the federation). Many federations self-organized as unions (USA, Canada, FRG, UAE, Mexico, etc.). In some cases, federations were formed by external forces (such as India in 1956, Nigeria in 1964 or the Federation of Bosnia and Herzegovina, created on the military base in Dayton in 1995). In this regard, it should be noted that the formation of federations is not always perceived by the general population as an absolute good.

Federalism, in our opinion, is not only a peculiar form of state structure, but also a special way of controlling it. It represents the way of governance, which involves an organic combination of economic, financial and other interests of the state with the interests of its individual parts, ensuring the unity and integrity of the country while respecting the independence of territories in matters included in their jurisdiction. The idea of federalism is the opposite of separatism, which leads to fragmentation of a state, counterweight to regional autonomy and their desire to move away from the center and become completely independent (sovereign). Neutralizing separatist trends, federalism secures three-tier system of governance, which closely links the economic and financial interests of the federation and its constituent communities.

The definition of federalism means that it includes the economic and political components of its formation. From an economic point of view federalism implies the existence of separate regional units of fiscal and tax system of government (autonomous regional budgets, regional taxes, etc.). And from the political point of view federalism is a system of power, divided between the central (federal) and subfederal (regional) public authorities and local authorities.

Federalism, which is a federal form of government arrangement and a special way of governance, is the fundamental basis for the formation of fiscal federalism, predetermining in turn, the budget arrangement and budget system of the federal state. The budget system is three-tier and consists of the federal budget, budgets of the members of the Federation and the budgets of municipalities (local budgets).

Fundamentals of budget arrangement and budget system of the Russian Federation are determined by its state structure, established by the Constitution of the Russian Federation (article 5) as a federal republic consisting of republics, krais, oblasts, federal cities, autonomous oblast, autonomous okrugs – equal constituent territories of the Russian Federation. In accordance with the Budget Code (article 6), the budget system of the Russian Federation is the complex of the federal budget, budgets of constituent territories of the Russian Federation, local budgets and state off-budget funds, based on economic relations and political structure of the Russian Federation, regulated by the legislation of the Russian Federation.

The fiscal federalism on the one hand, is the base on which the inter-budget relations “rest”, and on the other hand, the fiscal federalism and its basic principles are most clearly manifested and implemented through a system of interbudget relations. Therefore, fiscal federalism often intersects with the concepts of “interbudget relations”, “budget control”, “budget setting”, etc. However, these concepts are not equal, since fiscal federalism is much wider and inter-budget relations, being a part of its structure, are an isolated, specific form of budgetary relations. In accordance with the Budget Code (article 6) inter-budget relations are the relationship between public legal entities on the issues of budgetary relations management, organization and implementation of the budget process .

In the economic and legal literature, there are many definitions of fiscal federalism, and until now there is no its definition in the Budget Code of the Russian Federation. In our view, the essence of fiscal federalism as a form of budget arrangement and budget system of a federal state is a legislative setting of budgetary rights and responsibilities of three equal parties – federal, regional and local authorities and management, rules of their interaction on the budget process stages (preparation, consideration, approval and execution of budgets) as well as methods for partial redistribution of budget resources between the levels of budget system of the country.

Basically, fiscal federalism is a form of budget arrangement in a federal state, which involves real participation of all parts of the budget system equally in a single budget process oriented on taking into account of national interests, and promoting of the interests of constituent territories of the Federation and municipalities.

Fiscal federalism is based on a single socioeconomic and fiscal policy of the federal state. This is such an organization of budget relations, which allows under independence (autonomy) of each budget combine fiscal interests of the federation with the interests of its constituent territories and local authorities.

The problem of fiscal federalism is not only and not so much a problem of relations of budgets of different levels of budget systems of a country. This is primarily a problem of the relationship between the state and its citizens by providing rational financial flows in the country. Accordingly, the way out of the socioeconomic and financial crisis, maintenance and strengthening of the territorial integrity and federal basis of the Russian state assume formation and implementation of the active center of regional economic and financial policies.

Today for Russia it is indispensable to realize that an effective model of fiscal federalism and inter-budget relations system is a compromise (rather than budget competition), the product of synthesis of economic and financial interests of the state (including all levels of government), the public and businesses.

It is important to note that the compromise of the above interests can be achieved with providing the regional economic development. We should not forget that the economic potential of the state is not formed at the central government level, it is established in regions, therefore today for Russia the problem of selfsufficiency of economic and fiscal capacity of regions becomes paramount. It is the solution to this problem that establishment of inter budget relations and the formation of fiscal federalism should be aimed to.

In the world practice there are several models of fiscal federalism.

The classical model of decentralized fiscal federalism focuses on the competition between territorial entities with their own “disjoint” taxes on the principle of “one tax – one budget”. This model of fiscal federalism is characterized by a high degree of decentralization of fiscal and budgetary processes of vertical power and budget system. In this case it is combined with the priority of the federal fiscal legislation which guarantees compliance of national interests and the possibility of the federal government to support the territorial entities. This model, applied, for example, in the USA, does not aim to align the tax potential of the region where it is below the national average. Regulation of inter-budget relations is used by the federal center is used as a means to implement its regional policy, provide financial support to states (USA constituent territories) based on targeted program method. It should be noted that not every federal state can realize at an appropriate stage in its development such a model of fiscal federalism, which is associated with a high degree of decentralization of management of fiscal processes.

Another model in the world carries the name of cooperative fiscal federalism. It is focused more on partnership, mutual support and active federal policy for the horizontal and vertical alignment of budget security of territorial entities in which it is less than the certain national average. In addition, in this model of fiscal federalism the autonomy of regional and local authorities in the field of taxation (e.g., Germany) significantly reduced.

However, there are mixed models of fiscal federalism (e.g., Canada, Switzerland). And in cooperative and mixed models of fiscal federalism the matter is the degree of decentralization and centralization of financial resources in the budget system of the country. In this regard, it is important that centralization was not excessive to the detriment of the population.

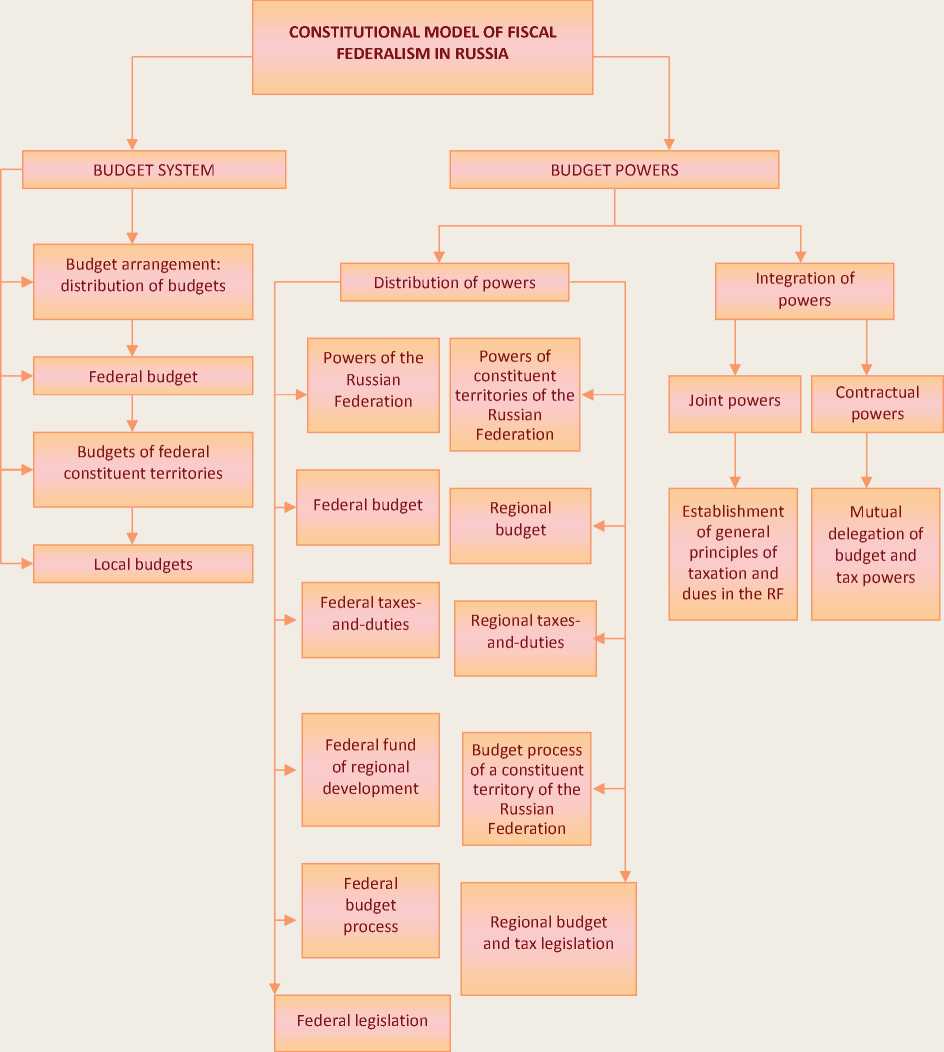

Russia’s fiscal federalism can be attributed to the cooperative model, and its essence is that it involves partnerships between the federal center and the federal constituent territories on interbudget relations. Therewith, the federal budget legislation in the Russian overrules the budget legislation of constituent territories of the federation, because it reflects their common interests, and above all interest in ensuring the integrity and unity of the federal state. The common law, in particularly constitutional base (model) of the Russian fiscal federalism is shown in figure 1.

Figure 1. Constitutional model of fiscal federalism in the Russian Federation

As noted, fundamental principles of fiscal federalism are realized through a system of interbudget relations. An important condition for the formation of fiscal federalism is development of effective budget relations between all levels of budget system which has to ensure consistency between revenues and expenditures of all types of budgets (budget balancing) and be equally fair (in terms of legitimate separation of financial burden) for all members (constituent territories) of the federation, and within constituent territories – for their constituent entities.

Over the past few years in Russia there were fundamental changes in the regulation of interbudget relations between budgets of different levels. These changes were implemented within the framework of the Concept of reformation of inter-budget relations in the Russian Federation in 1999 – 2001 respectively, adopted by the RF Government Decree of 30 June 1998 № 862, and the Program of Fiscal Federalism development in the Russian Federation for the period until 2005. Adoption of federal laws on general principles of organization of legislative (representative) and executive governmental bodies of the constituent territories of the Russian Federation, the organization of local self-government in Russia, as well as amendments to the Budget Code regarding regulation of inter-budget relations have created a legal basis which in a new way governing inter-budget relations in the RF. There are positive developments in the field of separation of budgetary powers between the federal authorities, state authorities of the constituent territories of the Russian Federation and local authorities, including the establishment on the legislative basis of the norms of distribution of revenues among the budgets of the budget system to ensure stable revenue sources for all budgets. In addition, inter-budget relations on the costs of the budget system of the Russian Federation on the basis of expenditure and budgetary commitments and their distinction between the budgets of different levels established by the Budget Code are regulated in a new way. Since then the principles of formation and distribu- tion of inter-budget transfers provided from higher level budgets to subordinate budgets and others are redefined in a new way. Finally, an important base for improving the inter-budget relations in Russia has become “The concept of increasing the efficiency of inter-budget relations and quality management of public and municipal finance in the Russian Federation in 2006 – 2008”, adopted by the Decree of the Government of the Russian Federation on April 3, 2006 № 467-p.

However, during the budgeting process a mismatch between revenue sources and expenditure obligations of the levels of the government and management, as well as inequality of budget security in different regions of the country continues to remain.

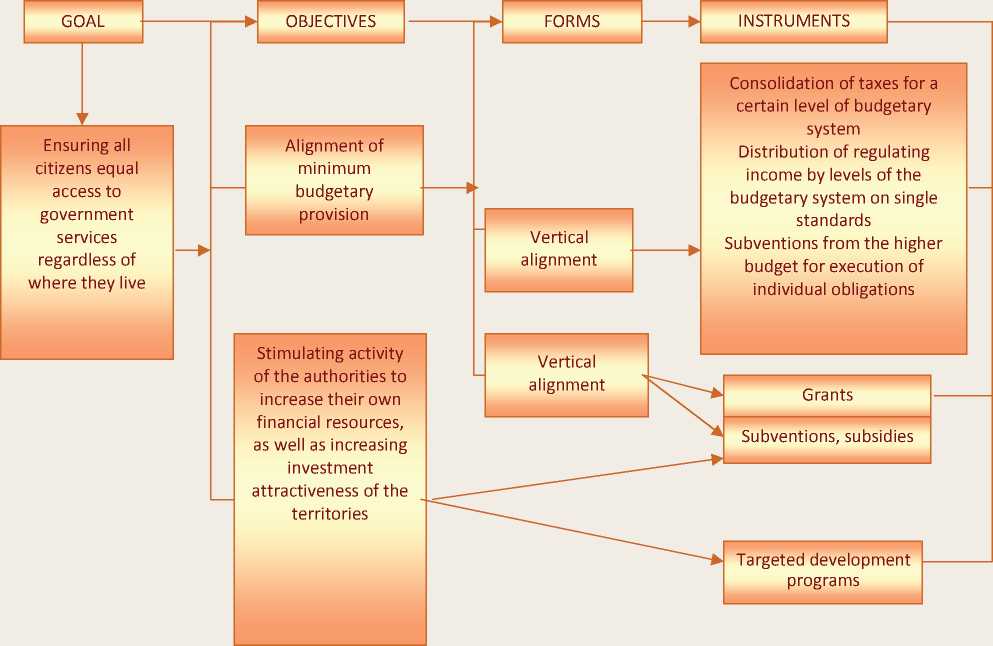

In terms of goals, objectives, forms and instruments for regulation of inter-budget relations vertical and horizontal regulation of interbudget relations of vertical and horizontal budget balance respectively are distinguished. Common scheme of vertical and horizontal regulation of inter-budget relations in Russia is shown in figure 2 .

Vertical regulation of inter-budget relations is the process to achieve balance between volume of commitments of every level of government by budget expenditures, and potential of revenue sources of budgets, with emphasis on tax revenues. It is unreal to completely eliminate discrepancy between incomes (tax revenue) and expenditures of budgets without regulation of inter-budget relations: there is no absolute coincidence between them.

The principle of vertical regulation of interbudget relations in order to balance the budget imposes certain requirements as to the higher level of government (federal level) as well as to regional and local levels. If potential possibilities ensuring the revenue side at the lower level are not sufficient to finance their functions and provision of public services, for which one or another regional and local authority is responsible, the higher level of government must provide the lower levels with missing budgetary resources.

Figure 2. The general scheme of vertical and horizontal regulation of inter-budget relations in Russia

Vertical regulation of inter-budget relations imposes on the regional and local authorities, firstly, the responsibility for financial support of their consolidated functions and provision of related services to the public or state institutions and organizations, either through the private sector, and secondly, the obligation to effectively and responsibly exercise their rights to preserve and increase own revenue, particularly tax potential. Instruments of vertical control of inter-budget relations in this case, as follows from figure 2, are: consolidation of taxes for a certain level of budgetary system; distribution of regulating incomes by levels of the budgetary system on single standards; provision of subsidies from the higher budget for execution of individual account obligations.

However, the vertical regulation of interbudget relations will not solve all the problems of fiscal federalism. Therefore, it is combined with construction of the horizontal (in the context of the budgets of the same level of the budget system) regulation of inter-budget relations.

Horizontal regulation of inter-budget relations is a process of proportional distribution of incomes (taxes) between territories by certain method (formula) to eliminate or reduce disparities in financial capacity of the RF constituent territories and municipalities. It is predetermined by the economic and financial inequality of regions, which leads to the inequality among different segments of population in the distribution of income and wealth, respectively, and to manifestations of social inequality conditioned by the territorial factor. Thus, the solution to the problem of having a single standard level of consumption of public services by residents of different regions in Russia is much more complex than in any other country in the world, due to significant differences in production and resource potential of the territories, which is determined by not only historical deployment of productive forces, but also a significant differentiation of climatic conditions. In addition, a significant impact on the provision of every citizen with minimum social standards have

Table 1. Proportion of population in the Russian regions with different levels of budget security, %

|

The level of budget security (in % to the average in Russia) |

Year of 2005 |

Year of 2006 |

||

|

Before alignment |

After alignment |

Before alignment |

After alignment |

|

|

Critically low (< 64) |

34 |

0 |

30 |

0 |

|

Low (64 – 70) |

4 |

30 |

8 |

27 |

|

Below average (70 – 75) |

7 |

8 |

11 |

8 |

|

Average (75 – 100) |

||||

|

Above average (100 – 150) |

24 |

24 |

25 |

25 |

|

High (> 150) |

11 |

11 |

13 |

13 |

Source: Dementiev D.V., Shcherbakov V.A. The budget system of Russia: textbook. – 2nd ed., stereotype. – M.: KNORUS, 2009. – P. 36.

had a process of privatization of the economy, accompanied by massive failure of enterprises from the social costs, maintenance of social and domestic sphere, and often the release of workers who were forced to apply for social protection to the state.

After assistance from the Federal Fund for Financial Support to the regions in the form of subsidies for their alignment in 2006 compared with 2005 the regions of the country were guaranteed budget security not less than 64% of the average level, while significant increase in budget has involved 1/3 of the population (tab. 1) .

However, analytical data show that because of these reasons, differences in budget security of the regions of Russia now reaches 40 times1.

The leading position in the overall system of inter-budget relations belongs to inter-budget relations between the federal budget and budgets of the Russian regions. The balance between revenues and expenditures for all budgets is provided with the help of established legal norms, mechanisms, methods and ways of regulating these inter-budget relations.

Foundation for constructing these interbudget relations and ensuring balanced budgets in this case are legal distinction between spending commitments by federal and regional levels of power and consolidation of own tax and nontax revenue to the respective budgets of the constituent territories of the Russian Federation. For example, for the budgets of the Russian regions their own tax revenues are such regional taxes as a tax on property of enterprises and organizations, a transport tax, a tax on gambling, which, in accordance with the Budget Code of the RF, are entered on continuing basis and fully (100%) in revenues for their budgets. However, practice shows that the problem of forming minimum required balanced budgets of the RF constituent territories only by fixing on a continuing basis and fully their own tax and nontax revenues can not be solved, because these revenues constitute the smallest portion of total revenues in budgets of the Russian Federation.

Therefore, one of the most important ways of regulating inter-budget relations between the federal budget and the budgets of Russian regions and ensuring balance to the latter is the flow of funds in the form of deductions from federal taxes and revenues (an income tax, a tax on income from private individuals, certain excise taxes, etc.). For the budgets of the constituent territories of the Russian Federation (also for the local budgets), these revenues are called regulatory or redistributed income. List and regulations (in percentage) of deductions from certain federal taxes and revenues in the budgets of the constituent territories of the Russian Federation on continuing basis are determined in this case in accordance with the Budget Code of the Russian Federation, and specific proportions of their distribution between the federal budget and the budgets of the constituent territories of the Russian Federation shall be approved annually by the Law on the federal budget for next fiscal year and planning period. This mode of regulation of inter-budget relations in Russia has long existed, since the Soviet era. Its advantage is ensuring the unity of revenue sources for all the budgets of Russia, as well as the interest of regional governments to fully mobilize not only property but also regulatory revenues and accountability. However, this method of regulation of inter-budget relations contains within itself the potential of dependency in some regions, it is possible to get more money in the form of regulatory incomes (the presence of subjective factors) without efforts to develop economy and increase their own tax base for their territories.

It should also be noted that as a result of excessive current economic and financial differences the majority of Russian regions are depressed (subsidized and oversubsidized). There are about 70 of 83 constituent territories of the Russian Federation.

Due to the absence of sufficient tax base in depressed regions possibility for increasing deductions from federal taxes in budget income is limited, hereupon their own and regulatory income taken together, do not cover the costs of the budgets of these regions. Therefore, a way is applied for financial assistance from the federal budget to budgets of the constituent territories of the Russian Federation in the form of grants, subventions, which has the name of gratuitous revenues of funds . These types of financial assistance are carried out through inter-budget transfers, i.e. funds provided by one budget of the Russian Federation budget system to another budget of the Russian Federation budget system (article 6 of the Budget Code) on certain principles .

Thus, grants are funds provided to the budget of another level of the budget system of the Russian Federation on a free and non-repayable basis to equalize the minimum budget security of the territories. Subventions are funds provided to the budget of another level of the budget system of the Russian Federation or a juridical person on free and non-repayable basis for certain target costs. Subsidies (assistance, support) are funds provided to the budget of another level of the budget system of the Russian Federation as well as a juridical or natural person on the basis of equity financing of target costs.

It is easy to see that the component of the system of inter-budget relations in Russia is also inter-budget transfers used to regulate these relations. Thus, to provide financial assistance to regions in the form of grants in the federal budget are created the following federal interbudget transfer funds :

-

1) The Federal Fund for Financial Support for Regions (FFSR) – in 1994;

-

2) The Federal Compensation Fund (FCF) – in 2001;

-

3) Federal Fund for Co-financing of Social Spending – in 2002.

Government of the Russian Federation approved a single method of calculation of formation and distribution of these funds. Volumes of these federal inter-budget transfer funds are approved annually by the federal law on the federal budget for next fiscal year and planning period.

Statistics indicate that up to the economic and financial crisis, when the federal budget of Russia was prepared and executed with a surplus, amounts in the federal inter-budget transfer funds had a constant tendency to increase. For example, for 5 years (2000 – 2007.) total volume of financing costs from these funds and existing in the period funds of regional development and reformation of regional and municipal finance, all together increased by 47%2. However, in recent years of crisis, in terms of a deficit in the federal budget, there is a trend of reducing financial volumes in regions from the federal inter-budget transfer funds. Thus, according to a draft of the federal budget for 2011 and 2012 – 2013 general inter-budget transfers are to be cut in comparison with 2010 by 130 billion rubles. In this case, subsidies to equalize budget security of the RF constituent territories and municipalities remain unchanged, i.e. without increase3.

Among all of the federal transfer funds takes a leading place belongs to FFSR, through which grants are provided to budgets of the constituent territories of the Russian Federation on the alignment of their minimal budget security. According to the federal budget for 2011, grants made from this fund for regional alignment of their budget security, would amount to 400 billion rubles. The list of recipients of subsidies was 70 constituent territories of the Russian Federation, which are about 100 million Russians. It turns out that each of them has 4,700 rubles from FFSR4.

FCF, included in the expenses of the federal budget, in essence serves as a way of exercising the authority of the federation in the social sphere. For ensuring the provision on the Russian Federation territory of government and municipal services relating to the powers of the RF constituent territories and municipalities, is the commitment of the entire state. Therefore, at the expense of FCF subventions are provided, which distribution is carried out among all, without exception, constituent territories of the Russian Federation and municipal entities, regardless of their level of budget security.

In fact, the fund is formed and distributed in order to ensure equal opportunities for funding from the budgets of Russian regions (within the scope of the consolidated budget of the constituent territories of the Russian Federation), the delegated funding to public authorities of Russian regions and local authorities for the execution of commitments. It is primarily costs on implementing the delegated authority for the provision of social support measures, in particular to pay 50% of housing services to certain categories of citizens in accordance with Federal Law on May 15, 1991 № 1244-1 “On Social Protection of Citizens Exposed to Radiation due to the Catastrophe of the Chernobyl NPP”; the Federal Law on January 12, 1995 № 5-FL “On veterans”; the Russian Federal Law on January 24, 1995 № 181-FL “On social protection of invalids in the Rus- sian Federation”, etc. Then formation of FCF within the federal budget is designed to use the new scheme of target funding of performance of the above laws. This fund is a new element in the system of inter-budget relations between the center and the regions of the country, aimed at ensuring partial provision of uniform government guarantees, social protection (with regard to these and other federal laws) throughout the Russian Federation provided by the federal law. It should be noted so that the establishment of the fund can be considered as an important step of the Government of the Russian Federation for clearer allocation of revenue and expenditure budget powers of all levels and reduction of the number of federal laws that have no specific funding sources.

Intermediate position between FFSR and FCF is the Federal Fund for Co-financing of Social Spending, which is designed to provide subsidies to the budgets of Russian constituent territories to participate in the financing (cofinancing) of the country’s priority expenses. The assets (grants) of this fund are distributed among all, without exception, constituent territories of the Russian Federation for target financing (partial refund) of the priority of socially significant costs (primarily for education, health, culture, social welfare, etc.) under certain conditions.

Goals and objectives, conditions for granting and disbursement of grants from FFCSR, selection criteria for constituent territories and / or municipalities to allocate these subsidies and their distribution among the constituent territories of the Russian Federation are established by Federal Laws (except the law on the federal budget for next fiscal year and planning period) and / or regulations of the Russian Government for a period of not less than 3 years. In this case the approval of undistributed subsidies among the constituent territories of the Russian Federation is allowed but not more than 5% of the total of the subsidy approved in the first year of the plan period and not more than 10% of the total of the subsidy approved for the second year of the plan period.

It should be noted that the constitutional model of fiscal federalism and inter-budget relations in modern Russia for 20 years of its history have undergone significant changes. Thus, in the 90 years of the twentieth century, in the absence of state power hierarchy and with weak legal regulation of inter-budget relations, as well as under the influence of political conjuncture, the desire of individual territories to acquire greater independence, up to obtaining the sovereignty in Russia there was spontaneous decentralization of budget resources. As a result, the share of regional budgets increased from 40% to 50 – 55%. Most importantly, the totality of these factors, in turn, jeopardized the integrity of the Russian state. In the second half of the 90-ies the approximate distribution of funds among the individual links of the budget system of Russia was characterized by the following data (tab. 2) .

Table 2. Distribution of funds between the links of the budget system of Russia in the second half of 1990, %

|

Consolidated budget of the RF, total |

100 |

|

Federal budget of the RF |

45-55 |

|

Consolidated budgets of the constituent territories of the RF, among them: |

55-45 |

|

budgets of the constituent territories of the RF (regional budgets) |

30-25 |

|

local budgets, including: |

20-25 |

|

city budgets |

16-10 |

|

district budgets |

7.5-8 |

|

settlement budgets |

0.5-0,7 |

|

village budgets |

1-1.3 |

|

Source: The budget system of Russia: textbook for high schools / ed. prof. G.B. Polyak. – M.: UNITY-DANA, 2003. – P. 29. |

|

In future, resulting in the restoration of state power vertical (through the creation of federal districts headed by Presidential Plenipotentiary of the RF), adoption and enactment of the Budget Code of the RF and a number of federal legislative and standard acts since 2000 in Russia principles of federalization (centralized fiscal federalism) began strengthening and there were changes in the allocation of funds between the links of the budget system of Russia in favor of the federal budget. Currently, about two-thirds of the budget (tax revenue) is concentrated in the federal budget. A worldwide practice proved that if the proportion of budget allocation between the federal budget and the budgets of constituent territories of the federation account for 60% and 40 percent respectively, the budget system of the country is functioning as a unitary state budget. Incidentally, in one of the “old” editions of the Budget Code of the RF was recorded that the allocation of tax revenues by the levels of the budget system of the RF tax revenue of the budgets of the Russian Federation must be at least 50% of the revenues of the consolidated budget of Russia5.

It follows that today in Russia there was a centralized system of inter-budget relations to the detriment of the regions. The result is their high financial dependence on the federal government. It turns out that the principle of independence of the budgets of the Russian Federation has an avowed nature, since these budgets are actually formed in the Ministry of Finance (in the process of forming the federal budget). It is there that the definition of subject’s accumulated revenues of their budgets takes place and supply is determined. In practice, the federal budget of Russia is essentially functioning as a centralized unitary state budget.

A special sub-system of inter-budget relations of the Russian Federation is inter-budget relations within the Russian constituent territories , where financial flows are circulating from the federal budget and budgets of constituent territories of the Russian Federation towards the budgets of municipalities (local budgets).

In this regard, we emphasize that the beginning of 2004 is marked by an important step of reforming local government, a system of local budgets and intra-regional inter-budget relations. The adoption of acts such as the Federal Law of July 4, 2003 № 95-FL “On Alteration in the Federal Law “On general principles of organization of legislative (representative) and executive bodies of the government authorities in the Russian Federation”, the Federal Law of October 6, 2003 № 131-FL “On general principles of organization of local government in the Russian Federation” served it. The latter came into force on January 1, 2006.

Following the reform of local government in accordance with the Federal Law № 131-FL in Russia was formed a two-tier system of local government, respectively, and local budgets. Thus, in the Vologda oblast there are 372 municipalities (instead of previously functioning 28 municipalities) and the number of local budgets increased from 28 to 372. They are 26 local budgets of municipal districts and 2 local budgets of urban okrugs (budgets of cities of Vologda and Cherepovets); 23 local budgets of urban settlements and 321 local budgets of rural settlements.

The analysis shows that the formation of local budgets only at the expense of its own tax and non tax revenues (tax on personal property, land tax, etc.) fully assigned to them (100%) and on an continuous basis, as well as at the expense of regulatory (redistributed) revenues generated in the form of deductions from federal and regional taxes (tax on personal income, profit tax, tax on property of enterprises and organizations, transport tax, etc.) on a sustained basis in accordance with the Budget Code and the annual Law on the subject budget of the Russian Federation, the problem of balance of these budgets can not be solved. Almost none of the municipalities at the expense of the above mentioned own and regulatory incomes, taken together, can not form more than half of the revenues from the local budget. Therefore largely the balance of local budgets is provided by non-repayable earnings from the higher budget, particularly from regional, in the form of grants, subventions and subsidies. Nonrepayable earnings account for a large share in total revenues of local budgets. Due to these revenues a significant part of local budgets is financed. For example, in 2008, in the Vologda oblast 43.6% of the total expenditures of local budgets of municipal districts and settlements have been funded from the amounts of grants from the regional budget6.

In order to provide non-repayable earnings (grants, subventions, subsidies) to local budgets in the budgets of constituent territories of the RF the regional inter-budget transfer funds are formed, which are an integral part of the system of inter-budget relations within the constituent territories of the Russian Federation. In the regional budget of the Vologda oblast, for example, the following regional transfer funds are formed:

-

- for financial support to municipal districts (urban okrugs) and financial support to settlements for the alignment of budget security of local budgets;

-

- co-financing of social spending on share financing of socially significant costs;

-

- compensation for the financial support of specific state powers referred to the municipalities.

The procedure for the formation of a regional fund for financial support to municipalities and method of distribution of grants, including the order of calculation and approval of grants by additional regulations of deductions from tax on individual income in local budgets are approved by the law of the subject of the Russian Federation. Grants are provided to municipal districts (urban okrugs), which level of budget security exceeds the performance criterion of alignment of calculated budget security of municipalities (urban okrugs). Determination of the level of calculated budget security of municipalities is made by a single method ensuring the comparability of their tax revenues, as well as the cost of public services per capita. The volume of regional inter-budget transfer funds is approved by the annual budget law of the subject of the Russian Federation for the next fiscal year.

Financial support from the budgets of municipalities to the budgets of settlements in the form of grants has similar character. Procedure for the formation of district transfer funds and distribution of grants is provided by the law of the subject of the Russian Federation. Grants from the district fund for financial support to settlements are provided to settlements, which

Table 3. Grants, subventions and subsidies provided by the regional transfer funds of the regional budget to local budgets

Municipal okrugs and districts Grants Subventions Subsidies Amount (thousand rubles) Percentage in the regional fund (%) Amount (thousand rubles) Percentage in the regional fund (%) Amount (thousand rubles) Percentage in the regional fund (%) City of Cherepovets - - 1438955.4 21.8 323997.2 21.9 City of Vologda - - 791195.4 12.0 217412.7 14.7 Vologda 81286.1 7.0 354705.9 5.4 52306.6 3.5 Veliky Ustyug 108367.6 9.4 334205.6 5.1 74588.4 5.0 Ust’-Kubinskoye 40580.6 3.5 81932.5 1.2 67415.0 4.6 Sokol 78545.3 6.8 279186.7 4.2 54636.5 3.7 Kichmengsky Gorodok 68593.2 5.9 125482.1 1.9 41035.1 2.8 Verkhovazh’ye 63971.6 5.5 101075.2 1.5 33249.5 2.2 Ustyuzhna 62945.3 5.5 164302.4 2.5 21448.5 1.5 Tarnoga 60039.9 5.2 94284.1 1.4 32203.0 2.2 Vozhega 51550.8 4.5 155550.0 2.4 63735.8 4.3 Babaevo 47243.4 4.1 160651.5 2.4 30436.3 2.1 Kharovsk 43147.4 3.7 185481.7 2.8 40275.5 2.7 Babushkino 44765.5 3.9 93800.8 1.4 22881.0 1.5 Tot’ma 42767.0 3.7 165487.7 2.5 28261.1 1.9 Vashki 42544.2 3.7 75986.3 1.2 14146.4 1.0 Kirillov 41511.2 3.6 119812.8 1.8 14241.2 1.0 Nyuksenitsa 40750.1 3.5 92108.8 1.4 19721.4 1.3 Syamzha 38152.2 3.3 79449.2 1.2 20437.5 1.4 Gryazovets 35786.5 3.1 228634.2 3.5 23760.8 1.6 Mezhdurech’ye 31509.3 2.7 68172.7 1.0 13979.0 0.9 Belozersk 29573.3 2.6 171436.3 2.6 24669.0 1.7 Chagoda 17187.1 1.5 146041.2 2.2 16020.0 1.1 Nikolsk 83388.3 7.2 153442.5 2.3 24669.0 1.7 Cherepovets - - 308216.4 4.7 60878.1 4.1 Vytegra - - 175951.1 2.7 67020.3 4.5 Kadui - - 148705.8 2.3 11983.7 0.8 Sheksna - - 191362.2 2.9 64353.8 4.4 TOTAL 1154205.9 100.0 354705.9 100.0 1478761.7 100.0 Source:

calculated budget security does not exceed the criterion of alignment of calculated budget security of settlements of this municipality. Settlements included in the municipal area, are obliged to transfer subventions (negative transfer) to the budget of the municipal district to address local issues of inter-municipal nature.

The procedure for calculation and use of subventions is set by the charter of the municipal district. The size of subventions is approved by the decision of the representative body of the municipal district and the decision of the representative bodies of settlement by common standard to all settlements per capita. Volume of the District Fund for financial support to settlements is approved by the decision of the representative body of the municipal district on the budget for next fiscal year.

Statistics show that up to the economic and financial crisis, the total amount of transfers from the regional budget of the Vologda oblast to the budgets of municipal districts and settlements has increased from 41.5% in 2006 to 43.6% in 20087. However, in recent years of the crisis due to the lack of regional budget financial support through the regional transfer funds to local budgets tends to decrease. Almost all of the local budgets of municipalities in the Vologda region are subsidized.

From the data of table 3 we can see that in 2008, except local budgets of two okrugs (the budgets of cities of Cherepovets and Vologda), as well as the budgets of four municipal districts (Cherepovets, Vytegra, Kaduy and Sheksna districts), local budgets of the remaining 22 municipal districts of the Vologda oblast are subsidized.

Note that not only in the Vologda oblast, but also in many other constituent territories of the Russian Federation today formally almost all local budgets are subsidized. And, we believe, it is not a matter of the deterioration of general economic and financial situation in the regions and their municipal formations, caused by the economic and financial crisis. Even before the crisis during sustained economic development of territories, especially the constituent territories of the Russian Federation, there was budget shortfall in municipal formations, caused by the increasing centralization of tax revenues to higher budgets, in particular the federal budget. In this regard, in modern Russia there is still too high financial dependence of local municipal budgets on higher budgets.

Considering the inter-budget relations of the Russian regions and municipal formations, in our opinion, particular attention must be paid to existing contradictions and the problem of determining the location and function of local budgets in the total budget system of Russia. The essence of these contradictions and problem lies in the fact that local budgets which are the foundation of the pyramid of the budget system of the country, at the same time are the main financial base of local government, which, however, in accordance with the Constitution (article 12), is not a part of public authorities. It turns out that the state budget funds (local budgets are state-owned) are used by non-governmental organizations (local governments) and local budgets virtually

“drop out” of the budget system of Russia. This situation undoubtedly affects the efficiency of inter-budget relations of the Russian regions and municipal formations in terms of creating the necessary conditions for the formation of long-term and stable local budgets. And since this subsystem of inter-budget relations mirrors inter-budget relations between the federal center and the constituent territories of the Russian Federation, without solving the contradictions it is impossible to create an effective system of inter-budget relations of the country as a whole and real fiscal federalism.

Thus, the existing legal norms, mechanisms, means and methods of regulating the system of inter-budget relations in Russia ill-suit to solving problems of creation of real fiscal federalism. In the country there is the redistribution of budget resources in favor of the federal budget; there is a centralized system of inter-budget relations; financial dependence on lower budgets is excessively high. Consequently, the budget system and the federal budget of Russia in particular, operate as a budget of not federal but unitary state. No doubt that there is a need for further improving of the legal framework and mechanisms to improve effectiveness of the inter-budget relations and the formation of real fiscal federalism in modern Russia.

In this case, the basis of a full-scale budget reform in terms of inter-budget relations promoting development and strengthening of fiscal federalism in the country, is the Concept of improving the efficiency of inter-budget relations and management quality of public and municipal finance in the Russian Federation. The implementation of this concept is to address the following main tasks:

-

- strengthening of the financial autonomy of the Russian constituent territories and municipal formations;

-

- creating of incentives to increase revenue income in the budgets of the constituent territories of the Russian Federation and local budgets;

-

- formation of incentives to improve management of public and municipal finance;

-

- increase of transparency of regional and municipal finance;

-

- providing of methodological and consultative support to the constituent territories of the Russian Federation in order to improve efficiency and quality of management of state and municipal finances, as well as the implementation of the reform of local government.

The key to solving these problems, as we see it, lies primarily in providing relatively uniform development of economy and finance, respectively, in expanding their own taxable capacity in all regions and municipal formations, primarily, of course, in the depressed regions of the country. Only through sustainable economic development the excessive gap between own revenue sources and spending obligations of the country can be overcome and existing today a high level of financial dependence on the federal government can be reduced. And this means that Russia is still on a considerable and difficult path to the real fiscal federalism. But it is necessary because preserving of the integrity of the Russian state depends largely on the successful solution to the problem of fiscal federalism.

Список литературы Fiscal federalism and inter-budget relations in the Russian Federation

- The Constitution of the Russian Federation. -M.: Joint editorial board of Ministry of Home Affairs of Russia, 1998. -62 p.

- Budget Code of the Russian Federation. -M.: Publishing house “Omega-L”, 2010. -208 p.

- Avetisyan, I.A. Problems of improving inter-budget relations in the Russian Federation/I.A. Avetisyan//Structural changes and challenges of economic reform: scient. articles. -Vologda: VoPI, 1997. -Pp. 4-10.

- Avetisyan, I.A. Fiscal federalism and the financial basis of local government in the Russian Federation/I.A. Avetisyan//Proceeding of the Institute in 2 vols. -Vologda: VoPI, 1998. -Vol. 2. -Pp. 126-130.

- Avetisyan, I.A. Historical and methodological aspects of the regulation of inter-budget relations in the Russian Federation/I.A. Avetisyan//Socio-economic reforms: a regional perspective: proceedings of the Third Russian scientific and practical conference. -Vologda: Vologda Scientific Coordination Centre CEMI RAS, 2001. -Pp. 27-32.

- The budget system of Russia: textbook for higher schools/ed. prof. G.B. Polyak. -M.: UNITY-DANA, 2003. -540 p.

- Dementiev, D.V. The budget system of Russia: textbook/D.V. Dementiev, V.A. Shcherbakov. -2 ed. stereotype. -M.: KNORUS, 2009. -256 p.

- -Access mode: www.zs.gos35.ru

- Uskova T.V., Gutnikova E.A. Small business development as a factor of increasing the financial autonomy of municipalities//Economic and social changes: facts, trends and forecasts. -Vologda: ISEDT RAS, 2010. -№ 2 (10). -P. 94

- Povarova A.I. Formation of the regional budget in the crisis//Economic and social changes: facts, trends, forecasts. -Vologda: ISEDT RAS, 2010. -№ 2 (10). -P. 101