Forecasting the effectiveness of methods for managing the income potential of regional budgets

Автор: Utkin A.I.

Журнал: Экономика и бизнес: теория и практика @economyandbusiness

Статья в выпуске: 1-2 (59), 2020 года.

Бесплатный доступ

In the conditions of multidirectional influence of positive and negative investment factors the impossibility of creating fundamentally new methods for managing the incomes of regional budgets determines the current objectives of correction of the income potential of the regions. The key objectives are to equalize the innovative provision of budgets and optimize the economic risks of their innovative development. The purpose of the research is to build a theoretical model for achieving maximum innovative efficiency of the methods for managing the incomes of regional budgets selected according to the established criterion. On the example of Vladimir and Ivanovo regions with the use of this model the forecast trends in the development of the income potential of regional budgets arising as a result of the application of the selected methods are revealed. The practical significance of the theoretical model as the main result of this study consists in the expediency of its application in the development of a unified strategy for equalizing the income potential of regional budgets.

Regional budget, income potential, methods for managing the incomes of budgets, economic risks, innovative effectiveness

Короткий адрес: https://sciup.org/170182002

IDR: 170182002 | DOI: 10.24411/2411-0450-2020-10066

Текст научной статьи Forecasting the effectiveness of methods for managing the income potential of regional budgets

The unevenness of income flows to regional budgets and the strengthening of negative trends in the budgetary process with a multidirectional impact of investment factors are the consequences of the inefficiency of the methods for managing the budget incomes [1; 2; 3]. The lag in the income potential of budgets of Vladimir and Ivanovo regions is especially noticeable. The main contradiction is that it is impossible to develop fundamentally new methods for performing modern objectives of correction of the income potential. The equalization of innovation and income provision of budgets and the optimization of economic risks of their innovative development depend on the correct correction and forecast of the effectiveness of the use of existing methods [4; 5].

The purpose of the research is to build a theoretical model for achieving maximum innovative efficiency of the methods for managing the incomes of consolidated budgets of Vladimir and Ivanovo regions.

A necessary condition for forecasting the effectiveness of income management methods applied to the consolidated budgets of Vladimir and Ivanovo regions is to determine the criterion of difference that allows to divide the existing methods into the most effective and not subject to further use. In their scientific works E.A. Kolodina [1], Zh.A. Mingaleva [2] and A.A. Maltseva [3] propose quite reasonable formulations of this criterion in relation to the regional budgets of the country as a whole. The synthesis of identical economic features of these criteria allows to combine the positions of scientists and give a modern formulation of the selection criterion of the methods for managing the incomes of regional budgets (figure 1).

The innovative development of the income potential of budgets of Vladimir and Ivanovo regions includes four projections: financial and economic potential, risk potential, population satisfaction potential and potential of the stability of internal processes. In this case, the selection criterion shows the target orientation to achieve a positive economic effect and favorable consequences for the innovative development of the regional economy. The improvement of the efficiency of income management methods becomes possible when achieving an internal balance between the innovative development of regional budgets and the socio-economic prosperity of the population [6].

Figure 1. Synthesis of economic features of the selection criteria disclosure applied to the methods for managing the incomes of regional budgets in the Russian Federation

The investment factors such as the reduction of the interest rate of the commercial loan, the creation of investment funds, the marginal efficiency of capital, the availability of borrowed funds have a positive impact on regional budgetary processes [7; 8]. So the innovative development of regional budgets can be assessed as unsatisfactory in the conditions of aggravation of problems that occur under the influence of negative investment factors (lack of savings transforming into investments and high concentration of structural transformations) [7]. The economic risks of innovative development of consolidated budgets of Vladimir and Ivanovo regions should be considered a key negative factor of the socio-economic development of these regions [9]. Their impact is detrimental to the budgetary process and evidenced by the low level of innovative development of both regions. At the same time, the condition of the budgetary process in Vladimir region is slightly better than in Ivanovo region (it is less exposed to economic risks).

The table presents recommendations for making corrections to the process of using the most effective methods for managing the incomes of consolidated budgets of Vladimir and Ivanovo regions selected according to the established criterion of difference.

Table. Recommendations about the correction of the methods for managing the incomes of consolidated budgets of Vladimir and Ivanovo regions

|

Essence of correction |

Method of the incomes management |

Conditions for stimulating the influence of positive investment factors and reducing the impact of negative investment factors |

Conditions for overcoming the problems of strengthening the income potential of budgets |

|

I. Prioritization of internal sources of additional financial resources received from credit organizations |

Method of finding additional financial resources |

|

|

|

II. Multi-level monitoring of the implementation of investment strategies in other regions (in order to model budget incomes in accordance with the market conditions of own region) |

Method of modeling budget incomes in accordance with market and financial conditions of the main taxpayers |

|

|

|

III. Creation of comfortable climate for tax rate satisfaction |

Method of controlling the timely receipt of the budget funds |

|

|

The correction of the method of finding additional financial resources allows to improve the process of its use by adding the parameter “Improvement of the sale order for state and municipal property (in order to fi- nance the unprofitable units of credit organizations)”. The method of controlling the timely receipt of the budget funds is supplemented by the parameters “Operational forecast of tax and non-tax incomes” and “Improvement of the sale order for state and municipal property (in order to reduce the share of state external borrowings)”. The correction of the method of modeling budget incomes only complements the full-fledged process of its implementation which can become fundamental in the formation of a strategy for the development of industrial production in the economy of these regions.

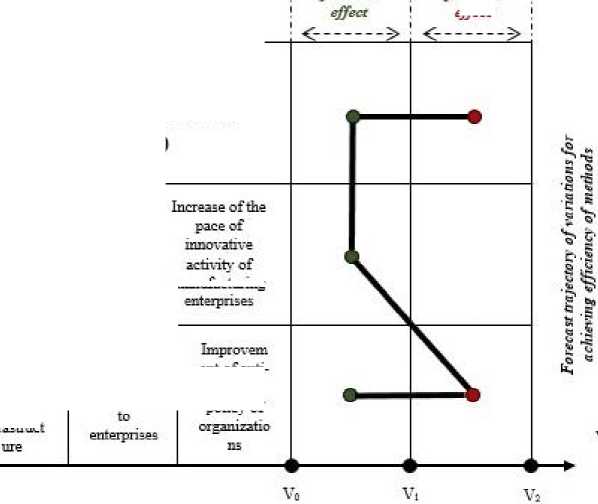

With the use of the method of hierarchy analysis, the theoretical model for achieving maximum innovative efficiency of the methods for managing the incomes of consolidated budgets of Vladimir and Ivanovo regions is constructed (figure 2). It not only provides forecasting the effectiveness of methods but also reflects the forecast trends in the development of the income potential of regional budgets.

Levels of system

Level!

(efficiency as a goal)

(criteria of efficiency)

Level 5 (variations .for achieving efficiency)

Negative forecast effect

Increase of the volume of lending

Positive forecast

Introduction of the latest resource-saving technologies

Developm ent of investment market infrastruct

Accumulation of financial resources of medium stiH large organizations

Variations for achieving efficiency

Maximum innovative efficiency (balance of the income potential of regional budgets)

тпэтптРэНпт тп^

Use of a short-term financing

ent of anti-

policv of

Figure 2. Theoretical model for achieving maximum innovative efficiency of the methods for managing the incomes of consolidated budgets of Vladimir and Ivanovo regions

Thus, the creation of the theoretical model on the example of Vladimir and Ivanovo regions allowed to determine the direction for achieving maximum innovative efficiency of the methods for managing the incomes of regional budgets. At the same time, the balance of the income potential of budgets depends on the forecast trajectory of variations for achieving efficiency of methods selected according to the established criterion. The practical significance of the model and recommendations is to identify ways to develop a unified strategy for equalizing the income po- tential of regional budgets. The theoretical model links the goal of sustainable development of regional budgets (maximum innovative efficiency of methods) and specific features of the socio-economic development of the regions. The direction of further research should be the suggestion of ways to improve the innovative development of the regional economy of the Russian Federation as a whole with a possible changes in the nature of the impact on the economic risks and the problems caused by them.

Список литературы Forecasting the effectiveness of methods for managing the income potential of regional budgets

- Колодина Е.А. Исследование результативности выравнивающей региональной политики в Российской Федерации // Региональная экономика и управление: электронный научный журнал. - 2019. - №4 (60). Номер статьи: 6007. - [Электронный ресурс]. - Режим доступа: https://eee-region.ru/article/6007/ (дата обращения: 28.12.2019).

- Мингалева Ж.А., Паздникова Н.П. Развитие методов управления бюджетным потенциалом региона // Экономика региона. - 2007. - №2 (10). - С. 263-267.

- Мальцева А.А., Клюшникова Е.В. Риски территорий инновационного развития: комплексный анализ для целей управления // Региональная экономика: теория и практика. - 2015. - №41 (416). - С. 13-32.

- Новоселова И.А. Оценка финансового состояния регионов // Современная экономика: проблемы, тенденции, перспективы. - 2009. - №2. - С. 26-36.

- Аландаров Р.А. Резервы роста доходной базы бюджетов бюджетной системы Российской Федерации // Финансовая аналитика: проблемы и решения. - 2014. - №43 (229). - С. 27-39.

- Дробышевская Л.Н., Ермакова Ю.С. Система формирования доходов региональных бюджетов и пути ее дальнейшего совершенствования // Современная научная мысль. - 2015. - №1. - С. 95-105.

- Уткин А.И., Сперанский С.Н., Ермолаев М.Б. Комплексный подход к корректировке доходного потенциала региональных бюджетов (на примере Владимирской и Ивановской областей) // Современные наукоемкие технологии. Региональное приложение. - 2019. - №2 (58). - С. 106-120.

- Зандер Е.В., Лобкова Е.В., Смирнова Т.А. Экономические проблемы регионов и отраслевых комплексов // Проблемы современной экономики. - 2014. - №4 (52). - С. 190-193.

- Селянинов А.В., Фролова Н.В. Практическое применение принципов эффективности и устойчивости в управлении национальной и региональными инновационными системами // Ars Administrandi. Искусство управления. - 2012. - №4. - С. 81-93.