Foreign direct investment in the economy of the Russian Far East

Автор: Minakir Pavel A., Suslov Denis V.

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Socio-economic development strategy

Статья в выпуске: 3 (57) т.11, 2018 года.

Бесплатный доступ

The article considers the trends and patterns of foreign direct investment in the Russian economy in the context of mega-regions, the features of attracting and spatial distribution of foreign direct investment (FDI) in the regions of the Far East. The purpose for the study is to assess the economic effects generated by foreign investment in the Far East. The hypothesis is the assumption that attracting foreign investment in the region is to a greater extent a tool to maximize the economy of scale, rather than eliminating financial imbalances. The initial data of the study are statistical materials of the Central Bank, as well as macroeconomic indicators published by federal and regional statistical agencies. The methodological framework of the study is the concept of modern general theory of foreign direct investment, in particular the concept of spatial distribution of foreign investment. The article presents the assessment results of spatial performance and modification of the spatial-sectoral structure of foreign investment in the Far East, and the macroeconomic effects of their application...

Far east, foreign direct investment, deployment, regions, investing country, offshore, northeast asia, foreign invested enterprises, projects, advanced special economic zone, free port of vladivostok

Короткий адрес: https://sciup.org/147224063

IDR: 147224063 | УДК: 330.322 | DOI: 10.15838/esc.2018.3.57.3

Текст научной статьи Foreign direct investment in the economy of the Russian Far East

One of the essential components of the “new economic policy” for the development of the Russian Far East is the stimulation of foreign capital inflow, primarily of foreign direct investment considered as an alternative resource for economic development and a source of technological innovation. The first attempt to use foreign investment as a resource for economic development in the Far East was concession agreements in the 1920s [1; 2]. Foreign direct investment began to be used as a source of economic development and a tool for developing the region’s natural resource base since the mid-1960s, when the first compensation agreements were concluded with Japan using the formula “capital and technology for natural resources”. Substantially, these agreements were large-scale barter transactions with parties represented by national governments [2; 3]. In the 1980s, foreign direct investment was already applied based on economic agents themselves, with institutional guarantees and special state incentives (benefits) for foreign investors localized in the region, established in the law on foreign investment (1987) [3]. The current stage of investment cooperation in the Far East is characterized by absence of a special institutional regime for foreign investment, which determines the subordination of performance, scale, sectoral and territorial structure of foreign investment to comparative advantages of the capital functioning in the region compared to other options for its placement.

Therefore, the performance and structure of foreign direct investment (FDI) can serve as an indirect indicator of success of the region’s economic development policy in terms of increasing its competitiveness in the capital market, as well as the assessment of potential of absolute advantages of the Far East in the field of natural factors of FDI attraction.

These estimates are described the article through analyzing the trends of FDI attraction and spatial distribution in the regions of the Far East, taking into account the changes in the information framework in connection with the transition to the methodology of the Central Bank in the accounting of foreign investments. Such studies have been widely conducted since the early 2000s both in relation to the Russian economy as a whole [4; 5; 6] and in the aspect of comparative spatial analysis of structural and dynamic indicators and effects [7; 8; 9; 10].

At the same time, the objective of assessing the responses of the socio-economic systems of specific regions to the use of foreign direct investment in the region has not been solved to date. In particular, it is necessary to investigate how the relations between the performance and scale of foreign investment, on the one hand, and macroeconomic dynamics in a particular region – on the other, are modified depending on the characteristics of the economic structure, domestic market capacity, integration of the regional system into interregional and global chains. Assessing the efficiency of accounting a set of specific factors for attracting and operating foreign investment in the investment and macroeconomic policy in a specific region.

Theoretical concepts of FDI research

The studies of the performance, the geographical and sectoral structure, the patterns of distribution, the forms and sources of funding, and the effects of foreign direct investment are based on the whole set of theoretical concepts.

These concepts are based both on the assumption that foreign direct investment is carried out in markets with perfect competition (presence of a large number of sellers and buyers, product homogeneity, free access to information, etc.), and on the assumption of imperfect markets (presence of barriers to foreign trade, transaction costs, transportation costs and taxes) [11; 12]. In both cases, a large number of variables and different factors (macro-, micro- and strategic) are considered.

Macro-factors include the size of the host economy’s FDI, the interest rates, wages and profitability. Micro-factors refer to the characteristics of firms and industries which provide certain advantages to transnational corporations as opposed to other firms. These include product differentiation, technological and promotional effects, product life cycle, and firm sizes. A number of strategic factors combine the circumstances that indirectly affect decision-making on foreign investment [13].

Theoretical concepts describing the spatial distribution of foreign direct investment according to investment motives in conditions of market of perfect competition, are based on the assumption that decisions about FDI location are dominated by comparative assessments of return on capital in different countries and regions [14; 15], the desire to diversify business [12; 16] as well as maximize the economy of scale through placement of investment in countries and regions with large market capacity for relevant products [12; 17; 18; 19; 20].

More complex structures describe the patterns of foreign direct investment with the introduction of the idea about a more realistic assumption of imperfection of markets. These include the hypothesis of industrial organization [21; 22; 23], the hypothesis of internalization [24; 25; 26], the hypothesis of spatial distribution [13; 27; 28; 29; 30], Dunning eclectic theory [31; 32; 33; 34], the hypothesis of product life cycle [35], the hypothesis of oligopolistic reaction [36] and some others.

Regardless of the type of markets which operate direct foreign investment, it is impossible to accurately and comprehensively explain the motives, causes and effects from capital placement only from the point of view of goal setting and internal capital efficiency. These grounds are sufficient when describing the motives and results of functioning capital placement in a homogeneous institutional environment, which is the national economy.

However, in the case of international flow of venture capital, the essential conditions influencing the decisions regarding FDI and the results of the implementation of these solutions are as differentiated across countries and regions as poorly formalized combinations of institutions and economic policies (especially modes of financing, exchange rate regimes, tariff and non-tariff barriers, tax policy, strategic priorities and restrictions on foreign capital entering national markets, etc.).

It is impossible to take into account this variety of conditions within any unified system of canonical concepts (theories). The essential specific features of combination of factors and conditions characteristic of specific cases of foreign investment location, make it mandatory to formulate adequate concepts and hypotheses describing the performance and structure of foreign investment related to a particular country or period. This to a greater extent is related to the problem of explaining regional FDI location (especially within medium and large countries), which is less represented in theories and hypotheses than in the case of national economies. This determines not only, and not so much the existence of a certain freedom in the formulation of hypotheses and application of various theoretical concepts in the description of the regional aspect of FDI, but also the need to test their adequacy empirically, their compliance with the features of territorial and sectoral development.

The testing can be carried out with the help of econometric models (with an adequate statistical framework), which has precedents in the Russian research practice [37; 38], but does not lead to reliable results since it takes into account only a limited set of important characteristics of regions for investors [39]. In some cases, the best results are obtained through descriptive analysis using author’s databases and questionnaire methods.

In Russia, one of the most well-known theoretical models of FDI location in the regional context is the model of hierarchical wave diffusion [40] based on the hypothesis that foreign investors create their first enterprises, as a rule, in key economic centers or their suburbs, and then “master” adjacent territories, which is expressed over time in reducing the territorial concentration of FDI. However, this model is much more suitable to describe the investment strategies of individual economic agents, rather than explain the comparative dynamics, especially the structure and effects of foreign investment in the regions. If the number of foreign investors remains constant the model can explain the investment processes in the interregional aspect. But with an increased number of new direct investors entering the country, which, like their predecessors, start with the largest economic centers, the concentration of FDI can continue and even increase. In addition, there are fundamental exceptions to this model, which relate just to the principal cases of conditions in the Russian economy. First, this model does not consider the situation where the market scale makes it sufficient for the investor to be limited to a limited amount (or even a single) of investment, exploiting economies of scale (as, for example, in the case of car assembly plants). Second, investment takes place in border regions, rather than in major economic centers. Third, there are situations where a foreign investor acquires a ready-made enterprise or develops cooperation ties. Finally, which is the most important in the framework of this article, the given model is not suitable for describing the situation of investment in development and export of natural resources, which is extremely important for the Russian Far East and similar economic regions.

Therefore, in this article, the hypothesis of spatial FDI location is considered a theoretical hypothesis explaining the trend and structure of foreign direct investment in relation to the Far Eastern federal district and its constituent entities of the Russian Federation, as in the case of other resource-oriented regions. According to it, FDI flow and location is based on immobility of production factors (labor force, sources of raw materials, etc.). This immobility leads not only to spatial differentiation of cost of production factors (which generates the effects of comparative advantages or, in a later version, the effects of economic units), but also to the limited effects of absolute economic advantages.

Features of information support for analysis of foreign direct investment in Russia

Until 2014, statistical accounting of foreign investment in Russia was carried out according to the “Methodological regulation on the organization of statistical monitoring of foreign investment according to the manual of balance of payments”1. The Unified Interdepartmental Information and Statistics System of the State Statistics Committee have collected quarterly data on foreign investment since 2004.

The features of the classification of foreign investment inflow were types of activity (according to Russian National Classifier of Types of Economic Activity (OKVED)), world countries (investors), regional breakdown by federal district and Russian constituent entity. The data were presented for all types of foreign investment (direct, indirect and other), which helped carry out a deep dynamic and structural analysis of foreign investment inflow in the sectoral and regional context to identify trends and regional characteristics. But since 2014, Russia has made a transition to accounting for only foreign direct investment2. This resulted in the loss of comparability of data on foreign investment for 2004–2014 and for the period from 2015.

Since the second half of 2015, Russia has started to publish FDI statistics collected by the Central Bank using a new technique, on direct investment accumulated at the beginning of 2015 by Russian constituent entity, including data on FDI accumulated in them, the structure of investment by country, geographical and economic zone of direct investors, and types of economic activity. The amount of FDI accumulated in a Russian constituent entity is a relevant statistical indicator for evaluating the existing regional disparities in attracting FDI [41]. However, it is impossible to analyze regional patterns, peculiarities and trends of foreign investment inflow from the regional perspective using this indicator, although these problems were widely analyzed in the scientific literature [42; 43; 44]. The Central Bank began to publish statistics not only on FDI received but also on FDI withdrawn only in 2011, while the significant inflow of foreign investment occurred in the 1990–2000s. In addition, statistics on FDI inflow have never been detailed: no open data on FID country of origin (to assess the role of offshore investment and other convenient jurisdictions) or on the sectoral structure of investment were available.

These and other statistical novelties have led to significant flaws in analytical studies on regional aspects of foreign direct investment in Russia [45; 46]. In some areas such as formulation and testing of various hypotheses, analysis of data on FDI flows and balances in Russian constituent entities, new statistics provide certain opportunities, but in general there are significant shortcomings which are noted by many experts and foreign investors3.

Imperfection of investment accounting becomes a problem for its objective analysis and making management decisions. An objective analysis of investment performance is often hampered by incomplete accounting data for small and medium investment projects and enterprises, imperfect methods of calculating accumulated investment and defining country’s ownership of investment. Official statistics on accumulated investment may differ several times from data based on the volume and structure of investment of individual projects. Thus, according to the Central Bank, by the end of 2016, accumulated direct investment from China to Russia amounted to 2.27 billion dollars and, according to the Eurasian Development Bank (EDB), they amounted to 8.23 billion dollars. The Chinese sources also do not provide an opportunity to clearly assess the scope of investment cooperation. The statements of official representatives of the Chinese side are also contradictory.

To some extent, the use of author’s databases on specific investment projects with foreign investment would help avoid the problems of incomplete statistics [47]. A good example can be EDB and IMEMO RAS databases.

The key advantage of such informationbased works is the degree of detail of data used for further analysis. It is possible to find out the country of investment origin (and understand whether investment is really foreign), the nature of a project (a start up or a ready-made business), its industry, the share of foreign investment in the company’s authorized share capital (whether a foreign investor controls the enterprise4).

However, the formation of an investment projects database is a very time-consuming process; which inevitably has to be limited to collection of information only about relatively large (or available) investment projects. Moreover, such databases offer a very limited scope for quantitative analysis of regional FDI distribution, as it is virtually impossible to obtain information on annual investment volumes.

The peculiarities of information support for analytical studies on the problem of foreign direct investment determine a number of limitations in integrity of conclusions regarding both regional aspect of FDI performance and structure, and its role in the economy of specific regions, particularly in the Russian Far East.

Foreign direct investment in the Russian economy: regional distributions

Taking into account the above features of information on FDI inflow and use in the Russian economy, which characterizes the movement of capital value in account balance, it should be noted that the distribution of investment in the context of macro-regions (federal districts) reflects these information features. The main area of FDI attraction is Moscow and the Northwestern federal district (mainly Saint Petersburg), where 72% of all investment is registered in 2012 and almost 78% – in 2017 ( Tab. 1 ).

Table 1. Foreign direct investment flows and balances by federal district, %, Russia=100%

|

2012 |

2017* |

|

|

Central federal district |

59.2 / 75.8 |

67.6 / 50.2 |

|

Northwestern federal district |

12.9 / 13.8 |

10.2 / -0.1 |

|

Southern federal district |

1.4 / 0.3 |

1.1 / -3.3 |

|

North Caucasian federal district |

0.1 / -0.1 |

0.4 / 0.3 |

|

Volga federal district |

3.3 / 2.0 |

2.0 / 1.1 |

|

Ural federal district |

14.3 / 12.2 |

4.7 / 8.1 |

|

Siberian federal district |

2.6 / -7.6 |

5.8 / 14.5 |

|

Far Eastern federal district |

4.7 / 1.1 |

7.5 / 27.0 |

|

* Data for 9 months. Note. Data excluding withdrawal of direct investment, undistributed investment by constituent entity and the Crimean FD. The data and use of signs are consistent with the IMF sixth edition of “The manual of balance of payments and international investment position” (MBP6) according to the principle of assets/liabilities. The operations signs: “+” – increased assets and liabilities; “-” means decreasing assets and liabilities. Signs of balance of operations in “Direct investment” line “+” – excess of assets over liabilities; “-” – excess of liabilities over assets. Source: data from the Bank of Russia. |

||

This is in line with the previously mentioned concept of concentration of foreign investment in metropolitan areas, which are associated with the main markets. The Moscow Oblast attracts investment also through the fact of a significant part of foreign companies and companies using foreign investment registered in Moscow. There is also another important reason for this extraordinary concentration of foreign direct investment – debt instruments account for a large share of foreign direct investment, and an accounting system based on balance of payments tracks financial flows associated with investment. Most of these investment flows to Moscow and through Moscow.

The situation with attracting and using foreign direct investment seems somewhat different if we take into account investment outflow. In this case, the proportion between applied investment in the areas of preferential production concentration focused on domestic and foreign markets changes significantly. In 2012–2017, the share of investment balances (inflow minus outflow) decreased for Moscow and the Northwestern federal district from 88.6

to 50.1%. At the same time, the share of macroregions with predominantly export-oriented foreign capital investment increased from 3.5 to 39.6% (see Table 1).

This indicates the replacement of investors’ expectations of effects of domestic market with foreign trade income. The indirect evidence of this trend is also the dramatic change in the characteristics of investment outflows compared to inflows. In 2012–2017, the ratio of withdrawn investment to the amount received for the corresponding year increased from 61 to almost 81% for “capital regions”, but decreased from 91 to 16% for Eastern regions.

The observed substitution effect is in line with the above-mentioned concept of production factors immobility as a basis for decisions in FDI location. But from the point of view of effects on the growth of the Russian economy, this trend is extremely negative. Shifting the FDI concentration zone towards the export primary sector means narrowing the basis for increasing domestic aggregate economic demand as a factor in economic growth.

Foreign direct investment in the economy of the Far East

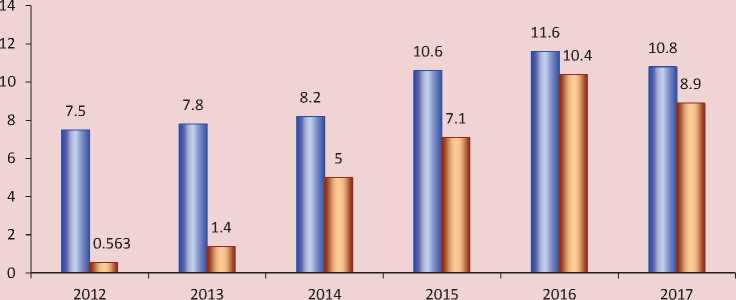

In general for the Far East, the performance of both inflow and balance of foreign direct investment is monotonous ( Fig. 1 ). In 2012– 2017, the economy of the region received more than 65 billion dollars of FDI, and the cumulative balance over the years amounted to over 33 billion U.S. dollars, or (at current exchange rates) more than 23% of the total fixed capital investment in the region over the years.

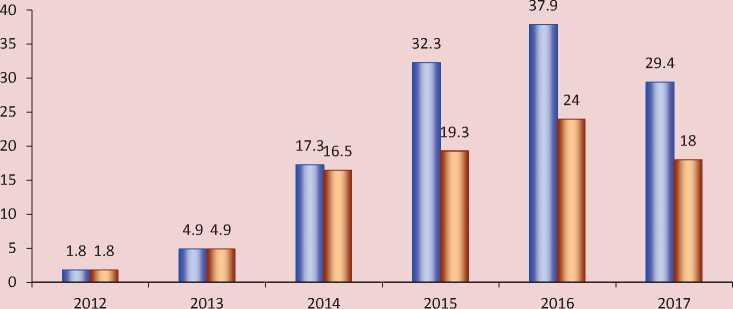

At the same time, the importance of foreign direct investment as a source of accumulation in the economy of the Far East rapidly increased, largely due to devaluation of ruble at the end of 2014 and a constant decline in investment withdrawal rate in the Far Eastern economy, which indicates investors’ long-term interests who in the region ( Fig. 2 ).

The nature of these interests is illustrated by the intra-regional distribution of FDI among Russian constituent entities. In 2012–2017,

68.4% of all FDI received by constituent entities, according to the Central bank, in the far East was accumulated in the Sakhalin Oblast5. That is, the main investment subject is production and processing of hydrocarbons.

In general, by the beginning of 2017, the accumulated volume or remains of foreign direct investment in the Far Eastern economy amounted to about 62 billion dollars, almost 90% of which were in the Sakhalin Oblast.

At the same time (in contrast to the average situation in Russia), loan capital comprised a small part (about 7% of FDI balances), which largely explains the low share of foreign capital outflow from the region ( Tab. 2 ).

Of course, in this case, a high degree of capital participation is achieved through investment in projects of the Sakhalin oblast (1.6% of the accumulated capital in the form of loans). For other constituent entities with the exception of Kamchatka Krai, foreign direct investment to a large extent takes the form of loans to finance investment projects. However ,

Figure 1. Performance of FDI in the economy of the Far East, billion U.S. dollars

□ income □ balance

Source: data from the Central Bank.

Note: 2017 – according to data for 9 months.

Figure 2. Share of FDI in total fixed capital investment in the Far East, %

□ share 1 □ share 2

Sources: data from the Bank of Russia; Socio-economic situation in the Far Eastern federal district for the corresponding years.

Note. Share 1 – with the actual average annual ruble exchange rate, share 2 – with the conditional ruble exchange rate equaling the average rate in 2013.

Table 2. Foreign direct investment in the Far Eastern federal district (FEFD), balances on Russia’s constituent entities by instrument (as of 1.01.2017, million U.S. dollars)

From this point of view, the Russian Far East has a significant advantage over other macro-regions where a much larger share of FDI refers to lending capital, i.e. the real impact of value-adding foreign investment is more limited. However, in the case of the Far East, there is a different problem in terms of the real impact of FDI on the region’s economy – the spatial-sectoral monopoly on FDI attraction and use.

More than 90% of FDI accumulated in the region is concentrated in natural resource extraction and exploration ( Tab. 3 ), mainly of fuel and energy minerals, which resulted in the formation of the asymmetric sectoral FDI structure, and therefore in suppressed investment multiplier.

Until 2012, the main investing countries (by place of registration of investing companies) in the Far East were the Netherlands and Japan. But during 2015–2017 the situation has changed significantly. The main investment donors for the Far East are offshore territories and other sources (the category “not distributed by country”) which are very difficult to decipher due to “confidential data”.

This is related to the transition to financing of major oil and gas projects through specially created companies in offshore jurisdictions. This explains the less noticeable share of Japan as an investor country judging by the role of Japanese companies in Sakhalin oil and gas projects. “New” statistics of the Central Bank has reflected this changed scheme of foreign investment (Tab. 4). The statistics “homeland” of more than 92% of FDI received in the Far East during this period is offshore territories such as the Bahamas, Bermuda and Cyprus, which reflects the general trend toward minimizing investment risks in emerging markets, in particular in Russia.

The real FDI impact on the region’s economy is evident at both macro- and microlevel. At the macro-level, this impact would have to be felt through the link of FDI balance inflows to gross regional product growth, as well as through the reaction of total investment in fixed capital to changes in FDI balance. However, this dependence is practically not detected ( Fig. 3 ).

Table 3. Foreign direct investment in the Far Eastern federal district, balance by economic activity, million U.S. dollars

|

Types of activity |

As of 01.01.2015 |

As of 01.01.2017 |

|

Total for the Far Eastern federal district |

41550 |

62245 |

|

Real estate operations |

61 |

100 |

|

Professional, scientific and technical work |

- |

- |

|

Finance and insurance |

50 |

38 |

|

Mineral extraction |

36816 |

56041 |

|

Manufacturing |

0 |

484 |

|

Other services |

830 |

1154 |

|

Agriculture, forestry, hunting and fisheries |

3 |

10 |

|

Constructions |

66 |

187 |

|

Wholesale and retail trade; vehicle and motor-vehicle repair |

51 |

120 |

|

Transportation and storage |

69 |

-28 |

|

Not distributed by economic activity |

3604 |

4139 |

|

Notes: 1. The data are consistent with the IMF “Balance of payments and international investment position manual”, 6th edition, and are presented according to the principle of assets/liabilities. The definition of types of economic activity corresponds to the main classification categories of the 4th revision of the UN International Standard Industrial Classification (ISIC4) and its European equivalent (NACE2). Data on economic entities receiving direct investment were initially formed based on the all-Russian classification of economic activities (OKVED) by main type of activity and then regrouped according to the ISIC4 methodology. Starting from 01.04.2017, OKVED2 is used. The main type of economic activity of a commercial organization is the one that, according to the results of the previous year, has the largest share in the total volume of products and services provided. 2. Data include investment in banks and other sectors; confidential data are included in the column “not distributed by economic activity”. Source: data from the Bank of Russia. |

||

Table 4. Geographic structure of accumulated direct foreign investment in the Far Eastern federal district, million U.S. dollars

|

As of 01.01.2015 |

As of 01.01.2016 |

As of 01.01.2017 |

As of 01.10.2017 |

|

|

Total investment |

41550 |

39431 |

62245 |

60952 |

|

The Bahamas |

20828 |

21227 |

33275 |

32486 |

|

Bermuda |

14443 |

13177 |

21192 |

20555 |

|

Cyprus |

2121 |

1942 |

2622 |

3247 |

|

Not distributed, including confidential data |

3059 |

2395 |

3593 |

3190 |

|

Other countries |

1099 |

690 |

1563 |

1474 |

|

Notes: 1. The data are developed according to the IMF “Balance of payments and international investment position manual” (6th edition). 2. Financial and non-financial investment included. Source: data from the Bank of Russia. |

||||

Figure 3. Growth of nominal values of investment and GRP (% to the previous year)

^^^^^winvestment foreign inv.^^^^^ ■ iGRP

This is partly due to the fact that, as noted above, FDI in the Far East is spatially localized within the Sakhalin Oblast, and the effects of its application are marginally localized within the Far East itself. In addition, investment in Sakhalin Shelf projects (main FDI recipients) is at a stage where investment lags are significantly greater than in the first years after starting exports of finished products. Accordingly, the period from 2012 to 2015 is not sufficient to capture the investment effects.

At the micro level, the effects of foreign investment are seen as a stimulus for entre- preneurial activity in the economy, in particular through an increase in the total amount of functioning economic actors. For some constituent entities in the region, foreign direct investment is indeed an important factor in increasing the amount of entrepreneurship (the Jewish Autonomous Oblast, the Amur Oblast, the Sakhalin Oblast). But in general, the entrepreneurial effect of foreign investment is very limited in terms of the share of enterprises with foreign investment in the total number of commercial enterprises operating in the district (Tab. 5).

Table 5. Number of enterprises with foreign participation as of 01.01.2017

|

Constituent entity in the Far Eastern federal district |

Foreign |

Joint |

Total with foreign participation |

Share in the total number of enterprises, % |

|

Far Eastern federal distric t |

3442 |

1444 |

4886 |

2,5 |

|

Sakha (Yakutia) Republic |

207 |

81 |

288 |

1,1 |

|

Kamchatka Krai |

60 |

77 |

137 |

1,2 |

|

Primorsky Krai |

1326 |

571 |

1897 |

2,7 |

|

Khabarovsk Krai |

548 |

302 |

850 |

1,9 |

|

Amur Oblast |

570 |

123 |

693 |

4,1 |

|

Magadan Oblast |

78 |

30 |

108 |

2,1 |

|

Sakhalin Oblast |

395 |

217 |

612 |

3,5 |

|

Jewish Autonomous Oblast |

239 |

36 |

275 |

8,2 |

|

Chukotka Autonomous Okrug |

19 |

7 |

26 |

2,4 |

|

Source: Russian regions. Socio-economic indicators. 2017: statistics book . Rosstat. Moscow, 2017. P. 653. |

||||

As a rule, we are talking about small enterprises, judging by the fact that in the Sakhalin Oblast, which accounts for almost 90% of foreign investment, only 12.5% of all enterprises with foreign investment operate in the district. The largest number of such enterprises (70% of the total) is registered in Primorsky and Khabarovsk krais and in the Amur Oblast, which account for only a small part of accumulated foreign direct investment but have a diversified economy, which provides much greater opportunities for establishing small domestic demand-oriented enterprises.

Institutional regime and foreign investment

Since 2012, the Far East has been implementing a set of institutional innovation united by the term “new Eastern policy” in scientific literature and official documents [48; 49]. One of the elements underlying it is overcoming the objective restriction caused by the narrow domestic market through establishing, including with the use of foreign capital, enterprises with export potential. The second declared goal of this policy is the expansion of the investment base to develop the economy of the Far East also by attracting foreign capital. The government has chosen the creation of localized preferential investment regimes and operation of enterprises in the form of advanced special economic zones (ASEZ) and free port of Vladivostok (FPV) as the main tool for solving this two-fold problem.

To date, such platforms with preferences for investors have been created in almost all regions in the Far East. From the above data it is not yet possible to draw conclusions about the results of institutional innovation in terms of expanding the intra-regional export base and increasing the total investment resource for regional economic development. As noted above, foreign investment is still allocated almost exclusively to operating the traditional export commodity sector and is concentrated mainly in a single, albeit a very large-scale, investment export project. This is evidenced by the portfolio of new investment projects of the Far East Investment Promotion Agency (IPA), which mainly offers investment projects in deposit development and mineral of natural resources (3.6 trillion of 4.6 trillion rubles).

Some hopes for the improvement of the investment and business climate are associated with the “institutional harbors” created and being created in the region. According to the report of the Ministry for the far East Development, the expected investment of non-resident companies in Russia in projects

Table 6. Projects with foreign investment in “institutional harbors” (end of 2017))

Conclusion

The analysis of the territorial and sectoral structure of FDI flow to the Russian Far East helps conclude that the main strategy of foreign investors in the region is to provide access to and opportunities for the development of mineral deposits (both hydrocarbons and other resources), i.e. extraction of natural resource rent, as well as further resource processing using other non-mobile production factors. This indicates the appropriateness of the hypothesis of spatial distribution of FDI resulting from the modern theory of FDI and spatial economics, whose consistency can be tested with accumulation of objective statistical data on FDI and analysis of databases on investment projects with foreign participation in the macro-region and some regions of the Far Eastern federal district.

The particular feature of direct foreign investment in the economy of the Far East is its pronounced spatial and sectoral localization. The main part of investment is concentrated in Sakhalin hydrocarbon projects. This determines the limited impact of FDI on the performance and structure of the region’s economy.

The institutional innovation of the past 5 years is not yet able to significantly change FDI interaction and regional macro- and microeconomics. However, the range of investing countries is expected to be significantly expanded and the level of FDI structural diversity – to be increased. The establishment of “institutional harbors” in each constituent entity in the Far East creates a fundamental opportunity to offer profitable projects in a variety of sectors in almost every Far Eastern region.

The study whose results are reflected in the article helps obtain new data on the system of economic effects of attracting and applying foreign direct investment in the economy of the Far East. It is demonstrated that in the context of the Far East, the spatial and sectoral localization of foreign investment is dominated by the economic availability of non-mobile production factors, rather than by the comparative efficiency of mobile factors. Accordingly, the most adequate theoretical concept for describing the process of FDI transfer is the hypothesis of spatial distribution that obtains reliable statistical evidence in the case of the Far East. The importance of institutional environment for regional development and spatial distribution of production factors widely discussed in the scientific literature is studied in the article in relation to the phenomenon of construction of “institutional harbors” in the Far East and their impact on the processes of foreign investment. It is established that in conditions of the modern Far East, the scale and location of foreign direct investment is invariant in relation to institutional modifications with maximum sensitivity to the possibilities of extracting natural resource rent.

Список литературы Foreign direct investment in the economy of the Russian Far East

- Shlyk N.L. Vneshneekonomicheskie svyazi na Dal'nem Vostoke . Moscow: Sov. Rossiya, 1989. 152 p.

- Minakir P.A. Ekonomika regionov. Dal'nii Vostok . Moscow: Ekonomika, 2006. 962 p.

- Minakir P.A. Pacific Russia: challenges and opportunities for economic cooperation with Northeast Asia. Prostranstvennaya ekonomka=Spatial economics, 2005, no. 4, pp. 5-20..

- Dement'ev N.P. Foreign direct investment: assessmen bvased on data from the Bank of Russia and Eurostat. Rossiiskii ekonomicheskii zhurnal=Russian journal of Economics, 2017, no. 2, pp. 56-69..

- Dement'ev N.P. Foreign direct investment in the Russian economy: moving in circles. Interekspo Geo-Sibir', 2017, no. 1, pp. 251-255..

- Fedorova E.A., Fedorov F.Yu., Nikolaev A.E. Which country's foreign direct investment is more beneficial for Russia? EKO=ECO, 2017, no. 7, pp. 112-123..

- Kuznetsova O.V. Accumulated foreign investment in Russian regions: territorial structure and the role of offshore capital. Problemnyi analiz i gosudarstvenno-upravlencheskoe proektirovanie=Problem analysis and state management design, 2015, issue 8, no. 6, pp. 47-62..

- Kuznetsova O.V. Formal and real role of Russian regions in attracting foreign investment (according to the Central Bank statistics). Sotsial'no-ekonomicheskaya geografiya: istoriya, teoriya, metody, praktika=Socio-economic geohraphy: history, theory, methods, practice, 2016, pp. 235-245..

- Kuznetsova O.V. Foreign direct investment in Russian regions amid sanctions. Mezhdunarodnye protsessy=International trends, 2016, vol. 14, no. 3, pp. 132-142..

- Kuznetsova O. Foreign direct investment in Russian regions: the 2000-s. Vestnik federal'nogo gosudarstvennogo uchrezhdeniya. Gosudarstvennaya registratsionnaya palata pri Ministerstve yustitsii RF=Bulletin of a federal state-financed institution State Registration Chamber with the Ministry of Justice of the Russian Federation, 2009, no. 1, pp. 32-39..

- Lizondo J.S. Foreign direct investment in International Monetary Fund, Determinants and systematic consequences of international capital flows. IMF occasional papers, no. 77, Washington DC, 1991. Pp. 68-82.

- Agarwal J.P. Determinants of foreign direct investment: A Survey. Weltwirtschaftliches archiv, 1980, vol. 116, pp. 739-773.

- Ohlin B., Hesselborn P.O., Wijkman P.M. (Eds.). The international allocation of economic activity. London: Mcmillan, 1977. 572 p.

- Weintraub R. Studio empirico sulle relazioni di lungo andare tra movimenti di capitali rendimenti differenziali. Rivista internazionale di scienze economiche e commercialle, 1967, vol. 14, pp. 401-405.

- Bandera V.N., White J.T. American direct investment and domestic markets in Europe. Economica internazionale, 1968, vol. 21, pp. 117-133.

- Yang Q. Repartition geographique de l'investment direct entranger en Chine: l'impact du capital humain. Revue d'economie du development, 1999, vol.3, pp. 35-59

- Ragazzi G. Theories of the determinates of foreign direct investment. IMF staff papers, 1973, vol. 20, p. 471-498.

- Balassa B. American direct investment in the common market. Banco Nazionale del Lavorno quaterly review, 1966. pp. 121-146.

- Jorgenson D.W. Capital theory and investment behavior. American economic review, 1963, vol. 53, pp. 247-259.

- Chenery H.B. Overcapacity and the acceleration principle. Econometrica, 1952, vol.20, pp. 1-28.

- Hymer S.H. The international operations of national firms: a study of direct foreign investment. Cambridge, Mass.: MIT Press, 1976. 253 p.

- Kindleberger C.P. American business abroad: six lectures on direct investment. New Haven, Conn.: Yale University Press, 1969. 225 p.

- Caves R.E. Multinational enterprise and economic analysis. Cambridge, University Press, 1982. 346 p.

- Buckley P.J., Casson M. The future of multinational enterprise. London: Mcmillan, 1976. 112 p.

- Rugman A.M. Internalization as a general theory of foreign direct investment: a re-appraisal of the literature. Weltwirtschaftliches Archiv, 1980, vol. 116, pp. 365-379.

- Buckley P.J. The Limits of explanation: testing the internalization theory of the multinational enterprises. Journal of International business studies, 1988, vol. 19, pp. 181-193.

- Casson M. Multinational corporations. Chaltenham: Edward Elgar, 1990. 478 p.

- Schneider F., Frey B.S. Economic and political determinants of foreign direct investment. World development, 1985, vol.13, pp. 161-175.

- Culem C.G. The locational determinants of direct investments among industrialized countries. European economic review, 1988, vol. 32, pp. 885-904.

- Nankani G.T. The intercountry distribution of foreign direct investment. New York: Garland. 1979. 368 p.

- Dunning J. The Determinants of international production. Oxford economic papers, 1973, vol. 25, pp. 289-336.

- Dunning J.H. Explaining changing patterns of international production: in defense of eclectic theory. Oxford bulletin of economics and statistics, 1979, vol. 41, pp. 269-295.

- Dunning J.H. The eclectic paradigm of international production: a restatement and some possible extension. Journal of international business studies, 1988, vol. 19, pp. 1-31.

- Dunning J. Multinational enterprises and the global economy. Reading, Addison-Wesley Publ. Co., 1993. 687 p.

- Vernon R. International investment and international trade in the product cycle. Quarterly journal of economics, 1966, vol.80, pp. 190-207.

- Knickerbocker F.T. Oligopolistic reaction and multinational enterprise. Boston, Mass.: Division of Research, Harvard University Graduate School of Business Administration, 1973. 236 p.

- Nesterova D.V., Mariev O.S. Factors of direct foreign investments involvement into Russian regions. Ekonomika regiona=Economy of region, 2005, no. 4, pp. 57-70..

- Polidi A.A., Sichkar S.V. The econometric estimation of the factors and dynamics of foreign direct investment in the region's economy. Ekonomika i predprinimatel'stvo=Journal of economy and entrepreneurship, 2013, no. 9, pp. 234-239.

- Investment climate in Russia 2012: poll among current and potential investors. Foreign Investment Advisory Committee. Moscow, 2012.

- Kuznetsov A.V. Internatsionalizatsiya rossiiskoi ekonomiki: Investitsionnyi aspect . Moscow: KomKniga, 2007.

- Kuznetsova O.V. Accumulated foreign investment in Russian regions: territorial structure and the role of offshore capital. Problemnyi analiz i gosudarstvenno-upravlencheskoe proektirovanie=Problem analysis and state management design, 2015, vol. 8, no. 6, pp. 47-62..

- Kuznetsova O. Foreign direct investment in Russian regions: the 2000-s. Vestnik federal'nogo gosudarstvennogo uchrezhdeniya. Gosudarstvennaya registratsionnaya palata pri Ministerstve yustitsii RF=Bulletin of a federal state-financed institution State Registration Chamber with the Ministry of Justice of the Russian Federation, 2009, no. 1, pp. 32-39..

- Valiullin Kh.Kh., Shakirova E.R. Foreign investment in regions of Russia and China. Problemy prognozirovaniya=Issue of forecasting, 2004, no. 5, pp. 101-115..

- Treshchevskii Yu.I., Kruglyakova V.M. Analyzing the performance of foreign investment in Russian regions. Terra Economicus, 2010, vol. 8, no. 1-2, pp. 151-159..

- Kuznetsova O.V., Kuznetsov A.V. Sistemnaya diagnostika ekonomiki regiona . Moscow: KomKniga, 2006.

- Matraeva L.V. Raspredelenie pryamykh inostrannykh investitsii v regiony Rossiiskoi Federatsii: problemy analiza i prichiny differentsiatsii . Moscow: Dashkov i K, 2013.

- Kuznetsov A.V., Kvashnin Yu.D. et al. Monitoring vzaimnykh investitsii v stranakh SNG 2015 . Report no. 32. Saint Petersburg: TsII EABR, 2015.

- Izotov D.A. The Far East: innovation in the public policy. EKO=ECO, 2017, no. 4, pp. 27-44..

- Minakir P.A. Expectation and realia of the "Turn to the East" policy. Ekonomika regiona=Economy of region, 2017, vol. 13, no. 4, pp. 1016-1029..