Impact of Economic Factors on Sustainability of the Fishing Industry of the Russian Arctic Zone

Автор: Vopilovskiy S.S.

Журнал: Arctic and North @arctic-and-north

Рубрика: Social and economic development

Статья в выпуске: 58, 2025 года.

Бесплатный доступ

The analysis of the influence of actual external and internal economic factors on the work of the fishing industry in general and in the Arctic zone in particular shows the stability and ability of the Russian fishery complex to fulfil the tasks of implementing the Food Security Doctrine of the Russian Federation and other strategic regulatory documents. Timely work of the state legislative bodies in decision-making at all levels of management in the current situation is noted. Key economic factors (export and import, supply and demand, shipbuilding and ship repair, logistics, etc.) that have direct and indirect impact after the introduction of sanctions are considered. The paper analyses the key performance indicators of the Russian fishery complex, provides an analytical review of the demand for fresh-frozen fish in the North-West region, the relationship between the population’s income and the consumption of fish and fish products in the country. The primary role of scientific support of the fishing industry in the successful realization of the general goals and achievement of the set tasks is emphasized. An assumption about opening of new logistic routes and expansion of geography of fish and fish products supplies to African and Latin American countries, countries of Asia-Pacific region is made on the basis of assessment of modern international relations. It is determined that the construction and repair of the fishing fleet in modern conditions is of concern to the state structures and fishing business community. The measures of state support of shipbuilding plants of the country are considered, the proposal on creation of ship repair cluster in the Arctic zone of the Russian Federation is substantiated.

Economy, fishing industry, food security, fishery science, fishing fleet, state support

Короткий адрес: https://sciup.org/148330872

IDR: 148330872 | УДК: [338.22:639.2](985)(045) | DOI: 10.37482/issn2221-2698.2025.58.5

Текст научной статьи Impact of Economic Factors on Sustainability of the Fishing Industry of the Russian Arctic Zone

DOI:

In the new economic conditions, the fishing industry has demonstrated the strength of its functioning and the ability to adapt to changes in the internal and especially external environment. The application of a situational approach in the management of the fisheries complex (FC) of the country made it possible to bring the industry functionality to an optimal state, to create conditions for the stable operation of fishing, processing and other segments of the industry. During the implementation of the Food Security Doctrine of the Russian Federation 1, the State Pro-

* © Vopilovskiy S.S., 2025

Zone. Arktika i Sever [Arctic and North], 2025, no. 58, pp. 5–22. DOI:

2698.20 25.58.5

This work is licensed under a CC BY-SA License gram “Development of the fisheries complex” 2, the Order of the Ministry of Health “On approval of recommendations for rational norms of consumption of food products meeting modern requirements of healthy nutrition” 3, No. 166-FZ “On fisheries and conservation of aquatic biological resources” 4, the investment quota program, the extraction and processing of catches in Russia is actively carried out, the level of self-sufficiency of the domestic fish products market has increased, conditions have been created for increasing the catch and economic efficiency of the fishery.

Under conditions of sanctions pressure, the fisheries complex (FC) of Russia was able to successfully compete and expand its presence in the world fish products market. The current foreign economic situation has made significant adjustments to the assessment of the impact on the industry of such economic factors as logistics, export, import, quotas, demand and price, shipbuilding, import substitution, science, government support and many others.

As a result of the sanctions changes, the fishing industry management made a number of amendments to the current legislation, and the business community demonstrated a timely transition to a model of more efficient use of aquatic biological resources (ABR). Nevertheless, the events of February 2022 entailed certain challenges: the technological component in equipping the fishing fleet, export orientation of fishing companies, ship repair, etc., became subject to sanctions. The consequences of the sanctions impact of unfriendly countries towards Russia lead to decisions on the transition to the model of change management in the extraction, processing and trade of ABR in the country and abroad.

Analysis of the FC functioning and food security: facts and factors

The strategic development of the country’s fisheries complex is carried out taking into account global political and economic trends, increasing geopolitical and sanctions pressure on the fishing industry and the entire Russian economy. The Food Security Doctrine of the Russian Federation is a normative act of strategic planning, in which the goals and objectives of the state socioeconomic policy are professionally developed, considering in-depth analysis of key indicators, directions and factors for ensuring the country’s food security are identified [1].

Food security of the Russian Federation (hereinafter referred to as food security) is a state of socio-economic development of the country, which ensures the food independence of the Russian Federation, guarantees physical and economic accessibility for every citizen of the country of food products that meet mandatory requirements, in quantities no less than rational norms of consumption of food products necessary for an active and healthy lifestyle 5.

The Ministry of Agriculture notes the balance of the fish products market: according to the results of 2022, the consumption of fish and fish products in the country amounted to 22.6 kg per person with the recommended consumption rate of fish products of 22 kg/year/person 6, developed to improve the health of children and adults. Provision of fish and fish products of domestic production in 2022 amounted to more than 153.3%, which is 1.8 times higher than the threshold value presented in the Doctrine: “maintaining the level of self-sufficiency in fish and fish products (in live weight — raw weight) of at least 85% per year”. Table 1 shows the dynamics of key performance indicators of the fishing industry.

Table 1

Key performance indicators of the fishing industry in 2018–2022.

|

Year |

Extraction (catch) of aquatic biological resources without withdrawal of commercial aquaculture, thous. tons |

Level of self-sufficiency in fish and fish products (live weight — raw weight), % |

Average consumption of fish and fish products in households per consumer, kg |

|

2018 |

5 054 |

159 |

21.7 |

|

2019 |

4 983 |

152.8 |

21.9 |

|

2020 |

4 975 |

160.7 |

22.2 |

|

2021 |

5 053 |

153.7 |

21.7 |

|

2022 |

4 920 |

153.3 |

22.6 |

In general, the fishing industry in 2022 demonstrated the ability to promptly adapt to changing political and economic conditions, establish sustainable production, sales and financial components. The turnover of specialized enterprises increased by 8% and reached 866 billion rubles, while the federal budget revenue amounted to about 62.7 billion rubles [2].

The total volume of ABR production in 2022 amounted to 4.92 million tons. The following were produced in Russian fishery basins: Far Eastern — 3.49 million tons; Northern — 527 thousand tons; Western — 82 thousand tons; Azov-Black Sea — 38 thousand tons; Volga-Caspian — 102 thousand tons; in exclusive economic zones of foreign states, convection areas and the open part of the World Ocean — 576 thousand tons [3].

The fishing industry occupies key positions in the structure of the agro-industrial complex (AIC) of Russia, and situational changes arising in the process of economic management make it necessary to analyze with special attention the emerging external economic factors influencing the economy of the industry [4, 5]. In general, the system functions in three directions: 1) biological — the volume of ABR caught; 2) economic — income and other financial indicators; 3) social — domestic consumption, jobs, etc. [6].

Demand and price . Steady and positive dynamics in fish production are maintained, despite the anti-Russian sanctions: in 2022, fishing companies caught 4.9 million tons, a slight decrease compared to the 2021 figure, for example, is due to such a factor as a poor salmon fishing season. Currently, industry science has taken a number of measures to organize the salmon fishing season for a more rational and efficient development of this volume of ABR, and comprehensive management measures have been carried out. The volume of ABR production has remained at the level of 5 million tons for the last few years, which allows Russia to be among the TOP-5 main fishing countries in the world 7, but in terms of consumption of fish products, our country is far from the world leaders. Price is a fundamental factor limiting the purchase of fish. More than 80% of the country’s population buys fish or fish products every month, and 30% of Russians refuse to buy it because of the high cost 8. Stable demand is noted for the following types of fish: mackerel — 33%, herring — 32%, pink salmon — 27%, trout — 25%, salmon — 21%, pollock — 20%.

The analytical review of the wholesale market for some popular types of fresh-frozen fish in the cities of Murmansk and St. Petersburg for January 2023 and February 2024 shows that: 1) prices of January 2023 and February 2024 have insignificant deviation, comparative price deviations towards “+” and “-” have insignificant limits, and the higher price of January 2022 for foreign currency types of fish — cod, herring, mackerel — is determined by the export component; 2) prices for the period January 2023 - February 2024 showed a slight increase, which is due to either active demand or limited volumes in the warehouse of this product, the exception was an increase in prices for halibut [7]. Tables 2 and 3 present an overview of wholesale prices for fresh-frozen fish in the cities of the Northwestern Federal District of Murmansk and St. Petersburg.

Table 2

Overview of wholesale prices for fresh-frozen fish in Murmansk

|

о |

ф .Cd ‘о Ф ею го ОС |

с ад о ъ с о о |

§ .£ ^ 2 ГО О- ° > |

§ .£ ^ 2 ГО О- ° > |

гм с ею О ~ 3 ш ° > |

о ГП о |

|||

|

from |

to |

from |

to |

from |

to |

||||

|

Cod, fresh-frozen gutted headless |

1000–2000 |

Russia |

295 |

315 |

265 |

275 |

280 |

300 |

+9 |

|

Haddock, gutted headless |

500–1000 |

Russia |

195 |

210 |

165 |

167 |

170 |

180 |

+8 |

|

Spotted wolffish, headless |

1000–3000 |

Russia |

235 |

255 |

210 |

220 |

290 |

298 |

+35 |

7 The world's leading fishing countries (Russia in the top 5). URL: (accessed 10 February 2024).

8 Analytical center NAFI. "Russians and fish: choice, purchase, consumption of fish, fish products and seafood". URL: (accessed 10 February 2024).

|

Atlantic wolffish |

1000–3000 |

Russia |

175 |

185 |

140 |

145 |

170 |

170 |

+25 |

|

Halibut |

1000–2000 |

Russia |

505 |

515 |

580 |

600 |

935 |

935 |

+56 |

|

Herring |

300+ |

Russia |

130 |

137 |

98 |

105 |

- |

||

|

Mackerel |

300+ |

Russia |

250 |

265 |

240 |

260 |

- |

Table 3

Overview of wholesale prices for fresh-frozen fish in St. Petersburg

|

"о |

ф Ъ ф ею го ОС |

с ад о ъ с о о |

N £ > ^ с ф ею 1го .У с |

ГП . 8 с 5 -§ с ф ад ^ го .У с |

^ .Е > -§ -Q Ф СЮ *- |

гп |

|||

|

from |

to |

from |

to |

from |

to |

||||

|

Salmon, fresh-frozen |

5000– 6000 |

Chile |

800 |

795 |

840 |

900 |

1150 |

1210 |

+34 |

|

Haddock, gutted, headless |

500–1000 |

Russia |

195 |

220 |

180 |

205 |

170 |

185 |

-10 |

|

Pollock, headless |

25+ |

FE |

117 |

125 |

105 |

110 |

122 |

130 |

+18 |

|

Cod, gutted, headless, Atlantic |

1000– 2000 |

Russia |

245 |

265 |

275 |

280 |

285 |

305 |

+9 |

|

Halibut |

1000– 2000 |

Russia |

535 |

555 |

550 |

580 |

825 |

930 |

+60 |

|

Herring, whole, Atlantic |

300+ |

Russia |

132 |

140 |

90 |

108 |

120 |

135 |

+25 |

|

Mackerel, headless, Atlantic |

300+ |

Russia |

282 |

295 |

228 |

275 |

320 |

375 |

+36 |

|

Spotted wolffish |

Russia |

240 |

255 |

245 |

265 |

303 |

315 |

+19 |

|

|

Sprat, fresh-frozen |

9–12 |

Baltic |

80 |

102 |

90 |

105 |

105 |

125 |

+19 |

Pricing for fish and fish products has a complex structure and depends, for example, on fishermen’s wages, household income, fish stocks, exports, development of fisheries science, vessel construction and many other costs.

In the Fishing and Fish Farming industry, fishermen’s wages increased by more than 20% in 2022. A significant increase in wages is one of the key factors that influenced the growth of industry costs and the decrease of financial indicators at the end of the year. Fishermen from Murmansk, Petropavlovsk-Kamchatskiy and Vladivostok are the leaders in terms of salaries 9. Nevertheless, the growth rate of income in the fishing industry reflects its stability, development opportunities, and attraction of young specialists.

According to experts, the increase in the cost of fish and fish products is associated with logistics and markups in retail chains and “brand” shops.

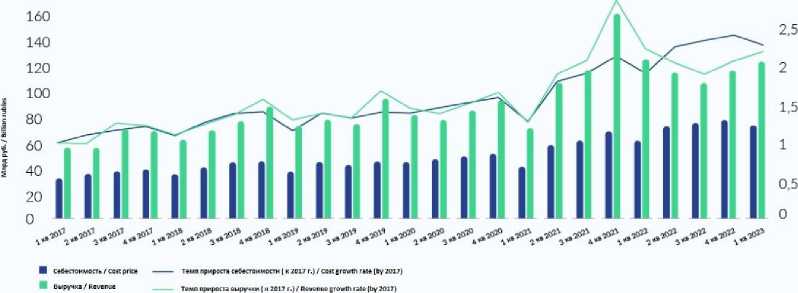

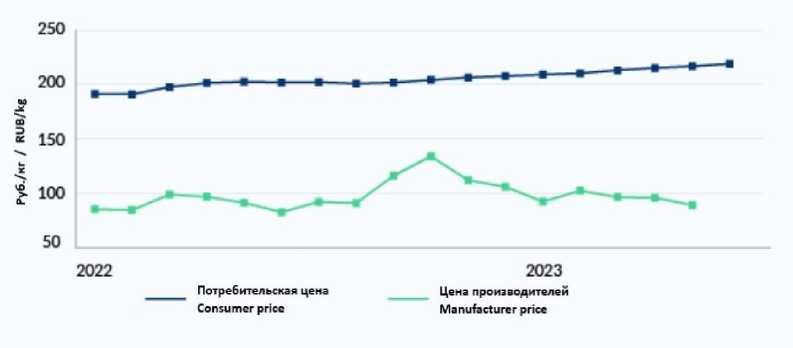

Analytical studies conducted by the Association of Fishing Fleet Owners show a significant increase in the cost of fish products in relation to the revenue of companies by an average of 27 percentage points (Fig. 1). With a cost increase of 19% in 2022–2023, an increase in producer prices was noted by only 4%, and the level of consumer prices for fish is twice as high as the prices of fishing companies 10 (Fig. 2).

The All-Russian Association of Fisheries Enterprises, Entrepreneurs and Exporters (VARPE), which accounts for more than 90% of the national catch of the aquatic biological resources, also notes a decrease in the level of industry profits — more than 30%, to 158 billion rubles, with stable catch volumes over the past few years at about 5 million tons.

Fig. 1. Indicators of foreign economic activity “Fishing and fish farming”. Cost price — revenue.

Fig. 2. Prices for frozen fish on the domestic market.

Analytical centers (AC) note the inequality of incomes of the Russian population. Analysis of the results of AC research shows that the largest number of consumers of fish and fish products are among the economically active population of the country, which has a high income level — 62%, less often fish products are purchased by Russians with a low income level — 22% [8].

Fisheries science . Fishing and fishing industry are processes aimed at achieving the key goals of the industry, and not only at satisfying consumer demand, this is a complex and laborintensive process associated with high risks and the qualifications of the fishing community [9]. The Russian Federal Research Institute of Fisheries and Oceanography (VNIRO) performs risk mitigation, rational use of ABR and many other aspects of scientific support, as well as the creation of conditions for effective management of the fisheries industry. Fisheries science is the main driver in the successful implementation of the main goals and objectives of the industry. In particular, the renewal of the research fleet alone will create a foundation for new resource research, increase the competitiveness of the domestic research fleet, and provide additional workload for Russian shipyards. The Russian Government plans to allocate 23 billion rubles for the renewal of research vessels by 2030 (for reference: in 2020, 28 billion rubles were allocated for the creation of 2 research vessels, and the keels of these vessels were laid in 2021). The construction of the fishing research fleet is being implemented within the framework of the Strategy for the Development of the fisheries complex of the Russian Federation 11.

The data obtained by scientists as a result of monitoring, assessing the state of populations, studying migration routes and analyzing other specific information make it possible to justify the quotas and fishing areas allocated for production, as well as to reduce the negative impact on the environment [10; 11; 12; 13]. The activities of research scientists result in a number of directions: economic — “cost optimization” is combined with “loss minimization”; ecological — environmental protection and the guarantee of food security of the country [14; 15].

Russian scientists closely cooperate with international scientific institutes. Thus, according to the Norwegian Institute of Marine Research, in the north-eastern part of the Arctic, it is recommended to reduce the quota for cod fishing in the Barents Sea for 2024, thereby reducing the total allowable catch (TAC) to 453,427 thousand tons (in 2023 — 573,784 thousand tons, in 2022 — 715,480 thousand tons). This issue is resolved by the Joint Russian-Norwegian Fisheries Commission (JRNFC), which, taking into account the recommendations of scientists, sets the TAC of aquatic biological resources in the Barents and Norwegian Seas, determines national catch quotas for Russia, Norway and third countries. Table 4 shows the JRNFC’s distribution of the national quota of Russia from 2018 to 2023 12.

Table 4

National catch quota of Russia according to the decision of the 47th–52nd sessions of the JRNC (t)

|

National quota of the Russian Federation |

||||||||

|

05 О у z * 00 Я ‘o ° sz ш о w JZ 4—> |

05 у ^ cn Я sz ш JZ |

05 у * о ‘о ° sz ш JZ ? |

05 у sz ^ JZ m |

05 у * CM Я О ° sz ш JZ 4—> LT) |

05 у * m Я sz ^ JZ Й |

О о о с го Q |

m Я о 4—> ‘о с го Q |

|

|

Cod |

331 159 |

309 697 |

315 277 |

378 635 |

302 605 |

241 782 |

+63 358 |

–136 853 |

|

Haddock |

86 230 |

72 080 |

92 159 |

100 348 |

75 130 |

71 177 |

+8 189 |

–29 171 |

|

Greenland halibut |

11 475 |

11 475 |

11 475 |

11 475 |

10 335 |

10 575 |

0 |

–900 |

|

Sebastes (S. mentella) |

7 878 |

11 676 |

12 055 |

13 908 |

14 098 |

14 020 |

+1 853 |

+112 |

Quotas . The trend towards a decrease in TAC and the agreed bilateral distribution of national quotas negatively affects the economic activity of fishing and fish processing companies in the Northern Basin, which is an external economic factor affecting the stable operation of the Russian FC [16]. Analysis of the data in Table 4 shows that the largest reduction in fish species was received by cod, which in turn is in the greatest demand among the population of the northern coastal regions of Russia, and is also one of the highest currency objects of aquatic bio-resources. According to forecasts, in 2024–2025, a 20% reduction in TAC in the Barents and Norwegian Seas is possible.

Export . Trade of fish, fish products, any type of goods or raw materials to other countries is especially important for the country’s economy. Table 5 presents data on fish, fish products and seafood export and its monetary value.

Table 5 Export of fish products, 2018–2022

|

Export |

Year |

||||

|

2018 |

2019 |

2020 |

2021 |

2022 |

|

|

Volume, thousand tons |

2 238 |

2 118 |

2 237 |

2 055 |

2 300 |

|

Monetary value, million $ |

5 117 |

5 381 |

5 287 |

6 630 |

6 100 |

The volume of Russian fish and seafood exports in 2022 increased compared to 2021 and amounted to 2.3 million tons, however, in monetary terms, exports decreased to 6.1 billion US dollars. The reason for the multidirectional dynamics is the decrease in prices for the main types of exported ABR due to high risks of sanctions for fish market participants. The main importers of Russian products remain the People’s Republic of China, the Republic of Korea, Japan, the Netherlands and Germany. Current relations with the European Union (EU) did not limit the supply of Russian fish and fish products to the EU market; in 2022, the volumes increased by 18.7% and amounted to 198.8 thousand tons. A significant share of exports was taken by Russian whitefish: cod — 57% by weight and 54.7% in value terms, and pollock products — 41% by weight and 32.3% in money terms. The Netherlands and Poland were the leaders in importing Russian cod, and Germany was the leader in importing pollock.

Analyzing the export deliveries of the Russian FC in the first quarter of 2023, we can note an increase in the export of fish products by 10% compared to 2022; in terms of value indicators, there is a decrease due to the fact that fish is traded at a noticeable discount. For example, about 274.5 thousand tons of Russian fish and fish products worth 676.7 million US dollars were delivered to the PRC, compared to the same period in 2022, the volume of imports increased by 32.9%, in value terms it grew by 28.4%. In general, experts predict positive dynamics in Russian exports of fish products, and modern technological equipment of ships and coastal processing plants contributes to the development of deep processing of fish, which is the driver of export growth.

International relations with Western countries are forcing Russian fish industry to open new logistics routes for the export of their products. Expanding the geography of fish product supplies is becoming a priority for export-oriented companies. According to the Federal State Information System (FSIS) “Argus” 13, Russian fish and fish products were supplied to 53 countries in 2022. The real trading partners are the United Arab Emirates, Saudi Arabia, Vietnam, Iran, Nigeria and others.

Fishing fleet: reality and challenges

The stability and sustainability of the industry is ensured by the fishing fleet — it is the guarantor of the economic and social development of all stakeholders. Currently, the domestic fishing fleet operates in normal mode in Russian waters and outside the economic zone of Russia. However, the state of the fishing fleet (wear and tear, aging) has been a matter of concern for fishermen, industrialists and managers for decades [17].

According to VARPE data, 744 vessels were built at foreign shipyards for the Russian fishing fleet (Russian shipyards have not built fishing and crab-fishing vessels for several decades), the age structure of fishing vessels built outside of Russia is in the range from 50 to 1 year, the average age is 31 years. Over the past 10 years, foreign shipyards built 32 vessels for the Russian fishing fleet.

The state program, developed in 2015 and aimed at modernizing the fishing fleet, developing fish processing plants and coastal infrastructure, provided fishermen with investment quotas in exchange for building vessels at Russian shipyards. This program was launched in 2017 — the first stage of investment quota allocation began — 20% of the total allowable catch was allocated under the obligation to build new fishing vessels at Russian shipyards and processing plants. The start of crab auctions in 2019 helped enterprises that received quotas for crab fishing: 50% of quotas were allocated for the construction of new crab fishing vessels.

The amendments introduced in No. 644-FZ “On amendments to the Federal Law ‘On fisheries and conservation of aquatic biological resources’” 14, signed by the President of the Russian Federation on December 29, 2022, opened the second stage of the investment quota reform. This stage is planned to attract private investments — 300 billion rubles, including 160 billion rubles from auctions for herring and pollock and 140 billion rubles — for crab. It is planned to build 12 fish processing plants, in addition to the 25 already built, plus the construction of 25-30 fishing vessels. The goal is the subsequent reconstruction of production capacities of the Russian fishing industry.

At the first stage of the “quota under keel” program, it was planned to build 105 high-tech vessels at domestic shipyards: 64 fish processing vessels and 41 crab fishing vessels. The laying down of the first hulls of the fishing fleet at domestic shipyards in 2018 revealed a number of difficulties that were resolved through the joint efforts of customers, shipbuilders and suppliers of ship equipment. As a result, 10 fishing and 4 crab fishing vessels out of 105 vessels were delivered to the customer in 2022, the total loss of domestic shipyards from the construction of 105 vessels amounted to approximately 42 billion rubles. There are many reasons for this: from lack of competences to tough sanctions and refusal of Western countries to work with Russia, all of which prevented shipyards from fully fulfilling their obligations to build a fishing fleet under commercial orders within the established time frame. The declared industry investments amount to about 300 billion rubles, the credit part of which is about 80%, therefore, fishing companies are under a great financial burden, as the deadlines for delivery of vessels are shifting to the right, prices are rising, and loans are still remaining. The delay from schedules is from six months to two years. The program of the first stage has been completed by 7%, and the forecast is not optimistic either: 25% of the planned vessels will be built by 2025.

State authorities, together with the shipbuilding business, find new priorities for the development of domestic shipbuilding in the new economic and geopolitical conditions. According to the Russian Maritime Register of Shipping (RS) and the Russian Classification Society (RCS) 15:

-

• in 2022, 367 vessels were under construction at Russian shipyards, 117 vessels were delivered to customers, including 35 offshore vessels (RS) and 82 floating objects (RCS);

-

• in 2021, 406 vessels were built, 89 vessels were delivered to customers: 50 for inland waterway navigation and 39 under the RS class;

-

• in 2020, customers received 116 vessels.

Assessing the activities of the United Shipbuilding Corporation (USC), it is necessary to recognize that the results of the shipbuilders’ work for 2022 seem stable. Domestic shipyards building fishing vessels perform a difficult task — construction of a complex type of fleet. One of the reasons is the desire of customers to provide their vessels with modern high-tech equipment. The

SOCIAL AND ECONOMIC DEVELOPMENT

Sergey S. Vopilovskiy. Impact of Economic Factors on Sustainability … process of improving the quality of vessels by adjusting various parts and mechanisms leads to changes in documentation, therefore, increases the working time. Nevertheless, shipbuilders build fishing vessels at domestic shipyards; the “quota under keel” program is implemented by 16 shipbuilding enterprises. For example, the Vyborg Shipyard delivered the vessels “Barents Sea” in 2020 and “Norwegian Sea” in 2021 of the KMT01 project to the Arkhangelsk Trawl Fleet (North-West Fishing Consortium). The high quality of construction was noted by the customer’s company and international representatives. The LFFT “Mekhanik Sizov”, built at Admiralty Shipyards for the Russian Fishery Company in August 2023, set course for the port of Vladivostok; the vessel departed to its home port along the Northern Sea Route. The start of the trawler’s fishing trials is scheduled for September. This is the third vessel of the ST-192 project (the technical design of the ST-192 was developed by the Marine Engineering Bureau - St. Petersburg Company). These are the largest and most technologically advanced Russian fishing vessels; the productivity of vessels of this project is 2.5 times higher than the productivity of vessels forming the basis of the fishing fleet in the Far East.

The conditions under which the orders were fulfilled remain very tense, primarily for the plant’s design departments and the procurement and supply departments of ship component equipment (SCE). During the previous ten years, the dependence of domestic shipbuilding and ship repair industry on foreign SCE was high.

Having the information on the issues of supplying shipbuilders with SCE, the federal center, together with business community, promptly implemented a system of subsidies to stimulate the activities of Russian industrial organizations to perform work on SCE development within the framework of the complex project implementation, taking into account the reconstruction of production and sale of the obtained products. The plans include reimbursing companies for 80% of their research and development (R&D) costs on SCE. The competition for subsidies is held by the Ministry of Industry and Trade of the Russian Federation, the volume of funding in 2022 amounted to 7 billion rubles, in 2023 — 14 billion rubles. According to updated data from the Ministry of Industry and Trade, in 2023–2024, subsidies of 15 billion rubles were provided for financial support for the costs of implementing comprehensive projects for the development, creation and implementation of SCE into serial production. Agreements on the provision of these subsidies in 2022 were concluded by 32 enterprises for 64 types of equipment, the total amount of financing was approximately 3.4 billion rubles. The implementation of complex projects in the domestic market will make it possible to produce new types of critical equipment starting from 2025. Therefore, there is an understanding of the necessity to actively involve supplies of SCE from friendly countries; at this stage, the share of the cost of foreign components in the cost structure of SCE for the civil fleet ranges from 40 to 85%.

For the same reasons, domestic ship repair industry requires a comprehensive solution to the issues of supplying SCE and spare parts, which can be realized with the development of shipbuilding and all related industries, as well as government support [18].

Effective operation of the fishing fleet in the Arctic Zone of the Russian Federation (AZRF) is associated with difficult climatic conditions, and the age of the fleet requires increased attention and maintenance [19]. According to the RS register book 16, 307 units of the sea fleet are registered to the port of Murmansk, and 186 units — to the port of Arkhangelsk. The average age of a vessel is 29 years. The modern ship repair capacities of the ports of Murmansk and Arkhangelsk, including the open ports of northern Norway, make it possible to service up to 80% of the fleet registered in Murmansk and Arkhangelsk. A 20% deficit in ship repair work affects the profitability of fishing and processing companies; vessels are sent for repairs to the ports of Kaliningrad and St. Petersburg, which increases the duration and cost of repair work and reduces the fishing time of the vessel. The volume of ship repair work with lifting into the dock is about 100 intermediate and 100 regular inspections per year.

The geopolitical situation in the region — possible closure of the northern ports of Båtsfjord, Tromsø, Kirkines by Norway (the rest were closed in 2022 by the Norwegian government) for entry of Russian-flagged vessels — will complicate the situation related to ship repair. Consequently, new opportunities and a stable market for future development in providing technological services to the needs of the fleet in AZRF are opening up for the ship repair industry. According to forecasts, in the period from 2023 to 2035, about 177 vessels of various classes will be commissioned for the port of Murmansk and 80 vessels — for the port of Arkhangelsk. The change in the number of fleet units will lead to an increase in the required dockings — up to 135 intermediate and 135 regular inspections annually. Large companies can create their own servicing bases for the fishing fleet, which can be an effective basis for optimal planning of vessels’ repairs based on the working schedule. According to experts, the cost of building a ship repair enterprise even with a partial repair cycle in the ports of Murmansk and Arkhangelsk may amount to 10-16 billion rubles. Related dredging work, acquisition of the necessary machinery equipment and many other things cause the necessity to attract investments into such projects and, possibly, investments from the state. It can be assumed that there is a timely need to build state ship repair clusters in the Arctic zone of the Russian Federation, taking into account the change in the direction of cargo flows and the increase in average operating distances on the lines of the Northern Sea Route (NSR).

State support . The state authorities have updated the plans for the next 5 years for the construction of the domestic civil fleet using the National Welfare Fund (NWF). The total investment volume is 231 billion rubles, with NWF funds amounting to 136 billion rubles. The State Transport Leasing Company (GTLK) acts as the customer for the construction of vessels. The vessels will be leased to companies for up to 25 years, the rate for fishing vessels will be 4.51% [20].

Currently, a draft law on tax incentives for ship repair is in the process of adoption — “zeroing” VAT rates for the provision of repair services for fishing vessels, sea vessels, inland waterway vessels, and mixed navigation vessels. Government authorities are making investments in the ship repair industry, including direct ones. For example, the Onega Shipbuilding and Ship Repair Plant will receive support from the Ministry of Industry and Trade of up to 2 billion rubles for the modernization of the slipway, construction and equipment of a new paint shop. This project of large-scale reconstruction of the Petrozavodsk shipyard started in 2022 and will create Russia’s first digital shipyard — a production system that integrates all processes into a single digital ecosystem [21; 22]. Completion of the reconstruction of the basic enterprise in Karelia for the production of ships up to 140 meters in size will increase the number of ships by 2.5 times — from 4 to 10 per year. The goal is to increase the competitiveness of domestic shipyards.

Conclusion

The fishing industry occupies an important place in the Russian agro-industrial complex and, despite its stability and rapid adaptation to the current operating conditions, is forced to increase additional volumes of production and processing of aquatic biological resources. Providing the country’s population with high-quality and healthy fish products is a necessary condition for the implementation of the Food Security Doctrine of the Russian Federation. Stability of the fishing industry, wage growth, new high-tech vessels and other socio-economic factors cause interest and desire of young specialists to work in the industry, increasing interest in maritime professions in educational organizations.

Modern conditions are changing the logistics of the industry. If in the last decades Russia exported fish products mainly to the EU, North America and Asia, today the markets of African and Latin American countries, as well as the Asia-Pacific countries are considered as alternatives. The change in logistics entails the need to build vessels for ocean fishing, which is a showcase of the Russian fishing industry. All changes will be evolutionary in nature, taking into account the interests of the Russian Federation and the readiness of potential markets to build economic partnerships.

The complication of the political situation in the Arctic zone leads to uncertainty about the future development of the Norwegian fishing business. There is a debate in Norway about the complete closure of Arctic ports to Russian vessels, but some political forces defend Russian-Norwegian cooperation in the fisheries sector, while Norwegian business opposes a complete ban on the use of its ports. Ignoring the geopolitical (population decline in the northern regions of Norway) and economic situation (multiple job losses over the next two to three years), the prudent Norwegian fishing community has emphasized collective responsibility to protect cod stocks in the Far North. Thus, by the decision of the Joint Russian-Norwegian Fisheries Commission (JRNFC), the quotas for cod fishing in the Barents Sea will be reduced since 2022 (Table 4), as a result, the TAC of aquatic biological resources in the Barents and Norwegian Seas will be reduced. This external economic factor of reducing quotas for aquatic biological resources in the northeastern Arctic is of significant importance for the participation of the Russian FC in the implementation of the Food Security Doctrine of the country.

The domestic fishing fleet serves as the vanguard of the country’s aquatic biological resources extraction, and the construction of the newest fleet is a large-scale task that is solved jointly by the state and private fishing companies. Consequently, food security is being strengthened, since each new domestic vessel is a significant contribution to the quality of nutrition and health of Russians. The sanctions restrictions have created a precedent for revising plans for the delivery of new fishing vessels at Russian shipyards, and the refusal to repair ships for Russian fishermen is undoubtedly one of the external economic factors.

At the current stage, specialists of enterprises and shipyards of the United Shipbuilding Corporation (USC) have noted significant progress in both the construction of the newest fishing fleet and the production of ship repair equipment. The solution to this large-scale task is being implemented in conjunction with the development of shipbuilding, all related industries and with government support. State support measures for the fishing industry include the following subsidies: to reimburse part of the costs of building fishing vessels; to reimburse part of the costs of building crab fishing vessels at shipyards in the Far Eastern Federal District (FEFD), various benefits, in particular, a benefit for payment of the fee for ABR use at a rate of 15% for city- and townforming fishing enterprises, and others. An important measure of state support is, of course, the investment of the National Welfare Fund for the construction of fishing vessels by the State Transport Leasing Company and their leasing to fishing enterprises. Moreover, this step allows us to make a preliminary conclusion about the first groundwork in the construction of the state fishing fleet.