Impact of Fisheries Exports on the Participation of Fisheries in Ensuring Food Security of the Country and the Arctic Region

Автор: Vasilyev A.M.

Журнал: Arctic and North @arctic-and-north

Рубрика: Social and economic development

Статья в выпуске: 57, 2024 года.

Бесплатный доступ

The article examines the impact of fish products export by fishermen of the Murmansk Oblast on the realization of two main indicators prescribed in the Food Security Doctrine: the volume of products supplied to the domestic market and their economic accessibility to the population. As a result of the study, it was found that the main indicator of the Doctrine implementation — the threshold value of fish products supply to the domestic market — is not met due to its excessive export. The level of under-supply, compared to the recommendations of the Doctrine, amounted to 53.4% in 2021. Fish is supplied to the Murmansk Oblast and other regions in volumes that ensure its sale at high wholesale prices set by fishermen and with little competition. The bulk of the Arctic fish catch — up to 75%, and over 90% of cod and haddock — is exported, which is facilitated by high world prices and the low rate of the Russian ruble. Even when Russian fish is sold abroad at a discount, fish producers prefer to export it. In the absence of incentives for the supply of fishery products to the domestic market, it is advisable to increase the legal status of the Doctrine and make the implementation of its recommendations mandatory, or change the rules for allocating fishing resources to economic entities. The economic availability of cut fish for the population of the producing region — the Murmansk Oblast — is lower than the Russian average. There is a declining level of consumption. This is a consequence of the use of high prices set in the domestic market in a non-market way. There is a need to establish prices for fish products on the domestic market using auctions or exchange trading.

Export, Food Security Doctrine, threshold values, implementation, food, availability, auctions, exchange trading

Короткий адрес: https://sciup.org/148330016

IDR: 148330016 | УДК: [339.564:639](470.2)(045) | DOI: 10.37482/issn2221-2698.2024.57.34

Текст научной статьи Impact of Fisheries Exports on the Participation of Fisheries in Ensuring Food Security of the Country and the Arctic Region

DOI:

Food security is an integral part of national security and is closely interrelated to other types of security and its aspects. The industries that ensure it are agriculture and fisheries.

The Russian fishery, along with agriculture, is a supplier of animal proteins and essential amino acids for the population’s nutrition. In the total balance of animal protein consumption, the share of fish proteins currently amounts to about 10%, in meat and fish — ~25% 1.

In terms of energy value, 1.5 kg of fresh fish is equivalent to 1.0 kg of meat. Fish is a unique natural product in terms of the macro- and microelements content. In countries with a developed

-

∗ © Vasilyev A.M., 2024

This work is licensed under a CC BY-SA License fishing industry, fish products satisfy the population’s needs for iron by 25%, phosphorus — 60-70%, magnesium — 20%, iodine — 90% 2.

According to our calculations, based on the data from the above source, the volume of fish and seafood catch in Russia in 2022 corresponded to ~12 million heads of cattle in terms of protein content. At the same time, the number of cattle raised for meat in Russia in 2022 was 10.1 million heads.

Fish processing waste is used to produce fodder meal, which is used in livestock farming and is the main component of feed for salmon and trout farming in aquaculture. It contains 50-67% protein, which is digested by animals and poultry by 85-90%. For comparison, plant feed has a protein content of 10-12% and is digested by 30–40% 3.

The main document, the implementation of which is designed to ensure the country’s food security, is the Food Security Doctrine (FSD) for 2020-2029, approved by the Decree of the President of the Russian Federation dated January 20, 2020. It was developed in accordance with the “Rome Declaration on World Food Security” 4.

The FSD uses the achievement of threshold values of domestic product supplies to the domestic market as the main indicators for ensuring the country’s independence and assessing food security. For fish products, until 2020, it amounted to 80% of the medical norm of its consumption, equal to 22 kg per person per year in whole form, from 2020 — 85%, that is, 18.7 kg per person per year. The volume of products prescribed by the document should be physically and economically available on the market for the population 5.

With the current population of Russia at 146.2 million people (152.0 million people, taking into account new territories), the Russian fisheries sector should supply at least 2733.9–2842.4 thousand tons (54.7%–56.8%) of the catch to the Russian coast to ensure the threshold level of fish consumption. Fulfilment of these indicators under rational management is guaranteed by selfsufficiency, which is about 190% due to catches of 5.0 million tons and aquaculture products of 350–400 thousand tons.

The presented data indicate the importance and great potential of the fisheries industry in solving problems related to ensuring food security in Russia. Despite this, the supply of fish prod- ucts to the Russian domestic market for the purpose of fulfilling the FSD in 2010–2019 was fulfilled on average by 76.8%, over two years of the new Doctrine — by 61.2% 6.

Level of fulfilment and measures to ensure threshold values of the Doctrine of Food Security for the supply of fish products to the domestic market by fishermen of the Northern Basin

The main commercial and production unit of the country’s fisheries is the Far Eastern fishery basin, which produces from 70 to 73% of the total volume of fish and seafood. Consequently, the solution of the problem of supplying fish products to the domestic market of Russia largely depends on the use of Far Eastern fish resources. However, there is an opinion that it is more profitable to sell fish caught in the Pacific Ocean to neighboring countries, and to buy the necessary amount of fish products for the European regions of Russia in Norway and other nearby countries. However, the events of recent years have shown the riskiness and unreliability of this option.

The Northern Basin, which includes the Murmansk and Arkhangelsk oblasts and the Republic of Karelia, exploits fishing stocks in the Western Arctic (about 95% of the total catch) and produces insignificant volumes of hydrobionts in the North-West and Central Atlantic. The share of the Northern Basin in Russia’s total catch is 12–15%. The main fishing region of the Northern Basin is the Murmansk Oblast, which accounts for about 72% of the total catch.

Based on the consolidated responsibility for the implementation of the Food Security Doctrine, the fishing enterprises of the Northern Basin, at the current level of catches, should deliver 475.0–493.0 thousand tons of fish to the Russian shore (868.7 thousand tons * 54.7%; 56.8%), including enterprises of the Murmansk Oblast — 340.3–353.4 thousand tons (622.2 thousand tons * 54.7%; 56.8%). The Doctrine does not define the species composition and assortment of products supplied. As a result, the domestic market is provided by fishermen mainly with fish that have low prices on the external market, insignificant demand among the population, as well as fish caught in insignificant volumes as by-catch: blue whiting, capelin, herring, wolffish, flounder, ruff, smallsized cod, haddock and perch. At the same time, fish products of Murmansk enterprises are annually supplied to 57–70 regions of the Russian Federation 7. The noted volumes of fish products supplies to the domestic coast, necessary to fulfil the obligations prescribed by the Doctrine, were observed by the fishermen of the Murmansk Oblast until 2013. The reason for the growth of fish exports by 10% in 2013 and the failure to meet the threshold values of the Doctrine was the increase in the catch quota for the main export hydrobiote — cod — by 28.9% compared to 2012 and the desire to improve the financial results of fishing activities 8. The stimulating factors for a further increase in the volume of Arctic fish exports abroad were the growth of export prices for cod by 81.3% in 2014 and by another 40.0% in 2015; for haddock — by 89.0% in 2014 [1, Vasiliev A.M., p. 28], as well as the change in the exchange rate of the ruble to the US dollar from 31.85 to 38.47 rubles in 2014 and to 61.0 rubles in 2015. In the subsequent period, export prices for fish also had an upward trend, which stimulated its export, and the recommendations of the Doctrine did not serve as a restraining factor. In the last year of the analyzed period — in 2021 — export prices for cod were 4.1 times higher than the 2013 level, for haddock — 2.7 times.

In addition, the growth of exports was also facilitated by the instruction of the Ministry of Agriculture’s instruction for Rosrybolovstvo (Federal Agency for Fisheries) to increase revenue from fish exports from $5.1 billion in 2018 to $8.0 billion by 2024, allegedly following from the Decree of the President of the Russian Federation No. 204 of May 7, 2018 “On the national goals and objectives of the strategic development of the Russian Federation”. In accordance with this Decree, the agro-industrial complex was instructed to increase export revenues from $24 billion to $45 billion per year. The Ministry of Agriculture, in turn, assigned part of the task to Rosry-bolovstvo, instructing it to increase export revenues from $4.1 billion in 2017 to $8.0 billion in 2024. This instruction was another factor stimulating export growth, despite the need to fulfil the FSD. Rosrybolovstvo, according to its management, intended to address the issue of increasing export revenues by increasing the production of deep-processed products. Speaking at the round table “Export of fish products: from the depths of the sea to the depth of processing” in 2018, the head of the Rosrybolovstvo Ilya Shestakov said: “We have to increase it (export — author) almost twofold. The task is quite serious and ambitious, we realize that we will not be able to increase the volume of production in such quantities. It is necessary to look for other sources, other resources to increase the value of exports. Therefore, the main task is to increase the cost per ton of exported products” 9. From the methodological point of view, this is a correct statement of the question. it should be taken into account that during “deep” processing, the consumption of raw fish (catch) increases significantly, and compensation for losses in product weight by increasing its cost depends on market conditions for different types of fish and does not always occur to a sufficient extent. As a result, the cost of processing the same volume of fish may not increase.

Our calculations show that for the main export fish of the Arctic seas — cod and haddock — the cost benefit of filleting depends on market conditions, and it is not always possible to obtain it. Thus, fillet production reduces the weight of the product by half compared to gutted headless fish. In addition, it is known that importers, including those in Europe and in the Asia-Pacific markets, prefer to buy less processed fish. In the EEC countries, a duty of more than 7% is set on cod fillets. There are also problems with fillet sales in the Asia-Pacific countries 10.

URL:

As a result of this and high wages in the Norwegian fishery, the production of cod fillets on fishing vessels is considered unprofitable and is allowed only if a license is obtained 11.

In Russia, the composition of items and the cost of fillet production differ from those in Norway. Its production is stimulated by economic measures by the state. Despite this, fillet production in the first 9 months of 2023, compared to 2022, decreased by 17% due to reduced demand in domestic and foreign markets 12.

As a result of the above factors, the value of fishery exports is increasing due to rising prices for Arctic fish and seafood, as well as increased catches sent abroad. The share of Murmansk Oblast fishermen’s catches exported increased from 47.1% in 2010 to 74.5% 13 (Table 1).

The article “Relationship between the Russian fishing fleet and domestic ports as the core for performing its state mission” shows that excessive export of fish products has become the main factor restraining their supply to the domestic market since 2013. In the previous period, 2009–2012, exports averaged 48.5% of production volume, which ensured the entry of fish into the domestic market in volumes roughly corresponding to the Doctrine recommendations [2, Vasiliev A.M., p. 3].

Table 1

Level of fulfilment of the recommendations of the Food Security Doctrine by the fishery of the Murmansk Oblast, export value 14

|

Indicators |

2017 |

2018 |

2019 |

2020 |

2021 |

|

Catch, thousand tons |

698.1 |

663.4 |

665.8 |

574.2 |

622.1 |

|

Production of fish products, thousand tons |

579.7 |

563.4 |

576.1 |

490.3 |

549.2 |

|

Volume of exported fish products, thousand tons |

337.4 |

335.8 |

297.3 |

272.6 |

319.1 |

|

Volume of products supplied to the domestic market, thousand tons |

242.3 |

227.6 |

278.8 |

217.7 |

230.1 |

|

Volume of exported fish in terms of unprocessed fish, thousand tons |

513.8 |

469.0 |

473.0 |

410.0 |

463.5 |

|

Share of catch supplied for export, % |

73. 6 |

70. 7 |

71.5 |

69.5 |

74.5 |

|

Required volume of supplies to the domestic market in accordance with the recommendations of the Doctrine, thousand tons |

З81.9 |

362.8 |

364.2 |

314.1 |

340.3 |

|

Actual volume of supplies to the domestic market in round form, thousand tons |

184.3 |

194.4 |

192.9 |

164.2 |

158.6 |

|

Volume of undersupply to the domestic market in unprocessed form, thousand tons |

197.6 |

168.4 |

171.3 |

149.9 |

181.7 |

|

Level of undersupply to the domestic market, % |

51.7 |

46.4 |

47.0 |

47.7 |

53.4 |

|

Value of exports, million dollars |

1010.3 |

1137.8 |

1182.5 |

1098.5 |

1697.9 |

|

Value of exports, billion rubles |

61.60 |

71.60 |

76.39 |

79.44 |

125.10 |

|

Value of 1 ton of exports, dollars |

3142.6 |

3383.6 |

3977.5 |

4029.7 |

5320.9 |

|

Value of 1 ton of exports, rubles |

182573.2 |

213156.3 |

257026.0 |

291427.9 |

392021.8 |

|

Economic turnover in fisheries, billion rubles |

73.6 |

83.7 |

100.5 |

91.7 |

127.6 |

Chain stores in Murmansk have not been selling fish products for several years. There are small counters for frozen fish, but it is not bought. The reason for this is uncompetitive prices. In addition, haddock is usually not available for sale, cod is available, but small in size, and some other types of fish are also unavailable. Fish is packed in non-standard volumes of different weights.

In our opinion, the main indicator characterizing the impact of fishery exports on the participation of the Arctic region’s fisheries in ensuring food security for the country is the undersupply of fish products to the domestic market. On average, for 2017–2021, it is 173.8 thousand tons (49.2% of the total volume of required supplies).

It should be noted that the need to supply fish products to the domestic market within the threshold values prescribed in the Doctrine is designed to restrain exports. Therefore, since 2020, in the new version of the Doctrine, the Government of the Russian Federation has decided to consider the level of self-sufficiency in products, that is, the availability of resources in comparison with needs, as the main indicator of its implementation. The threshold values for the supply of fish products to the domestic market are still indicated in the Doctrine, but they are not reported. Besides, there are no scientific publications on this topic.

This procedure allows not showing the actual level of the country’s provision with fish. An example can be given: in 2022, in the materials prepared “for the government hour” of the 530th meeting of the Federation Council, with significant undersupply of fish to the domestic market, the fulfilment of the Food Security Doctrine was stated on the basis of a high level of selfsufficiency [3, p. 53].

Fishermen of the Northern Basin, as well as in the whole Russia, work in contradictory legal conditions. On the one hand, it is necessary to fulfil the Doctrine and supply most of the catches to the domestic market, on the other hand — to fulfil the order of the Ministry of Agriculture to increase foreign exchange earnings and sell more products for export. Taking into account their own economic interests, they prefer to export most of the catches abroad to the detriment of fulfilment of the Doctrine. Since the task of the President of the Russian Federation to increase export income was addressed to the Ministry of Agriculture, and Rosrybolovstvo was not mentioned in it, we believe that fishermen should fulfil the Food Security Doctrine first of all.

The head of Rosrybolovstvo I. Shestakov spoke in favor of the priority implementation of the Doctrine in the media. This decision is also correct from the perspective that the participation of fisheries in the implementation of the food program, as shown in the introduction to the article, is much more important than foreign currency revenues.

Currently, the Government of the Russian Federation economically stimulates the export of certain types of deep-processed fish products by allowing deductions from the fee for the provision of fishing resources. Since export sales in the context of a weak ruble are already profitable for fishermen, then, on the contrary, it is advisable to exempt bioresources, the products of which are supplied to the domestic market, from fees in order to stimulate the implementation of the Doctrine.

“State participation in resolving this issue can also be realized by establishing tariff quotas for export of fish products and changing the mechanism of distribution of quotas for the extraction of aquatic biological resources” [4, Kolonchin K.V., p. 30].

As noted in the article above, fishermen of the Western Arctic region fulfill the requirements of the Doctrine for the supply of fish to the domestic market mainly due to the so-called “social fish”. In particular, the article by Karlina E.P. and Arslanova E.R. “Place and role of fishery complex in food security system of Russia” is devoted to solving the issues of expanding the range and improving the quality of the balance of fish supplied to the domestic market [5].

In the current conditions, in order to comply with the standards of the Doctrine, it is necessary either to change its legal status or to take measures to change the procedure for allocating commercial bioresources.

Issues of economic accessibility of fish products and proposals for their solution

The second most important indicator that characterizes the participation of the fishing industry of the Arctic region in ensuring food security of the Russian Federation and which is dependent on exports is the economic availability of fish products. On the one hand, it is determined by self-sufficiency, catch and supply of fish to the domestic market, and on the other hand — by the purchasing power of the population.

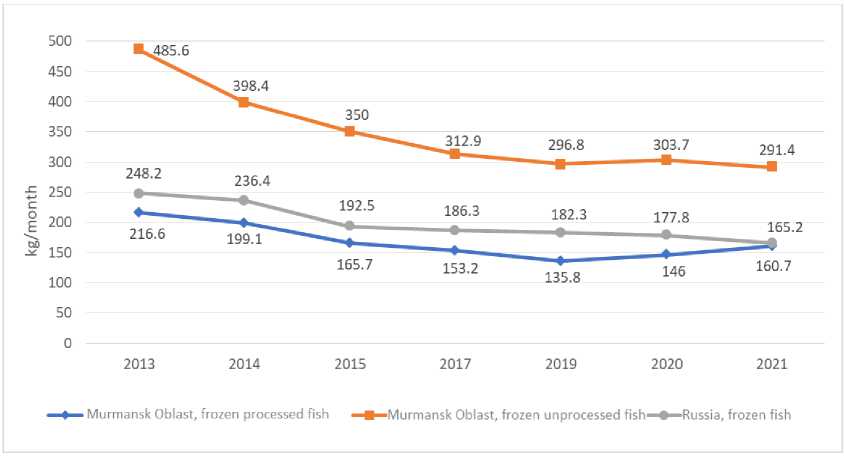

Russian fish producers (owners of fishing enterprises), despite market factors influencing the prices of goods — high self-sufficiency in fish in Russia as a whole and the Arctic regions in particular, and Russia’s GDP, approximately 2 times smaller in terms of purchasing power parity compared to the main countries importing Russian fish (the USA, the main EEC countries) 15 — determine wholesale prices for fish products on the domestic market, focusing on the level of export prices. As a result of the increase in export prices in 2014 for the main foreign exchange-intensive species of Arctic fisheries — cod and haddock — and their use as wholesale prices on the domestic market, there was a decrease in the purchasing power of the population of the Murmansk Oblast by 18.0%, compared to 2013, and by another 16.7% for frozen processed fish and by 12.1% for frozen unprocessed fish in 2015, despite an increase in household income by 5.9% and 8.8%, respectively (Table 2, Fig. 1).

The data presented in Table 2 and Fig. 1 show that the purchasing power of the population of the Murmansk Oblast in 2014–2015, calculated for the purchase of frozen processed fish, decreased by 25.8%, and unprocessed fish — by 40.0%. At the same time, fish prices increased by 2.6–2.8 times with income growth of only 1.6 times. In Russia as a whole, there are data on the purchasing power of the population only for frozen fish without assortment division. They correspond approximately to the average value of the data for the Murmansk Oblast.

At the beginning of the stage of fish price increase — in 2014–2015 — the Government of the Russian Federation could not allow a one-time large increase in fish prices, since fish industry companies had no reason to sell fish products on the domestic market at international prices. In accordance with the “Law of One Price... identical goods sold in different places must be sold at the same price when prices are expressed in the same currency” 16.

Table 2

Purchasing power of average per capita money income of the Murmansk Oblast population 17

|

Indicators / years |

2013 |

2014 |

2015 |

2017 |

2019 |

2020 |

2021 |

Ratio of 2021 to 2013, % |

|

Average per capita income of the MO population, thousand rubles |

31.9 |

33.8 |

36.7 |

39.3 |

44.3 |

46.6 |

51.2 |

160.5 |

|

Average consumer prices for fish, rubles/kg processed (except for salmon and fillets) |

147.3 |

169.7 |

221.7 |

256.3 |

325.9 |

319.5 |

318.3 |

2.6 times |

|

unprocessed |

65.7 |

84.8 |

105.0 |

125.5 |

149.1 |

153.5 |

175.6 |

2.8 times |

|

Purchasing power of the MO population, kg/month frozen processed fish frozen unprocessed fish |

216.6 485.6 |

199.1 398.4 |

165.7 350.0 |

153.2 312.9 |

135.8 296.8 |

146.0 303.7 |

160.7 291.4 |

74.2 60 |

|

Basic indices, processed fish |

100.0 |

82.0 |

76.5 |

70.7 |

62.7 |

67.4 |

74.2 |

74.2 |

|

Basic indices, unprocessed fish |

100.0 |

82.0 |

72.1 |

64.4 |

61.1 |

62.5 |

60.0 |

60.0 |

|

Purchasing power of the Russian population, kg/month frozen fish |

248.2 |

236.4 |

192.5 |

186.3 |

182.3 |

177.8 |

165.2 |

66.5 |

Fig. 1. Purchasing power of the population of the Murmansk Oblast and Russia

In this case, the currencies of the importing countries and Russia had different values, and domestic prices for fish in Russia should be determined taking into account other factors.

The theory of changes in domestic prices taking into account exchange rates is considered in the article by Prokopyev M.G. “Transfer effect of import and export prices changes into the prices of home market: methodical aspects”. It notes that the effect of transferring export prices to domestic prices is insignificant if the share of imports in the aggregate demand is relatively small [6, Prokopyev M.G., p. 113]. Consequently, for the fishing industry, which is an export-oriented sector of the economy, the effect of transferring changes in export prices to domestic prices is insignificant.

In the article by Korneychenko E.N. and co-authors “Consumer prices in Russia: effects of the exchange rate shocks” an attempt is made to determine the impact of exchange rate changes on domestic consumer prices of various goods in Russia, including fish products. It is shown that in the period 1997–2008, the impact of changes in the ruble exchange rate on the price of frozen processed fish was 29.8% after 12 months from the event, 40.8% — after 24 months, on the price of frozen unprocessed fish — 49.8% and 70.6%, respectively. Estimates for the periods 2008–2014 and 2014–2018 are significantly lower [7, Korneychenko E.N. et al., p. 11].

Since demand for imported products is usually taken into account to a greater extent than for exports, and prices for imported fish products are usually significantly higher than Russian ones, it can be argued that the increase in prices was mainly influenced by imports.

According to the theory, differences in setting the levels and dynamics of world and domestic prices for exported and imported goods based on exchange rates result from the gap between the official exchange rate of the currency in which they are expressed and the real exchange rate. If the market exchange rate of a currency moves over a long period of time in accordance with the real one, calculated on the basis of purchasing power parity, then the price dynamics will be reflected quite objectively and reliably 19.

In this case, it is known that the real exchange rate of the ruble to the US dollar at purchasing power parity in Russia is underestimated by about 2 times 20. As a result, domestic national prices for fish products should be lower than external ones and should be determined taking into account the costs and purchasing power of the population. The instrument for setting prices on the domestic market is exchange trading. The current wholesale prices published in the Weekly Bulletin of International Fishing Business cannot be called market prices, as they are set by fish industry companies.

After a large one-time increase in fish prices in 2014–2015, the Government of the Russian Federation and legislative bodies developed some measures to reduce fish prices, mainly related to the organization of exchange trading and limiting trade margins, but they have not yet been put into practice. The Izvestia newspaper has published a report that in 2024, exchange trades in fish will be held on the St. Petersburg International Mercantile Exchange (SPIMEX), which, according to the authorities, “will reduce the cost of products and increase competition in the market”. It is also reported that the Ministry of Finance has drafted a law allowing such trading 21.

Exchange trading should reduce administrative regulation of the market, take into account supply and demand, and reduce prices, which imply an increase in fish consumption by the population. Fish trading on the exchange will allow retailers to purchase it directly without intermediary markups and make prices more transparent.

At the same time, the Izvestia newspaper’s report contains information that “the exchange has organized fish product trades several times in recent years, but it has not been possible to launch them on a large scale, since many market participants are reluctant to do this and do not want additional pricing transparency”. The official reason for the fishermen’s refusal to trade on the exchange is the statement that fish products are not exchange goods. This is despite the fact that fish exchanges and auctions operate successfully in many countries, including the main importers of Russian fish — South Korea and Norway [8, p. 4]. In this regard, the authorities may need to stimulate the process of attracting fishermen to sell products on the exchange.

Regional authorities are mainly responsible for practical solution of the issues of high prices for fish products and increasing their availability. However, their rights in these matters are limited. For example, in the Murmansk Oblast, there is a governor’s program “Our Fish” for selling cod and haddock with the consent of suppliers at reduced prices on weekends. The sales volume is about 400 tons per year, which corresponds to about 2 kg of fish per year per citizen. In Sakhalin, the “Regional product ‘Affordable Fish’” is being implemented to ensure greater availability of fish to the population. “Despite the fact that the production of processed fish products in the region is increasing, consumption of these products by the population tends to decrease due to the outpacing growth of prices compared to incomes” [9, Pitilyak D.A., p. 103].

Similar projects, according to our data, exist in all coastal regions, but they solve local problems. In general, fish prices in Russia continue to rise, while the purchasing power of the population is declining. According to Rosstat, fish consumption in 2022 decreased by another 10% — to 19.2 kg per person per year. Apparently, given the current situation, in August 2023, Russian President V.V. Putin, at a meeting with members of the Government, once again set the task of developing a set of measures to stimulate domestic consumption of fish products 22.

Analysis of proposals for the formation of a “road map” to increase fish consumption by the population, published in the latest issues of the Rybny Kurier Profi collections and in other publications, indicates the lack of new effective proposals. Thus, the head of Rosrybolovstvo I. Shestakov gave a large interview on this topic to Rossiyskaya Gazeta newspaper, in which he calls the main economic and organizational tools for increasing the availability of fish to the population: compliance with existing standards for transportation, storage, display of products, reduction of trade markups, branding, marketing activities, popularization of fish, state and municipal orders for the supply of fish products. At the same time, he admitted that supplies are limited by the high cost of domestic fish, which confirms the need to reduce wholesale prices. I. Shestakov also recognized the appropriateness of introducing state subsidies for products, “which should make products more accessible to the population, including pensioners and low-income families” 23.

The head of Rosrybolovstvo listed measures to increase the availability of fish products for the population, which are not the function of the Ministry of Fisheries and should be carried out by other participants in the process of selling fish products. The President of the Russian Federation drew attention to this shortcoming at the meeting of the State Council of the Russian Federation on October 15, 2015, as a result of which one of the Instructions was issued as a proposal “on the formation of a unified system of management and coordination of the activities of state bodies and organizations, including those involved in the extraction (catch) of aquatic biological resources, production, storage, transportation and sale of fish products”. It can be concluded from the interview that the order of the President of the Russian Federation has not been fully fulfilled, although it states that Rosrybolovstvo “takes action in its area of responsibility and initiates work in related areas”.

Similar additions to the functions of Rosrybolovstvo, in order to fulfil the main trends of fisheries development, determined by the state, including the Food Security Doctrine, are proposed by Kolonchin K.V. and co-authors [10, Kolonchin K.V. et al., p. 8].

Much attention is paid to foreign trade in fish products in the country. Along with the Law “On the fundamentals of state regulation of foreign trade activity” No. 164 and other documents regulating it; there is an authoritative All-Russian Association of Fisheries Enterprises, Entrepreneurs and Exporters. At the same time, the coordination of activities of the most important fish markets of the country is not given an appropriate attention. In this regard, we would like to note that in Norway, which has extensive experience in organizing the activities of the fishing industry, one of the functions of the semi-governmental body, the Export Council, is “implementing the marketing of fish products at the national and international levels”.

Conclusion

Provision of the population with fish products can be considered as complying with the Food Security Doctrine, if fish supplies are carried out in volumes not less than those specified in this document. The study of fish product sales indicates a systematically low level of its supplies to the domestic market. The fulfillment of the above indicator in 2021 was 46.6%. The insignificant availability of products on the market and weak competition do not contribute to reducing prices and increasing the purchasing power of the population, although the high level of profitability of sales of Arctic fisheries makes this possible. In the context of a low ruble exchange rate, fish sales abroad are preferable.

The systematic failure to fulfil the quantitative indicator for assessing the degree of food security — 85% of fish product supplies to the domestic market — indicates the need to increase the legal status of the Doctrine or change the rules for the allocation of commercial bioresources.

The second important factor for organizing the sale of fish products at market prices is the use of exchange or auction trading. This problem has long been discussed in Russia at the initiative of the Federal Antimonopoly Service (FAS). There are both supporters and opponents of the development of exchange trade in fish. Surprisingly, the idea is not particularly favored by the Fish Union, whose members — fish processing enterprises of Murmansk city and the Oblast — are experiencing a shortage of fish raw materials due to its excessive export and are purchasing raw materials at high prices 24, 25.

The study of foreign experience shows that the auction form of trading used in Norway and South Korea is more suitable for Russia. In our opinion, this form of trade is less expensive and takes into account the interests of buyers to a greater extent.

In accordance with the instructions of the Head of State dated August 16, 2023, the Government of the Russian Federation should develop a “road map” by February 1 to increase domestic consumption of fish products by 2030. It is necessary to establish annual target indicators for its implementation and provide for measures to increase the availability of fish products to the population.

Analysis of proposals for the formation of a “road map”, published in available documents and scientific sources, indicates a lack of effective proposals. Leaders of various ranks and deputies of the Federal Assembly repeat proposals that have been used for many years, but have not produced results.

Список литературы Impact of Fisheries Exports on the Participation of Fisheries in Ensuring Food Security of the Country and the Arctic Region

- Vasiliev A. M., Lisunova E. A. Market Pricing for Fish. Fisheries, 2023, no. 3, pp. 25–30. DOI: https://doi.org/10.37663/0131-6184-2023-3-26-30

- Vasiliev A.M., Komlichenko V.V., Lisunova E.A. Relationship between the Russian Fishing Fleet and Domestic Ports as the Core for Performing its State Mission. IOP Conference Series: Earth and Envi-ronmental Science, 2019, vol. 302, art. 012141. DOI: https://doi.org/10.1088/1755-1315/302/1/012141

- On the Implementation of the Food Security Doctrine of the Russian Federation. Analytical Bulletin, 2022, no. 22 (812), 170 p.

- Kolonchin K.V. Export of Russian Fisheries Products: Current Barriers and Main Directions of Devel-opment. Part 2. Food Industry, 2019, no. 3, pp. 30–34.

- Karlina E.P., Arslanova E.R. Place and Role of Fishery Complex in Food Security System of Russia. Vestnik of Astrakhan State Technical University. Series: Economics, 2019, no. 4, pp. 37–48. DOI: https://doi.org/10.24143/2073-5537-2019-4-37-48

- Prokopyev M.G. Transfer Effect of Import and Export Prices Changes into the Prices of Home Mar-ket: Methodical Aspects. Economics of Contemporary Russia, 2017, no. 3 (78), pp. 105–115.

- Korneychenko E.N., Novopashina A.N., Pikhteev Yu.N. Consumer Prices in Russia: Effects of the Ex-change Rate Shocks. Izvestiya of Saratov University. Economics. Management. Law, 2020, vol. 20, no. 1, pp. 4–15. DOI: https://doi.org/10.18500/1994-2540-2020-20-1-4-15

- Exchange Trade in Fish and Fish Products. World Experience. Association of Pollock Fishermen. Vla-divostok, 2010, 18 p. (In Russ.)

- Pitilyak D.A., Karyakina I.E., Zakharchenko D.A. The Main Trends in the Development of Production and Consumption of Fish Products in the Sakhalin Region. Russian Journal of Regional Studies, 2020, vol. 28, no. 1, pp. 80–110. DOI: https://doi.org/10.15507/2413-1407.110.028.202001.080-110

- Kolonchin K.V., Betin O.I., Rudashevsky V.D., Mukhamedova T.O. Transformation of the Russian Fisheries Management System. Problems of Fisheries, 2022, no. 4, pp. 5–15. DOI: https://doi.org/10.36038/0234-2774-2022-23-4-5-15