Impact of remittances on the trade balance in the countries of the South Asian region

Автор: Shah Imtiyaz Ahmad, Nengroo Tariq Ahad

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Global experience

Статья в выпуске: 1 т.16, 2023 года.

Бесплатный доступ

The present study empirically examines the relationship between trade balance and remittances in five selected countries of the South Asian Association for Regional Cooperation (SAARC). Besides the joint impact of remittances on the trade balance, the individual impact of remittances on Bangladesh, India, Sri Lanka, Pakistan, and Nepal and comparison among these countries are also provided. To conduct this analysis, annual data of 20 years from 1991-2019 were collected from World Bank and Penn World database. Pooled OLS, random effect, and fixed models are used to estimate the joint impact of remittances. Further, dummy variable interaction models are used to estimate the individual impact of remittances on five South Asian countries. Our panel regression analysis confirms the increasing impact of remittances on the trade deficit of five South Asian countries by triggering import-led consumption expenditures. Other control variables, exchange rate, foreign direct investment, investment, and human capital have a significantly negative impact on the trade balance. On the other hand, rent has a significant positive impact on the trade balance of SAARC countries. Dummy variable interaction model confirms the negative impact of remittances on India, Nepal, and Pakistan, while remittances have an insignificant impact on Bangladesh and Sri Lanka. The paper provides various policy impactions for SAARC region.

Remittances, trade balance, south asia, panel data

Короткий адрес: https://sciup.org/147240256

IDR: 147240256 | УДК: 336.74 | DOI: 10.15838/esc.2023.1.85.13

Текст научной статьи Impact of remittances on the trade balance in the countries of the South Asian region

Remittances are considered a stable source of household income in developing countries (Alferi et al., 2005). Every year South Asian migrants send a large amount of remittances (Sutradhar, 2020). South Asia receives about 10% of global remittances from 2015 to 2019. They exceed the foreign direct investment and foreign aids except for Maldives and Afghanistan. Within South Asia, India is the largest recipient globally, receiving about 360 billion USD from 2015 to 2019. Remittances are used to raise domestic savings, minimize the constraints associated with foreign exchanges and balance of payments (Sutradhar, 2020). Remittances help to reduce poverty reduction and economic development1.

On the negative impact, it could damage the economic growth when skilled and highly educated laborers migrate, also known as brain drain (Topxhiu, Krasniqi, 2017). It also hampers economic growth through exchange rate appreciation and makes the trade sector less competitive2. It adversely impacts the labor supply decision of families by increasing their preference for more leisure after receiving remittances in the form of non-labor income (Sutradhar, 2019). It also increases the inequality between families with remittances and those without remittances. Further, remitted income is mainly spent on consumption rather than productive activities (Hasan, Shakur, 2017).

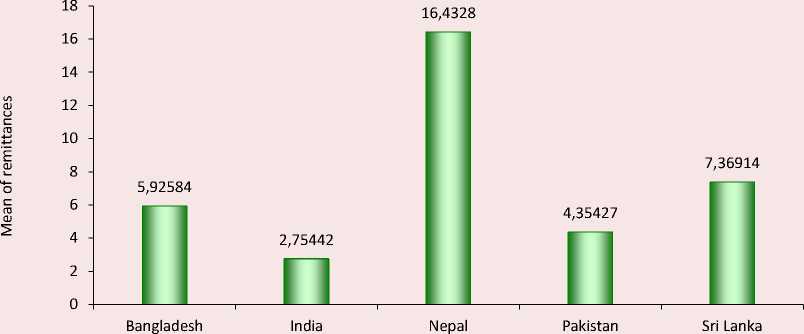

During the study period (1991–2019), Nepal has the largest remittances inflow as a share of GDP in the SAARC region (16.43%) and fifth in the world. Nepal is followed by Sri Lanka (7.36%), Bangladesh (5.92%), Pakistan (4.35%), and lastly, India (2.75%; Fig. 1 ).

However, South Asian countries have been accumulating a deficit in their trade balance during the same period. Figure 2 shows the difference between exports and imports as a percentage of GDP.

One of the possible reasons for the huge trade balance of SAARC countries is the current account deficit due to a weak export structure. South Asia has an unusual export pattern with primary exports and low intensive manufactured exports (Wood, Mayer, 2001). S. Lall (Lall, 2000) examines that South Asia suffers from the deterioration of their small share although having a substantial industrial base. Exports from South Asia are reliant on low technology. The trade deficit for a sustained period increases debt level and low sovereign credit rating, which deteriorates the future international borrowings (Hasan, 2003).

Remittances impact trade balance in different ways. First, remitted income can be consumed, invested, or saved domestically. Local domestic goods can be produced with investment and used as import substitutes, and the rest can be exported. In this way, remittances help reduce the trade deficit and assist in job creation. On the other hand, the

Figure 1. Average remittance inflow in SAARC countries (1991–2019)

Source: own calculation based on World Bank data, 2021.

Figure 2. Mean of exports and imports (1991–2019)

Mean of exports ■ ■ Mean of imports

Source: own calculation based on World Bank data, 2021.

impact of remittances on export competitiveness, exchange rate, and Dutch disease effect has been an important debate in recent years. Remitted income appreciates the local currency and might impact the long-run growth of the economy. Remittances may exhibit Dutch disease effect on the tradable sector of the economy if remittances inflow causes overvaluation of local currency.On the other hand, remittances increase the purchasing power, and preferences towards imported goods may increase. Also, large remittances inflow reduces the labor force participation and therefore leads to adverse economic development. This fact results in the deterioration of the external balance of remittances receiving country and could worsen the overall balance of payments of the country.

The question arises at which extent remittances inflows impact the trade balance of SAARC countries. The contribution of present reseach is threefold: the present study empirically examines the relationship between trade balance and remittances in five selected countries of the SAARC region. To the best of authors knowledge no smilar study is found in SAARC countries. Besides the joint impact of remittances on the trade balance, the individual impact of remittances on Bangladesh, India, Sri Lanka, Pakistan, and Nepal and comparison among these countries are also provided. To conduct this analysis, annual data of 20 years from 1991–2019 were collected from World Bank and Penn World database. Second, our research study follows the study by Farzanegen and Sherif (Farzanegan, Sherif, 2016), which examines how remittances affects the trade balance of Middle East and North Africa. Lastly, study examines the link between household consumption, remittances and trade balance.

The originality of this research paper is that it uses the country-specific impact of remittances and the overall impact of remittances on five countries of the SAARC region, as most of the previous research works provide only joint impact of remittances for emerging or group of developing countries. The joint impact of remittances on five SAARC countries is obtained using Pooled ordinary least square (OLS), random effects (RE), and fixed effects (FE). Then, the dummy interaction model is used to examine the separate impact of remittances of each five countries. The regression model results confirm the significant negative impact of remittances on the trade balance of five SAARC countries. The dummy variable interaction model confirms the significant negative impact of remittances on India, Nepal, and Pakistan.

The paper is structured as follows: the “Literature review” section reviews previous studies on the relationship between remittances and trade balances. The “Theoretical model” section discusses the trade balance model. The “Methodology” section explains the variables of the model, data sources, relevant econometric model, and empirical estimation of the present study. The “Empirical results” section presents results of relevant econometric models. Lastly, “Conclusion” presents the concluding results and policy recommendations.

Список литературы Impact of remittances on the trade balance in the countries of the South Asian region

- Akoto L. (2019). Empirical analysis of the determinants of trade balance in post-liberalization Ghana. Foreign Trade Review, 54(3), 177–205.

- Alferi A., Havinga I., Hvidsten V. (2005). Definition of Remittances and Relevant BPM5 Flows. New York: Statistics Division, United Nations.

- Barro R., Sala-i-Martin X. (2004). Economic Growth. 2nd edition. Cambridge, MA: MIT Press.

- Bhattacharya S.K., Das G.G. (2014). Can South–South Trade Agreements reduce development deficits? An exploration of SAARC during 1995–2008. Journal of South Asian Development, 9(3), 253–285.

- Bjorvatn K., Farzanegan M.R. (2013). Demographic transition in resource rich countries: A blessing or a curse? World Development, 45, 337–351.

- Bouhga-Hagbe J. (2004). A theory of workers’ remittances with an application to Morocco. IMF Working Paper, 04, 194. Washington D.C.: International Monetary Fund.

- Falk M. (2008). Determinants of the Trade Balance in Industrialized Countries. FIW Research Report 13. Vienna.

- Farzanegan M.R., Sherif M.H. (2016). How does the flow of remittances affect the trade balance of the Middle East and North Africa? SSRN Scholarly Paper. Rochester, New York: Social Science Research Network.

- Farzanegan M.R., Sherif M.H. (2020). How does the flow of remittances affect the trade balance of the Middle East and North Africa? Journal of Economic Policy Reform, 23(2), 248–266.

- Hasan G.M., Shakur S. (2017). Nonlinear effects of remittances on per capita GDP growth in Bangladesh. Economies, 5(3), 1–11.

- Hasan M. (2003). Export performance of South Asia after trade liberalization in the early 1990s. The Chittagong University Journal of Business Administration, 18, 107–120.

- Khan M.A., Faheem U.R., Hussain F., Razzaq A. (2021). Study on determinants of trade deficit in selected SAARC countries: The role of infrastructure. Indian Journal of Economics and Development, 9, 13.

- Lall S. (2000). The technological structure and performance of developing country manufactured exports, 1985–1998. Oxford Development Studies, 28(3), 337–369.

- Lartey E.K.K. (2018). The effect of remittances on the current account in developing and emerging economies. Policy Research Working Paper, 8498. Washington, D.C.: World Bank.

- Nguyen P.H. (2017). The impact of remittance on trade balance: The case of Malaysia. Journal of Economics and Public Finance, 3, 531.

- Okodua H., Olayiwola W. (2013). Migrant workers' remittances and external trade balance in Sub-Sahara African countries. International Journal of Economics and Finance, 5. DOI: 10.5539/ijef.v5n3p134.

- Pfaffermayr M. (1996). Foreign outward direct investment and exports in Austrian manufacturing: substitutes or complements? Weltwirtschaftliches Archive, 132(2), 501–522.

- Ramirez M., Sharma H. (2008). Remittances and growth in Latin America: A panel unit root and panel cointegration analysis. Estudios Economicos de Desarrollo Internacional, Euro-American Association of Economic Development, 9(1), 5–36.

- Rifa F., Thahara A.F., Fathima R., Kalideen S. (2021). The relationship between exchange rate and trade balance: Empirical evidence from Sri Lanka. Journal of Asian Finance Economics and Business, 37-0041.

- Sutradhar S. (2020). The impact of remittances on economic growth in Bangladesh, India, Pakistan, and Sri Lanka. International Journal of Economic Policy Studies, 14(3).

- Topxhiu R.M., Krasniqi F.X. (2017). The relevance of remittances in fostering economic growth in The West Balkan countries. Ekonomika, 96(2), 28–42.

- Tung L.T. (2018). Impact of remittance inflows on trade balance in developing countries. Economics and Sociology, 11(4), 80–95.

- Wood A., Mayer J. (2001). South Asia’s export structure in a comparative perspective. Oxford Development Studies, 29, 5–29. DOI: 10.2139/ssrn.189810