Impact of the COVID-19 pandemic on the consumer market in Russia and China

Автор: Anosov Boris A.

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Global experience

Статья в выпуске: 6 т.15, 2022 года.

Бесплатный доступ

For many decades, Russia and China have been major trade and economic partners, whose close and effective cooperation is of particular importance in the context of Western sanctions. New strategic guidelines of Russian-Chinese relations determine the scientific relevance and practical significance of studying the consumer markets of the two countries. It is especially important to study the features and trends of changes in consumer markets in the conditions of the epidemiological crisis. The purpose of this work is to analyze the impact of the COVID-19 pandemic on four areas of the consumer market in China and the Russian Federation: e-commerce market, luxury goods market, food delivery market and online education market. Studying the impact of crisis processes on the consumer markets of individual countries seems to be very relevant for the development of effective measures to overcome similar situations in the future. To achieve the research goal, we use methods of analysis and synthesis of statistical data. The research results prove that the COVID-19 pandemic has had a significant negative impact on the consumer market in Russia and China. A large-scale epidemiological crisis has led to deterioration in the material well-being and consumer opportunities of both countries. At the same time, the COVID-19 pandemic has also led to a number of positive changes in certain sectors of the consumer market in Russia and China: further rapid development of distance trading, growth of the goods delivery market, acceleration of the trend of online education development. Such positive trends will contribute to further information and innovation development, economic growth of Russia and China. The scientific novelty of the research is to identify the consumer market areas that have felt the greatest impact of the pandemic in terms of accelerating their development, as well as a comparative analysis of these areas in cross-country comparison.

Consumer behavior, economic digitalization, online retail, coronavirus pandemic, retail turnover

Короткий адрес: https://sciup.org/147239135

IDR: 147239135 | УДК: 339.13(47+57) | DOI: 10.15838/esc.2022.6.84.15

Текст научной статьи Impact of the COVID-19 pandemic on the consumer market in Russia and China

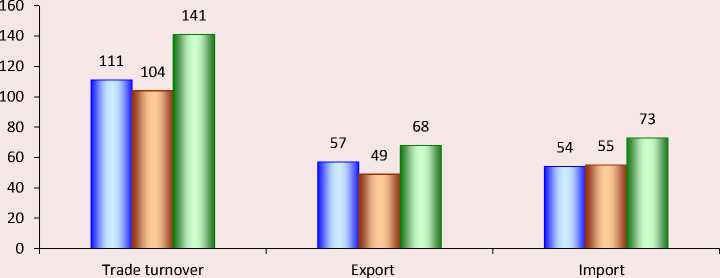

Relations between Russia and China – the largest states in the world – have a centuries-old history. Today, more than 30 agreements have been signed between the Russian Federation and the People’s Republic of China, which contribute to the development of trade, economic and political cooperation. On July 16, 2001, an agreement on good neighborliness and friendship was signed, which marked the beginning of mutually beneficial long-term partnership relations between the Russian Federation and China (Nagornyi, 2015). Since 2010, China has become Russia’s largest trading partner. According to the Federal Customs Service, China ranks first among the most important trading partners in the total volume of exports and imports of Russia. In 2021, compared with 2020, the trade turnover between the countries increased by more than a third and exceeded 140 billion dollars (Fig. 1). Russian exports to China increased by 38% in 2021 and exceeded 68 billion dollars, while imports from China increased by 33% and amounted to 73 billion dollars. Moreover, Russia and China intend to reach a trade turnover of 200 billion dollars by 2024. Russia supplies goods with a low degree of processing, such as non-ferrous metals, oil, wood, and China supplies light industry goods, high-tech engineering products, electrical engineering1.

Under the conditions of Western sanctions, the relations of the Russian Federation with China are of great importance for replacing enterprises and

Figure 1. Structure of trade turnover between Russia and China in 2019–2021 (billion dollars)

□ 2019 □ 2020 □ 2021

Source: Rosstat data. Available at: companies that have left the Russian market. China is ready not only to export its final products, but also to create new jobs and localize its technologies in Russia. In addition, under the sanctions influence of the West, China will be able to fill the national market with high-tech equipment, machinery and vehicles, as well as other necessary goods (Madiyarova, 2022).

In June 2019, the Chinese President Xi Jinping and the Russian President Vladimir Putin signed a Joint Statement of the People’s Republic of China and the Russian Federation on the development of a Comprehensive strategic partnership in a new era, which raised bilateral relations to a new level (Madiyarova, 2022).

The new strategic guidelines of Russian-Chinese cooperation determine the scientific relevance and practical significance of studying the consumer markets of the two countries. It is especially important to investigate the features and trends of changes in consumer markets in the context of the COVID-19 pandemic, which radically changed many socio-economic processes at the international and national levels, had a significant impact on the mechanisms of development and functioning of the consumer sphere.

Analysis of scientific publications on the research topic

The problems of the COVID-19 pandemic influence on the world economy, the socio-economic situation of individual countries, and the development of national consumer markets are of high scientific interest among Russian and foreign researchers. Numerous works of scientists are devoted to the study of various areas of functioning of the Russian and Chinese economies in the context of the pandemic.

The works (Minakir, 2020; Smotritskaya I.I., 2020, Li Zhimeng, et al., 2022) present variant calculations of economic and financial damage, estimate parameters of economic dynamics and changes in consumer behavior in connection with the restrictions imposed, and substantiate the principles, priorities and vectors of postcrisis economic recovery. In the joint study, the researchers characterize the state of business activity in the manufacturing and non-manufacturing sectors of the national economy, summarize the main measures of the anti-pandemic policy of the Chinese and Russian governments, examine the dynamics of functioning in the conditions of the COVID-19 pandemic offline spheres of the economy aimed at personal communication (tourism, catering, retail trade, transport, culture, entertainment), as well as online spheres involving human-computer interaction (online retail, express delivery, remote work, telemedicine) (Li Zhimeng, et al., 2022).

The scientific literature, devoted to studying the influence of the epidemiological crisis directly on the consumer market, pays significant attention to the consideration of such aspects as the formation of new patterns of consumer behavior, changes in the functioning of the food market in order to ensure food security, the development and mass dissemination of modern technologies and digital innovations in the field of consumption, and the transformation of the consumer lending market.

For instance, the works of E.K. Karpunina, N.N. Gubernatorova, T.G. Sobolevskaya, and M.D. Beletskii determine the pandemic effects that influenced the behavior of the Russian consumer. The authors systematize new patterns determining the nature of consumer behavior of Russians during the pandemic. The emphasis is placed on noticeable changes in the subjective perception of socio-economic processes by the population, a surge in consumer inflation expectations, which led to an increase in the share of food products in the general structure of consumption and intensive development of the FMCG segment of the e-commerce market, active use of free food delivery services and widespread use of non-cash payment instruments. The works substantiate the impact of changing consumer behavior on the production and marketing activities of enterprises. The research determines the role of the state in overcoming the pandemic effects (Karpunina, et al., 2022). Changes in consumer behavior of Russians on the market in the pandemic are also characterized in the works of A.R. Ishniazova, S.A. Andronova, I.I. Yunusova. The studies note the focus of consumers on health-saving goods and environmentally friendly food, and substantiate the dependence of consumer market trends on the implemented strategies of citizens’ behavior under the threat of the coronavirus infection (Ishniazova et al., 2021).

N.V. Gribova examines the dynamics and key trends in consumption of Chinese households, the main factors of consumer behavior of families, assesses the impact of the pandemic on the state and prospects of consumer demand in China. The consumer behavior model of Chinese households has its own characteristics and features and is constantly changing under the influence of various factors. The most important among them are the level of family income, demographic structure, consumer habits and preferences, as well as the widespread use of digital technologies. The pandemic and restrictive measures have had a negative impact on the income and consumer spending of households in the country. At the same time, they contributed to the formation of new consumer priorities, which, according to the author, will continue in the future and promote new consumption models in China (Gribova, 2021).

The research of Russian scientists (Zyukin, Reprintseva, 2022) also examines the impact of the pandemic and related changes in consumer behavior on the grocery retail market. We should also note that attention is focused on the functioning of the Russian consumer lending market, the analysis of factors that caused both the growth and the decline of the market under the influence of the pandemic, the assessment of dynamic changes in key indicators that determine the state of this economic sector (Glushchenko et al., 2020). In the work of a foreign author (Nuerzhada, 2021) devoted to the development of consumer loans in China, it is shown that in a crisis, consumer credit can increase effective demand and stabilize economic growth, while stimulating early consumption, thereby leading to a structural transformation of the economy.

In a large number of works, the topic of the development of e-commerce is touched upon. For instance, the studies (Rossinskaya, Mamayeva, 2020; Plotnikov, 2021; Revinova, Tretiakova, 2021) determine the influence of information technologies on the sphere of consumption in the context of the pandemic, justify the need to intensify the functioning of online trading platforms and services in order to increase the efficiency of interaction of market participants, and emphasize the high potential of online commerce for the Russian market of goods and services. The study of I.N. Dement’eva and Sheng Fangfu analyzes the state of online retail trade in China and Russia, presents a comparative analysis of the differences in the development of online consumption in the two countries in the context of modern socioeconomic transformations. The paper proves that the coronavirus pandemic acts as a catalyst for the development of distance trading. The economic downturn against the background of the coronavirus, quarantine restrictions and the transformation of lifestyle and consumer behavior have contributed to a sharp and thorough transition to the use of the latest technologies in retail in China and Russia (Dement’eva, Sheng Fangfu, 2022).

In general, despite the wide range of problems raised in the works of foreign and Russian researchers, the insufficiently developed issues are those related to the assessment of the state and development of individual sectors of the consumer market of Russia and China in conditions of changing social reality under the influence of the global epidemiological crisis, which served as the basis for this study.

The purpose of our work is to analyze the impact of the COVID-19 pandemic on four areas of the consumer market in China and the Russian Federation: the e-commerce market, the luxury goods market, the food delivery market and the online education market. The choice of these four areas is resulting from the fact that the restrictions imposed on the population movement in Russia and China have led to the growth of distance services: not being able to move freely within urban spaces, the population of the two countries began shopping online more often, ordering food at home, and also using the services of online teachers. To achieve the goal of the research, we consider the following issues: how the pandemic affected the consumer patterns of the population of the two countries and why the change in consumer behavior led to the growth of the four selected market areas for research. We analyzed data for 2020 – the first half of 2022.

Research methodology and data resources

To solve the research tasks, we have used general scientific methods and techniques (dialectical method, statistical analysis method, generalization, systematization, comparison method).

Research results

Changes in consumer behavior in Russia and China during the COVID-19 pandemic

Numerous studies show that the most important determinants defining consumer behavior and influencing the development of the consumer market are the population incomes and prices of goods and services. According to Rosstat, in the context of the pandemic, the real disposable income of Russians in 2020 decreased by 1.4%, while consumer spending decreased by 4.7%. Based on the results of the first half of 2020, the disposable incomes of the Chinese population in real terms decreased by 1.3% in the country as a whole, real consumer spending per capita decreased by 9.3% (Gribova, 2021). As a result, by the end of 2020, retail trade turnover in Russia decreased by 4.1% compared to 2019 in comparable prices, retail sales of consumer goods in China decreased by 3.9%.

Against the background of the deterioration of the financial situation and the reduction of the purchasing power of the population’s income, significant changes are taking place in consumer behavior, habits and preferences of residents of Russia and China are changing.

The audit and consulting agency “EY” conducted a study of the consumer behavior of Russians in conditions of increased economic uncertainty, during which four consumer groups were identified according to the criterion of the impact of the pandemic on the incomes and expenses of Russians: they have not suffered and are not worried (33%), they are holding up normally, but they are adapting (13%), they face difficulties and worry (34%), they have suffered a lot, but remain optimistic (20%)2. Interestingly, the main criteria that guide Russian consumers to reduce the impact are price, health benefits, availability of goods, quality of service and environmental friendliness.

The COVID-19 pandemic has led to improved technological solutions and the growth of online commerce in Russia. The research of the Moscow School of Management “Skolkovo” notes3 that since the beginning of the pandemic, there has been a transition of Russians from free consumption to thrift (interestingly, promotions and bonuses from manufacturers and distributors of goods and services began to have a greater impact on consumers), but it is obvious that the pandemic contributed to an increase in the share of online purchases from total retail sales. Also, Skolkovo analysts say that online purchases are cheaper than offline, both in the perception of the population and in fact. Among Russian consumers, there was a trend toward a sharp reduction in impulsive purchases due to the transition to online, a decrease in the attendance of hypermarkets and shopping centers4.

The pandemic has also affected the consumer habits and preferences of Chinese citizens. For the convenience of the analysis, we propose the following classification of Chinese consumers by demographic criterion. Consumers who were born before the 1960s grew up in difficult times for the country, so the share of savings from disposable income in this consumer group is the highest. For representatives of this category, the price of the product and its quality are very important. Consumers, born in the period 1966–1976, (the years of the “Cultural Revolution” in China) are balancing between “old” and “new” consumer habits; they are also strongly inclined to accumulate funds, it is important for them to accumulate funds for raising a child and for medical expenses. Millennials who have received a good education and are open to new experiences, like to support new trends and technologies, are more inclined to online shopping than offline. For migrant workers aged 25 to 45, the price is extremely important, they are trying to save money. Wealthy Chinese (with an annual disposable income of more than 1 million dollars) live in big cities; they are willing to overpay for quality goods and prefer imported goods5.

One of the trends in the pandemic can be called economic nationalism or patriotism, which has spread in China. The idea of economic patriotism assumes a greater importance of state intervention in the economy than the ability of the market to independently regulate the internal economy of the state. According to the study, economic patriotism, due to “commodity-oriented ethnocentric behavior” and isolation due to the pandemic, strongly influenced consumers’ willingness to buy local goods and brands, since people believe that the consumption of domestic goods has a positive impact on economic recovery (Verma, Naveen, 2021).

Since the pandemic “regime” in China is still ongoing, the consumption pattern is changing relatively slowly. A survey conducted by researchers among 697 people showed that even in the first wave of the pandemic, most Chinese consumers reduced spending on entertainment, redirecting spending on essential goods, children’s education and medical expenses. The survey results, conducted during the second wave, indicated that the trend continues to persist. Despite the fact that the national economy and social life are gradually returning to normal, consumers are still cautious about the pandemic situation in the short term (Yuan et al., 2021).

At the same time, it is interesting to note that the research results showed the propensity of Chinese consumers to offline purchases (during the first wave, 50% of respondents stated that they made purchases offline, during the second wave, 85% already noted their commitment to offline purchases), and the commitment of Chinese residents to preserving traditional consumer habits was also recorded, which were before the COVID-19 pandemic. This trend can be explained by two reasons: first, in many nonurban areas, the e-commerce network is not fully established, which is why the purchase of essential goods in them is possible only in a physical store, and second, during the outbreak of the pandemic, Chinese local authorities imposed restrictions on logistics (Yuan et al., 2021).

Thus, it is possible to identify the same trends in changing consumer habits of the population of China and the Russian Federation. First, in both countries, the pandemic has led to a reduction in the income, which explains the change in the priority of spending, namely, a reduction in spending on entertainment and unnecessary spending and an increase in spending on essential goods, medical expenses, etc. Second, the restrictions imposed by the authorities on movement have led to the growth of e-commerce and various deliveries. Third, in both countries, there was an increase in consumer interest in goods and services of local production in order to support small and medium-sized enterprises, whose operating activities were most affected by the pandemic. Fourth, the increase in commodity prices since the beginning of the pandemic, as well as general uncertainty, contributed to an increase in the percentage of savings from disposable income, that is, the population of both countries realized in conditions of uncertainty that it was necessary to have a financial cushion.

E-commerce and luxury goods market

According to the Statista portal, the number of online buyers in China in 2021 reached 842 million people (about 60% of the population)6, the number of Russians who made at least one online purchase in 2021 amounted to 64.8 million people (about 45% of the population) 7. The total volume of the Internet sales in China in 2021 reached 2,639 trillion dollars8, the volume of the retail Internet trade market in Russia amounted to 4.1 trillion rubles (69.7 billion dollars)9. According to these data, we can conclude that the Chinese e-commerce market is about 22 times larger than the Russian one. If we consider the share of online purchases from the total retail sales in the two countries, then in China this figure is 24.5%, in the Russian Federation – 9.2%.

Yandex.Market and GfK Rus conducted a survey among the Russian audience of online stores and identified the most popular categories of goods purchased online: adult clothing and shoes (64.1%), face, body and hair care products (59.3%), smartphones and tablets (54.6%), toys and hobby goods (51.5%), products (except prepared food and alcohol, 49.7%), decorative cosmetics and perfumes (49.3%), household goods and tableware (47.7%), bags, belts, accessories (45.5%), medicines and health supplements (44.8%), small household kitchen appliances (40.6%)10:

The survey data showed that during the first wave of COVID-19 and the introduction of selfisolation in Russia, the demand for leisure and entertainment goods, such as books and musical instruments, increased. Users also became more interested in goods for cottages and gardens (an increase of 23%), for animals (by 18%), computer equipment (by 15%). At the same time, the demand for clothing, shoes and accessories fell by 30%.

The most popular categories of goods among the Chinese are cosmetics (55%), handbags (40%), women’s clothing (40%), women’s shoes (35%), accessories (35%), home decoration products (25%), perfumes (20%), lingerie (18%), men’s clothing (15%), and men’s shoes (15%)11.

According to Euromonitor International, the luxury goods market in Russia decreased by 18% in 2020, from 14.7 billion dollars to 12.1 billion dollars. The markets of fine wines and spirits and premium and luxury cars suffered the least, in 2020, compared with 2019, having decreased by 17.3 and 5.7%, respectively. The personal luxury goods market suffered the most, decreasing by 30% in 2020 compared to 2019. Interestingly, if we consider the categories of goods, the smallest decline was recorded in sales of decorative and care cosmetics (21.1%)12.

However, at the same time, the growth dynamics of the luxury goods market was noted in China. According to a joint report by Bain and Company and Tmall Luxury, the growth of the luxury goods market in 2020 was expected to grow by 48% and reach almost 346 billion yuan (53 billion dollars). The global luxury goods market shrank by 23% in 2020, and China’s share increased from about 11% in 2019 to 20%. In this report, the authors assumed that by 2025 China would account for the largest share of the global luxury goods market13. During the pandemic, the growth of online sales of luxury goods amounted to more than 150%. Experts identified four reasons for this phenomenon: the return of Chinese emigrants back to China, the increasing involvement of representatives of generations Y and Z in the consumption of luxury goods, deepening digitalization and the development of duty-free shops in Hainan. It is interesting to note that sales at duty-free shops in Hainan jumped by more than 230% in July 2020, after the government tripled the quota for purchases to 100 thousand yuan (810 thousand rubles or 14.9 thousand dollars) for each buyer.

The pandemic has also affected the online retailers themselves, whose goal was to attract as many people as possible to their site. For example, in China, the second outbreak of the development of online streaming aimed at the sale of goods and services has been recorded. All major Chinese online platforms (Taobao, JD.COM , Kwai, TikTok, etc.) began actively promoting broadcasts conducted by bloggers and celebrities. According to the Chinese Internet Information Center, by the end of 2020, the number of viewers of Internet broadcasts reached 617 million people, an increase of 10% compared to 2019, accounting for 66.2% of the total number of buyers shopping online, and the volume of goods purchased through online broadcasts amounted to more than 30% of the total number of purchases on the Internet (Deng, 2021). After the beginning of the pandemic, when offline traffic moved online, new channels of interaction between sites and end users continued developing: online broadcasts, microapplications inside large applications. For example, many additional applications have been created in the Chinese social network “WeChat” to increase sales, and such techniques of interaction between sites and consumers as influencer marketing and SMM marketing have become the norm. Similar trends can be noted among Russian retailers. For example, the Ozon platform has launched Ozon Live, which allows making online broadcasts with products presented on the marketplace. It is worth noting that Russian goods were also sold in China with the help of online broadcasts. So, during the broadcast, which took place in November 2020 at the TMall site, Russian goods worth 1.8 million dollars were sold in half an hour.

In general, against the background of the pandemic, new consumer practices have been formed related to the active use of the Internet for shopping in both countries. The luxury goods category has become one of the subgroups of goods most affected by the pandemic. However, in China, the growth dynamics of the luxury goods market was noted, which indicates the confidence of Chinese consumers about their financial prospects.

Food delivery market

The pandemic and, first of all, the regime of restriction or prohibition of the population movement have affected the rapid growth of the food delivery market at home. According to a survey conducted in 2019 in Russia, 65% of respondents over the age of 18 have used food delivery services from restaurants over the previous three months, and for people aged 18–44, this figure was 75%14.

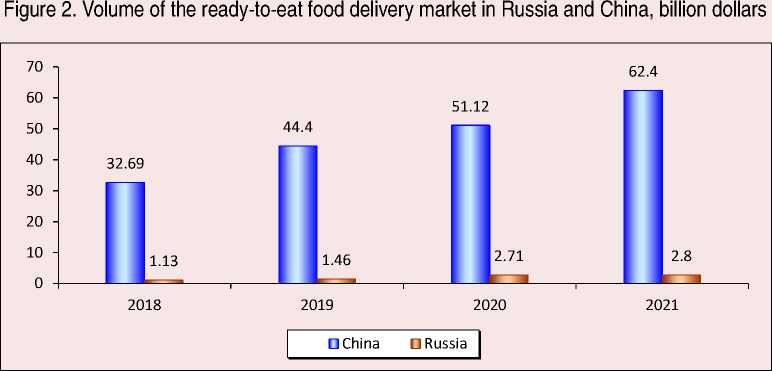

A survey conducted by the Chinese company “China Youth Daily” demonstrated that in 2018, 64.9% of respondents buy takeaway food at least twice a week in restaurants15. If we analyze the volume of the ready-made food delivery market, then in 2021 in Russia it amounted to 329 billion rubles (2.8 billion dollars), in China it was 811.7 billion yuan (62.4 billion dollars). It is obvious that the Chinese food delivery market is much larger (it is expected that in 2022 the Chinese market will become the largest in the world) than the Russian one. At the same time, it is important to note that in the last four years, the trend of growth of the food delivery market in both countries has continued ( Fig. 2 ).

The food delivery market is a duopoly dominated by Chinese tech giants Alibaba and Tencent, which own Ele.me ( 饿 了么 ) and Meituan ( 美 团 ) respectively. Together, these two delivery apps control 95% of the food delivery market in China. Ele.me occupies 26% of the Chinese food delivery market, and Meituan – 69%. It is important to note

Source: own calculation based on Statista and RAEC data.

According to iiMedia Research report, such a volume of the Chinese food delivery market is due to the frequency of customer orders; 27% of Chinese consumers order food from six to ten times a month, 14.3% – from 11 to 20 times a month. It is noteworthy that only 18.5% of respondents said they never order food online17. In China, there is a change in the main consumer of the food delivery market: in 2015, about 63% of users of online food delivery applications were white-collar workers, and 30.5% were students. However, in 2022, 83% are white-collar workers and only 10% are students. If we consider consumers by gender and age, then women make up 51% of users of food delivery apps. Users are mostly young, 85% are between the ages of 18 and 40. It is important to note that the total number of online food delivery orders made by representatives of the generation of homelanders has increased by almost 20%.

Such popularity of food delivery services in China can be explained by the relative cheapness. The extreme availability of food delivery in China is due to fierce competition between providers of these services. Due to intense competition between delivery applications, Chinese consumers receive large discounts and coupons when placing an order, and there is often a situation in which ordering food at home becomes cheaper than cooking it yourself at home. It is worth noting that for example, the company Meituan became profitable only in 2020; it means that nine years after it appeared on the market (its unprofitability is due to subsidies provided to customers in order to attract as many new customers to the service as possible).

In Russia, the pandemic has also affected the growth of the food delivery market. According to Tinkoff Data, which takes into account all transactions of Tinkoff Bank customers, sales of ready-made food and foodstuffs via the Internet in Russia increased more than 4 times in 2020. The main players in the ready-to-eat food delivery market in 2020 in the Russian Federation were Delivery Club (17.6%), Yandex.Food (10.1%), Dodo Pizza (7%), Domino’s Pizza (1.5%), Local Kitchen (1.4%)18.

According to a survey conducted by OMI in 2019, married respondents order food more often than others (70%)19. The presence of children in the family also affects the frequency of delivery orders. The more children there are, the more likely it is to use the service: 76% of families with one child, 79% with two and 81% with three children ordered food through some service in the last three months. The most common sum per person is from 300 to 500 rubles (43% of respondents). In Moscow, the average sum in the order is higher – 500–700 rubles (36%).

The Marilyn platform highlights the following trends in the food delivery market: more and more restaurants are trying to create their own delivery services, as aggregators take from 20 to 30% commission from the order value; the development of “dark kitchen” (a shadow format of cafes and restaurants that work exclusively for delivery, without seats in the hall); delivery of personalized food sets for several days; development of delivery of food sets for self-cooking; reduction of delivery speed and development of accelerated delivery;

development of services that provide combined delivery services from different restaurants and shops20.

If we consider the delivery market in Russia as a whole, then food and FMCG products, as well as ready-made food, are the most popular categories of goods among consumers. Fifty-four percent of the surveyed consumers order the delivery of food and FMCG goods, 42% – the delivery of readymade food from cafes and restaurants. Most consumers are satisfied with the delivery services; 82% of respondents rated their experience of using the services as positive or rather positive. Home delivery is the most popular, half of the surveyed consumers use it21.

It is important to note that in the first quarter of 2022, there was a decrease in the number of orders of ready-made food and cooking kits by 38.3% in annual terms. From March 1 to March 20, 2022, the number of orders of ready-made food from restaurants decreased by 12–15% compared to the same period in February, the online turnover of ready-made food delivery decreased by 18% in monetary terms, and the number of orders decreased by 16%22. Due to the sanctions imposed against Russia, the range of products began shrinking, there were problems with logistics. Some experts assumed that by October – November 2022 there would be mass closures of businesses in the catering sector. However, the withdrawal of many brands from the Russian market may cause rapid growth in the development of their own trademarks of Russian companies.

In general, the pandemic has significantly accelerated the migration of sales of goods from regular stores to online channels, while increasing the demand for fast and reliable delivery. Similar trends are typical for both China and Russia.

Online education market

As the country with the largest population in the world, China has an extensive education system: about 282 million people studied in schools and universities in China in 2021 and about 17.32 million teachers taught. In total, the country’s educational system has almost 530 thousand educational institutions. Online learning has become an important channel of teaching and learning for teachers and students, and it looks like it will be the “new normal” of education after the pandemic. In addition, as competition in the workplace becomes tougher, an increasing number of working people are seeking to improve their skills through online training.

According to the UNICEF report, students in China faced the following problems during the pandemic23:

– lack of self-learning skills (almost half (46.95%) of all high school students surveyed had significantly decreased academic performance, while 34.68% maintained stable results, and 18.36% noted improvement (Guo et al., 2022);

– use of digital devices has led to the possibility of harm to health (primarily vision);

– lack of computers and the Internet in rural areas has limited students’ access to education (as the latest statistics show, the number of Chinese households with Internet access is only 47.4%).

If we consider the online education market in China, the COVID-19 pandemic has only accelerated the trend of its development. If in 2016

the online education market in China was estimated at 78.7 billion yuan (11.3 billion dollars), then in 2021 its volume increased almost 4 times and amounted to 308.2 billion yuan (44.5 billion dollars). According to forecasts, the volume of the online education market in 2024 may amount to 490.5 billion yuan (70.8 billion dollars)24.

However, it is important to note that a quantitative increase in the number of online courses does not correlate with their qualitative improvement. According to a study conducted in China, the number of training platforms negatively correlates with the quality of the courses presented, demonstrating a significant negative forecasting effect. The more training platforms, the lower the quality of the courses; however, the number of courses that students take correlates positively with the quality of the courses: the more courses students attend, the higher the probability of improving the assessment of the quality of the course (Jing et al., 2021).

The volume of the online education market in Russia is not growing at the same pace as in China. In 2016, the entire market was estimated at 20.7 billion rubles (340 million dollars); in 2021 this figure amounted to 53.3 billion rubles (873 million dollars). If we consider the structure of the online education market in Russia, we can distinguish the following segments (the shares of the total education market in Russia are indicated): preschool online education (0.3%), general secondary online education (1.5%), additional school online education (6.8%), higher online education (4.4%), secondary vocational online education (1%), additional vocational online education (10.9%), and language online-education (15.9%)25.

According to a survey conducted in 2021 by Data Insight and Netology, several important trends were recorded26:

-

– public spending on online adult education exceeded spending on offline education and amounted to 226 billion rubles;

-

– in average, those who receive additional online education study 2–3 programs per year, about a quarter of students (23%) have completed 4 programs or more in a year;

-

– 70% of those who received online education in the last 12 months studied for professional purposes;

-

– the majority of respondents (84.6%) have plans to study online in the future; 34.4% of them are beginners who use online education for the first time.

In general, against the background of the COVID-19 pandemic, online education has become an urgent option for organizing training in many countries of the world including China and Russia. The process of switching to distance education in the course of the fight against the coronavirus spread is a unique example of the rapid and high-quality building of a new paradigm for the provision of educational services on a large scale.

Conclusions

The consumer market is one of the most important elements of the modern market economy. Its sustainable development is a determining condition for the well-being, stability and economic security of the territory. The COVID-19 pandemic has had a significant negative impact on the consumer market in Russia and China. A large-scale epidemiological crisis has led to a deterioration in the material well-being and consumer opportunities of both countries. At the same time, the COVID-19 pandemic has also contributed to a number of positive changes in certain sectors of the consumer market in Russia and China.

First, the pandemic is the driver of the development of distance trading. Quarantine restrictions have led to the emergence of new opportunities and additional areas of growth for the e-commerce sector. China, being the absolute leader of online commerce in the world, in 2020 demonstrated the most significant volumes of the Internet sales market. The Russian e-commerce market is the most dynamic, Russia ranks first in terms of the growth rate of online retail (Dement’eva, Sheng Fangfu, 2022).

Second, contrary to global trends in China, we have noted the growth dynamics of the luxury goods market, which is largely due to the confidence of Chinese consumers in their financial prospects, as well as the socio-cultural characteristics of consumers of Chinese society, whose roots go back to traditional values. One of these consumer patterns is a tendency to demonstrative behavior and loyalty to brands (Morozova, Reunova, 2021).

Third, the pandemic and related restrictions have affected the rapid growth of the food delivery market. The Chinese food delivery market is significantly superior to the Russian one. Such popularity of food delivery services in China can be explained by the relative cheapness in conditions of fierce competition between delivery service providers. In Russia, the pandemic has also affected the growth of the food delivery market. The introduction of Western sanctions contributes to the development of Russian companies’ own trademarks.

Fourth, the COVID-19 pandemic has noticeably accelerated the trend of online education development in China. However, the quantitative increase in online educational platforms does not correlate with their qualitative improvement. The volume of the online education market in Russia is not growing at the same pace as in China. In the structure of the Russian online education market, the main directions are language and professional online education.

The epidemiological crisis caused by the coronavirus spread has given an additional impetus to the development of certain areas of the Russian and Chinese consumer market. Such positive trends will contribute to further information and innovation development, economic growth of Russia and China.

Список литературы Impact of the COVID-19 pandemic on the consumer market in Russia and China

- Dement’eva I.N., Sheng F. (2022). Online retail in China and Russia: Current state and development prospects. Ekonomicheskie i sotsial’nye peremeny: fakty, tendentsii, prognoz=Economic and Social Changes: Facts, Trends, Forecast, 15(4), 242–261 (in Russian).

- Glushchenko M.E. (2020). Impact of the Covid-19 pandemic on the transformation of the consumer credit market. In: Omskie nauchnye chteniya-22020: materialy Chetvertoi Vserossiiskoi nauchnoi konferentsii [Omsk Scientific Readings-2020: Materials of the Fourth All-Russian Scientific Conference.]. Omsk (in Russian).

- Gribova N.V. (2021). Chinese households’ consumption: Key trends and the pandemic factor. Problemy natsional’noi strategii=National Strategy Issues, 1(64), 33–59 (in Russian).

- Guo C., Xu Z., Fang C., Qin B. (2022). China survey report on the online learning status of high schools during the COVID-19 Pandemic. ECNU Review of Education. DOI: https://doi.org/10.1177/20965311221089671

- Ishniyazova A.R., Andronova S.A., Yunusova I.I. (2021). Trends in the development of the consumer market of Russia in modern conditions of the pandemic. Teoriya i praktika obshchestvennogo razvitiya=Theory and practice of Social Development, 12(166), 121–127 (in Russian).

- Jing Lia, Chunlei Qinb, Yanchun Zhua (2021). Online teaching in universities during the Covid-19 epidemic: A study of the situation, effectiveness and countermeasures. Procedia Computer Science, 187, 566–573.

- Junzhi D. (2021). The development of e-commerce in China during the COVID-19 pandemic on the example of the textile industry. BRICS Journal of Economics, 2(3), 54–69.

- Karpunina E.K., Gubernatorova N.N., Sobolevskaya T.G. (2022). Effects of the COVID-19 pandemic: New patterns of consumer behavior. Vestnik Severo-Kavkazskogo federal’nogo universiteta=Newsletter of North-Caucasus Federal University, 1(88), 63–76 (in Russian).

- Li Z., Lukin E.V., Sheng F., Zeng W. (2022). Assessing the impact of the COVID-19 pandemic on the economics of China and Russia. Ekonomicheskie i sotsial’nye peremeny: fakty, tendentsii, prognoz=Economic and Social Changes: Facts, Trends, Forecast, 14(5), 277–299 (in Russian).

- Li Z., Sheng F. (2020). Impacts of COVID-19 on China’s industry and consumption and relevant countermeasures. Jiangxi Social Sciences, 3.

- Madiyarova D.M. (2022). Foreign trade relations between Russia and China. Vestnik nauki, 6(51), 40–45 (in Russian).

- Minakir P.A. (2020). Pandemic economy: The Russian way. Prostranstvennaya ekonomika=Spatial Economics, 16(2), 7–18 (in Russian).

- Morozova V.S., Reunova V.A. (2021). Sociocultural features of consumer behavior in modern Chinese society: A view from Russia. Rossiya i Kitai: problemy strategicheskogo vzaimodeistviya: sbornik Vostochnogo tsentra, 24, 68–71 (in Russian).

- Nagornyi A. (2015). Global’nyi treugol’nik. Rossiya - SShA – Kitai [The Global Triangle. Russia – USA – China]. Moscow: Knizhnyi mir.

- Nuerchzhada T. (2021). Research on the development of the Chinese consumer credit market and its countermeasures. Ekonomika i sotsium=Economy and Society, 3-2(82), 216–222 (in Russian).

- Plotnikov V.A. (2021). The Covid-19 pandemic, consumer market and digitalization. Ekonomicheskoe vozrozhdenie Rossii=The Economic Revival of Russia, 3(69), 92–104 (in Russian).

- Revinova S.Yu., Tretiakova D.A. (2021). E-commerce in Russia amid COVID-19 restrictions. Voprosy innovatsionnoi ekonomiki=Russian Journal of Innovation Economics, 11(4), 1319–1338 (in Russian).

- Rossinskaya M.V., Mamaeva L.I. (2020). Pandemic as an engine of online trade. Naukosfera, 12-2, 283–287 (in Russian).

- Smotritskaya I.I. (2020). Russian economy on the background of global pandemics: The basic contours of “new reality”. Menedzhment i biznes-administrirovanie=Management and Business Administration, 2, 4–15 (in Russian).

- Verma M., Naveen B.R. (2021). COVID-19 impact on buying behavior. Vikalpa, 46(1), 27–40.

- Yuan X., Li C., Zhao K, Xu X. (2021). The changing patterns of consumers’ behavior in China: A comparison during and after the COVID-19p. Int J Environ Res Public Health, 18(5), 2447.

- Zyukin D.A., Reprintseva E.V. (2022). Features of the functioning of the regional food market. Vestnik NGIE=Vestbik NGIEI, 7(134), 103–113 (in Russian).