Importance of estimation of financial and economic effectiveness of investments

Автор: Ismanova K., Arslonova X.

Журнал: Экономика и социум @ekonomika-socium

Статья в выпуске: 4 (47), 2018 года.

Бесплатный доступ

In this article, one of the main factors in the development of economics has been the issue of assessing the effectiveness of investment. Multiple objective examples were provided for specific purposes. The required parameters are calculated and evaluated by the formula.

Короткий адрес: https://sciup.org/140236687

IDR: 140236687

Текст научной статьи Importance of estimation of financial and economic effectiveness of investments

Considering that the future development of Uzbekistan and the world economy, mainly dependent on investments, is understood by almost every specialist and managing subject today, investments in the economy of the republic, in particular, the attraction of foreign investments, it is difficult to understand that it is an important factor in ensuring the effective implementation of the ongoing economic reforms. It is impossible to implement and modernize the economy, to equip enterprises with modern technologies, and to produce competitive products without attracting foreign investment, especially with the expansion of foreign investment in leading industries.

As international experience has shown, foreign investment projects can develop market relations through the expansion of the pace and scale of the structural reorganization and further integration of the national markets into the world markets. This is especially important in our country, which is experiencing a transition to a market economy.

The assessment of investment effectiveness is a critical process, which includes the analysis and evaluation of technical, economic and financial indicators. As a result, the most optimal way to optimize the allocation of resources is by choosing this option [2].

Are the current costs involved in assessing any investment project to cover project revenues? It is natural that the question arises. After all, the main purpose of the analysis and evaluation of investment projects is to assess the realistic achievement of the results.

Evaluating the effectiveness of investment projects the following factors:

-

• the large number of income from the project and low labor costs;

-

• Short term of project implementation;

-

• the quality of production and the market place of production;

-

• the cost of the expenses.

The evaluation also takes into account the effectiveness of research and development activities, which, while on the one hand, leads to lower costs, on the other hand, allows for a relatively short period of time to implement the project.

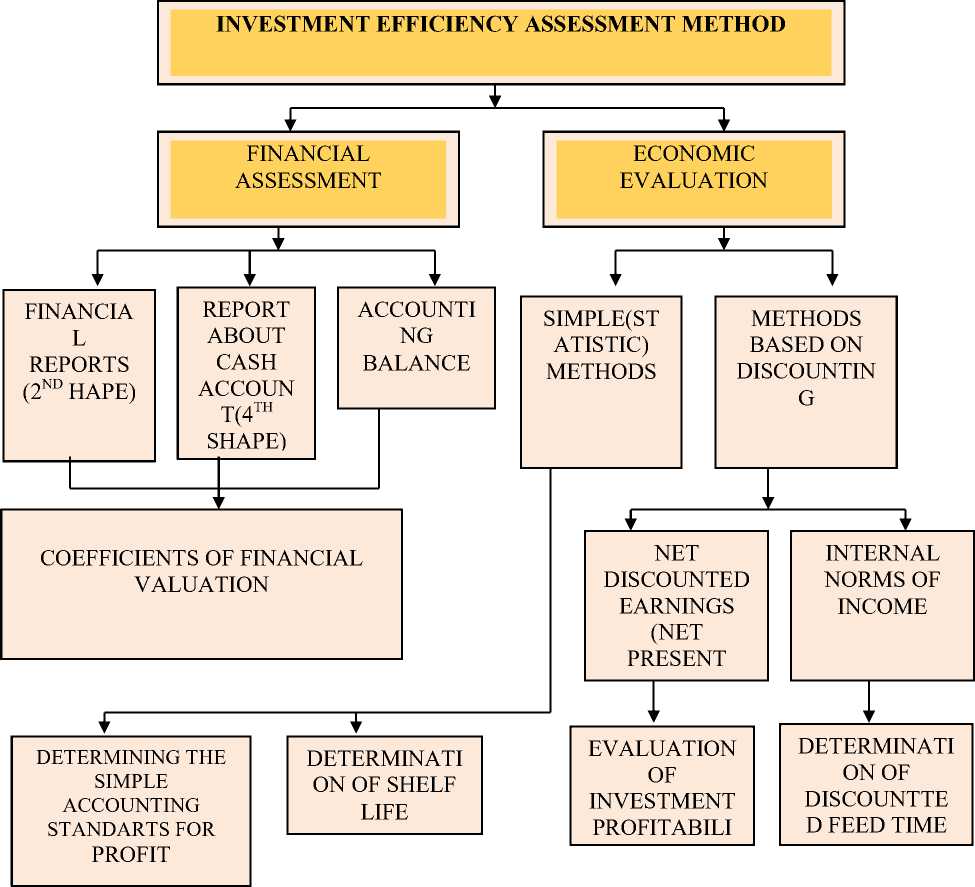

According to foreign experience, investment efficiency assessment is based on two criteria: financial and economic assessment.

The Financial Assessment will determine whether the financial resources of the entity are adequate to meet its overall financial commitment to carry out the project in time.

Economic evaluation is the potential of investment, which is used to maintain the value of funds invested in the project and to estimate the level of their growth. The following figure outlines the basic definition methods for each criterion:

GRAPHS:

Nobody can estimate the investment projects in advance with quick and precise accuracy. However, the proposed evaluation methods will help eliminate shortcomings and coincidences in adopting investment projects. The reason for the investment project valuation approach is the change in the amount of money in time.

Today's soum is not the same as yesterday's soum. The notion that such a situation only occurs in an investment is not always true, since the current one is attracted to any commercial transaction, and in a year, its value will go up. The main slogan of a project analyst is: "Today's soum is worth more than one soum in the future!" Here's a very simple example:

If you deposit 100 rubles at a rate of 10%, then next year this amount will be:

FV1 = 100 (1 + 10) = 110 soums

If you do not take another year,

FV2 = [100 * (1 + 10)] * (1 + 0,10) = 100 * (1 + 0,10) 2 = 100 * 1,21 = 121 soums. This method, that is, the increase in your funds can be summarized as follows:

FV = PV * (1 + K) n (1)

The formula for the above formula is called computational formula, where: FV is the future value, PV current or current value, K-rate of return, n-savings period

(year, month, day).

When it comes to finding the true value, it is important to consider:

-

- Any enterprise or firm tries to increase its own wealth;

-

- funds spent at different times do not have the same value.

The net present value is the difference between the discounted cash receipts (which is the result of the investment).

The following formula can be used to determine the true valid value:

NPV = CF1 / (1 + K) 1 + CF2 / (1 + K) 2 + ... CFn / (1 + K) n-I0 = (Sum) nt = 1 * CFe / (1 + K) * te-I0

If the net present value (NPV) is positive, the investment will be effective for this project. In some cases, long-term investments are made, and long-term money earnings are generated. That is, the flow of cash flows for several years.

The following formula can be used:

NPV = (Sum) nt = 1CF1 / (1 + K) t- (Sum) n t = 1 I1 / (1 + K) t

The Gorden formula is used when calculating NPV in the unlimited life span of the project:

NPV = CF1 / (1 + q) -I0

Here is the CF1 cash flow, the gains of Q-money earnings. Example: The company is launching a new "Model House" for $ 510 million. to buy for auction. The rate of alternative income during this period is 15%. Annually, the venture will invest

-

70 million USD. soums. Is It Right to Buy an Enterprise?

NPV = 70 / 0.15-510 = 466.7-510 = -43.3

As it can be seen, acquisition of the company will cause damage to the firm. Let's assume that earnings will grow by 4% and at the end of the year - $ 70 million. That is, it is effective, that is

NPV = 70 / (0,15-0,04) -510 = 70 / 0,11-510 = 636,4-510 = 126,4 million sum

Investing profitability PI is an indicator that shows how much each investment made in the UZS is often a profit margin and can be determined by the following formula:

PI = [(Summa) nt = 1CFt / (1 + K) t] / I0

At the same time: I0 - initial investment amount, CF- money earnings, t-period. If there is a "long term expense - long term earnings", the formula will have the following shape:

PI = [sum] nt = 1CFt / (1 + K) t] / [(Sum) nt = 1It / (1 + K) t]

Back to previous example (models home), we determine the project profitability:

PI = 100 * 6,1446 / 500 = 1.23 = 123%

At the same time, each UZS spent on the project brings a net profit of 0,23 soums. If NPVs are positive and higher than 0, and PI is greater than 10, the investments are effective.

Список литературы Importance of estimation of financial and economic effectiveness of investments

- "Iqtisodiyotni modernizatsiyalash sharoitida investitsiya loyihalarini moliyaviy-iqtisodiy baholash". Sadikova Komilova Saidmuratovna (Dissertatsiya ishi, 1-bob, Toshkent-2011)

- Lectures on the subject "Investitsiyalarni tashkil etish va moliyalashtirish" (O’zbekiston davlat soliq qo’mitasi va soliq akademiyasi, Toshkent-2016)

- Educational-methodical complex on science"Xorijiy investitsiyalar" T.Dadbayev, S.Allabayev, G.SHokirova. (NamMQI, Menejment kafedrasi, Namangan 2017).